Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 23, 2021

Daily Global Market Summary - 23 June 2021

All major European equity indices closed higher, while US and APAC markets closed mixed. US government bonds closed lower and most benchmark European bonds were higher. CDX-NAIG and iTraxx-Europe closed flat, while those indices' high yield counterparts closed slightly tighter. The US dollar, copper, natural gas, silver, oil, and gold all closed higher on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

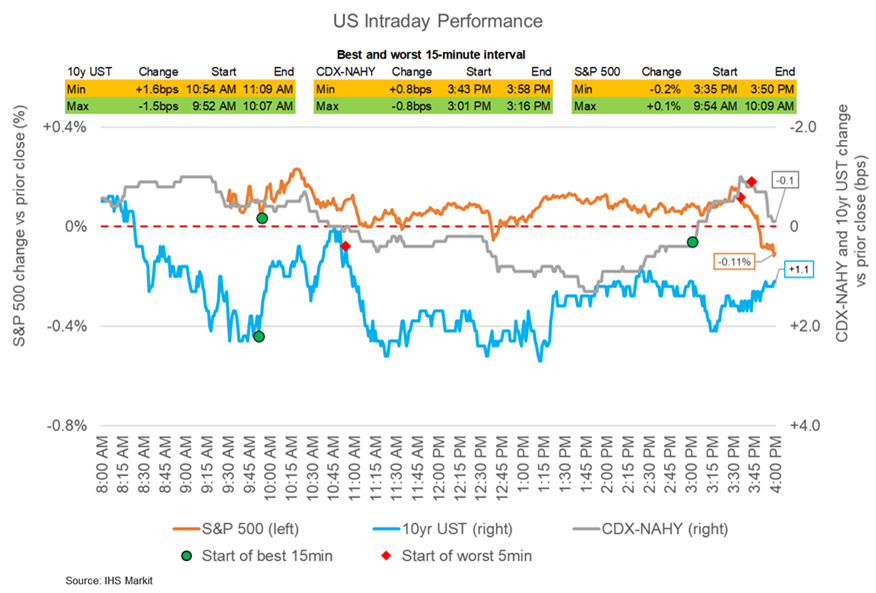

- Major US equity indices closed mixed; Russell 2000 +0.3%, Nasdaq +0.1%, S&P 500 -0.1%, and DJIA -0.2%.

- 10yr US govt bonds closed +2bps/1.49% yield and 30yr bonds +2bps/2.11% yield.

- CDX-NAIG closed flat/49bps and CDX-NAHY -1bp/276bps.

- DXY US dollar index closed +0.1%/91.8.

- Gold closed +0.3%/$1,783 per troy oz, silver +1.0%/$26.11 per troy oz, and copper +2.4%/$4.33 per pound.

- Crude oil closed +0.3%/$73.08 per barrel, which is the highest close since October 2018 and has recently broken through a critical resistance level.

- Natural gas closed +2.3%/$3.33 per mmbtu.

- In one fell swoop, the Supreme Court crushed Fannie Mae and Freddie Mac shareholders and gave President Joe Biden carte blanche to rewrite the rules for the U.S.'s massive housing market. The high court's decision Wednesday largely shot down investors' claims that Obama era regulators exceeded their authority when they decided to send nearly all of Fannie and Freddie's profits to the U.S. Treasury -- a ruling that could save the federal government more than $100 billion. The justices also made clear that the president can remove the head of the Federal Housing Finance Agency, Fannie and Freddie's overseer. (Bloomberg)

- Adjusted for seasonal factors, the IHS Markit Flash U.S.

Composite PMI Output Index posted 63.9 in June, down from 68.7 in

May, but nonetheless signaling a historically elevated rate of

expansion in output across the private sector. (IHS Markit

Economist Chris

Williamson)

- Price pressures also remained elevated in June. The rate of input price inflation softened slightly but was the second-fastest on record. Manufacturers continued to note rapid increases in raw material and fuel costs, whilst service providers highlighted higher wage bills to attract workers plus greater transportation fees and fuel costs.

- The seasonally adjusted IHS Markit Flash U.S. Services PMI™ Business Activity Index registered 64.8 in June, down from May's series record of 70.4. The marked expansion was the second-sharpest since data collection began in October 2009.

- June data signaled the greatest improvement in operating conditions among goods producers on record, as highlighted by the IHS Markit Flash U.S. Manufacturing Purchasing Managers' Index (PMI™) posting 62.6, up from 62.1 in May.

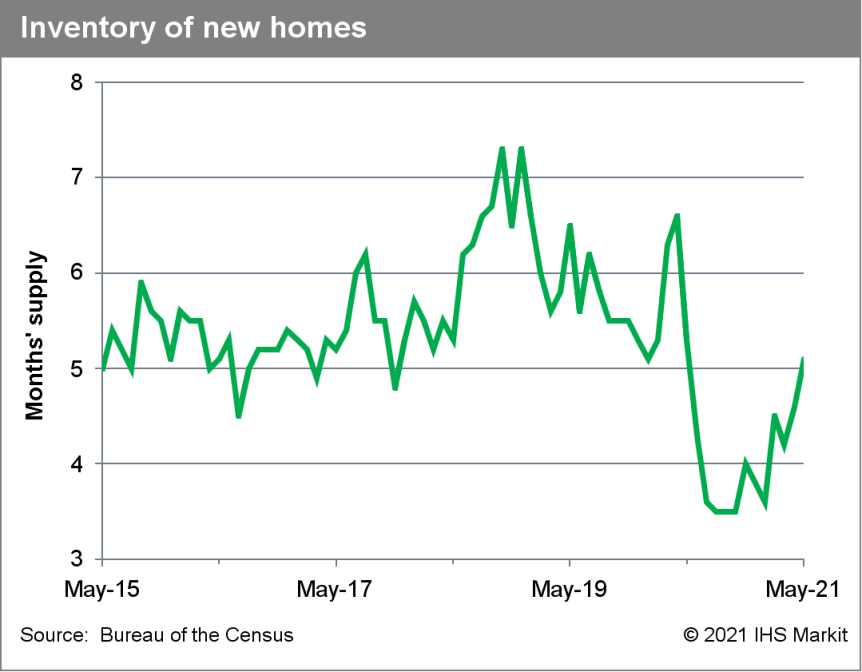

- US new home sales fell 5.9% in May (±18.6%, not statistically

significant) to a 769,000 seasonally adjusted annual rate.

January's 993,000 sales total may turn out to be the seasonally

adjusted cyclical high. (IHS Markit Economist Patrick

Newport)

- Sales figures for February through April were collectively revised down by 108,000 units. Note: about one-fourth of new home sales are imputed; these consist of homes sold before a permit is issued and account for the lion's share of data revisions.

- The three-month average of new home sales, which peaked last September at 974,000 units, moved down to 824,000. The three-month and quarterly estimates are more reliable than monthly estimates because averaging reduces statistical noise.

- The prices of new homes have skyrocketed—the median and average new home prices in May were up 18% and 17%, respectively, from a year earlier. From 2016 to just before the pandemic struck in early 2020, new home prices hardly changed.

- Meanwhile, the Census's construction cost index for homes under construction was up 10% from a year earlier in May. Although home price estimates are noisy and are subject to large revisions, they suggest that builders' profit margins have widened.

- Inventory rose by 15,000 units to 330,000. The months' supply

increased 5 ticks to 5.1 months.

- The US current-account deficit widened by $20.7 billion to

$195.7 billion in the first quarter of 2021. The deficit was the

largest in 14 years. (IHS Markit Economist Patrick

Newport)

- The goods and services deficit expanded by $16.0 billion as imports increased more than exports.

- The surplus on primary income edged down by $3.9 billion to $50.3 billion; the deficit on secondary income (transfers) widened by $0.8 billion to $33.3 billion.

- The current-account deficit moved up three ticks to 3.6% of GDP, the largest since the fourth quarter of 2008.

- The outlook for US chemicals production in the second-half of

2021 remains strong despite risks from supply chain constraints and

COVID-19 hotspots hitting demand in some regions of the world.

Total US chemicals production volumes are expected to grow 1.4%

this year, after declining by 3.6% in 2020, according to ACC.

Basics production is forecast to increase just 0.5% in 2021, due in

part to the impact of winter storms on the US Gulf Coast, but

specialties volumes are expected to rise 3.8% and agchems volumes

are forecast to increase 1.3%. The recovery in chemicals production

should gain steam in 2022 before tapering off. Total chemicals

volumes are forecast to grow 3.2% in 2022, with 3.4% growth in

basics, 4.1% growth in specialties, and 2.1% growth in agchems. Key

risks are: (IHS Markit Chemical Advisory)

- The upbeat outlook contains some risks for both chemicals and end-use markets, however. Chief among these are supply constraints, which could put a lid on production and are already increasing costs, feeding into inflation fears. A resurgence of COVID-19 infections is another risks, with new variants of the virus developing and particular concerns in parts of the world with weak vaccination programs.

- Constraints on the supply chain have been an ongoing problem for several months, and appear likely to continue.

- Chemicals production has been hit by supply chain issues, as evidenced by the havoc in February and March when winter storms knocked out petrochemical production in the US Gulf Coast. Producers are also contending with congestion at ports, a shortage of shipping containers, and high freight costs, Swift notes.

- The chaos reverberates to end-use markets, as well, which could put a lid on chemicals demand. A shortage of semiconductor ships is hitting the automotive industry, for example, curtailing the potential of a key chemicals end market, at least for the moment. Tight supply networks also increase vulnerability to random events, such as hurricanes, taking out key production nodes.

- Oshkosh Defense will build its upcoming United States Postal Service (USPS) delivery truck in the US state of South Carolina, sourcing engines, transmissions, and other parts from Ford. It will build a new facility to produce the vehicles and plans to hire 1,000 employees. Oshkosh will also repurpose an expansive warehouse facility in Spartanburg, South Carolina, "with the innovative features needed to accommodate a large-scale manufacturing operation that meets the technical requirements of producing cutting-edge vehicles for USPS", according to a company statement. Production is due to begin in mid-2023. Separately, Reuters has reported that Ford has confirmed that it will provide engines, transmissions, and other parts. Reportedly, these will include parts for both battery electric and internal combustion engine (ICE) versions as well as suspension and other components. (IHS Markit AutoIntelligence's Stephanie Brinley)

- LiDAR startup for autonomous vehicles (AVs) Quanergy Systems has agreed to go public through a reverse merger deal with CITIC Capital Acquisition Corp., a China-based special purpose acquisition company (SPAC). The combined business value by equity and enterprise is expected to reach about USD1.4 billion and USD1.1 billion respectively. The deal will provide the LiDAR company with around USD278 million in pro forma net cash, including USD40 million in private investment in public equity (PIPE) funding. As part of the agreement, the combined company will be publicly listed on Nasdaq under the ticker symbol "QNGY". The deal is expected to be closed in the second half of 2021. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Toyota Mobility Foundation (TMF), in partnership with Energy Systems Network (ESN), has selected May Mobility to launch a free autonomous shuttle service in Central Indiana (US). The service, which was launched as a part of TMF's Together in Motion Indiana initiative, began on 1 June and will run until 19 November, to serve the public in the downtown Indianapolis and Indiana University-Purdue University Indianapolis (IUPUI) communities. May Mobility's autonomous technology is deployed in five Lexus RX 450h vehicles and one wheelchair-accessible Polaris GEM shuttle operating on routes designed to increase mobility options. In the next phase of this initiative, May Mobility will operate an autonomous shuttle service in Fishers (Indiana), slated to begin in November. (IHS Markit Automotive Mobility's Surabhi Rajpal)

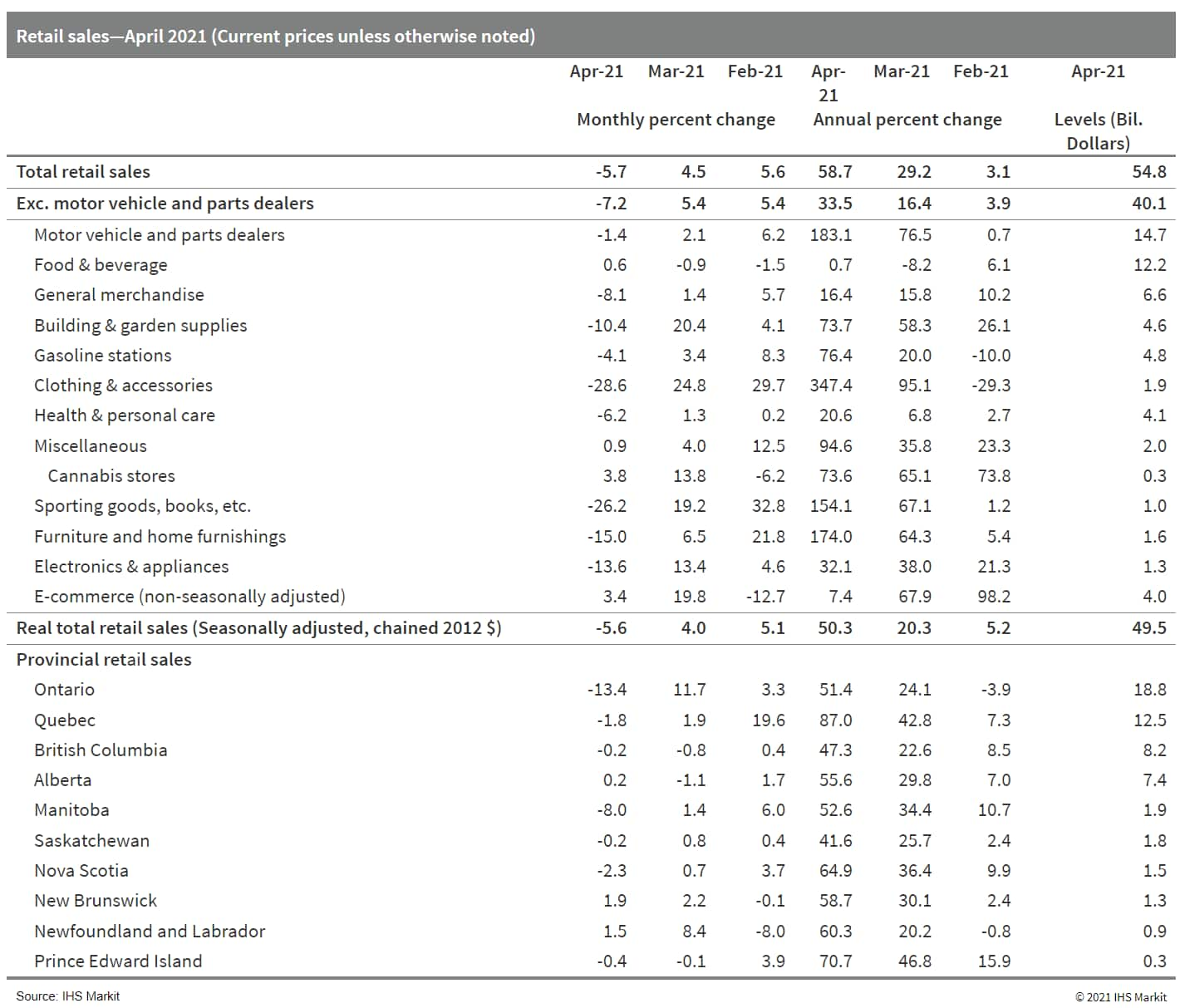

- Canada's nominal retail sales fell 5.7% month on month (m/m) to

$54.8 billion in April as provincial public health restrictions

were enacted early in the month. (IHS Markit Economist Evan

Andrade)

- Core retail sales, excluding gasoline and motor vehicle sales, recorded the second largest decline on record at 7.6% m/m.

- Despite a strong acceleration of consumer price growth in April, the pull back in sales volume was similar, falling 5.6% m/m.

- With public health orders extending into May, the preliminary

sales estimate from Statistics Canada is a sizable 3.2% m/m

drop.

- The Canadian Pest Management Regulatory Agency (PMRA) has decided to cancel all uses of the insect growth regulator, (S)-kinoprene, and products based on the active ingredient. It is an insect juvenile hormone analogue that controls the growth of insects during the moulting process, and is effective against aphids, whiteflies and mealybugs. The Agency proposed to cancel registration of the ai in August last year, citing risks to occupational workers. US agrochemical company Wellmark International (Palo Alto, California) is the registrant of (S)-kinoprene in Canada. The company sells one product based on it, Enstar EW, in the country. In its final re-evaluation decision, the PMRA notes that an assessment of available scientific information flagged risks to human health when the ai was used according to current label instructions, or updated risk mitigation measures. According to the Agency, risks were identified for occupational workers and certain terrestrial or aquatic organisms, although the risks were shown to be acceptable for aquatic organisms and beneficial arthropods when the ai was used in accordance with additional precautionary label statements. (IHS Markit Crop Science's Akashpratim Mukhopadhyay)

- The June policy meeting of the Central Bank of Paraguay (Banco

Central del Paraguay: BCP) marked a full year with the bank's key

policy rate at a historic low of 0.75%. The Monetary Policy

Committee (MPC) decided unanimously to hold the policy rate at

0.75% and further emphasized the 'transitory' nature of ongoing

upward pressures. (IHS Markit Economist Jeremy Smith)

- The BCP cut rates by 325 basis points from March to June 2020 in order to support the economy through the coronavirus disease 2019 (COVID-19) virus pandemic.

- The BCP's views of ongoing inflationary dynamics caused by supply chain disruptions and rising food and energy prices have shifted over the first half of 2021. The bank's February communiqué spoke of initiating the monetary policy normalization process in the 'near future'. However, as these price pressures have begun to filter through the Paraguayan economy, the BCP monetary policy committee (MPC) has gradually walked back this language. Consumer prices rose 3.7% year on year (y/y) in May, the highest figure since May 2019, but this increase is almost entirely explained by the base effect of deflationary forces in the second quarter of 2020.

- The consumer price index rose just 0.6% from January to May this year, and services inflation remains negligible as COVID-19-related restrictions continue to suppress economic activity. Currency appreciation has also helped contain potential price jumps.

Europe/Middle East/Africa

- Major European equity indices closed lower; UK -0.2%, France -0.9%, Italy -0.9%, Spain -1.1%, and Germany -1.2%.

- Most 10yr European govt bonds closed higher except for UK closing flat; France -2bps and Germany/France/Italy/Spain -1bp.

- iTraxx-Europe closed flat/47bps and iTraxx-Xover -4bps/230bps.

- Brent crude closed +0.6%/$74.50 per barrel.

- Flash UK PMI signals record surge in employment, a near-record

increase in demand recorded by the PMI survey encouraged more

companies to take on extra staff during June, driving the largest

monthly rise in employment in the PMI survey's 23-year history. The

latest PMI data are broadly indicative of employee jobs growing at

a quarterly pace of around 300k, underscoring the impressive

upsurge in job creation. (IHS Markit Economist Chris

Williamson)

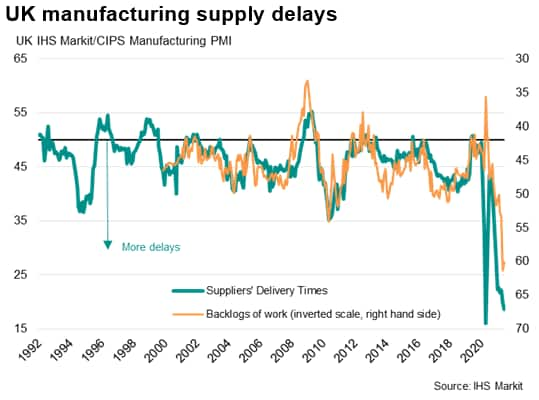

- Strong jobs growth was recorded in both manufacturing and services. However, while jobs growth in the service sector accelerated to a rate just shy of the prior record seen in 2014, manufacturing payroll growth slowed, in part reflecting growing reports of difficulties in filling vacancies.

- Despite the jump in employment, companies again reported difficulties in meeting the recent surge in demand, as measured by new orders, resulting in the largest accumulation of backlogs of orders yet recorded by the survey. An especially steep build up in uncompleted orders was seen in manufacturing, though the service sector also reported an unprecedented accumulation of outstanding business.

- While the record increase in backlogs of work bodes well for

the existing pipeline of order books to help sustain robust output

growth in coming months, a concern is that the lack of available

capacity alongside labor shortages and supply chain delays will add

further to inflationary pressures. Labor shortages in particular

have the potential to drive up wage growth, meaning any

'transitory' spike in inflation due to higher materials prices

could prove stickier.

- The Eurozone economy is booming at a pace not seen for 15 years

as businesses report surging demand. The headline IHS Markit

Eurozone Composite PMI® increased from 57.1 in May to 59.2 in June,

its highest since June 2006, according to the preliminary 'flash'

reading. The latest reading indicated a fourth successive month of

accelerating output growth as the economy continued to open up from

COVID-19 related restrictions and vaccine progress boosted

confidence. (IHS Markit Economist Chris

Williamson)

- Although manufacturing continued to lead the upturn, reporting a twelfth successive month of output growth with the rate of expansion picking up again, it was the service sector that again reported the biggest improvement in performance, with business activity growth accelerating to a pace not exceeded since July 2007.

- However, the strength of the upturn - both within Europe and globally - means firms are struggling to meet demand, suffering shortages of both raw materials and staff. Under these conditions, firms' pricing power will continue to build, inevitably putting further upward pressure on inflation in the coming months.

- Despite a rise in employment during the month, with job gains in both manufacturing and services hitting the highest since 2018, firms reported the largest accumulation of backlogs of work since data were first available in 2002.

- Rising backlogs of work were accompanied by widespread supply shortages for many inputs. Manufacturers reported a lengthening of supply chains that was only slightly less marked than the 24-year survey record seen in May. Producers' inventories of finished goods stock meanwhile fell at the sharpest rate since 2009 as high sales depleted warehouses.

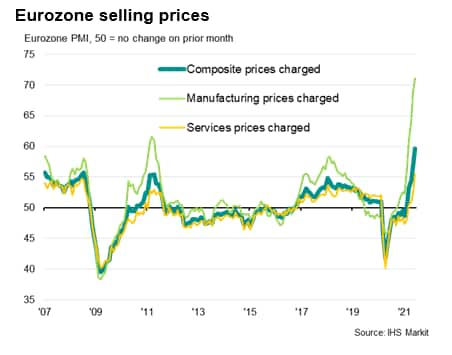

- Average prices charged for goods and services meanwhile rose at

by far the fastest pace since comparable data for both sectors were

first available in 2002, with prices rising in each sector at rates

not exceeded for approximately two decades.

- Daimler is considering the possibility of manufacturing its own battery cells for electric vehicles (EVs), according to a Business Insider report. Apparently Daimler is considering the plan as a result of uncertainty over a deal with Chinese-American battery supplier Farasis Energy. The two companies signed a deal in September 2019 to supply Mercedes-Benz with passenger car battery cells. The plan at the time, according to Daimler board member Markus Schaefer, was for Farasis to build a multi-gigawatt battery plant in Germany from where it will supply the lithium-ion battery cells to Daimler's battery plants in Kamenz, Bruehl, and Sindelfingen. However, this is yet to happen, and concerns have also reportedly been voiced by Mercedes-Benz engineers over the performance of initial cell pre-production cell samples from Farasis. (IHS Markit AutoIntelligence's Tim Urquhart)

- The Volkswagen (VW) Group and the company's main passenger car brand are maintaining their previous profit margin forecasts for 2021 despite indications that the global semiconductor shortage is not easing, according to a Reuters report. The news agency asked VW for clarification after the Business Insider publication claimed that it had seen internal VW documents showing that it expected production losses of up to 800,000 units across the Group during the year. The Group said in a statement that it still expects to achieve a 2021 operating profit margin of between 5.5% and 7% for the Group and between 3% and 4% for its main brand. (IHS Markit AutoIntelligence's Tim Urquhart)

- LyondellBasell and Neste inked a deal for the Finnish refiner and marketer to supply renewable feedstock to global chemicals giant's steam cracker in Wesseling, Germany, they said. The feedstock will be converted by LyondellBasell into polymers and sold under its renewables-based CirculenRenew brand. The long-term agreement will see Neste supply its Neste RE feedstock, produced from bio-based sources such as waste and residue oils and fats, to LyondellBasell, the companies said. The commercial agreement will make polymers and chemicals made from renewable feedstock more widely available to global brands, they say. (IHS Markit Climate and Sustainability News' Mark Thomas)

- A Danish electrolyzer maker partly owned by the world's largest container ship operator completed an over-subscribed IPO in Europe in recent days. A.P. Moller Holding, the owner of ship operator Maersk, has a minority stake in electrolyzer manufacturer Green Hydrogen Systems. Kolding, Denmark-based Green Hydrogen Systems, launched in 2007, manufactures modular alkaline electrolysis units and is seeking to expand production. The company delivered five units of a 22-strong order book prior to the IPO. Its customers include Danish wind developer Ørsted, and French hydrogen producer Lhyfe. The 8 June IPO on Nasdaq Copenhagen attracted "demand substantially exceeding the number of shares offered" from large Danish and international institutional investors as well as the general public in Denmark, leading to an early close of the retail and institutional offer on 15 June. As of 17 June, Maersk's stake in the company had decreased from 17.81% to 12.38%. The manufacturer's other major shareholders are Danish growth fund Nordic Alpha Partners Fund (27.48%) and Danish building utility services provider Norlys Holding (9.53%). (IHS Markit Climate and Sustainability News' Cristina Brooks)

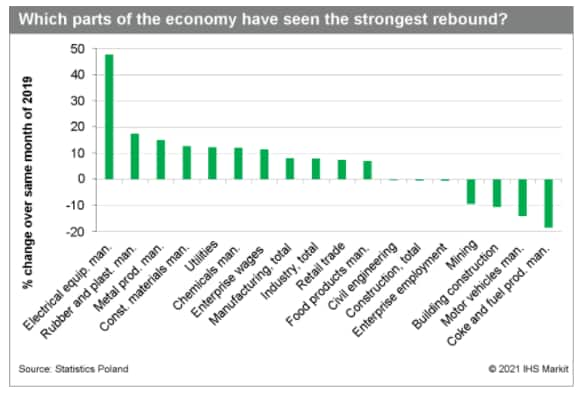

- Poland's May data signal strong rebound in Q2 2021. Benefiting

from low base effects, industry, retail trade, and construction all

reported year-on-year (y/y) growth in May. Seasonally adjusted

results were also favorable, signaling a second-quarter-2021

economic revival. (IHS Markit Economist Sharon

Fisher)

- Polish industrial output surged by 29.8% y/y in May while rising by 0.8% month on month (m/m) in seasonally adjusted terms. May output benefited from y/y growth in all three industrial sectors (mining, manufacturing, and utilities), particularly in the latter two.

- Within manufacturing, most key branches recorded double-digit gains, while motor vehicle production reached more than twice its year-earlier level. Coke and refined petroleum products recorded a slight decline.

- In comparison with output from the same month of 2019,

electrical equipment manufacturing reported especially robust

growth, while several manufacturing branches have yet to fully

recover (including coke and refined petroleum products and

transport equipment).

Asia-Pacific

- APAC equity markets closed mixed; Hong Kong +1.8%, South Korea +0.4%, Mainland China +0.3%, Japan flat, India -0.5%, and Australia -0.6%.

- Tesla has unveiled the longest supercharging route in China. It is a 5,000-km stretch across China (east to west) with 27 electric vehicle (EV) charging stations. According to Bloomberg, the route covers nine cities, starting from the eastern coastal hub of Zhoushan and stretching to the western city of Horgos bordering Kazakhstan. The route will now have one charging station every 100-300 km along the Silk Road, and customers can charge their cars to run for up to 250 km in just 15 minutes. Tesla is said to have already set up 840 charging stations in China, covering over 310 cities. According to media reports, setting up charging stations along the Silk Road is part of Elon Musk's plan to establish a charging route covering 6,000 miles from Shanghai to London. To accomplish that, it would need to fill gaps across Central Asia, the Middle East, and Eastern Europe. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Autonomous vehicle (AV) startup WeRide.ai has raised USD310 million in a funding round at a USD3.3-billion valuation, reports Reuters. Investors for the funding round include the Renault-Nissan-Mitsubishi Alliance and the China Structural Reform Fund. The startup also said that it would expand collaboration with Nissan on autonomous technology for the China market. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese battery manufacturer SVOLT Energy Technology yesterday (22 June) signed an agreement with Lishui District, Nanjing, to set up a power battery manufacturing base in the district with an annual capacity of 14.6 GWh, according to Gasgoo. The battery manufacturer plans to invest CNY5.6 billion (USD863 million) in the base. The Lishui base will be built in two phases. The first phase will involve an investment of CNY2.6 billion and will result in a capacity of 6.6 GWh, while the rest of the investment will be deployed during the second phase and will increase the site's annual capacity by another 8 GWh. Following the first phase, operations are expected to begin in November. (IHS Markit AutoIntelligence's Nitin Budhiraja)

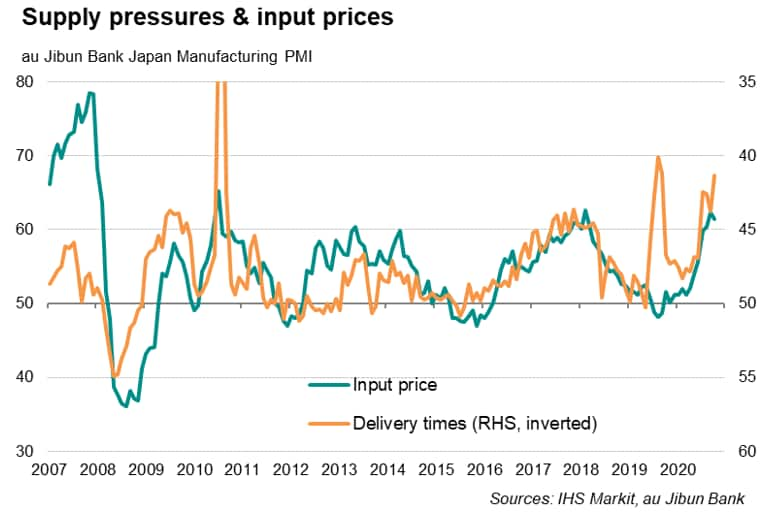

- The au Jibun Bank Flash Japan Composite PMI indicated Japan's

private sector shrank for a second straight month and at a faster

pace in June. Manufacturing output notably slipped back into

contraction after growing for four consecutive months while

services output fell for the seventeenth month in a row. (IHS

Markit Economist Jingyi Pan)

- The extension of the state of emergency into June contributed to the decline in output, particularly for the manufacturing sector. At the same time, anecdotal evidence also found many manufacturers suffering supply delays for parts, notably including semiconductors. As a result, even though new orders continued to improve from May, albeit marginally, manufacturing output was dragged into contraction.

- Meanwhile services business activity continued to shrink, though at a slower rate in June. Demand, including foreign orders, remained lackluster, one month ahead of the Tokyo Olympics. While overseas spectators had long been determined to miss the event, it remains to be seen what the 10,000 domestic fans per venue, announced June 21, will do for services performance.

- The flash PMI sub-indices continued to reflect the issue of supply constraints and price pressures in June. As shown in the graph, the rate of industrial input price growth remained at elevated levels compared to historical data in June even as it eased marginally from May. Meanwhile lead times worsened, lengthening at the fastest rate since May 2020.

- The most positive indications from the June flash PMIs were the

employment and future output sub-indices. Job creation was reported

for a fifth straight month across the private sector as a whole,

with manufacturing seeing the fastest increase in staffing levels

since January 2020. Despite manufacturing output dipping into

contraction territory in June, firms continued to expand their

operating capacity in anticipation of a future pickup in

demand.

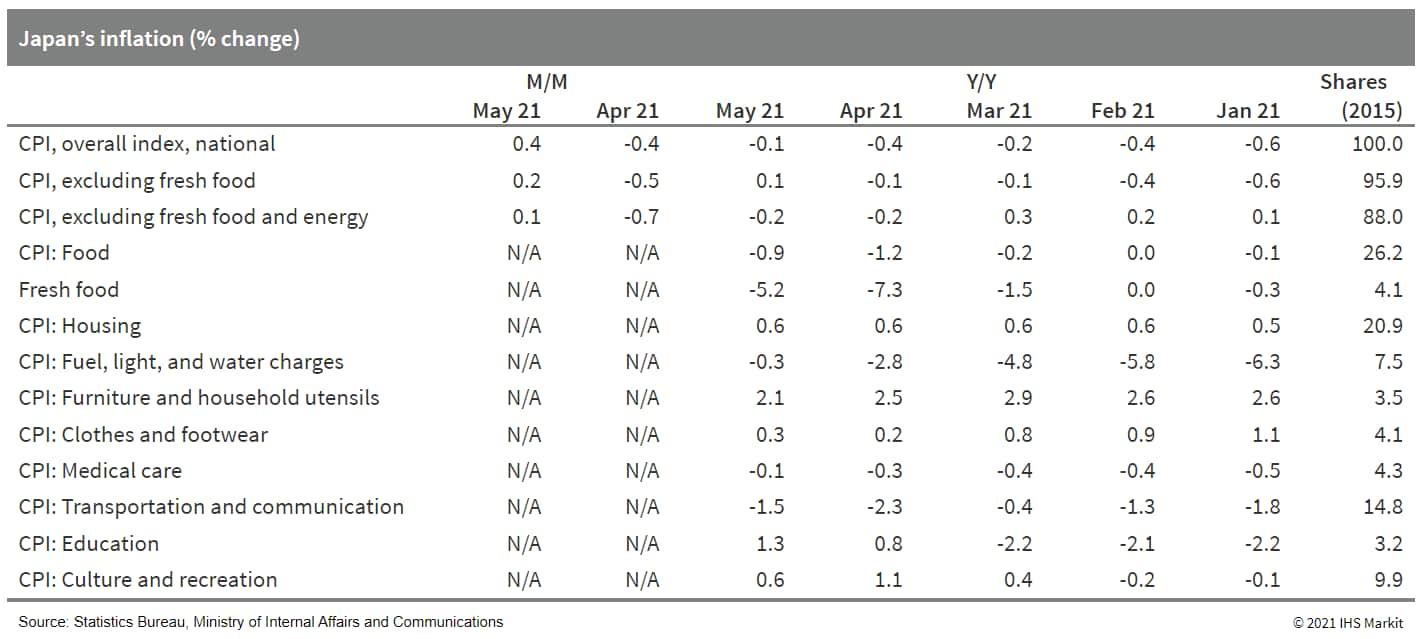

- Bank of Japan maintains monetary policy but focuses support

investment on curbing climate change. (IHS Markit Economist Harumi

Taguchi)

- The Bank of Japan (BoJ) left its monetary policy unchanged at its 17 and 18 June monetary policy meeting (MPM). The bank will continue quantitative and qualitative monetary easing (QQE) with yield curve control (YCC).

- The BoJ also maintained its commitment to increase the monetary base until the year-on-year rate of rise in the observed Consumer Price Index (CPI) exceeds 2% and stays above this target in a stable manner. The contraction of year-on-year change in the CPI softened to 0.1% in May, and the CPI, excluding fresh food, the BoJ's reference series, turned positive at 0.1% largely thanks to higher energy prices. The bank maintained its inflation outlook that prices will increase gradually from the current level of around 0%.

- The bank expressed concern that prolonged uncertainties over the pandemic could push out the timing for growth with a virtuous cycle from income to spending intensifying, which could lower households' and firms' medium- to long-term growth expectations and in turn inflationary expectations.

- The BoJ decided to introduce a new fund-provisioning measure

through which it provides funds to financial institutions for

investments or loans to address climate change issues. The new

measure will replace fund-provisioning measures aimed at

strengthening the foundations for economic growth (scheduled to end

in June 2022). The bank aims to launch the new measure within

2021.

- LG Electronics and Magna will launch a new joint venture (JV), LG Magna e-Powertrain, in July. According to a press release issued by LG, this new JV will produce electric vehicle (EV) components that combine Magna's know-how of electric powertrain systems and automotive manufacturing capabilities with LG's ability to develop components for e-motors and inverters. LG will own 51% of the new company and Magna will have a 49% stake. The companies are currently in the process of selecting board representatives for the new JV, and it has already been reported that LG will appoint the company's CEO. (IHS Markit AutoIntelligence's Jamal Amir)

- Some of the top insurers of coal-fired power plants under development in South Korea, representing $24.9 billion in underwriting, are unwilling to guarantee either the construction or the operation of new projects, according to Seoul-based nonprofit Solutions for Our Climate. DB Insurance, Hyundai Marine & Fire Insurance, Hanwha General Insurance, and Hana Insurance-which represent nearly half the sector's $52 billion of underwriting-made their plans known to the "Korean Beyond Coal" campaign, which disclosed them publicly 22 June. The four insurers will neither back construction nor operation of new coal-fired capacity, including the 2.1-GW Samcheok Blue Power facility, which is set to be the country's last coal project following a promise from the current Moon administration to phase out new coal-fired generation and a pledge to reach net-zero carbon levels by 2050. (IHS Markit Climate and Sustainability News' Amena Saiyid)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-june-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-june-2021.html&text=Daily+Global+Market+Summary+-+23+June+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-june-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 23 June 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-june-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+23+June+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-june-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}