Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 17, 2020

Daily Global Market Summary - 17 June 2020

Global equity markets closed mixed across each region, with relatively subdued price action in either direction compared to the past two days. Benchmark government bonds closed modestly higher on the day. iTraxx closed slightly higher and CDX lower, with oil also lower on the day. The markets will focusing on tomorrow's weekly US initial claims for unemployment insurance report at 8:30am EST for any signs of a slowdown in US job losses and will continue to closely monitor the recent uptick in COVID-19 infections in China and the southern US for any signs of improvement or further deterioration.

Americas

- Most US equity markets closed lower today, except for Nasdaq +0.2%; Russell 200 -1.8%, DJIA -0.7%, and S&P 500 -0.4%.

- 10yr US govt bonds closed higher at -2bps/0.73% yield.

- CDX-NAIG closed +3bps/72bps and CDX-NAHY +9bps/469bps.

- Crude oil closed -1.1%/$37.96 per barrel. Today's 10:30am EIA weekly petroleum status report indicated that US crude inventories continue to creep higher but days of operations cover suggest the inflection point is likely passed. Despite commercial crude inventories inching up by 1.2 MMbbls to a fresh all-time high of 538 MMbbl last week, there are clear signs that the US crude industry has moved past the worst of the crisis. Crude stocks in days of operations cover, which peaked at a high of 25 days for the first week of May, have now fallen to 23.7 days in last week's data. While the road back to "normal" - 16 to 18 days of cover - is still long, the system appears to have started to recover despite elevated import levels. The next big test for US stocks will be the return of shut-in volumes in coming weeks and whether recovering refinery runs and lower seaborne imports can sustain the tightening trend. (IHS Markit Energy Advisory's Roger Diwan and Karim Fawaz)

- Spending on renewable power is set to overtake oil and gas drilling for the first time next year as clean energy affords a $16 trillion investment opportunity through 2030, according to Goldman Sachs Group Inc. Renewables including biofuels will account for about a quarter of all energy spending next year, up from about 15% in 2014, Goldman analysts including Michele Della Vigna said in a June 16 note. This is in part driven by diverging costs of capital, as borrowing rates have risen to as high as 20% for hydrocarbon projects compared with as little as 3% for clean energy. (Bloomberg)

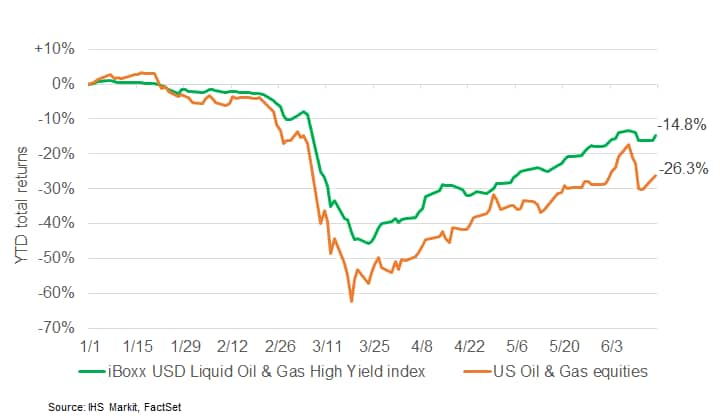

- The graph below compares YTD total returns for the iBoxx USD

Liquid Oil & Gas High Yield Index versus US oil & gas

sector equities (based on FactSet sector data). As of yesterday, US

O&G high yield debt is -14.8% and equities are -26.3% YTD.

- US housing permits are more informative than starts because

they are better measured, less affected by weather, and forward

looking. Housing permits increased 14.4% (+/- 1.1%, statistically

significant) to a 1.220 million rate in May. (IHS Markit Economist

Patrick Newport)

- Housing permits were 8.8% below last May's level but 20.6% below January's level. Housing starts and permits were elevated early in the year because of mild weather and were poised to drop by about 200,000 units—so the year-earlier level is a better reference point for comparisons.

- Single-family permits bounced back 11.9% (+/- 1.9%, statistically significant) to a 745,000 rate; multifamily permits jumped 18.8% to a 475,000 rate. Single-family and total permits posted solid gains in all four regions. The eight regional estimates for total and single-family permits all met the 90% statistical significance standard.

- Housing starts increased 4.3% (+/- 15.5%, not statistically significant) in May to a 974,000-unit seasonally adjusted annual rate (SAAR). Not statistically significant means that "it is uncertain whether there was an increase or decrease", according to the report's explanatory notes. Starts increased in the Northeast and West and fell in the Midwest and South. The estimates for the Northeast and Midwest were not statistically significant.

- Social distancing is more easily practiced in building new homes than most other lines of work. This should allow this industry to bounce back before other sectors hammered by COVID-19.

- We expect housing starts to quickly come back from a second-quarter bottom, reaching a 1.20 million rate in the second quarter of 2021.

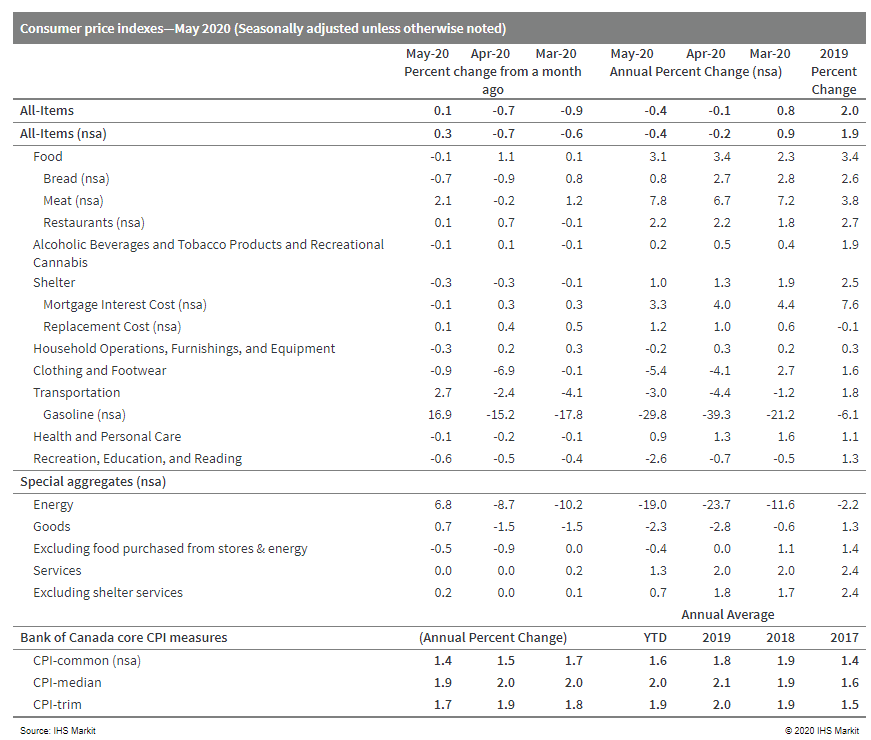

- Canadian consumer prices inched higher by 0.1% month on month

(m/m) on a seasonally adjusted basis (sa) and 0.3% m/m on a

non-seasonally adjusted basis (nsa). (IHS Markit Economist Arlene

Kish)

- The annual inflation rate sank a bit further, to -0.4 % year on year (y/y) sa and nsa.

- Core inflation readings edged lower as well, ranging from 1.4% y/y to 1.9% y/y.

- Gasoline prices contributed the most to the monthly bump in consumer prices, but these also were the biggest downward contributors to annual inflation.

- Large discounts on some items because of weak demand, excluding

energy, are cooling core inflation measurements.

- Tesla has announced that the US Environmental Protection Agency (EPA) has given the Model S Long Range electric vehicle (EV) model an estimated 402-mile range rating. Tesla posted the Model S range update announcement on its company blog, although the EPA has not updated its posting on the vehicle. To achieve the rating, Tesla says it carried over lessons learned from the engineering design and manufacturing of the Model 3 and Model Y to the Model S and Model X, enabling it to achieve mass reduction in new areas. In addition, standardization of Tesla's in-house seat manufacturing and lighter weight materials are being used in the battery pack and drive units, resulting in reduced weight. <span/>(IHS Markit AutoIntelligence's Stephanie Brinley)

- A media report has suggested that the Tesla Model Y may be facing production and quality issues following the company's resumption of production. Electrek reports that the issues have surfaced after Tesla resumed production following the COVID-19 related shutdown. The news outlet reports that Tesla internet forums have seen more comments from new buyers reporting issues with the Model Y and refusing deliveries, and in some cases, they say that Tesla has proactively cancelled deliveries due to production issues. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Audi has announced the opening of a new automated vehicle operation research and development (R&D) office in San Jose, California, while VW has announced additional investment of up to USD200 million in QuantumScape solid-state battery specialist. According to Audi's statement says the new office will focus on creating advanced driver assist systems specifically for the North American market, and is the first Audi office dedicated to this purpose. The company has various R&D offices throughout the US. Audi plans to hire up to 60 engineers for artificial intelligence, software development and Silicon Valley startup collaborations. Audi has outfitted a fleet of Q7 utility vehicles with roof-mounted sensor kits to collect data; the vehicles are wrapped with a QR code that enables a link to a webpage that discusses Audi's related technology breakthroughs and developments. The data acquisition of this initial fleet will be used to develop various cloud-based automated driver assistance functions planned for launch by 2023. Separately, Volkswagen (VW) has increased investment in QuantumScape for the purpose of driving forward the joint development of solid-state technology. The two have been working toward commercialization of solid-state batteries since 2018, although VW noted that the two companies have been collaborating since 2012. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/ Africa

- European equity markets closed mixed; France +0.9%, Germany +0.5%, UK +0.2%, and Italy/Spain -0.2%.

- 10yr European govt bonds closed mixed; UK -2bps, France/Germany flat, and Italy/Spain +2bps.

- iTraxx-Europe -1bp/64bps and iTraxx-Xover -3bps/364bps.

- Brent crude -0.6%/$40.71 per barrel.

- Tesla has secured a supply of cobalt from Swiss mining firm Glencore for use in battery production in its Chinese and forthcoming German Gigafactories, according to a Financial Times (FT) report. The business paper reported that sources close to the matter said that the company's battery factory in China, Giga Shanghai, and the forthcoming plant in Germany, Giga Berlin, will both be supplied with the battery material by Glencore. (IHS Markit AutoIntelligence's Tim Urquhart)

- Renault Group has reported detailed the job cuts that it plans to undertake in France as part of its new cost-saving strategy. According to an article published by Le Figaro, the automaker told a meeting of the Central Social and Economic Committee (CCSE) held yesterday (16 June) that the number of positions lost in production is 2,100. Furthermore, it will reduce its engineering headcount by 1,500, which is around 17% of its workforce in this area. In addition, 1,000 jobs will be lost in support and administration functions. However, the company also confirmed that this would take place without redundancies, stating that it will introduce a number of program including early retirement, internal mobility or retraining. (IHS Markit AutoIntelligence's Ian Fletcher)

- Following record month-on-month (m/m) falls in eurozone retail

sales and industrial production in April, data for exports and

construction output have followed suit. (IHS Markit Economist Ken

Wattret)

- Exports collapsed by 24.5% m/m, taking the combined drop from February to April to over 30% (measured in values rather than volume terms).

- Imports fell by a less pronounced 13.0% m/m, with the cumulative decline since February at around 21% (again, in value terms).

- April's eurozone trade surplus plunged accordingly, by over EUR24 billion to just EUR1.2 billion (USD1.3 billion), the lowest monthly surplus since October 2011.

- The first-quarter breakdown of eurozone GDP by expenditure component showed a relatively modest drag from net trade (-0.4 percentage point) but April's trade figures are indicative of a much larger negative contribution in the second quarter.

- Output in the eurozone construction sector plummeted by 14.6% m/m in April. With March's decline revised down to 15.7% m/m, construction output was the only major eurozone data release for April not to show a record m/m contraction.

- Indeed, while sentiment in the construction sector has fallen markedly since February, the magnitude of the decline has been less precipitous than in other areas of the economy, including service-sector activity in particular.

- As all the "hard" activity data fell off a cliff in April following an already very weak March, carry-over effects for the second quarter are extremely negative and eurozone GDP is therefore shaping up for an unprecedented quarter-on-quarter (q/q) decline. Our current baseline forecast is for the first quarter's record 3.6% q/q contraction to be followed by a near-12% q/q decline in the second quarter.

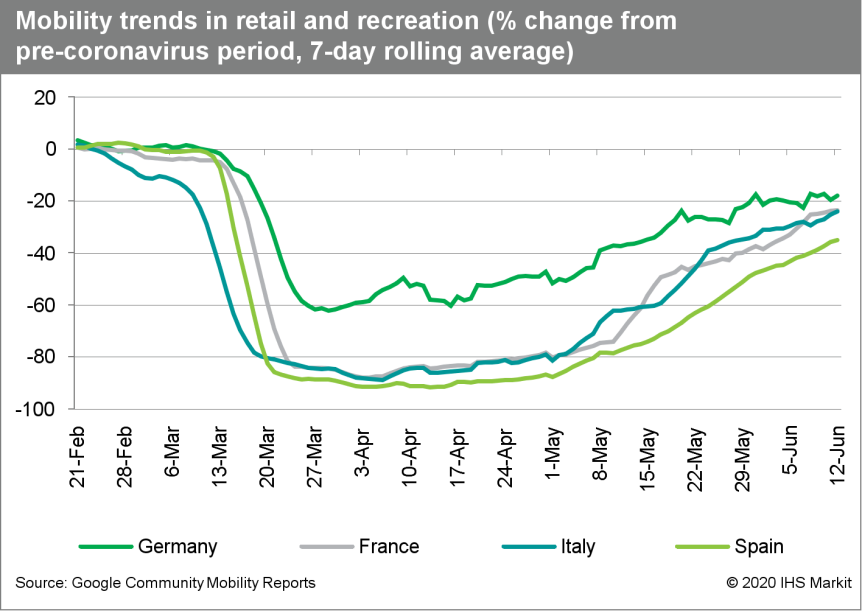

- However, with COVID-19 virus-related containment measures

having been relaxed over the course of the second quarter, there is

set to be a huge swing in momentum during the period. This is

already evident in higher-frequency, unofficial data, including

Google mobility indices.

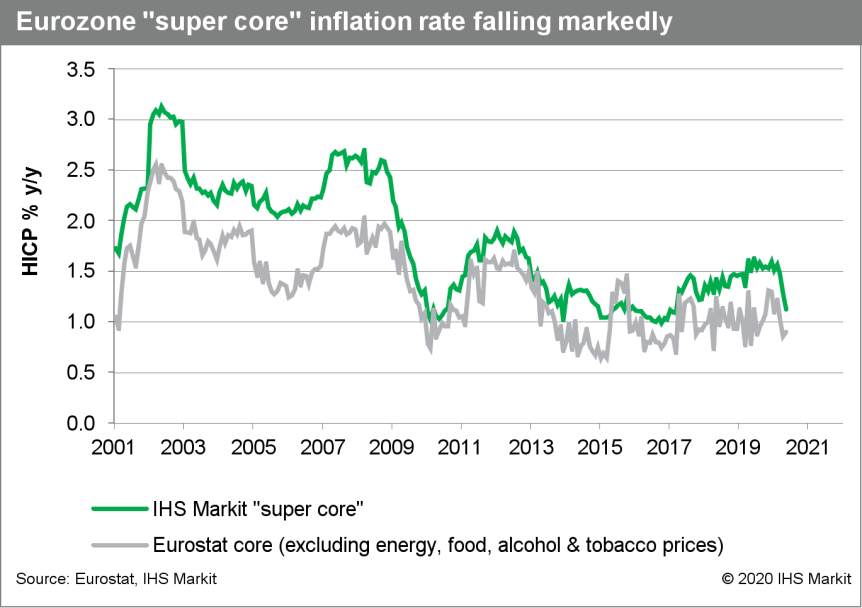

- May's "flash" Eurozone Harmonised Index of Consumer Prices

(HICP) inflation rate of just 0.1% was confirmed in the final

release, the lowest rate since June 2016. Deeply negative energy

inflation was again the main factor driving the deceleration. At

-11.9% year on year (y/y), the rate of decline was the largest

since July 2009. Simultaneously, inflation for unprocessed food

moderated for the first time in nine months. (IHS Markit Economist

Ken Wattret)

- The inflation rate excluding food, energy, alcohol, and tobacco prices was unrevised and unchanged from April at 0.9%, its lowest level since August 2019. A modest rebound in service-sector inflation following weakness in March and April was offset by a further deceleration in core goods inflation. Weak producer price inflation data point to further downward pressure on the latter.

- Despite the slight rebound in services inflation in May, IHS Markit's "super core" measure of inflation dropped sharply for the third straight month, sliding to 1.12%, its lowest level since March 2017.

- Given the expected surge in debt burdens in the aftermath of

the COVID-19 virus pandemic, the rapid expansion of central bank

balance sheets, and possible deglobalization trends, some economic

commentators have been flagging the possibility of a return to much

higher inflation rates in future. However, we continue to see the

risks very much in the opposite direction for the eurozone.

Weakness in crude oil prices has seen headline inflation in the

eurozone tumble over recent months, although given the partial

recovery since late April, the downward pressure on inflation from

energy will abate in the coming months.

- According to the Office for National Statistics (ONS), UK

consumer price inflation fell again in May, to 0.5%, its lowest

level since June 2016. It sits below the Bank of England's

inflation target of 2.0%. The main highlights of the May release

are as follows: (IHS Markit Economist Raj Badiani)

- Falling automotive fuel prices were again a major drag on the overall inflation rate in May. Specifically, fuel and lubricant prices dropped by 16.7% year on year (y/y), after a 12.2% y/y fall in April. The lever was tumbling crude oil prices, with Dated Brent falling for a fourth successive month, plunging by 58.7% y/y to average USD29.42 per barrel (pb) in May.

- Clothing and footwear prices continued to evolve weakly, down by 3.1% y/y during May. Overall, these prices have fallen in 12 of the last 17 months, which illustrates the continued pressure on some retailers to price generously to attract absent consumers.

- Furniture, household equipment, and maintenance price inflation remained negative. Specifically, the annual rate of change decelerated for the fifth straight month, standing at -0.7% in May. This illustrates the already difficult retail trading conditions made more precarious by the closure of non-essential retail premises during April and May to combat the spread of the COVID-19 virus.

- All-services price inflation was at 1.9% in May (down from 2.0% in April), and -0.9% (down from -0.4% in April) for all goods.

- Core inflation (excluding energy, food, alcoholic beverages, and tobacco prices) declined for a third straight month to 1.3% in May.

- According to our June update, we expect inflation to average 0.5% in 2020 after standing at 1.8% in 2019.

- Inflation is likely to continue to drift downwards in the next few months, probably to zero, with several factors placing downward pressure. These include the impact of the anti-contagion measures, severe GDP losses in the first half of this year, collapsed consumer spending, and Crude oil prices (Dated Brent) are expected to average a multi-year low of $35.90/per barrel in 2020.

- In addition, many retailers hit previously by zero footfall due to the closure of their premises are expected to resort to heavy price discounting to shift their large inventories.

- European dairy commodity markets have been relatively quiet over the past week, as markets have taken stock of a still-fragile European and global economy. The pronounced upturn of the past few weeks has given way to a more nuanced picture, with SMP and whey powder markets in particular showing some weakness. German sources report that buyers' willingness to commit to longer-term contracts for SMP has declined in recent weeks, with many purchasers having already covered their requirements for the time being. "It looks like the market is taking a breath while it assesses the macroeconomic damages caused by Covid19," commented Robert Schorsij of Dutch trader Greenmark Dairy. "Banks and governments are bombarding media with very negative outlooks particularly for H2 2020, and meanwhile, developments in China [the re-imposition of lockdown curbs in Beijing] don't do much to lift spirits either." (IHS Markit Agribusiness' Chris Horseman)

- With interest rates near zero, the National Bank of Poland

(NBP) will rely on other measures to mitigate the negative economic

impact of the COVID-19 virus pandemic. (IHS Markit Economist Sharon

Fisher)

- Following interest rate cuts worth 140 basis points in March-May, the NBP maintained the policy rate at a historic low of 0.1% during its monetary policy session on 16 June.

- After surging in early 2020, consumer price inflation fell to a six-month low of 2.9% year on year (y/y) in May and no longer represents a threat in the near term. The NBP now sees risks on the downside but believes its monetary policy measures reduce the risk of inflation falling below the 2.5% target over the medium term.

- The exchange rate represents another concern for the NBP, which hinted that without further monetary easing, the zloty may be too strong to support the economic recovery. After weakening significantly in the second half of March, the currency has since appreciated, although it remains well below the levels a year earlier.

- The Lebanese pound has strengthened somewhat on the parallel

market following an announcement last Friday (12 June) that the

central bank would supply dollars to money change offices to

support the currency. However, the foreign currency injections are

expected to only slow or delay the decline of the currency, and an

eventual devaluation of the official rate is likely, barring a

substantial influx of foreign currency. (IHS Markit Economist Ana

Melica)

- Last week, the Lebanese pound weakened to LBP5,300 per US dollar and reportedly as much as LBP7,000 on the parallel market (black market), sparking protests and riots in several cities over the rising cost of living. Following an emergency cabinet meeting called by Prime Minister Hassan Diab on Friday 12 June, President Michel Aoun announced that the central bank would inject dollars in the market, and the currency began to stabilize after the announcement.

- The central bank, Banque du Liban (BDL), will reportedly supply USD5-9 million daily to a subset of foreign exchange offices with the aim of reducing the rate used at these offices back to LBP3,200 from LBP3,940. However, most exchange bureaus will not have access to these funds.

- On Monday 15 June, the pound strengthened to LBP4,300-4,500, which was approximately the rate in early June. However, by Tuesday 16 June, it had weakened to LBP4,850.

- This amounts to USD150-270 million per month. This compares to goods imports of USD745 million in April 2020 (most recent month of data), or a monthly average of USD840 million in the last three months (February-April 2020). During that time, fuel, food, and medicine were 60% of imports, or USD500 million monthly (food is around 20% of imports, fuel is around 30%, and pharmaceutical products 10%).

- The BDL reportedly has USD18 billion in foreign exchange reserves remaining, according to media reports. This is down from USD22 billion in readily available reserves in March, USD21 billion in April, and USD20 billion in May. Therefore, at recent import levels and reserve drawdown rates, reserves could cover as much as 18 months of goods imports.

Asia-Pacific

- APAC equity markets closed mixed; Australia +0.8%, Hong Kong +0.6%, China/South Korea +0.1%, India -0.3%, and Japan -0.6%.

- Chinese officials cancelled hundreds of flights in and out of Beijing, restricted movement and renewed closures of businesses and schools as they battled to contain a fresh wave of new coronavirus cases in the nation's capital. (WSJ)

- Great Wall Motors (GWM) signed a memorandum of understanding (MOU) with the Maharashtra state government yesterday (16 June) and officially announced its investment into its Talegaon manufacturing facility. The plant will be equipped with the latest world-class technology, and along with the research and development (R&D) center in Bengaluru, will generate employment for more than 3,000 people in a phased manner, the automaker said in a press release. Affirming the company's India plans, Parker Shi, managing director of the Indian subsidiary of GWM, said, "This would be a highly automated plant in Talegaon with advanced robotics technology integrated in many of the production processes. Overall, we are committed to USD1 billion of investment in India in a phased manner, which is directed towards manufacturing world class intelligent and premium products, R&D center, building supply chain and providing jobs to over 3,000 people in a phased manner." <span/>(IHS Markit AutoIntelligence's Jamal Amir)

- Japan's trade deficit narrowed by 13.7% year on year (y/y) to

JPY833.0 billion (USD7.8 billion) on a non-seasonally adjusted

basis and by 42.4% from the previous month to JPY601 billion in

May. (IHS Markit Harumi Taguchi)

- The softer trade deficit largely reflected an accelerated decline in imports to 28.2% y/y from 7.1% y/y in the previous month, while the contraction of exports also widened to 28.3% y/y from 21.9% y/y in April.

- Global containment measures continued to dampen Japan's exports of transport equipment severely, as a 60.3% y/y drop in exports of transport equipment accounted for 14.1 percentage points of the contraction of total exports.

- By region, exports to the US (down 50.6% y/y) and the European Union (down 33.8% y/y) worsened, while a milder decline in exports to Asia (down 12.0% y/y) reflected a softer contraction of exports to China (down 1.9% y/y).

- The decrease for import volume was milder (down 14.8% y/y) than for import value. The decline in imports largely reflected weak prices of oil and other resources.

- Imports of mineral fuel contributed 12.3 percentage points to the contraction of total imports.

- Other major factors behind the steep decline included imports of aircraft (down 74.0% y/y), clothing and accessories (down 32.6% y/y), and motor vehicles (down 1.1% y/y), reflecting weaker demand under containment measures in response to an extended period of a state of emergency.

- Japan's antibiotic feed additive production increased in fiscal

2019 by around 8%. The Japanese Fertilizer and Feed Inspection

Services (JPPIS) detailed antibiotic feed additive production for

fiscal 2019 ended March 31, 2020. Total production of antibiotic

feed additives went up by 8.3% to 74,529kg, compared to fiscal

2018. Major products were polyethers - such as salinomycin, narasin

and monensin - accounting for about 73.2% of total antibiotic feed

additives. Other products included avilamycin (23.7%) and

flavophospholipol (3.1%). There was no production of polypeptides,

tetracyclines and macrolides in 2019. However, production of

polyethers went up by around 39%. The increase in antibiotic feed

additive production in 2019 bucks the trend of recent years. Japan

witnessed declining antibiotic feed additive production in 2017 and

2018. Despite the upturn in 2019, the latest total is still less

than 2017's figure in terms of volume. Earlier this year,

authorities said sales of animal health products in Japan jumped by

around 4% during the latest year on record. These figures showed

sales of antimicrobials tend to increase year-on-year in Japan.

However, the growth each year has slowed. (IHS Markit Animal

Pharm's Dr. Atsuo Hata)

- Hyundai has signed a memorandum of understanding (MOU) with the South Korean Ministry of Defense; Ministry of Trade, Industry, and Energy; and Ministry of Environment to supply 10 fuel-cell electric vehicles (FCEVs) - one fuel-cell bus and nine Nexo FCEVs - to the defense ministry by the end of next year, reports Korea JoongAng Daily. These vehicles are expected to be used for transportation at Jaundae, an army training site located in Daejeon, in a pilot program. The defense ministry will gradually expand the number of FCEVs based on the results of test operations. Hyundai will also set up a hydrogen fueling station for both private and military usage near the base by the first half of 2021. Under the MOU, the defense ministry will provide an area for the hydrogen fueling station, while the trade, industry, and energy ministry will support the development and operation of technology related to fuel-cell batteries, and the environment ministry will contribute in setting up the hydrogen fueling station. (IHS Markit AutoIntelligence's Jamal Amir)

- New vehicle sales in the Philippines fell 84.6% year on year

(y/y) during May to 4,788 units, reports the Philippine News

Agency, citing data released by the Chamber of Automotive

Manufacturers of the Philippines Incorporated (CAMPI) and the Truck

Manufacturers Association (TMA). (IHS Markit AutoIntelligence's

Jamal Amir)

- Sales of passenger vehicles fell by 84.7% y/y to 1,389 units, while commercial vehicle (CV) sales declined by 84.5% y/y to 3,399 units. "While May figures are still way below the industry's monthly average sales performance, we welcome any positive signs of recovery amid the pandemic and this season of new normal where dealerships have resumed operations at a reduced level and stringent safety protocols are being implemented at all times," said CAMPI president Rommel Gutierrez.

- In the year to date (YTD), total vehicle sales in the country have decreased by 51.1% y/y to 69,463 units, compared with 142,185 units in the same period of 2019. This is split between passenger vehicle sales of 19,201 units (down 55.2% y/y) and CV sales of 50,262 units (down 49.4% y/y).

- Toyota Motor Philippines is the top seller during the YTD with a market share of 40.5% and sales of 28,163 units (down 52.2% y/). It is followed by Mitsubishi with a share of 18.5% and sales of 12,865 units (down 49.0% y/y) and Nissan with a share of 12.5% and sales of 8,696 units (down 49.0% y/y).

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-june-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-june-2020.html&text=Daily+Global+Market+Summary+-+17+June+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-june-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 17 June 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-june-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+17+June+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-june-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}