Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 22, 2020

Daily Global Market Summary - 22 October 2020

US equity markets closed higher, while most APAC and European markets closed modestly lower. US and European benchmark government bonds continued their sell-off, with the 30yr US government bond closing at its highest yield since mid-March. European iTraxx credit indices closed wider, while North American CDX spreads were close to flat on the day. The US dollar and oil were higher on the day, while silver and gold were lower.

Americas

- US equity markets closed higher; Russell 2000 +1.7%, S&P 500/DJIA +0.5%, and Nasdaq +0.2%.

- 10yr US govt bonds closed +5bps/0.87% yield and 30yr bonds +4bps/1.68% yield, which are the highest closing yields since 8 June and 19 March, respectively.

- CDX-NAIG flat/57bps and CDX-NAHY -1bp/375bps.

- DXY US dollar index closed +0.5%/93.03.

- Gold closed -1.3%/$1,905 per ounce and silver -2.1%/$24.71 per ounce.

- Crude oil closed +1.5%/$40.64 per barrel.

- On Oct. 20, the U.S. District Court for the Northern District of Georgia heard the first case against the US national moratorium on evictions, Richard Lee Brown, et al. v. Secretary Alex Azar, et al.. That challenge, brought by a nonprofit called the New Civil Liberties Alliance, has been joined by the National Apartment Association, which represents some 85,000 landlords responsible for 10 million rental units. Lawyers and scholars working on behalf of plaintiffs in the cases say that the CDC lacks the constitutional authority to enact a policy affecting rents. Such a decision could trigger a surge in evictions: More than 6 million households missed their rent or mortgage payment in September, according to an analysis by the Mortgage Bankers Association. Recent surveys by the Census Bureau show that as many as 11 million people living in rental housing — 1 in 6 adult tenants — were late or behind on rent as of last month. (Bloomberg)

- US seasonally adjusted (SA) initial claims for unemployment

insurance fell by 55,000 to 787,000 in the week ended 17 October.

Initial claims remain at historically high levels, although well

below the all-time high of 6,867,000 in the week ended 28 March.

The not seasonally adjusted (NSA) tally of initial claims fell by

73,125 to 756,617. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, fell by 1,024,000 to 8,373,000 in the week ended 10 October. Prior to seasonal adjustment, continuing claims fell by 1,018,737 to 7,992,238. The insured unemployment rate in the week ended 10 October was down 0.7 percentage point to 5.7%.

- There were 345,440 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 17 October. In the week ended 3 October, continuing claims for PUA fell by 425,820 to 10,232,853.

- In the week ended 3 October, there were 3,296,156 such claims for Pandemic Emergency Unemployment Compensation (PEUC)benefits.

- The Department of Labor provides the total number of claims for benefits under all its programs with a two-week lag. In the week ended 3 October, the unadjusted total fell by 1,046,493 to 23,150,427.

- Technical note: California has completed its pause in processing of initial claims for unemployment benefits. Numbers for the two prior weeks have been revised to reflect the actual counts for California. The previous week's level of initial claims was revised down from 898,000 to 842,000.

- US existing home sales soared 9.4% in September to a

6.54-million-unit annual rate—the highest reading since May

2006. Single-family sales climbed 9.7% to a 5.87 million rate;

condo/coop sales increased 6.3% to a 670,000 rate. Sales were up

20.9% from a year earlier and 13.5% from February—the month

before COVID-19 shut down vast swaths of the US economy. (IHS

Markit Economist Patrick Newport)

- Inventory of single-family homes dipped to 1.24 million, by far the lowest September reading on record. Our seasonally adjusted single-family homes inventory estimate, 1.17 million, was an all-time low. Unsold inventory of all homes amounted to a record-low 2.7-month supply at the current sales pace, down from 3.0 in August. A 5.0-month supply is considered normal.

- The National Association of Realtors' affordability index has been dropping in recent months (housing has become less affordable) as house price increases have offset falling mortgage rates; the monthly mortgage payment used in the affordability index equation has risen from $984.00 in February to $1,062.00 in August. We expect September's reading to be similar to August's.

- High-end homes are driving the numbers. Sales of homes in the $1.0-million-plus category were up 107% from last September, while those in the $750,000-1.0 million range increased 86%.

- The Mortgage Bankers Association's seasonally adjusted purchase index remains elevated, but has dropped four straight weeks, suggesting that September may be a high point for sales.

- Formosa is deferring major construction on the Sunshine Project, its proposed olefins complex in St. James Parish, Louisiana, until the COVID-19 pandemic has subsided or an effective vaccine is widely available, according to a spokesperson for FG LA, the subsidiary established to pursue the project. "The widespread impacts of a global pandemic, including the challenge it creates in evaluating construction costs and the restrictions it has placed on international travel, are being felt across all industries and businesses, including FG," the company says. The project, which is still awaiting a final investment decision (FID), would be built in two phases. The first phase includes an ethane cracker, propane dehydrogenation (PDH) unit, and associated derivatives plants. The second phase includes an ethane cracker and natural gas-fired power plant. The company's statement notes that activities will continue throughout the second half of 2020, including widening a highway adjacent to the site, utility relocations, soil testing, placement of test piles, and a pipeline removal. Several other North American petrochemical projects have been slowed down by the COVID-19 pandemic. This summer Chevron Phillips decided to postpone FID on a 2-million metric tons/year ethane cracker complex being developed along the US Gulf Coast in partnership with Qatar Petroleum. In March, Pembina announced that it was freezing capital spending on its PDH/PP plant in western Canada. Companies with construction already under way, including Shell and Nova, have also reported delays due to COVID-19.

- GMC says that the USD112,595, Edition 1 version of the Hummer EV sold out in less than 10 minutes of the company's website being opened for customers to make USD100 reservations of the upcoming electric pick-up. According to an Automotive News report, Buick-GMC vice-president Duncan Aldred said that the company would sell the electric vehicle (EV) using a no-haggle pricing model. He said, "There will be no incentives. There will be no trickery. We are trying to construct a dealer margin in such a fashion that it really is a no-haggle price." GMC is looking to ensure dealers do not add exorbitant mark-ups to an already expensive product, risking alienating consumers. Although GMC has confirmed that the Hummer EV Edition 1 sold out, and "thousands" of buyers reserving a 3X version have also put themselves on a waiting list for the Edition 1, the company has not indicated the volumes involved. (IHS Markit AutoIntelligence's Stephanie Brinley)

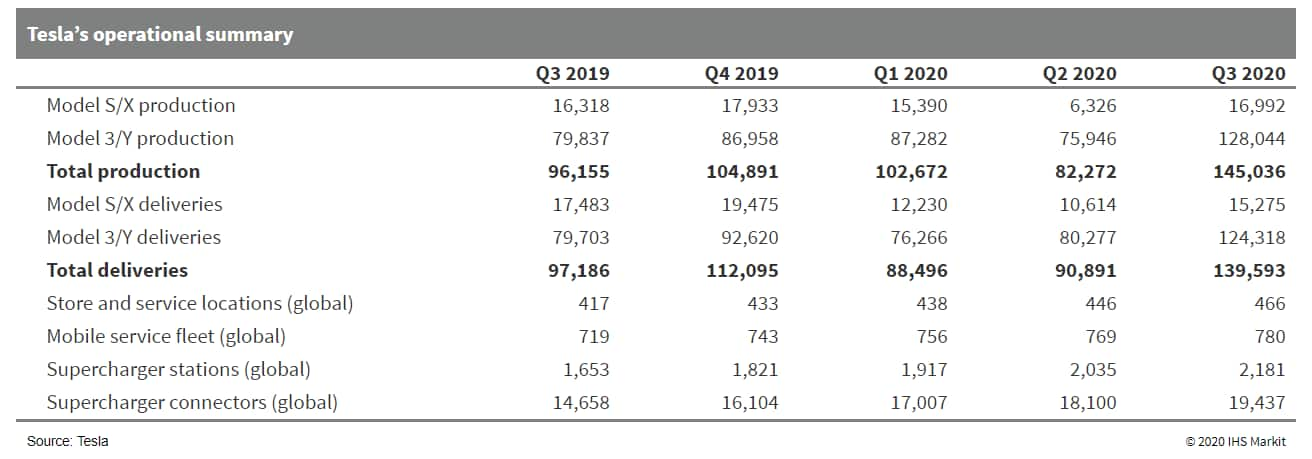

- Tesla posted a profit for a fifth consecutive quarter in the

third quarter of 2020. The electric vehicle (EV) manufacturer

increased its vehicle deliveries in the third quarter, compared

with a year earlier, with the year-on-year comparison assisted by

production at its plant in Shanghai, China, and the Model Y

becoming available. (IHS Markit AutoIntelligence's Stephanie

Brinley)

- Tesla released its third quarter 2020 results to shareholders and held a conference call with analysts and the media, led by CEO Elon Musk and chief financial officer (CFO) Zachary Kirkhorn.

- In the conference call, Musk kicked off his comments by stating that the third quarter was the best quarter in the company's history. The CEO also thanked the company's team for being able to deploy fully self-driving vehicles in beta form in October.

- Musk expects broader deployment of self-driving vehicles by the end of the year. He stated that the self-driving system is designed to be able to drive the vehicle even with no connection to GPS or cellular signal for map data.

- Musk said that the company expects to begin delivering cars from its production sites in Berlin, Germany, and Austin, United States, in 2021; these factories are under construction. Musk also said he expects that it will take 12 to 24 months for those two plants to reach their production capacity.

- In the third quarter, Tesla hosted its long-promised Battery Day, during which the company announced plans to begin building its own battery cells. Relating to the company's financials, Kirkhorn stated that annual capital expenditure will increase to USD2-2.5 billion in 2021 and part of the increase will be on in-sourcing for that production.

- Kirkhorn also stated that the pay-off on that investment may take longer to realize than the return on the investment in the Shanghai plant.

- As expected, Tesla's sales volume in the third quarter was largely a function of production capacity. Although most OEMs are concerned as much about weak global auto demand in the aftermath of the COVID-19 pandemic as they are about lost production, Tesla has increased its capacity and product offerings and is benefiting from increasing global demand and increased capacity to deliver on that demand.

- Tesla continues to report that it has sufficient liquidity to

fund its current product roadmap, long-term capacity expansion

plans, and other expenses. Tesla did not provide detailed guidance

on its results in 2020, although it stated that, for the trailing

12 months, it has achieved an operating margin of 6.3% and expects

to see this continue to grow, particularly with its capacity

expansion and localization plans.

- USDA's Food Safety and Inspection Service (FSIS) plans to

gather more information about cell-based meat and poultry products

before it issues labeling regulations. The agency on Thursday (Oct.

22) told IHS Markit that it intends to publish an Advanced Notice

of Proposed Rulemaking (ANPR) seeking public comments to inform

future labeling rules for cell-based meat and poultry products.

"The ANPR will help ensure that a public process, allowing

stakeholder comments, is used to develop labeling regulations,"

according to FSIS. (IHS Markit Food and Agricultural Policy's JR

Pegg)

- The agency did not provide specifics on when it would release an ANPR but said the rulemaking will be listed in the fall Unified Regulatory and Deregulatory Agenda and then published in the Federal Register. USDA's move to gather more information will be welcomed by many industry stakeholders - earlier this week the North American Meat Institute (NAMI) and a coalition of cell-based meat and seafood developers called for it to issue an ANPR rather than a proposed labeling regulation.

- Information solicited through an ANPR will provide FSIS with "substantive data" needed to better inform mandatory labeling rules for cell-based meat and poultry products, NAMI and the Alliance for Meat, Poultry and Seafood Innovation (AMPS Innovation) said in their October 19 letter to USDA Under Secretary for Food Safety Mindy Brashears.

- Issuing an ANPR would appear to complement a decision made earlier this month by FDA, which put out its own request for information on labeling of cell-based seafood and is working with FSIS to develop a joint regulatory framework for cell-based products.

- Under the terms of a Memorandum of Understanding (MOU) signed in March 2019, FDA is set to serve as the primary regulator at the beginning of the process and will oversee premarket consultations as well as cell collection, development and production through the time of harvest.

- Once the cells are harvested, oversight will likely shift to FSIS, which will regulate the production and labeling of cell-based meat and poultry products.

- The MOU gives FDA sole authority over any cell-based seafood except for catfish, which is under USDA's jurisdiction, but FDA is expected to develop its labeling rules in tandem with FSIS.

- The agencies have set up three working groups to iron out specifics - one led by FDA is focused on pre-market safety and a second is exploring jurisdictional issues related to inspection oversight. The third group, led by FSIS, is tasked with developing joint principles for product labeling.

- In its comments to IHS Markit, FSIS said the groups are still completing their reviews and there is no timeframe for when their work will be completed.

- At least 20 US companies are developing cell-based products and while none are yet commercially available, developers claim that could change in the next year or so. But sizeable issues related to scaling up production and crafting final products remain and the bullish claims by companies may not match reality.

- Colombia's ISE declined by 1.2% month on month in August. This

follows three months of consecutive monthly growth that the country

experienced after economic activity bottomed out in March and April

(contracting 7.8% and 15.1% m/m, respectively). (IHS Markit

Economist Lindsay Jagla)

- The greatest drivers of change to Colombia's economic activity are tertiary activities such as retail, food services, transportation, and entertainment, among others. Tertiary activities as a whole declined by 0.12% m/m in August.

- Primary activities, which include agriculture, fishing, and mining, faced the biggest monthly contraction: -4.57%. Secondary activities, such as manufacturing and construction, continued to grow m/m in August, but had fared significantly worse overall at the height of the economic shutdown in April and May.

- In yearly terms, economic activity, along with all subcategories of activities, remains well below 2019 levels with the overall ISE in August facing a -10.6% year-on-year contraction.

- August's monthly decline in economic activity signals a slowdown in Colombia's overall economic recovery. This is in line with IHS Markit's analysis of other high-frequency economic indicators, such as industrial production and retail sales, which also recorded monthly declines in August.

Europe/Middle East/Africa

- European equity markets closed modestly lower except for UK +0.2%; Spain -0.2% and Germany/Italy/France -0.1%.

- 10yr European govt bonds closed lower across the region; UK +4bps, France/Spain +3bps, and Italy/Germany +2bps.

- iTraxx-Europe closed +2bps/56bps and iTraxx-Xover +7bps/334bps.

- Brent crude closed +1.7%/$42.46 per barrel.

- Autonomous vehicle trials are set to begin in Oxford (United Kingdom) this week, reports The Times. The trials will involve six autonomous Ford Mondeos driving a nine-mile round trip from Parkway railway station to the main station. The vehicles have Level 4 autonomy deployed with Oxbotica's autonomous vehicle (AV) software and will have a safety driver ready to take over if necessary. These trials are part of Project Endeavour, a government-backed research and development project that will run until 2021. The project will involve AV live tests conducted in three major UK cities, starting with Oxford. Laura Peacock, Innovation Hub manager at Oxfordshire County Council, said, "It is exciting to be part of Project Endeavour. Oxfordshire County Council's Innovation Hub has been at the forefront of autonomous mobility for the last four years. The progress that has been made in the Connected Autonomous Vehicle ecosystem is huge, moving from simulation, trials in isolated environments and now to the first live on-road public trials in Oxford." Project Endeavour was part-founded by the Centre for Connected and Autonomous Vehicles (CCAV) and Innovate UK. The project consortium consists of Oxbotica, DG Cities, Immense, Transport Research Laboratory (TRL), the British Standards Institution (BSI), and Oxfordshire County Council. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The BMW Group has said in a company statement that it will begin manufacturing electric vehicle (EV) powertrain components at its Regensburg plant from 2021. Battery cells for high-voltage batteries will be coated at the facility from next year while complete high-voltage batteries will be produced from 2022. BMW will invest in the region of EUR150 million (USD177.6 million). This is the latest investment push in BMW's EV program. In July, the company opened the Competence Center for E-drive Production in Dingolfing and doubled the production capacity of high-voltage batteries at BMW Brilliance Automotive by opening another battery center in China. Last month BMW announced it would be producing battery modules at its facility in Leipzig from 2021 (see Germany: 24 September 2020: BMW announces EUR100-mil investment for e-drive component production at Leipzig plant). BMW has also recently announced a strategy for 50% of its global sales to be electric or hybrid by 2030, which also means its production capacities will need to increase. IHS Markit forecasts that by 2025, BMW's global production will include 2.5 million units with hybrid, electric or plug-in hybrid propulsion systems, while its production of vehicles with only ICE stop/start systems will fall to 120,000 units. The company's full electric production is forecast at about 451,000 units in 2025. (IHS Markit AutoIntelligence's Tim Urquhart)

- France's business sentiment index has declined from 92 in

September to 90 in October. Sentiment had collapsed between March

and April (when the index fell to 53), but it had since recovered.

October's decline in the index is the first in six months. The

index sits below its long-term average of 100. (IHS Markit

Economist Diego Iscaro)

- The tightening of containment measures in response to the COVID-19 virus pandemic has had a particularly negative impact on the service sector, with the related index declining from 94 in September to 89, a three-month low. While service-sector providers have reported improving demand over the previous three months, the indices measuring their views on the general economic outlook, expected activity, and demand have all collapsed. Confidence in the accommodation/restaurants sector has fallen particularly sharply in October.

- Meanwhile, confidence in the manufacturing sector has declined to a lesser extent, with the index waning by 1 point to 93. As in the service sector, sub-indices measuring past activity have improved, while expected demand and general production expectations have worsened.

- However, the extent of their deterioration has been substantially less marked than in the service sector. The quarterly business survey for the industrial sector also conveys a similar message.

- Meanwhile, confidence in the retail trade sector has remained unchanged in October at a level well below its long-term average.

- Business sentiment is likely to remain closely linked to developments on the pandemic front. Confronted with a rising number of COVID-19 cases, the authorities have so far resorted to localized containment measures. On 14 October, President Emmanuel Macron imposed a state of emergency in the Paris region and another eight cities for a minimum period of four weeks. Measures in these regions include a night-time curfew and the closure of bars.

- Renault Group has announced that it is involved in two new electricity storage projects. According to a statement, the first Advanced Battery Storage installation has been put in place at Douai (France) facility by NIDEC. It is said to be based on a combination of second-life and new electric vehicle (EV) batteries, the latter planned to be future after-sales use. They are compiled in containers and this location has an installed capacity of 4.7MWh. Renault added that it is eventually targeting an installed capacity of nearly 50 MWh at several sites in France. The project is being carried out in partnership with the Banque des Territoires, the Ecological Transport Modernisation Fund managed by Demeter and the German startup The Mobility House. The second initiative is the SmartHubs project with Connected Energy, in West Sussex (UK). This also uses second life batteries from Renault vehicles and will be operated alongside other technologies as part of a local energy system. The batteries will be installed in the specially designed E-STOR systems, several of which will be installed with 360kWh of capacity on industrial and commercial sites. Some will be linked to solar panels and EV chargers. The SmartHubs project is one of four UK government-initiated projects to help design the energy systems of the future, and partners include Moixa, PassivSystems, ICAX, Newcastle University, West Sussex County Council, and Innovate UK. With the growing number of EVs on the world's roads, there is now a great deal of consideration over what to do with the batteries once they are at the end of their effective lives in these applications. (IHS Markit AutoIntelligence's Ian Fletcher)

- A long-running investigation into a 'cold meat cartel' appeared to be drawing to a close in July of this year, when French Competition authorities dished out fines totaling EUR93 million to some of the country's largest pork processors. Fast forward three months however, and France's largest pig producer is refusing to go down without a fight - saying it was effectively thrown under a bus by a rival company and warning that the financial penalty could force it to close some of its meat plants. Of the 12 companies implicated in the case, Cooperl Arc Atlantique - France's leading charcuterie firm - was hit hardest with a fine of EUR35.53 million. France's Autorité de la Concurrence said the company had worked with others to manipulate prices between 2010 and 2012. Cooperl disputes this however, and says its conviction was based on falsified records provided by the sales director of Aoste, a subsidiary of the Campofrio group. Because it agreed to supply information to investigators, Campofrio, which is owned by Mexico's Sigma Alimentos, saw its own fine reduced to EUR1 million under French leniency arrangements. Cooperl appealed the decision at the end of September and plans to ask the Paris Appeals Court to delay enforcing the fine until the case is heard. Interviewed on RTL this week, Cooperl's general manager Emmanuel Commault said some of its meat plants may have to close if the company is forced to pay the EUR35.53 million fine in the coming days. He said costs to the company could eventually be four times that amount as it would undermine confidence in the company among financial institutions. The French Economy Ministry took the threat seriously enough to issue a statement promising to ensure that Cooperl's future is not jeopardized by the ruling. If the fine stays in place, the ministry says it would make sure that payment conditions will be set in a way that "avoids risking the activity of the group and the employment of its workers". (IHS Markit Food and Agricultural Commodities' Max Green)

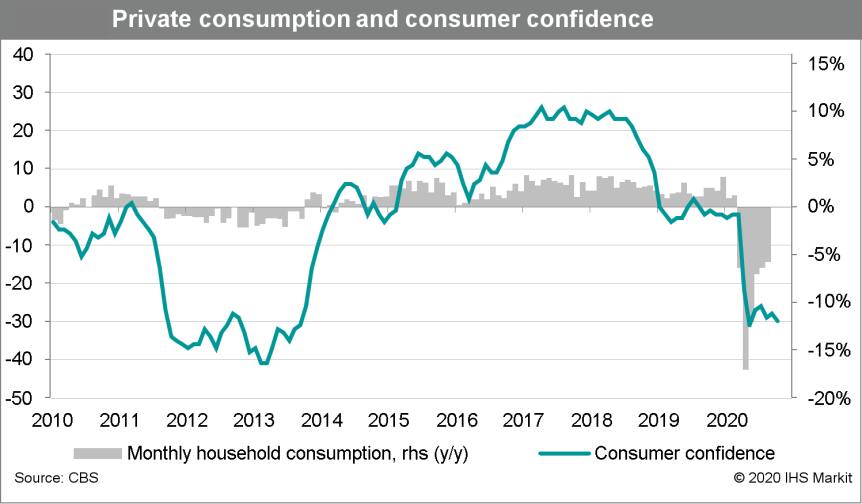

- Dutch consumer confidence indicators are on a par with or even

below the level in April-May, during the first wave of the COVID-19

virus pandemic. As the Netherlands is one of the worst-affected

countries in Europe by the second wave, the key risk is negative

quarterly growth in the fourth quarter, driven by a drop in private

consumption. (IHS Markit Economist Daniel Kral)

- The consumer confidence index compiled by Statistics Netherlands (Centraal Bureau voor de Statistiek: CBS) declined marginally from -28 in September to -30 in October. Among the main sub-categories, there was a marked deterioration in expectations of economic situation in 12 months, from -40 to -46, and assessment of economic climate, from -58 to -61.

- Given the timing of the survey, some of the pessimism may capture the partial national lockdown imposed in mid-October. The October reading of -30 is only marginally better than the record low of -31 in May, at the peak of the first lockdown.

- Balance of responses on the expectations of future unemployment have hit a near-record low of -87. This is down from -81 in May and -83 in August.

- In a separate release, the CBS reports that number of employed people dropped in September by 3,000, the first monthly decline since May. However, the unemployment rate decreased marginally from 4.6% to 4.4% between August and September, as the participation rate dropped by 15,000.

- In another release, the monthly indicator measuring domestic

household consumption improved slightly in August. Based on

shopping-day-adjusted data from the CBS, it was down by 5.8% year

on year (y/y). However, this is a marked slowdown compared to the

improvements since April.

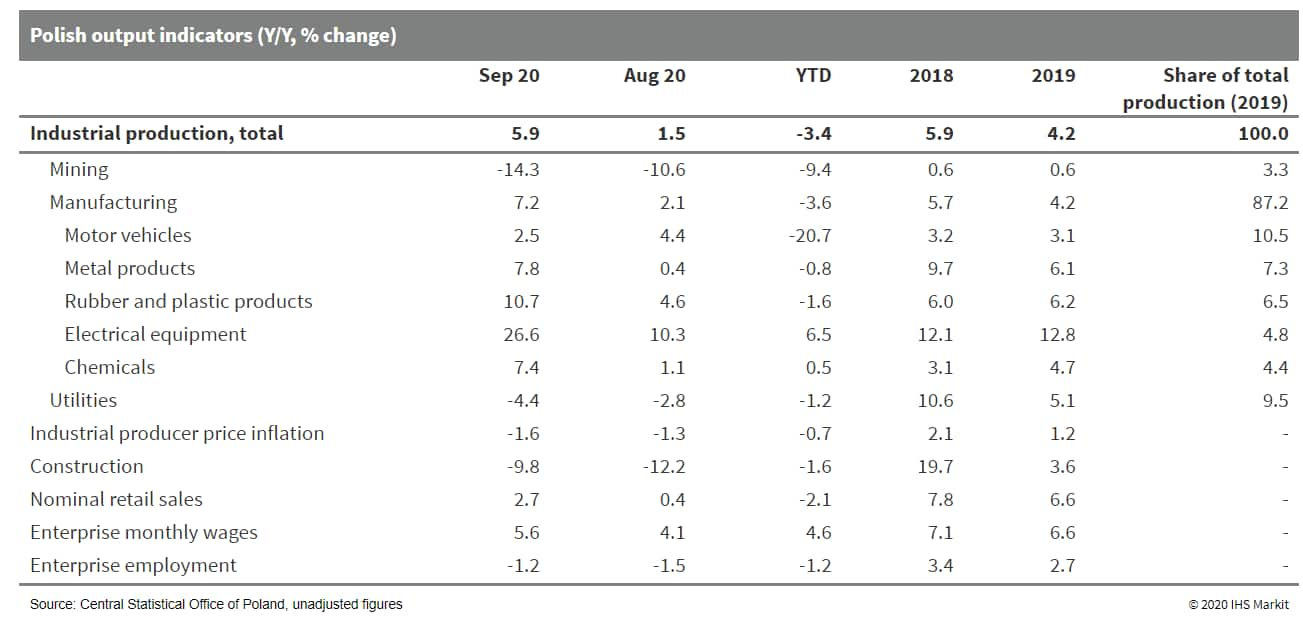

- Poland's Unadjusted industrial production jumped 5.9% year on

year (y/y) in September, while output rose 3.0% month on month

(m/m) in seasonally adjusted terms. September output was driven by

the manufacturing sector (up 7.2% y/y), but mining and utilities

production continued to decline. (IHS Markit Economist Sharon

Fisher)

- Within manufacturing, electrical equipment and rubber and plastic products posted double-digit gains, while growth was also strong in the metals and chemicals branches. Industrial producer prices fell further into negative territory (down 1.6% y/y).

- By industrial grouping, the production of consumer durables surged 21.2% y/y. Also encouraging was a 2.6% y/y increase in capital goods, the first rise since February.

- The positive industrial output results were matched by a stronger retail sales performance, rising 2.7% y/y in nominal terms (including the automotive sector) and 2.5% in real terms. Key labor market indicators also showed improvement, with enterprise wages up 5.6% y/y and employment falling just 1.2% y/y.

- Construction was the one sector that continued to struggle in September, although the decline in activity (at 9.8%) was somewhat less steep than in August. While the modest recovery of capital goods production in September indicated a possible revival of investment, plunging civil engineering construction (down 14.5% y/y) gave the opposite signal.

- The September industrial output results were stronger than

expected, signaling a likely upgrade of our third-quarter forecast

in the November round. That could translate to an upgrade of our

full-year 2020 outlook for Polish GDP growth, which currently

stands at -4.5%, below the consensus figure.

- Poland's retail pharmaceutical market returned to growth in September, with total sales of pharmaceuticals in retail pharmacies increasing by 4.4% year on year (y/y) to PLN3.206 billion (USD831.4 million), according to data from Polish pharmaceutical market research organization PEX PharmaSequence. The largest growth was registered in non-reimbursed prescription medicines, whose sales were up 7.4% y/y to PLN727 million. Sales of reimbursed prescription medicines reportedly grew by 2.9% y/y to PLN1.042 billion, and sales of non-prescription medicines increased by 4.0% y/y to PLN1.412 billion. Growth in the retail market from January to September was reported at 2.0% y/y, amounting to PLN27.777 billion. The market segment most negatively affected by COVID-19 was reimbursed prescription medicines, sales of which reportedly declined by 1.4% y/y in January-September. After a dramatic surge in sales in March (up 33% y/y), the subsequent five months registered declines in the retail pharma market - although the declines in July and August (3.2% y/y and 0.5% y/y respectively) were considerably lower than those in April, May, and June. (IHS Markit Life Sciences' Brendan Melck)

Asia-Pacific

- APAC equity markets closed lower except for Hong Kong +0.1%; South Korea/Japan -0.7%, Mainland China/India -0.4%, and Australia -0.3%.

- The flash au Jibun Bank manufacturing purchasing managers' index showed a slight improvement for the sector, with the reading rising to 48 from 47.7 previously, the slowest deterioration in conditions since January. It remained below the 50-point level which signifies expansion. "The recovery is slow-going and could remain so in the coming months as a global resurgence of Covid-19 cases could weigh on Japanese economic activity, particularly in the external-facing sectors," said Bernard Aw, principal economist at IHS Markit, which compiles the survey. (FT)

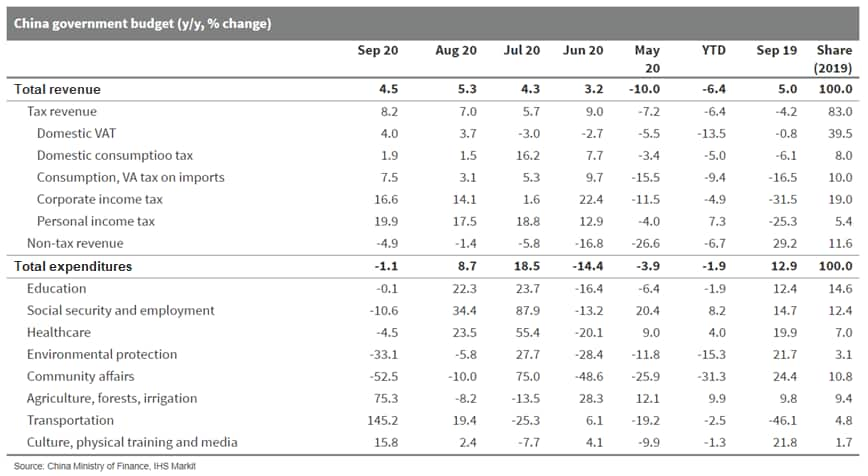

- China's public fiscal revenue growth fell by 0.8 percentage

point to 4.5% year on year (y/y) in September, according to release

by the Ministry of Finance (MOF) on 18 September. (IHS Markit

Economist Yating Xu)

- The headline moderation was entirely driven by faster contraction in non-tax revenue, while tax revenue growth rose to 8.2% y/y with broad-based acceleration across tax items. Domestic value-added tax and domestic consumption tax increased at faster rates with rising bases. Consumption tax and value-added tax of imports rose significantly with rebound in imports.

- Public fiscal spending deteriorated to 1.1% y/y contraction on a high base effect, following two consecutive months of expansion in July and August. Central government spending improved to a 12.9% y/y expansion from contraction in August, while local government spending fell. Transportation, agriculture, and debt interest payment led the fiscal spending, while payments in social security and employment, education, and healthcare declined.

- Government fund revenue growth accelerated as land sales revenue grew faster despite tightening financing policy on the property market. Land sales revenue grew 18.7% in September, compared with a 4.2% y/y expansion through August.

- In the first three quarters, fiscal revenue declined 6.4% y/y with a fall across sub-tax items except individual income tax and stamp tax. Fiscal spending declined by 1.9% y/y through September with decline in all sub-spending items except an increase in debt interest payment, agriculture, social security, and healthcare.

- Fiscal revenue has stayed in y/y expansion for four consecutive

months under the sustained economic recovery since April. Growth

momentum is expected to continue into the fourth quarter and help

with the achievement of the -5.3% y/y fiscal revenue target.

- Chinese electric vehicle (EV) startup Xpeng Motors has said that its P7 high-performance electric sedan reached the 10,000-unit production milestone on 20 October. Xpeng began P7 production at its Zhaoqing plant in Guangdong in mid-2019. Deliveries of the P7 reached 2,573 units in September, accounting for 74% of Xpeng's total deliveries that month. The base version of the P7 with a 70.8-kWh battery pack starts from CNY230,000 (USD34,525) after subsidies. Xpeng has achieved this new milestone after launching production of the P7 in China last year. The model, the second EV from Xpeng, is gaining traction in the market thanks to its long driving range, more spacious interior compared with Tesla's Model 3, and the application of an array of driver assistance technologies. The P7 is also the first model Xpeng has produced at its own manufacturing facility. The smooth ramp-up of production of the P7 will help the startup to earn credit as a trusted EV manufacturer and shorten production delivery times to enable it to compete with its startup rivals, NIO and Li Auto. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chinese automaker BYD says that it entered into an agreement with Japanese truck-maker Hino Motors yesterday (21 October) to establish a joint venture (JV) in China in 2021 focusing on electric commercial vehicle (CV) manufacturing. The 50:50 JV will also be engaged in component manufacturing for electric vehicles (EVs). The chief executive of the JV will be appointed by BYD, while its president will be appointed by Hino, according to a statement from BYD. and Hino have taken forward their plan to jointly develop and produce electric CVs with the signing of this JV agreement, although the production launch timeframe is unclear at this stage. Leveraging Hino's expertise in medium and heavy-duty CVs, BYD will be able to tap into the CV market where demand for pure electric models is growing, fueled by government incentives and economic benefits such as low operational costs that electric CVs can offer to business owners. (IHS Markit AutoIntelligence's Abby Chun Tu)

- China's Hubei province has introduced supportive measures to

boost local consumption in auto and home appliance sectors,

according to the provincial government's news conference on 19

October. (IHS Markit Economist Lei Yi)

- From October 2020 until March 2021, Hubei plans to offer a 3% subsidy to passenger car buyers, as long as the vehicle is locally produced, sold, and registered. In line with the nationwide support for new energy vehicles, existing subsidy and tax exemption policies will be extended until the end of 2022. To facilitate car usage, restrictions for night parking on certain streets will be eased, and existing parking facilities will be further improved.

- A three-year (2020-22) plan to promote home appliance upgrade is also unveiled, in which Hubei aims to build an orderly and efficient home appliance recycling system and realize a proper recycling rate of over 50%. The local government will also build a smart internet of home appliances, to facilitate the replacement and recycling process.

- Stimulus measures targeting big-ticket items could help further revive local consumption. Furthermore, given Hubei's role as an important manufacturing hub with auto manufacturing contributing over 10% of industrial value-add, an unveiled policy could also benefit local car producers and stabilize local employment.

- Sluggish income growth remains the key hurdle for a substantial consumption rebound in the near term. Through the end of the third quarter, disposable income of Hubei's residents remains in a year-on-year (y/y) contraction, with urban and rural residents reporting a decline of 6.3% y/y and 4.5% y/y, respectively.

- Great Wall Motor has signed an agreement with the municipal government of Jingmen to set up a production base in the city. The automaker will acquire an existing vehicle manufacturing facility owned by the city government and invest in plant renovation for expansion as well as a product line upgrade. The new production base will be dedicated to the production of sport utility vehicles (SUVs) and pick-up trucks. Great Wall has not released any details regarding a production launch timeline for the new facility in Jingmen. However, it could take a few years for the new plant to reach a significant volume level. Great Wall has been expanding its manufacturing footprint in China more aggressively than most other Chinese automakers. This is in part intended to spread out the automaker's production network beyond central China, where its headquarters are located, and prepare new facilities for the company's expanding product portfolio across its four brands - Great Wall, Haval, Wey, and Ora. In 2020, Great Wall has begun production of a new Ora electric vehicle at its Rizhao plant in Shandong province. This plant is the newest addition to the automaker's production network. According to IHS Markit forecasts, Great Wall's Baoding plant in Hebei province will remain the largest facility by output in the automaker's production network through to 2023, with its annual output reaching more than 550,000 units in 2023. This site will be followed by the Chongqing plant as the second-highest volume facility in Great Wall's production network. <span/>(IHS Markit AutoIntelligence's Abby Chun Tu)

- Hong Kong SAR's labor market deteriorated in September, with

the unemployment rate reaching the highest reading of 6.4% in

almost 16 years, hit by the new wave of COVID-19 infections in July

and August and seasonal factors. With the tourism sector remaining

at a standstill, retail sales and the labor market will continue to

face a severe headwind in the near term until the pandemic comes

under control domestically and globally. (IHS Markit Economist

Ling-Wei Chung)

- With the COVID-19 virus pandemic forcing consumption and tourism-related activities into a standstill, while other activities remain sluggish, the seasonally adjusted unemployment rate skyrocketed to nearly a 16-year high in September of 6.4%. The reading in September was the highest level since January 2005, outpacing those reported during the 2008-09 global financial crisis.

- This came after the unemployment rate briefly eased to 6.1% in July and August 2020 from 6.2% in June. The increase in the September unemployment rate occurred across major economic sectors, led by the sectors hard-hit by the pandemic.

- The unemployment rate of the consumption- and tourism-related sectors, including retail, accommodation, and food services sectors, surged to 11.7%, marking the highest reading since the severe acute respiratory syndrome (SARS) outbreak in 2003. Among them, the jobless rate in the food and beverage service sectors jumped to 15.2% in September 2020. The deterioration was also registered in the arts, entertainment, and recreation sector. The unemployment rate in the construction sector remained high at 10.9% in September.

- Concurrently, the number of unemployed persons (not seasonally adjusted) rose by 11,500 in September. Total employment fell by 15,600, marking a 5.8% contraction from a year earlier.

- The increase in the September jobless rate was partly attributed to the new wave of COVID-19 infections in July and August, which prompted the government to reimpose stricter containment measures. Local infections eased in September and early October, prompting a slight relaxation of containment measures, including an increase in the limit of group gatherings from two to four. That said, the remaining social distancing restrictions and seasonal factors, such as students graduating from schools and looking for jobs, pushed up the unemployment rate again in September.

- With the tourism sector remaining at a standstill, retail sales and the labor market will continue to face a severe headwind in the near term, despite the government's employment support scheme and other relief measures to support job retention and creation.

- Electric vehicle (EV) battery manufacturer LG Chem plans to triple its production capacity for cylindrical batteries and is considering expansion in Europe and North America to meet surging demand, reports Reuters. The South Korean company, an EV battery supplier to an array of major automakers including Tesla, Hyundai, Renault, and General Motors, forecasts a further rise in its battery sales and profit in the fourth quarter of 2020 after posting record quarterly earnings in the third quarter thanks to growing demand for EV batteries and home appliances. No investment timeframe has been given at this stage for its plans to triple cylindrical battery capacity. LG Chem has overtaken its main rivals, Contemporary Amperex Technology Co. Ltd (CATL) and Panasonic, this year to become the largest EV battery supplier in the global market. According to SNE Research, LG Chem captured a market share of 25% in the first eight months of 2020 as its sales almost doubled to 15.9 gigawatt hours. That compares with a 10.7% share a year earlier. A surge in EV sales in the European market during 2020 has given LG Chem a boost and has also strengthened its confidence to widen its customer base in certain regions, especially Europe. CATL is also looking to start production in Europe as early as 2021 in an attempt to secure the leading position in the global market. The Chinese battery manufacturer has already become a dominant player in the Chinese EV battery market, although it faces fierce competition from LG Chem in terms of shipments in overseas markets. In Europe, LG Chem's EV battery plant in Poland is now operating in a stable manner as the defect rate has declined and the company says it is on track to boost its production capacity to 100 gigawatt hours by the end of 2020. (IHS Markit AutoIntelligence's Abby Chun Tu)

- The number of subscribers to Hyundai Motor Group's connected-car services in South Korea has exceeded 2 million. This figure includes subscribers to all of its connected-car services, including Blue Link by Hyundai Motor, UVO by Kia Motors, and Genesis Connected Service. The automotive group exceeded the 1.5-million threshold for connected-car subscriptions in April. Hyundai plans to have all of its vehicles equipped with connected-car solutions by 2022, with the aim of having 10 million subscribers. Hyundai has outlined plans to increase connectivity and reach a point of global leadership in the connected-car field, through a concept it calls "transcend connectivity". The company's vision is to take its cars past simple wireless communication, enabling each car to become an edge cloud, communicating bi-directionally with an external system. By 2022, Hyundai expects to have the largest secure data in the world, and it has announced that it will offer data to third-party collaborators. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The global operations of India's Dr Reddy's Laboratories have reportedly been hit by "a data breach" affecting the company's servers. According to Indian news source TheEconomic Times, the company has "shut down its global plants", with manufacturing sites in the United States, the United Kingdom, Brazil, Russia, and India all impacted. The company stated that "In the wake of a detected cyber-attack, we have isolated all data center services to take required preventive actions", according to the LiveMint news service. Mukesh Rathi, the chief information officer, said that the company is expecting all services to return to normal within 24 hours. Dr Reddy's is one of India's largest pharmaceutical companies with extensive global reach. The company has stated that it does not see any major impact on its operations from the incident, but local news sources report that key plants in various countries were shut down, which could adversely affect production output if it is not fully rectified promptly. The incident occurred days after Dr Reddy's received approval from the Drugs Controller General of India (DGCI) to conduct an adaptive Phase II/III human clinical trial for the Russian Gamaleya Institute's Sputnik V (Gam-Covid-Vac) vaccine candidate in India. (IHS Markit Life Sciences' Sacha Baggili)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-october-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-october-2020.html&text=Daily+Global+Market+Summary+-+22+October+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-october-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 22 October 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-october-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+22+October+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-october-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}