Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 02, 2020

Daily Global Market Summary - 2 December 2020

Global equity markets closed mixed across each region, with mostly modest price action across major indices. US government bonds closed slightly lower and the curve steepened, while benchmark European bonds closed mixed. European iTraxx and CDX-NA credit indices were close to flat across IG and high yield. The US dollar closed lower, while copper/silver were unchanged and gold/oil were higher on the day.

Americas

- US equity markets closed slightly higher except for Nasdaq -0.1%; S&P 500/DJIA +0.2% and Russell 2000 +0.1%.

- The House unanimously approved legislation on Wednesday that threatens a trading ban of shares of Chinese companies such as Alibaba Group Holding Ltd. over concerns that their audits aren't sufficiently regulated. The bipartisan measure passed the Senate in May and could quickly become law with President Trump's signature. Under the measure, Chinese companies and their auditors would have three years to comply with the inspections before a trading prohibition could take effect. If a breakthrough looked unlikely, the companies would probably respond ahead of a ban by either going private or moving their listing to a non-U.S. exchange. (WSJ)

- 10yr US govt bonds closed +1bp/0.94% yield and 30yr bonds +2bps/1.69% yield.

- CDX-NAIG closed flat/50bps and CDX-NAHY -4bps/300bps.

- DXY US dollar index closed -0.3%/91.01.

- Gold closed +0.7%/$1,831 per ounce, silver flat/$24.08 per ounce, and copper flat/$3.49 per pound.

- Crude oil closed +1.6%/$45.28 per barrel.

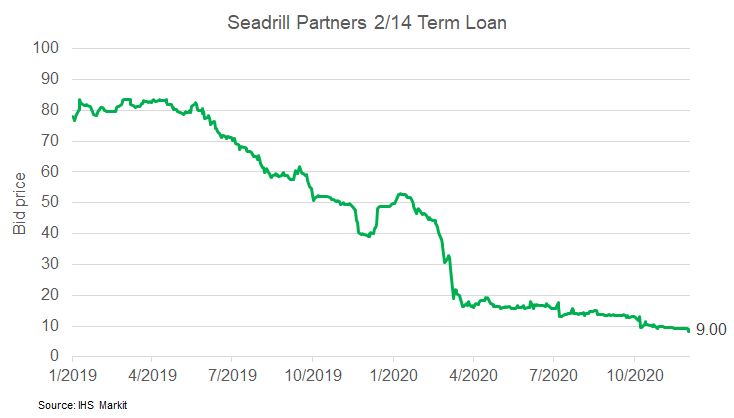

- Seadrill Partners LLC has filed voluntary petitions under chapter 11 of the Bankruptcy Code. Seadrill Partners is a limited liability company formed by Seadrill to own and operate offshore drilling units. The Chapter 11 filing follows Seadrill Partners' negotiations with an ad hoc group of lenders under the company's Term Loan B credit facility regarding a consensual reorganization of the company's balance sheet and is supported by the ad hoc group. Seadrill Partners intends to use the bankruptcy process to ensure that all customer, vendor and employee obligations are met without interruption and to complete a consensual restructuring of its debt. (IHS Markit Upstream Costs and Technology's Matthew Donovan)

- The below chart shows the daily bid prices for Seadrill

Partners 2/14 term leveraged loan, which closed at a price of 9.00

today.

- Hospitalizations for COVID-19 in the U.S. increased by more than 1,000 a day at the end of November, data released Tuesday from the Department of Health and Human Services show. The number of inpatients jumped 9.6% to a record 96,668 on Dec. 1 from 88,167 on Nov. 23. California recorded a 38% surge over the eight-day period, with 8,171 coronavirus patients as of Tuesday. Arizona's Covid-19 inpatients jumped 28% to 2,479. Coronavirus cases account for more than a fifth of hospitalized patients in North Dakota and South Dakota, Rhode Island, New Mexico, Indiana, Illinois, Minnesota and Michigan. (Bloomberg)

- United Parcel Service Inc. imposed shipping restrictions on some large retailers such as Gap Inc. and Nike Inc. this week, an early sign that the pandemic-fueled online shopping season is stretching delivery networks to their limits. The delivery giant on Cyber Monday notified drivers across the U.S. to stop picking up packages at six retailers, including L.L. Bean Inc., Hot Topic Inc., Newegg Inc. and Macy's Inc. according to an internal message viewed by The Wall Street Journal and confirmed by UPS workers in different regions. (WSJ)

- Disrupt or be disrupted. Currently, this mantra is extremely

pertinent to the animal protein industry, with alternative meat

companies making inroads. These firms are gaining consumer

attention and market share from 'real animal protein' producers.

Disruptive innovation is usually defined as a process where a new

product or technology is launched and gradually overtakes the

existing market leaders. (IHS Markit Animal Health's Sandeep

Juneja)

- While the reach and adoption of alternative meat sources are in the nascent stages, many in the animal health industry may be worried after a few large animal meat producers (Tyson Foods, Smithfield Foods and Purdue Farms) have chosen to actually join the trend rather than tackle it head on.

- While disruption is inevitable, and innovations often seem like common sense solutions once they gain popularity, few tasks are more difficult or require greater dedication than bringing innovation to a stagnating industry.

- The animal protein industry has been stagnating over the past decade. This is particularly obvious in developed countries. There have been minimal efforts to innovate or promote the health and nutrition benefits of animal protein to millennials.

- However, the alternative meat sector has showed the power of the millennial via the valuations some of the emerging start-ups in the space have seen in a relatively short period of time.

- With increasing availability and growing acceptance from mainstream consumers, meat and dairy alternatives are one of the fastest growing categories at key supermarket chains. As per data from The Good Food Initiative, grocery sales of plant-based meats have grown at 11% in the last year (2018/2019) and cumulatively 29% in the last two years to reach $5bn in 2019.

- However, with plant-based burgers, sausages and chicken becoming increasingly popular and available in fast food restaurants and grocery stores across the US, a new group of companies has started making meatless meat. These are the food conglomerates and conventional meat producers that Beyond Meat and Impossible Foods originally set out to disrupt.

- In recent months, major food companies like Tyson Foods, Smithfield Foods, Perdue, Hormel and Nestlé have rolled out their own meat alternatives, filling supermarket shelves with plant-based burgers, meatballs and chicken nuggets.

- This trend spells bad news for the already battered food animal segment, which is reeling partly from the onslaught of African swine fever and a recurrence of avian influenza in certain markets. Could this also hasten the process of the companion animal market overtaking the food animal segment in terms of global revenue share?

- Starting largely as alternatives to animal meat products for vegans and vegetarians, and supposedly having a smaller environmental footprint, plant-based protein is being adopted in large volumes, with significant expansion across multiple geographies. As per Swiss investment firm UBS, the market for lab-cultured meats and plant-based meat alternatives may hit $85bn by 2030.

- Question marks remain regarding claims of sustainable agricultural practices, as common ingredients of alternative plant meat products include soya, rice and maize, which are part of a highly industrialized production process. Concerns also remain on the usage of GMO yeast and soya - genetically modified to resist the herbicide glyphosate - as key ingredients in plant burgers.

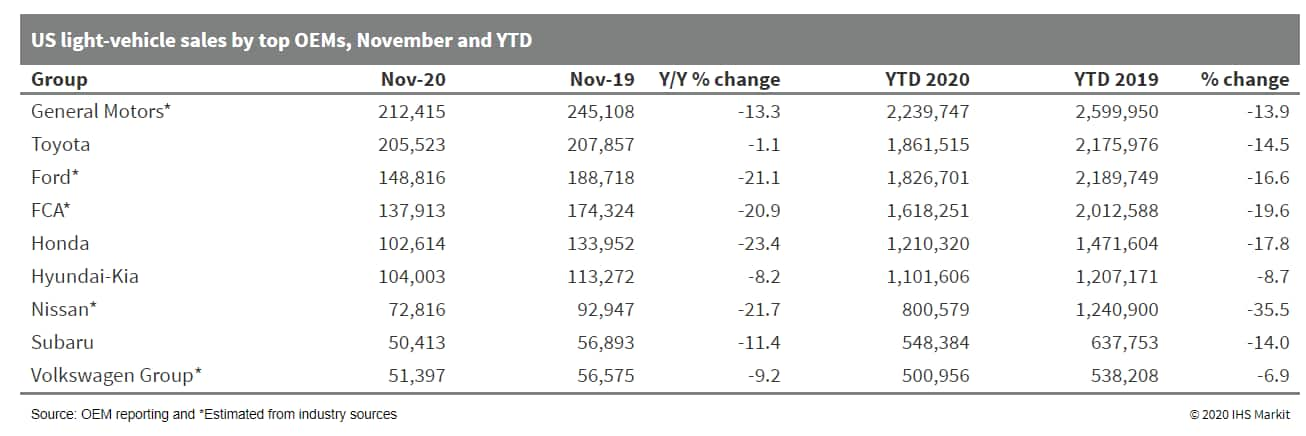

- US light-vehicle sales declined 14.0% year on year (y/y) to

1,214,891 units in November, partly on there being three fewer

sales days during the month in 2020 than in 2019. The estimated

seasonally adjusted annual rate (SAAR) of sales was 15.6-15.9

million units in November, a decline from the 16.2-million-unit

reading in October.(IHS Markit AutoIntelligence's Stephanie

Brinley)

- General Motors (GM) remains the top-selling automaker in the United States and its sales are estimated to have decreased 13.3% y/y in November and declined 13.9% y/y in the year to date (YTD; January to November). Despite the all-new Encore GX, Buick sales were down 23.1% y/y in November and 23.4% in the YTD. Encore sales in November dropped 82.8%, much more than sales of the top-selling Encore GX were able to absorb, while Envision sales also saw a sharp decline.

- Toyota Motor North America (TMNA) reported a 15.8% y/y drop in YTD sales, eased by a second consecutive monthly improvement. With its November results, Toyota pulled ahead of Ford in terms of YTD sales as well as monthly performance. In November, Toyota's sales slipped only 1.1% y/y. In the YTD, the Toyota division's sales are down 15.1% y/y and Lexus sales are down 9.9%, although in November, Toyota sales were essentially flat and Lexus sales fell 6.9% y/y. The RAV4 continues to be the Toyota volume leader and the distance is still increasing between its sales and the Camry's sales, which have dropped 14.8% y/y in the YTD, although they increased 19% y/y in November.

- Ford is expected to release its sales figures on 2 December, and the figures reported here are estimates. Ford's sales dropped 21% y/y in November, leaving the company with a 16.6% decline in the YTD. The Ford brand's sales dropped 21% y/y and the Lincoln brand's sales improved 22.9% in November.

- American Honda reported a 23.4% y/y sales decline in November and its sales fell behind the Hyundai-Kia group's sales last month. In the YTD, Honda's sales are down 17.8% y/y. Honda brand's sales have fallen 18.1% in the YTD, with car sales down 24.0% and truck sales down 13.1%.

- Nissan continues to struggle, with sales down 35.5% y/y over

the first 11 months of 2020. Nissan's efforts to adjust its

business after years of reliance on fleet sales and incentives have

been hindered by the COVID-19 pandemic and changes in management.

In the YTD, Nissan brand's sales have dropped 35.6% y/y, with car

sales down 42.1% and light truck sales down 31.0%. Nissan's all-new

Rogue arrived in October, and the new entry brings a compelling

package that might help the model revive some of its earlier strong

segment performance in 2021.

- Lucid has announced completion of construction of its plant in Casa Grande (Arizona, US); initial capacity is for 30,000 units per annum, with phased expansion planned up to 400,000 units. Lucid calls the plant Lucid AMP-1 (Advanced Manufacturing Plant). With the first phase of construction complete, Lucid says "the commissioning of production equipment and processes" are under way for a planned production start between March and May 2021. The next expansion phase is scheduled to begin in early 2021 as well, preparing for production of Lucid's sport utility vehicle (SUV) in 2023, under the development name Project Gravity, which is an interesting counterpoint to the sedan being called the Lucid Air. There are four planned phases through 2028; Lucid intends to expand from its current 999,000 square feet to 5.1 million square feet. The water-based paint shop has been designed to be future-proofed for expansion through all phases of plant expansion. In a statement announcing the milestone, CEO and CTO Peter Rawlinson was quoted as saying, "We broke ground on the 590-acre Lucid AMP-1 site in Casa Grande, Arizona, on December 2, 2019, and slightly less than a year later we have completed the first purpose-built [electric vehicle] EV factory in North America. As the Lucid Air nears production, Lucid has been revealing more details on the vehicle and pricing (see United States: 15 October 2020: Lucid Motors announces entry version of Air sedan, United States: 10 September 2020: Lucid reveals production Air sedan, initial pricing, and United States: 24 August 2020: Lucid claims fastest charging EV, with 900V+ electrical architecture). IHS Markit forecasts Lucid's global sales will rise to above 30,000 units in 2025, after Project Gravity comes on the scene, although having the capacity to build at that pace sooner can allow Lucid to meet demand if it is higher than forecast. Lucid's Air boasts strong technology and an attractive exterior, but it is coming to market as consumers are being flooded with EV options. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Ford Otosan, US automaker Ford's joint venture (JV) with Turkey's Koç Holding, has partnered with Velodyne Lidar to test and develop autonomous heavy commercial trucks. Ford Otosan will deploy Veloyne's Velarray H800 LiDAR sensors in its next-generation vehicles to enable safe navigation and collision avoidance. LiDAR sensors are necessary for autonomous vehicles (AVs) as they measure distance via pulses of laser light and generate 3D maps of the world around them. Burak Gökçelik, assistant general manager at Ford Otosan, said, "Autonomous vehicle technology, powered by lidar, can bring multiple efficiency and safety benefits to the trucking industry. Our autonomous driving initiative with Velodyne looks to improve roadway safety by helping trucks understand and react to approaching road conditions and surroundings." Autonomous trucks are gaining a great deal of traction in the logistics industry because of a growing shortage of drivers and improved efficiency. These trucks enable autonomous loading and unloading of containers in yards, thereby improving efficiency. Ford Otosan has expanded its partnership with AVL to jointly trial hub-to-hub autonomous highway transportation using 'Level 4 Highway Pilot' technology. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Livermore Amador Valley Transit Authority (LAVTA) in the United States has begun carrying passengers for its shared autonomous vehicle (SAV) project. After undergoing rigorous testing, the vehicle has been certified for use on public streets by the National Highway Traffic Safety Administration (NHTSA). The project will provide first- and last-mile passenger rides by connecting them between the Dublin/Pleasanton Bay Area Rapid Transit (BART) station and nearby locations. The vehicle will have a safety operator on board and will travel along a one-mile route that includes two stops and one traffic light. The vehicle is manufactured by French autonomous vehicle (AV) startup EasyMile and is operated by public transport company Transdev. The project has implemented coronavirus disease 2019 (COVID-19) virus-related safety measures, including limiting the vehicle's capacity to three passengers, making face masks or coverings mandatory for passengers, and regular cleaning and sanitization of vehicle touchpoints between each ride. Transdev is already engaged in pilot AV deployments in multiple countries; the firm has carried a total of 3.5 million passengers and clocked up 1.6 million kilometers. In 2019, Transdev and French manufacturer Lohr unveiled the i-Cristal autonomous shuttle. It is also operating the world's first commercial driverless service on energy company EDF's campus in Civaux (France), working with partners including Vedecom and SystemX. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- According to Peru's National Institute of Statistics and

Information (Instituto Nacional de Estadística e Informática:

INEI), the country's consumer price index increased by 0.52% month

on month (m/m) in November and by 2.14% year on year (y/y). (IHS

Markit Economist Jeremy Smith)

- After several consecutive months of flat or negative changes in consumer prices, prices rose across all consumption categories in November, causing inflation to jump by 0.52% m/m and bringing the overall consumer price index above the Central Reserve Bank of Peru (Banco Central de Reserva del Perú)'s 2% target in yearly terms for the first time since mid-2019.

- Increases in the price of food and beverages, the largest portion of the consumption basket, made by far the largest contribution to the uptick, as products in this category rose by 0.88% m/m and 2.81% y/y. Fruits and meats recorded the largest price increases. In addition, prices in the housing rental, petrol, and electricity category rose by 1.38% m/m because of a 2.8% increase in residential electricity rates.

- Put together, the above two categories accounted for 93% of the November increase in the consumer price index. By contrast, core inflation, the portion of the consumption basket excluding more volatile food and energy prices, increased by just 0.11% m/m and 1.75% y/y.

- The fact that core inflation has hardly budged since dropping below target in March supports IHS Markit's view that demand remains quite weak. In October, new vehicle sales eclipsed 2019 levels for the first time this year, perhaps indicating some pent-up demand for durable goods; however, this effect has not yet exerted much influence on prices.

- Ford is to invest USD580 million in a plant in Argentina and has confirmed plans to launch four models in South America in 2021. Lyle Watters, president of Ford South America, announced that the automaker plans to invest USD580 million in its General Pacheco plant in Argentina for the production of the new generation of the Ranger pick-up, reports Automotive Business. The Ranger is scheduled to be launched in 2023. Watters said, "Investments will be made to modernize the Pacheco plant and in many efforts to locate components." Ford also confirmed the plans to launch four models in South America and said that the products would arrive during 2021. The products that will be part of Ford's portfolio next year include the Transit utility vehicle, the Ranger Black pick-up, the limited-edition Mustang Mach 1, and the new Bronco sport utility vehicle (SUV). Watters said, "They are vehicles that serve different customers and segments, but they all have connectivity in common, which will be progressively available in different countries. This technology brings great functionality and expands the possibilities of offering a wide range of services to meet the needs and the growing desires and expectations of consumers." The new-generation Ranger will be based on the same T6 platform as the current generation, but it will be part of the P703 program, unlike the current generation's P375 program, which started in 2012 and is to continue until 2022. According to IHS Markit's light-vehicle production and export data, 43.3% of the Ford Ranger vehicles produced at the General Pacheco plant in 2023 will be exported to Brazil and 13.3% to Mexico, while 30.3% of the production will be for the Argentinian market. (IHS Markit AutoIntelligence's Tarun Thakur)

Europe/Middle East/Africa

- European equity markets closed mixed; UK +1.2%, Spain +1.0%, France flat, Germany -0.5%, and Italy -0.6%.

- 10yr European govt bonds closed mixed; Italy -4bps, Spain -2bps, France -1bp, and Germany/UK +1bp.

- iTraxx-Europe closed +1bp/47bps and iTraxx-Xover flat/251bps.

- Brent crude closed +1.8%/$48.25 per barrel.

- Mini is developing a battery electric vehicle (BEV) version of the high-performance flagship model, the Cooper S John Cooper Works (JCW), according to a company statement. According to Mini, the company's direction in terms of platform and future battery cell developments will give it the opportunity to combine what it refers to as 'extreme performance and genuine driving enjoyment'. Bernd Körber, the head of the Mini brand said, "With the Mini Electric, we've shown how well brand-typical driving enjoyment and electric mobility can be combine. Now it's time to translate the passion for performance of the John Cooper Works brand to electromobility. That's why we're working to develop concepts for electric John Cooper Works models." The company has already successfully launched the Mini Electric, which Körber addresses above, so the brand already has an electrified offering and it is likely that any battery-electric JCW will use a variant of this existing powertrain. However, the existing Mini Electric only has a 32.6 kwh battery and a somewhat limited range as a result of between 124 and 144 miles on the WLTP cycle. High-performance driving will shorten that capability significantly, and this is the main issue Mini has with developing a BEV version of the JCW. (IHS Markit AutoIntelligence's Tim Urquhart)

- According to Federal Statistical Office (FSO) data, German real

retail sales excluding cars rebounded by 2.6% month on month (m/m)

in seasonally and calendar-adjusted terms during October, more than

unwinding September's decline of 2.3% m/m. Together with the

combined increase of 2.8% during July-August, October's retail

sales thus exceeded the June level (just before the VAT cut) by 3%.

(IHS Markit Economist Timo Klein)

- As recent developments build on the huge rebound seen in May after the end to the COVID-19 virus-related lockdown period - then helped by catch-up effects - October's unadjusted year-on-year (y/y) rates reached 8.2% in real terms and 9.4% in nominal terms. This compares with average growth of 3.2% and 3.7%, respectively, in 2019, and even lower long-term trend growth of 0.6% and 1.3%.

- Recent above-trend retail sales are attributable to three factors: the temporary VAT cut (July-December 2020); catch-up effects due to the enforced inability to make purchases during the March-April lockdown; and substitution effects with respect to income that cannot be used for services which - for public health reasons - are either not available at all or only with restricted capacity (e.g. restaurants). Furthermore, with a greater share than usual spent indoors, people want to improve their living conditions at home and thus turned to DIY and household equipment.

- Major categories of the price-adjusted y/y data for October (total 8.0% y/y; for details, see table below) show a somewhat stronger increase for non-food sales (9.0%) than for food sales (7.3%). Among the former, internet and mail order sales remained well ahead of the rest (up 29.8% y/y), followed by furniture/household goods/DIY (up 14.2%), and sales in specialty stores such as for toys, books, and bicycles (up 4.5%). The other major groups of goods all posted declines, specifically -0.8% y/y for pharmaceutical/cosmetic goods, -2.3% y/y for sales at general department stores, and -6.4% y/y for textiles/shoes.

- A clear distinction needs to be made between retail sales alone and consumer demand in general, given the aforementioned catching-up, substitution, and tax effects. Many services in the recreation and entertainment sector will remain underutilized until widespread vaccination against COVID-19 has been completed, which is unlikely before mid-2021. Until that time, consumers will spend an above-average share of their income on retail goods, compared with long-term trends.

- The improvement of Austria's labor market indicators around

mid-2020 has gone into reverse in November due to the constraints

on economic activity caused by the second lockdown needed to

counter the second wave of COVID-19 infections. A sustained

improvement will require widespread vaccination, and should

therefore not be expected before mid-2021. (IHS Markit Economist

Timo Klein)

- According to the Austrian Labour Market Service (AMS), there were 390,858 unemployed people in Austria at end-November, up 32,000 from October and up 91,000 (30.5) versus November 2019.

- The gap with the unemployment rate a year earlier had peaked at 5.4 percentage points at the height of the initial lockdown in April before narrowing to 1.7 points in October, but November's rate at 9.5% was 2.2 points higher than in November 2019. The closure of hotels and restaurants and large parts of the retail sector and the educational system is having a major impact, although continuing operations in the manufacturing sector mean that the situation will remain far better than during March-April.

- The unemployment rate on a harmonized, seasonally adjusted basis as calculated according to European Union and thus International Labour Organization (ILO) criteria, which is only available until October, has remained steady at 5.4% (September revised down from 5.5%). This compares to an interim peak of 5.9% in June, caused by ramifications of the March-April lockdown, and a cyclical low point of 4.3% in November-December 2019.

- Vacancies, which had still exceeded their year-ago level until February, were down 18.2 y/y in November (absolute level: 58,243). Vacancies no longer are recovering now, the year-on-year (y/y) decline thus deepening anew.

- Finally, dependent employment declined by 55,000 (or 1.5%) y/y in November, representing the second consecutive month of deterioration following a phase in which the annual decline diminished from a peak of 200,000 (or -5.0%) in April to just 35,000 (or -0.9%) y/y in September. The dip by 55,000 in combination with the unemployment increase of 91,000 means the labor force has increased by 36,000 y/y (or 0.9%). This indicates a bottoming, as September's increase had been only 0.7% y/y, down from April's peak at 2.0% y/y.

- The corrective improvement seen in the Austrian labor market since May, when the initial lockdown was lifted, will partly unwind again during the next few months due to the negative knock-on effects of the new lockdown. Even if the current strict measures are removed again in January, it is clear that employment related to large public gatherings or people potentially being in close contact to one another, such as spectator sports, festivals, fairs, cinemas, or theatres, will remain lower than normal until mid-2021 in any case. Labor market conditions will improve lastingly only once widespread vaccination has been achieved. During the next six to eight months, company insolvencies and thus unemployment will increase once more.

- Groupe PSA has announced that it plans to launch battery-electric variants of its compact light commercial vehicle line-up in 2021. According to a statement, the Peugeot e-Partner, Citroën ë-Berlingo van, Opel Combo-e and Vauxhall Combo-e will feature a water-cooled 50kWh electric battery and a 100kW electric motor. The onboard charger offers two levels of power, a 7.4kW single-phase and 11kW three-phase. It said that as well as the commercial variants, the same powertrain will also feature in the Peugeot e-Rifter, Citroën ë -Berlingo, Opel Combo-e Life and Vauxhall Combo-e Life passenger versions. The launch of the battery-electric variants of these vehicles will lead to PSA offering electrified variants of all its models before the end of 2021. The company has already begun offering battery-electric variants of the Citroën Jumper, Peugeot Expert, Opel Vivaro and Vauxhall Vivaro, as well as the larger Peugeot Boxer and Citroën Jumpy, which will be joined by Opel and Vauxhalls based on these models in due course. These new compact vans use the same electric motor used by the mid-size vans, as well as the Peugeot e-208, Peugeot e-2008 and its other vehicles based on the CMP architecture. It also uses the same battery size as the other CMP models ,with which they share a platform. (IHS Markit AutoIntelligence's Ian Fletcher)

- After demand was underpinned by market support measures, the Italian passenger car registrations went into decline during November. According to the latest data published by the National Association of Foreign Vehicle Makers' Representatives (Unione Nazionale Rappresentanti Autoveicoli Esteri: UNRAE), registrations fell by 8.3% year on year (y/y) to 138,405 units. This means that registrations in the year to date (YTD) are now down by 29% y/y to 1,261,802 units, not helped by the significant impact of the COVID-19 virus in earlier months. November has marked a return to decline for the Italian passenger car market after government support measures helped lift demand during the past couple of months. However, the performance is far better than we had expected for the month, when lockdown measures for parts of the country returned from 6 November as COVID-19 infections rose again. The new rules introduced an overnight curfew across the country and public transport running at half capacity as part of the three-tier system of measures rolled out on a regional basis, which allowed businesses, factories, pharmacies, and supermarkets to remain open. (IHS Markit AutoIntelligence's Ian Fletcher)

- Passenger car registrations in Spain recorded another decline during November, according to the latest data published by the Spanish Association of Passenger Car and Truck Manufacturers (Asociación Española de Fabricantes de Automóviles y Camiones: ANFAC). Demand fell by 18.7% y/y to 75,708 units. The YTD figure now stands at 745,369 units, a decline of 35.3% y/y, as the COVID-19 virus pandemic had a heavy impact in earlier months. The decline in the Spanish passenger car market has been despite support, introduced in mid-June, for parc replacement and those looking to purchase alternative powertrain vehicles. Although there was some initial uplift in July, interest has since waned. The 24.4% y/y fall in private customers during November underlines the thinking that these measures are not generous enough to lure uncertain consumers to the market. The 35.4% y/y decline in registrations to rental fleets adds to the woes of the Spanish automotive industry, not helped by the far weaker tourism market this year. (IHS Markit AutoIntelligence's Ian Fletcher)

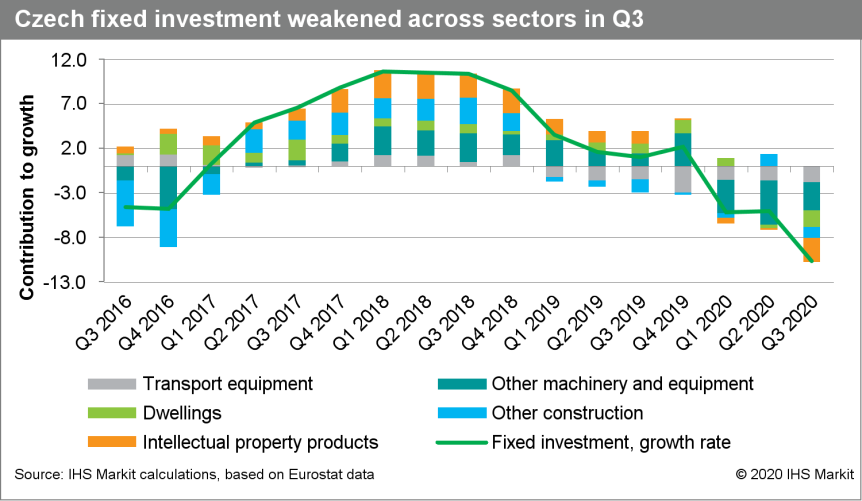

- Despite the economy's better-than-expected third-quarter

performance, the short-term outlook for Czechia remains bleak,

affected by restrictions aimed at limiting surge in coronavirus

COVID-19 cases. Seasonally adjusted GDP jumped by 6.9% quarter on

quarter (q/q) in the third quarter, considerably faster than the

'flash' estimate of 6.2%. In year-on-year (y/y) terms, Czechia's

GDP fell by 5.0%, versus a preliminary decline of 5.8%. (IHS Markit

Economist Sharon Fisher)

- Detailed data indicate that net exports were the main driver of the third-quarter recovery, with exports significantly outpacing imports in both q/q and y/y terms, partly thanks to a drop in fuel imports. Although goods exports slightly exceeded year-earlier levels in the third quarter (amid rising sales in the electronics and food categories), services exports continued to fall, down by 20.2% y/y.

- Private consumption (up by 4.9% q/q) supported q/q growth during the third quarter, while inventories, fixed investment, and public consumption had a negative impact on growth. According to the Czech Statistical Office, fixed investment fell by 10.7% y/y and 5.0% q/q, and the steepest declines were recorded in investments in dwellings, transport equipment, and intellectual property products.

- Data by sector indicate that industry and trade were the main drivers of third-quarter growth in value added, recording double-digit q/q gains. In a y/y comparison, only agriculture and public administration recorded positive results.

- Czechia's third-quarter GDP results were considerably weaker than in neighboring Poland, where both private consumption and exports of goods and services exceeded year-earlier levels, contributing to a decline in GDP of just 1.5% y/y. Data by sector indicate that value added from Polish industry rose by 2.9% y/y, whereas Czechia's declined by 5.5%.

- In the November forecast round, IHS Markit downgraded its GDP forecast for Czechia for both 2020 and 2021. We are currently projecting a 7.1% decline this year, followed by a recovery to +2.6% in 2021.

- Given the upgrade in the third-quarter figure, we will consider raising our full-year growth projection for 2020. Our November forecast had assumed a 3.6% q/q decline in the fourth quarter, and keeping that figure stable would result in a 6.6% drop in GDP for 2020 as a whole.

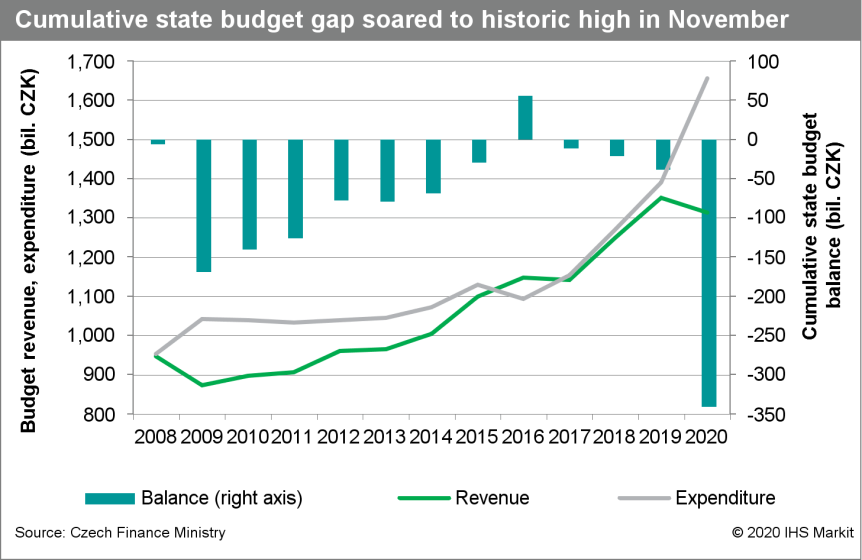

- State budget data for the first 11 months of 2020 indicate that

the budget gap has widened sharply this year, as a surge in

expenditure (up by 19.1% y/y) was matched by a drop in revenues

(down by 2.8% y/y). Budget receipts would have fallen faster if not

for EU transfers, which increased by 5.5% y/y.

Asia-Pacific

- APAC equity markets closed mixed; South Korea +1.6%, Japan +0.1%, Australia flat, Mainland China/India -0.1%, and Hong Kong -0.1%.

- Direct impact on first-time buyers is expected to be limited as

the down-payment ratio for first-home mortgages remains unchanged.

Although raising the bar for presale could further limit financing

sources, especially for small developers, the move is still likely

to help improve overall financial stability. (IHS Markit Economist

Lei Yi)

- The housing bureau of Xi'an City (Shaanxi Province) issued a notice on further regulating the local housing market on 1 December. According to the notice, rules on the presale system will be tightened and the down-payment ratio requirement for second home purchases will be higher.

- On the housing demand side, the local government will impose differentiated down-payment requirements based on the floor space of the buyer's existing home and the second home the buyer is trying to purchase with a mortgage. Post the adjustment, the down-payment ratio could vary from 40% to 70% for second home purchases, compared with 40% across the board previously.

- The latest notice also increases the hurdles faced by developers in applying for presale permits. To qualify for the permit, buildings with seven floors and below will need to have the basic structure completed, while buildings with over seven floors must have construction of a third of all floors, or seven floors, completed, whichever is greater. Prior to the adjustment, the threshold was set at six floors across the board.

- Additionally, the notice states that funds received from presales should be fully stored in regulatory accounts, and will be strictly prohibited from being used by developers for other purposes.

- The strength of housing demand in Xi'an can partly be attributed to the city's attractiveness as a regional center for talent inflow. New home prices in Xi'an have been rising significantly faster than in other peer tier-2 cities. Through October, year-on-year (y/y) home price inflation averaged at around 5.5% y/y for all tier-2 cities, compared with over 9% y/y for Xi'an. Still, as the newly launched policy focuses on adjusting credit policy for second-home buyers, the direct impact on first-time buyers is expected to be limited.

- Chinese electric vehicle (EV) manufacturers NIO and Xpeng Motors have announced their delivery results for November. EV startup NIO delivered 5,291 vehicles in November, an increase of 109.3% year on year (y/y). The deliveries included 1,387 units of the ES8, 2,386 units of the ES6, and 1,518 units of the EC6. From January to November, NIO delivered 36,721 vehicles, an increase of 111.1% y/y. As of 30 November, NIO's cumulative deliveries of the ES8, ES6, and EC6 totaled 68,643 units. Meanwhile, Xpeng said it delivered 4,224 vehicles in November, up 342% y/y. Deliveries of the P7 sedan and the G3 sport utility vehicle (SUV) totaled 2,732 units and 1,492 units respectively in November. From January to November, Xpeng's combined deliveries of its two models were 21,341 units, up 87% y/y. NIO and Xpeng have both reported record monthly deliveries in the Chinese market during November, an indication of a positive market response to their respective new products. (IHS Markit AutoIntelligence's Abby Chun Tu)

- The US pecan association (APC) has just released October export data, revealing that Chinese recovery is strengthening. Global sales totaled 11.3 million in-shell basis pounds this October, 87.3% more year-on-year, bringing seasonal (September-October 2020) exports to 20.7 million pounds, 56% more y-o-y. The Chinese appetite for in-shell pecans was the driver of growth. China and Hong Kong SAR imported 5.8 million in-shell pounds, five times more than in October 2019. Shelled sales recovered strongly to 2.7 7 million pounds, 22% more year-on-year. Canada and the Netherlands were the main importers, accounting for 44.3% and 15%, respectively, of the total volume. Exports are confirming that Chinese purchases are cutting in-shell stocks, as IHS Markit reported on 24 November, finishing the huge disparity between US in-shell and shelled inventories and the industry being ready for rising prices. (IHS Markit Food and Agricultural Commodities' Jose Gutierrez)

- South Korean automakers posted a 5.1% y/y decline in their

combined global vehicle sales to 674,040 units in November,

according to data released by the five major domestic

manufacturers, as reported by Yonhap News Agency and compiled by

IHS Markit. (IHS Markit AutoIntelligence's Jamal Amir)

- The five automakers reported a 5.3% y/y increase in their combined domestic sales last month to 143,591 units, while their combined overseas sales went down by 7.6% y/y to 530,449 units.

- South Korea's top-selling automaker, Hyundai, posted global sales of 376,704 units in November, down 4.3% y/y. Hyundai's domestic sales surged 10.9% y/y to 70,035 units last month, while its overseas sales declined by 7.2% y/y to 306,669 units.

- Global sales of Hyundai's affiliate, Kia, increased by 2.0% y/y to 256,019 units in November.

- General Motors (GM) Korea reported a 45.6% y/y plunge in its total sales to 21,384 units last month, with its domestic sales down 10.5% y/y to 6,556 units and its overseas sales down 53.7% y/y to 14,828 units. The plunge in GM Korea's global sales last month was mainly due to several rounds of industrial action at its plants over this year's wage negotiations. This industrial action has resulted in a production loss of around 25,000 vehicles.

- SsangYong's global sales increased by 10.3% y/y to 11,859 units during November. Last month, the automaker sold 9,270 units in South Korea, up 0.3% y/y, and around 2,589 units in its overseas markets, up 71.0% y/y.

- Renault Samsung's sales nosedived by 48.7% y/y to 8,074 units in November, with its domestic sales plunging by 10.8% y/y to 7,207 units and its overseas sales plummeting by 88.7% y/y to 867 units. Renault Samsung suspended production operations at its sole Busan plant in South Korea on 2 and 3 November in a bid to keep inventories at manageable levels as the COVID-19 virus pandemic has weighed down on export demand.

- The decline in South Korean automakers' global sales during November was mainly due to a poor performance in overseas markets owing to the COVID-19 virus pandemic, which has caused a contraction in consumer spending. The decline last month can also be attributed to industrial action at GM Korea and production suspensions at Renault Samsung's plant.

- Hyundai Motor Group (HMG) has announced an overview of information about its new E-GMP global electric vehicle (EV) platform, which will transition HMG EVs to rear-wheel drive and promises range of at least 500 kilometers (WLTP) and bi-directional charging. HMG's unveiling of its dedicated EV platform comes on the heels of a series of announcements across the industry as an increasing number of automakers get closer to production of new EV products that have been in development for several years. Hyundai's approach with the E-GMP platform bears similarities to the strategies of General Motors and others to create a modular and flexible solution. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Indonesia's headline consumer price inflation nudged up to 1.6%

year on year (y/y) or a five-month high in November, but it is

still a far cry from Bank Indonesia (BI)'s 2.0-4.0% target range.

Proposals in a draft finance omnibus bill will broaden the central

bank's mandate to include sustainable growth and employment in

addition to the inflation target, but drop at least one

controversial proposal previously floated that threatened the

central bank's future independence. (IHS Markit Economists Angus

Lam and Bree Neff)

- Food prices were the primary source of inflationary pressure in November as they ticked up to a five-month high because of the start of the rainy season that lifted prices for chicken, eggs, red chilies, and onions, according to Statistics Indonesia. Health prices also remained elevated, nudging back up to 3.0% y/y potentially because of the persistence of the coronavirus disease 2019 (COVID-19) pandemic in the country.

- Implying continued weak demand pressures, core consumer price inflation nudged down to a fresh record low of 1.67% y/y in November, as other price pressures otherwise remained subdued (hanging close to record lows) across most consumer spending categories.

- BI cut its policy rate - the seven-day reverse repurchase (repo) rate - on 19 November by 25 basis points to 3.75%. This is a fresh record low for this policy rate that was introduced in 2016. BI's Board of Governors indicated that low inflation and improved external stability (read as - rupiah stability) allowed for the rate cut, and it is intended to help bolster the country's economic recovery.

- The inflation outlook for Indonesia remains benign because of the persistence of COVID-19 in Indonesia and the resulting negative effects on employment and consumer confidence. Enhanced food price monitoring systems by BI should help contain food prices beyond temporary disruptions. Therefore, barring a significant shock to food supplies, food price inflation should not worsen too much in the next few months.

- Annual average inflation for 2020 is likely to come in right around 2.0%, but will only creep into the central bank's target range by mid-2021 and will meaningfully reach the top of that band around late 2021, supported by recovering demand domestically and globally.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-december-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-december-2020.html&text=Daily+Global+Market+Summary+-+2+December+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-december-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 2 December 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-december-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+2+December+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-december-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}