Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 02, 2021

Daily Global Market Summary - 2 March 2021

European and APAC equity markets closed mixed, while all major US indices closed lower. US government bonds closed mixed, with the curve steeper on the day. European government bonds closed mixed. European iTraxx and CDX-NA closed almost flat on the day across IG and high yield. The US dollar and oil closed lower, while gold, silver, and copper were higher on the day.

Americas

- US equity markets closed lower; Russell 2000 -1.9%, Nasdaq -1.7%, S&P 500 -0.8%, and DJIA -0.5%.

- CDX-NAIG closed flat/53bps and CDX-NAHY +4bps/297bps.

- 10yr US govt bonds closed -2bps/1.41% yield and 30yr bonds +1bp/2.20% yield.

- DXY US dollar index closed -0.3%/90.79.

- Gold closed +0.6%/$1,734 per ounce, silver +0.7%/$26.88 per ounce, and copper +2.7%/$4.22 per pound.

- Crude oil closed -1.5%/$59.75 per barrel.

- Yesterday was day one at 2021's virtual CERAWeek was already

making waves for cleantech investors, as multiple panels and

discussions focused on the energy transition. With high level

decisionmakers in dialogue all day, a few moments stood out (IHS

Markit Energy Advisory's Roger Diwan and Peter Gardett):

- Reward us by our progress, not by our current emissions profile: That was the message from BP's Bernard Looney at an opening session of CERAWeek on Reinventing Energy. Tellingly, Looney was in conversation with the CEO of Amazon's AWS, whose cloud data architecture is enabling BP's "experimentation" in its transition from an IOC to what Looney called an IEC: an "integrated energy company." He noted that BP expects to double its number of customer interactions and work with partners as it invests in a 20-fold increase in renewables and a 10-fold increase in total low-carbon capex.

- Capital will be more available to the cleanest barrel, and downstream firms that are transitioning aspects of their operations from a high to a low carbon footprint will have plenty of capital available to them, Carlyle's Marcel van Poecke said at the "Investing in Energy" panel led by Roger Diwan.

- The hydrogen pure-play companies are "clearly in a bubble," van Poecke said, noting double-digit valuation multiples on decade-ahead forecasted earnings. He expects established oil and gas and downstream firms to be able to take advantage of hydrogen economics and existing infrastructure.

- IHS Markit recently reported on the increase in US market share of electric vehicle (EV) registrations, but there was a significant jump in market share of hybrid electric vehicles (HEVs) in 2020 as well, from 3.0% in 2019 to 3.7% last year. The increase in new vehicle market share of EVs is a more closely watched metric than that of HEVs as automakers are pouring billions into EV development, but HEVs are also providing fuel-efficiency improvements and helping automakers to meet regulatory challenges. As was seen with EVs, HEV registrations in December 2020 represented the highest monthly market share for new HEV registrations last year, at 4.7%, compared with 2.9% in December 2019 and 3.0% in January 2020. In volume terms, about 535,400 HEVs were registered in the United States in 2020, up from nearly 520,600 units in 2019 and 366,000 units in 2018, when the market share of HEVs was only 2.6%. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The Indiana Economic Development Corp., a state organization that supports local investment, says electric vehicle (EV) startup Electric Last Mile will begin production in the third quarter of 2021, and that it will hire 960 workers by the end of 2024. The organization also says that ELMS intends to invest USD300 million to produce its urban delivery vehicle, which it is calling UD-1, at the Mishawaka (Indiana) plant. The report indicates ELMS is planning for production volume of 100,000 units per year, and that it has pre-orders for 30,000 units. The state, according to an Automotive News report, has committed to USD10 million conditional tax credits, up to USD200,000 in conditional training grants based on the company's plans for new jobs, and another USD2.8 million in conditional tax credits based on plans for further capital investment. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Corteva Agriscience is to discontinue sales of its herbicide, FeXapan (dicamba), in the US and Canada. The product, along with other dicamba-based herbicides, has been embroiled in legal disputes over alleged damage from spray drift. The controversy dates back over three years when the US EPA issued a conditional registration for a Bayer legacy company Monsanto herbicide, which growers alleged had damaged non-target crops across some 3.6 million acres (1.4 million hectare) in one season. That prompted the EPA to adopt industry-recommended label changes that reclassified XtendiMax—and similar dicamba herbicide—as "restricted use" and impose additional training requirements, extending to FeXapan the following year. Last June, the US Court of Appeals for the Ninth Circuit vacated the registrations of Fexapan and other dicamba herbicides, agreeing with environmentalists that the EPA had failed to fully assess the potential environmental harm from the pesticides. Subsequently, the Court of Appeals for the Ninth Circuit denied a request by manufacturers to reconsider the order to vacate the products. (IHS Markit Chemical Advisory)

- Merck & Co (US) has entered into a definitive agreement to acquire Pandion Therapeutics (US), a clinical-stage biotechnology company specialized in developing treatments for autoimmune diseases. Merck has agreed to buy Pandion's shares for USD60 in cash, representing a total equity value of USD1.85 billion. The company's lead candidate, PT101, is an engineered IL-2 mutein fused to a protein backbone that can selectively activate and expand regulatory T cells (Tregs). It is being developed for the treatment of ulcerative colitis (UC) and systemic lupus erythematosus (SLE), with the completion of a Phase Ia trial earlier this year confirming the candidate's safety and tolerability, as well as proof of mechanism by selectively expanding Tregs in healthy volunteers. Pandion's pipeline also includes PD-1 agonists that are in development for multiple autoimmune indications. The transaction is expected to close in the first half of 2021, subject to certain customary closing conditions. Pandion's TALON technology helps to design precision immune modulators that target critical immune control nodes (Tregs) and could "re-balance the immune response with potential applications across a wide array of autoimmune diseases", according to Merck Research Laboratories' president Dean Yi. (IHS Markit Life Sciences' Margaret Labban)

- Canada's real GDP jumped 9.6% quarter on quarter annualized

(q/q.) in the final quarter of the year. Real GDP declined 5.4% in

2020. (IHS Markit Economist Arlene Kish)

- The retreat in household spending was small, with relatively flat spending on services and a slightly larger-than-expected decline in semi-durable goods expenditures. The government sector did the heavy lifting, contributing the most to final consumption in the quarter.

- Real residential investment trended higher again. However, non-residential investment was mixed. Construction spending on non-residential buildings falling sharply, yet investment in machinery and equipment was up with most subsector spending easily gaining.

- Real trade activity matched expectations with real imports growth doubling real exports. Services exports gained for the first time in a year. Canada's terms of trade advanced in the quarter thanks to the decent jump in goods export prices.

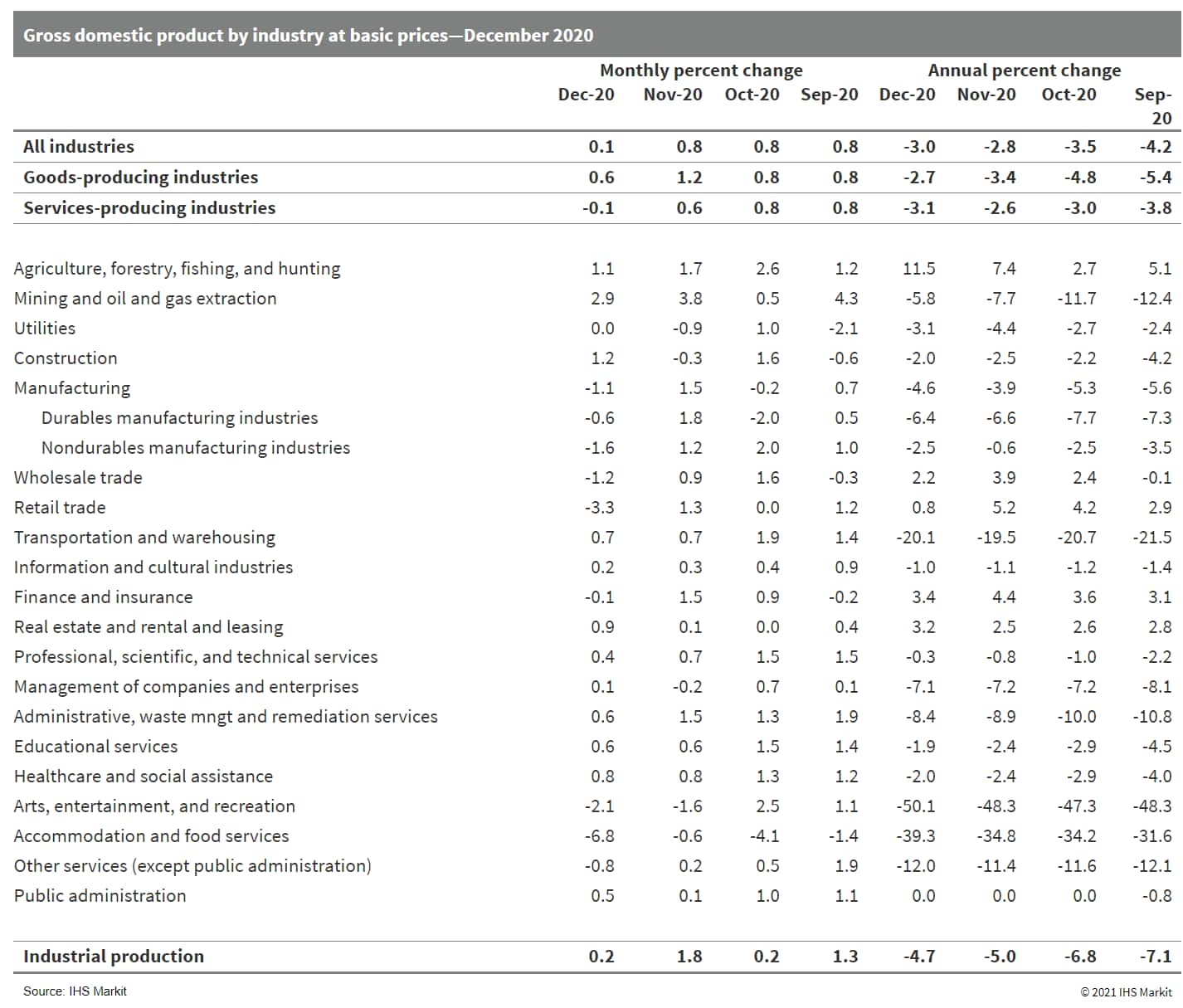

- Canada's real GDP by industry output edged up 0.1% month over

month (m/m) in December. (IHS Markit Economist Chul-Woo Hong)

- Output in the goods-producing industries jumped 0.6% m/m while output in the services-producing industries decreased 0.1% m/m.

- Industrial production advanced for the fourth consecutive

month, up 0.2% m/m mainly owing to strong increases in mining and

oil and gas extraction and in construction output.

- The National Statistics Office of Mexico (INEGI) reported that

GDP grew by 3.3% in the fourth quarter of 2020, compared with July

to September (quarter on quarter; q/q). This is based on seasonally

adjusted data. (IHS Markit Economist Rafael Amiel)

- Compared with the same quarter in 2019 and using unadjusted data, Mexico's GDP shrunk by 4.3% in October to December 2020. This shows that there is still a long way to return to pre-COVID-19 virus pandemic levels.

- In full-year 2020, Mexico's GDP plunged by 8.2%; the country was not only hit by the COVID-19 virus directly but also through lower oil prices that hurt public finances and through lower demand from the United States, whose economy sunk by 3.5%.

- Although agricultural output expanded, industry and services suffered significantly; within industry, manufacturing (an export-led sector) and construction reduced by double digits. In the services sector, all sub-categories fell except for healthcare and government services; tourism and entertainment plummeted by 43% and 50%, respectively.

- Labor market data show that the recovery of jobs (lost during the worst of the pandemic) has stalled in the first month of 2021. The economy lost almost 10 million jobs, out of 55 million, and as of January there were still 3 million jobs lost. This will have a negative effect on consumption in the short term.

Europe/Middle East/Africa

- European equity markets closed mixed; UK +0.4%, France +0.3%, Germany +0.2%, Spain -0.3%, and Italy -0.8%.

- 10yr European govt bonds closed mixed; UK -7bps, Germany -2bps, France -1bp, Spain flat, and Italy +2bps.

- iTraxx-Europe closed flat/48bps and iTraxx-Xover flat/249bps.

- Brent crude closed -1.6%/$62.70 per barrel.

- On 1 March, the European Banking Authority (EBA), European Securities and Markets Authority (ESMA) and the European Insurance and Occupational Pensions Authority issued co-ordinated advice statements to the European Commission regarding potential key performance indicators (KPIs) for future disclosure by financial institutions and the wider corporate sector on their environmentally sustainable activities. The statements were in response to a Commission request in September 2020 for advice on KPIs. The EBA's main proposal is to recommend the introduction of a Green Assets Ratio (GAR), a measure to identify the proportion of an banking institution's financing activities compatible with the EU (Green) taxonomy, along with parallel KPIs on activities other than lending and investments. (IHS Markit Country Risk's Brian Lawson)

- Following January's record acceleration in Eurozone inflation,

from -0.3% to 0.9%, HICP inflation was stable at 0.9% in February

according to Eurostat's 'flash' estimate. This matched the market

consensus expectation. (IHS Markit Economist Ken Wattret)

- Upward pressure on the energy inflation rate continued because of higher crude oil prices and base effects. The year-on-year (y/y) rate of change reached -1.7% in February, the highest for a year.

- Following a record jump in January also, from 0.2% to 1.4%, the HICP inflation rate excluding food, energy, alcohol, and tobacco prices slipped back to 1.1% in February. This again matched the market consensus expectation.

- Services inflation moderated from 1.4% to 1.2% in February but remained well above the 2020 trend (ending last year at 0.7%).

- Inflation for non-energy industrial goods dropped more markedly, from 1.5% to 1.0% in February, but also remained well above its end-2020 rate (of -0.5%; see second chart below).

- January's surge in headline and core inflation rates reflected a range of influences, including energy price rises, VAT increases in Germany, annual reweighting of HICP items, and delayed seasonal sales (including for clothing and footwear).

- According to Germany's Federal Statistical Office (FSO) data,

retail sales excluding cars in volume terms shrunk by 4.5% month on

month (m/m, seasonally and calendar adjusted) after a 9.5% m/m drop

in December. (IHS Markit Economist Raj Badiani)

- Retail sales in January were also affected by some consumers bringing forward their major purchases to exploit the temporary VAT cut, which expired on 31 December 2020. The main value-added tax rate fell from 19% to 16%, while the reduced rate applied to food, and some other everyday items decreased from 7% to 5%.

- In annual terms, the volume of retail sales stood 5.8% lower. Spending on non-essential goods plummeted, with the sale of clothing and footwear and furniture, household appliances, and building supplies falling by 76.6% year on year (y/y) and 43.2% y/y, respectively.

- Online retailing continued to benefit from the closure of non-essential physical shops and shifting consumer-shopping habits, with sales rising by 31.7% y/y.

- A strong recovery in retail sales is likely once non-essential shops reopen, probably sometime in March. Chancellor Angela Merkel and the state premiers are to meet on 3 March to discuss a gradual easing of lockdown measures that are in place until at least 7 March.

- Germany's financial watchdog has taken direct oversight of day-to-day operations at Greensill Bank, as the lender's ailing parent company warned that its loss of $4.6 billion of credit insurance could cause a wave of defaults and 50,000 job losses. (FT)

- Daimler Truck and Volvo Group have legally completed the formation of the alliance to work together on the development of fuel cells for medium and heavy commercial vehicle (MHCV) applications, according to a company press statement. The Volvo Group has acquired 50% of the existing Daimler Truck Fuel Cell GmbH & Co. KG for approximately EUR 0.6 billion on a cash and debt-free basis, with the new entity being renamed Cellcentric GmbH & Co. The ambition is to make the new joint venture (JV) a leading global manufacturer of fuel cells, and thus help the world take a major step towards climate-neutral and sustainable transportation by 2050. (IHS Markit AutoIntelligence's Tim Urquhart)

- Volvo Cars has announced that it will become a battery electric vehicle (BEV)-only automaker from 2030. The company has said in a statement that it is "committed to becoming a leader in the fast-growing premium electric car market" and that it intends to "phase out any car in its global portfolio with an internal combustion engine [ICE], including hybrids" at this point. It added that its ambitions for 2030 represent an "acceleration of Volvo Cars' electrification strategy, driven by strong demand for its electrified cars in recent years and a firm conviction that the market for combustion engine cars is a shrinking one." (IHS Markit AutoIntelligence's Ian Fletcher)

- Norway wants to see an expansion of carbon tax regimes across

the globe, Minister of Petroleum and Energy Tina Bru said 2 March,

calling on her fellow policymakers around the world to accelerate

such efforts. (IHS Markit Climate and Sustainability News' Keiron

Greenhalgh)

- Speaking at CERAWeek by IHS Markit, Bru said that countries cannot just set ambitious net-zero goals, they have to follow through on them.

- Instituting a price on carbon is such a way, she said, adding that one of the few silver linings from the global COVID-19 pandemic was an opportunity to reset the economic norms. The minister and her colleagues were "seeing many countries use this opportunity to enhance their green policies and think of rebuilding again from a greener perspective, which I think is putting us on the right track" to tackling climate change, she said.

- "Carbon pricing is of course one of the main things that we are using in Norway, because we have seen that it works, we know it is effective. It is a good way to actually make that transition that we know needs to happen," she said.

- Norway plans to cut its carbon emissions by 50-55% by 2030 compared with 1990 levels and 90-95% by 2050 even though the country is heavily dependent on oil and natural gas for jobs and taxes.

- The tightening of monetary policy at the beginning of November

2020 slowed economic growth in the fourth quarter, but Turkish GDP

nonetheless managed to grow by 1.8% for the year as a whole. (IHS

Markit Economist Andrew Birch)

- With monetary policy still defensive and COVID-19 infections still high, growth headwinds will remain strong in early 2021. Nonetheless, IHS Markit anticipates full-year GDP growth reaching 4.0% thanks to recovering exports and a revival of domestic demand in the second half.

- The pivot from the expansionary economic policies in January-October to the more restrictive approach in the final couple of months directly affected household consumption. Although private consumption remained well above year-earlier levels because of the high base built up in the first three quarters, consumption growth slumped to just 0.8% q/q in seasonally adjusted terms in the fourth quarter.

- Similarly, the new restraint in credit expansion also had a significant impact on fixed capital investment. Fixed capital investment actually contracted by 2.7% q/q in the fourth quarter, although total activity was still well up from its year-earlier level.

Asia-Pacific

- APAC equity markets closed mixed; Mainland China -1.2%, Hong Kong -1.2%, Japan -0.9%, Australia -0.4%, India +0.9%, and South Korea +1.0%.

- Chinese electric vehicle (EV) startup NIO has announced its

unaudited financial results for the fourth quarter and full year

2020. The startup's total revenues were CNY6.641 billion (USD1.026

million) during the fourth quarter of 2020, an increase of 133.2%

year on year (y/y) and 46.7% quarter on quarter (q/q). (IHS Markit

AutoIntelligence's Nitin Budhiraja)

- The company's vehicle sales margin was 17.2% in the fourth quarter, compared with minus 6.0% in the fourth quarter of 2019 and 14.5% in the third quarter of 2020. The company recorded a gross profit of CNY1.141 billion in the fourth quarter, up 133.2% y/y and an increase of CNY 556.1 million from the third quarter of 2020. NIO's net loss attributable to equity holders stood at CNY1.492 billion in the fourth quarter, representing a decrease of 48.4% y/y.

- NIO's vehicle deliveries continued to increase during the fourth quarter of 2020. The automaker delivered 17,353 vehicles in the period, comprising 4,873 ES8, 7,574 ES6, and 4,906 EC6 vehicles. By comparison, the company delivered only 8,249 vehicles in the same quarter of 2019 and 12,206 vehicles in the third quarter of 2020.

- IHS Markit expects NIO's light-vehicle sales to increase by 40.8% to around 62,600 units in 2021.

- Chinese autonomous vehicle (AV) technology startup Haomo.AI has completed a pre-A funding round of CNY300 million (USD46.4 million), reports Gasgoo. Haomo.AI, the former AV unit of Chinese automaker Great Wall Motors, received the funding from SG Fund, Meituan and Hillhouse Ventures. Haomo.AI became an independent company in 2019 and focuses on developing autonomous systems for passenger cars as well as low-speed vehicles for logistics enterprises. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Tokyo plans to ask the Japanese government to extend the COVID-19 state of emergency that is due to expire this weekend, the Nikkei reported, citing multiple unidentified people. (Bloomberg)

- Hyundai held a virtual groundbreaking ceremony for HTWO Guangzhou, the automotive group's first fuel-cell system facility outside South Korea, according to a company statement. HTWO Guangzhou will be built in the Guangzhou development district of Guangdong Province (China), with the aim of completing the project in the second half of 2022. The facility will initially produce 6,500 fuel-cell systems per year and aims to gradually increase capacity in line with market demand. (IHS Markit AutoIntelligence's Jamal Amir)

- Australia's international border will remain shut for at least another three months, as the government considers the Covid-19 situation overseas an "unacceptable public health risk." The human biosecurity emergency period will be extended to June 17. (Bloomberg)

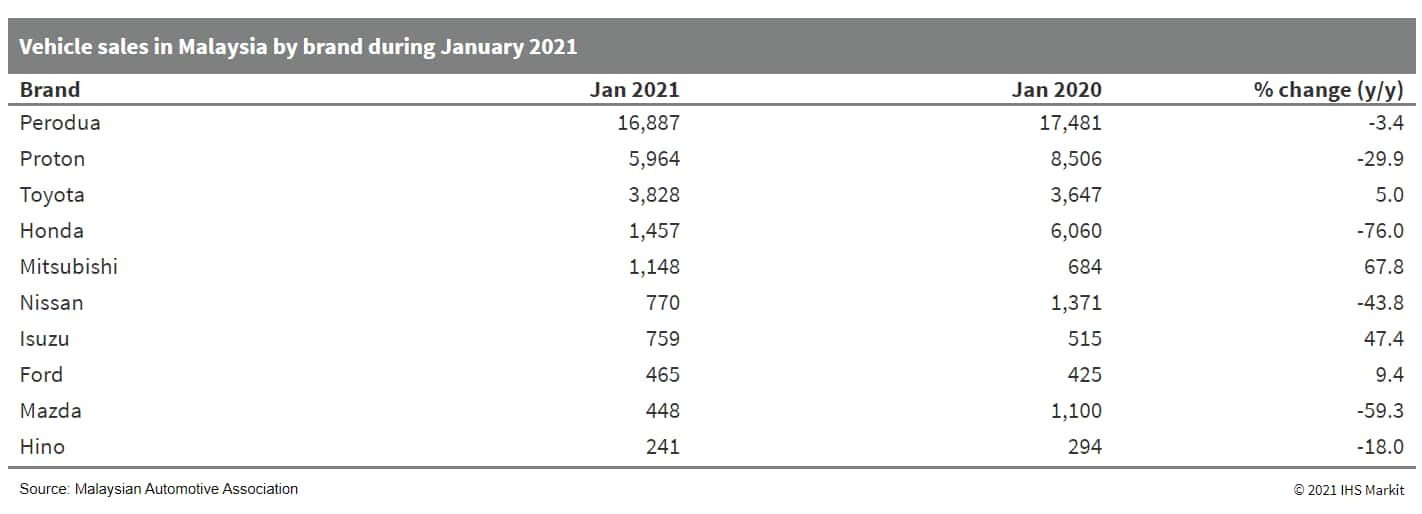

- New vehicle sales in Malaysia plunged by 23.6% year on year

(y/y) to 32,829 units during January, according to figures released

by the Malaysian Automotive Association (MAA) and data compiled by

IHS Markit. Of this total, passenger vehicle sales accounted for

28,872 units, down by 26.7% y/y, while commercial vehicle (CV)

sales stood at 3,957 units, up by 12.0% y/y. It is important to

note that the monthly data do not include sales by Mini, BMW,

Mercedes-Benz or Scania. We expect that light-vehicle sales in the

country will grow by 6.7% y/y in 2021 to around 550,000 units, up

from an estimated 515,600 units in 2020. We also forecast that

light-vehicle production in the country will grow by 11.1% y/y to

around 533,300 units this year, up from an estimated 480,000 units

in 2020. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-march-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-march-2021.html&text=Daily+Global+Market+Summary+-+2+March+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-march-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 2 March 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-march-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+2+March+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-march-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}