Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 02, 2021

Daily Global Market Summary - 2 July 2021

Most major US equity indices closed higher following the slightly better than expected US non-farm payroll report, while APAC and European markets were mixed. US and benchmark European government bonds closed higher. European iTraxx was close to flat across IG and high yield, while CDX-NA was modestly tighter. The US dollar and WTI closed lower, while silver, natural gas, Brent, gold, and copper closed higher on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Most major US equity indices closed higher except Russell 2000 -1.0%, with the Nasdaq +0.8%, S&P 500 +0.8%, and DJIA +0.4% all closing at new all-time record highs. It's worth noting today was the seventh consecutive new high for the S&P 500, which is the most since August 2020.

- 10yr US government bonds closed -2bps/1.44% yield and 30yr bonds -2bps/2.05% yield (the US bond market closed early at 2:00pm ET ahead of the Independence Day holiday weekend).

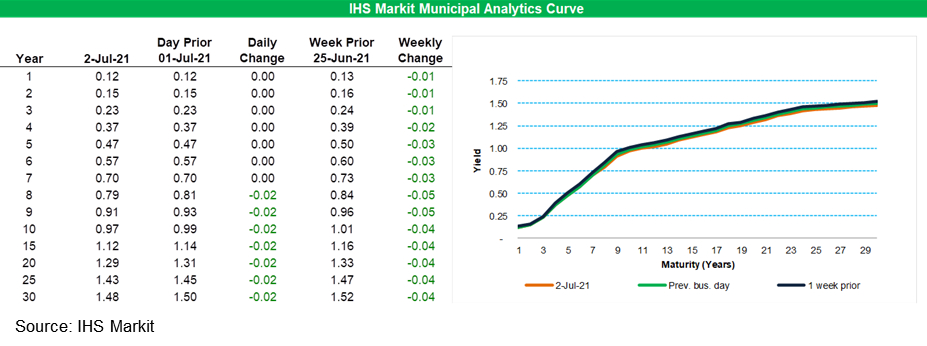

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC)

rallied 2bps for 8-year and longer paper, with that same part of

the curve 4-5bps better week-over-week.

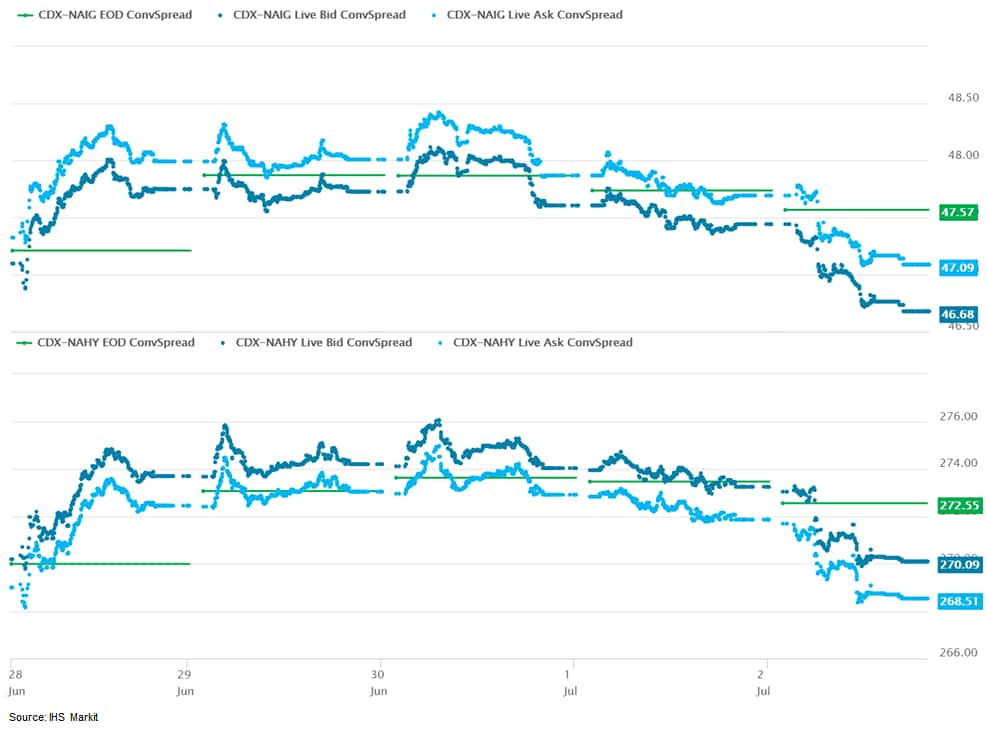

- CDX-NAIG closed -1bp/47bps and CDX-NAHY -4bps/269bps, which is

flat and -1bp week-over-week, respectively.

- DXY US dollar index closed -0.4%/92.23.

- Gold closed +0.4%/$1,783 per troy oz, silver +1.5%/$26.50 per troy oz, and copper +0.9%/$4.28 per pound.

- Crude oil closed -0.1%/$75.16 per barrel and natural gas closed +1.1%/$3.70 per mmbtu.

- In what would be the first advanced reactor approval for the US nuclear industry, the Nuclear Regulatory Commission (NRC) is proposing to certify NuScale Power's 77-MW small modular reactor (SMR) design as safe for domestic commercial use. The NRC, in a 1 July Federal Register notice, cited a previously granted assessment that found "no significant environmental impact" from certifying NuScale's reactor as well as the agency's positive safety evaluation of the technology from August 2020. The agency's proposed rule is giant step forward for NuScale, leaving only a final regulatory hurdle—final NRC approval—before it becomes the first US SMR vendor able to take its reactor to market. As further indication of the market's optimism about NuScale, the company announced on 30 June that it has finalized an investment agreement with GS Energy North America Investments, the US entity of the South Korean leading energy services provider. As part of a long-term strategic relationship established under the agreement, GS Energy will provide a cash investment in NuScale Power and support deployment of NuScale plants. (IHS Markit Climate and Sustainability News' Kevin Adler)

- US nonfarm payroll employment rose 850,000 in June, about as we

had assumed but above the consensus estimate. The unemployment rate

rose 0.1 percentage point to 5.9%; this was unexpected. The broad

contours of the June employment report are consistent with

continued healing in labor markets, but not all systems are "go."

(IHS Markit Economists Ben

Herzon and Michael

Konidaris)

- The headline gain in payrolls was driven by large increases in leisure and hospitality (343,000) and in education services (public and private; 268,000). The payroll gain outside of these sectors (239,000) was unspectacular.

- The private workweek was revised lower for May and declined 0.1 hour in June to 34.7 hours. The workweek remains elevated relative to the pre-pandemic norm (34.4 hours) but is under downward pressure, as the shorter-workweek jobs that were lost to the pandemic return.

- Average hourly earnings (AHE) rose 0.3% in June, as we expected. Moderate gains in AHE reflect a balance between a boost from acceleration in some industries and drag from a rising share of lower-wage employment, as lower-wage jobs that were lost to the pandemic return.

- The increase in the unemployment rate mainly reflected a reported small decline in civilian employment (from the Household Survey). The labor-force participation rate was unchanged at 61.6%. If expiration of enhanced unemployment benefits is to boost labor-force participation, we may start to see those effects in the July employment report.

- US manufacturers' orders rose 1.7% in May, about as expected.

Shipments rose 0.7% and inventories rose 0.9%. Revisions to core

orders and shipments through May were modest. (IHS Markit

Economists Ben

Herzon and Lawrence Nelson)

- Both orders and shipments remain in line with a firming trend and have both exceeded their pre-pandemic levels.

- Some of the recent strength in (nominal) orders and shipments reflects accelerating prices in the manufacturing sector.

- The Producer Price Index (PPI) for net output in the manufacturing sector rose at a 21.5% annual rate over the six months ending in May.

- Orders and shipments of core capital goods remain elevated. In May, orders for core capital goods were 16.2% above the February 2020 level while shipments were up 12.9% over the same period.

- Despite supply-chain constraints, manufacturers continue to build inventories, and at all stages of production. Materials and supplies, work in process, and finished goods inventories have all firmed in recent months.

- The US trade deficit (nominal) widened by $2.1 billion to $71.2

billion in May, the second-largest reading on record, as imports

rose more than exports. The real goods deficit increased by 3.1

billion chained (2012) dollars—petroleum products accounted for

nearly all of the increase. (IHS Markit Economist Patrick

Newport)

- Nominal exports of goods and services increased 0.6%; goods exports grew 0.3%, but real goods exports (which matter for growth), dropped 2.0%, dragged down by a 3.9% drop in real industrial supplies. Real exports in May stood just below their pre-pandemic level. They should rise above that level in the upcoming months as economies across the world pick up steam.

- Nominal imports increased 1.3%, with goods imports rising 1.2% in nominal terms, but unchanged after adjusting for inflation. Averaged over the prior three months, real imports stand 10% higher than in the fourth quarter of 2019. The three-month average for real consumer goods is a whopping 24% above its fourth-quarter 2019 reading.

- Nominal imports from mainland China skyrocketed by $10.9 billion in March, only to plunge by $6.0 billion and $5.2 billion in April and May. These erratic swings may simply be a matter of the seasonal adjustment factors giving distorted readings because of the pandemic.

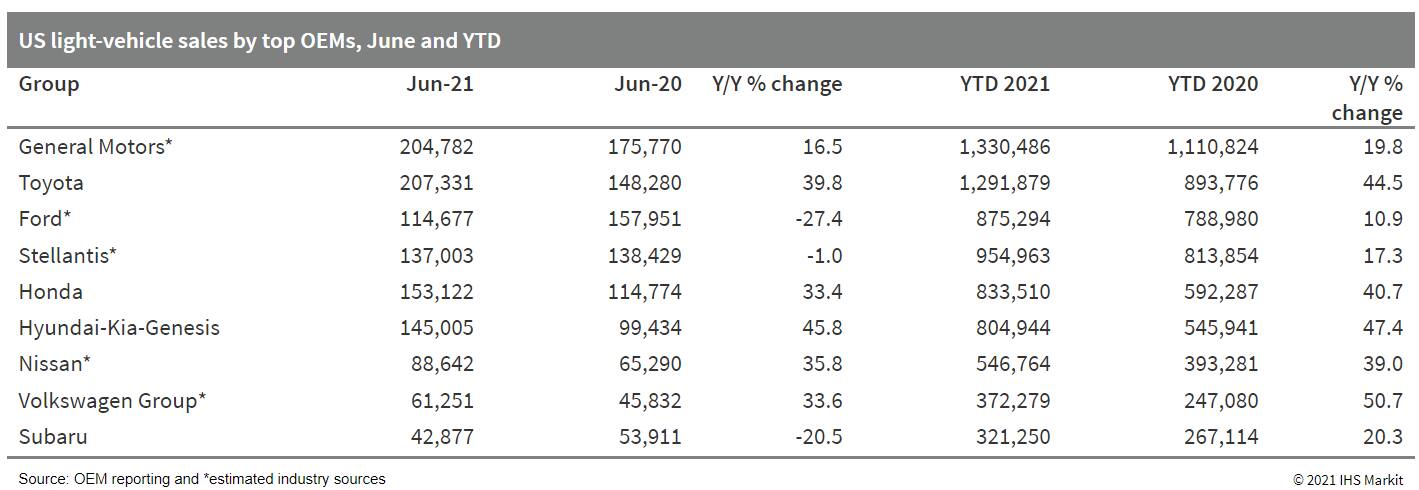

- After a 17.0-million-unit seasonally adjusted annual rate

(SAAR) reading in May 2021, the SAAR for June is estimated to have

dropped to between 15.2 million and 15.7 million units. Stronger

than in June 2020 (13.0 million units), the frenetic pace of the

past three months was slowed by inventory issues in June 2021, as

expected. On a volume basis, US light-vehicle sales increased 16.4%

y/y in June. A result of the progressively falling inventory levels

and a possible pull-forward effect in the torrid pace of auto

demand over the previous three months, light-vehicle sales dropped

significantly in June, confirming our assumption that monthly sales

levels would moderate. Although we expect an improvement in

inventory during the second half of the year, not much is likely to

be seen in July or August. IHS Markit forecasts full-year

light-vehicle sales will reach 16.8 million units in 2021. (IHS

Markit AutoIntelligence's Stephanie

Brinley)

- Autonomous vehicle (AV) system developer Ghost Locomotion has raised USD100 million in a Series D funding round, according to a company statement. Returning investors Sutter Hill Ventures and Founders Fund as well as new investor Coatue participated in the round. The company plans to use the capital for research and development (R&D) as it continues to develop its crash prevention technology to bring AVs to highways. Ghost Locomotion is a US-based startup that was founded in 2017 by John Hayes and Volkmar Uhlig. The company focuses on developing crash prevention technology which uses artificial intelligence and physics to track objects, regardless of speed, size, or type. Unlike existing systems, Ghost Locomotion does not need to recognize an obstacle to avoid it. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The US processor McCormick increased its Q2 sales (March-May)

by 11% year-on-year to 1.5 billion, bringing H1 sales to USD3.3

billion, 16% more y-o-y thanks to robust flavor sales after the

hostelry industry is gradually recovering. (IHS Markit Food and

Agricultural Commodities' Jose Gutierrez)

- Gross profit increased by 6% to USD614.6 million in Q1

- Consumer segment fell by 4.7% due to impact of foreign exchange currency and a slight fall in home cooking trends. However, McCormick explained that home cooking data is still higher than before the pandemic.

- Flavor segment sales increased by 7.6% between March-May due to Horeca recovery, especially in the EU.

- Operating income in 2021 is expected to grow by 6-8% from USD1.0 billion in 2020. In addition, transaction and integration expenses related to the Cholula and FONA acquisitions may total USD42 million in 2021.

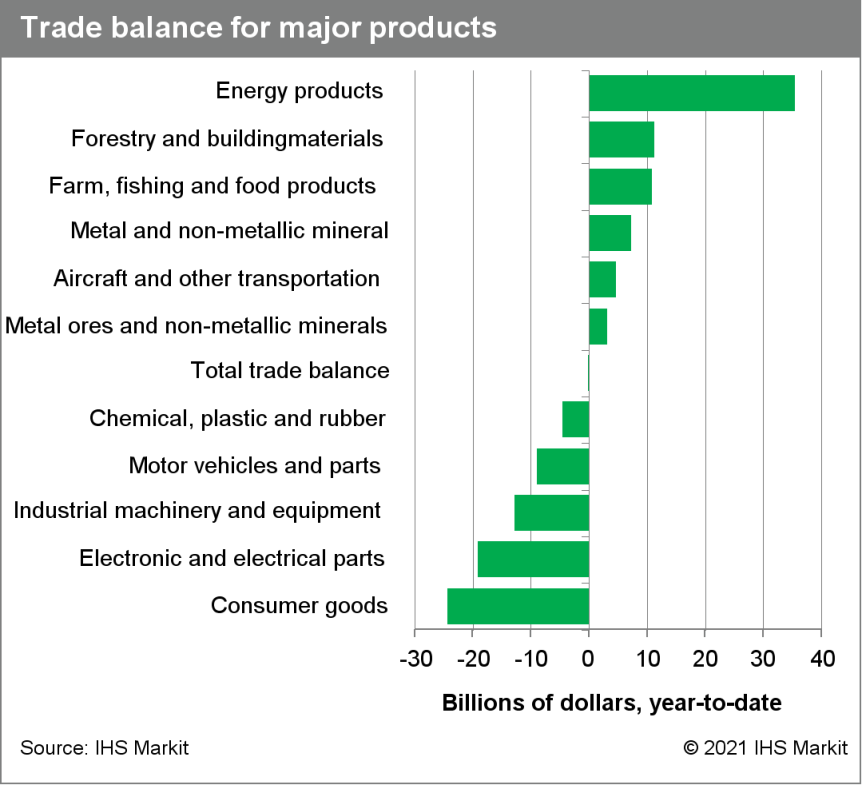

- Canada's merchandise trade balance reached a deficit of $1.4

billion in May, while April's surplus was revised down to $462

million. (IHS Markit Economist Evan Andrade)

- Nominally, exports fell 1.6% month on month (m/m) to $49.5 billion and imports rose 2.1% m/m to $50.9 billion.

- Owing to the strong appreciation of the Canadian dollar between April and May, the export volume fell 3.5% m/m and import volume rose 2.9% m/m.

- There was little change in the service trade balance, registering a deficit of $384 million.

- The broad decline across export product categories was led by

an 8.8% m/m drop in consumer goods. Within this category, an early

start to the snow crab season—owing to environmental

concerns—meant that seafood exports fell by $467 million in

seasonally adjusted terms.

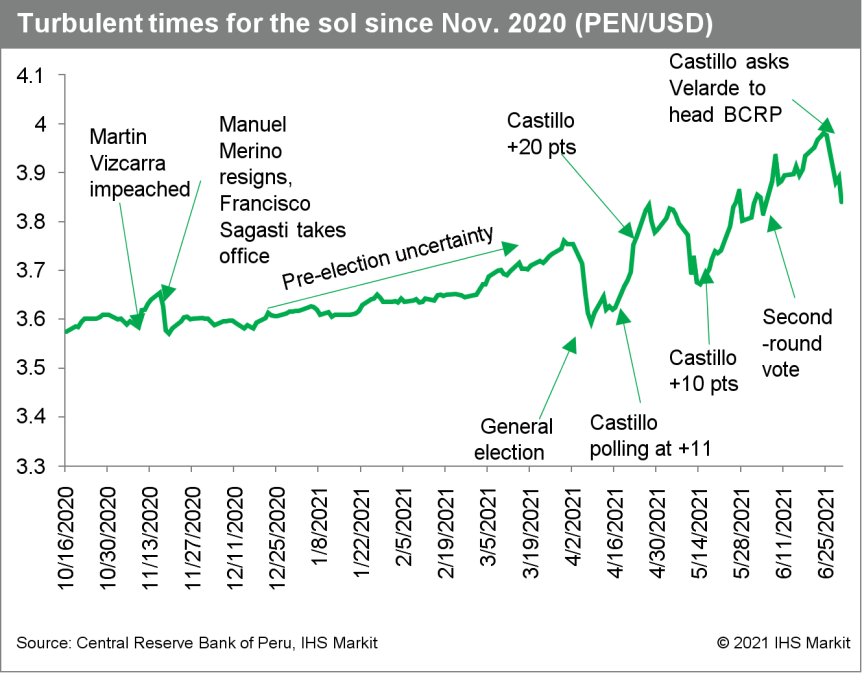

- Peruvian politics have battered the country's currency so far

in 2021, highlighting investor concerns over the interventionist

agenda of far-left presidential candidate Pedro Castillo. Portfolio

investment could leave the country en masse if Castillo takes

office and succeeds in carrying out major reforms, but the baseline

outlook views moderation as the most likely outcome. (IHS Markit

Economist Jeremy Smith)

- The choice between Pedro Castillo and conservative candidate Keiko Fujimori in Peru's second-round presidential election, held on 6 June, has raised fundamental questions over the future of the Peruvian economic model and the role of the state in the economy.

- Investor confidence and foreign-exchange markets have been shaken by Castillo's vision for a much more interventionist public sector. Castillo's current policy proposals include revisions to the economic chapter of the country's 1993 Constitution and renegotiation of extractive-sector contracts (see Peru: 30 June 2021: Peru's presidential election). These proposals have been subject to frequent changes, only increasing uncertainty.

- The path of the Peruvian sol in recent months, illustrated in

the chart below, shows the high degree of market sensitivity in

response to political events, especially polls and vote counts

pointing towards a likely Castillo victory.

Europe/Middle East/Africa

- Major European equity indices closed mixed; Germany +0.3%, UK/France/Italy flat, and Spain -0.3%.

- 10yr European govt bonds closed higher; France/Italy/Spain/UK -3bps and Germany -4bps.

- iTraxx-Europe closed flat/46bps and iTraxx-Xover -2bps/227bps,

which is flat and +2bps week-over-week, respectively.

- Brent crude closed +0.4%/$76.17 per barrel.

- The renewable arm of French-state-owned multinational utility EDF Group has launched a 50-MW battery storage system for electric vehicle (EV) charging spots, the first of "up to 40" so-called SuperHubs intended to help meet the UK's net-zero goals. The battery system installed for the city of Oxford, England, is part of Energy SuperHub Oxford (ESO), one of three grid-scale and domestic battery demonstration projects funded in part by the UK Government's innovation agency, Innovate UK. It was built by EDF Renewables' newly acquired battery developer, Pivot Power, and will supply energy for EV charging stations (initially for a parking lot with 38 charging points) as well as domestic heat pumps, and smart energy management technologies in the city. Assets like these may become key to improving the flexibility of the electric grid as decarbonizing heating and transport picks up pace to meet the nation's net-zero carbon emissions deadline in 2050. The government currently has several grant programs targeting EV and domestic heating consumers. The Green Homes Grant, which the parliament's Environmental Audit Committee called "botched," was canceled in March. (IHS Markit Climate and Sustainability News' Cristina Brooks)

- On 30 June the European Banking Authority (EBA) published its

latest quarterly risk dashboard which incorporates data for the

first quarter from a sample of 161 European banks. (IHS Markit

Economist Brian

Lawson)

- Risk levels remain at the highest level for asset quality, market risk and profitability, but with the reversal in bond yields and improvement in profitability over the last quarter, are projected to improve in two of these three areas, but future asset quality is causing growing concern.

- Within the sample, 70% of banks expect deterioration of asset quality in the SME sector, with 65% and 55% forecasting worsening in consumer credit and commercial real estate exposures. This does not yet appear in non-performing loans (NPL) data, with the average NPL ratio falling 10 basis points to 2.5%, but this is heavily masked by ongoing forbearance measures.

- The sector remains strongly capitalized: the sample recorded a CET1 capital ratio of 15.6%, with its leverage ratio at a healthy 5.6%.

- The most encouraging development is that sector profitability improved significantly, reaching 7.6% ROE in the first quarter of 2021 versus 1.9% in the preceding quarter.

- The year-on-year (y/y) rate of increase in the eurozone

producer price index (PPI) continued to surge in May, rising by two

percentage points to 9.6%, the highest rate in the series' history,

although slightly below the market consensus expectation (of 9.5%,

according to Reuters' survey). (IHS Markit Economist Ken

Wattret)

- Energy prices remained pivotal to the acceleration, with the inflation rate jumping by over four percentage points to 25.6%, also a record high.

- Although strong base effects stemming from the declines in crude oil prices during the first wave of the COVID-19 virus pandemic from March to May 2020 have contributed to the recent surge in eurozone PPI inflation, this is only part of the story.

- Energy prices rose by 2.1% month on month (m/m) in May, following several prior months of strong gains.

- Moreover, eurozone PPI inflation excluding energy prices has also soared. May's 4.9% rate was also a record high, with various business surveys pointing to further increases in the months ahead (discussed below), including IHS Markit's PMIs.

- In addition to energy, May's PPI data also revealed continued strength in prices of intermediate goods, which rose by 1.8% m/m following a similar gain in April (see table below). The y/y rate of increase rose to 9.2%, yet another record high.

- The European Food Safety Authority (EFSA) is seeking genotoxicity data on artificial sweeteners, including the widely used, aspartame, as part of the re-evaluation program for food additives already on the market when the EU regulation (on food additives 1333/2008) took effect on 20 January 2009. Artificial sweeteners are the final group of food additives to be reviewed since they were the last to be assessed before the 2008 regulation replaced the EU's old additives legislation. The sweeteners review and the additives re-evaluation program itself were supposed to have been completed by the end of 2020 but the sheer volume of work and missing data means delays. In a 30 June call for data, EFSA explains that it has already started the reassessment work but during the preliminary assessment of the available data on some substances its Food Additives and Flavorings (FAF) Panel decided additional information was needed. The call for data spells out what the Panel needs, whether from published, unpublished or newly generated studies. (IHS Markit Food and Agricultural Policy's Sara Lewis)

- Uber has partnered with TotalEnergies to accelerate electric mobility in France, according to a company statement. Uber aims to increase its electric vehicle (EV) fleet in France to 50% of its total fleet by 2025. To achieve this, Uber drivers will be provided with TotalEnergies cards that gives them access to charging points. Uber drivers will have access to 20,000 charging stations by the end of this year and more than 75,000 by 2025. (IHS Markit Automotive Mobility's Surabhi Rajpal)

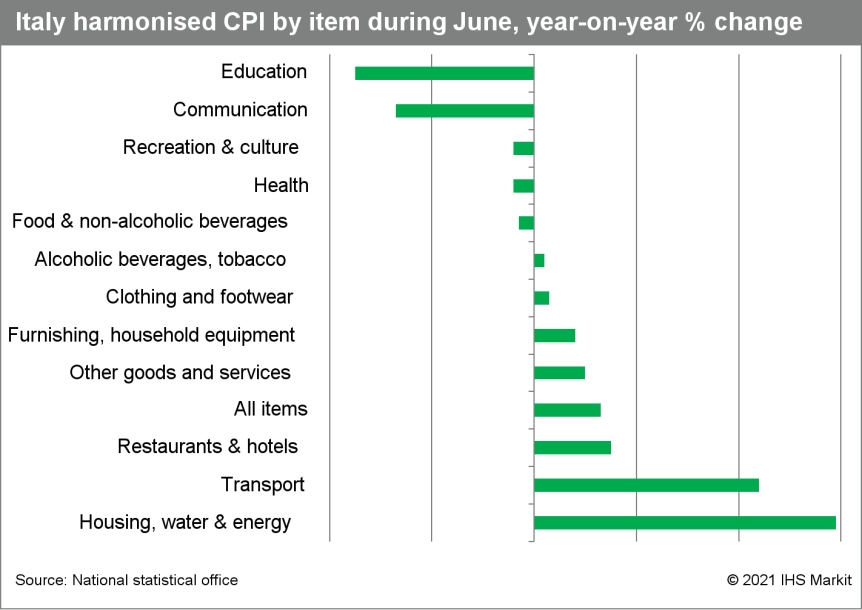

- According to its preliminary estimate, the national statistical

office (ISTAT) reports that Italy's 12-month rate of consumer price

index (CPI, harmonized) inflation increased to 1.3% in June from

1.2% in May. (IHS Markit Economist Raj

Badiani)

- The energy component of the CPI index climbed notably in June, up by 14.4% year on year (y/y). This was triggered by global crude oil prices rising by 81.3% y/y to average USD73.01 per barrel (pb) that month.

- Transport and housing, water, electricity, gas and other fuel prices increased by 4.8% y/y and 5.9% y/y, respectively.

- Less restrictive COVID-19 containment measures on the hospitality and leisure sectors helped to revive restaurant and hotel prices, which were up by 1.5% y/y during June, a notable step-up from the 0.1% y/y gain in May.

- Core inflation (all items excluding energy and unprocessed

food) rose marginally to 0.3% in June from 0.2% in May.

- Swiss manufacturer Lonza has announced the completion of divestment of its specialty ingredients division to the Bain Capital (US) and Cinven (UK) investment partnership for an enterprise value of CHF4.2 billion (USD4.5 billion). The initial agreement had been announced on 8 February. Bain Capital and Cinven have considerable experience in manufacturing-sector investment. Lonza's former specialty ingredients business employs about 2,800 people across 17 manufacturing sites around the world, and is a leader in provision of disinfectants and antiseptics for use in professional and personal care settings, alongside customized manufacture of specialty chemicals and ingredients for use in electronics, aerospace, food, and agrochemicals. (IHS Markit Life Sciences' Janet Beal)

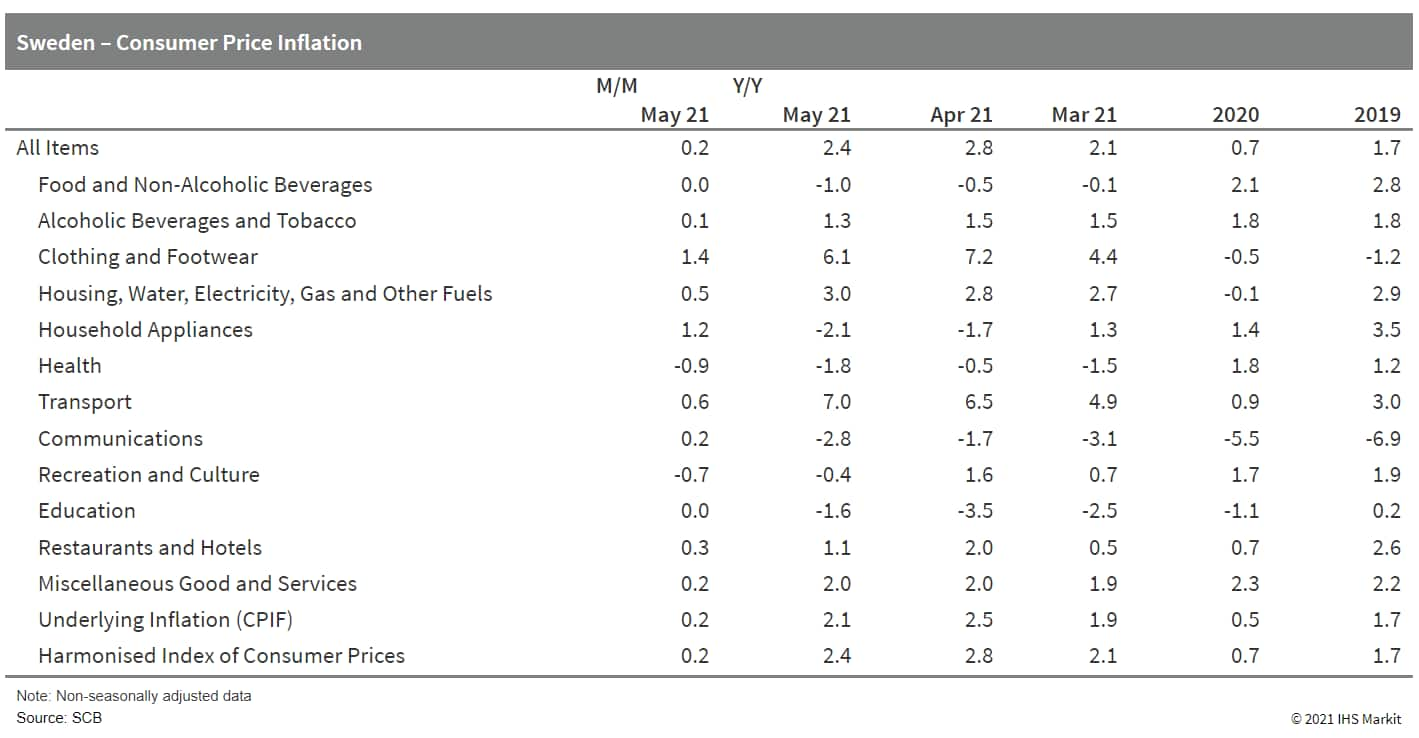

- The Executive Board of the Swedish central bank (the Riksbank)

in its July monetary policy meeting left the key policy interest

rate, the repo rate, unchanged at 0%. The policy rate has been at

this level since December 2019, when it was increased by 25 basis

points. (IHS Markit Economist Venla

Sipilä)

- Similarly, the Riksbank also announced that its asset purchase program will remain intact within the envelope of SEK700 billion (USD81.6 billion) during the fourth quarter of 2021. Stressing that sustainability is needed in Swedish monetary policy, it noted that it that continues to purchase securities and offer liquidity within all the launched channels. These include bond purchases totaling SEK68.5 billion.

- The board expects the interest rate to remain unchanged until the end of the Riksbank's forecast horizon, which currently extends until the end of the third quarter of 2024. It also intends to maintain its holdings in their entirety at least until the end of 2022.

- The board notes that while the spread of the COVID-19 virus has eased and economic recovery is taking place in several regions, the pandemic is not over, with new variants adding to risks. Inflation pressures are still modest, and expansionary monetary policy is still necessary in Sweden to assist economic recovery and ensure inflation reach its target (2%) on a sustainable basis.

- The latest inflation data from Statistics Sweden show that the

consumer price index with a fixed interest rate (CPIF; CPI with a

fixed interest rate) in May eased to 2.1% year on year (y/y) from

2.4% y/y in April. Housing costs were pushed up owing to the rising

prices of electricity, and these presented the biggest contribution

to inflation. In addition, increased fuel prices pushed up

transport prices, while clothing prices also increased.

- The total unemployment rate in Saudi Arabia went down from 7.4%

in the final quarter 2020 to 6.5% in the first quarter 2021,

according to the General Authority of Statistics (GASTAT). Although

not fully reaching pre-crisis levels yet, the total unemployment

rate, including Saudi nationals and non-nationals, has been

trending down steadily from the peak of 9.0% reached in the second

quarter 2020 when the impact of COVID-19-related lockdown measures

hit the economy. (IHS Markit Economist Ralf

Wiegert)

- Unemployment of Saudi nationals even fell below pre-crisis levels. At 11.7%, the rate edged down below the previous cyclical low of the first quarter 2020 (11.8%). This was due to a steep fall of unemployment among female workers, which had been close to 30% before the crisis. The rate briefly shot up to 31.4% when the crisis hit the labor market in the second quarter, but it subsequently fell and was only 21.2% in the first quarter 2021.

- The female unemployment rate is still high compared with male Saudis, but it is an interesting development, especially as the female labor participation rate has been increasing at the same time, from 20.5% in the first quarter 2019 to 32.3% in the first quarter 2021. It should be noted that the Saudi Vision 2030 pledges to raise the female labor market participation rate to over 30%.

- The Bank of Botswana has published its June 2021 Financial Stability report highlighting moderate credit risks but increased risks to asset quality deterioration. Overall, credit growth slowed to 1.6% year on year (y/y) in March compared with annual growth of 10.7% y/y in March 2020. A drop in loans to the corporate sector was the main contributor to the slowdown in overall credit growth. Corporate-sector loans experienced a decline of 6.1% y/y in March compared with annual growth of 4% y/y over the same month in 2020. This drop resulted from a "significant reduction" in credit to parastatals, mining (-38.8% y/y, manufacturing (-41.7% y/y), and agriculture (-10.2% y/y). Therefore, corporate credit as a share of total credit decreased to 34% in March from 37% in March 2020, while the household sector accounted for 66% of total credit in March, up from a 63% share in March 2020. (IHS Markit Banking Risk's Ronel Oberholzer)

Asia-Pacific

- APAC equity markets closed mixed; Australia +0.6%, India/Japan +0.3%, South Korea flat, Hong Kong -1.8%, and Mainland China -2.0%.

- Great Wall Motor (GWM) has unveiled the latest smart vehicle solutions as part of its Smart Coffee 2.0 strategy, reports China Daily. Mu Feng, vice-president of research and development (R&D) at GWM said, "The Smart Coffee 2.0 can enable vehicles to think, make their decisions and get upgraded." The automaker showcased chassis-by-wire technology that it claims is a prerequisite for autonomous operations because it is controlled by electric signals to steer or brake. This eliminates the need for drivers to do the task manually using mechanical linkages in traditional chassis. The company also revealed new electric and electrical architecture as well as upgrades in on-board functions, smart driving, and smart services. GWM also said that it expects 40% of its vehicles sold in 2025 to be preinstalled with high-level autonomous functions. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- GAC Motor is planning to work closely with Chinese ride-hailing app company Didi Chuxing (DiDi) and Chinese telecom giant Huawei on autonomous vehicle (AV) technologies. By 2024, the companies aim to mass-produce Level 4 autonomous vehicles (AVs), which can operate almost entirely without human input. The vehicles will use GAC design and manufacturing capabilities and autonomous software from DiDi and Huawei. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Sea freight rates have risen while schedule reliability remain

poor in all of 2021 as important ports and regions continue their

battle of congestion. On Asia to North America West Coast, at its

peak, vessel arrivals that were seven-13 and 14-20 days late was

higher than at the height of the 2015 US West Coast labor dispute.

In January-May 2021, about 700 vessel arrivals were over a week

late, of which 340 vessel arrivals were more than 14 days late,

with 132 of the vessel arrivals being more than 21 days late,

according to Sea-Intelligence ApS. (IHS Markit Food and

Agricultural Commodities' Hope Lee)

- For comparison, from January 2012 to December 2020, 1,535 vessel arrivals were more than a week late, 330 were more than two weeks late, and a combined 104 vessel arrivals were over 21 days late.

- On Asia-North Europe, 461 vessel arrivals were more than seven days late in January-May 2021, of which 134 were more than 14 days late, and 30 were more than 21 days late.

- Schedule reliability has been largely consistent these past few months, albeit at a much lower level than the industry stakeholders would have preferred. In May 2021, schedule reliability declined by -0.2 percentage points month-on-month to 38.8%. On a year-on-year level, schedule reliability was down a massive -36.0 percentage points.

- LG Electronics and Magna yesterday (1 July) launched a new joint venture (JV), LG Magna e-Powertrain, reports the Yonhap News Agency. LG owns 51% of the new company and Magna holds the remaining 49% stake. Headquartered in Incheon (South Korea), LG Magna e-Powertrain will employ about 1,000 workers to produce powertrain products, such as motors and inverters, for electric vehicles (EVs). It will have two subsidiaries - LG Magna Nanjing e-Powertrain Vehicle Components Company and LG Magna e-Powertrain USA Incorporated. LG has previously said that it expects the JV to post annual sales growth of 50% from 2022 to 2025. (IHS Markit AutoIntelligence's Jamal Amir)

- SHI received the approval in principle (AIP) from DNV for its solid oxide fuel cell (SOFC) powered LNG carrier. The new design, jointly developed with Bloom Energy, a US fuel cell maker, replaces the ship's propulsion engine with an SOFC. DNV has also issued an AIP for SHI's fuel cell powered crude oil tankers back in 2019. (IHS Markit Upstream Costs and Technology's Jessica Goh)

- Charge CCCV (C4V), a lithium-ion battery technology and manufacturing company based in New York (United States), has announced an investment of INR40.15 billion (USD538 million) in the battery manufacturing sector in Karnataka (India), reports India Today. The company, which manufactures lithium-ion batteries for use in electric vehicles (EVs) and portable electronics, plans to set up a 5-gigawatt-hour (GWh) plant in the Indian state of Karnataka, and to start work in 2022. Karnataka state Industries Minister Jagadish Shettar said, "C4V is a leading company with over a hundred patents and lithium battery cell manufacturing and technology. The company's investment of Rs 4,015 crore [INR40.15 billion] in the state will create more than 4,000 jobs." He added, "We have pioneered the future of green with the recent changes in the latest Electronic System Design and Manufacturing Policy (ESDM) policy and the Electric Vehicle Policy in the state. The cell manufacturing sector will play an important role in reducing environmental pollution." (IHS Markit AutoIntelligence's Tarun Thakur)

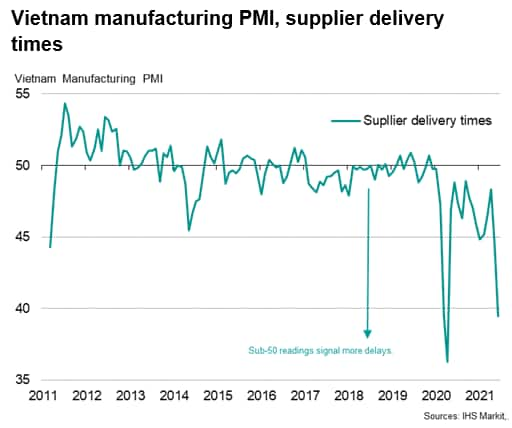

- Vietnam has been one of the world's fastest growing emerging

markets in the past decade, boosted by strong foreign direct

investment inflows into its manufacturing sector. The pace of

economic growth slightly exceeded 7% in both 2018 and 2019. (IHS

Markit Economist Rajiv

Biswas)

- Rapid growth of manufacturing exports and large new inflows of foreign direct investment have been important growth drivers for Vietnam, notably driven by rapid expansion in the textiles and electronics sectors. Total electronic and electrical manufacturing exports accounted for 33% of total merchandise exports in 2019, with textiles, clothing and footwear accounting for a further 19.4%.

- Total foreign direct investment inflows reached USD 20.4 billion in 2019, up 6.7% year-on-year, driven by strong investment by multinationals in establishing new manufacturing production facilities in Vietnam. Samsung has been a key investor, with total foreign direct investment into Vietnam of around USD 17 billion in the decade to 2018. Vietnam has become the biggest foreign production hub for Samsung Electronics, which booked USD 66 billion of sales in 2018 out of its Vietnamese operations, which was equivalent to around 28% of Vietnam's GDP. Around 50% of Samsung's smartphones and tablets are produced in Vietnam and exported globally. Samsung Vietnam has also built its largest R&D center in Southeast Asia near Hanoi.

- Economic growth momentum moderated significantly in 2020, due to the impact of the COVID-19 pandemic. For calendar 2020, the Vietnamese economy grew by 2.9% y/y, compared with a 7.1% GDP growth rate in calendar 2019.

- Output and new orders both decreased at the sharpest rates

since the first outbreak of the pandemic in early-2020, while firms

scaled back their employment and purchasing activity accordingly.

The pandemic also impacted supply chains, resulting in a

near-record lengthening of delivery times. For example, four

industrial parks in Bac Giang province in northern Vietnam were

temporarily closed in late May, due to outbreaks of COVID cases,

which also impacted on some manufacturing facilities of Foxconn and

Samsung.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-july-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-july-2021.html&text=Daily+Global+Market+Summary+-+2+July+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-july-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 2 July 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-july-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+2+July+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-july-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}