Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 20, 2021

Daily Global Market Summary - 20 September 2021

All major US, European, and APAC equity indices closed lower on concerns over Mainland China's real estate sector, with almost every index being in negative territory the entire session. US and benchmark European government bonds closed sharply higher. European iTraxx and CDX-NAIG rolled to new series and CDX-NAHY closed sharply wider on the day. The US dollar and gold closed higher, while natural gas, oil, copper, and silver were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Most major US equity indices closed lower; S&P 500 -1.7%, DJIA -1.8%, Nasdaq -2.2%, and Russell 2000 -2.4%.

- 10yr US govt bonds closed -6bps/1.31% yield and 30yr bonds -5bps/1.85% yield.

- CDX-NAIG 37.1 closed 54bps and CDX-NAHY +8bps/286bps.

- DXY US dollar index closed +0.1%/93.28.

- Gold closed +0.7%/$1,764 per troy oz, silver -0.6%/$22.20 per troy oz, and copper -3.1%/$4.12 per pound.

- Crude oil closed -2.3%/$70.14 per barrel and natural gas closed -2.4%/$4.99 per mmbtu.

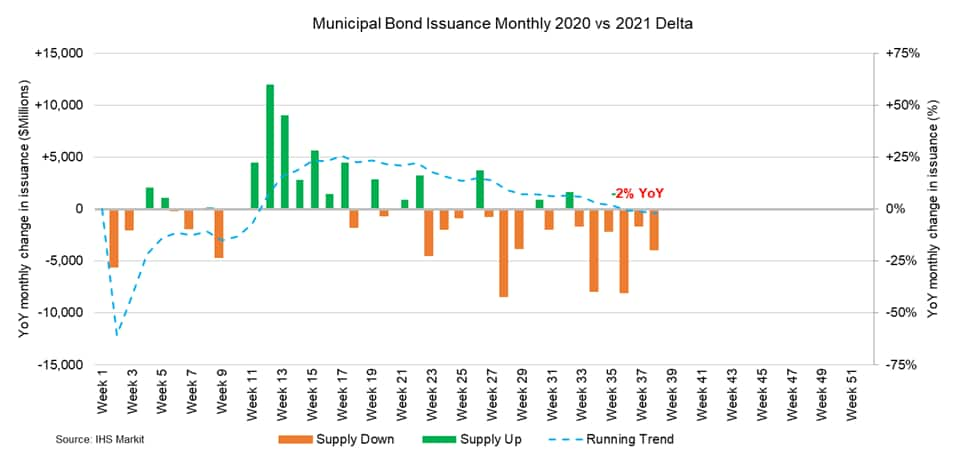

- US municipal bond primary offering volume is on track to remain

in the double digit range after last week's calendar supplied $12.7

billion, with the majority of volume oriented in the long end of

the curve following several large general obligation issues which

surfaced in the primary arena. The State of California provided a

substantial portion of last week's volume after $2.1 billion of

general obligation bonds successfully priced, spanning across two

series with the majority of par size issued in the October 2041

maturity. Institutional demand was front and center across the

scale after bumps of 5bps were registered in the 2037 maturity,

falling +30bps off the interpolated MAC curve. The New York City

Municipal Finance Authority also stepped up to the plate last week

to price $630 million of water and sewer system revenue bonds with

bumps registered across the scale, after the series BB-2 06/2027

maturity priced through the interpolated MAC at -7bps or 0.43 yield

given overarching buyside demand. This week's calendar is slated to

provide $11.4 billion spanning 224 new issues with another strong

presence from California, supplying $3+ billion of new issue

offerings with the bulk of issuance flowing within the intermediate

range of the curve. The Triborough Bridge and Tunnel Authority

(-/AA+/AA+/AA+) will lead this week's negotiated calendar,

supplying $881 million MTA bridge and tunnel senior lien bonds

spanning 05/2022-05/2056 across three series with the majority of

($) par size found in the long end of the curve. The Department of

Airports for the City of Los Angeles California will also come to

market with $750 million private activity revenue bonds with

proceeds designated for Los Angeles International Airport, senior

managed by Jefferies. This week's competitive calendar will include

117 issues for a total of $3.3 billion led by the Commonwealth of

Massachusetts auctioning three separate general purpose obligation

tranches for an aggregated total of $961 million, selling

throughout Tuesday morning 09/21. (IHS Markit Global Market Group's

Matthew

Gerstenfeld)

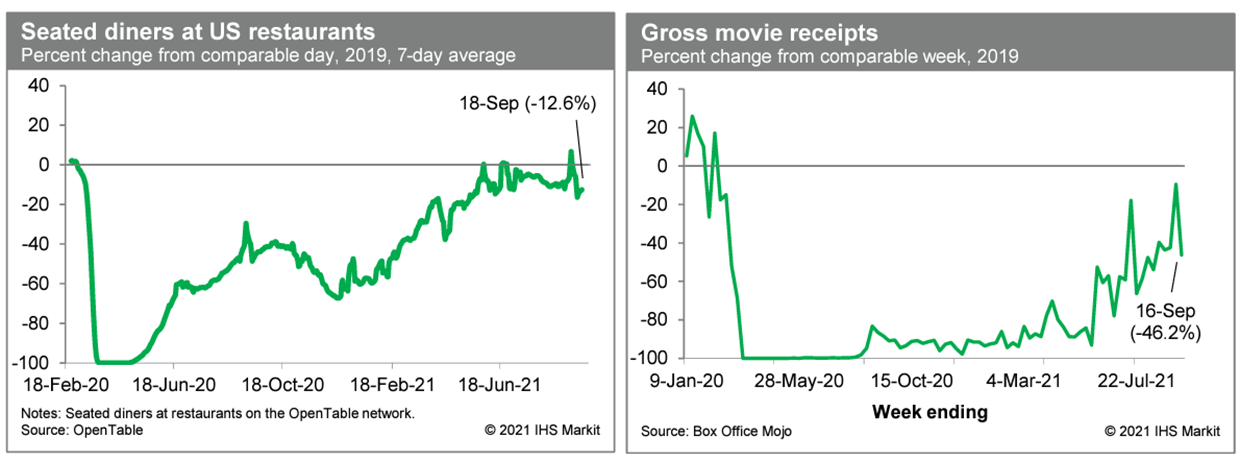

- Averaged over the last seven days, the count of seated diners

on the OpenTable platform was 12.6% below the comparable period in

2019. This was down from the prior two weeks and likely more

indicative of the underlying trend in dining activity, as the

timing of the Labor Day holiday probably created some volatility in

recent comparisons. Meanwhile, box-office revenues last week were

46.2% below the comparable week in 2019, well below the prior

week's reading, which was the best to date in the pandemic-era.

Last week's favorable comparison reflected the timing of Labor Day

weekend as well as the release this year of a popular Marvel film

(Shang-Chi and the Legend of the Ten Rings). The latest weekly

reading is in line with prior weeks. (IHS Markit Economists Ben

Herzon and Joel

Prakken)

- The headline US housing market index inched up 1 point to 76 in

September—the first gain in three months. A reading above 50

indicates that more builders view conditions as good rather than

poor. Given the index's volatility, a 1-point increase should be

seen as a flat reading. (IHS Markit Economist Patrick

Newport)

- The current sales conditions index edged up a point to 82; the index measuring sales prospects over the next six months was unchanged at 81 for the third straight month; the traffic of prospective buyers' index moved up 2 points to 61.

- By region, the Northeast dropped 9 points to 67, a 15-month low; the Midwest and South gained 5 and 3 points to 69 and 80; and the West lost 5 points to 80.

- The index's 1-point September gain may be related to plummeting lumber prices and a small drop in the producer price index for residential inputs in August—which might herald further drops.

- The US FDA's independent Vaccines and Related Biological Products Advisory Committee (VRBPAC) has voted unanimously in favor of a recommendation to grant an emergency use authorization (EUA) for a third-booster dose of Pfizer/BioNTech's Comirnaty vaccine, but restricted only to those aged 65 and over and groups considered at high risk of severe COVID-19. The panel agreed that healthcare workers and others at high risk of occupational exposure should be included in the latter groups. The VRBPAC recommended that the third dose should be administered at least six months after the two primary doses. However, the committee rejected an application for the use of third-booster doses in the general population aged 16 and over, apart from these groups. (IHS Markit Life Sciences' Janet Beal)

- Stellantis will test two new safety notification technologies involving vehicle-to-everything (V2X) connectivity to alert drivers to potential hazards in their path, according to a company statement. The automaker, in collaboration with the 5G Automotive Association (5GAA), will demonstrate a cellular 5G connection with Multi-access Edge Computing (MEC) platform, allowing localized systems to quickly make decisions at the location where data is collected. The MEC platform can locally process and communicate safety risks to on-site pedestrians and approaching vehicles. This technology will be tested at the University of Michigan's Mcity Test Facility involving a pair of 2021 Jeep Wrangler 4xe plug-in hybrid vehicles equipped with the Uconnect system. The second technology, safety cloud notification, will alert the vehicle's Uconnect system to indicate when emergency vehicles are close. V2X technology facilitates the operation of advanced driver-assistance systems (ADAS) and is designed to be compatible with 5G technology. The Uconnect 5 system, which FCA (now merged with Groupe PSA into Stellantis), introduced in January 2020, raised the company's technology base with a cloud-based system and in 2019 the company added the Uconnect Market system that has been updated with Uconnect 5. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Europe/Middle East/Africa

- All major European equity indices closed lower; UK -0.9%, Spain -1.2%, France -1.7%, Germany -2.3%, and Italy -2.6%.

- 10yr European govt bonds closed higher; UK -5bps, Germany -4bps, France -3bps, Spain -2bps, and Italy -1bp.

- European iTraxx indices rolled today, with iTraxx-Europe 36.1 closing 51bps and iTraxx-Xover 36.1 252bps.

- Brent crude closed -1.9%/$73.92 per barrel.

- British meat processors say an impending shortage of CO2 could

cause some businesses to grind to a halt once current stocks run

out, which it estimates could occur in less than 14 days. The

British Meat Processors Association (BMPA) says the shortage could

result in companies having to close production lines leading to

further backlogs of animals on farms. (IHS Markit Food and

Agricultural Commodities' Max Green)

- Representatives of the industry have been in emergency talks with the government over the crisis which is a knock-on effect of the Europe-wide surge in natural gas prices.

- CO2 is used to humanely stun animals before slaughter as well as for vacuum-packing meat products - but that CO2 is the by-product of fertilizer production. The spike in gas prices has prompted UK fertilizer plants to suspend or reduce production. To make matters worse, the meat industry fears similar issues may be affecting plants in Europe that they would normally have turned to in an emergency.

- The BMPA said in a statement that the crisis looked set to be "a lot worse" than the last CO2 shortage experienced in 2018. Because of labor shortages, tens of thousands of pigs are already backed up on farms, with this number rising by an estimated 15,000 a week due to processors reducing throughput. This logjam could now worsen as a result of CO2 shortages.

- SSE Renewables will combine its 2.3 GW Berwick Bank and 1.85 GW Marr Bank offshore wind projects to be developed off the east coast of Scotland. The combination, which is at an advanced stage of planning, could see the development have a capacity of up to 4.1 GW. The company intends to submit a planning application to the Scottish Government in the spring of 2022, and if accepted, will proceed to completion before 2030. SSE Renewables held an online event earlier in the year to advertise future supply chain opportunities for the projects. (IHS Markit Upstream Costs and Technology's Melvin Leong)

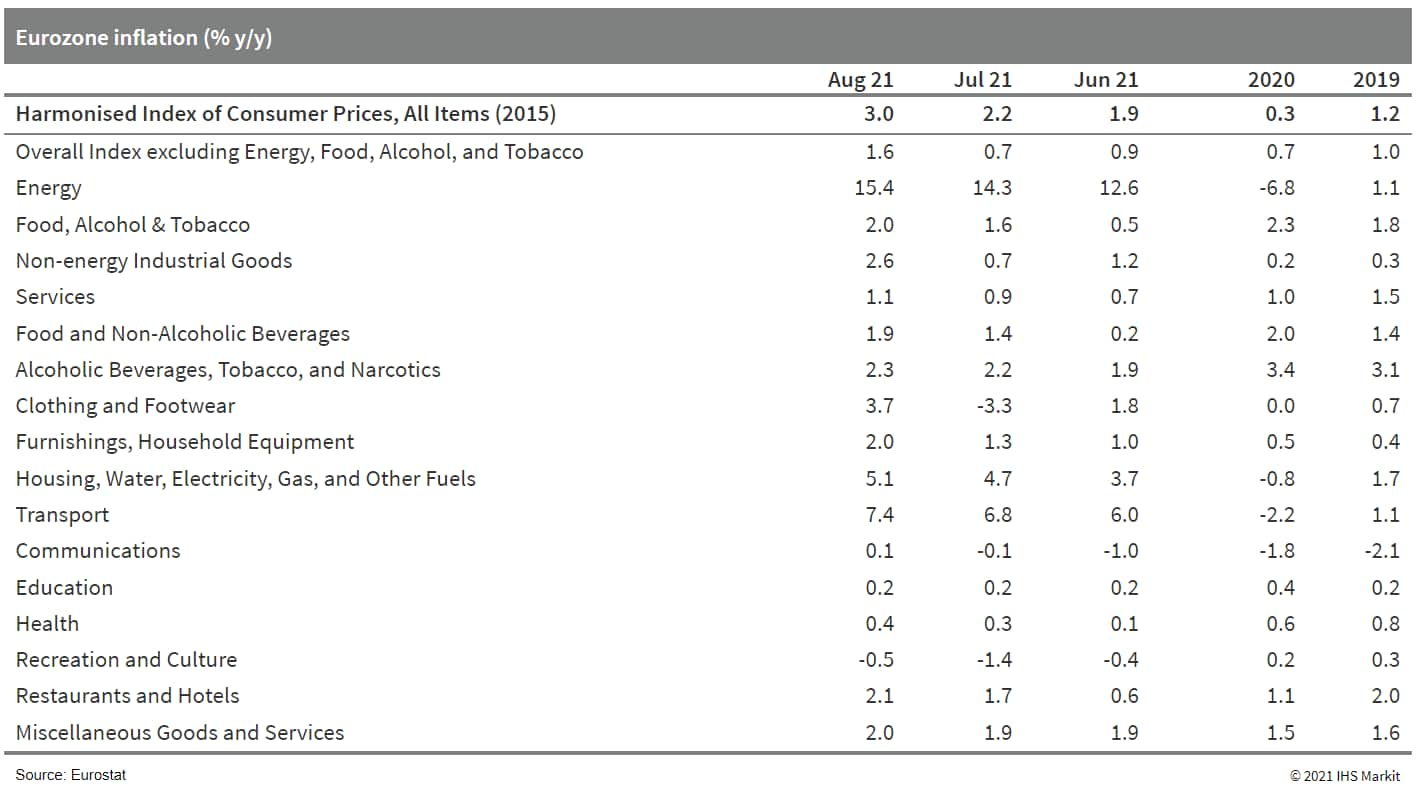

- Eurostat's final HICP data for August have confirmed the jump

in eurozone HICP inflation from 2.2% to 3.0% already reported in

the prior 'flash' estimate. This is the highest rate since 2011.

(IHS Markit Economist Ken

Wattret)

- The marked pick-up in core inflation was also confirmed. The rate excluding food, energy, alcohol, and tobacco prices shot up from 0.7% to 1.6%. Both outcomes exceeded initial market consensus expectations.

- Rising energy inflation again contributed to the elevation of the overall inflation rate (see table below), although the standout feature of August's HICP data was the contrast between the two components of the core inflation rate: i.e., soaring non-energy industrial goods (NEIG) inflation and still subdued services inflation.

- NEIG inflation jumped to 2.6% in August, a record high (revised

marginally downwards versus the 'flash' estimate of 2.7%). Services

inflation edged up from 0.9% to 1.1% (unchanged from the 'flash'

estimate).

- France has selected a list of companies that qualify for the next stage of its first commercial floating offshore wind tender to develop a 270 MW project off the south of Brittany. Amongst the list includes Equinor; the consortium of Shell, Valeco (a subsidiary of EnBW), and Eolien en Mer Participations (a subsidiary of Caisse des Depots et Consignations); the consortium of TotalEnergies, Green Investment Group, and Qair; the consortium of Elicio, BayWa r.e., Iberdrola, RWE, and Ocean Winds; the consortium of wpd, Vattenfall, and BlueFloat Energy; the consortium of EDF Renewables and Maple Power (a joint-venture between CPP Investments and Enbridge). (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Yara International says it is slashing ammonia production in

Europe because of "record high natural gas prices" in the region.

High gas costs are eroding ammonia production margins, and as a

result Yara is curtailing production at a number of its European

plants, including optimization of ongoing maintenance. (IHS Markit

Chemical Advisory)

- Yara says that by the end of this week, it will have curtailed about 40% of its ammonia production in Europe. The company has not provided details of which plants are impacted. Yara says it will continue to monitor the situation, with the objective of continuing to supply customers but curtailing production where necessary.

- Yara says the impact on its output of fertilizer products such as ammonium nitrate (AN) is currently minor. The company is understood to be sourcing some of the ammonia needed to produce AN from outside Europe or third parties.

- Yara has about 4.4 million metric tons/year (MMt/y) of ammonia capacity in Europe, according to IHS Markit data. This implies that the cuts in output total 1.8 MMt/y. Yara's ammonia production is split among sites at Brunsbüttel, Germany; Ferrara, Italy; Hull, UK; Le Havre, France; Porsgrunn, Norway; Sluiskil, Netherlands; and Tertre, Belgium. The Brunsbüttel, Hull, and Porsgrunn facilities are those where maintenance is taking place and will be optimized, CW understands.

- Soaring gas prices are a major issue across Europe's fertilizer industry. CF Industries announced last week that it would halt operations at Billingham and Ince, UK, as a result of high gas costs. The company produces ammonia and AN at Billingham and Ince. Its ammonia capacity at the two plants totals 730,000 metric tons/year.

- Nigerian President Muhammadu Buhari on 14 September requested

the Senate's approval of new external loans of USD4.179 billion and

EUR710 million under the Nigerian federal government's 2018-21

Medium Term Expenditure Framework (MTEF). The external borrowing

will include sovereign loans from the World Bank, the French

Development Agency (AFD), China-Exim Bank, the International Fund

for Agricultural Development (IFAD), Credit Suisse Group, and

Standard Chartered/China Export and Credit (SINOSURE). (IHS Markit

Economist Thea

Fourie)

- The Nigerian government plans to allocate the funding to federal and state governments' projects, focusing on infrastructure, healthcare, agriculture and food security, energy, education, and human capital development, including coronavirus disease 2019 (COVID-19) pandemic response efforts.

- The Nigerian government is also planning to issue a USD3-billion Eurobond in the first half of October, which forms part of the total USD6.1 billion of external borrowing approved for 2021. Proceeds from the Eurobond are to be used to meet 2021 budget deficit needs in conjunction with above loan demands. Remaining proceeds are to be used to shore up overall foreign-reserves holdings. The 2021 budget allowed for USD6.1 billion in external borrowing at the previous official exchange rate of NGN379:USD1.00.

Asia-Pacific

- All major APAC equity markets closed lower, with South Korea, Mainland China, and Japan markets closed for a holiday. India -0.9%, Australia -2.1%, and Hong Kong -3.3%.

- After months of treating the crisis at indebted developer China Evergrande Group as largely contained, investors on Monday rushed to price in the risk that Xi will miscalculate as he tries to curb China's property-market excesses without derailing the economy. Evergrande has around $300 billion worth of liabilities, more than any other property developer in the world. It's a whale in China's high-yield dollar bond market, accounting for about 16% of outstanding notes. Some $83.5 million of interest on a five-year dollar bond comes due Thursday, and failure to pay within 30 days may constitute a default. Evergrande also needs to pay a 232 million yuan ($36 million) coupon on an onshore bond the same day. (Bloomberg)

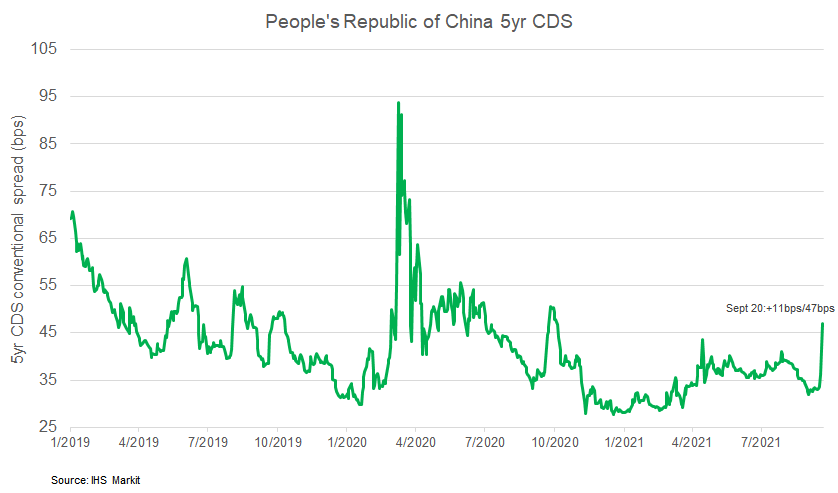

- People's Republic of China 5yr CDS spreads closed +11bps/47bps,

which is the widest close since October 2020.

- China's State Administration for Market Regulation has plans to implement a new standard on driving automation for vehicles (GB/T 40429-2021) in March 2022. The new standard classifies six levels of driving automation, ranging from 0 to 5, based on various factors, including dynamic driving task, minimal risk condition, and minimal risk maneuver. The standard also states the different operational responsibilities that the drivers will have at each level. The new standard states that the autonomous system, not the driver, will monitor object recognition and response tasks at Level 3 and higher. The wording in the standard describing the human in charge of dynamic driving task fallback has also changed from "drivers" to "users". This implies that under conditionally automated driving conditions, drivers can keep their hands free and only take over the driving when necessary, reports Gasgoo. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- DeepWay, a Baidu-backed company, has unveiled a smart new energy heavy-duty truck Xingtu, reports China Daily. It has computing power of more than 500 trillion operations per second (TOPS) and an ultra-long-range detection of more than 1 km. The truck, which is equipped with 10 onboard cameras, a 5-mm wave radar, and three infrared detectors, along with advanced algorithms, is powered by Baidu's artificial intelligence (AI) technology stack and the Apollo autonomous platform. The first generation of Xingtu is designed to enable Level 3 automation on high-speed freight routes with an aim to achieve Level 4 autonomous capabilities on these same routes between 2024 and 2026. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The au Jibun Bank Japan Composite PMI, compiled by IHS Markit,

indicated Japan's private sector contracted for the fourth

consecutive month in August. The PMI's Composite Output Index

dropped from 48.8 in July to 45.5 in August, pointing to the

fastest fall in private sector output since a year prior. The

contraction was led by the fastest reduction in services activity

for 15 months, alongside a softening in the rate of increase in

manufacturing production. (IHS Markit Economist Usamah Bhatti)

- Stricter pandemic restrictions across South East Asia due to elevated infection rates exacerbated ongoing supply chain issues in August. This contributed to softer growth of the Japanese manufacturing sector to its lowest during its current seven-month series of expansion. There was also a more pronounced slowdown in new order intakes among manufacturers, as the seasonally adjusted New Orders Index reached its lowest since the start of 2021.

- Despite the lack of a boost from the Tokyo Olympics, confidence about the outlook for Japanese private sector remained strong in August by historical standards, although sentiment across both the manufacturing and services sectors did ease to the lowest points since January.

- Optimism was underpinned by hopes that the accelerating

vaccination program would stimulate a broad-based recovery in

demand conditions. Latest government figures place the vaccine

rollout on track to match the fully vaccinated rate to the same

level of the US by the end of September, with a target of November

for 80% of the population to be fully inoculated against the

disease.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-september-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-september-2021.html&text=Daily+Global+Market+Summary+-+20+September+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-september-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 20 September 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-september-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+20+September+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-september-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}