Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 18, 2022

Daily Global Market Summary - 18 February 2022

All major US and European equity indices closed lower, while APAC markets closed mixed. US and most benchmark European government bonds closed higher. European iTraxx and CDX-NA closed wider across IG and high yield. The US dollar, silver, and oil closed higher, while gold, copper, and natural gas were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower; DJIA -0.7%, S&P 500 -0.7%, Russell 2000 -0.9%, and Nasdaq -1.2%.

- 10yr US govt bonds closed -4bps/1.93% yield and 30yr bonds -6bps/2.24% yield.

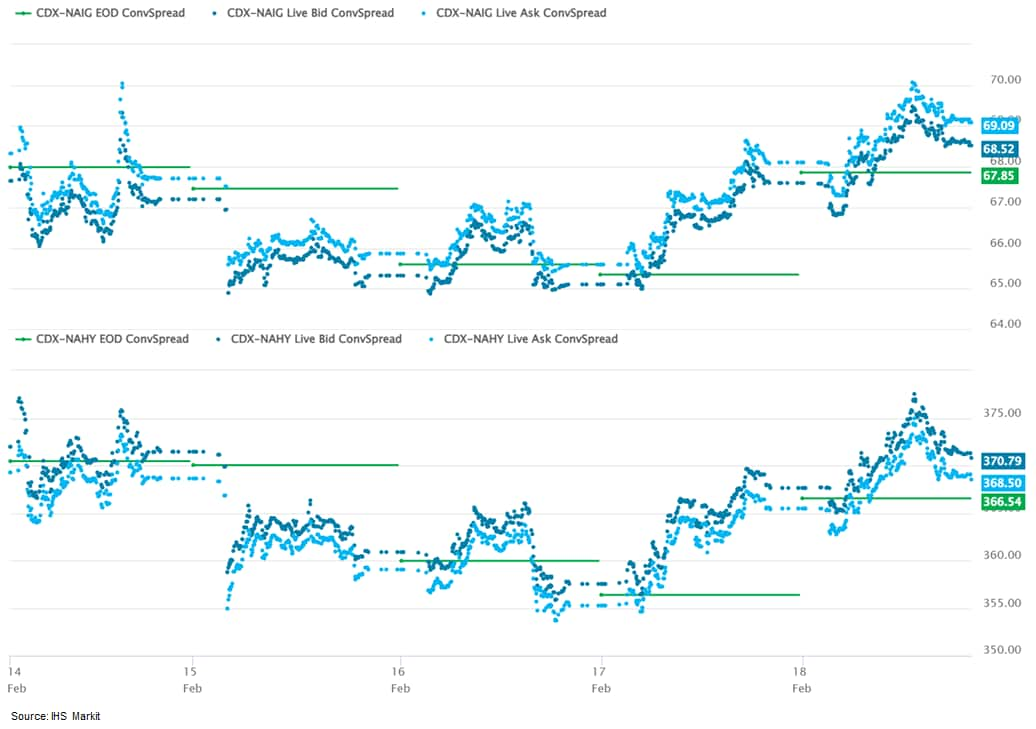

- CDX-NAIG closed +1bp/69bps and CDX-NAHY +3bps/370bps, which is

+1bp and flat week-over-week, respectively.

- DXY US dollar index closed +0.3%/96.04.

- Gold closed -0.1%/$1,900 per troy oz, silver +0.5%/$23.99 per troy oz, and copper -0.1%/$4.52 per pound.

- Crude oil closed +0.2%/$90.21 per barrel and natural gas closed -1.2%/$4.43 per mmbtu.

- Cryptocurrency miners are poised to play an increasingly large

role in addressing the vulnerabilities of the US power grid, even

as scrutiny from lawmakers intensifies after miners decamped in

droves to American shores following a Chinese government ban,

raising electricity price and climate impact concerns. (IHS Markit

Net-Zero Business Daily's Keiron Greenhalgh)

- Miners can currently provide speedy flexibility for grid operators, and at least one company recently stopped production during wintry blasts of weather to sell the power under its control. But the future offers even greater rewards for the backbone of President Joe Biden's climate goals, analysts and executives say.

- Cryptocurrency mining has possibilities as an additional revenue source for solar or wind developers, a storage asset, or even a strategy for regulated utilities to make money with, they say.

- The dominant cryptocurrency is Bitcoin. Bitcoin mining's total known power use globally was 3.338 GW at the end of December, according to data compiled by Coinshares Research, a Jersey, Channel Islands-headquartered digital investment house. The largest share of that mining power use was based in the US at 1.38 GW, or 41.3%, while 787 MW or 23.6% was in Kazakhstan.

- America's share of Bitcoin mining increased from 4% in August 2019 to 35% in July 2021, according to US Senator Elizabeth Warren, Democrat-Massachussets. The US' share of mining soared after the Chinese ban came into effect in May 2021 and then was updated in September 2021, which the lawmaker said left 500,000 mining operations looking for new homes.

- Computer servers known as "mining rigs" perform complex calculations to earn cryptocurrency blockchain such as Bitcoin. These servers require vast computational power and substantial amounts of electricity. As a result, miners typically seek out the cheapest power as a result. Where that is coal-fired generation, miners have attracted negative publicity against the backdrop of more ambitious US climate goals.

- Warren and fellow lawmakers Sheldon Whitehouse, Jeff Merkley, Maggie Hassan, Ed Markey, Katie Porter, Rashida Tlaib, and Jared Huffman, sent letters 27 January to crypto mining companies seeking answers on their grid and climate impact. The six companies—Riot Blockchain, Marathon Digital Holdings, Stronghold Digital Mining, Bitdeer, Bitfury Group, and Bit Digital—were given until 10 February to respond.

- "The extraordinarily high energy usage and carbon emissions associated with Bitcoin mining could undermine our hard work to tackle the climate crisis—not to mention the harmful impacts crypto mining has on local environments and electricity prices," said Warren in a statement revealing her latest consumer protection inquiries.

- US single-family housing permits, perhaps the most important

number in this report, increased for the fourth straight month,

jumping 6.8% to a 1.205-million-unit rate. The three-month moving

average for single-family permits is moving up in all four Census

regions. Single-family permits matter a lot because they are well

measured, forward-looking, and are affected less by weather than

single-family housing starts. Multifamily permits dropped to a

694,000-unit annual rate—the second highest in 30 years after

December's 757,000-unit 30-year high. (IHS Markit Economist Patrick

Newport)

- Builders took out an annualized 1.899 million housing permits in January, the highest total since May 2006.

- Housing starts fell 4.1% (plus or minus 13.7%, not statistically significant) in January to a still-solid 1.638 million unit annual rate. Single-family starts dropped 5.6% (plus or minus 12.0%, not statistically significant) to a 1.116 million rate, and multifamily starts fell 0.8% to a still solid 522,000-unit yearly rate, only the seventh time in the past 30 years this category has crossed the 500,000-unit threshold.

- The number of homes under construction increased to a seasonally adjusted 1.543 million in January. That is the highest total since September 1973 and partly explains why builders are struggling to find labor and materials.

- This month, the Census changed the way it measures permits. The new method, the "cutoff sample," uses data from state and state and local governments "with the highest level of permit activity" and models those with "little to no permit activity." The previous "representative sample "method, sampled about half of permit issuing places monthly and collected hard data from the rest annually. The new methodology will allow the Census to publish monthly county and metropolitan housing permits estimates.

- US seasonally adjusted e-commerce retail sales registered

$218.5 billion in the fourth quarter of 2021, a 1.7% increase from

the third quarter and 9.4% year on year (y/y); e-commerce retail

sales have increased 45.0% over the last eight quarters. (IHS

Markit Economist Patrick

Newport)

- The e-commerce share of total retail trade edged down from 13.0% to 12.9%. The share was 11.0% in the fourth quarter of 2019 and then shot up after the pandemic struck; it peaked at 15.7% in the third quarter of 2020 amid business closures.

- Total e-commerce sales for 2021 totaled $870.8 billion, up 14.2% from 2020. Total retail sales in 2021 increased 17.9% from 2020. E-commerce sales in 2021 accounted for 13.2% of total sales, down from 13.6% in 2020.

- Going forward, we expect that e-commerce retail sales as a share of total retail will ramp back up over the fourth quarter and continue on an upward trajectory as consumers remain cautious about COVID-19. Consumers have embraced online shopping as a permanently larger part of their retail consumption, and so we do not expect the share to decline toward its pre-pandemic level even if COVID-19 concerns eventually dissipate.

- Nissan has announced investment into its Canton (Mississippi, US) plant for electric vehicle (EV) production in 2025, and has promised further investment. The investment will make room for a new Nissan EV and a new Infiniti EV, according to statements from both brands. Nissan says the investment is "preserving and upskilling" 2,000 jobs, suggesting it is not requiring new hires. Nissan COO Ashwani Gupta said, "Today's announcement is the first of several new investments that will drive the EV revolution in the United States. Nissan is making a strong investment in Canton's future, bringing the latest technology, training and process to create a truly best-in-class EV manufacturing team." Infiniti also confirmed its involvement, with chairman Peyman Kargar saying, "By 2030 we envisage that the majority of INFINITI models sold globally will be electrified. In confirming one of the future locations where our new generation of electric products will be built, we progress towards achieving this goal." Nissan has indicated that it expects 40% of its US sales to be electric vehicles by 2030. The announcement is the first direct impact for the US for Nissan's Ambition 2030 project to raise the company's EV sales in the US to 40% of its annual volume in 2030. (IHS Markit AutoIntelligence's Stephanie Brinley)

- On-demand transit technology company RideCo has raised USD20 million in Series A funding round led by Eclipse Ventures. The company plans to use the capital to continue to accelerate its growth and innovation in product engineering and customer support. Prem Gururajan, co-founder and CEO of RideCo, said, "We built RideCo because our own family members were struggling to use transit to get to work, and we realized that this is an unnecessary challenge millions of people around the world struggle with daily". RideCo was launched in 2015 with an aim to make transit convenient to ride and cost-effective to operate. The company partners with public transportation agencies, municipalities, and local fleet operators to design and operate on-demand transit services that address travel pain points for both riders and agencies. RideCo's software has powered more than 60 services throughout cities worldwide. Its biggest competitor is Via, whose software is used by more than 500 partners in 35 countries. (IHS Markit Automotive Mobility's Surabhi Rajpal)

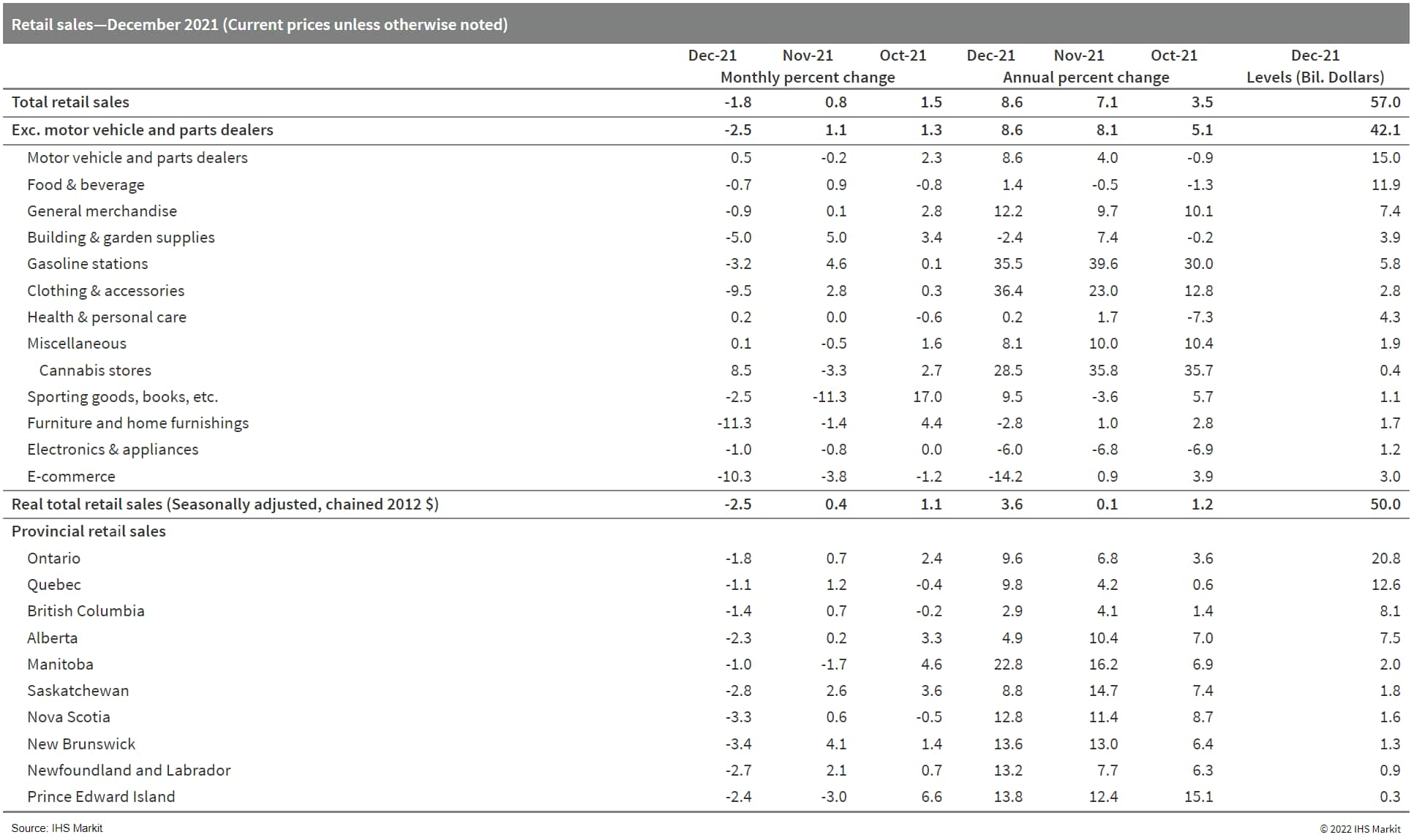

- Canada's retail sales dropped 1.8% month on month (m/m) to

$57.0 billion in December, a smaller decline than initially

reported by the advance estimate. For a modest headline decline in

retail sales, weaker sales performance was broad in December.

Retail volumes fell by 2.5% m/m, removing gains from earlier in the

quarter. (IHS Markit Economist Evan Andrade)

- The advance estimate for January was a gain of 2.4% m/m. This is surprisingly strong given the rapid introduction of public health restrictions and most likely reflects rising implicit inflationary prices impacts.

- Of the 11 retail categories, 8 reported sales declines from November. Clothing and accessories store sales had a disappointing end to the holiday season, as sales fell 9.5% m/m. This was the largest contribution to the headline decline.

- Building material and garden equipment store sales fell 5.0% m/m after a strong four-month run, while furniture and home furnishings fell a considerable 11.3% m/m. Gasoline station sales fell 3.2% m/m, as people were subject to public health restrictions and advised to work from home. Vehicle and parts dealer sales managed to rise modestly, but this was due to parts and other vehicle dealer sales.

- Both new and used car dealerships reported weaker sales. While

many public health restrictions were imposed prior to Christmas,

sales were still 8.6% higher than a year earlier. In addition,

weekly December consumer confidence readings saw only minor

deterioration in the second half of the month.

- Brazil's Braskem and France's Veolia will jointly invest in a

renewable energy project in Alagoas to power its petrochemical

production, Braskem said this week. The Brazilian petrochemical

company signed a BRL 400 million ($77 million) investment agreement

with French environmental services company Veolia to produce

renewable energy using steam from eucalyptus biomass, Braskem said.

(IHS Markit Chemical Market Advisory Service's Chuan Ong)

- The project will generate 900,000 mt/yr of steam for 20 years, which will mean emission reductions of approximately 150,000 mt/yr of CO2, said Braskem.

- Braskem plans to site the plant in Marechal Deodoro municipality in Brazil's state of Alagoas, and to begin operating in 2023.

- The company expects the project advances two of its objectives: a 15% reduction in greenhouse gas emissions by 2030, and achieving carbon neutrality by 2050.

- The eucalyptus biomass project is a new energy generation method for Braskem that is intended to sustainably fulfil steam demand for petrochemical plant operations, the company said.

- "We will reduce the greenhouse gas emissions generated by our operations in Alagoas by one-third, based on our 2020 emissions," said a Braskem executive.

- Veolia will manage most of the project, including agricultural and forestry management involving over 5,500 hectares of eucalyptus groves. It will also handle the engineering concept of the project, construction of biomass processing and steam production plants, plus operation and maintenance of the entire facility for the 20-year agreement period, said Braskem.

- It will make internal investments to adapt its Marechal Deodoro complex to this new thermoelectric system.

Europe/Middle East/Africa

- All major European equity markets closed lower for a second consecutive day; France/UK -0.3%, Italy -0.6%, Spain -0.9%, and Germany -1.5%.

- Most major 10yr European govt bonds closed higher; UK -8bps, Germany -4bps, France -2bps, and Italy +1bp.

- iTraxx-Europe closed +3bps/70bps and iTraxx-Xover

+10bps/341bps, which is +3bps and +17bps week-over-week,

respectively.

- A global investor group voiced its concern that European

companies and financial institutions will not submit complete

reports as required under the 2020 EU Taxonomy regulation. A paper

by the Switzerland-based investor trade body, the International

Capital Market Association (ICMA), says investors and companies

will be unable to fully use the EU Taxonomy and its delegated acts

that specify which sustainable investments are in step with the EU

as it moves towards carbon neutrality. (IHS Markit Net-Zero

Business Daily's Cristina Brooks)

- Without changes to policy, investors will be "seriously impaired" when they try to label investments as green under the EU Taxonomy regulation, and foreign investors' books may look less green than they are.

- At the same time, the ICMA confirmed an issue that NGOs have previously reported: that certain proposed criteria for gas-fired power plants create a need for grandfathering of investments.

- Using the criteria in the regulation to grade the sustainability of investments, investors such as European financial institutions and companies are required to make disclosures about the turnover, capital spending, and operating expenses of green products they finance.

- Prior to this, they used the ESG financial reporting mechanism known as the 2018 Non-Financial Reporting Directive (NFRD), which captures 11,000 companies in Europe.

- The NFRD is set to be replaced by the Corporate Sustainability Reporting Directive (CSRD) and EU Taxonomy regulation, which will expand reporting requirements to around 50,000 companies, while asset managers and financial advisors will be caught by the Sustainable Finance Disclosure Regulation (SFDR).

- Member states will also have to align the green financial products they issue to the EU Taxonomy rules.

- Green hydrogen producer Hy2Gen AD has secured €200 million

($227.3 million) from a variety of investors to construct

facilities to deliver this clean fuel for use in a variety of

aviation, maritime, ground transport, and industrial applications

in Europe and North America. The Wiesbaden, Germany, company said

it raised the private capital from a variety of investors,

including Hy24, a green hydrogen investment platform launched in

October with the sole purpose of raising €1.5 billion ($1.7

billion) to accelerate large-scale clean hydrogen projects and

infrastructure. (IHS Markit Net-Zero Business Daily's Amena

Saiyid)

- "As early as 2021, we were looking for the best possible combination of financial and strategic investors to build e-fuel production facilities," Hy2Gen CEO said in the 17 February announcement. "These have the potential to decarbonize entire industries and transport sectors. We are now very pleased that all parties have sealed the largest investment in this segment."

- With growing demand from regulators and investors to decarbonize transportation and manufacturing sectors, hydrogen, especially the "green" variety produced from renewable power sources, is increasingly being viewed as an alternative to carbon-intensive fossil fuels. In liquid form, hydrogen can be transported in existing pipelines or shipped in specially designed seaborne carriers, while in solid form it can be used in fuel cells for automobiles, and can be used to produce steel and cement, two traditionally carbon-intensive industrial processes.

- The International Renewable Energy Agency in January said green hydrogen could be most economical in locations that have "the optimal combination of abundant renewable resources, space for solar or wind farms, and access to water, along with the capability to export to large demand centers."

- The Hy2Gen project is Hy24's first investment foray. It is funding the Hy2Gen from its clean hydrogen infrastructure fund for which it has raised €1 billion ($1.13 billion) to date, Hy24 CEO Pierre-Etienne Franc said in a statement accompanying the 17 February announcement. This investment will enable Hy24 to "step into its role as a catalyst for hydrogen-based projects at scale to foster the energy transition," Franc added. Other investors in the Hy2Gen project include French investment firm Mirova, Canada-based pension fund Caisse de dépôt et placement du Québec (CDQP), and French engineering and construction firm Technip Energies.

- Stellantis is looking to close some of its non-production sites in France, reports Reuters. A company spokesperson told the new service that the company intends to reduce the number of sites in the Paris (France) region that focus on administration and research from five to three as staff shift to working from home. It said that the move would also reduce costs. The representative the sites most likely to close were those at Satory and Trappes. Separately, the Italian government has indicated that it will provide support for battery facility investment planned by Stellantis in the country. Minister of Economic Development Giancarlo Giorgetti was quoted as telling Il Sole 24 Ore in an interview, "We are convinced that Stellantis should continue to be engaged in Italy and the gigafactory in Termoli which [the Italian government] will support with EUR369 million of public money demonstrates this." The senior politician also told the newspaper that a package of measures to support the purchase of low emission vehicles and the conversion of facilities to battery electric vehicles (BEVs) worth around EUR1 billion per year for at least three years could be approved by the government on Friday (18 February). (IHS Markit AutoIntelligence's Ian Fletcher)

- Belgium's Solvay plans to retrofit its soda ash plant in France

with a refuse-derived fuel (RDF) unit which will be operated by

Veolia, Solvay said yesterday. Solvay will build the energy

cogeneration unit at its Dombasle-sur-Meurthe site in France's

Grand Est region, replacing three coal-fired boilers with a boiler

room equipped with two furnaces running on RDF, derived from

non-hazardous waste, the company said. (IHS Markit Chemical Market

Advisory Service's Chuan Ong)

- French environmental services company and Solvay's project partner Veolia expects the boiler room to be the biggest RDF cogeneration unit in France, and one of the largest in Europe.

- Veolia will supply 350,000 mt/yr of RDF to the unit, which will halve Solvay's carbon footprint by 240,000 mt/yr at the site, while eliminating imports of 200,000 mt/year of coal, Veolia said.

- This project will also help locally transform non-recyclable waste into green energy, and reduce water usage by 7%, said Veolia.

- The new cogeneration unit will produce heat and electricity simultaneously, with 181 MW thermal power and 17.5 MW electrical power that will be used for industrial processes, said Veolia, which will operate it from 2024.

- Solvay, which said it targets carbon neutrality by 2050, expects savings from the RDF cogeneration unit amid volatile fossil fuel prices, and taxes imposed on coal use. According to Veolia, the Solvay site in Dombasle-sur-Meurthe was founded in 1873, and is one of Solvay's oldest soda ash plants - it produces both sodium carbonate (soda ash) and sodium bicarbonate, supplying the glass, detergent and chemical, health, agri-food, animal feed and flue gas purification markets.

- OPIS records indicate that Solvay can produce 700,000 mt/yr of soda ash and 120,000 mt/yr of sodium carbonate in Dombasle.

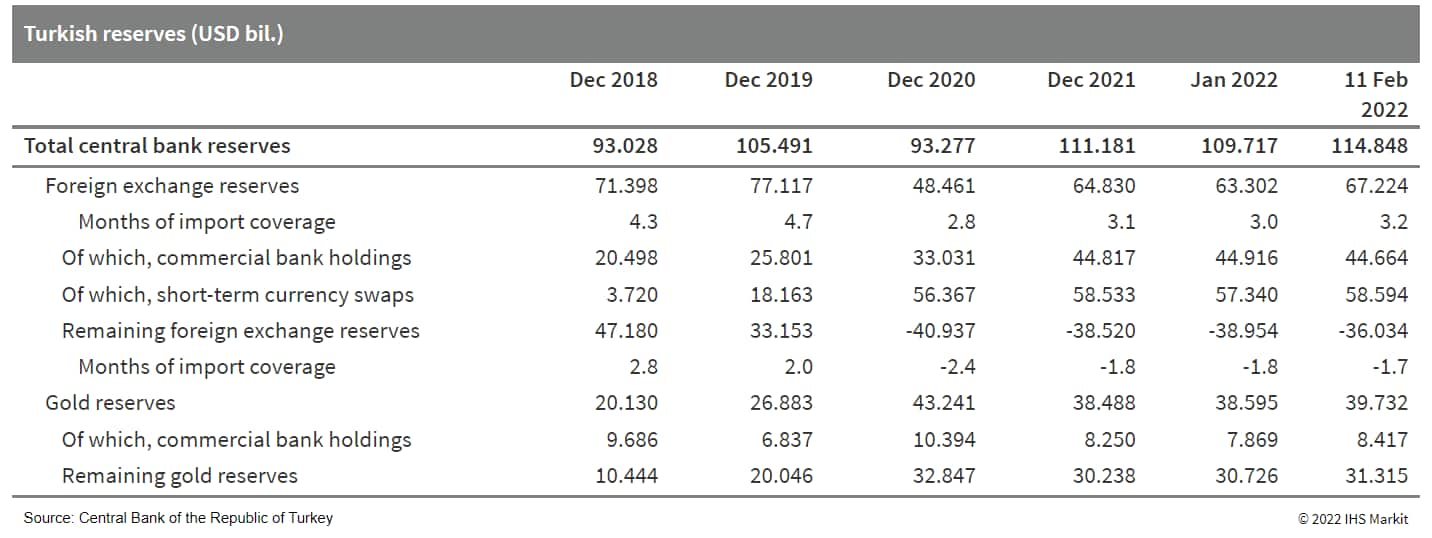

- The Monetary Policy Committee of the Central Bank of the

Republic of Turkey (Türkiye Cumhuriyet Merkez Bankası: TCMB) held

its main policy rate, the one-week repo rate, unchanged at 14.0% at

its regularly scheduled, monthly policy-setting meeting on 17

February. This was the second month in a row that the rate was held

steady after the bank reduced the rate by 500 basis points between

September and December 2021. (IHS Markit Economist Andrew

Birch)

- In its press release alongside the meeting, the TCMB states that current inflation is "driven by pricing formations that are not supported by economic fundamentals". Included in these pressures are global energy prices, food and commodity prices, ongoing supply constraints, and demand developments.

- The bank claims to be confident that a disinflation process will begin soon given actions taken by the TCMB and the government and due to shifting base effects. For those reasons, the bank declined to raise the policy rate even though the annual inflation rate soared to 48.7% in January.

- In recent weeks, President Recep Tayyip Erdoǧan has pushed through a couple of administrative changes to try to limit inflationary pressures. On 16 February, he announced that the government would adjust electricity tariff levels, benefiting 4 million households. Additionally, his energy secretary announced the next day a 25% reduction in electricity prices for small tradespeople. These moves partially reverse the sharp increase in energy prices that began immediately after the beginning of the year. Those price adjustments have triggered a wave of protests.

- Additionally, the government had previously announced the

reduction of sales taxes on many foods from 8% to 1% in the hope of

combatting inflationary pressures.

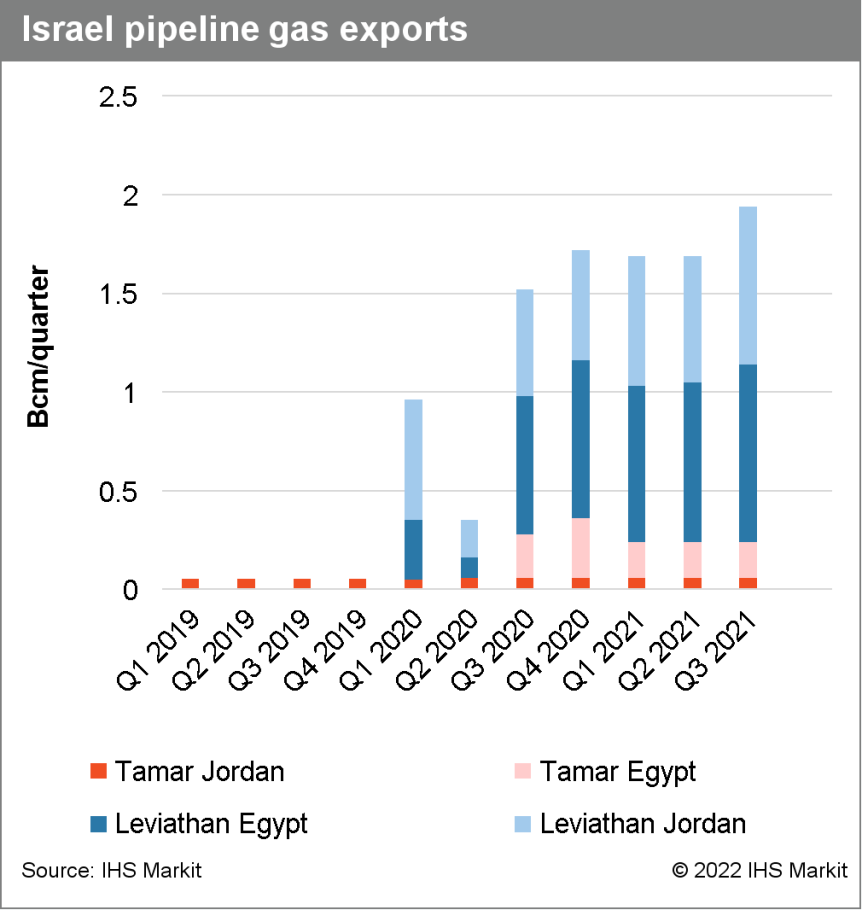

- Israel's Ministry of Energy has approved the start-up of gas

flows via Jordan to Egypt, effectively retooling the Arab Gas

Pipeline to meet the volumes agreed as part of the 85.3 Bcm Blue

Ocean Energy (formerly Dolphinus) contract with the Leviathan and

Tamar partners. The partners in Israel's two producing fields are

already supplying Egypt with about 4-5 Bcm of gas under the same

contract via the el-Arish Ashkelon pipeline, but a schedule to

increase volumes to 6.7 Bcm/year from July 2022 has run up against

constraints on the southern Israeli grid, which will take more than

a year to work around. The Israeli ministry reported that exports

to Egypt through the Arab Gas Pipeline could start later this

month, reaching some 2.5-3 Bcm in 2022, with potential to increase

to 4 Bcm/year in future, alongside supplies of around 3 Bcm/year to

Jordan supplied under. This is a win-win for regional gas

diplomacy, fostering further ties in the southeastern

Mediterranean, maximizing Egypt's export capacity, helping reduce

upstream spare capacity in Israel, and likely earning transit gas

royalties for energy-poor Jordan. (IHS Markit E&P Terms and

Above-Ground Risk's Catherine

Hunter)

- The National Bank of Rwanda raised its policy rate by 50 basis

points to 5% during its February meeting for fear that food costs

could push inflation above the 8% medium-term inflation target.

(IHS Markit Economist Ronel Oberholzer)

- The increase in the policy rate from 4.5% to 5% is the first rate increase since May 2012. The central bank expects inflation to average 7.5% in 2022. Monetary policy in Rwanda shifted to a price-based approach in January 2019 from a quantity-based monetary policy framework. As a result, the medium-term inflation target is now between 2% and 8%.

- The latest figures from the National Institute of Statistics of Rwanda show that the Urban Consumer Price Index (CPI) - the headline index for monetary policy purposes - increased by 4.3% year on year (y/y) in January 2021 compared with 1.9% y/y in December 2021. This translates into a 2.1% month-on-month (m/m) jump between December 2021 and January 2022.

- The monthly increase was attributed to the stellar increase in the food and non-alcoholic category of 4.5% m/m, as meat, in particular, increased by 7.2% m/m. Other categories that contributed to the monthly increase includes transport (4.7% m/m); alcoholic beverages, tobacco, and narcotics (5.6% m/m); and education (19.2% m/m).

- IHS Markit has revised its outlook on Rwanda's inflation upwards to 7.7% y/y for 2022 from the previously expected 4.7% y/y, reflecting the diminishing base-year effects of low food prices, rapid domestic growth, and supply-side bottlenecks. Moreover, the gains from the previous year from a bumper harvest that muted price growth last year have ended as below-average October-December rainfall in the Eastern Province is estimated to have reduced harvests by up to 60%.

Asia-Pacific

- Major APAC equity markets closed mixed; Mainland China +0.7%, South Korea flat, India -0.1%, Japan -0.4%, Australia -1.0%, and Hong Kong -1.9%.

- Baidu has launched trial operation of its Apollo Go robotaxi service in the Chinese city of Shenzhen, according to a company statement. Users can hail a ride via the Apollo Go app at one of approximately 50 stations in Shenzhen's Nanshan district to provide them with access to residential areas, commercial areas, entertainment and cultural areas, and other high-frequency transport destinations. The company said it plans to expand the service to more than 300 stations in Shenzhen by the end of 2022. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Volkswagen (VW) is in talks with Chinese tech giant Huawei about acquiring an autonomous vehicle unit, reports Reuters citing German business magazine Manager Magazin. The automaker is said to have been negotiating the deal for several months, according to Manager Magazin citing inside sources. The automaker declined to comment when approached by Reuters on the matter. VW Group CEO Herbert Diess said on 16 February that the company was pursuing more partnerships to increase its self-sufficiency in software. Diess also said he expects widespread adoption of vehicle automation technologies in cars within 25 years. VW has been expanding its software development unit since 2019, with the aim for all of the group's new models to run on its own operating system from 2025 onwards. It is still too soon to tell if VW could reach a deal with Huawei on the development of automated technologies. A possible tie-up with the Chinese tech giant by either partnerships or acquisitions would strengthen VW's capacity to introduce competitive smart electric vehicles (EVs) to its key markets, especially China. Huawei already introduced its smart cabin and automated driving systems to several new models on sale in China. The Arcfox Alpha-S, an electric sedan introduced by Arcfox, is equipped with Huawei's automated operation systems, while the AITO M5, a new model introduced by Seres, also features Huawei's smart cabin systems. (IHS Markit AutoIntelligence's Abby Chun Tu)

- The Indian government-backed thinktank Niti Aayog plans to

publish the national battery-swapping policy within the next three

months, CEO Amitabh Kant told the Times of India (TOI) in an

interview published on 7 February. On 1 February, while presenting

the Union Budget for 2022-23, India's Finance Minister Nirmala

Sitharaman had proposed the formulation of an electric vehicle (EV)

battery-swapping policy, including the interoperability standards

for these batteries, in order to encourage the adoption of EVs in

the subcontinent. Niti Aayog plans to come up with the EV

battery-swapping standards over the next 60 days, Kant said in his

interview, adding that the government has received an overwhelming

response to the National Programme on Advanced Cell Chemistry

Battery Storage for achieving manufacturing capacity of 50 GW. "We

received responses from 10 bidders for 130 GW, which has surpassed

our expectations," he told TOI. Providing an update on the

government's production linked incentive (PLI) scheme for

automobiles and the auto components industry focusing on EVs, Kant

said that it is expected to bring in fresh investments of over

INR430 billion (USD5.72 billion) and has received a tremendous

response too. He also updated that more than 27 states in India

have moved forward in formulating the state-specific EV policies

and 18 states have already notified these EV policies. Speaking

about the government's FAME scheme, also known as the Faster

Adoption and Manufacturing of Hybrid and Electric Vehicles scheme,

he said that the scheme was completely restructured to reduce the

upfront cost of two-wheelers, three-wheelers and electric buses.

"We have now made the electric two- and three-wheelers cheaper than

the combustion engine vehicles," he said, adding that the FAME

scheme has supported more than 500,000 EVs so far. According to

Kant, while the government has already approved the installation of

2,877 EV charging stations across 68 cities, it has given approval

for another 1,576 EV charging stations across 16 highways and nine

expressways under the FAME scheme. Additionally, India's oil

marketing companies are in the process of installing 2,200

integrated fast charging stations at their respective retail

outlets. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-february-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-february-2022.html&text=Daily+Global+Market+Summary+-+18+February+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-february-2022.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 18 February 2022 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-february-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+18+February+2022+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-february-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}