Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 02, 2022

Daily Global Market Summary - 2 February 2022

All major APAC and most US equity indices closed higher, while European indices closed mixed. US government bonds closed slightly higher, while benchmark European bonds closed mixed. CDX-NA closed wider across IG and high yield, while European iTraxx was slightly tighter on the day. The US dollar closed lower, while natural gas, oil, gold, silver, and copper closed higher on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Most major US equity indices closed higher except Russell 2000 -1.0%; S&P 500 +0.9%, DJIA +0.6%, and Nasdaq +0.5%.

- 10yr US govt bonds closed -1bp/1.78% yield and 30yr bonds -1bp/2.11% yield.

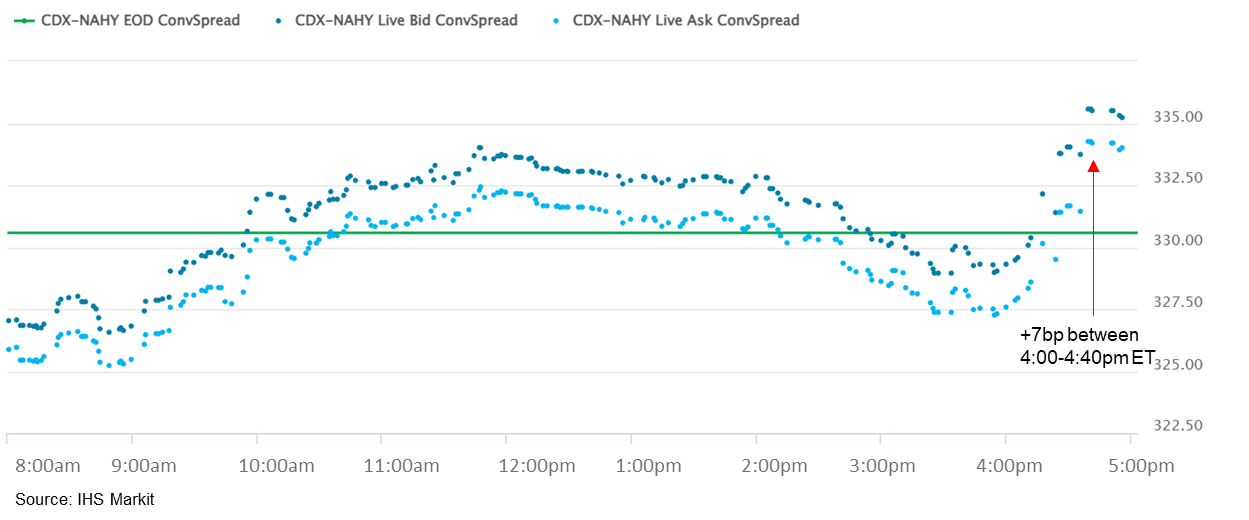

- CDX-NAIG closed +1bp/60bps and CDX-NAHY +4bps/335bps.

- CDX-NAHY widened 7bps after Facebook parent Meta Platforms'

worse than expected Q4 earnings report released shortly after

4:00pm ET.

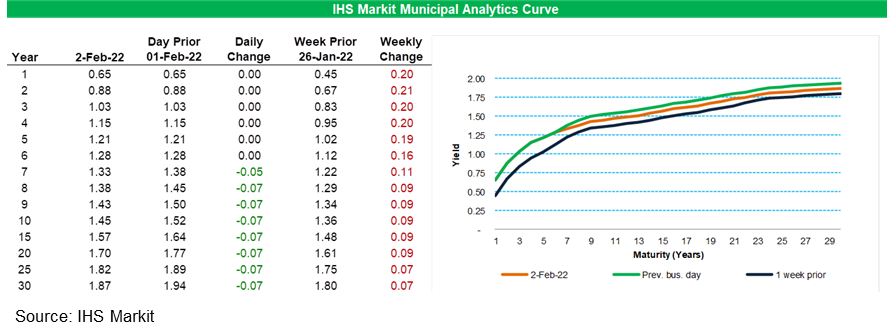

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC)

rallied 5-7bps for 7-year and longer maturities, with that part of

the curve now only 7-11bps worse week-over-week.

- DXY US dollar index closed -0.5%/95.94.

- Gold closed +0.5%/$1,810 per troy oz, silver +0.5%/$22.71 per troy oz, and copper +1.4%/$4.50 per pound.

- Crude oil closed +0.1%/$88.26 per barrel and natural gas closed +15.8%/$5.50 per mmbtu.

- Equinor and technology firm Battelle have signed a memorandum

of understanding to develop a decarbonized energy cluster in Ohio,

Pennsylvania, and West Virginia, the two announced February 1. (IHS

Markit PointLogic's Annalisa Kraft)

- Chris Golden, Equinor U.S. country manager, sees major low-carbon opportunity in Appalachia. "The Appalachian Basin is an important energy-producing region that also shows great promise in being a leader for the decarbonization of American industry.

- The partners agreed to undertake feasibility studies and work together on stakeholder outreach. According to the joint release the partners already have a presence in the tri-state region. "The partnership between Equinor, a global broad energy company, with offices in Hannibal, Ohio and Triadelphia, West Virginia and Columbus, Ohio-based Battelle, the world's largest independent research and development company, will enable the timely and progressive development of one of the first low-carbon industrial regions in the United States."

- The release detailed the companies' expertise in CCS. "Battelle is a leader in geologic carbon dioxide capture, use and storage with more than 100 projects worldwide over the past 20 years. Equinor has decades of experience with CCS projects of various sizes, from research and development to operations. Since 1996, Equinor has captured and safely stored more than 23 million tons of CO2."

- Companies cut jobs in January for the first time in more than a year as the spread of the Covid omicron variant appeared to hit hiring, payroll processing firm ADP reported Wednesday. Private payrolls fell by 301,000 for the month, well below the Dow Jones estimate for growth of 200,000 and a marked plunge from the downwardly revised 776,000 gain in December. It was the first time ADP reported negative job growth since December 2020. (CNBC)

- The IHS Markit manufacturing PMI for January showed output growth deteriorating markedly. The sub-index covering production fell to 50.5 from 53.8 in December, its lowest since the recovery form the first COVID-19 lockdowns began in July 2020. The news was followed by the ISM survey's output gauge also falling, down to its lowest since June 2020. However, at 57.8 compared to 59.4 in December, the ISM index is still indicative of production rising at a substantial rate whereas the IHS Markit index is signaling almost no growth. For both surveys, any index reading above 50 means more companies reported higher output during the month than reported lower output. (IHS Markit Economist Chris Williamson)

- The US homeowner vacancy rate—the proportion of residential

inventory vacant and for sale—remained at a record-low 0.9% in

the fourth quarter. Data-collecting procedures and response rates

are nearly back to normal—the data now appear to be more

reliable. The readings from the first quarter of 2020 to the first

quarter of 2021 were tainted by bad data related to low response

rates and Census workers' inability to make on-site visits. (IHS

Markit Economist Patrick

Newport)

- The rental vacancy rate—the proportion of rental inventory vacant and for rent—fell to 5.6%, from 6.5% a year earlier.

- The gross vacancy rate, the number of vacant units divided by the number of housing units, fell to 10.5%, down from 10.9% four quarters earlier and from 11.5% in the fourth quarter of 2019, the last pre-pandemic quarter.

- The homeownership rate came in at 65.5%, down from 65.8% four quarters earlier.

- Estimated housing inventory increased to 141.183 million, up 1.223 million from a year earlier.

- Markets are especially tight in the suburbs. Rental vacancy rates were highest outside of metropolitan statistical areas (MSAs; 7.7%), followed by principal cities (5.7%) and the suburbs (5.1%); the homeowner rate was lowest in the suburbs (0.7%), followed by places outside MSAs (1.0%) and principal cities (1.1%).

- US job openings fell by 150,000 to 10.9 million between the

last business days of November and December. The job openings rate

was unchanged at 6.8%. (IHS Markit Economist Patrick

Newport)

- The number of hires moved down by 333,000 to 6.3 million during December; the rate edged down two ticks to 4.2%.

- Job separations decreased by 305,000 to 5.9 million; the separations rate slipped 0.2 percentage point to 4.0%. Separations consist of quits, layoffs and discharges, and other separations.

- Quits fell by 161,000 to 4.3 million; the quits rate dropped from a series-high 3.0% to 2.9%. Typically, a high quits rate is a good thing, as it indicates that workers can improve their lot by pursuing opportunities elsewhere. In the age of COVID-19, though, quits could rise because workers are leaving unsafe working conditions or eschewing vaccine mandates. (Note: quits exclude retirements.)

- Layoffs and discharges fell by 140,000 to 1.2 million, a series low; the rate fell 0.1 percentage point to a series-low 0.8%.

- Other separations moved down by 5,000 to 392,000; the other separations rate was unchanged at 0.3%. Other separations include retirements, deaths, employee disabilities, and transfers to other locations.

- Over the 12 months ending in December, there was a net employment gain of 6.4 million. This compares with payroll and household employment increases of 6.4 million and 6.1 million, respectively, from a year earlier in December.

- There was a record-low 0.6 unemployed worker for every job opening at the end of December.

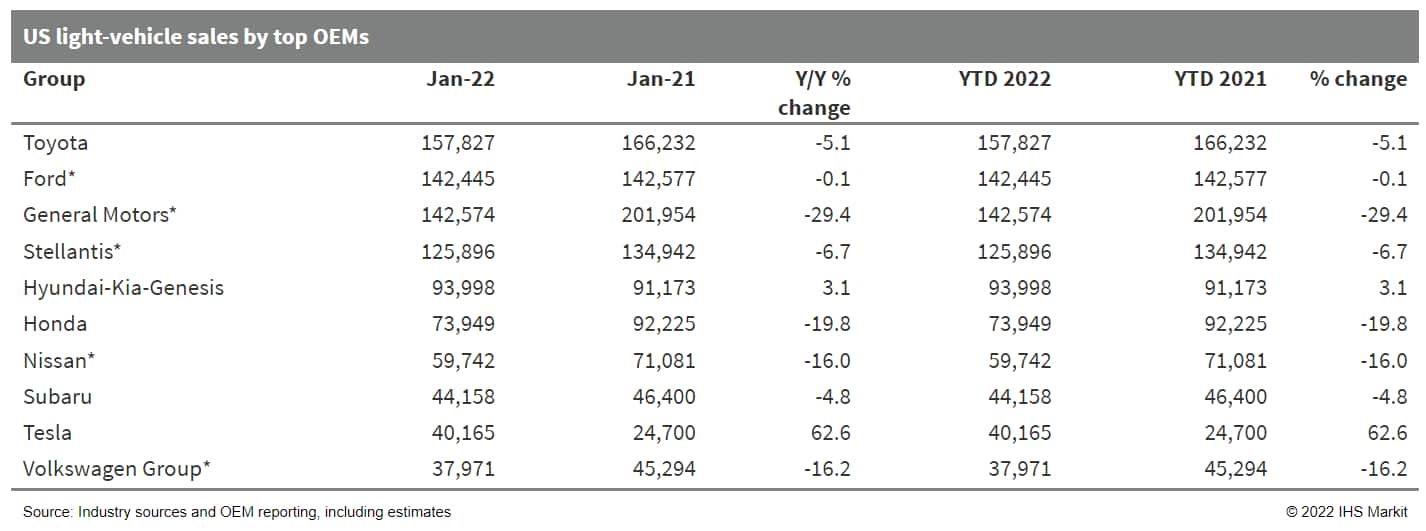

- A lack of inventory pushed US light-vehicle sales down by 9.8%

y/y in January. The estimated seasonally adjusted annual rate

(SAAR) of sales is 14.8-15.2 million units in January. The pace of

sales is expected to improve during the year, but low levels of

new-vehicle inventory are set to prevent a sharp change in sales

results. US light-vehicle sales in 2021 reflected the limited

demand growth given current inventory conditions. In the first half

of 2022, the market is expected to suffer much of the same

conditions and then sales quicken in the second half of the year.

Given current inventory conditions, it is difficult to project

significant demand recovery in the first half of 2022. However, by

the end of 2022, we expect the pace of sales to be more

recognizable in terms of pre-COVID-19 levels. Sales volume growth

is expected to be inventory-limited over the next 12 months and IHS

Markit projects US light-vehicle sales to reach approximately 15.6

million units in 2022. (IHS Markit AutoIntelligence's Stephanie

Brinley)

- Cruise Automation is to start giving free public rides in its autonomous vehicles (AVs) in San Francisco, California (United States) and has announced increased investment from SoftBank. The additional investment of USD1.35 billion is not new, however; Cruise has received the funding after reaching the milestone of operating fully driverless cars. Cruise Automation interim CEO Kyle Vogt announced the extra funding in a blog post on 1 February, saying, "This additional capital will help us expand our world-class team and quickly scale this technology across SF [San Francisco] and into more communities." Regarding the company providing free AV rides to the public, Vogt said there was no charge "for now… We're starting with a small number of users and will ramp up as we make more cars available, so sign up now to lock in an early spot." On the Cruise website, the company states that it has USD9.25 billion in funding, although it may have other milestones to reach before it is able to access all this money. Honda, for example, committed to investing USD2.75 billion in funding, but only USD750 million went directly to Cruise at the close of the deal. The remaining USD2.0 billion in investment is in ongoing AV development and is to roll out over 12 years, beginning in 2018. Nevertheless, the company's ability to deploy the AVs for the public is an accomplishment. A main reason the rides are free is that Cruise has not yet received approval to charge customers from the Californian authorities; however, the vehicles have been transporting Cruise employees. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Uber Technologies and electric vehicle (EV) charging firm Wallbox are expanding their partnership nationwide in the United States, according to a company statement. Following a pilot programme in the Bay Area in October 2021, the companies are expanding their collaboration to provide Uber drivers a discounted package for a Wallbox Pulsar Plus charger. The rollout is expected to take place in four phases: the first covering Los Angeles, Portland, and Seattle in January; followed by Phoenix, New York, and Boston in February; the Midwest and Southeast will be covered in March; and the final phase covering the rest of the US excluding Alaska in April. Andrew Macdonald, Uber's senior vice-president of mobility and business operations, said, "Helping drivers go electric is a crucial part of our plan to get to zero-emissions by 2030 in the U.S. This partnership with Wallbox helps drivers by making it more affordable and accessible to charge their EVs, and we're excited to give more drivers the chance to take advantage of it." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Mexico's real GDP declined 0.1% in the last quarter of 2021,

compared with the July-September quarter, reports the National

Institute of Statistics and Geography (Instituto Nacional de

Estadística y Geografía: INEGI). This followed a 0.4% q/q

contraction in the third quarter. The figures are based on

seasonally adjusted data. (IHS Markit Economist Rafael

Amiel)

- Two consecutive quarters of decline in real GDP put Mexico's economy back in a technical recession. Previously, from the fourth quarter of 2019 through mid-2020, Mexico was also in a recession, which started before the coronavirus disease 2019 (COVID-19) pandemic. At the end of 2021, Mexico's real GDP was 4.2% lower than at the end of the third quarter of 2019.

- INEGI's flash GDP report highlights that growth in the primary sector (mostly agriculture) and industry was offset by a sizeable decline in services output (see table below). Since August 2021, the services sector has been affected significantly by new legislation on outsourcing. This implies that many workers and services stopped operations, which led to decreased overall output.

- Mexico's industry has been growing since the third quarter of 2020, when it started recovering from plunging output driven by the lockdowns and restrictions imposed at the beginning of the pandemic. Despite a shortage of semiconductors and global supply chain distortions, manufacturing continues to grow on strong demand from the United States.

- Based on seasonally adjusted data, INEGI reports that, in the full year 2021, Mexican GDP grew 5.0%, after plunging 8.4% in 2020. This 5.0% growth number for 2021 implies that the growth rate for one or more of the first three quarters of the year has been revised downwards; otherwise, growth for the full year would be slightly higher at 5.2%. This information is to be published on 25 February when the first revision of GDP numbers is published.

Europe/Middle East/Africa

- Major European equity markets closed mixed; UK +0.6%, Italy +0.6%, France +0.2%, Germany flat, and Spain -0.2%.

- 10yr European govt bonds closed mixed; UK -5bps, France flat, Germany/Spain +1bp, and Italy +7bps.

- iTraxx-Europe closed -1bp/57bps and iTraxx-Xover -1bp/281 bps.

- Brent crude closed +0.3%/$89.47 per barrel.

- On 1 February, the National Pig Association (NPA) and the

National Farmers' Union of England and Wales (NFU) wrote a letter

to UK Environment Secretary George Eustice and said their farmers

are stuck looking after 170,000 pigs because of delays in

abattoirs. (IHS Markit Food and Agricultural Policy's Pieter

Devuyst)

- They called on Eustice to convene an emergency summit with stakeholders from across the supply chain and "agree on a plan to get these pigs off farms and onto people's plates".

- The groups explained that the delays are caused by labor shortages in the meat processing industry following COVID-19 outbreaks and the departure of many eastern European workers after Brexit.

- The NPA added that the backlog has forced farmers to cull 35,000 healthy pigs without being able to sell their meat and believes this number could be higher due to many unreported cases. The industry group also claimed that the crisis saw 40 farms leave the sector and is taking a toll on pork producers' mental health.

- Mobility services provider FREE NOW plans to double the volume of its operations in Romania in 2022, reports Business Review. Since November 2019, FREE NOW has offered ride-sharing and taxi services in Romania and is currently available in nine cities across the country. The company said that the average number of electric vehicle (EV) rides in Romania increased by 15% year on year (y/y) in 2021. In the same year, Romanian capital Bucharest ranked seventh in terms of the number of rides among the 170 European cities where FREE NOW operates, and a total distance of almost 24 million km was travelled in Romania. In 2021, the average cost of a trip was about USD3.9 and the average distance was slightly over 5 km. (IHS Markit Automotive Mobility's Surabhi Rajpal)

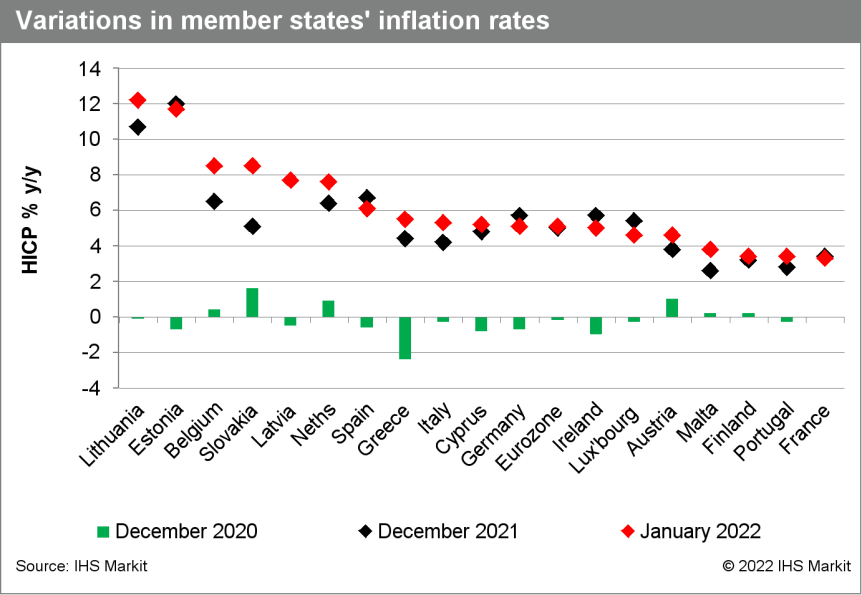

- 'Flash' estimates for eurozone headline and core inflation

rates in January again markedly exceeded expectations, although the

latter declined. Inflation will moderate during 2022 but is likely

to remain uncomfortably elevated for most of the year in the

absence of a reversal of the recent surge in energy prices. (IHS

Markit Economist Ken

Wattret)

- Contrary to expectations of a large, base-effect-driven decline, the flash estimate of January's eurozone Harmonised Index of Consumer Prices (HICP) shows the inflation rate ticking up to 5.1%, a new record high and well above the market consensus expectation (of 4.4%, according to Reuters' survey).

- Energy prices were again primarily responsible, rising by 6% month on month (m/m), the largest increase on record. Despite favorable base effects, therefore, the year-on-year (y/y) rate of increase in energy prices accelerated to a new record high of 28.6%. The contribution of energy to overall HICP inflation jumped to a new record high.

- A full breakdown of the HICP by item will not be available until the final January release on 23 February, but soaring gas and electricity prices remain key sources of upward pressure.

- Unprocessed food inflation also continued its recent run of

increases in January, rising to 5.2%, the highest rate since June

2020 and almost quadruple October 2021's rate.

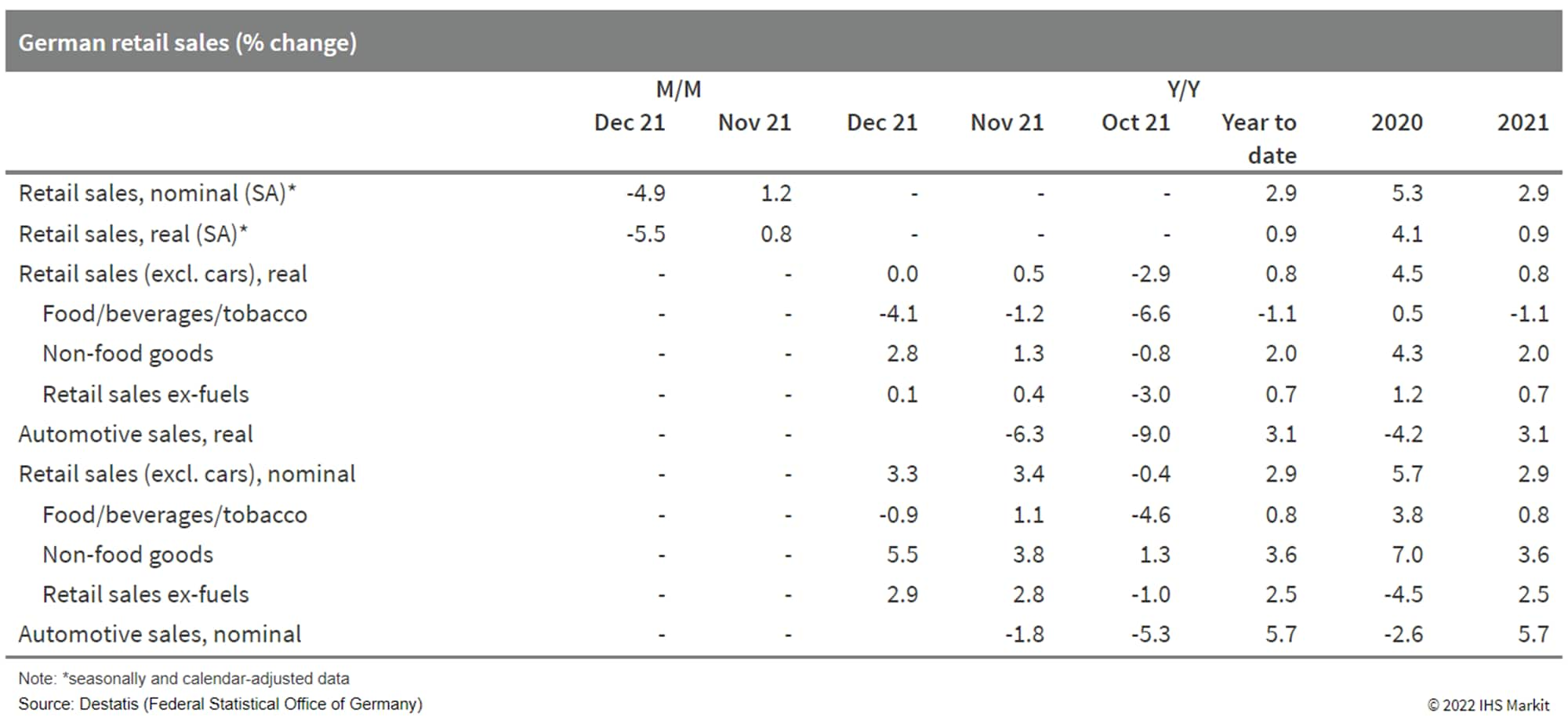

- According to German Federal Statistical Office (FSO) data, real

retail sales excluding cars declined by 5.5% month on month (m/m;

seasonally and calendar-adjusted) in December 2021. Nevertheless,

previous gains have ensured that the December 2021 level of

inflation-adjusted retail sales remains slightly above that seen

just prior to the pandemic in February 2020. In nominal terms, the

increase versus February 2020 is even close to 5%. (IHS Markit

Economist Timo

Klein)

- The key reason for the setback in December 2021 is the tightening of administrative restrictions, specifically the rule prohibiting unvaccinated people from entering retail stores even if they have a negative test (except stores for necessities like food and medicine). In addition, the fact that the public holidays for Christmas fell on a weekend led to an over-adjustment for the calendar effect, as available shopping days were underutilized.

- The December 2021 breakdown by goods category, based on

price-adjusted year-on-year (y/y) data (total 0.0% without

shopping-day adjustment; see table below), once again revealed the

underperformance of food versus non-food sales. Food sales were

4.1% below year-ago levels, whereas non-food sales increased by

2.8% y/y. Among non-food goods, 'internet and mail orders' were

surprisingly weak for a change at -5.5% y/y, whereas clothing/shoes

at 32.0% y/y seemingly made up for some of the weakness earlier in

the year. The base effect of the full lockdown in mid-December 2020

helped greatly, as is the case for categories such as sales at

general department stores (19.2% y/y) and sales at specialized

shops (11.3%). In contrast, sales of 'furniture/household

goods/DIY' essentially stagnated (0.1%) and those of

pharmaceutical/cosmetic goods edged up just modestly (0.7%).

- The Norwegian passenger car market has dropped substantially during January. According to the latest data published by the country's Road Traffic Information Council (Opplysningsrådet for Veitrafikken: OFV), volumes have fallen by 22.8% year on year (y/y) to 7,957 units. The biggest-selling brand during the month was Audi which rose by 17.1% y/y to 952 units, followed by Hyundai which surged by 159.8% y/y to 704 units. Volkswagen (VW) increased by 22.7% y/y to 659 units. Elsewhere in the Norwegian market, registrations of light commercial vehicles (LCVs) of up to 3.5 tonnes tumbled by 36.2% y/y to 1,495 units during January, as medium and heavy commercial vehicle (MHCV) registrations slipped by 7.7% y/y to 469 units. While some passenger car brands have recorded strong growth in January, others have dropped off steeply during the month. Those to suffer steep double-digit percentage declines included Toyota, BMW, Volvo and Peugeot, and their performance may not be helped by the semiconductor shortage. It is also a typically a weak month for Tesla, which focuses on fulfilling orders towards the end of a quarter. Despite the fall, volumes of zero-emission passenger cars, which are mainly made up of battery electric vehicles (BEVs), continued to expand in January, growing by 21.9% y/y to 6,660 units. This represents a market share of around 83.7%. (IHS Markit AutoIntelligence's Ian Fletcher)

- Turkey's headline merchandise-trade deficit narrowed in 2021.

However, a switch in the direction of the gold trade led to the

improvement, with the non-gold trade deficit worsening somewhat.

Nonetheless, with the headline trade gap smaller, the

current-account deficit narrowed. In 2022, a weaker lira will keep

export gains strong, but may not inhibit imports as significantly.

The trade and current-account gaps will hold more or less steady

against their 2021 levels. (IHS Markit Economist Andrew

Birch)

- In 2021, Turkey posted a merchandise-trade deficit of USD46.1 billion according to customs-based data from the Turkish Statistical Institute (TurkStat). The gap was down by 7.5% from 2020, when the deficit had been USD49.9 billion.

- A turnaround in the gold trade overwhelmingly affected the headline trade balance. After running a gold trade deficit of USD19.9 billion in 2020, Turkey ran a surplus of USD3.9 billion in 2021. This left the overall non-gold trade deficit in 2021 at USD50.0 billion, up from USD30.0 billion in 2020.

- In 2021, non-gold exports increased by 31.5%. The weaker lira has helped to buoy export competitiveness, with export volume growth significantly stronger in the latter half of the year as compared to the first half of the year, even considering a negative base effect.

- Meanwhile, non-gold imports rose by 37.0% in 2021 as a whole. Higher global commodity prices sent the value of imports of commodities - particularly energy, iron and steel, aluminum, and copper - soaring last year. Increased manufacturing also drove demand for these inputs as well.

- UAE's consumer price inflation slightly slowed down to 2.5%

year on year (y/y) in December from 2.6% in November, according to

the Federal Competitiveness and Statistics Centre. Price inflation

thus slowed for the first time in six months, when the rate of

annual inflation had still been in negative territory at -0.5% y/y.

(IHS Markit Economist Ralf

Wiegert)

- The price index for food and beverages remained all but unchanged in December from the previous month, transporting costs, which includes fuel prices, edged up 0.3% at the same time. Average fuel prices in the UAE had been reduced from AED2.80 per liter Super 98 in November to AED2.77 per liter in December, according to Gulfnews, though. Still, transportation costs have been the main driving force of price inflation in y/y terms, having posted an increase of 18.0% from December 2020, while food costs rose only 3.7% at the same time.

- Annual consumer price inflation averaged just 0.2% for the year 2021 as a whole, marking the first increase following two consecutive years of falling consumer prices in 2020 and 2019. The period of price deflation thus officially ended.

- On 31 January, Reuters reported that Kuwait Credit Bank (KCB),

a state-owned development bank that provides interest-free housing

loans, plans to issue KWD1-billion (USD3.3-billion) bonds to raise

capital. The bank has seen liquidity pressure increase in the face

of high demand for it to finance real estate and housing loans in

Kuwait. KCB director general Salah Al-Mudhaf estimated that the

bank needs KWD16 billion to fully finance the current eligible

citizens through to 2035. On 25 January, Kuwait's parliament

increased the KCB's capital by KWD300 million from the Kuwait Fund

for Arab Economic Development. The current capital of the KCB is

around KWD3.3 billion. (IHS Markit Banking Risk's Tan Wang)

- The KCB disbursed KWD400 million of loans in 2021. Total household loans in Kuwait's banking sector increased from KWD12.0 billion before the pandemic to KWD13.9 billion as of September 2021.

- Established in the 1960s, the KCB, previously regulated under the State Ministry for Housing Affairs, provides interest-free housing loans worth up to KWD70,000 for all citizens regardless of income level to build, buy, or renovate housing, with repayment terms of 60 years.

- The bank's drive to increase capital and liquidity is mainly attributed to increasing housing demand and population growth. Although liquidity is tight at the KCB, the alternative for Kuwaiti citizens is to finance houses through other commercial banks with higher interest rates.

- Egypt is officially reincluded on the JPMorgan index after it

exited it in June 2011. With the reinclusion, the country is

expected to make 14 issuances with a total value of USD26 billion,

gaining a 1.85% weighting, after having been added to the watch

list for inclusion last April within a three-year process. (IHS

Markit Economist Yasmine

Ghozzi)

- Egypt's bonds have also been added to the GBI-EM Broad Diversified Index with a share of 1.47% and the GBI-AGG Diversified Index with a share of 0.24%. Egypt has been added to the investment bank's green bond index following its USD750-million issuance in November 2020. Egypt became the first country in the Middle East and North Africa region to issue sovereign green bonds. Given its success, the Ministry of Finance is looking to tap the green bond market for a second time with another USD750-million issuance, although no timeframe has been set for the sale.

- This could provide some leeway for the central bank, whether with regards to pressure on the exchange rate or interest rate, and with the flows of investments through this index, it can cover any negative part in the banks' net foreign assets.

- Egypt is also preparing for the first sovereign sukuk sale in the first half of 2022. Sukuk adds another financing tool for Egypt to meet external financing needs without further recourse to International Monetary Fund (IMF) funds. Issuing sovereign sukuk is part of a wider strategy to reduce government debt and shift towards longer-term borrowing. Egypt is also planning on issuing USD500 million in JPY-denominated bonds (Samurai bonds) in the first half of 2022.

- Japan Motors Trading Company's (JMTC) new vehicle assembly facility in Ghana, which entailed an investment of USD8 million, is set for completion, reports Africa Briefing. The 5,000-square-foot facility will assemble the Nissan Navara pick-up. Ghana's Minister for Trade and Industry Alan John Kwadwo Kyerematen said, "I inspected the progress of the construction of Japan Motors Plant under the Ghana Automotive Development Programme and I'm impressed on the progress made by the team. Once complete the plant will assemble [the] new Nissan Navara Pick-up and the Nissan Almera vehicles with a capacity to hold 10,000 new vehicles." The JMTC plant will consist of four warehouses for the assembly and testing lines, along with a special underground shower with a 180-cubic-inch water tank, along with a showroom and offices. (IHS Markit AutoIntelligence's Tarun Thakur)

Asia-Pacific

- All major APAC equity markets are closed higher today; Japan +1.7%, India +1.2%, and Australia +1.2%.

- Taiwan's economy ended 2021 on a stronger note, driven by a

broad-based recovery as consumer spending resumed growth in the

fourth quarter, while investment spending and exports maintained

double-digit expansions. Supported by the territory's advanced

technology and export competitiveness, along with supply shortages

in semiconductors, robust exports and business spending are likely

to remain the driving force of the economy. However, key downside

risks will come from the continued fallout of the pandemic and the

Omicron variant of the COVID-19 virus, unfavorable base effects,

headwinds from mainland China's economic concerns, supply chain

disruptions, and possible monetary tightening around the globe.

(IHS Markit Economist Ling-Wei

Chung)

- Preliminary data show that the economy picked up steam during the final quarter of 2021 as expansions were registered across the board. Real GDP jumped 4.9% year on year (y/y) in the fourth quarter, accelerating from a 3.7% y/y increase posted in the third quarter. For 2021 as a whole, the economy climbed 6.3%, accelerating from a 3.4% gain posted in 2020. It also marked the fastest expansion since 2010.

- In seasonally adjusted quarter on quarter (q/q) terms, the economy also picked up momentum in the fourth quarter, as real GDP increased by an annualized 11.1% from the preceding quarter, strengthening from a 1.1% gain in the third quarter.

- Gross investment continued to provide the main impetus to economic growth during the fourth quarter, jumping 13.9% y/y, albeit decelerating from a 31.7% y/y surge in the third quarter. Local companies, such as semiconductor and other technology firms, have continued to invest on advanced technology and expand capacity to meet demand, which in turn bolstered investment in machinery equipment and related outlays. Investment in factory expansion, combined with that in 5G infrastructure, green energy, and construction sectors, has boosted investment spending in the past quarters.

- This reflected a 15.2% y/y expansion in imports of capital goods (in Taiwan dollar terms), with imports of semiconductor equipment surging 23.2%. Manufacturing production of investment goods also climbed 10.8% y/y as investment on machinery equipment, construction, and transportation equipment expanded across the board.

- Major automakers in India, including passenger vehicle and

commercial vehicle (CV) manufacturers, have reported their

wholesale vehicle deliveries for January. Maruti Suzuki dominated

the Indian passenger vehicle market yet again ahead of Hyundai,

Tata Motors, M&M, and Kia. (IHS Markit AutoIntelligence's Isha

Sharma)

- Maruti Suzuki continued to lead the passenger vehicle market during January by a significant margin but reported that its dispatches to dealers declined by 7.3% year on year (y/y) to 128,924 units during the month. In its filing with the Bombay Stock Exchange (BSE), the automaker stated that its shipments in the passenger car segment, including mini, compact, and mid-size cars such as the Alto, S-Presso, Wagon R, Swift, Celerio, Ignis, Baleno, Dzire, Tour S, and Ciaz, grew by 12.7% y/y to 103,435 units last month. Sales of Maruti Suzuki's utility vehicles, including models such as the Ertiga, Gypsy, S-Cross, Vitara Brezza, and XL6, decreased by 10.3% y/y to 23,887 units, whereas sales of the Eeco vans grew by 10.9% y/y to 11,680 units.

- In second spot, Hyundai Motor India Limited (HMIL) reported a 15.3% y/y decline to 44,022 units last month. The automaker's exports during the month rose 16.0% y/y to 9,405 units. Tata Motors in third place dispatched 40,777 units to its dealers last month, a 51.0% y/y surge. This included 2,892 electric vehicles (EVs), up from 514 units in January 2021, and 37,885 units of internal combustion engine (ICE)-powered models, up 43.2% y/y.

- M&M took fourth place and dispatched 19,964 units last month, a decline of 3.0% y/y. "Despite various global supply chain challenges, we fulfilled our commitment of billing the first 14,000 XUV700s by January 2022 and have registered close to 100,000 bookings since launch, a major milestone in the Indian SUV [sport utility vehicle] industry. We continue to closely monitor the semi-conductor related parts issue and take corrective action as appropriate," said Veejay Nakra, CEO of the automotive division at M&M.

- Kia followed in fifth place with wholesales of 19,319 units during the month, up 1.4% y/y.

- In the next two slots were Honda and Renault with 10,427 units (down 7.8% y/y) and 8,119 units (down 1.0% y/y), respectively.

- Automakers in India posted mixed results last month amid the ongoing supply chain crisis triggered by the global semiconductor shortage as well as rising cases of the Omicron variant of COVID-19. Hyundai regained second spot during the month, but its production remained affected by the chip shortage. Maruti continued to lead the market but also posted a decline of more than 7% y/y.

- HDFC Bank and the Spices Board of India have partnered to

launch an innovative digital platform Spice Xchange India. The

exchange is designed to strengthen the board's ability to provide

an international link between Indian exporters and importers

abroad. The newly created portal would support all B2B

transactions. HDFC bank is the only banking partner for the

exchange and would play a crucial role for all stakeholders in the

spice trade ecosystem. (IHS Markit Food and Agricultural

Commodities' Julian

Gale)

- The platform was launched by Som Parkash, minister of state for commerce and industry, government of India, in Kochi.

- The Spices Board, under the Ministry of Commerce and Industry, government of India, is the flagship organization for developing and promoting Indian spices worldwide. The Board has 6,000 members from across India.

- The bank has created a web portal with a unique Payment Gateway platform that would support all B2B transactions for the Board and its members. All members would be eligible to join. They can register themselves on the portal by paying a one-time/annual fee of INR44,000 ($588) with applicable taxes.

- India intends to quintuple the size of a subsidy scheme for

domestic solar photovoltaic (PV) module makers, pushing forward

with the country's Atmanirbhar Bharat (Self-reliant India) strategy

for decarbonizing its economy. (IHS Markit Net-Zero Business

Daily's Max Lin)

- To help counter climate change, the world's third largest GHG emitter is aiming to have 500 GW of renewable energy capacity installed by 2030-including at least 280 GW of solar-before reaching net-zero emissions by 2070.

- In the budget for April 2022 to March 2023, New Delhi would allocate an additional Rs 19,500 crore ($2.61 billion) to the Production Linked Incentive (PLI) program to promote domestic PV module manufacturing, Sitharaman said.

- The PLI, which started with Rs 4,500 crore ($600 million) in the last annual budget, offers subsidies to selected module plants based on their sales, product quality, and local content.

- IHS Markit estimates 80%-90% of India's solar components are imported, with China the main supplier. Government figures show India currently has annual production capacity of just 2.5 GW for PV cells and 9-10 GW for modules.

- But the initial PLI budget will help drive the expansion of India-based manufacturers, according to the National Investment Promotion & Facilitation Agency (NIPFA), and India's capacity of integrated module plants that can convert wafer-ingots to modules is expected to reach 10 GW by the end of March 2023.

- The government agency expects India's annual module manufacturing capacity to expand by 30-35 GW between 2021 and 2025, in part driven by strong demand and policy incentives.

- As anticipated the Reserve Bank of Australia (RBA) announced

the conclusion of its government bond-buying program following the

Monetary Policy Board's first meeting of 2022. However, the central

bank remains steadfast that it will not be raising the official

cash rate target from 0.10% any time soon, defying expectations

that the RBA would shift its tone on this key matter after recent

data releases. (IHS Markit Economist Bree

Neff)

- The government bond-purchasing program will make its final purchases on 10 February, after the RBA Monetary Policy Board weighed market conditions and the actions of other major central banks against the recent domestic labor and inflation data (see Australia: 26 January 2022: Inflation and unemployment data for year-end 2021 increase pressure on Reserve Bank of Australia to change tone).

- The decision to end the bank's quantitative easing program was not a major surprise to markets. What was a surprise was that RBA governor Philip Lowe held the long-held position on raising the policy rate, stating that the central bank will not raise the official cash rate target from 0.10% until headline inflation is sustainably within the bank's 2-3% target range. The post-decision press statement emphasized the point with the direct statement, "Ceasing purchases under the bond purchase program does not imply a near-term increase in interest rates."

- The RBA will be releasing revised forecasts on 4 February, but

the press statements indicate that inflation forecasts have been

upwardly revised with underlying or core inflation seen hitting

3.25% in coming quarters (up from 2.25%) before easing to 2.75% in

2023. The unemployment rate is expected to plunge below 4% by the

end of 2022 (previously 4.25%) and fall further to 3.75% by the end

of 2023.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-february-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-february-2022.html&text=Daily+Global+Market+Summary+-+2+February+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-february-2022.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 2 February 2022 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-february-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+2+February+2022+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-february-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}