Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 18, 2022

Daily Global Market Summary - 18 January 2022

All major US and European, and most major APAC equity indices closed lower on the day. US and benchmark European government bonds closed sharply lower. CDX-NA and European iTraxx closed wider across IG and high yield. The US dollar, silver, and oil closed higher, while natural gas, gold, and copper were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed sharply lower; DJIA -1.5%, S&P 500 -1.8%, Nasdaq -2.6%, and Russell 2000 -3.1%.

- 10yr US govt bonds closed +8bps/1.87% yield and 30yr bonds +6bps/2.19% yield, with 10s closing at the highest yield since January 2020.

- CDX-NAIG closed +2bps/55bps and CDX-NAHY +7bps/314bps.

- DXY US dollar index closed +0.6%/95.73.

- Gold closed -0.2%/$1,812 per troy oz, silver +2.5%/$23.49 per troy oz, and copper -0.9%/$4.38 per pound.

- Crude oil closed +1.8%/$84.83 per barrel and natural gas closed -0.8%/$4.05 per mmbtu, with the former closing at the highest price since October 2014.

- Disruptions have helped ease concerns of oil surpluses in

1H2022 and heightened geopolitical tensions are sharpening fears of

potential shortages. Oil prices at the top of our range of

$65-$90/bbl benefit from biases on both sides of the balance

ledger. (IHS Markit Energy Advisory's Roger

Diwan, Karim

Fawaz, Ian Stewart, and Sean Karst)

- Towering inflation rates reaffirm the short-term demand story and push aside risk of Omicron-related slowdowns, while burgeoning fears of limited global spare capacity are stoked as tensions rise on the Ukrainian-Russian border and in the Mideast with the Houthi attack on oil infrastructure in Abu Dhabi.

- Drone attacks on Abu Dhabi over the weekend, while limited in direct impact on oil production, have catapulted the global geopolitical risk temperature that was already rising from Russia-Ukraine to feverish levels, drawing capital into oil markets with no immediate catalyst to create more sellers.

- The Houthi-claimed drone attack on Abu Dhabi is a reflection of

events in Yemen, and the ability of the Houthis to retaliate

against the latest UAE-backed offensive. Importantly, this attack

is an indication that ongoing tensions in the Gulf are unlikely to

be resolved with a prospective Iran deal, if it materializes, with

a scenario for continued escalation even in tandem with

de-escalation on the US-Iran front.

- Municipal bond buyside demand for new issue paper remains in-tact after last week's calendar provided $10.9 billion of par ($) size for institutional participants, marking greater supply to complement overarching investor demand registered across the primary market. The State of Louisiana (Aa2/AA-/-) represented one of the larger negotiated deals from last week, selling $621 million of taxable gasoline and fuel tax revenue refunding bonds, spanning across 05/2022-05/2041, with noteworthy bumps of 10-25bps witnessed throughout the scale given robust investor demand. The Comal Independent School District, TX (Aaa/-/-) also priced in the negotiated arena last week, offering $419 million unlimited tax school building bonds spanning across 02/2023-02/2047 with MAC spreads of +16bps registered in the 10YR maturity, given bumps of 1-5bps noted across the scale, with the greatest bumps noted in the short term durations. This week's Holiday-shortened calendar is slated to provide $8.1 billion of new issue paper, spanning across 182 deals with the New York City Transitional Finance Authority (Aa1/AAA/AAA) leading the negotiated calendar to sell $950 million of future tax secured subordinate bonds across 02/2024-02/2051 on Thursday 01/20 with JP Morgan listed as the book running manager. The New Jersey Transportation Trust Fund Authority (Baa1/BBB/BBB+/A-) will also tap into the negotiated arena to sell $750 million of transportation program bonds spanning 06/2031-06/2050 with ~$385 million of bonds housed in longer dated maturities. This week's competitive calendar will span across 105 new issues for a total of $1.63 billion, led by Fairfax County, Virginia (Aaa/AAA/AAA) auctioning $272 million of public improvement bonds across 10/2022-10/2041, selling on Wednesday 01/19. (IHS Markit Global Market Group's Matthew Gerstenfeld)

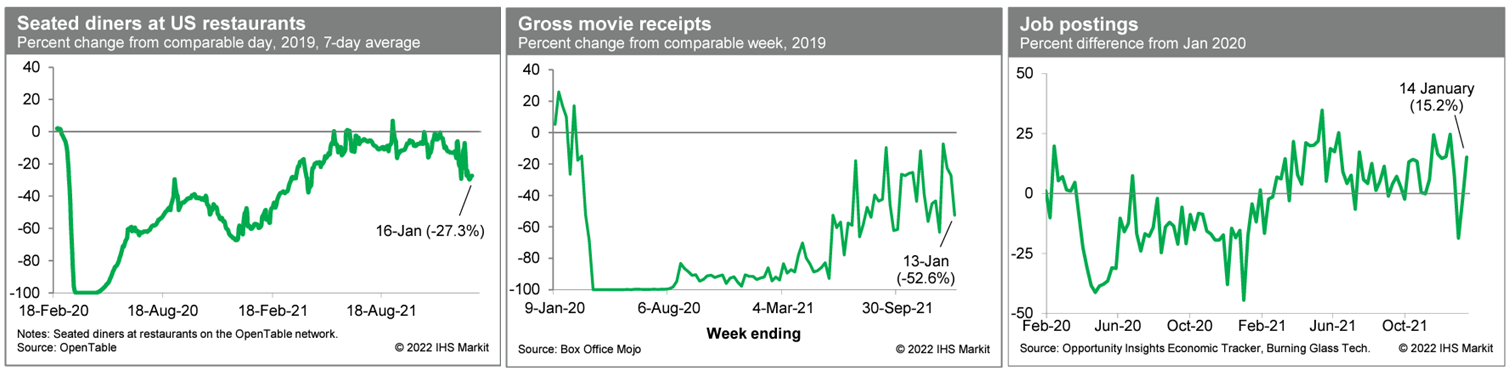

- Averaged over the last seven days, the count of US seated

diners on the OpenTable platform was 27.3% below the comparable

period in 2019. After some volatility around the turn of the year,

this indicator seems to be pointing out some underlying weakness in

dining out in response to the rapid spread of the Omicron variant.

Meanwhile, box-office revenues last week were 52.6% below the

comparable week in 2019. This is in line with averages just prior

to last year's release of Spider-Man: No Way Home and indicative of

ongoing weakness in movie-theater activity. This reading is likely

also indicative of heightened caution on the part of would-be

moviegoers. Finally, job postings last week were 15.2% above the

January 2020 level. This is close to averages during December,

prior to a seasonal lull over the last couple of weeks, suggesting

that labor demand remains on a solid footing. (IHS Markit

Economists Ben

Herzon and Lawrence Nelson)

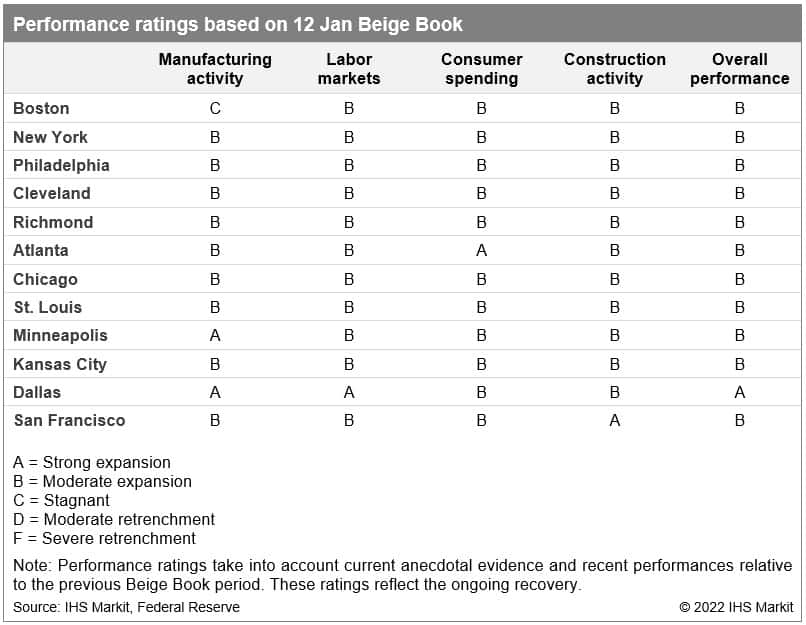

- Robust consumer spending ahead of the holiday season and a

tight labor market contributed to a modest pace of economic growth

in much of the country from late November to December, according to

the US Federal Reserve's latest Beige Book report, containing

anecdotal information from regional business contacts. Stronger

hiring in Texas despite persistent labor and supply chain

challenges led to more robust gains in the state. Retail sales and

leisure spending remained solid for much of December, but the

arrival of the Omicron variant in the Northeast dampened restaurant

and hotel bookings toward the end of the month. Concern over the

degree of spread of the new variant led to widespread postponements

and cancellations of events and conventions throughout the country.

Manufacturers in the Northeast were slowed by difficulties

obtaining materials, while auto producers around the Great Lakes

dealt with the ongoing microchip shortage. Home construction

remained steady, but a lack of workers and materials restrained

home sales. (IHS Markit Economist James

Kelly)

- Consumer spending rose modestly in most regions of the country, but the arrival of a surge in Omicron variant cases negatively affected parts of the Northeast and mid-Atlantic. Holiday retail sales and leisure spending tapered off in New York and Pennsylvania by late December as COVID-19 cases soared. Sick and quarantined workers led to limited service at hotels and shorter hours at restaurants along the East Coast. Hotels and airlines noted canceled bookings throughout the country as concern over the new variant mounted.

- Labor markets expanded moderately around the country with a robust employment rise in Texas. Every region saw very high demand for workers but limited availability of labor. In the South, childcare concerns and remaining federal payments led to shortages of workers. Hospitality businesses in the Northeast noted that fewer workers might be needed going forward as they implement new technology and automation.

- Manufacturing activity increased at a slow pace in the Northeast as supply chain disruptions further hindered deliveries of raw inputs. While Texas and the upper Midwest saw brisk expansions in new orders and production, mainly in food processing and chemicals, the rest of the country managed modest growth. Supply chain challenges and labor shortages persisted in most regions. Manufacturers in the Plains States noted that COVID-19 is not a top concern, but the risk of another surge would likely disrupt operations.

- Construction activity generally remained steady throughout the

country as supply chain problems and increased costs prevented

stronger homebuilding. While builders struggled to keep up with

demand in Missouri, Arkansas, and most of the South, difficulties

obtaining materials and rising prices limited sales of finished

homes.

- The headline US Housing Market Index moved down 1 point in

January to 83, still the fifth-highest reading on record (data

start in 1985). A reading above 50 indicates that more builders

view conditions as good rather than poor. (IHS Markit Economist Patrick

Newport)

- The current sales conditions index was unchanged at 90, the third-highest reading on record; the index measuring sales prospects over the next six months dropped 2 points to 83; the traffic of prospective buyers' index also lost 2 points and now stands at 69.

- By region and three-month averages, the South and West both reached 88 by moving up 1 point; the Northeast lost a point to 73; the Midwest gained a point to 75.

- January's numbers were solid. What is interesting is the contrast between January's among-the-highest readings ever and the National Association of Home Builders (NAHB)'s tone in its press release. For example, the press release opens on a dour note: "Growing inflation concerns and ongoing supply chain disruptions snapped a four-month rise in home builder sentiment even as consumer demand remains robust."

- The reality is that builders are facing stiff, pandemic-fueled headwinds—rising material costs, labor shortages, and issues with the supply chain for building materials—on top of the pre-pandemic headwinds—lack of buildable lots and skilled labor. Another headwind—higher mortgage rates, which have moved up 40 basis points in the past three weeks—is picking up.

- ExxonMobil plans to reach net-zero carbon levels from its

global operating assets by 2050, but not for the downstream use of

the fuels it produces, it said in a progress report released 18

January. (IHS Markit Net-Zero Business Daily's Amena

Saiyid)

- For the supply chain emissions, the global oil and natural gas giant said it would focus on "developing and deploying emission-reducing technologies and products."

- ExxonMobil is the laggard among major US oil companies in announcing net-zero CO2 goals, according to IHS Markit's Markit's Corporate GHG Emissions Tracker, which shows APA, Occidental Petroleum, ConocoPhillips, Chevron, Devon, Diamondback, EOG, Hess, and Pioneer with plans already in place.

- In Advancing Climate Solutions - 2022 Progress Report, ExxonMobil said it would build on its 2030 plans to reduce Scope 1 and 2 GHG emissions across its assets. Scope 1 refers to direct releases from production activity, while Scope 2 refers to the emissions released through purchases of heat and power for its operations.

- These plans include an additional $15 billion over the next six years in lower-emissions solutions, including carbon capture and storage, hydrogen, and biofuels.

- ExxonMobil released 104 million metric tons (mt) of Scope 1 GHGs and 7 million mt of Scope 2 emissions across its crude and gas operations in 2020, according to the progress report.

- Honda and LG Energy Solution are reportedly in early talks to form a joint venture (JV) in the US to set up a KRW4-trillion (USD3.3-billion) electric vehicle (EV) battery factory, reports The Korea Herald. The report mentioned that the two companies are planning to set up a battery plant with annual production capacity of 40 GWh, which it estimates is enough to power nearly 600,000 EVs. Details such as establishment date, location and ownership structure have not been decided yet but are expected to be ironed out in six months, highlights the report. "Nothing has been decided yet," said a company official, who added that the firm "has continued talks with various global automakers for possible partnerships." (IHS Markit AutoIntelligence's Jamal Amir)

- Canada's Housing starts plunged 22.3% month over month (m/m) to

236,106 units (annualized). (IHS Markit Economist Chul-Woo

Hong)

- The plunge in Ontario's housing starts was led by the 56.3% m/m plummet in urban multiples mainly due to the large pullback in the Toronto area. Ontario's urban single starts fell 9.1% m/m. Starts in Alberta and Quebec also fell sharply, returning to more normal levels.

- Urban multiple starts fell 29.0% m/m while urban single starts dropped 4.2% m/m. Rural starts declined 3.4% m/m.

- The loss was concentrated in Ontario (down 46% m/m), hitting the lowest level since May 2020.

- Despite the larger-than-expected drop in housing starts, the overall trend was in line with the IHS Markit expectation that starts will moderate in the short term.

- Total dwellings under construction (not seasonally adjusted) fell for the first time since September 2020.

Europe/Middle East/Africa

- All major European equity markets closed lower; UK -0.6%, Spain/Italy -0.7%, France -0.9%, and Germany -1.0%.

- Major 10yr European govt bonds closed lower; Germany/France/Spain +1bp and Italy/UK +3bps.

- iTraxx-Europe closed +1bp/54bps and iTraxx-Xover +5bps/264bps.

- Brent crude closed +1.2%/$87.51 per barrel, trading at its highest level since October 2014.

- UK-based startup Wayve said that it has raised USD200 million from investors in a series B funding, reports The Business Times. According to the source, the investment will aid Wayve in scaling up its autonomous driving technology globally as well as in launching more pilot projects with commercial fleet partners. The current investment includes funding from D1 Capital Partners, Moore Strategic Ventures, and Linse Capital, and capital from existing investors including Microsoft. Wayve CEO Alex Kendall said, "Instead of telling a car how to drive we've built a system that learns to drive and can learn to do intelligent things." Wayve was founded in 2017 and focuses on artificial intelligence (AI) and machine learning to train systems for autonomous vehicles (AVs), rather than sensors and hand-coded rules. So far, Wayve has raised over USD258 million in funding. Wayve recently partnered with supermarket giant Asda to conduct an autonomous grocery delivery trial. (IHS Markit Automotive Mobility's Tarun Thakur)

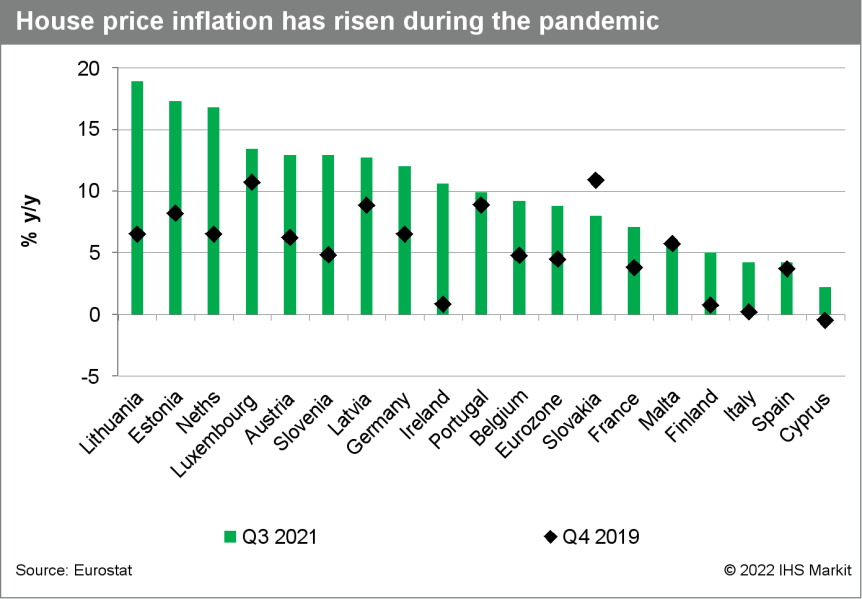

- House prices in the eurozone increased by 8.8% y/y in the third

quarter of 2021, up by two percentage points versus the prior

quarter and the fastest rate of increase in the series' history,

which dates back to 2005. (IHS Markit Economist Ken

Wattret)

- The y/y rate of increase has picked up in seven of the past eight quarters, with the cumulative increase in eurozone house prices compared with the pre-pandemic level exceeding 13%.

- Unlike some other indicators, the exceptionally strong y/y rates of increases in house prices are not a result of base effects. The third quarter of 2021's quarter-on-quarter (q/q) increase was 3.3%, following a 2.6% gain the prior quarter, representing the biggest back-to-back increases on record.

- The strength in the third quarter of 2021's data was broad-based across most of the eurozone, with nine of the 18 member states for which data are available (Greece is the exception) showing y/y increases in double digits.

- In general, although not uniformly, there has been a divide between house price dynamics in the northern member states and those in the south, with the latter having suffered lasting damage in the period after the post-global financial crisis as the bubbles that had built up beforehand burst with devastating consequences. However, although comparatively low, even in the southern member states, y/y rates of increase in house prices have also been picking up in recent quarters.

- Increases in house prices are not a new development in the eurozone. Prices have been increasing on a q/q basis since the start of 2015, consistent with very accommodative monetary policy, reflected in record low interest rates and favorable credit conditions.

- What is relatively new is the acceleration in the pace of the

house price increases in many member states since the start of the

COVID-19 virus pandemic, as demand for accommodation has

strengthened while monetary policy has remained

ultra-stimulative.

- The new German coalition government has modified an initial pledge made at the end of last year to have 15 million fully electric vehicles (EVs) on the country's road by 2030, reports Reuters. According to the report, in an initial policy document, the new government said the target involved fully electric vehicles only, but subsequently it has modified this to include hybrids. Transport Minister Volker Wissing of the Free Democratic Party (FDP) told a forum that the plan had been changed because a target of that number of full battery EVs (BEVs) was too ambitious. He said, "We want electrically powered vehicles. Of course, hybrids also make a contribution to this." However, Wissing's coalition government colleague Stefan Gelbhaar of the Green Party, who is an expert on environmental transport policy, hinted that he disagreed with the decision to abandon the BEV target. He said, "We agreed on a clear goal in the coalition agreement of at least 15 million fully electric passenger vehicles by 2030. I am confident that Transport Minister Volker Wissing will make clear and swift progress here." (IHS Markit AutoIntelligence's Tim Urquhart)

- Spain's farming industries expect production costs to rise

significantly in 2021, increasing from 47% of revenues to 62%,

driven by major increases in important inputs. (IHS Markit Food and

Agricultural Commodities' Jose Gutierrez)

- Farming associations estimates year-on-year rises in 2021 in electricity (up 300%), diesel oil (up 80%), fertilizers (up 50%), animal feed (up 26%), seeds (up 20%) and irrigation water (up 33%).

- Electricity is essential for coldstores and irrigation. The Spanish irrigated area totals around 3.8 million hectares (14% of the planted area), producing around 65% of total volume, and the technology which cuts water expenses is itself intensive in electricity consumption.

- Agricultural production costs in Spain rose significantly last year, driven largely by increases in the cost of diesel oil and electricity. The government estimates costs grew almost 11% between June 2020 and August 2021 with energy costs 38% higher, and fertilizers and animal feed costs rising by 12% and 16%, respectively.

- Farmgate prices kept pace, up by 12% in August 2021 year-on-year. However, there was significant variation between crops, with cereals rising 35%, oilseeds/beets up 45%, olive oil up 64% and citrus fruit up 26%. Meanwhile, livestock and dairy prices were up only 2%, vegetables up 4%, grapes/must/wine/vinegar up 9% and potatoes down 13%.

- Prices for Spanish agricultural products are likely to rise in H1 2022 and begin to stabilize in Q3.

- Financial markets have started factoring in risks associated

with the unabating tensions along the Russian-Ukrainian border, but

no major risk adjustments have taken place yet. Both the Russian

ruble and the Ukrainian hryvnia have recorded a notable decline in

their external values against the US dollar in the past five days,

as debt yields of the two countries climbed. (IHS Markit Economist

Lilit

Gevorgyan)

- The USD/RUS pair was priced at 76.5 at the time of writing this article, marking a nine-month low. The ruble fell by 3% following unsuccessful Russia-US talks over the security demands presented by Russia to prevent the NATO expansion last week.

- The ruble's weakness is comparable to its losses in April, when markets also expressed some concern over the military build-up of Russian and Ukrainian forces at the common border and the increased risk of new large-scale clashes.

- It is noteworthy that the recent peak of weakness for the ruble was on 5 January. At that point, the USD/RUS pair rose to 76.7. The ruble felt the impact of the Ukrainian crisis, as well as the Russian troops' arrival in Kazakhstan to support the incumbent president in quelling political and social unrest in the Central Asian country.

- Ruble-based asset prices have also tumbled in recent days. The MOEX index, which is the main ruble-denominated benchmark of the Russian stock market, has fallen by 6.6% since the start of the year. Ruble-based assets have experienced the worst selloff since April 2020 when the Russian economy was hit by the historic collapse in crude oil prices and the start of the COVID-19 virus pandemic.

- The Russian RTX index, the dollar-denominated benchmark for the Russian stock market, fell again on 17 January when the markets opened. State-owned Sberbank Rossii, Yandex, and energy giant Rosneft have seen the largest sell off in recent days.

- Russian 10-year government bond yields increased notably, hitting the levels seen in March 2020. Bond yields rose to 9.26% on 17 January. Unlike other measures of market reaction, the sovereign bond yields showed strong anxiety.

- The long-term ruble denominated OFZ treasury bond yields rose to 9.45%, marking a six-year high. Nonetheless, the OFZ bond yields remain far below the recent historic high of 14.39% on 12 January 2015, reported at the peak of the Russia-Ukraine conflict.

- The Ukrainian hryvnia has been on a steady path of weakening against the US dollar since early October 2021, and its losses have accelerated since the start of the current year. At the time of writing this article USD/UAH pair was trading at 28.2, marking 3.5% decline in the tender's value against the USD.

- The National Bank of Ukraine (NBU) reported that its foreign currency reserves had reached USD31 billion by end-2021, offering a measure of buffer. The latest data from the NBU suggest a significant increase in foreign currency sales during 10-14 January to support the hryvnia.

- In annual comparison, the external liquidity injection has increased by nearly ten-fold. The continued pressure on the hryvnia will remain a drag on the NBU's hard currency reserves.

- On the debt front, Ukraine was hit harder than Russia. Ukraine's long-term dollar linked bonds index was up to 11.9% as of 14 January from 9.1% at the start of the year. The sell-off indicates that increased risk perception is outweighing the attractiveness of profitable Ukrainian debt.

- Botswana's CPI inflation edged up 0.1 percentage point to 8.7%

y/y in December 2021, from 8.6% y/y in November, as prices

accelerated moderately in almost all categories. Price data from

statistical agency Statistics Botswana reveal that categories with

the most significant contribution to the December inflation outcome

were transport (4.3%), housing, water, electricity, gas and other

fuels (1.4%), food and non-alcoholic beverages (1.0%), and

miscellaneous goods and services (0.7%). (IHS Markit Economist Archbold

Macheka)

- Price inflation of alcoholic beverages and tobacco increased to 9.4% y/y in December, from 9.2% y/y in November, as the general increase in the price level of alcoholic beverages rose to 10% y/y, compared with 9.8% y/y, during the period under review. Price inflation of food and non-alcoholic beverages increased to 7.2% y/y in December, from 6.7% y/y in the previous month, as prices continued to strengthen of meat (fresh, chilled and frozen), oils and fats and milk, and cheese and milk products.

- Housing, water, electricity, gas and other fuels price inflation came in at 8.2% y/y in December, up slightly from 8.1% y/y in November, supported by the general increase in the sub-index of rent paid by tenants. Despite decelerating moderately, transport price inflation remained elevated at 18.3% y/y in December, compared with 18.7% y/y in the previous month, as prices remained firm in the sub-groups of operation of personal transport and purchase of vehicles.

Asia-Pacific

- Most major APAC equity indices closed lower except for Mainland China +0.8%; Australia -0.1%, Japan -0.3%, Hong Kong -0.4%, South Korea -0.9%, and India -0.9%.

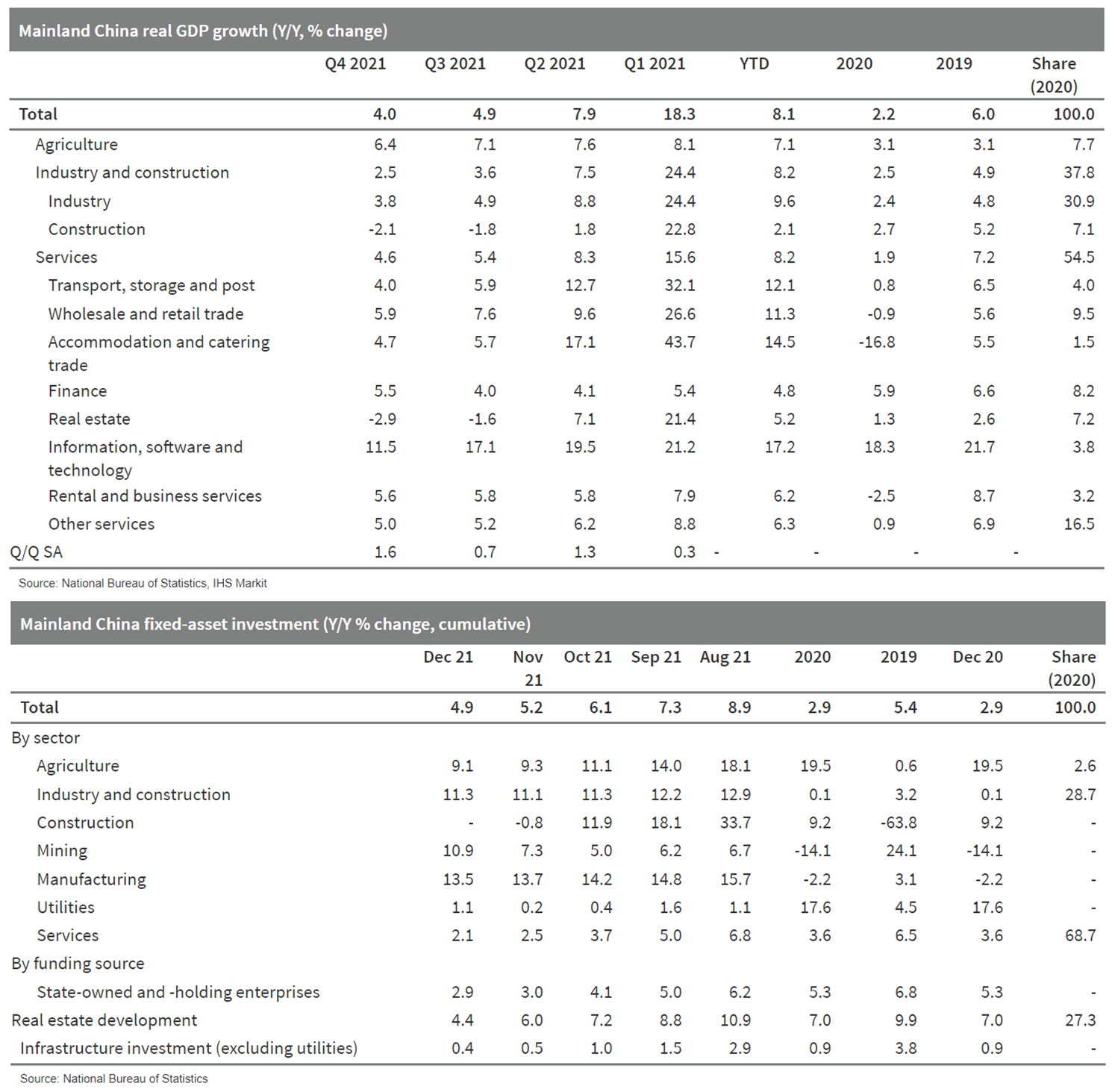

- Mainland China's real GDP grew 8.1% y/y in 2021, recovering

from a pandemic-led low-base of 2.3% in 2020.The 2020-21 average

growth recorded 5.1%, compared with a 6.1% y/y expansion in 2019.

The 2021 full-year nominal GDP came in at CNY114.4 trillion (USD18

trillion) with a growth of 12.8% y/y, implying a 4.4% GDP deflator,

which was the highest since the global financial crisis.

- From supply side, the secondary and tertiary sectors both expanded at 8.2% y/y in 2021, leading the headline GDP recovery. From demand side, consumption drove up real GDP growth by 3.4 percentage points, which was the largest contributor to the annual GDP growth, compared with 0.5 point of drag in the previous year.

- Net exports contributed to an increasing share in GDP growth, from 0.7 percentage point in 2020 to 1 percentage point in 2021. However, the rising contribution from consumption was largely due to the weakening investment, which drove down GDP growth by 0.5 percentage point, compared with a 2.2 percentage point lift in the previous year.

- By quarter, annual growth was in rapid recovery in the first half and slowdown in the second half amid the rising baseline, power shortage, and real estate deleveraging campaign. The y/y growth from the first quarter to the fourth quarter came in at 18.3%, 7.9%, 4.9%, and 4% respectively.

- By sector, the sequential acceleration in the fourth quarter was largely driven by services as its two-year average growth rose by 0.8 percentage point from the third quarter with improvement in rental and business services, accommodation and catering, as well as government-led other services. However, industry and construction and agriculture continued to decelerate from the third quarter to the fourth quarter.

- Industrial value-added growth accelerated to 4.3% y/y in December 2021 from 3.8% y/y in the previous month, the third consecutive month of improvement since the power crunch-led drop in September. Meanwhile, the 2020-21 average growth rose for the first time since May 2021. The month-on-month (m/m) growth accelerated to 0.42% from 0.37 in the previous month. By sector, the headline acceleration was driven by improvement in upstream sectors and stable mid and downstream production. Production in mining accelerated notably and ferrous metals and non-metal minerals improved with speeding up of major infrastructure projects. Meanwhile, auto manufacturing improved for the second consecutive month as the chips shortage eased. Also, high-tech manufacturing, such as telecommunication and pharmaceutical maintained double-digit growth with exports' strength.

- Fixed-asset investment (FAI) improved with accelerated

infrastructure and strong manufacturing growth; real estate

remained the main drag. FAI growth declined to 4.9% y/y through

December from 5.2% y/y in the first 11 months of 2011. On a 2020-21

average basis, the growth at 3.9% was unchanged from the previous

month. According to IHS Markit estimates, de-cumulative FAI in

December increased by 2.1% y/y, the first expansion since

September. The seasonal adjusted m/m figure remained in expansion

but was slightly slower than November growth.

- Mainland China's average new home price deflation narrowed by

0.05 percentage point to 0.28% month on month (m/m) in December

2021, staying in deflation territory for the fourth consecutive

month, according to the survey conducted by the National Bureau of

Statistics covering 70 major cities. (IHS Markit Economist Lei Yi)

- While both tier-2 and tier-3 cities registered smaller month-on-month new home price declines in December, tier-1 cities' average new home price deflation widened to 0.07% m/m in December from 0.03% m/m in November. Notably, Shanghai was the only exception to the general housing price decline among the four tier-1 cities—new home prices in Shanghai registered a gain of 0.4% m/m in December, 0.2 percentage point higher than the month-ago reading.

- Up to 50 out of the 70 surveyed cities reported month-on-month new home price declines in December, down by 9 cities from November. A total of 15 cities registered month-on-month new home price gains, up by 6 cities from the prior month.

- Average year-on-year (y/y) new home price inflation came in at 2.0% y/y in December, lower by 0.4 percentage point from the month before. The disinflation was again broad across city tiers, and tier-1 cities continued to report higher year-on-year new home price inflation than lower-tier cities.

- WeRide (China) announced that it has reached a milestone of 10 million km of autonomous driving on public roads out of which 2.5 million km are in fully driverless mode, according to company sources. The completion of 10 million km will aid WeRide in further optimizing its data models and algorithms. WeRide focuses on deploying Level 4 autonomous vehicles (AVs) on public roads and has offered more than 300,000 robotaxi rides to the general public. The company has received permits to test AVs without a driver in California (US) and Guangzhou (China). It has launched three products: a robotaxi, a mini robobus, and a robovan to provide multiple services including online ride-hailing, on-demand transport, and urban logistics. It has received strategic investments from global automakers including Renault-Nissan-Mitsubishi Alliance, Yutong Group, and GAC Group. In January 2022, WeRide launched a fully driverless minibus service for the public on Guangzhou International Bio Island in China. (IHS Markit Automotive Mobility's Tarun Thakur)

- China's Sinopec Zhenhai Refining & Chemical has achieved

on-spec material at its new monoethylene glycol (MEG) line, a

market source told OPIS today. (IHS Markit Chemical Market Advisory

Service's Chuan Ong)

- This new 800,000 mt/year MEG line is not running at full capacity yet, but production rate is increasing, said the source.

- The company's new line started up in early-January this year. The company runs an older MEG line that can produce 600,000 mt annually.

- Sinopec Zhenhai will now have a total MEG capacity of 1.4 million mt/year at its Ningbo City production base, within China's Zhejiang Province.

- The first phase of production resumed on 12 January at the iPhone manufacturing plant near Chennai in Tamil Nadu, which is operated by Taiwan-based Foxconn, a contractor of Apple. The plant had been closed since mid-December 2021 following strikes by thousands of laborers against reportedly poor housing and living conditions in the plant's dormitories. Foxconn delegates the management of staff at the plant to third-party labor agencies. According to Indian media reports, the full resumption of production would take up to two months. Strikes by laborers similar to those at Foxconn's plant are likely to recur. The strikes resulted from labor-market arrangements that groups of workers or sector-specific trade unions highlight as being harmful to labor interests. Physical damage to assets worth about USD60 million was reported following a strike by thousands of laborers over the non-payment of wages at another iPhone plant operated by Taiwan-based Wistron near Bengaluru, Karnataka in December 2020. The government is unlikely to take action against Foxconn or Apple, but is likely to introduce more standards for third-party labor staffing agencies. In general, there is increasing scope for more labor strikes throughout 2022, with the Indian government proposing to promulgate four laws governing labor arrangements - opposed by most major labor unions - by April. These include rules regarding hiring-and-firing of workers, minimum wages, safety arrangements, and standards for factory audits, among others. Although opposition to the laws will vary by sector and by state, we assess that resolving trade unions' concerns is crucial to achieving India's supply chain and domestic manufacturing objectives. Both smartphone plants where the strikes occurred were established as part of a Production Linked Incentive Scheme (PLIS) that the government initiated in large-scale manufacturing of electronics in 2020. (IHS Markit Country Risk's Deepa Kumar)

- The Bank of Japan (BoJ) left its monetary policy unchanged

during its 17 and 18 January monetary policy meeting (MPM). The

bank will continue quantitative and qualitative monetary easing

(QQE) with yield curve control (YCC). It also left the guidelines

for asset purchases unchanged. The BoJ maintained its commitment to

raising the monetary base until the year-on-year (y/y) rate of

increase in the observed Consumer Price Index (CPI) exceeds 2% and

stays above this target in a stable manner. (IHS Markit Economist

Harumi

Taguchi)

- The BoJ revised up its assessment, now noting that "a pick-up in Japan's economy has become evident", reflecting the ongoing resumption of private consumption in line with the waning negative effects of the coronavirus disease 2019 (COVID-19) pandemic. The bank revised down its real GDP growth forecast for fiscal year (FY) 2021/22 (starting from April 2021) to 2.8% (the medians of the policy board members' forecasts) largely because of supply chain disruption.

- The BoJ revised up its projected growth for FY 2022/23 to 3.8% from 2.9%, anticipating an upside from the government's economic measures and a recovery in production to catch up with demand. The bank's forecast growth for FY 2023/24 was revised down to 1.1% from 1.3%, factoring in the waning effects from those upside factors. The BoJ stated that the risks to the economy remain skewed to the downside, reflecting uncertainties over the pandemic, supply-side constraints, and commodity prices for the time being, but are generally balanced thereafter.

- Despite its solid growth outlook and the recent increases in import prices of goods and corporate good prices, the BoJ revised up its inflation outlooks (the y/y changes in the CPI; all items excluding fresh food) only marginally from 0.9% to 1.1% in FY 2022/23 and from 1.0% to 1.1% in FY 2023/24. The bank mentioned that risks to prices are generally balanced, compared with its previous assessment that they were "skewed to the downside". The BoJ considers that the pass-through of cost increases to selling prices could accelerate by more than expected, depending on the degree of upward pressure from raw material costs, yen depreciation, and firms' inflationary expectations under continuing improvements in the output gap.

- Toyota has announced revised production plans for February 2022. According to a company statement, due to rising numbers of COVID-19 cases among employees and shortages of semiconductor chips, the automaker has adjusted its planned production by around 150,000 units globally to be around 700,000 vehicles. As a result of the revision, the automaker forecasts its total global production in the fiscal year ending 31 March 2022 to be lower than the volume of 9 million units it forecast previously. In Japan, Toyota plans to suspend operations of 11 lines at eight plants for different periods next month. At the Motomachi plant, which produces the GR Yaris, the automaker plans to shut the GR line for 12 days during February. At the Miyata plant, which produces the NX, CT, UX models, production line 1 is to be shut for 10 days. At the Iwate plant, which produces the C-HR, Aqua, and Yaris models, production lines 1 and 2 are to be closed for 11 days. At the Fujimatsu plant, which produces the Noah and Voxy, production line 2 is to be suspended for 13 days. At both the Takaoka plant and the Tsutsumi plant, which produce models including the Corolla, RAV4, Harrier, Prius, and Camry, production lines 1 and 2 are to be shut for two days during February. Since September, Toyota has trimmed its global output substantially owing to challenges in acquiring components because of the spread of the COVID-19 virus in Southeast Asian countries. However, this is the first time that the automaker has lowered its yearly production target of 9 million units. Meanwhile, last week, Toyota's operations at its joint-venture plant in China were affected due to new lockdown and testing protocols after cases of the Omicron variant of COVID-19 surfaced. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- The European Commission vetoed the HHI-DSME merger proposal

citing that the merger would reduce competition and increase

newbuild prices for the LNG carriers. This decision was reached

after the European Union's (EU) in-depth investigation which was

resumed 16 months after its previous suspension. The EU found that

the merger would create a dominant player and reduce the number of

suppliers in the LNG carrier newbuild market as well as lead to

higher prices to transport LNG. (IHS Markit Upstream Costs and

Technology's Jessica

Goh)

- The EU estimated that the LNG carrier construction market represented up to USD45.6 billion (EUR40.0 billion) over the last five years, with European customers accounting up to almost 50% of all orders. The EU did not receive any remedies with regards to the Commission's concern, hence the decision to block the merger was made.

- Back in February 2019, the USD1.8 billion (KRW2.2 trillion) merger was announced with HHI acquiring 55.7% of DSME from KDB (Korea Development Bank). HHI planned to raise USD1.0 billion (KRW1.3 trillion) through the sale of DSME shares to repay DSME's debt after the merger.

- Following the veto by the EU, both companies will withdraw all antitrust filings submitted to various countries for the proposed merger.

- Australia's Electric Vehicle Council (EVC) and the Australian

Trucking Association (ATA) are requesting official policy measures

to promote electrification of commercial vehicles (CVs), reports

AAP Bulletins. The head of the EVC, Behyad Jafari, said, "Every

government in Australia has committed to net-zero, but this can't

be achieved without decarbonizing the transport sector." According

to the report, there is a huge gap between the running costs of a

diesel truck and an electric truck. There are also growing concerns

that if Australia is left behind in the transition to electric and

zero-emission trucks, exporters will become uncompetitive while

stuck with higher freight costs. ATA chair David Smith said, "It

costs about AUD117 to fuel a diesel truck for 300 kilometers, but

just AUD18 for an electric truck." Truckers' bodies have

recommended an exemption for electric trucks from urban curfews on

trucks, a change in Australian weight and width standards to

accommodate electric models, and a waiver on stamp duty for

electric trucks. Truckers' bodies are also calling for subsidies to

reduce the upfront purchase price difference between electric or

zero-emission trucks and ICE trucks. Australia is somewhat late in

rolling out measures for electric vehicles (EVs) compared to

countries such as China, the United States, and several European

countries. In 2019, the Labor Party proposed a climate change

policy aimed at cutting emissions by 45% by 2030, including a push

to increase the number of EVs on the country's roads. (IHS Markit

AutoIntelligence's Nitin Budhiraja)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-january-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-january-2022.html&text=Daily+Global+Market+Summary+-+18+January+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-january-2022.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 18 January 2022 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-january-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+18+January+2022+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-january-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}