Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 21, 2021

Daily Global Market Summary - 21 April 2021

All major US and European equity indices closed higher, while most APAC markets were lower. US government bonds closed flat and benchmark European bonds were mixed. European iTraxx and CDX-NA closed slightly tighter across IG and high yield. Gold, silver, and copper closed higher, while the US dollar, oil, and natural gas were lower.

Americas

- US equity indices closed higher; Russell 2000 +2.4%, Nasdaq +1.2%, DJIA +0.9%, and S&P 500 +0.9%.

- 10yr US govt bonds closed flat/1.56% yield and 30yr bonds flat/2.26% yield.

- CDX-NAIG closed -1bp/51bps and CDX-NAHY -3bps/294bps.

- DXY US dollar index closed -0.1%/91.16.

- Gold closed +0.8%/$1,793 per troy oz, silver +2.8%/$26.57 per troy oz, and copper +1.6%/$4.28 per pound.

- Crude oil closed -2.1%/$61.35 per barrel and natural gas closed -1.3%/$2.69 per mmbtu.

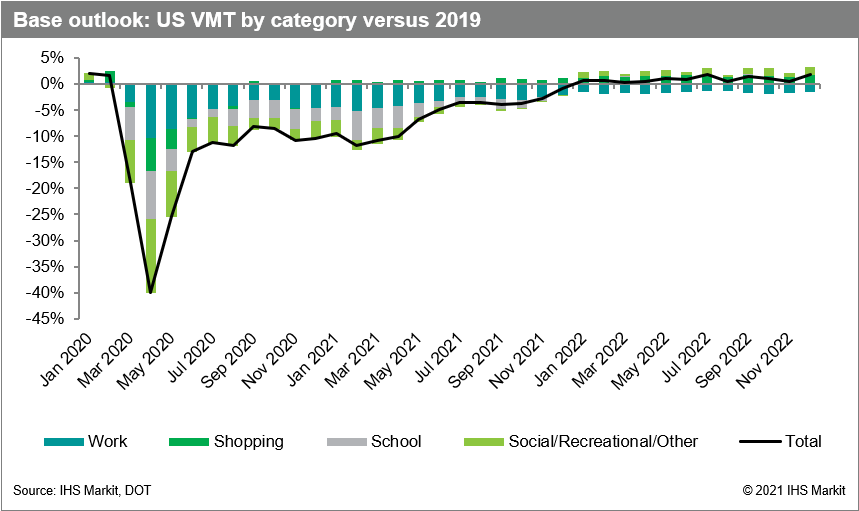

- The US gasoline market is in a sharp turnaround from a year

ago, when COVID-19 led to an unprecedented drop in demand. While

markets will continue to feel the effects of the pandemic through

the next few years, the impacts of COVID-19 on miles driven and

gasoline demand are expected to diminish as an increasing share of

the population of the United States is vaccinated and the economy

reopens. (IHS Markit Energy Advisory's Roger Diwan, Brian Stetter,

Susan Bell, Fellipe Balieiro, and Debnil Chowdhury)

- Work-from-home levels remain elevated, averaging about 23% as of February. As a result, work commute vehicle miles traveled (VMT) is still significantly off from its pre-pandemic highs. However, an improving employment picture and a slow return to in-office work should support commuting VMT over the next few years.

- Online/hybrid learning is still prevalent, particularly on the West Coast. Although only accounting for 7% of miles driven, school VMT has been weak because of the persistence of online and hybrid learning in both K-12 and higher education schools.

- Other VMT sectors are starting to show more substantial

recovery. Recreational/social and shopping VMT are already showing

signs of recovery and are expected to exceed pre-pandemic levels by

next year.

- More people were diagnosed with COVID-19 last week than any other since the pandemic began. The World Health Organization this week warned that new infections are increasing everywhere except Europe, led by rocketing numbers in India with cases also rising in Argentina, Turkey and Brazil. (Bloomberg)

- Processing vegetables (excluding potatoes and mushrooms) per capita availability in the US rose 5% in 2020 totaling 116.6 pounds, the USDA Economic Research Service (ERS) reported. Despite the pandemic, Federal programs helped, boosting personal income and driving up demand for food. Although the pandemic led to an estimated 19% drop in restaurant and bar sales, increased vaccination rates, warmer weather and income growth are likely to spur resurgence in consumer restaurant visits this summer and autumn. The National Restaurant Association expects industry sales to recover a portion of last year's losses with a projected 11% in 2021. Although an estimated 110,000 restaurant establishments closed permanently or long-term in 2020, the gain in industry sales is expected to slightly favor full-service establishments, which appear to have suffered the majority of the pandemic closures. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

- Motional, a joint venture (JV) between Hyundai and Aptiv, has partnered with Derq to develop a technology to provide a 360-degree bird's eye view of the environment for its autonomous vehicles (AVs). At the beginning of the pilot project, two intersections in Las Vegas, Nevada (United States) and their traffic data are to be analyzed offline. In the next phase of the pilot, Derq's cameras installed above busy intersections are to be connected to its artificial intelligence-based perception systems and roadside units (RSUs). It will then transmit the data to Motional's AVs in real time to help inform its decision-making. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Minerals firms Energy Fuels (Lakewood, Colorado) and Hyperion Metals (Belmont, North Carolina) have signed a memorandum of understanding (MOU) under which Hyperion will supply an unspecified amount of natural monazite sands for processing into mixed rare earth elements (REEs) at Energy Fuels' facility in White Mesa, Utah. The MOU is nonbinding. The monazite sands covered under the deal will be sourced from Hyperion's Titan Project, a heavy mineral sands mining development in Tennessee. Hyperion is currently undertaking a three-phase drilling and bulk sampling program at the Titan Project. The company is evaluating production of titanium minerals, zircon, and silica from the site, in addition to monazite. The site "saw significant historic exploration from 1960 to 1990 by DuPont, BHP, and others," according to Hyperion. The company expects a full mineral resource estimate from the site, which is located near Chemours' New Johnsonville, Tennessee, pigment plant, to be complete in the second quarter of this year. (IHS Markit Chemical Advisory)

- As expected, the Bank of Canada made no interest rate changes

and it is continuing to pull back its quantitative easing weekly

bond purchase program to $3 billion from a minimum of $4 billion.

(IHS Markit Economist Arlene Kish)

- The April Monetary Policy Report (MPR) baseline forecast is stronger than January's estimates as Canada's real GDP rebounds 6.5% this year, advances 3.7% next year, and climbs 3.2% in 2023.

- The annual 2021 inflation outlook was revised up to 2.3%, followed by 1.9% in 2022 and 2.3% in 2023.

- The Bank of Canada also raised its estimates for potential output or moved the target that helps measure the output gap and the amount of excess slack.

- There was some change in the Bank's extraordinary forward guidance given the upwardly revised outlooks. Excess slack in the economy will persist until mid-2022. The Bank will look for a broad-based recovery before hiking rates. The next policy announcement is scheduled on 9 June.

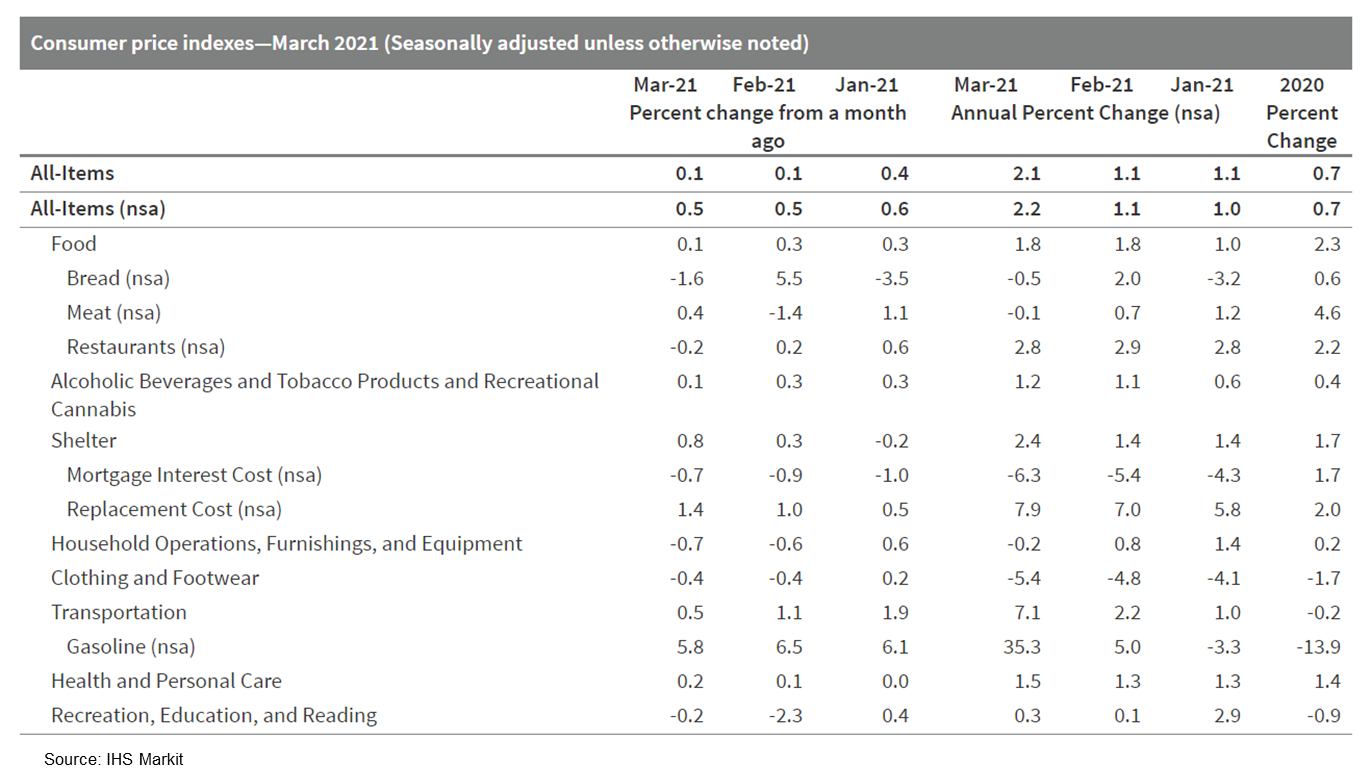

- Canada's consumer prices increased 0.1% month on month (m/m) on

a seasonally adjusted basis (SA) and 0.5% m/m in March on a

non-seasonally adjusted basis (NSA). (IHS Markit Economist Chul-Woo

Hong)

- The annual inflation rate accelerated by 1.1 percentage points to 2.2% year on year (y/y) NSA and by 1.0 percentage point to 2.1% y/y SA.

- Core inflation rates averaged 1.9% y/y, up from 1.8% y/y in February as all three Bank of Canada core consumer price inflation rates accelerated.

- Partially owing to the effects of the low base year, annual

inflation pressure will remain solid in the coming months.

Europe/Middle East/Africa

- Major European equity indices closed higher; France/Spain +0.7%, UK +0.5%, Germany +0.4%, and Italy +0.3%.

- 10yr French government bonds closed +8bps/0.07% yield, which is the worst single-day sell-off since 18 March 2020 and the highest closing yield since exactly one year ago tomorrow.

- 10yr European govt bonds closed mixed; UK +1bp, Germany flat, Spain -1bp, and Italy -3bps.

- Conservative policymakers at the European Central Bank have put aside their discomfort with ultra-loose monetary policy to stand behind the region's COVID-19 crisis-hit economy. But even as the continent remains mired in rising infections, the "hawks" are urging the central bank to prepare to scale back its huge bond-buying program. This potential shift, which risks dividing the ECB governing council and unsettling investors in eurozone bond markets, is expected to be discussed at the bank's monetary policy meeting on Thursday, although any action is unlikely before its next meeting in June at the earliest. (FT)

- iTraxx-Europe closed flat/51bps and iTraxx-Xover -3bps/252bps.

- The European Central Bank (ECB) announced on 19 April the results of its "Targeted Review of Internal Models" (TRIM), a multi-year project involving 65 systemically important banking institutions and approximately 200 site visits. Although "institutions generally have the capability to build… adequate models", the report identified over 5,800 findings regarding in-house models: 30% "have a high severity". The main weaknesses related to credit risk modelling, which in the retail and SME segment focused on inadequate risk differentiation and loss-given-default (LGD) estimation mechanisms. Many findings related to low default portfolios (LDPs), notably focusing on "calibration" and "long term default" levels. Other areas highlighted relate to market risk models, particularly the use of value at risk (VAR) and stressed VAR models, and counterparty credit risk models, along with non-model-specific issues such as the arrangements for internal validation and management of model changes. (IHS Markit Country Risk's Brian Lawson)

- French ride-sharing firm BlaBlaCar has raised EUR97 million (USD115 million) in a funding round led by existing investor VNV Global, according to a company statement. New investors Otiva J/F AB and FMZ Ventures also participated in the round. The company plans to use the infused capital to accelerate its expansion strategy. BlaBlaCar was founded in 2006 and offers a long-distance car-pooling platform that connects drivers with empty seats. The company has more than 90 million registered users on its platform and is present in 22 countries. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Mario Draghi will next week unveil a €221 billion recovery package for a radical restructuring of Italy's economy as it seeks to bounce back from its deepest recession since the second world war. The plan, which features big-ticket investments in high-speed rail and green energy, as well fully digitalizing the country's public administration, will draw on the EU's pandemic recovery fund. (FT)

- Volvo Group has said that it is aiming for battery electric vehicles (BEVs) to make up half of its truck sales in Europe by the end of the decade. Alongside the existing medium-duty FL Electric and FE Electric, its line-up of BEVs will be joined by heavier duty products which will start production in Europe during the second half of 2022. For transport, the company will introduce the FM Electric and FH Electric. The former is said to be intended to "perform high capacity grocery deliveries, container transports, crane services and more in metropolitan areas with less environmental impact", while the latter will be intended for longer distance, regional transportation. In terms of its specification, both are offered with the same options. (IHS Markit AutoIntelligence's Ian Fletcher)

- The detailed data released by the Russian Federal State

Statistical Service (RosStat), the headline industrial output index

increased by 1.1% year on year (y/y) in March, compared to y/y

declines of 3.2% in February, and 1.9% in January. (IHS Markit

Economist Lilit Gevorgyan)

- The headline index fell by 1.3% y/y in the first quarter, following y/y declines of 1.7% in the fourth quarter of 2020, 4.8% in the third, and 6.7% in the second, when the negative impact of the COVID-19 virus pandemic started to materialize.

- The mining sector remains a drag on the overall index, shrinking continuously since March 2020, in annual terms. The extractive sector's output fell by 7.3% y/y in the first quarter of this year, moderating from 8.1% y/y and 11.5% y/y declines in the fourth and third quarters of 2020, respectively.

- Conversely, the manufacturing sector offset partially the mining sector losses in March, rising by 4.2% y/y. However, the sector had a poor start to the year. After expanding by 7.9% y/y in December 2020, it fell by 0.2% y/y in January and 1.7% y/y in February.

Asia-Pacific

- Most APAC equity markets closed lower except for Mainland China flat; Australia -0.3%, South Korea -1.5%, Hong Kong -1.8%, and Japan -2.0%.

- The world will see a sharp 4.8% rebound in annual energy-related carbon emissions in 2021, the International Energy Agency (IEA) said, with emissions from coal, natural gas, and China leading the surge. This increase would counteract nearly all the emissions reductions the IEA observed in 2020 when the global economic slowdown led to a 5.8% reduction in energy-related emissions to 31.5 billion mt. Issuing what it called a "dire warning," the Paris-based intergovernmental agency said the global economic recovery this year will generate a 1.5-billion mt increase in energy-related carbon emissions to 33 billion mt. It would be the second-highest year's emissions on record, only behind the 33.4-billion mt level of 2019, and would represent a retreat from meeting Paris Agreement goals for 2030 or 2050. (IHS Markit Climate and Sustainability News' Kevin Adler)

- Chinese food-delivery giant Meituan has raised USD10 billion in a stock and convertible bonds sale with an aim to automate deliveries, reports Reuters. Meituan sold USD7 billion in shares and roughly USD3 billion in two-tranche convertible bonds. The company plans to use the proceeds to develop autonomous delivery vehicles, delivery drones, and other cutting-edge technology. Meanwhile, Meituan has launched its new-generation driverless delivery vehicle in China's Shunyi district, Beijing, reports Caixin Global. The vehicle is able to detect obstacles in its surroundings within a radius of more than 150 meters. In addition, the vehicle is able to cover 80 kilometers on a single charge with a loading capacity of 150 kilograms. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Following a resurgence of COVID-19 cases in India, several states and union territories have declared fresh restrictions to curb the spread of the virus. According to several local media reports, states including Delhi, Rajasthan, Madhya Pradesh, Uttar Pradesh, and Chhattisgarh have announced partial lockdowns for several days. Maharashtra had already declared a similar move. The restrictions mainly include night curfews, the closure of public places, activities, and services, except essential services, as well as mandatory RT-PCR tests for inter-state travel. (IHS Markit AutoIntelligence's Isha Sharma)

- According to a press notice issued by DBS Group on 20 April, the bank has acquired a 13% stake in Shenzhen Rural Commercial Bank for CNY5.3 billion (USD820 million). This deal is part of DBS's plan to accelerate "its expansion in the rapidly growing Greater Bay Area". The stake purchase has already received regulatory approval from Singaporean and Chinese regulators the Monetary Authority of Singapore (MAS) and the China Banking and Insurance Regulatory Commission (CBIRC). In the notice, DBS stated that, for Shenzhen Rural Commercial Bank, "40% of its total loans are in the retail segment and remaining 60% in corporate segment, largely to Shenzhen-based small-and-medium-enterprises" in 2020. (IHS Markit Banking Risk's Angus Lam)

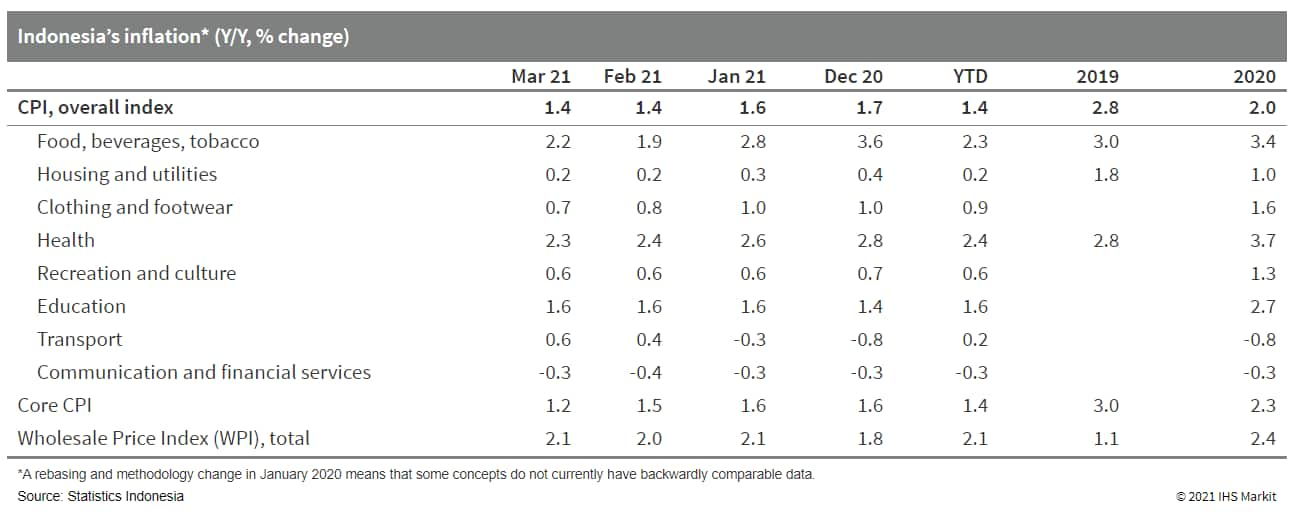

- The Bank Indonesia's (BI) Board of Governors kept its key

policy rate, the seven-day reverse repo rate, unchanged at 3.50%

during the latest monetary policy review on 20 April. The bank also

maintained the Deposit Facility (DF) rate at 2.75% and Lending

Facility (LF) rate at 4.25%. The policy rates were last reduced in

February 2021, ending the series of rate cuts initiated in February

2020 and aimed at cushioning the Indonesian economy from the effect

of the COVID-19 pandemic. (IHS Markit Economist Hanna

Luchnikava-Schorsch)

- Consumer price inflation remains low and stable, with headline CPI inflation hovering at 1.4% year on year (y/y) in February and March 2021, because of still-compressed domestic demand and anchored inflation expectations. While citing food prices as a risk, BI has reinforced its commitment to policy co-ordination with the government in controlling food inflation, particularly during the month of Ramadan and Eid ul-Fitr festive period.

- BI also highlighted improving monetary policy transmission to

borrowers since the policy rate cut in February and BI's repeated

moral suasion to banks. According to BI's policy statement, the

banks' prime lending rate came down by 171 bps in February, led by

state-owned banks, which reduced lending rates by 266 bps to 8.7%.

The lending rates were reduced across all loan types.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-21-april-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-21-april-2021.html&text=Daily+Global+Market+Summary+-+21+April+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-21-april-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 21 April 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-21-april-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+21+April+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-21-april-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}