Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 17, 2021

Daily Global Market Summary - 17 March 2021

Major US equity indices closed higher fueled by today's relatively dovish FOMC meeting statement, while European and APAC markets were mixed. Both US and benchmark European government bonds closed sharply lower on the day. European iTraxx was close to unchanged across IG and high yield, while CDX-NA closed slightly tighter. The US dollar, oil, gold, and natural gas closed lower, while copper and silver were higher on the day.

Americas

- The Federal Open Market Committee (FOMC) concluded its scheduled two-day policy meeting this afternoon (17 March). The statement released at the conclusion of today's meeting contained no surprises. There was unanimous support among the 11 voting members for the current stance of policy, which includes maintaining the target for the federal funds rate at a range of 0.00-0.25% and continuing large-scale asset purchases averaging approximately $120 billion per month. The FOMC will remain patient with a highly accommodative stance of monetary policy for an extended period. Prospects for stronger growth and a transitory rise of inflation have not persuaded the FOMC to shrink the amount of accommodation; it will not begin to do so until "substantial further progress" is made toward its employment and inflation objectives. (IHS Markit Economists Ken Matheny and Kathleen Navin)

- The FOMC statement triggered rallies across US equities, credit, and government bonds, but a sharp sell-off in the US dollar. However, the bond market's reaction was ironically the most underwhelming given the dovishness of the statement, with 10yr US govt bonds yields giving back much of the post-FOMC rally before 4pm EST and closing +3bps at 5pm.

- US equity markets closed higher, with the DJIA +0.6% and S&P 500 +0.3% closing at new all-time highs; Russell 2000 +0.7% and Nasdaq +0.4%.

- 10yr US govt bonds closed +3bps/1.65% yield and 30yr bonds +5bps/2.43% yield.

- CDX-NAIG closed -1bp/51bps and CDX-NAHY -6bps/294bps.

- DXY US dollar index closed -0.5%/91.44, with almost all of the day's decline occurring shortly after the 2:00pm EST FOMC statement.

- Gold closed -0.2%/$1,727 per troy oz, silver +0.2%/$26.06 per troy oz, and copper +1.2%/$4.12 per pound. Gold rallied 1.3% (post-settlement time) on the FOMC statement.

- Crude oil closed -0.3%/$64.60 per barrel and natural gas closed -1.7%/$2.56 per mmbtu.

- Colocation of floating photovoltaic solar generation with

existing energy infrastructure is driving a new phase of project

financing that is less dependent on government incentive programs

and underpins more than $9 billion of planned new projects through

2025. (IHS Markit EnergyView Climate & Cleantech's Roger Diwan

and Peter Gardett)

- Floating PV (FPV) is increasingly being installed on the lakes created by hydroelectric dams, the slurry ponds that service industrial mining operations and wastewater treatment reservoirs close to electricity demand centers or existing power transmission infrastructure. Investors favor the access to existing power markets, the potential for long-term offtake agreements and the lower maintenance cost profile.

- Recent projects feature investors like Temasek and HPS-backed private equity play Cypress Creek Renewables at the largest US FPV project at a wastewater treatment plant in California and the largest European FPV project from German conglomerate BayWa (BWY6) alongside Dutch solar firm Groenleven at a sandpit wastewater facility, later sold to a private investor. Investec (INVP) and Credit Agricole (ACA) have recently organized lending consortiums for renewables developers with FPV projects already at collocation sites or in development.

- US single-family permits, arguably the most important number in

this report, tumbled 10.0% (plus or minus 0.8%; statistically

significant) in February, the first setback in 10 months. The

127,000 seasonally adjusted monthly drop was the fifth largest

since 1960. (IHS Markit Economist Patrick Newport)

- Multifamily permits sank 12.5% to a still solid 539,000 annual rate. Total permits were down 10.8% (plus or minus 1.0%; statistically significant) to a 1.682 million rate.

- Housing starts plunged 10.3% (plus or minus 10.5%, nearly statistically significant) in February. Single-family starts fell 8.5% (plus or minus 9.3%, not statistically significant) to a 1.040 million rate; multifamily starts stumbled 15.0% to a respectable 381,000-unit rate.

- January's numbers were solid. February's were awful. What

happened?

- First, the weather: February was cold—and not just in Texas. This February was 19th coldest in the contiguous 48 states since record keeping began 127 years ago and the coldest since 1989, according to the National Oceanic and Atmospheric Administration.

- Second, construction costs are soaring: The producer price index for lumber was up 59% from a year earlier in February; diesel fuel (up 37%), steel mill products (up 20%), copper and brass mill shapes (up 31%), and plastic construction products (up 8%) are also eating into builders' profit margins.

- Third, mortgage rates moved up about 30 basis points from early January to the end of February.

- These headwinds are exacting a toll. We expect that single-family housing starts will start running out of steam in the second quarter, dipping over several quarters before stabilizing in about two to three years at a level set by increases in households.

- Tyson Foods has unveiled plans to expand its case-ready meat business as part of a strategy to increase production of consumer ready products. The US-based business said it aims to reopen an idle plant in Columbia, South Carolina and convert it into a meat cutting facility. The repurposed unit will produce retail ready, portioned packages of sliced, fresh beef and pork, as well as ground beef, for grocery and club stores in the eastern US. Initially Tyson will invest about USD42 million to transform the facility into a meat portioning and packaging operation that is currently expected to begin production in May 2021. Over the next three to five years the company plans to invest in additional improvements and production equipment with a total investment estimated at USD55 million. The new operation will employ 330 people, more than double the number who worked at the facility when it closed in August 2020. (IHS Markit Food and Agricultural Commodities' Max Green)

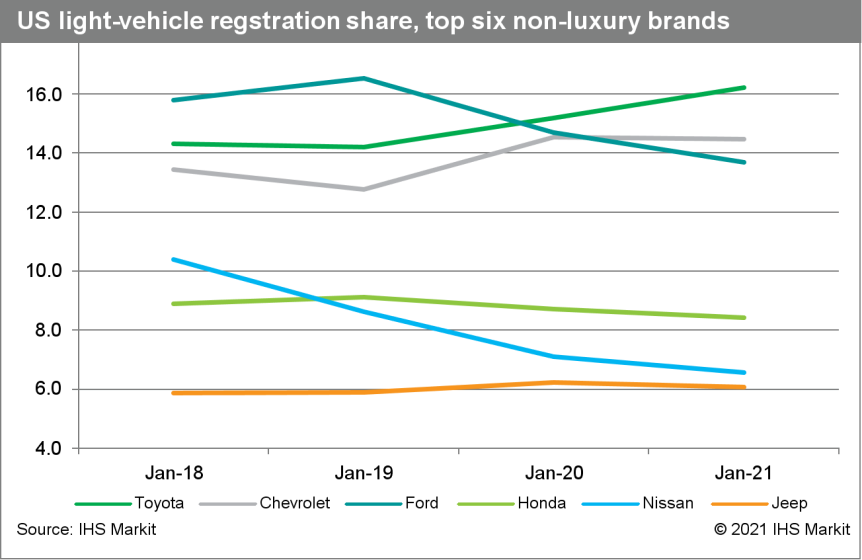

- IHS Markit has reviewed newly available total US light-vehicle

registrations for January 2021, finding that utility vehicles had

more than a 50% share, hybrid electric vehicle (HEV) sales growth

outpaced overall EV growth, and luxury vehicle market-share gains

stalled compared with registrations in January 2020. US

light-vehicle registrations in January occurred against the

backdrop of a relatively strong sales month. IHS Markit

light-vehicle registration data show a 7.0% y/y decline in January,

but the monthly SAAR figure was near pre-COVID-19 levels at 16.6

million units. Total light-vehicle registrations in January show

the consumer preference for nearly anything but cars continue to

impact on registrations. The light-vehicle market share of utility

vehicles first exceeded 50% in December 2020 in terms of monthly

sales, and the January 2021 registration data suggest this could

become a permanent feature. Pressure on traditional ICE offerings

is greater from HEV options than BEV options. This could change

with the plethora of BEVs arriving, including Ford's Mustang Mach-E

being available from February 2021. (IHS Markit AutoIntelligence's

Stephanie Brinley)

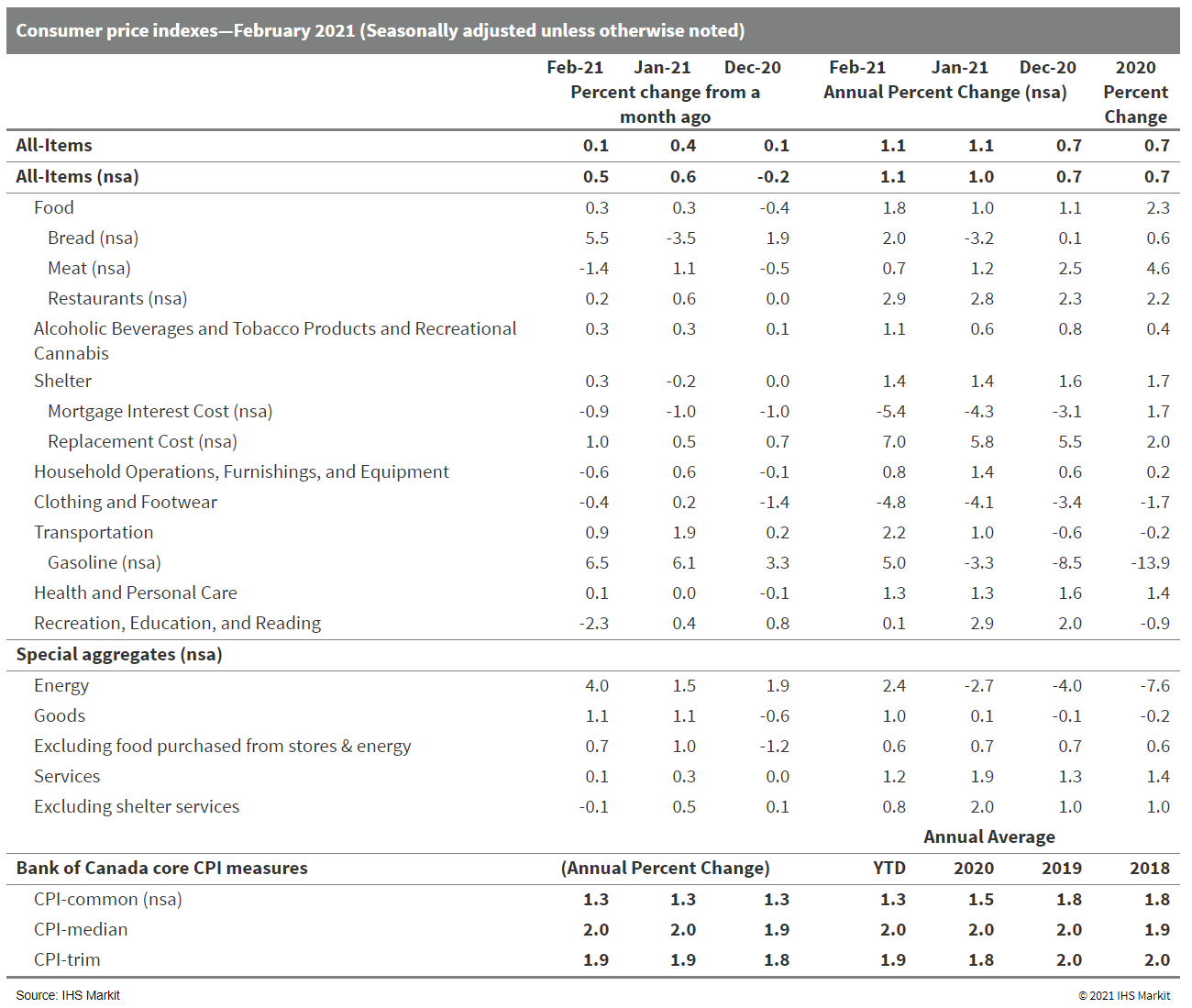

- Canada's consumer prices inflation decelerated from the

previous month with a 0.1% month-on-month (m/m) rise on a

seasonally adjusted basis (SA) and a 0.5% m/m jump on a

non-seasonally adjusted basis (NSA). (IHS Markit Economist Arlene

Kish)

- Annual inflation was 1.1% year on year (y/y) SA and NSA. There was a small acceleration in NSA consumer price inflation.

- Core inflation measures were unchanged from January, averaging 1.7% y/y.

- Steady inflation was a result of growth polarizing

sub-component inflation. Luck will run out soon as inflation will

temporarily head much higher, averaging nearly 2% this year.

- Peru's output index rose at a seasonally adjusted

month-on-month (m/m) rate of 0.2%, continuing a trend of slowing

recovery since economic reopening began in May 2020. Monthly output

fell by 1.0% in year-on-year (y/y) terms after increasing for the

first time in December. (IHS Markit Economist Jeremy Smith)

- Although most sectors have returned to growth, economic weakness is now concentrated in the most affected areas such as transportation and storage (-18.8% y/y) and hospitality and restaurants (-26.6% y/y). Industrial sectors such as manufacturing and construction are now among the strongest performers; however, mining notably remains in decline at -7.1% y/y.

- Newly released quarterly data indicate that nationwide employment ended 2020 5.5% below the 2019 level. The unemployment rate dipped to 7.5%, but the economically inactive population remained up by 10.9% y/y; the latter figure is more indicative of labor market conditions as the vast majority of workers who lost their jobs exited the labor force altogether. In addition, the rate of informal employment rose from 66.4% in 2019 to 68.5% in 2020. More recent monthly data for Metropolitan Lima, which accounts for around one-third of the Peruvian population, showed a concerning 4.6% decline in total employment in February.

Europe/Middle East/Africa

- European equity markets closed mixed; Germany +0.3%, Italy +0.1%, France flat, UK -0.6%, and Spain -0.7%.

- 10yr European govt bonds closed sharply lower; Italy/Spain +7bps and France/Germany/UK +5bps.

- iTraxx-Europe closed +1bp/48bps and iTraxx-Xover +2bps/243bps.

- Brent crude closed -0.6%/$68.00 per barrel.

- A new COVID-19 variant is spreading in the French region of Brittany, where a handful of patients whose infection was confirmed with samples from blood or deep in the respiratory system had tested negative at first with gold-standard tests, called PCR. The mutation was confirmed by sequencing in eight patients within a cluster of 79 at the hospital in Lannion, in northwestern Brittany, according to the statement. (Bloomberg)

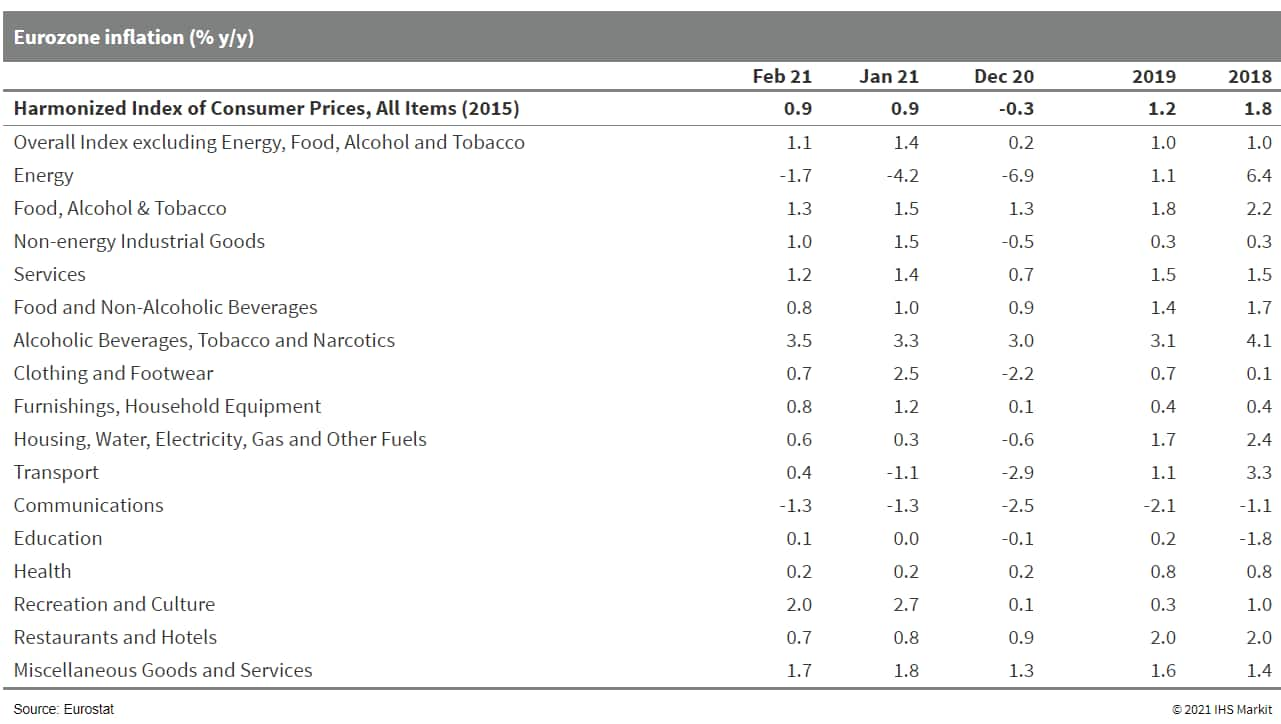

- According to Eurostat's "final" February release, Harmonised

Index of Consumer Prices (HICP) inflation in the eurozone is

confirmed at 0.9%, unchanged from January, although this followed

an unprecedented acceleration a month prior (from -0.3% in December

2020). (IHS Markit Economist Ken Wattret)

- The upward pressure on headline inflation from energy prices will continue in the coming months, with base effects set to become more powerful, and the peak is likely in April according to IHS Markit's forecast for crude oil prices.

- The HICP inflation rate excluding food, energy, alcohol, and

tobacco prices is confirmed at 1.1% in February, down from 1.4% in

January, although this too followed an unprecedented acceleration

(from 0.2% in December 2020, which was a record low).

- The VW Group has presented its annual press conference on forward strategy and full financial results, including incoming CFO Dr Arno Atlitz presenting his views on ensuring that cost containment and ICE sales will fund the company's transition to e-mobility and software services. With this year's events, VW explained how it expects to transition from a traditional business model to what it calls "new auto." The approach prioritizes BEV and mobility development and includes reduced support for ICEs, although it takes a slightly softer line than some other automakers. (IHS Markit AutoIntelligence's Stephanie Brinley and Tim Urquhart)

- In December VCI said it expected domestic production to rise

1.5% and sales to increase 2.5% in 2021. The German

chemical-pharmaceutical industry also posted a positive performance

in the fourth quarter of 2020, with recovery accelerating compared

with previous months due to rising demand for chemical products in

Germany and internationally. (IHS Markit Chemical Advisory)

- Chemical production in the fourth quarter climbed by 7.4% sequentially and was up 4% on a year-on-year (YOY) basis, with capacity utilization improving from 81.6% to 85.0%, VCI says. Prices of chemical products continued to recover and were 0.4% higher than in the third quarter of 2020, but still 1.7% lower YOY.

- Sales rose 8.1% sequentially, to €47 billion, supported by the developments in production and pricing, but remained 0.6% below the prior-year quarter, VCI says. The number of jobs in the chemical-pharmaceutical industry was stable in the fourth quarter at 464,000.

- The loss in 2019, as noted in a financial update provided by

the company in February, was mainly the result of an impairment

charge of €760.0 million that Wacker recognized related to its

polysilicon production facilities that year, it says. EBITDA

declined 14.9% year on year to €666.3 million, while EBIT of €262.8

million compared with a loss of €536.3 million in 2019. (IHS Markit

Chemical Advisory)

- The company's silicones business reported a 9% decline in sales, to €2.24 billion, due to lower prices for standard silicones, reduced volumes, and negative currency effects. EBITDA decreased 19%, to €387.8 million.

- Wacker's polymers division posted a slight, 1%, decline in sales to €1.30 billion, due to price declines and negative exchange-rate effects. EBITDA was 39% higher, at €270.5 million, with positive effects coming from improvements in the cost of goods sold and a decline in raw material prices, the company says.

- The biosolutions business recorded sales that were 1% higher at €246.1 million, due mainly to volume growth in biopharmaceuticals and cyclodextrins. EBITDA increased 23%, to €38.1 million, because of volume growth and an improved cost structure, Wacker says.

- Wacker's polysilicon division saw sales increase 2%, to €792.2 million, due to volume growth and a better product mix. EBITDA, however, dropped 92% to €4.7 million. The fall in EBITDA is mainly because special income of €112.5 million in insurance compensation booked for the Charleston incident was included in 2019, the company says.

- The BMW Group has given details of its future model and technology strategy at its annual press conference, with one of the biggest announcements being the company's 'Neue Klasse' architecture, which will be introduced from 2025, according to a company press statement. The Neue Klasse architecture is described by BMW as "a completely redefined IT and software architecture, a new generation of high-performance electric drivetrains and batteries and a radically new approach to sustainability across the entire vehicle life cycle". The Neue Klasse architecture will be the first volume architecture from BMW dedicated to pure battery electric vehicles (BEVs), with the company having previously employed a flexible platform strategy in terms of fuel types. The Neue Klasse architecture will also be able to be configured using what BMW refers to as "regionalizable technology stacks", which will allow a vehicle's operating system to be tailored to an individual region's predominant digital ecosystem. (IHS Markit AutoIntelligence's Tim Urquhart)

- Continental's board has approved a restructuring of the business related to systems for advanced driver assistance and automated vehicles. From the start of 2022, the business will be recognized as an independent "Autonomous Mobility" division within the Automotive Technologies group sector. Continental CEO Nikolai Setzer said, "We are implementing our strategy with determination. Accordingly, we are investing in our growth areas and future technologies, seizing market opportunities, enhancing our capacity to respond and providing for greater transparency." Continental has also announced that it will spend between EUR200 million (USD238.2 million) and EUR250 million (USD297.8 million) on developing technologies for automated vehicles. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Bearing manufacturer SKF in partnership with Einride is trailing an autonomous electric truck for freight operations. The vehicle is transporting goods on public roads between SKF's factory and its warehouse in Gothenburg (Sweden). Jonas Hernlund, commercial manager at Einride, said, "With the partnership with SKF, we now have customers in all our priority segments: trade, consumer goods, and industrial goods, which we are very proud of. Together with them, we will learn and grow quickly." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Nigeria's headline inflation rate edged up to 1.5% month on

month (m/m) during February, pushing the annual rate up to 17.3%, a

level last seen in April 2017. Nigeria's headline inflation

averaged 16.9% y/y for the first two months of 2021, from 12.1% for

the same period last year. (IHS Markit Economist Thea Fourie)

- All sub-categories in the consumer basket recorded higher inflation during February, with the sharpest increases recorded for food, up to 21.8% y/y from 20.6% y/y in January, followed by transport costs, up to 14.1% y/y from 13.5% y/y. Health costs rose 15.2% y/y during February, from 14.5% y/y in the previous month.

- Imported food inflation remained contained, ending February at 16.8% y/y from 16.7% y/y in the previous month.

- "Core" inflation (excluding farming and energy products) was 1.3% m/m in February, leaving the annual rate at 12.9% last month, from 12.5% in the previous month. Core inflation averaged 12.7% y/y for the first two months of 2021, from 9.8% for the same period last year.

- On 17 March, BusinessTech reported that the Banking Association South Africa (BASA) has indicated that only ZAR18 billion (USD1.2 billion) of loans out of the ZAR200 billion available under the loan guarantee scheme have been approved by banks; this is equivalent to 9% of the total amount. In April 2020, the South African Reserve Bank (SARB) and the National Treasury instituted a bank-guarantee-scheme loan to support borrowers affected by the COVID-19-virus pandemic (see South Africa: 22 April 2020: South Africa to commit ZAR200 billion in bank loan guarantees to mitigate impact of COVID-19-virus outbreak). BASA also indicated that one of the main reasons for banks' low approval rates was concern about a high incidence of default on payments, given that many enterprises were not in good financial standing before the pandemic. (IHS Markit Banking Risk's Ana Souto)

Asia-Pacific

- Most APAC equity markets closed mixed; Japan/Mainland China flat, Hong Kong flat, Australia -0.5%, South Korea -0.6%, and India -1.1%.

- WeRide has unveiled details about its WeRide Master Platform

(WMP), which supports the mass production of Level 4 autonomous

vehicles (AVs), according to a blog posted on the Medium website.

The platform consists of four elements: a sensor integration

solution, WeRide One, an automatic big data platform, and a fully

safety redundancy design. (IHS Markit Automotive Mobility's Surabhi

Rajpal)

- The sensor integration solution is based on its Lidar Camera System (LCS), comprising customized unit modules that are fully configurable.

- WeRide ONE is a set of universal algorithms that can operate on diverse hardware configurations and with different urban traffic scenarios. WeRide has built an automatic big data platform that supports the simultaneous testing and operation of its large-scale autonomous fleets in multiple cities.

- The massive amount of data collected by WeRide's autonomous fleets is processed efficiently at a global data center for "key scenario collection, HD map generation, deep-learning model training, as well as scenario simulation and validation". WeRide's redundancy design covers sensors, compute units, drive-by-wire (DBW), and network connection.

- WeRide, in collaboration with OEMs, has also designed a systematic process for vehicle fault diagnosis and safety verification.

- SAIC Motor has begun to roll out its first battery-swappable electric vehicles (EVs) across China. Under a partnership with Aulton, a Shanghai-based EV transport solution provider, the Roewe Ei5 EV featuring battery-swapping technologies is to join the city of Shanghai's public transportation service network. The Roewe Ei5 is equipped with a 52.5-kWh battery pack, which is chargeable to 80% of capacity in 30 minutes using fast-charging mode. SAIC claims the driver can replace a vehicle's battery pack at Aulton's battery-swapping stations in less than half a minute. (IHS Markit AutoIntelligence's Abby Chun Tu)

- LG Electronics has been aggressively expanding production capacity of its automotive business in recent years to tap into growing demand from automotive clients for new technology solutions. According to the Yonhap News Agency, the company states in its 2020 business report that production capacity of its vehicle component solutions (VS) division, which manufactures telematics and audio-video-navigation components, reached 29.57 million units in 2020, up from 11.72 million units in 2017. The VS unit has been increasing its capacity targeting advanced markets, such as North America and Europe, with a focus on in-vehicle infotainment solutions. The company's sales from the infotainment sector stood at KRW3.6 trillion (USD3.1 billion) last year, up by 12% year on year (y/y), and accounted for more than 60% of the VS division's total revenue. LG's automotive business is primarily focused on infotainment, powertrain, and the auto lighting system. The VS division reported sales of KRW5.80 trillion in 2020, up by 6.1% from a year ago. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Hyundai's vice-chairman Chung Euisun said that the company has recently received certification for Level 4 autonomous technology. The automaker expects commercialization of fully autonomous vehicles (AVs) in 2023, reports Pulse News Korea. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Australian state of Victoria is set to become the first to introduce taxes on electric vehicles (EVs). According to the Australian Associated Press, if the law is passed by parliament, the state will levy a tax of 2.5 cents for every kilometer driven by EVs and a tax of 2 cents on plug-in hybrid electric vehicles (PHEVs). The state government is expected to raise AUD30 million (USD23.2 million) over four years with the introduction of these taxes. Although EVs are more environmentally friendly than internal combustion engine vehicles, they put a dent in the coffers of government authorities, which could have received millions in taxes if those who bought an EV had bought a fossil-fuel-propelled vehicle instead. It will be interesting to see how this proposed policy affects sales of EVs in Australia in the near future. (IHS Markit AutoIntelligence's Nitin Budhiraja)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-march-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-march-2021.html&text=Daily+Global+Market+Summary+-+17+March+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-march-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 17 March 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-march-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+17+March+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-march-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}