Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 19, 2021

Daily Global Market Summary - 19 November 2021

All major European and most US equity indices closed lower, while most APAC markets closed higher. US and benchmark European government bonds closed sharply higher. European iTraxx and CDX-NA closed modestly wider across IG and high yield. The US dollar, natural gas, and copper closed higher, while oil, gold, and silver were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Most major US equity indices closed lower except for Nasdaq +0.4%; S&P 500 -0.1%, DJIA -0.8%, and Russell 2000 -0.9%.

- 10yr US govt bonds closed -6bps/1.55% yield and 30yr bonds -9bps/1.91% yield.

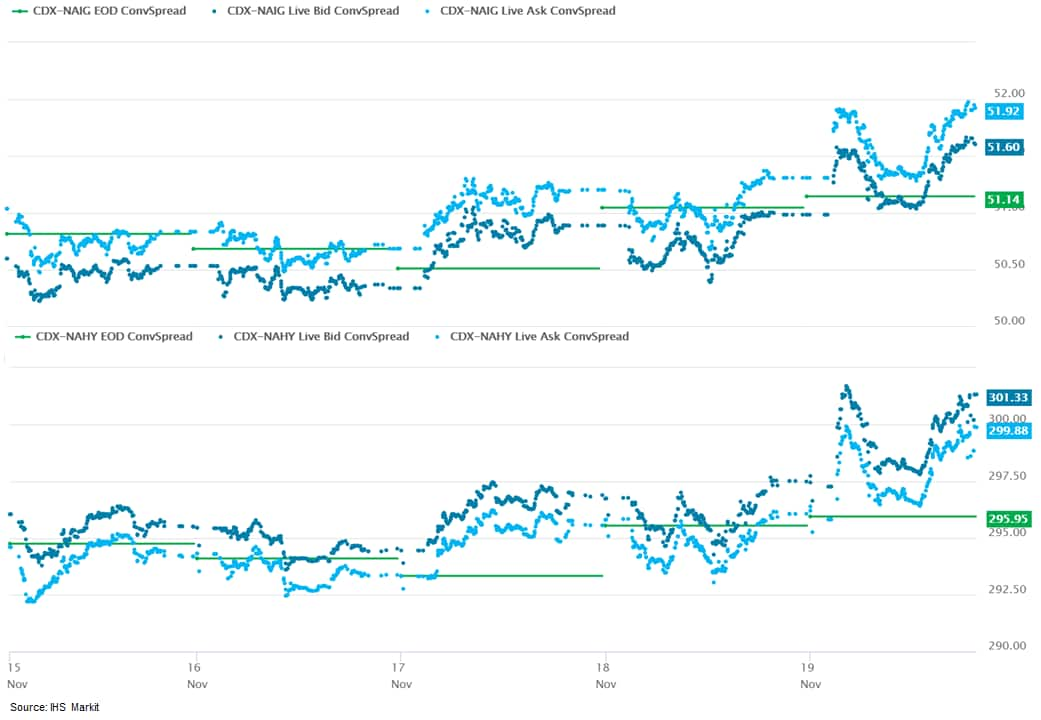

- CDX-NAIG closed +1bp/52bps and CDX-NAHY +5bps/301bps, which is

+1bp and +6bps week-over-week, respectively.

- DXY US dollar index closed +0.5%/96.03.

- Gold closed -0.5%/$1,852 per troy oz, silver -0.5%/$24.78 per troy oz, and copper +2.4%/$4.41 per pound.

- Crude oil closed -3.2%/$75.94 per barrel and natural gas closed +3.0%/$5.15 per mmbtu.

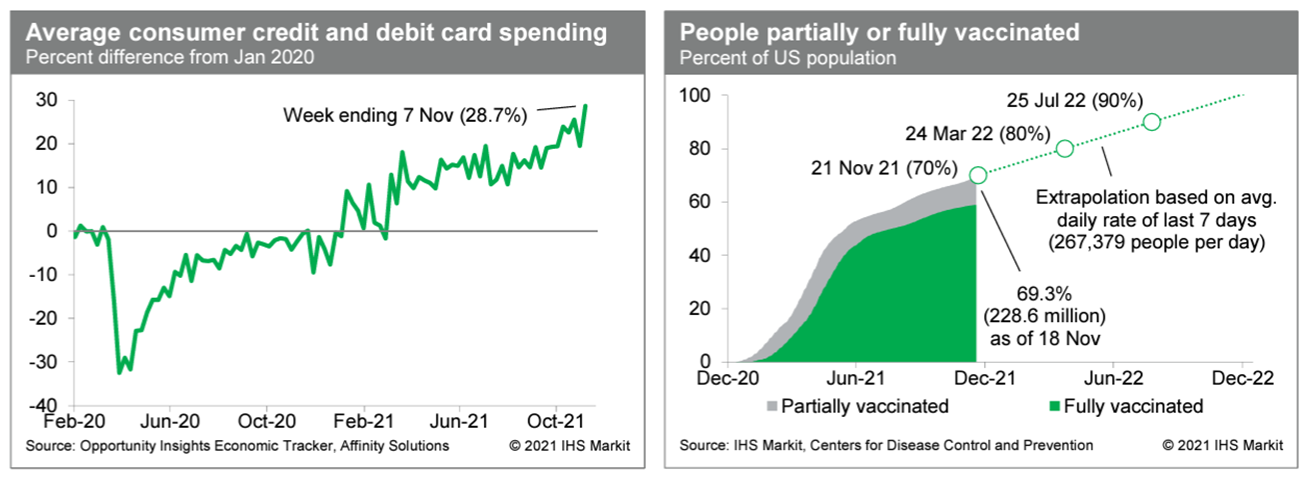

- Average US consumer credit- and debit-card spending during the

week ending 7 November was 28.7% above the January 2020 level,

according to the Opportunity Insights Economic Tracker. This was

well above the recent trend and sets up November for solid growth

of retail and food services sales. Meanwhile, averaged over the

last seven days, about 267,000 people per day received a first (or

only) dose of a COVID-19 vaccination, up considerably from the last

couple of weeks. The increase likely reflects authorization of the

Pfizer-BioNTech vaccine for children aged 5-11. As of yesterday,

about 229 million US residents, or about 69% of the population,

were at least partially vaccinated against COVID-19. (IHS Markit

Economists Ben

Herzon and Joel

Prakken)

- Apple is reportedly accelerating its efforts to develop an electric vehicle and focusing on creating a fully autonomous product rather than one with limited autonomous capabilities. Bloomberg reports that the company has made another shift in development and that in recent years, the tech company had been exploring simultaneous paths for a model with limited autonomous capabilities on steering and acceleration or a version with full autonomous capability. However, the report says that the latest leader on the project, Kevin Lynch, has engineers' concentration on the fully autonomous option. However, Bloomberg sources requested anonymity. Bloomberg reports that Apple's ideal car would have no steering wheel or pedals and the interior would be designed around hands-off driving. Apple has reportedly considered a design in which the infotainment would be in the middle of the vehicle for users to interact throughout the ride, and that it would be heavily integrated into Apple's other services and devices. Bloomberg reports that Apple has reached an undisclosed key milestone in achieving autonomy, that the company believes it has completed much of the core work on the processor it plans to use, and that the chip was developed by engineers who created processors for the iPhone, iPad, and Mac instead of within the car group. Apple is reportedly hiring engineers to test and develop safety functions, as well as more autonomy and car hardware engineers. The tech giant has also reportedly hired a climate system expert from Volvo Car, a manager from Daimler Trucks, battery systems engineers from Karma and others, a sensor engineer from General Motors' (GM's) Cruise, other engineers from Tesla, and safety engineers from Joyson Safety Systems. The report notes that Apple aims to launch an autonomous car in four years, which is faster than the five-to-seven-year timeline reported earlier. (IHS Markit AutoIntelligence's Stephanie Brinley)

- General Motors's (GM)'s electric vehicle (EV) commercial vehicle business BrightDrop has announced that its customer Merchants Fleet has expanded its order to 18,000 vehicles, an increase of 5,400 units of the mid-size EV410 van. Merchants Fleet earlier ordered 12,600 of the EV600 large commercial van. The company intends to start integrating the BrightDrop vans into its fleet in 2023. Merchants Fleet provides vehicles to businesses around the United States, and it has identified the need to expand and offer EV vehicles going forward. The expanded orders reflects expectations for demand, as BrightDrop has only begun production and not yet delivered the first vehicles. Along with Merchants Fleet, BrightDrop has orders from FedEx and Verizon as well. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Ford CEO Jim Farley confirmed to Automotive News that the company plans to double electric vehicle (EV) capacity in 24 months, to 600,000 units. During the interview, Farley said the added capacity would be split between the Mustang Mach-E, the F-150 Lightning, and the E-Transit. Farley is quoted as saying, "The demand is so much higher than we expected. It's a really new experience for this big company, trying to be agile. We had to approach it very differently than we've done capacity planning…In the Lightning's case we have to find physical space for more final assembly." The executive says Ford has the ability to add another shift of capacity at the Mexico plant building the Mach-E, although not at the Rouge facility building the F-150 Lightning. Farley also said that the reservation list for the F-150 Lightning is approaching 200,000 units, and that he expects "north of 80%" to convert to actual sales; the team originally projected volumes of 20,000 units per year for the electric pick-up truck. (IHS Markit AutoIntelligence's Stephanie Brinley)

- General Motors (GM) president Mark Reuss said that the company is looking to reduce the number of unique microcontroller units required in its vehicles by 95%, according to media reports. Automotive News quotes the executive as saying GM will streamline hardware and software advancements to help secure its semiconductor supply chain. Under the new strategy, GM hardware and software developers will draw from three families of chips, put together by partnerships between GM and various suppliers. Reuss was speaking during a Barclays Global Automotive and Mobility Tech Conference. The new strategy will be part of GM's efforts to double its revenue by 2030, including a greater proportion of the business being related to software services on vehicles. The change, Reuss reportedly said, could strengthen the flow of GM's semiconductors after the shortage. The company also expects its semiconductor requirements will more than double over the next several years. GM will consolidate core microprocessor chip purchases into three families, which will be co-developed, sourced, and built with leading semiconductor manufacturers. Reuss says the strategy should support electric vehicle, autonomous vehicle, and connected services growth. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Ford announced a partnership with GlobalFoundries (GF), a semiconductor manufacturer, to explore supply and development of automotive semiconductors, potentially including US manufacturing. According to a joint statement, the non-binding agreement "opens the door for GF to create further semiconductor supply for Ford's current vehicle lineup and joint research and development to address the growing demand for feature-rich chips to support the automotive industry. These could include semiconductor solutions for ADAS, battery management systems, and in-vehicle networking for an automated, connected, and electrified future. GF and Ford also will explore expanded semiconductor manufacturing opportunities to support the automotive industry." (IHS Markit AutoIntelligence's Stephanie Brinley)

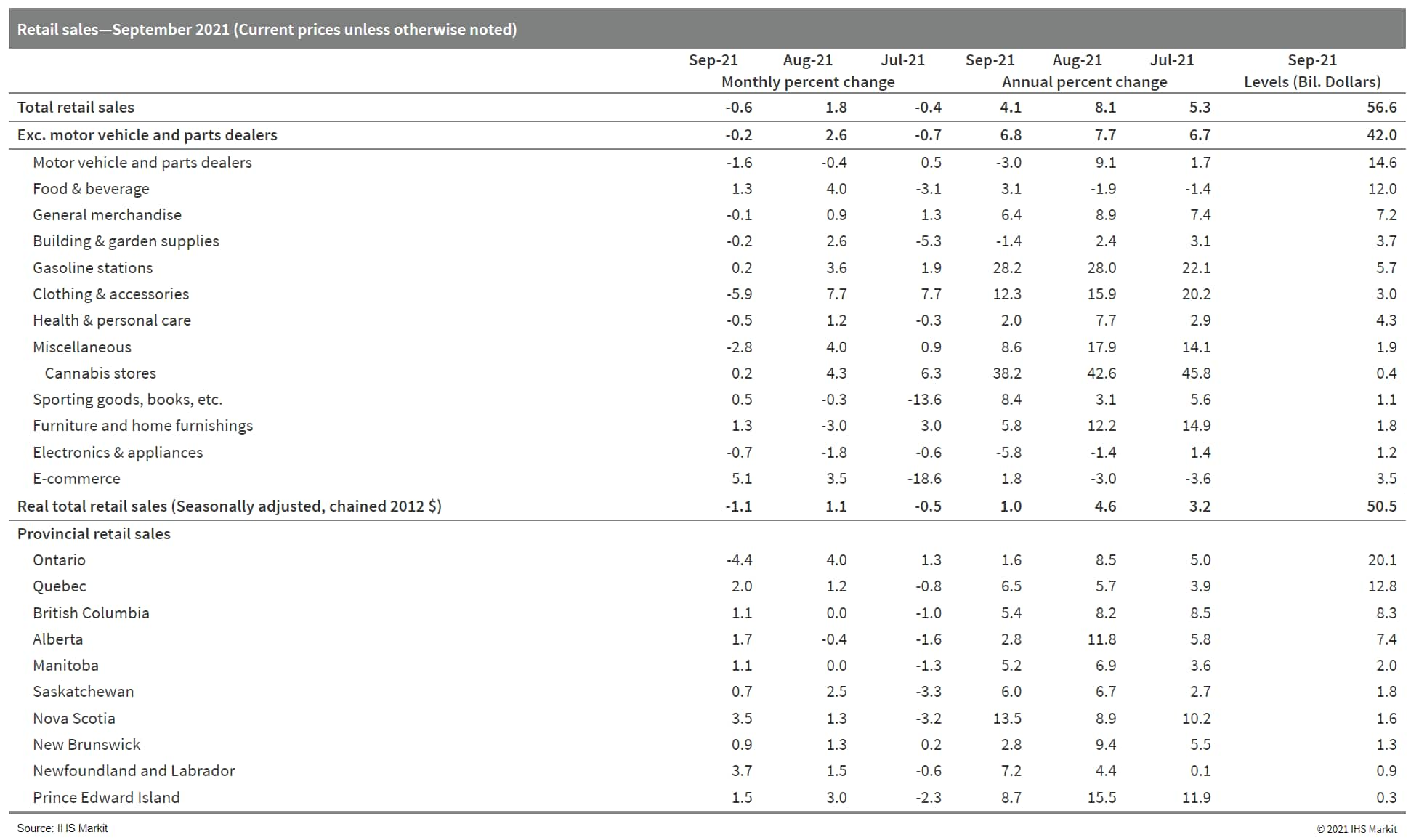

- Canada's September retail sales fell 0.6% month on month (m/m)

to $56.6 billion, which is substantially better than the advance

estimate of a 1.9% m/m contraction. The sales gain in August was

revised down to 1.8% m/m. (IHS Markit Economist Evan Andrade)

- Excluding vehicle and gasoline station sales, the core retail group still slipped 0.3% m/m.

- Retail volumes, which exclude price effects, decreased 1.1% m/m.

- Statistics Canada's advance estimate for October calls for a gain of 1.0% m/m, based on a 50% response rate.

- Sales at new car dealerships fell 2.8% m/m, while the 6.3% m/m jump in used-car dealership sales provided a slight offset. This suggests that the semiconductor shortage is putting pressure on new car inventory and that consumer demand for vehicles has remained relatively stable. With a downward revision to August sales as well, motor vehicle and parts dealer sales are now 3.0% below sales from September 2020.

- Weakness extended beyond autos, as sales for 7 of 11 product categories declined from the previous month. Clothing store sales dipped after recording strong growth over the summer months. Miscellaneous store sales also declined after four months of improvement. Electronics and appliances sales have not experienced a positive print since March, as supply chain issues may be hurting the available stock at these stores as well.

- The strongest gain was in food and beverage store sales, but

this was mostly due to higher prices.

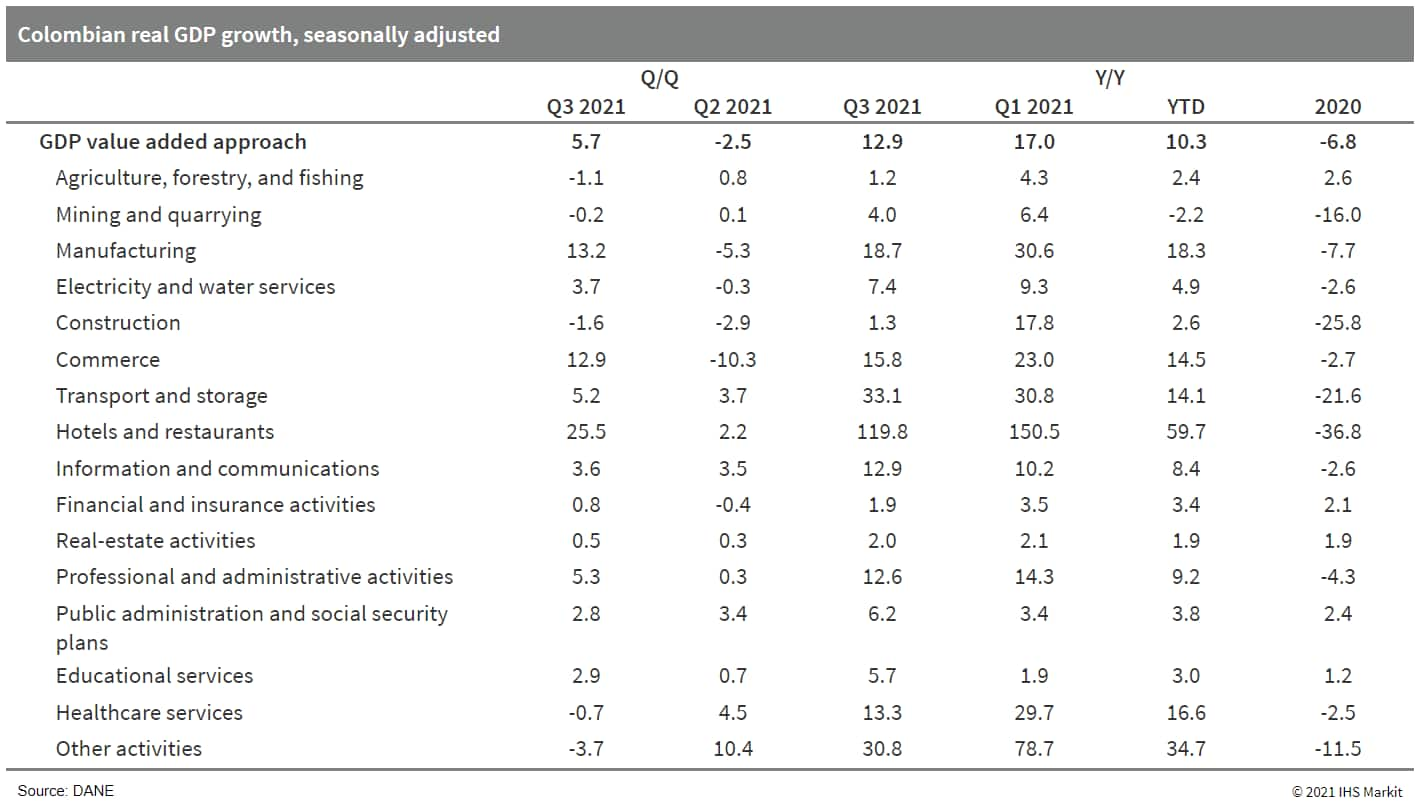

- The latest data from the National Statistics Office of Colombia

(Departamento Administrativo Nacional de Estadística: DANE) show

that Colombia's economy grew by 5.7% q/q in the third quarter of

2021. This was above IHS Markit's forecast of 4.0% q/q and marked a

strong rebound from the 2.5% q/q decline in the second quarter when

COVID-19-related restrictions were tightened and widespread

government protests hit economic activity. (IHS Markit Economist

Dariana Tani)

- The breakdown of the third-quarter GDP expenditure data shows that output growth was mostly driven by significant increases in public consumption and net trade. Fixed investment bounced back strongly, although it did not fully recover from the second-quarter contraction. Furthermore, private consumption posted another solid increase, expanding by 2.6% q/q as the economy reopened in the third quarter.

- Separate data from DANE show that industrial production grew by

15.5% y/y in September, with large increases in manufacturing

(15.5% y/y) and mining and quarrying (14.5% y/y). Meanwhile,

electricity and gas supply and water collection, treatment, and

distribution grew by 8.2% y/y and 3.0% y/y, respectively. In

addition, retail sales volumes expanded by 15.3% y/y in September,

after increasing by 32.0% y/y in August.

Europe/Middle East/Africa

- All major European equity indices closed lower for a second consecutive day; Germany -0.4%, France -0.4%, UK -0.5%, Italy -1.2%, and Spain -1.7%.

- 10yr European govt bonds closed sharply higher; Italy/Germany/Spain -7bps, France -6bps, and UK -5bps.

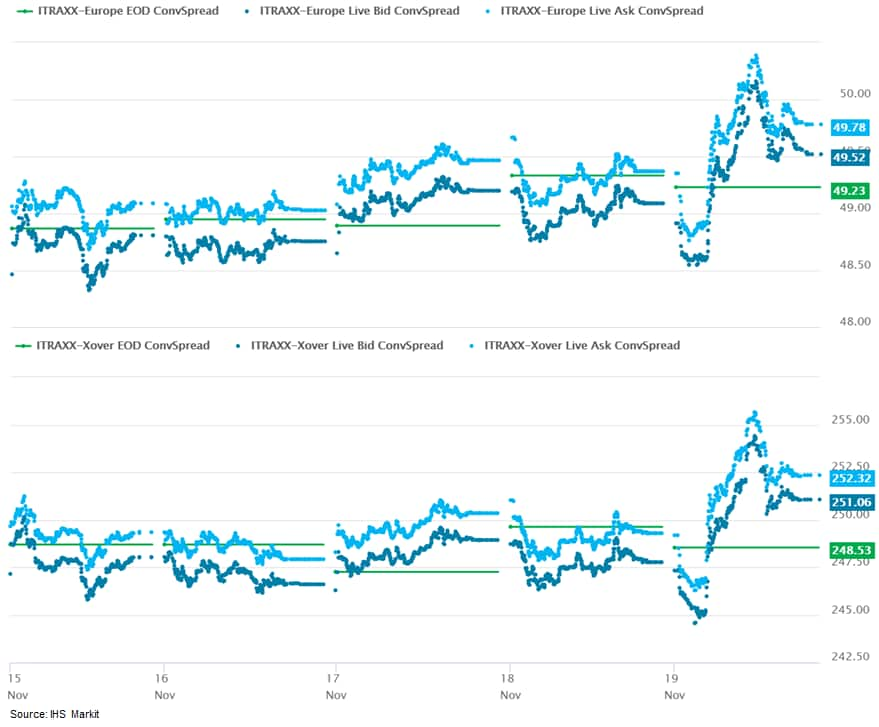

- iTraxx-Europe closed +1bp/50bps and iTraxx-Xover +3bps/252bps,

which is +1bp and +3bps week-over-week, respectively.

- Brent crude closed -2.9%/$78.89 per barrel.

- Daimler will produce its first in-house electric motor at its oldest plant in Berlin, reports Reuters. The motor is a fraction of the weight of its diesel counterpart and can increase an electric vehicle's (EV)'s range by up to 7%. It is known as an axial flux motor and is designed by YASA, a UK-based startup that Daimler acquired earlier this year. There was no mention of a commencement date for the motor's production. Investment in the Berlin-Marienfelde plant, previously pinned at a two-digit million-euro amount, will rise to a low three-digit million-euro amount in the next six years, according to Daimler. The investment brings relief to workers who were concerned that the Berlin plant was on the verge of massive layoffs. They were worried for their jobs after Daimler announced in 2020 that production of the six-cylinder diesel engine built there will be phased out within a year. The workers will also be offered retraining in software and coding. The digital training campus, which Daimler collaborated with Siemens in March to develop, will go live in 2022 and will also create new jobs, according to Jörg Burzer, head of manufacturing. However, the e-motor is easier to manufacture than its diesel counterpart, therefore the plant will eventually employ fewer people - but the exact number of job losses is not yet known, according to Burzer. The current union deal guarantees the plant's 2,300 employees their jobs until the beginning of 2030. (IHS Markit AutoIntelligence's Jamal Amir)

- Iveco will focus on zero-emission trucks and buses and try to function like an agile startup, as its owner CNH Industrial prepares to spin off the company to focus on agricultural and construction equipment, reports Reuters. Iveco should be seen as a "150-year-old startup" able to "outthink and outsmart" larger competitors, according to chief executive-designate Gerrit Marx. Iveco will develop a range of electric buses by 2023 and a new range of electric and fuel-cell heavy-duty trucks by 2024. Iveco would be interested in collaborations in Asia that allowed it to exchange technology, mutually supply components, or explore joint development projects, according to Marx. "That is a collaboration on a global scale that makes sense ... that's pretty much what we've set ourselves up for," he said in response to a query about possible interest from Hyundai and Geely. The company expects sales of EUR16.5-17.5 billion (USD18.7-19.9 billion) by 2026, representing a 5% compound annual growth rate compared with 2019, before the COVID-19 virus pandemic. As reported earlier, CNH Industrial has confirmed that the 'On Highway' business, which will soon be spun off, will be called Iveco Group. The Iveco Group will comprise Iveco's light, medium, and heavy commercial vehicle operations; Iveco Astra, which builds heavy-duty trucks; the Iveco Bus and Heuliez Bus bus- and coach-building business; Magirus, which manufactures fire-fighting vehicles; Iveco Defence Vehicles; the FPT Industrial powertrain technologies unit; and the Iveco Capital financial services arm. (IHS Markit AutoIntelligence's Jamal Amir)

- The Turkish central bank has cut its main policy rate for the

third time in three months, this time by 100 basis points. The

one-week repo rate now stands at 15%, well below the prevailing

annual rate of both headline and core inflation. Although we

anticipate that this will be the end of the cutting cycle, risks

remain substantial that the bank could cut yet again in December.

The rate cutting is having a negative impact on lira stability,

inflation, and the inflow of foreign capital. (IHS Markit Economist

Andrew

Birch)

- The Monetary Policy Committee of the Central Bank of the Republic of Turkey (TCMB) cut its main policy rate, the one-week repo rate, by 100 basis points at its regularly scheduled, monthly meeting on 18 November. The cut was the third in three months, bringing the rate down from 19% prior to the September meeting to 15% currently.

- The rate cut was in line with IHS Markit expectations, as well as with consensus opinion. In the days prior to the meeting TCMB officials had been highlighting the deceleration of core inflation from September and October (see Turkey: 4 November 2021: Turkish annual consumer, producer price inflation continue to rise in October, increasing instability risks), preparing markets for a subsequent rate cut.

- In its press release alongside the move, the TCMB once again pointed to what it claims will be a "transitory effect" of supply-side impacts - supply constraints, higher food and energy prices, administrative price changes - on inflation as a reason for its easing of monetary policy. The TCMB is also concerned about restimulating commercial and consumer loans, according to its press release.

- With the most recent rate cut, the one-week repo rate now stands almost 500 basis points below the prevailing, annual rate of consumer price inflation. Although the TCMB has focused attention on the core inflation rate as the guiding principal of its monetary policy, the main policy rate is now 182 basis points below even that prevailing annual rate.

- In anticipation of the rate cut, the lira was depreciating sharply. From 12 November to immediately prior to the rate decision, the lira depreciated by 4.9% against the US dollar. In the immediate post-decision trading, the lira fell to TRY10.976/USD1 prior to a modest rally late in the day, down by another 3%.

- Saudi Arabia announced in a royal decree on 11 November that

Saudi citizenship would be granted to select individuals of

"distinguished talents". The government subsequently announced that

an initial group of expatriates, including doctors, academics, and

Islamic scholars, had been the first to be included under the new

policy. The measure aligns with the objective specified in the

'Vision 2030' program to attract highly skilled foreign workers to

Saudi Arabia and facilitate economic diversification away from

hydrocarbons. (IHS Markit Country Risk's Jack

Kennedy)

- The easing of citizenship laws improves the attractiveness of Saudi Arabia as a regional business hub. International media reported in November that demand for Grade A office space in Riyadh had increased by 2.9% in the 12-month period ending in the third quarter of 2021; the Saudi government announced in October that it had licensed 44 multinational companies to move their regional headquarters to Riyadh, in line with the Programme Headquarters policy.

- The UAE is likely to respond by further easing its own restrictions regarding residency and work limits. The UAE, particularly Dubai, is the most exposed regionally to increased competition from Saudi Arabia to attract the regional headquarters of multinational firms, and to preserve its competitiveness it has already eased regulatory restrictions for foreign workers in the Emirates.

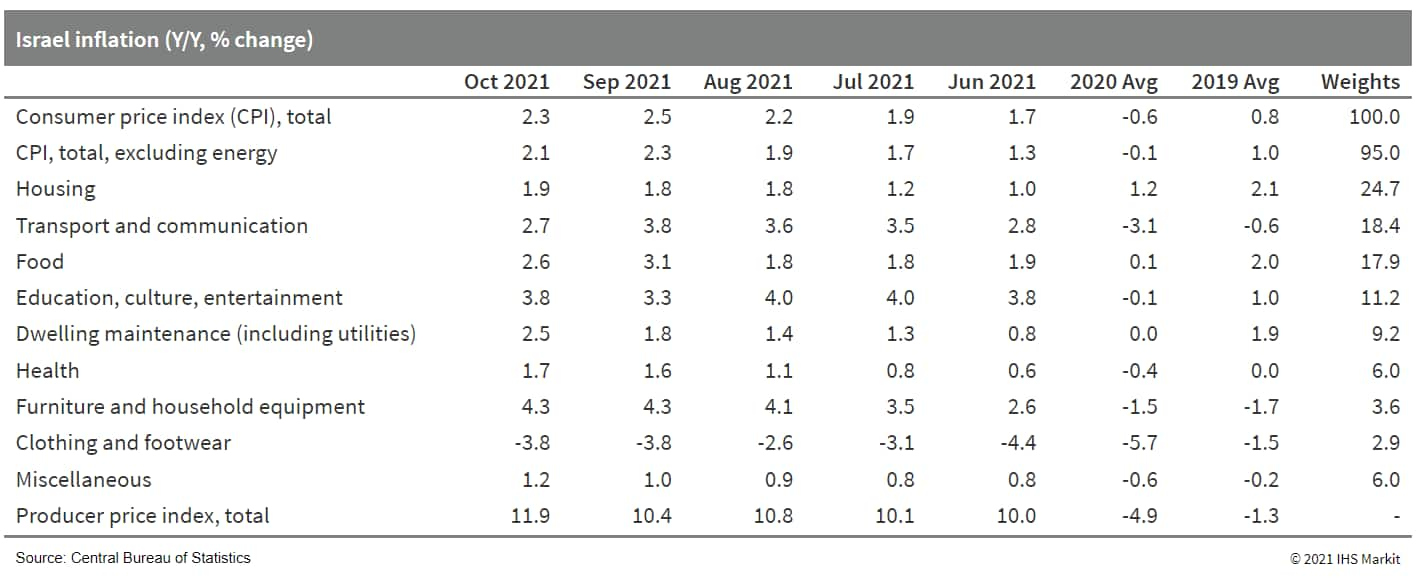

- Israeli consumer price index (CPI) inflation edged down to 2.3%

year on year (y/y) in October after reaching 2.5% y/y in September,

the highest annual rates since 2011. Inflation excluding energy was

2.1% y/y, the highest rate since 2013, although this was down from

2.3% y/y in September, the highest rate since 2011. The two series

tend to track each other relatively closely. (IHS Markit Economist

Ana

Melica)

- CPI inflation has been driven by transport and communication, food, and housing prices. Transport and communication price inflation eased to 2.7% in October from 3.8% in September, but its contribution to headline inflation was still the largest at 0.5 percentage point (ppt), down from 0.7 ppt in September.

- Food price inflation also eased, to 2.6% from 3.1%, although housing price inflation rose slightly. Their contributions each remained near 0.5 ppt. Education, culture, and entertainment was also a key inflation driver, rising 3.8% y/y and providing a contribution of 0.4 ppt.

- The largest drag on inflation came from clothing and footwear prices, which remained down 3.8% y/y, although this only removed 0.1 ppt from overall inflation.

- On a month-on-month (m/m) basis, prices rose 0.1% in non-seasonally adjusted (NSA) terms, easing slightly from an increase of 0.2% m/m in September. The seasonally adjusted (SA) rate was -0.2% m/m, notably lower than 0.3% m/m in September.

- The largest price gains came from food (0.4% m/m), clothing and

footwear (3.6% m/m), and education, culture, and entertainment

(0.7% m/m). The largest decline came from transport and

communication prices, which fell 1.1% during October, the first

decline in a year.

- The Kenyan Treasury published its draft Budget Policy Statement

for the 2022/23 financial year on 15 November, proposing that

budgeted expenditures increase by 9.2% from the previous year's

budget, from USD27 billion to USD29.5 billion. (IHS Markit Country

Risk's William Farmer and Ronel Oberholzer)

- The additional outlays, primarily for social spending, appear driven by electoral considerations ahead of the 9 August 2022 election. The 2022/23 budget cycle begins in July 2022, shortly before the 9 August 2022 general election. In addition to higher social spending, the government also plans to reduce power prices for small-scale consumers by one-third in December 2021.

- Despite the plans for increased spending, Kenya's fiscal position is already constrained, with International Monetary Fund (IMF) focus on loss-making state-owned enterprises (SOEs). According to the World Bank, debt service costs on total external debt absorbed 16.2% of total foreign exchange earnings in 2020, but IHS Markit estimates that this ratio is likely to increase to 19.5% and 20% in 2021 and 2022, respectively, as non-concessional borrowing increases. The growing debt service burden already led the government to raise taxes on mobile phone data and airtime; efforts to remove fuel subsidies in September proved highly unpopular and prompted a fuel VAT reduction from 8% to 4% in October.

- International financial institutions and bond markets are likely to show greater caution towards Kenya's sharply growing sovereign debt. In the last seven years, Kenya has issued four international bonds worth roughly USD7.85 billion. Rising yields on Kenya's debt, with the yield for its 10-year Eurobonds increasing from 3% in mid-September to 3.8% in mid-November, according to Central Bank of Kenya data, indicate decreasing investor appetite for Kenyan sovereign debt, probably due to concerns over increasing debt levels.

Asia-Pacific

- Most major APAC equity indices closed higher except for Hong Kong -1.1%; Mainland China +1.1%, South Korea +0.8%, Japan +0.5%, and Australia +0.2%.

- Chinese automaker Great Wall Motor has unveiled the first model from its Shalong brand. The new vehicle, a mid-sized sport sedan, features four LiDAR sensors provided by Huawei. As well as the LiDAR sensors, the model, called the Jijialong, is also equipped with 11 cameras, 5 millimeter wave radars, and 12 ultrasonic radars. The vehicle has a 115-kWh battery that provides a maximum driving range of 802 kilometers under the China Light-Vehicle Test Cycle. Great Wall says that the Jijialong is able to receive up to 450 kW of charging power, which allows it to add 401 kilometers of range in 10 minutes. According to Great Wall, the first batch of 101 units of the Jijialong can now be reserved at CNY488,000 (USD76,441). Deliveries of the model are expected to begin in the first half of 2022. This electric sports sedan, which many would describe as a type of 'muscle car', is another effort by Great Wall to please younger consumers with a unique-looking model. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Vehicle production in South Korea plunged 21.6% y/y during

October to 263,723 units, reports the Yonhap News Agency, citing

data released by the South Korean Ministry of Trade, Industry, and

Energy. Vehicle exports from the country also fell during the

month, by 18.1% y/y to 159,520 units. In terms of value, overseas

shipments decreased by 4.7% y/y in October to USD3.83 billion. By

destination, vehicle shipments to North America declined by 24.8%

y/y in October to USD1.49 billion, while vehicle exports to the

European Union grew by 2.9% y/y to USD661 million. Exports to

Eastern Europe also gained 20.9% y/y to USD469 million. The decline

in South Korean vehicle production and exports during October was

mainly due to production disruption amid the global semiconductor

shortage. GM Korea and SsangYong reduced their production by 50% in

October because of the semiconductor supply issue. "A supply crunch

of semiconductors for automobiles was initially expected to be

eased in the third quarter, but the recovery has been delayed due

to supply disruptions in South East Asian countries, including

Malaysia," said the Ministry of Trade, Industry and Energy.

Furthermore, the prolonged COVID-19 virus pandemic is also

affecting vehicle production and new vehicle demand in the country.

(IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-november-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-november-2021.html&text=Daily+Global+Market+Summary+-+19+November+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-november-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 19 November 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-november-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+19+November+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-november-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}