Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 21, 2020

Daily Global Market Summary - 21 October 2020

Most major APAC equity markets closed higher, while European and the US markets closed lower. US and European benchmark government bonds closed lower, with the US dollar also lower on the day. iTraxx and CDX indices were close to flat across IG and high yield, while oil was sharply lower. US markets will likely be focusing on tomorrow's (Thursday) US initial claims for unemployment insurance after last week's report showed an unexpected uptick in claims.

Americas

- US equity markets turned lower after a 3pm EST report that the vote on a US COVID-19 relief package may not occur until after the election; Russell 2000 -0.9%, DJIA -0.4%, Nasdaq -0.3%, and S&P 500 -0.2%.

- 10yr US govt bonds closed +3bps/0.82% and 30yr bonds +5bps/1.64% yield.

- White House officials and House Speaker Nancy Pelosi on Wednesday opened the door to passing a coronavirus relief package after the election, a signal that time and political will has likely run out to enact legislation before then. (WSJ)

- CDX-NAIG closed -1bp/57bps and CDX-NAHY flat/376bps.

- DXY US dollar index -0.5%/92.64 as of 5:35pm EST.

- Gold closed -1.1%/$1,930 per ounce and silver +1.0%/$25.24 per ounce.

- Crude oil closed -4.0%/$40.03 per barrel.

- The oil market remains deep in the throes of a protracted

demand crisis, with mass vaccine deployment the only path back to

100 MMb/d global liquids demand. The critical time for this

transition is likely to be 2Q-3Q2021. Until then, we expect Brent

to remain below $50/bbl as oil markets struggle with weak and

stagnant demand. (IHS Markit Energy Advisory's Roger Diwan, Karim

Fawaz, Justin Jacobs, Edward Moe, and Sean Karst)

- Evidence is mounting that the demand recovery has stalled, and we expect global liquids demand to plateau through March 2021 as early signs of fresh spikes in COVID-19 cases are pointing to a difficult winter.

- The loss of momentum in end-user demand as mobility and economic drivers lose steam will be compounded over the winter by a slowdown in Chinese crude buying after it's binge earlier this year and broad-based refining headwinds.

- With demand remaining weak, the market's attention will turn to the OPEC+ group's ability to keep supply off the market to continue to tighten fundamentals and draw down inventories. We believe OPEC+ will be forced to extend its cuts well into 2022, keeping very large volumes of spare capacity on the sidelines.

- Low oil prices and a more conservative approach to deploying capital will take fuel out of the shale growth engine. With prices in the $40-45/bbl range through the first half of next year, our base case forecast sees US production holding largely flat at around 11.1-11.2 MMb/d in 2021 and much of 2022 as companies have enough capital to cover their maintenance spending and deliver small returns to shareholders, but not to generate meaningful growth.

- Iran looms large over the market recovery in the short- and medium-term. Joe Biden's commanding lead in presidential election polls is bringing back to the fore the likely partial or full return of the 2.0 MMb/d of Iranian oil under sanctions.

- Some corners of the market have started to forecast a post-COVID supercycle, fueled by a better-than-expected demand recovery and inadequate investment in new supply as the energy transition prematurely saps capital from the upstream sector. While we do find a continuation of tightening conditions into 2022, helping set the market and global upstream industry on firmer footing, we find the supercycle case unconvincing.

- From a fundamental standpoint, a sustained multi-year resource-induced supercycle is unlikely because the resource to meet decelerating global demand needs through most of the 2020s clearly exists if prices cross $70/bbl, including short-cycle barrels. The emerging carbon constraint is real and will shape the future of the upstream industry, but the supercycle case overstates its impact over the next five years.

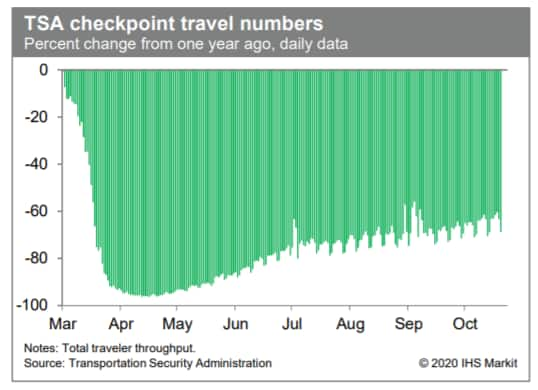

- Passenger throughput at US airports averaged over the last week

was 64.2% below the year-ago level, according to the TSA, a slight

improvement over the prior week, when throughput was down 65.2%.

(IHS Markit Economists Ben Herzon and Joel Prakken)

- GM announced a series of planned investments in US manufacturing on 20 October, with the largest and most significant being a USD2-billion investment to convert its plant in Spring Hill, Tennessee, from its current ICE vehicle production to production of both ICE and electric vehicles, as GM already does at its Orion Township plant in Michigan. The investment will enable the Spring Hill plant to produce EVs, including the Cadillac Lyriq. GM says that the investment includes "major expansions" to the paint and body shops and "comprehensive upgrades" to the general assembly facilities. The investment in general assembly will include new machines, conveyors, controls, and tooling. The work on this plant will begin immediately, the company said. A GM spokesperson confirmed to IHS Markit that, while the work will mean some downtime at the plant, this is not expected to be extensive, as it is for the company's Factory Zero, formerly the Detroit-Hamtramck Assembly plant. GM's revealing of the GMC Hummer EV has been among the most anticipated industry events of 2020, although GM has been gradually releasing information on its EV technology for months. Given that GM's shift towards EV technology is about much more than one product or brand, it may help position GM as an EV technology leader. GM's announcement of the investment in EV production on the same day as the reveal of the electric pick-up shows that the GMC Hummer EV is not a one-off project. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Through a Medium blog post, Ford Autonomous Vehicles has announced its latest autonomous test vehicle, which it says is the fourth generation. This version is based on the Ford Escape Hybrid, and is also significant for being the "architecture and platform we have chosen to use to bring our autonomous vehicle service online," according to John Davis, Ford autonomous vehicle (AV) chief engineer. In several ways, this iteration is the most significant. Prior to this Escape Hybrid, Ford had been using the Fusion sedan. The Escape Hybrid is characterized as "launch intent," however. Davis says that it has the components Ford believes will be needed to support commercialization. Davis also confirmed via email to IHS Markit that the interior is being redesigned "to create the best experience possible to support the movement of people and goods." More details on those changes will be provided later, however. As automakers and technology suppliers come closer to resolving issues with Level 4 autonomy, we should expect an increase in the volume of news and announcements. These technologies have been in development for several years, with many having targeted 2021 for a commercial launch and some having targeted 2020. The launch targets were also based on whether the technology was mature enough, and programs are being held back rather than launching prematurely. However, General Motors (GM) has recently received approval to test without a backup driver in California and Waymo has announced opening its Arizona program to public riders, instead of only its first early program participants. Ford also announced earlier in October several milestones for test programs, particularly in Austin where Ford has selected the site for its planned autonomous vehicle terminal. (IHS Markit AutoIntelligence's Stephanie Brinley)

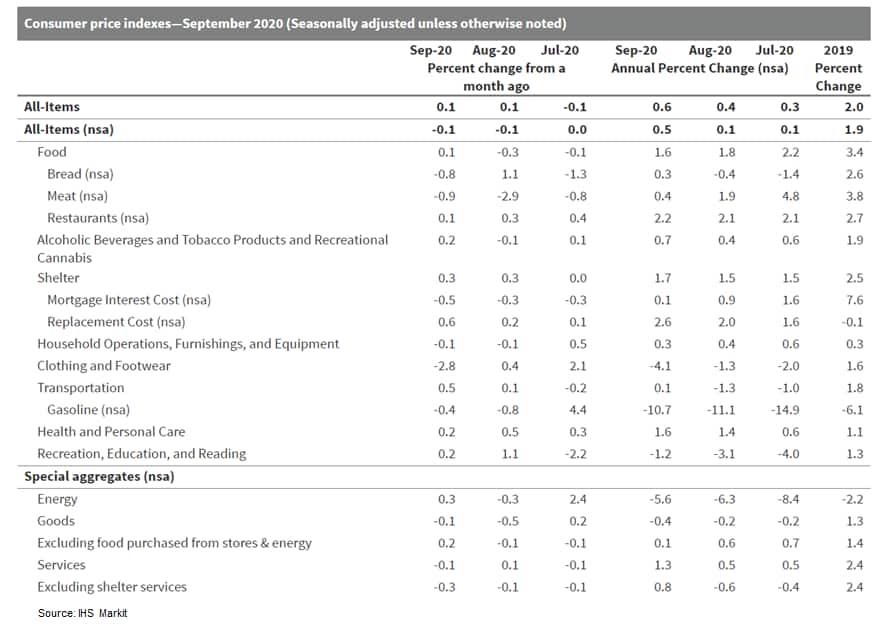

- Canada's consumer prices were relatively unchanged from a month

earlier again as inflation ticked up 0.1% on a seasonally adjusted

basis (sa) and ticked 0.1% lower on a non-seasonally adjusted basis

(nsa). (IHS Markit Economist Arlene Kish)

- Annual inflation accelerated slightly to 0.5% year on year (y/y) nsa and 0.6% y/y sa.

- The core consumer price index (CPI)-trim quickened while the other core inflation measures were steady, maintaining an average 1.7% y/y.

- The goods price inflation (-0.4% y/y) was the weakest since May and the services price inflation (1.3% y/y), which more than doubled from last month, was the highest since June.

- Low and slow inflation trends linger, keeping the Bank of Canada comfortably on the sidelines for a while longer as quarterly inflation rates exactly match expectations in the July Monetary Policy Report.

- Weaker gasoline prices in October will slow the Canadian inflation outlook for the final quarter of the year, slowing the annual average pace to 0.8% in 2020 and 1.4% in 2021.

- The decline in the gasoline price index was in line with expectations. Going forward, gasoline's October price decline from a month earlier is putting more downward price pressures on the overall index on a monthly and annual basis.

- Food price inflation is decelerating thanks to lower prices for food from stores at 1.3% y/y, the slowest pace in almost two years.

- Yet during the pandemic, food purchased from restaurants inflation has been relatively unchanged around 2.2% y/y as fast food and takeout restaurant prices jumped 2.5% y/y, which is a 0.8-percentage-point leap from the previous month's pace. October restrictions on indoor dining in some regions are likely to put downward pressure on demand.

- Clothing and footwear price declines were larger in September thanks to big discounts on women's clothing on lower demand. However, the upward price pressure contribution from the transportation price index was from higher purchase of passenger vehicle prices in addition to passenger vehicle insurance premiums on stronger demand. Public transportation prices are falling 1.2% on smaller price declines for air transportation on extremely soft demand after the summer months.

- Tuition fees reversed course with the annual update, rising

1.9% y/y from the previous 3.6% y/y decline over the past 12

months. This was due to a 6.0% y/y leap in Alberta after the

tuition freeze ended. Plus, Ontario's tuition fees increase was

0.3% y/y, after the government enforced tuition price cuts (-8.9%

y/y) in the 2019 school year.

Europe/Middle East/Africa

- European equity markets closed lower across the region; Italy -2.0%, UK -1.9%, Spain -1.7%, France -1.5%, and Germany -1.4%.

- 10yr European govt bonds closed lower across the region; UK +6bps, Italy +4bps, and France/Spain +1bp.

- iTraxx-Europe closed flat/55bps and iTraxx-Xover -4bps/327bps.

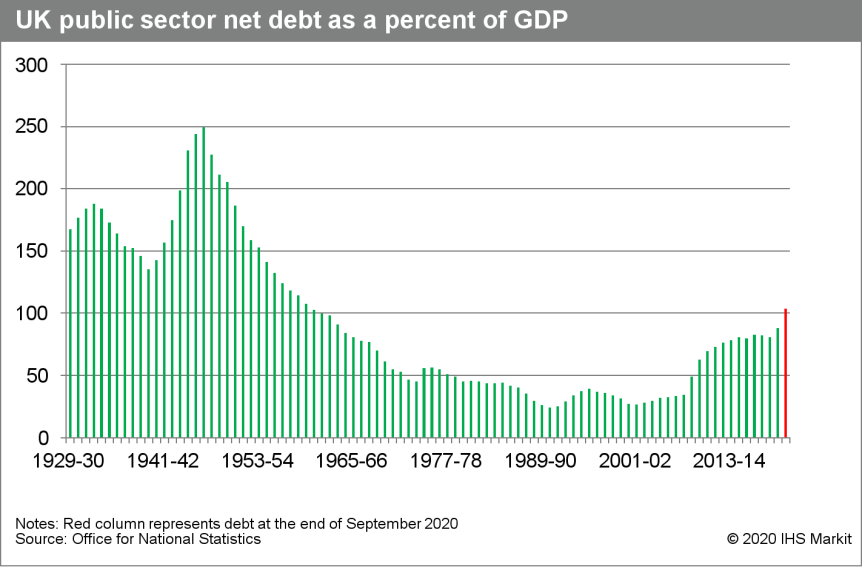

- UK public-sector net borrowing (excluding public-sector banks;

PSNB ex) was GBP208.5 billion (USD267.7 billion) in the first six

months of the current fiscal year (April to September), up from

GBP34.0 billion a year earlier. This was the highest borrowing in

any April-September period since records began in 1993. (IHS Markit

Economist Raj Badiani)

- Central government net cash requirements were GBP246.3 billion in April to September 2020, up from GBP33.2 billion in the comparable period a year earlier. Central government finances are displaying considerable stress from the COVID-19 crisis. Substantial fiscal costs are resulting from the public health measures and policies deployed to support businesses and households.

- Chancellor of the Exchequer (Finance Minister) Rishi Sunak has revealed that direct spending to combat the COVID-19 crisis has risen to GBP158.7 billion. Including the new measures announced in his summer statement, direct spending will rise to GBP190 billion, or around 9.5% of nominal GDP (estimated at GBP1.9876 trillion in 2020).

- The ONS reports that general government borrowing (public-sector net borrowing excluding public-sector banks; PSNB ex) stood at GBP36.1 billion in September, which was GBP28.4 billion higher than a year earlier. This was third highest borrowing in any month since records began in 1993.

- Central government receipts collected by HM Revenue & Customs fell for the seventh straight month in September. They declined by 13.4% year on year (y/y) to GBP52.5 billion, pulled down by lower-than-normal economic activity, job losses, and companies deferring tax payments.

- Central government expenditure increased by 30.2% y/y to GBP77.8 billion in September. This partly reflected the cost of the Coronavirus Job Retention Scheme (CJRS) and Self-Employment Income Support Scheme (SEISS), higher grants to local authorities, increased funds for frontline public services, and emergency funding for Transport for London.

- The furlough schemes (CJRS and SEISS) added GBP52.7 billion to borrowing in the April-September period. In September, the total cost of the CJRS and SEISS schemes was GBP4.3 billion.

- The UK's net debt position increased by 23.0 percentage points over the year, standing at 103.5% of GDP in September (see second chart below), the highest level since 1960. In monetary terms, it was at a record high of GBP2.06 trillion, more than GBP274.0 billion than at the same time in 2019.

- According to the IHS Markit October forecast, general

government borrowing requirements in the current fiscal year (April

2020 to March 2021) are likely to be at least 17% of GDP, or in

excess of GBP350 billion. Meanwhile, the fiscal watchdog, the

Office for Budget Responsibility, suggests that borrowing in the

current financial year could exceed GBP370.0 billion.

- According to the Office for National Statistics (ONS), UK

consumer price index (CPI) inflation rose to 0.5% in September

after falling back notably to a five-year low of 0.2% in August.

(IHS Markit Economist Raj Badiani)

- During the first nine months of 2020, inflation averaged 1.0%, well below the Bank of England's target of 2.0%.

- A major development was the ending of the government's "Eat Out to Help Out" scheme, which ran from Monday to Wednesday during August, offering 50% off food up to a value of GBP10 (USD13). This scheme provided discounts for more than 100 million meals.

- Value-added tax (VAT) has been cut from 20% to 5% in the hospitality, accommodation, and holiday attraction sectors, which was a negative pull on inflation in August and September.

- Restaurant and café prices rose by 1.0% year on year (y/y) in September after falling by 2.6% y/y in August, which was the first annual drop since records began in 1989.

- Clothing and footwear prices continued to slide, falling by 1.5% y/y in September and 1.3% y/y in the first nine months of 2020. They have fallen for seven straight months, which illustrates continued pressure on some retailers to price generously to attract absent consumers.

- Energy-related prices continued to slide on an annual basis, led by average petrol prices being 11.0% lower than a year earlier. A key factor was global crude oil prices, which fell by 34.5% y/y to average USD40.91 per barrel in September.

- Airfares fell in August, unprecedented in the peak month of the holiday season. However, the drop in airfares normally observed in September because of the end of the school holidays was much less pronounced this year. The ONS reports that "prices are subdued this year, as fewer people have been travelling abroad".

- Meanwhile, all-services price inflation climbed to 1.4% in September, compared with 0.6% in August; for goods, it stood at -0.3%, from -0.2% in August.

- Core inflation, excluding energy, food, alcoholic beverages, and tobacco prices, increased from 0.9% in August to 1.3% in September.

- Overall, we expect several factors to continue to apply

downward pressure on the inflation rate in the next few months.

They include:

- The effect of notably lower global crude oil prices, compared with a year earlier, remains an important narrative. Specifically, crude oil prices (dated Brent) are expected to average a multi-year low of USD41.3 per barrel (/b) in 2020, down from USD64.3/b in 2019. This implies that crude oil prices in y/y terms will fall, probably by around one-third in the latter stages of 2020, placing sustained, downward pressure on automotive fuel and energy utility prices.

- The VAT cut for the hospitality and accommodation sector runs from 15 July 2020 to 12 January 2021.

- Severe GDP losses in the first half of this year, in tandem with collapsed consumer spending, will limit underlying retail price pressures on high-street and online stores.

- Many retailers hit previously by zero footfall because of the closure of their premises will resort to generous pricing to shift their unsold inventories.

- Uber plans to invest more than GBP5 million (USD6.5 million) towards developing public charging infrastructure in some of the poorest boroughs of London (United Kingdom). With this move, the company aims to encourage its drivers to switch to electric cars. The company took this decision after discovering that drivers who do not live in affluent areas lack sufficient access to charging infrastructure to make the switch. Jamie Heywood, Uber's regional general manager for Northern and Eastern Europe, said, "Drivers consistently tell us that having reliable, accessible charging near where they live is a key factor when deciding if they should switch to electric. If we address this challenge for professional drivers now, it will help create a mass market for electric vehicles in the years to come. As we all know this is critical if the UK is to achieve our goal to be net-zero." The company plans to invest the money by 2023 and is expecting to work with areas that have a low number of charging facilities, such as Newham, Brent, and Tower Hamlets, reports the Guardian. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Germany's Ministry of Transport is planning to draft legislation to allow driverless vehicles to operate on streets, reports Reuters. This legislation will allow companies to deploy these vehicles for regular operation and not just for testing, as is currently the case. In a draft document, the ministry says that, initially, the driverless vehicles will be deployed in defined operating zones. The document states that, potentially, these driverless vehicles could be used in logistics, in shuttle services for employees, and to transport people between medical centres and nursing homes. The working draft document states that, currently, there is no uniform framework for autonomous vehicles in Europe. Therefore, it aims to define which technical requirements vehicles with an autonomous capability must meet and where these vehicles may be deployed. Overall, the ministry considers that driverless cars will be safer on the roads than those driven by people, saying "the vast majority of all traffic accidents in Germany are based on human error". This development follows a recent announcement by German Chancellor Angela Merkel that the country should take a "pioneering" role in autonomous vehicle field. She also announced plans to issue regulation that will enable Germany to be the "first country in the world to permit driverless vehicles in regular operation". The country aims to put cars with partial autonomy on roads from 2022. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Responding to rising demand for poultry meat, Nordic meat processor Atria is to ramp up production capacity in Finland through the largest investment in its history. The company is investing about EUR155 million to construct a new processing plant on its existing site in Nurmo. The project includes new slaughtering, cutting and packaging lines and will boost poultry production capacity by approximately 40%. Atria said the new processing plant will help strengthen its position as market leader for poultry products in Finland. It will also enable the company to increase exports and enable the development of a product portfolio for further processed products. Poultry consumption has been increasing rapidly in Finland - rising by almost 4% per year between 2010 and 2019. The consumption of both processed and unprocessed poultry meat is forecast to continue increasing over the next few years. Highlighting Atria's ability to produce poultry without antibiotics, Gröhn noted the importance of labelling to show consumers the origin of the chicken all the way to the farm. Atria said construction work would begin as soon as possible with an estimated completion date of 2024 at the earliest. (IHS Markit Food and Agricultural Commodities' Max Green)

- Russian car production has declined 25.9% year on year (y/y) to 848,000 units in the first three quarters of 2020, according to data from the Russian Federal State Statistics Service. The country's carmakers recorded signs of improvement in September with 142,000 units produced, which was an increase of 5.7% y/y. If there are prolonged and highly difficult market conditions this may cause some foreign OEMs to question their commitment to the market in the long term, with General Motors (GM) and Ford both withdrawing from Russia in recent years. Prior to the last financial crisis, Russia was on target to overtake Germany as the European region's biggest market and exceeding sales of 3 million units, with the light-vehicle market posting a record figure of 2.96 million units in 2008. However, it was one of the worst hit by the 2008/09 financial crisis (although the effects landed later than in other major markets). For 2020 IHS Markit sees light-vehicle production at 1.18 million units, down from 1.61 million units in 2019. (IHS Markit AutoIntelligence's Tim Urquhart)

- The wide Georgian trade deficit continued to narrow in the

third quarter, with both imports and exports contracting. Similar

trends are likely to continue in the near term even if at a slower

pace, while the flexible exchange rate will continue to be

instrumental in keeping the external imbalances manageable. (IHS

Markit Economist Venla Sipilä)

- According to the Georgian National Statistical Office (GeoStat), Georgian goods exports in the third quarter of 2020 contracted by 5% year on year (y/y), after falling by a fourth y/y in the second quarter. Imports fell by 12.8% y/y following a slide of some 30% y/y in the second quarter.

- As a result, the trade deficit in July-September narrowed by around 18% y/y, after moderating by 34% y/y in the second quarter. Settling at USD3.3 billion, the cumulative trade gap for January-September narrowed by 18.5% y/y, as exports fell by 12.1% y/y and imports diminished by 15.9% y/y.

- Exports to the Commonwealth of Independent States (CIS) fell by nearly 19% y/y, while exports to the European Union also contracted somewhat faster than average. In contrast, Georgia's exports to other countries increased by approximately 29%.

- The above was mainly explained by soaring exports to China, which was Georgia's leading export market in January-September, leaving Azerbaijan and Russia to the second and third places, respectively. A share of 14.8% of Georgian goods exports were directed to China, significantly up from 4.6% in the first nine months of 2019. Exports to Ukraine, Turkey, Armenia and the United States also fell significantly.

- Meanwhile, rising CIS imports in the third quarter compensated for sharply falling imports from other countries, including those in the EU. In January-September, imports fell from all the top 10 countries apart from Armenia.

- Turkey remained the leading import provider, even after a fall of 14.8% y/y in imports. The relatively modest fall of 5.1% y/y in Russian imports contributed to the overall growth of CIS imports.

- Copper ores and concentrates and motor cars remained the two most important export good categories, with shares of around 23% and 13%, respectively. Motor cars, copper ores and concentrates, and petroleum and petroleum products remained the leading import good categories.

- The contraction of imports is helping to counteract the impact of falling exports on the trade balance, but the trade deficit is now narrowing at a decelerating pace. This exactly matches our expectations.

- Turkey's Automobile Joint Venture Group Inc. (Türkiye'nin Otomobili Girişim Grubu: TOGG) has announced the signing of a letter of intent to partner with Chinese-based lithium-ion battery-producing company Farasis Energy Inc. for the use of the latter's battery cells in its range of TOGG products, reports the Daily Sabah. According to a company statement, under the agreement the battery cells will be provided by Farasis, while the battery modules and packs will be jointly developed as well as produced in Turkey. TOGG CEO Gürcan Karakaşsaid, "The agreement was signed as a result of a large-scale evaluation process initiated in 2018 during which more than 30 global battery suppliers have been evaluated, within the framework of confidentiality agreements (NDAs), including possible domestic collaborations. Among them, the company that best met our technical, commercial and strategic criteria and one of the world's leading li-Ion battery manufacturers, Farasis, has been chosen as our business partner." He added, "TOGG's mobility ecosystem will become an important regional player that develops technology and creates serious economic value." The partnership is aimed at reducing Turkey's dependence on foreign energy, improving battery research and development capabilities to accelerate the development of a zero-emission future, and also attracting more EV projects in Turkey. In August, TOGG announced the signing of an agreement with German-based automotive engineering services provider FEV to collaborate on the production of a domestically made electric vehicle (EV) in Turkey . In July, TOGG started construction of a production facility in Bursa. Also in July, EDAG Engineering, a Wiesbaden (Germany)-based independent engineering company that serves the automotive industry, opened its first office in Turkey as part of its partnership with TOGG. (IHS Markit AutoIntelligence's Tarun Thakur)

- NESBITT Investment Nigeria Limited has acquired Peugeot Automobile Nigeria (PAN) and is taking over management of PAN as the core investor, reports the Guardian. NESBITT will invest USD150 million in Peugeot over the next three years for retooling and the upgrading of the automaker's assembly line, supporting infrastructure as well as working capital. PAN Nigeria chairman Ahmed Wadada Aliyu said, "We treasure our human capital and strongly believe in them to drive our visions and aspirations for PAN Nigeria and that is why we are immediately putting in place an attractive condition of service that will retain and motivate our human capital and also attract the best hands, so as to restore PAN Nigeria to its number one position in Nigeria and within the ECOWAS [Economic Community of West African States] region." He added, "PAN under the supervision of the board shall undergo massive restructuring, and in so doing, we shall observe strict governance protocols, transparency, business integrity, efficiency and ethics in all our undertakings." Aliyu has also appealed to the Central Bank of Nigeria (CBN) and other assembly plants to make foreign exchange available for their imports. The acquisition has been made with the aim of eventually launching new and affordable vehicles for Nigerians, with the support of car-financing schemes to increase vehicle reach. (IHS Markit AutoIntelligence's Tarun Thakur)

Asia-Pacific

- APAC equity markets closed higher today except for Mainland China -0.1%; Hong Kong +0.8%, South Korea +0.5%, India +0.4%, Japan +0.3%, and Australia +0.1%.

- Ola Källenius, chairman of Daimler and Mercedes-Benz, said China will remain Mercedes-Benz's biggest growth market in the next decade. The head of the premium carmaker made the remarks during a recent interview with ICFW, according to Reuters. "Last year we sold around 700,000 passenger cars in China. The next biggest market is the U.S. with between 320,000 and 330,000 cars. In the next 10 years we also expect the biggest growth in China." Källenius was quoted saying. He also took an open attitude toward reviewing the group's production locations in the face of increasingly strained relations between China, the United States and Europe. "We need to look at our production footprint and where it makes sense, shift our production," added Källenius. Källenius's remark did not give specifics regarding its production plan, especially information regarding further localisation of higher-segment models, for the Mercedes-Benz brand and its AMG performance line. However, strong demand from Chinese consumers for premium vehicles and the potential the market holds for the growth of AMG will place China at the center of the Daimler's business development plan. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Swancor Renewable Energy (SRE) has further strengthened its presence in Taiwan with the signing of a Memorandum of Understanding (MOU) with Taiwan's Metal Industries Research and Development Centre (MIRDC). The MOU will see the two parties cooperate on supporting and developing technology, and the local supply chain, for floating wind in Taiwanese waters. The MOU comes shortly after SRE's September announcement that it progressing the development of 4.4 GW of offshore wind projects in the northwestern territorial waters of Miaoli County in Taiwan. The development is expected to achieve operations post-2025, subject to various government approvals, project contracts, and financing, and will cover about 18 to 20 kilometers over three sites -Formosa 4-1, Formosa 4-2, and Formosa 4-3. Both bottom-fixed and floating foundations will be considered for the development. SRE has led the development of 504 MW of offshore wind farms to date through Formosa 1 and Formosa 2. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Snacking has become the Chinese 'fourth meal' and consumption of nut is growing thanks to the advertising of the health benefits of various nuts in recent years. Three Squirrels, one of the most well-known Chinese consumer nut companies, announced that its wholly-owned subsidiary East China Supply Chain has signed an 'Investment Agreement' with Anhui Wuwei Economic Development Zone Management Committee. Three Squirrels will cooperate with its suppliers and plan to build a Three Squirrels Alliance Factory. The total investment will be CNY2.06 billion (USD303 million). The first phase will cost CNY1.0 billion and East China Supply Chain will contribute less than CNY100 million. In H1 2020, Three Squirrels recorded sales of CNY5.252 billion, up by 16.42% compared with the same period of last year, with nuts contributing 54% of total revenue. Nut sales grew by 11.4% while dried fruit saw a fall of 9%. On sales channel, third party ecommerce accounted for 85%. Offline sales continue to grow steadily. Impacted by Covid-19, the company has slowed down the pace of new store opening. Its flagship Feeding Store has 139 units, selling snacks and merchandising and offering a place to interact with consumers. It has 478 franchised stores. The company strengthened its logistics in H1 by building more warehouses. Major competitors include Be & Cheery (PepsiCo owned), Liangpin Puzhi (Bestore), Yilaifen, ChaCheer (Qiaqia), Dahaoda (DHD) and Wolong. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- Seoul Semiconductor has developed a next-generation Wafer Integrated Chip on PCB (WICOP) Ultra High Luminance (UHL) Series LED for vehicle headlamps, according to a company press release. The company plans to begin mass production of the LED in 2021. WICOP, a fundamental technology of the new product, is the world's first patented package-less LED technology developed by Seoul Semiconductor. Unlike flip chip technology, which must be bonded in the semiconductor process, WICOP LEDs can be easily surface-mounted in the general substrate bonding process. Mini-LEDs also use the WICOP technology with a robust structure. The company has emphasized that battery power consumption is one of the critical factors that determine the range of an electric vehicle (EV). The new LEDs help reduce headlamp power consumption by up to 20% for EVs. They also offer an improvement in heat dissipation performance of up to 40%, according to the company. The company claims that by applying WICOP UHL technology to vehicle headlamps, the weight of the lamp heat sink structure can be reduced by 75%. The new LEDs also enable a slim headlamp design, thanks to an extremely small LED-emitting area of the product. In September, Seoul Semiconductor began supplying its WICOP Bi-color LED products for daytime running lights (DRLs) and front turn signals for the model-year (MY) 2020 Audi A4 headlamp.(IHS Markit AutoIntelligence's Jamal Amir)

- Keppel O&M, together with M1 Limited (M1) and other partners, will introduce smart wearables from Samsung Electronics to its workforce in its yards. This is inline with its digital transformation plan to for its yard operations. The wearables are not only capable of monitoring heart rates, they also come with fall detection capability as well as providing real time positions for immediate response should incidents occur. They are also equipped with COVID-19 safe management features ensuring workers operate in their assigned work zones. On the other hand, M1 will provide high speed connectivity throughout the yards and reliable real-time communication. M1, one of the major telecommunicating service providers in Singapore, is jointly owned by Keppel Corporation and Singapore Press Holdings (SPH). (IHS Markit Upstream Costs and Technology's Jessica Goh)

- DSME has developed an artificial intelligent hot-pressing robot, Goknuri, for use in shipbuilding in its Okpo yard. Hot pressing is used to make steel plate into curved surfaces at very high temperature. The curved steel surfaces are used at the front and rear of the hulls. According to DSME, the hot-pressing robot can be operated by unskilled personnel who had undergone simple training. (IHS Markit Upstream Costs and Technology's Jessica Goh)

- Vietnamese automaker VinFast has started testing its electric bus on the internal road of its plant in Haiphong, reports the Vietnam News Brief Service. VinFast's electric buses will be operated by VinBus Ecology Transport Services LLC, which was established by Vingroup, VinFast's parent company, in 2019 with registered capital of VND1 trillion (USD43.1 million). VinBus will launch its own mobile app to combine with VinID to provide customers with information on the bus network, aiming to help passengers look up optimal route information. In the first phase, VinBus will run 150-200 electric buses in Hanoi, Ho Chi Minh City, and Phu Quoc Island. The Vietnamese Ministry of Transport, in its documents to the People's Committees in Hanoi and Ho Chi Minh City, agreed with Vingroup's proposal on the implementation of electric bus routes to reduce environmental pollution. VinFast, a new entrant in the car manufacturing segment, aims to produce 500,000 cars a year by 2025, with a local content rate of 60%. VinFast also aims to be one of the top car manufacturers in the Southeast Asian region by 2025. In June 2019, the automaker began deliveries of its Fadil hatchback and in August it started deliveries of its two luxury models - the LUX A2.0 sedan and LUX SA2.0 sport utility vehicle (SUV). VinFast has partnered with world-leading automotive technology and manufacturing consulting firms such as BMW, Magna Steyr, and AVL. It has also signed agreements with companies such as Pininfarina, Siemens, Bosch, Torino Design, Italdesign, Zagato, and the German Chamber of Commerce and Industry to develop products. The latest development is in line with the automaker's plan to introduce two electric passenger vehicles, one electric bus, and four e-scooters. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-21-october-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-21-october-2020.html&text=Daily+Global+Market+Summary+-+21+October+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-21-october-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 21 October 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-21-october-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+21+October+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-21-october-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}