Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 19, 2021

Daily Global Market Summary - 19 August 2021

US equity indices closed mixed, while all major European and APAC markets were lower. US government bonds closed higher and benchmark European bonds were mixed on the day. European iTraxx was wider across IG and high yield, while CDX-NA was close to flat on the day. The US dollar closed at the highest level in nine months, while gold, silver, copper, oil, and natural gas were all lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Major US equity indices closed mixed; S&P 500 +0.1%, Nasdaq +0.1%, DJIA -0.2%, and Russell 2000 -1.2%.

- 10yr US govt bonds closed -2bps/1.25% yield and 30yr bonds -2bps/1.88% yield.

- CDX-NAIG closed flat/50bps and CDX-NAHY +1bps/297bps.

- DXY US dollar index closed +0.5%/93.57, which is the highest close since 2 November.

- Gold closed -0.1%/$1,783 per troy oz, silver -0.8%/$23.23 per troy oz, and copper -1.9%/$4.04 per pound. Copper is now 14.9% below the all-time high close of $4.79 per pound set on 11 May.

- Crude oil closed -2.6%/$63.50 per barrel and natural gas closed -0.6%/$3.83 per mmbtu, which is the first consecutive six-day losing streak for Crude oil since February 2020.

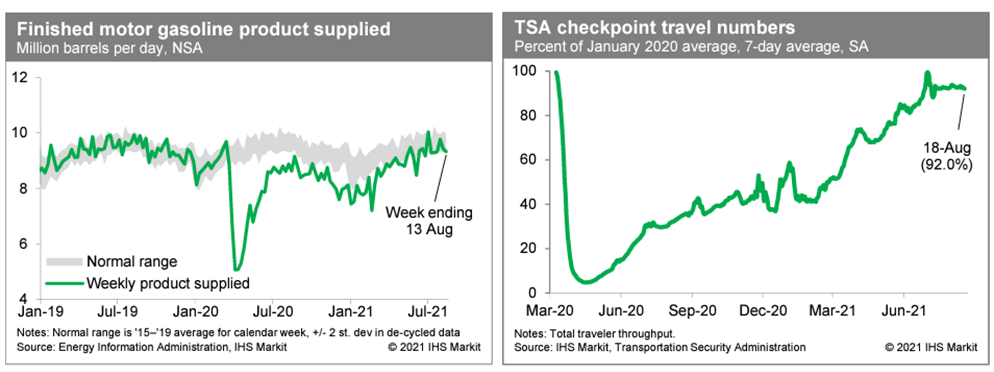

- Consumption of gasoline slipped last week, according to the

Energy Information Administration, but remained near the lower end

of a range that we view to be normal for this time of year. This

suggests that internal mobility has not weakened in response to the

recent surge in COVID-19 infections. Meanwhile, airport passenger

traffic in recent days (after seasonal adjustment) has been running

at 92% of the January 2020 level (our estimate based on daily data

from TSA). This is close to readings over the last month or so, as

the recovery in air travel appears to have stalled somewhat short

of a full recovery. (IHS Markit Economists Ben

Herzon and Joel

Prakken)

- US seasonally adjusted (SA) initial claims for unemployment

insurance fell by 29,000 to 348,000 in the week ended 14 August.

Initial claims declined for the fourth consecutive week and show no

signs of increasing in response to the delta variant driven fourth

wave of COVID-19. While the level of initial claims is trending

down and is far below the pandemic-era high, initial claims closer

to 200,000 would suggest a normal level of "churn" for an economy

in its prime. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs) fell by 79,000 to 2,820,000 in the week ended 7 August, hitting its lowest since 14 March 2020. The insured unemployment rate was unchanged at 2.1%.

- In the week ended 31 July, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) fell by 66,081 to 3,786,488.

- In the week ended 31 July, continuing claims for Pandemic Unemployment Assistance (PUA) rose by 56,881 to 4,877,668.

- In the week ended 31 July, the unadjusted total of continuing claims for benefits in all programs fell by 311,787 to 11,743,515.

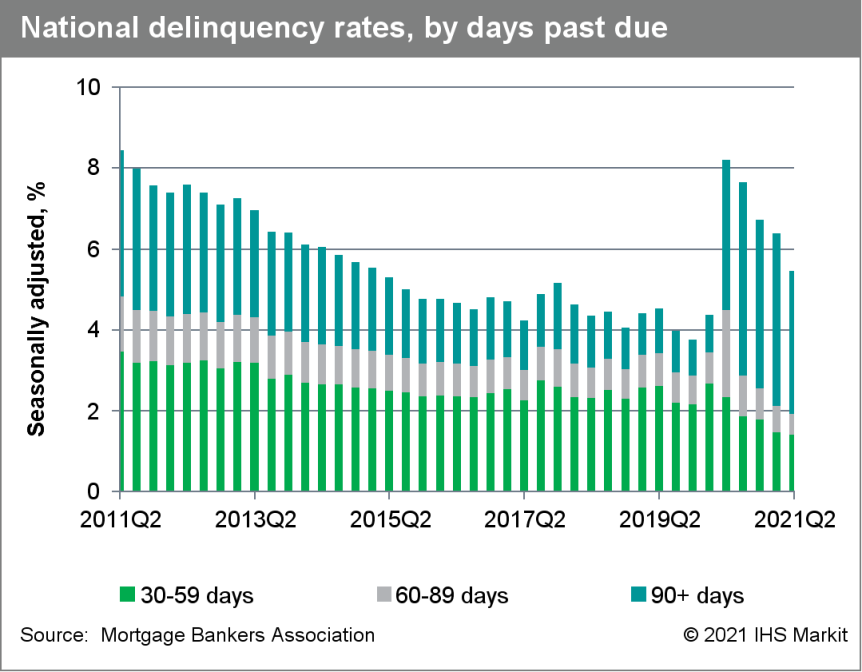

- The seasonally adjusted US mortgage delinquency rate fell 91

basis points from the first quarter and 275 basis points from a

year earlier to 5.47%; it was 3.77% at the end of 2019, the last

quarter not impacted by the pandemic. (IHS Markit Economist Patrick

Newport)

- The serious delinquency rate—loans more than 90 days delinquent or in foreclosure—was 4.03%, down 23 basis points from a year earlier; it was 1.76% in the fourth quarter of 2019.

- The percentage of loans in the foreclosure process was 0.51%, down 17 basis points from a year earlier and the lowest reading since the fourth quarter of 1981.

- The seasonally adjusted 30-day delinquency rate and 60-day delinquency rate fell to 0.41% and 0.52%, respectively—both record lows (data start in 1980).

- The seasonally adjusted rate on new foreclosures remained at a survey low 0.04%—almost zero.

- The key to understanding this report is that the Mortgage Bankers Association (MBA) considers loans in forbearance to be delinquent because "the payment was not made based on the original terms of the mortgage." A forbearance delays, not forgives, mortgage payments.

- Seasonally adjusted US e-commerce retail sales registered

$222.5 billion in the second quarter of 2021, an increase of 3.3%

from the first quarter. (IHS Markit Economist James

Bohnaker)

- Growth was 9.1% year on year (y/y), down from a growth rate of 39.3% in the previous quarter.

- The e-commerce share of total retail trade edged down from 13.6% to 13.3%. Prior to the pandemic, the share was 11.0% in the fourth quarter of 2019 and then peaked at 15.7% in the second quarter of 2020 amid business closures.

- We had expected the share of e-commerce sales to total retail trade to drop to 13.1%, so this report shows that consumers allocated a greater portion of their retail spending to e-commerce purchases on the heels of large stimulus received in the second quarter, despite significantly eased restrictions on in-person shopping and mobility.

- Among retail categories for which detailed e-commerce data is

available, year-on-year growth of e-commerce sales at motor

vehicles and parts stores (49.6%) led the pack. Ecommerce sales at

clothing stores (4.7%) and building materials and garden equipment

stores (5.7%) were also in positive territory while sales in most

other categories eased from their elevated levels last year.

- EPA is banning use of chlorpyrifos on food crops because of the potential neurological harm to children, handing a major victory to environmental groups and farmworker advocates who have been pursuing a ban on the insecticide for more than a decade. The agency announced Wednesday (August 18) that it has finalized a rule to revoke food tolerances for chlorpyrifos after concluding aggregate exposures from use of the insecticide cannot be deemed safe under the Federal Food, Drug and Cosmetic Act (FDCA). The rule will become effective six months after published in the Federal Register. EPA said it will also issue a notice of intent to cancel all registered food uses associated with the revoked tolerances. The decision comes in response to an April 19 order from the US Court of Appeals for the Ninth Circuit that directed EPA to revoke or modify food tolerances for chlorpyrifos to comply with the FDCA. To comply with the court order, EPA is publishing a final rule and is not taking public comment on the tolerance revocations. (IHS Markit Food and Agricultural Policy's JR Pegg)

- Waymo has selected truck fleet operator Ryder System Inc to manage and maintain its Class 8 autonomous trucks, according to a company statement. Under this partnership, Ryder will handle maintenance services for the autonomous trucking unit of Waymo, Waymo Via, at its US sites in Texas, Arizona, California, Michigan, and Ohio, as well as roadside services between hubs. Charlie Jatt, head of commercialization at Waymo Via trucking, said, "There are many synergies between our Waymo Via vision and operations and Ryder's expertise and resources, and we look forward to unlocking best-in-class solutions within the industry and bringing autonomously driven trucks to market throughout the US." (IHS Markit Automotive Mobility Surabhi Rajpal)

- Latin America's demand for hydrogen could grow by as much as two-thirds by 2030, bolstering support for low-carbon hydrogen in the region in the process, a new report found. The International Energy Agency (IEA) on 12 August released "Hydrogen in Latin America: From near-term opportunities to large-scale deployment," which argues that low-carbon hydrogen, as a promising but undeveloped clean technology, could benefit the Latin American regional economy if given the right opportunities. By the same logic, progress is critical in the near term-which the IEA defines as the 2020s-if policy and industry leaders want to see their hydrogen industries compete on the world stage. "The next decade will be crucial for the long-term promise of low-carbon hydrogen in Latin America, and much can be done today to develop and demonstrate emerging technologies and prepare the ground for their future scaling-up," the report said. The report lays out two cases for Latin America's hydrogen growth: a Baseline case is most likely, and an Accelerated case defines a more optimistic growth outlook. The Baseline case shows a demand increase of 52%, reaching 6.2 million metric tons (mt) by 2030. Regional hydrogen demand totaled 4.1 million mt in 2019, or about 5% of global demand, according to the report. Almost all of the Baseline case's growth would occur in existing technologies and processes, specifically in the oil refining sector. Ammonia production likewise would grow by more than 50%, stemming from demand in Brazil and Mexico. In the Accelerated case, demand would rise by 67% to 6.8 million mt. It would be driven by new applications in transportation and industry, as well as a "rapid deployment of enabling infrastructure" like recharging stations for electric vehicles, whose batteries can run on hydrogen fuel cells. (IHS Markit Net-Zero Business Daily's William Fleeson)

Europe/Middle East/Africa

- All major European equity indices closed lower; Spain -0.8%, Germany -1.3%, UK -1.5%, Italy -1.6%, and France -2.4%.

- 10yr European govt bonds closed mixed; UK -3bps, Germany/France -1bp, Spain flat, and Italy +2bps.

- iTraxx-Europe closed +1bp/47bps and iTraxx-Xover +3bps/238bps.

- Brent crude closed -2.6%/$66.45 per barrel.

- A number of initiatives have been announced this week that will

support the UK government's plan for the country to ban the sale of

internal combustion engine (ICE) cars by 2030, while it also wants

the country to become a center of excellence for zero-emission

vehicle (ZEV) manufacturing and technology. Seven companies and

organizations have joined a consortium to develop solid-state

batteries for battery electric vehicles (BEVs) in the UK, according

to a press release. The consortium involves Johnson Matthey,

Faraday Institution, startup Britishvolt, Oxford University, UK

Battery Industrialization Centre, manufacturing experts Emerson

& Renwick, and the University of Warwick. Solid-state battery

technology is seen as something of a holy grail in terms of the

development of BEVs as it offers significant potential advantages

over conventional lithium-ion batteries in terms of energy density

and thus vehicle range. The four projects are (IHS Markit

AutoIntelligence's Tim Urquhart):

- GBP41.2 million of joint industry and government funding will be allocated to REE to develop and manufacture its REEcorner technology, which packages critical vehicle components (including steering, braking, suspension, powertrain and control) into a single compact module located between the chassis and the wheel, enabling fully flat EV platforms for commercial EVss.

- GBP26.2 million of joint industry and government funding will be allocated to the BMW Group to develop an electric battery in Oxford that will rival ICE ranges.

- GBP14.6 million of joint industry and government funding has been awarded to Cummins to develop a novel zero-carbon, hydrogen-fuelled engine for medium and heavy commercial vehicles (MHCVs).

- GBP9.7 million of joint industry and government funding will be committed to a project led by Sprint Power to create ultra-fast charging batteries for electric and fuel cell hybrid vehicles that can charge in as little as 12 minutes.

- The eurozone's seasonally adjusted trade surplus narrowed again

in June. The surplus slipped to EUR12.4 billion, below the upwardly

revised EUR13.8 billion surplus in May and roughly half its

pre-pandemic level. (IHS Markit Economist Ken

Wattret)

- For the second quarter as a whole, the eurozone trade surplus averaged EUR13.2 billion, compared with an average of EUR23.4 billion in the first quarter of 2020.

- Exports from the eurozone declined by 0.7% month on month (m/m) in June (in value terms), only the second decline since April 2020. June's exports were 0.7% below their pre-pandemic level in February 2020.

- During the second quarter overall, exports rose by 2.2% quarter on quarter (q/q), the fourth consecutive increase, although the growth rate moderated in each of those quarters.

- Eurozone imports were unchanged on a m/m basis in June but were 6.6% above their pre-pandemic level. In the second quarter as a whole, imports rose by 8.8% q/q, the fourth consecutive increase and the biggest rise since the third quarter of 2020.

- The last of the "hard" activity releases for June, eurozone construction output, showed a 1.7% m/m contraction, the fourth decline in five months. In level terms, construction output in June was 2.3% below where it was in February 2020.

- Solar became more prominent in the EU energy mix over the last

three years and now generates a record 10% share of power across

the bloc during the peak summer months, led by rising output in the

Netherlands and Spain. Nonetheless, that figure is still surpassed

by the share of power generated by coal plants in the same period

(14%), according to analysis of solar power markets compiled by

UK-based energy think tank and non-profit Ember. (IHS Markit

Net-Zero Business Daily's Cristina Brooks)

- European solar power reached a record level in the June-July 2021 peak months after its capacity grew at an ever-faster rate between 2019 and 2021. The EU states with the highest solar generation shares in their electricity supplies were the Netherlands (17%), Germany (17%), Spain (16%), Greece (13%), and Italy (13%). The bloc saw solar plants in June-July generate 39 TWh, up from 28 TWh in the same period in 2018. However, coal's generation for those summer months remained higher at 58 TWh.

- Not only the bloc, but also eight EU countries set a new solar record share during the summer peak this year: Estonia, Germany, Hungary, Lithuania, the Netherlands, Poland, Portugal, and Spain.

- Estonia and Poland installed large amounts of solar for the first time, reaching 10 and 5% of their generation stacks, respectively, during the peak months, Ember said.

- Germany's Siemens says it will focus on making acquisitions in the area of battery electric vehicle (BEV) charging infrastructure, according to a Reuters report. The acquisitions will be made by the company's Smart Infrastructure (SI) unit division. However, the Siemens board member responsible for the SI division, Matthias Rebellius, said they would be careful not to overpay for any acquisition. He said, "It's less a question of how much you are prepared to pay, and more about... what growth can we create and how much value can we add." Siemens has already been very active making strategic acquisitions this year, spending EUR550 million (USD648 million) on a software acquisition for its mobility business as well as USD700 million on electrical component supplier Supplyframe. (IHS Markit AutoIntelligence's Tim Urquhart)

- The Swiss flavor and essential oil company Firmenich reported that its revenues reached CHF4.2 billion ($4.58 billion) in FY2020-21 (July-June) thanks to consumption recovery in H1 2021. Ebitda totaled CH874 million (+6.2% y/y). Perfumery and ingredients and taste and beyond visions were the drivers of growth thanks to robust recovery in demand for beverages and ingredients, especially in North America, China and India. (IHS Markit Food and Agricultural Commodities' Jose Gutierrez)

- According to Rosstat data, Russian wheat stocks totaled 7.7 million tons as of 1 July, up 250,000 tons compared to the previous year, a three-year high. This figure includes the volume of new-crop wheat which was reduced y/y, as the harvesting campaign was delayed in southern regions, the head of the analytical center at Rusagrotrans JSC, Igor Pavensky explained. He added: "Russia has entered the new season with the highest old-crop wheat stocks since 2018, which will partially offset the expected decline of wheat production in 2021." (IHS Markit Food and Agricultural Commodities' Louisa Sabin)

- South Africa's total real seasonally adjusted retail trade

sales gained by 0.6% month on month (m/m) and 10.9% year on year

(y/y) during June, latest numbers by South Africa Statistical

Service (StatsSA) show. This leaves South Africa's retail sales

volumes solidly above pre-COVID-19 levels. (IHS Markit Economist Thea

Fourie)

- Sectors showing the biggest contribution to the annual gain in total real seasonally adjusted retail trade sale during June included general dealers, followed by the textiles, clothing, footwear and leather goods sector and food, beverages, and tobacco in specialized stores.

- South Africa's headline inflation rate furthermore fell back to 4.6% in July 2021, down from 4,9% in June 2021. The main contributors to the annual increase were food and non-alcoholic beverages (1.1 percentage point); housing and utilities (0.9 percentage point); transport (1.1 percentage point); and miscellaneous goods and services (0.7 percentage point).

- South Africa's headline inflation averaged 4.0% for the first seven months of 2021 from 3.4% for the same period a year ago - well in line with the South African Reserve Bank's inflation target range of 3%-6%.

Asia-Pacific

- All major APAC equity markets closed lower; Australia -0.5%, Mainland China -0.6%, Japan -1.1%, South Korea -1.9%, and Hong Kong -2.1%.

- As a further positive indicator for international investment in

mainland China's debt markets, BlackRock Investment Institute (BII)

has published research stating that China should be viewed as "an

investment destination separate from emerging [and developed]

markets" while stating that its economy has "come through the

COVID-19 shock stronger than global peers, just as it did after the

global financial crisis". According to Wei Li, Chief Investment

Strategist, "China is under-represented in global investors'

portfolios but also, in our view, in global benchmarks". (IHS

Markit Economist Brian

Lawson)

- BII recommends an equity weighting "two to three times" that in current global indices, favoring holdings of around 10% of global portfolios.

- For debt, it favors growing holdings "a bit more" than for equities in some portfolios.

- China's development policy is shifting from "allowing

unbalanced growth" to "social equality," suggesting stronger

measures to regulate excessively high incomes. Chinese leaders

vowed to tackle social inequality and push for "common prosperity"

during an economic policy meeting chaired by President Xi Jinping

on 17 August. (IHS Markit Economist Yating

Xu)

- Income distribution reform was highlighted as a key focus area in the meeting. To realize this goal, top leaders pledged to strengthen regulation of high incomes, through implementing "reasonable adjustment" of excessive incomes and encouraging high-earning groups and enterprises to give back to society. The importance of support for the development of rural areas and small and medium-sized firms, including enhancing rural infrastructure and public service system and protecting intellectual property rights, was also emphasized.

- Authorities at the meeting also underscored the need for concerted action to prevent and resolve major financial risks and enhance steady development of finance.

- Chinese electric vehicle (EV) startup Leapmotor has raised CNY4.5 billion (USD693 million) in a new funding round. China Capital Investment Group and state-owned Assets Supervision and Administration Commission of the Hangzhou municipal government led the funding round, reports Gasgoo. The automaker said the funds would be used for faster product research and development (R&D), as well as branding, promotion, and expansion of its sales network. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Chinese battery manufacturer Contemporary Amperex Technology Co. Ltd (CATL) has signed an agreement with the Shanghai municipal government to set up a high-end manufacturing base in the city, reports Gasgoo. According to the deal, CATL set up a global innovation center to develop advanced materials, structural design, and business models; headquarters of its international businesses, and the energy research institute in Shanghai. The battery supplier has also signed another framework agreement with Sichuan Development Holding for research and development of charging and battery swapping facilities and aerodynamic technologies, the integration of upstream raw materials, smart mining, and commercial vehicle electrification. CATL has been expanding its production capacity in China and overseas to ensure a robust supply of batteries to its customers, including leading OEMs such as Tesla, Hyundai, Daimler Trucks, BMW, SAIC, and GAC Motor. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Chinese electric vehicle (EV) startup Xpeng has signed an agreement with the Zhaoqing municipal government and the Zhaoqing High Technology Industry Development Zone for expansion of its Zhaoqing Smart EV Manufacturing Base in Guangdong Province, according to a company statement. After completion, annual output capacity of the Zhaoqing Base will increase from 100,000 units to 200,000 units. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Autonomous delivery startup Neolix has secured an undisclosed multi-million investment amount in a Series B funding round. The round was co-led by CICC Capital and SoftBank Ventures Asia with participation from existing investors Yunqi Capital and Glory Ventures, reports Gasgoo. Neolix, which was founded in 2014, offers Level 4 autonomous delivery vehicles and has its own production plant. So far, Neolix has deployed nearly 1,000 driverless vehicles in 30 cities across nine countries globally, completing over 1.3 million km. (IHS Markit AutoIntelligence's Surabhi Rajpal)

- Daewoong Pharmaceutical and Hanall Biopharma (both South Korea) have agreed to invest USD1 million in Alloplex Biotherapeutics (US), with the aim of developing the US company's immunotherapy candidates, the companies said in a statement. Under the agreement, the South Korean companies plan to leverage Alloplex's immunotherapy platform to develop an autologous cell therapy derived from peripheral blood mononuclear cells targeting a wide range of tumors. Further financial details were not disclosed. (IHS Markit Life Sciences' Sophie Cairns)

- In its 18 August meeting, the Reserve Bank of New Zealand's

(RBNZ) Monetary Policy Committee (MPC) kept the OCR unchanged from

where it has been since March 2020, despite market expectations of

a rate rise. This decision was made "in the context of the

Government's imposition of Level 4 COVID-19 restrictions on

activity across New Zealand," and follows last month's halting of

new bond purchases under the large scale asset purchase (LSAP)

program. (IHS Markit Economist Andrew Vogel)

- The recent cluster of COVID-19 cases (about 10) and the resultant lockdown - as well as global supply chain disruptions from COVID-19 outbreaks in other countries - highlight the ongoing health and economic risks posed by the pandemic and its variants (such as the Delta variant). The MPC believes these disruptions and their secondary effects on confidence can have a serious dampening effect on the economy, and increase future uncertainty.

- Recent data has been widely positive however, with the New Zealand economy rebounding stronger than most other countries thanks to relatively minimal disruptions caused by COVID-19. According to the MPC, employment has already reached its maximum sustainable level, with the labor market showing evidence of capacity pressures in terms of high vacancies and rising wages despite declining unemployment. Additionally, inflation is projected to briefly rise above 3% due to near-term pressures from rising oil prices, housing costs, and supply shortages before returning around the RBNZ target of 2% by mid-2022.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-august-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-august-2021.html&text=Daily+Global+Market+Summary+-+19+August+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-august-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 19 August 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-august-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+19+August+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-august-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}