Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 20, 2021

Daily Global Market Summary - 20 October 2021

All major European and most US equity indices closed higher, while APAC was mixed. US government bonds closed lower, while benchmark European bonds were higher on the day. CDX-NA and European iTraxx closed almost flat on the day across IG and high yield. The US dollar closed lower, while oil, natural gas, gold, silver, and copper closed higher on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Most major US equity indices closed higher, with the DJIA +0.4% and reaching a new record close; Russell 2000 +0.6%, S&P 500 +0.4%, and Nasdaq -0.1%.

- 10yr US govt bonds closed +2bps/1.66% yield and 30yr bonds +4bps/2.13% yield.

- CDX-NAIG closed flat/51bps and CDX-NAHY -2bps/295bps.

- DXY US dollar index closed -0.2%/93.56.

- Gold closed +0.8%/$1,785 per troy oz, silver +2.4%/$24.45 per troy oz, and copper +0.7%/$4.74 per pound.

- Crude oil closed +1.2%/$83.42 per barrel and natural gas closed +1.6%/$5.17 per mmbtu.

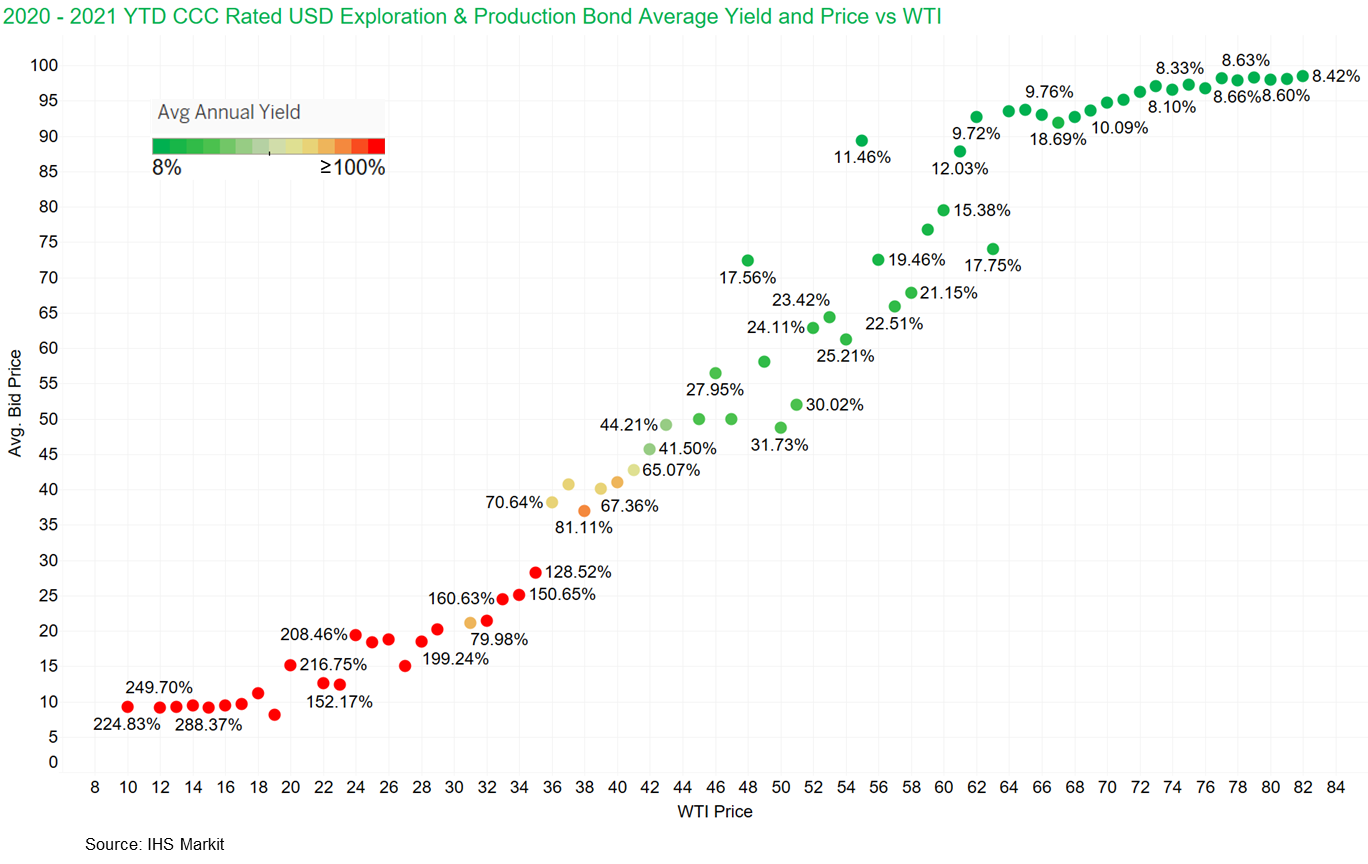

- The below graph shows the relationship between the price of US

Crude oil (WTI) vs CCC rated US E&P corporate bond average

prices labeled with average bond yields from 2020-2021 YTD (as of

October 18), with average bond yields remaining below 20% once WTI

breached $59/barrel. Bond yields for this cohort closed at 8.47% on

October 18.

- Demand for municipal new issue paper remains strong after last week's holiday-shortened calendar supplied $9.5 billion, led by the Empire State Development which sold a combined $2.4 billion across six tranches which was well received by competitive bidders. Rising rates continue to play a factor in new issue spreads, after the Texas Water Development Board (-/AAA/AAA/-) issued $387 million of state revolving fund revenue bonds which priced tighter to the scale after the 2031 maturity fell +15bps off the interpolated MAC curve. The National Finance Authority of New Hampshire also tapped into the negotiated space last week, selling $346 million of federal lease revenue bonds in a single 04/2032 duration, offering yield-focused investors a return of 3.30% or +173bps off the 10YR UST. This week's calendar is positioned to climb higher to double digit levels of $11.8 billion, represented by 279 new issue offerings and a hefty presence of ESG offerings, representing an aggregate of $3.1 billion across various labels. The Central Puget Sound Regional Transit Authority, WA (Aa1/AAA/-) will lead this week's negotiated calendar supplying $875 million of sales tax and motor vehicle tax improvement refunding bonds across maturities 11/2022-11/2050, carrying a green bond designation status and senior managed by JP Morgan. The Hudson Yards Infrastructure Corporation will also tap into the negotiated market on Wednesday 10/20 to finance $452 million of revenue bonds with a green bond designation status on behalf of Kestrel Verifiers. This week's competitive calendar will span 167 new issues for a combined total of $2.24 billion, driven by the North Texas Municipal Water District auctioning $202 million of water system revenue refunding bonds across 09/2022-09/2032, selling on Monday 10/18. (IHS Markit Global Market Group's Matthew Gerstenfeld)

- The Biden Administration Roadmap to Build an Economy Resilient

to Climate Change Impacts seeks to accelerate government efforts to

improve corporate tracking and disclosure of GHG emissions, and

illustrates the determination of the administration to use

financial regulation to drive companies in this direction. (IHS

Markit Net-Zero Business Daily's Kevin Adler)

- As an extension of a "whole-of-government strategy" to protect consumers and the economy from the impacts of climate change, the roadmap places improving the financial system's ability to identify risk atop the agenda. It builds on the 20 May

- Executive Order on Climate-Related Financial Risk that set in motion studies of financial risk by several agencies, and placed GHG emissions as a factor in federal contracting and climate risk into long-term budgeting.

- "Extreme weather has cost Americans an additional $600 billion in physical and economic damages over the past five years alone. Climate-related risks hidden in workers' retirement plans have already cost American retirees billions in lost pension dollars. Climate change poses a systemic risk to our economy and our financial system, and we must take decisive action to mitigate its impacts," the administration said in announcing the roadmap.

- Investors keep moving their money away from risk sectors most immediately exposed. This week, the Ford Foundation announced that its $10-billion endowment will no longer hold stock in fossil fuel companies. It follows September announcements by Harvard University ($52-billion endowment) and the MacArthur Foundation ($8 billion) that they will be divesting their fossil fuel assets, and the announcement in August by the New York State Public Employee Retirement Fund, the third-largest public pension plan in the country, that it may restrict investment in firms it feels are not adequately planning for the energy transition.

- On October 20, Mitsubishi Power Americas Inc. and El Paso

Electric (EPE) announced that they have signed a joint development

agreement (JDA) creating a collaboration framework to jointly

develop projects that will enable EPE to achieve its clean energy

goals. The JDA extends EPE's commitment to reducing carbon

emissions by replacing carbon-intensive assets with a combination

of renewables, storage and power generation using hydrogen. The JDA

will cover development of strategies and alternatives to attain an

80% carbon-free resource mix by 2035 and develop a roadmap to

achieve a 100% carbon-free energy mix to meet EPE's future customer

needs by 2045. The JDA will focus on (IHS Markit PointLogic's Barry

Cassell):

- Developing a hydrogen vision and roadmap for EPE to generate carbon-free energy across its overall power generation fleet;

- Developing a strategy to convert the Newman Power Station's newest unit from being fueled by 100% natural gas to a blend of up to 30% hydrogen, then to eventually being fueled by 100% hydrogen for carbon-free power generation;

- Supporting the resource planning process with the integration of hydrogen and carbon-free resources;

- Evaluating future regional transportation, commercial and other industrial sector coupling opportunities to promote decarbonization and economic growth

- US licensed hemp planted area rose by 24% y/y to 284,790 acres in September 2021, according to USDA data. This means a 44% fall in planted acreage compared to 2019, when the US reached a record of 511,400 acres, after the 2018 Farm Bill fueled optimistic expectations about hemp and CBD industries. This fall is due to a combination of drought and a long-term regulatory uncertainty, especially about fiber processing for textile and construction, trading sources explained. In addition, the US states and territories licensed 9,210 producers in 2020, down from a record of 20,000 in 2019. 021 Hemp Outlook: Licensed acreage tanks 24% in 3rd year of nationwide production. The state of New York was the main origin with 33,034 acres (indoor+outdoor), 11% more y/y. (IHS Markit Food and Agricultural Commodities' Jose Gutierrez)

- Fleet and supply-chain company Ryder and autonomous technology company Gatik have announced plans for a new business-to-business (B2B), short-haul logistics autonomous delivery network. In a joint statement, the two announced a "multi-year partnership designed to establish an autonomous logistics network for Gatik's customers in the US and Canada". The deal follows Ryder Ventures' participation in Gatik's latest funding round, which generated USD85 million. It was not disclosed what portion specifically came from Ryder Ventures, although Ryder noted that it was its first investment in an autonomous trucking company. Gatik will lease medium-duty, multi-temperature box trucks from Ryder, integrate its commercial-grade autonomous driving technology into the leased fleet, and create an "Autonomous Delivery as a Service" (AdaaS) business model for new and existing customers. Ryder will service and maintain the trucks, including calibration of autonomous sensors and pre-and post-trip inspections. Under the comprehensive deal, the two will also "explore opportunities" for Ryder to manage the logistics operations of the autonomous fleet. No financial terms or specific timeline targets for expansion have been announced, including specifically when the first trucks will be deployed. The operations are aimed purely at B2B opportunities, rather than the last-mile delivery on which several other autonomous technology companies have focused. The initial fleet is reported to be about 20 vehicles, and it will start in the Dallas-Fort Worth, Texas, area; Gatik and Ryder both expect to expand the service throughout the United States and Canada. (IHS Markit AutoIntelligence's Stephanie Brinley)

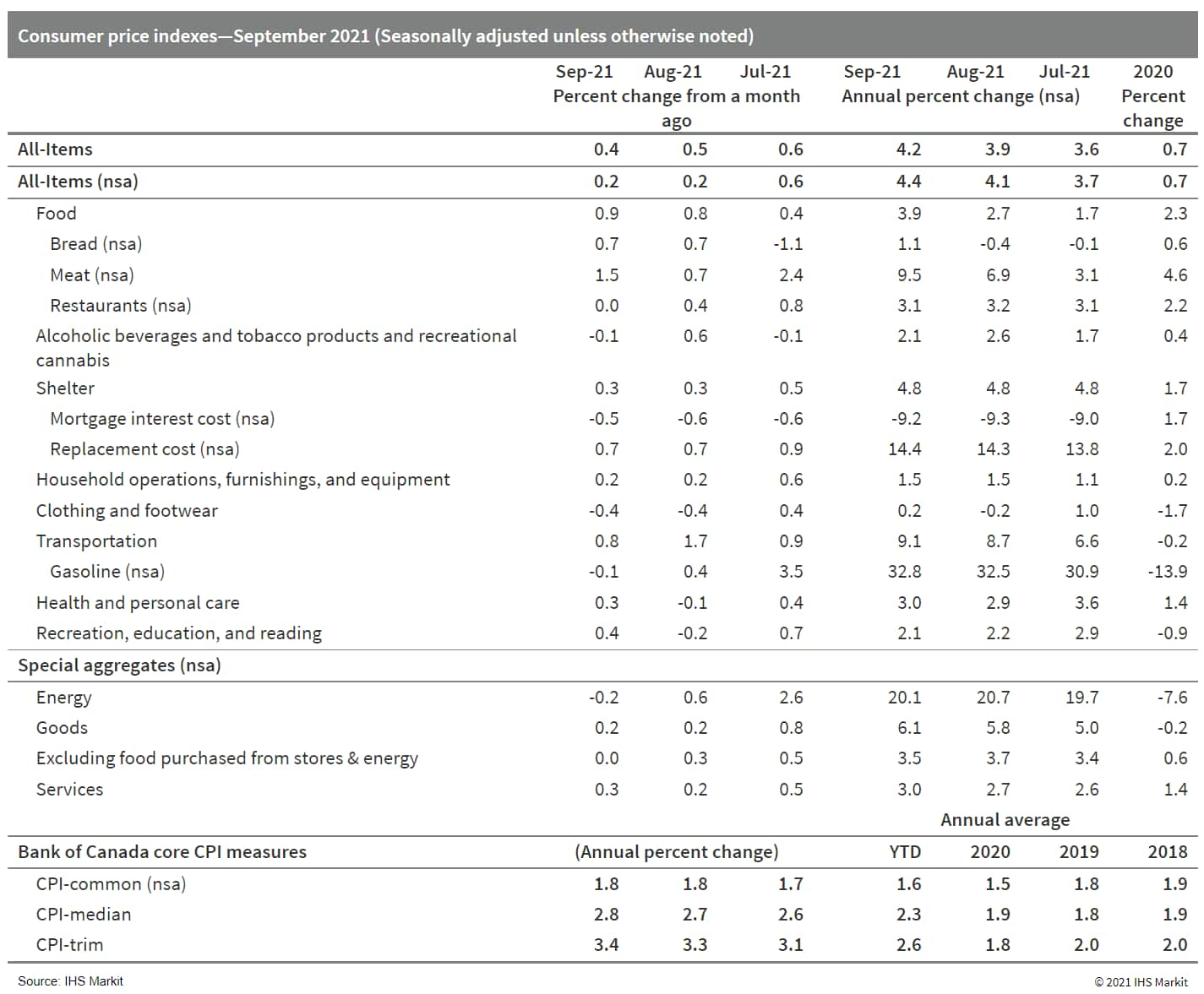

- The top upward contributors to Canada's inflation in September

were as expected, particularly costs for gasoline, housing, autos,

and food. Gasoline is adding significantly to headline inflation,

rising at a similar pace as last month of 32.8% y/y. Yet, when

gasoline is excluded, inflation is 3.5% y/y. Homeowners'

replacement costs increased by a milder 0.1 percentage point to

14.4% y/y. Other owned accommodation expenses inflation rose to

14.2% y/y, while subtracting from inflation was the 9.2% y/y

decline in mortgage interest costs. (IHS Markit Economist Arlene

Kish)

- Consumer prices are climbing at a consistent monthly pace, rising 0.4% month on month (m/m) on a seasonally adjusted basis (SA) and 0.2% m/m on a non-seasonally adjusted basis (NSA).

- This increased annual inflation rates to 4.2% year on year (y/y) SA and 4.4% y/y NSA.

- The average core inflation rate edged up to 2.7% y/y, with the Consumer Price Index (CPI)-trim inflation rate remaining above the Bank's 3.0% y/y upper bound of the target range.

- Within the goods categories, non-durable goods inflation is the highest, at 7.8% y/y, followed by durable goods at 5.3%. Semi-durable goods inflation is very mild at just 0.8% y/y. Services inflation quickened to 3.0% y/y.

- The Bank of Canada's inflation drivers remain the same. Some

inflation pressures are temporary, like gasoline, and some are not.

Deep scrutiny of core inflation drivers will be highlighted in the

October Monetary Policy Report and the policy announcement. Price

inflation is high, yet excess capacity remains.

- Hortifrut, a Chile-based global berry giant, is set to acquire

100% of Atlantic Blue for an investment of about $280 million; both

companies have been in partnership since 2000. Atlantic Blue is a

leading company in variety development, production and sales of

berries in Europe and Northern Africa and Peru. (IHS Markit Food

and Agricultural Commodities' Hope Lee)

- Through this acquisition, Hortifrut will increase its growing area by about 20%, adding roughly 850 hectares across the three countries where Atlantic Blue operates, including 400 ha in Spain, 248 ha in Morocco and 200 ha in Peru.

- The purchase of the ha in Morocco will allow the company to complete the supply of its own blueberries in Europe year-round.

- With the combined production of raspberries in Morocco and Portugal, Hortifrut is on its track towards the supply of the full berry category all year-round for the European market.

- Hortifrut has been running a genetic program called Berry Blue and developed 18 new owned and exclusive varieties of blueberries. These new varieties are the base of Hortifrut's most recent plantation projects in China and have started to gain space in the group's consolidated plantations in Peru, Chile and Mexico.

- In terms of organic blueberries cultivation areas, the company has 578 ha in Chile, Mexico 41 ha, Peru 97 ha, the US 76 ha, according to its 2020 annual report.

Europe/Middle East/Africa

- All major European equity indices closed higher; Italy +0.9%, France +0.5%, Spain +0.2%, and UK/Germany +0.1%.

- 10yr European govt bonds closed higher; Germany/France/Italy/Spain/UK -2bps.

- iTraxx-Europe closed flat/50bps and iTraxx-Xover -1bp/253bps.

- Brent crude closed +0.9%/$85.82 per barrel.

- The UK National Health Service (NHS) Confederation, which represents NHS providers, has issued a warning statement to the UK government (available here) in light of a worrying recent upturn in COVID-19-related hospitalizations and deaths. The organization has pushed for the government not to waste undue time over implementation of a "Plan B plus" for tightening of public restrictions, including the possible reintroduction of some social distancing measures, in order to avoid "stumbling into a winter crisis". Confirmed cases of COVID-19 in the UK have surpassed 40,000 for the past seven days, with 43,738 recorded on 19 October and 49,156 the previous day, returning levels to those in mid-July. There has been a 10% increase in COVID-19-related hospitalizations within the past week in NHS England, totalling 7,749 cases, with COVID-19-linked mortality (within 28 days of a confirmed positive diagnosis) currently averaging 120 per day, although on 19 October there were 223 deaths. According to NHS Confederation CEO Matthew Taylor in the source, upcoming months could represent "the most challenging winter on record", with the current rise in hospitalizations set to coincide with expected increases in infections from other "winter" viruses to which the public may have lower resistance than in previous years. Taylor has urged that "the government should not wait for COVID infections to rocket and for NHS pressures to be sky-high before the panic alarm is sounded". (IHS Markit Life Sciences' Janet Beal)

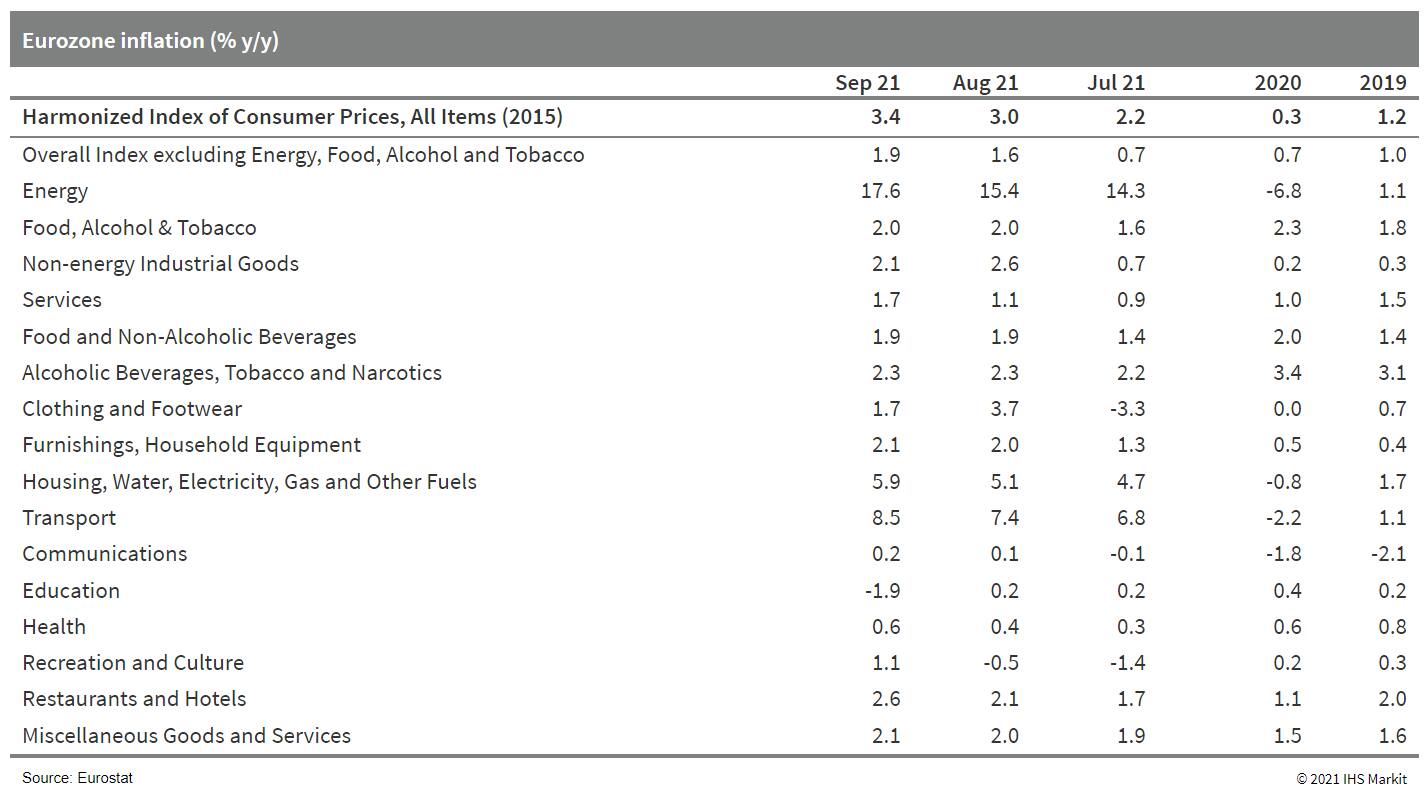

- Eurostat's final September Harmonised Index of Consumer Prices

(HICP) release confirms the rise in headline inflation from 3.0% to

3.4%, the highest rate since September 2008. (IHS Markit Economist

Ken

Wattret)

- The record-high rate of energy inflation has been revised up marginally to 17.6%, contributing around half of the overall inflation rate. The upward pressure on energy inflation will continue to push up headline inflation over subsequent months.

- The rise in September's core inflation rate excluding food,

energy, alcohol, and tobacco prices from 1.6% to 1.9% is also

confirmed in the final release. This is the highest rate since

November 2008, with further increases to follow.

- France is to invest €2 billion ($2.3 billion) in three "revolutionary areas" comprising digital technology, robotics and genetics. The investment will be part of "France 2030", which is a €30 billion ($34.8 billion) investment plan unveiled by French President Emmanuel Macron. The France 2030 plan sets ten objectives to be achieved by 2030. One of those objectives is about investing in healthy, sustainable and traceable food. The investment should make it possible to: decarbonize agricultural production; get away from certain pesticides; and improve productivity and food tracing, the President said. (IHS Markit Crop Science's Sanjiv Rana)

- Stellantis has announced that it is establishing a partnership with Italian startup, TheF Charging, which aims to create a public electric vehicle (EV) charging network in Europe. According to a statement, the network will be open to all EVs, but will have "exclusive conditions for Stellantis customers." It added that the infrastructure would focus primarily on "quick" chargers that will be built up in over 15,000 locations in Europe with 2 million parking spaces between 2021 and 2025. It noted that the pair have already "identified over 1,000 owners or operators of locations across the whole of Europe," and that facilities installed will be built to fulfil customers' main charging requirements. (IHS Markit AutoIntelligence's Ian Fletcher)

- AkzoNobel says net income in the third quarter of 2021

decreased 25% year on year (YOY), to €164.0 million ($190.6

million), mainly owing to a €278.0-million increase in raw material

and other variable costs, including freight costs, compared with

the same period in 2020. Raw material inflation was the main reason

of this increase in cost of sales, as it more than offset the

company's pricing initiatives, AkzoNobel says. The company has

raised its prices by an average of 9% YOY during the third quarter,

reaching 10% at the end of it, AkzoNobel says. (IHS Markit Chemical

Advisory)

- The company's revenue was up 6% YOY, to €2.41 billion, driven mainly by the implementation of pricing initiatives and despite a 6% reduction in volumes due to supply chain constraints and lockdowns, AkzoNobel says. EBITDA was down 25% YOY, to €313.0 million, missing analysts' consensus estimate of €330.9 million, provided by Vara Research (Frankfurt, Germany). Operating income declined 31% YOY, to €226.0 million, missing consensus of €231.5 million.

- Thierry Vanlancker, CEO at AkzoNobel said during an analysts' call earlier today that the company expects "raw material inflation and supply chain disruptions to continue through mid-2022. Margin management and cost discipline are in place to deliver an average annual 50 basis points increase in return on sales between 2021 and 2023."

- At its October meeting, the The Bank of Uganda (BoU) monetary

policy committee (MPC) announced that it was maintaining the CBR at

6.5%, as it continued to raise concerns about the uncertainty

regarding the implications of further waves of the COVID-19 virus

pandemic on the economy, as well as sluggish private-sector credit

growth. (IHS Markit Economist Alisa Strobel)

- The MPC also decided to maintain the target band on the CBR at plus or minus 2 percentage points, while the margin on the rediscount rate and bank rate was left unchanged at 3 and 4 percentage points on the CBR, respectively. The rediscount rate and the bank rate were maintained at 9.5% and 10.5, respectively, at the MPC meeting.

- The BoU highlighted that disinflation has persisted since October 2020 and that annual headline inflation and core inflation averaged 2.3% and 3.1% in September, below the bank's target of 5%. Furthermore, the BoU expects near-term price pressures to pick up as pent-up demand and pressure from the recent exchange-rate depreciation feed through.

- According to Thisday, in the week ending 15 October, Nigeria's

Access Bank Plc announced that it had acquired a 78.15% share in

African Banking Corporation of Botswana Limited (BancABC Botswana).

According to the statement, the acquisition will form part of

Access Bank's "nexus for trade and payments in Southern Africa and

the broader COMESA trade region". Access Bank GMD/CEO Herbert Wigwe

explained that BancABC Botswana's retail operation would

efficiently add to Access Bank's wholesale banking capabilities.

(IHS Markit Banking Risk's Ronel Oberholzer)

- IHS Markit has elucidated its expectation of an increase in mergers and acquisitions after the COVID-19 virus pandemic. These larger banking groups can support large projects, improve efforts to foster financial inclusion, and create more capable and diversified groups that can withstand economic shocks.

- Access Bank is Nigeria's second-largest bank by assets, accounting for about 15.3% of total sector assets at the end of 2020. First Bank of Nigeria holds first place with 15.4% of total sector assets. The latest acquisitions, however, are likely to push Access Bank into first place.

Asia-Pacific

- Major APAC equity indices closed mixed; Hong Kong +1.4%, Australia +0.5%, Japan +0.1%, Mainland China -0.2%, South Korea -0.5%, and India -0.7%.

- Mainland China's average new home prices fell by 0.08% month on

month (m/m) in September, compared with a 0.16% month-on-month

increase in August, according to the survey conducted by the

National Bureau of Statistics covering 70 major cities. The latest

reading marked the fourth consecutive month of decline in

month-on-month new home price inflation, as tight mortgage rules

persistently dampen home sales. (IHS Markit Economist Lei Yi)

- While the weakness in new home price inflation was broad across the three city tiers, the September month-on-month new home price decline came almost entirely from tier-3 cities. New home prices of the 35 surveyed tier-3 cities on average reported deflation of 0.2% m/m in September, down by 0.2 percentage point from the prior month. Tier-1 and tier-2 cities also reported the lowest month-on-month new home price inflation since the nationwide resumption of economic activities last April post the height of the pandemic. Notably, the city of Guangzhou reported new home price deflation of 0.1% m/m for both August and September.

- Up to 36 out of the 70 surveyed cities reported month-on-month new home price declines in September, rising by 16 cities from the month before, the highest number since mid-2015. A total of 27 cities registered month-on-month new home price gains, down by 19 cities from August.

- Average year-on-year (y/y) new home price inflation reached 3.3% y/y in September, lower by 0.4 percentage point from August. Similar to the situation in July and August, the disinflation in September was again broad based and led by tier-3 cities. Through the end of third quarter, year-on-year new home price inflation of tier-3 cities has continuously declined for six months since April.

- Horizon Robotics has partnered with Trunk.Tech to accelerate mass production of automated commercial vehicles, reports Gasgoo. The companies will jointly develop a new mass-producible autonomous solution based on Horizon's Journey series auto-grade intelligent chips and Trunk.Tech's Level 4 commercial vehicle domain controller research and development (R&D) capabilities. The two companies also aim to expand the intelligent logistics market by establishing strategic collaborations with commercial vehicle manufacturers and other resources. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Taiwan's Foxconn is looking at building its newly unveiled battery electric vehicle (BEV) models in Europe, as well as potentially India and Latin America, reports Reuters. In Taipei earlier this week, Foxconn, best known as the main contract manufacturer of Apple products, unveiled three new prototypes, including its new premium-positioned Model E flagship BEV sedan, with Italian design house Pininfarina contributing to the car's design. When questioned on where outside of Asia the car potentially will be built, the company's chairman, Liu Young-way, said, "Europe will be a bit faster, I agree with that. But as to where, I can't tell you." The three prototypes unveiled by Foxconn on 18 October were the Foxtron Model C crossover, the Model T urban bus, and the Model E. (IHS Markit AutoIntelligence's Tim Urquhart)

- Japan's trade balance recorded a deficit of JPY623 billion

(USD5.4 billion) on a non-seasonally adjusted basis in September.

The seasonally adjusted balance also recorded a deficit (JPY625

billion) for the fourth consecutive month. Exports continued to

increase, but growth softened to 13.0% year on year (y/y) in

September following a 26.2% y/y rise in the previous month. Import

growth eased to 38.6% y/y in September after a 44.7% y/y expansion

in August. (IHS Markit Economist Harumi

Taguchi)

- The continued moderation of export growth was due partially to the dropout of low base effects, but weaker export volumes were more of a factor. Supply chain-disruption severely affected the export of autos (down 40.3% y/y). The major contributors to export growth were exports of iron and steel (up 94.4% y/y) and mineral fuel (up 167.9% y/y), thanks largely to higher export prices, as well as the export of semiconductors (up 20.2% y/y). Exports to the US declined by 3.3% y/y in September following a 22.8% y/y rise in August. Exports to the European Union softened to a 12.1% y/y increase in September from a 29.9% y/y rise in the previous month, largely reflecting sharp declines in the export of autos.

- Higher prices for energy and other commodities continued to underpin strong growth for imports, while import volume weakened to 7.6% y/y. While imports of mineral fuels remained the major driver of imports, contributing 13.2% percentage points to total imports, imports of medical products (up 84.1% y/y), mobile phones (up 195.5% y/y), iron ore (up 125.6% y/y), and semiconductors (up 47.9% y/y) also contributed substantially to the solid growth of imports.

- Media reports suggest that Stellantis is in talks with Samsung SDI on battery supply, following the company's announcement of a memorandum of understanding with LG Energy Solutions (LGES) on 18 October. Reuters suggests that the Samsung SDI deal may also be to supply the North American market, although it does not indicate where the battery production would be located. The potential deal with Samsung SDI is likely to be in addition to the agreement announced with LGES, although it has not been confirmed formally at the time of writing. When Stellantis held its electric vehicle (EV) day in July, it noted that it would work with suppliers to reach its target of having more than 130 gigawatt hours of battery capacity by 2025, including three factories. At that time, Stellantis indicated that the first three factories would be in either North America or Europe. Potential suppliers suggested during that presentation included LGES, Svolt, and Samsung SDI, as well as CATL and BYD. Although an agreement with Samsung SDI is not yet confirmed, Stellantis's July comments suggest that a deal could easily be in the works. (IHS Markit AutoIntelligence's Stephanie Brinley)

- DESTEN has unveiled an ultra-fast charger, packed with 900 kW

of power, that can charge a DESTEN battery-powered car to achieve

500 km of range in less than 5 minutes in Indonesia, according to a

company press release. The company says that its batteries can be

recharged from 0% to 80% state of charge in 4 minutes and 40

seconds. It plans to showcase this through a global roadshow

starting in Asia, before moving to the Middle East, Europe, and

North America. DESTEN's battery has received UN 38.3 certification,

passing all safety tests, making it an ideal technology for

automotive-grade battery solutions. The battery can achieve 3,000

cycles and over 1.5 million km of total driving range through

engineering of materials and cell structure featuring novel

chemical formulations produced on a custom manufacturing line. (IHS

Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-october-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-october-2021.html&text=Daily+Global+Market+Summary+-+20+October+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-october-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 20 October 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-october-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+20+October+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-october-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}