Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 23, 2021

Daily Global Market Summary - 23 November 2021

Major US and APAC equity indices closed mixed, while most European markets were lower on the day. US and benchmark European government bonds closed sharply lower for a second consecutive day. European iTraxx closed wider across IG and high yield, while CDX-NA was almost unchanged on the day. Oil, natural gas, and copper closed higher, while the US dollar, silver, and gold were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Major US equity indices closed mixed; DJIA +0.6%, S&P 500 +0.2%, Russell 2000 -0.2%, and Nasdaq -0.5%.

- 10yr US govt bonds closed +5bps/1.68% yield and 30yr bonds +5bps/2.04% yield.

- CDX-NAIG closed flat/53bps and CDX-NAHY +1bp/307bps.

- DXY US dollar index closed -0.1%/96.49.

- Gold closed -1.2%/$1,784 per troy oz, silver -3.5%/$23.44 per troy oz, and copper +0.6%/$4.42 per pound.

- Crude oil closed +2.3%/$78.50 per barrel and natural gas closed +3.6%/$5.04 per mmbtu.

- Retailers say shoplifting is getting more brazen in the U.S.: A California Nordstrom store was recently hit by a flash mob of more than 80 people who made off with designer goods, while more than a dozen people pilfered from a Louis Vuitton location in a suburb of Chicago. On Tuesday, the impact of shoplifting reached Wall Street, with Best Buy Co. shares plunging after the electronics retailer said widespread theft contributed to a decrease in one gauge of profitability. Last month, Walgreens said it would close five San Francisco stores after theft rates there spiked. (Bloomberg)

- US private sector firms signaled a sharp upturn in business

activity during November, despite the rate of expansion slowing

from October. Softer overall growth was largely led by the service

sector, as manufacturers posted a slightly stronger increase in

production. Nevertheless, pressure on capacity remained stark as

labor and material shortages weighed on the private sector. (IHS

Markit Economist Chris

Williamson)

- Flash US Composite Output Index at 56.5 (57.6 in October). 2-month low.

- Flash US Services Business Activity Index at 57.0 (58.7 in October). 2-month low.

- Flash US Manufacturing PMI at 59.1 (58.4 in October). 2-month high.

- Flash US Manufacturing Output Index at 53.9 (52.1 in October). 2-month high.

- The level of outstanding business rose at the second-sharpest pace on record (since October 2009), slipping only slightly from October's series high.

- Both manufacturing and services recorded marked upturns in backlogs of work amid further severe supply chain delays and labor shortages.

- The rate of job creation was solid overall, but many firms noted outstanding vacancies which had not been filled for several months.

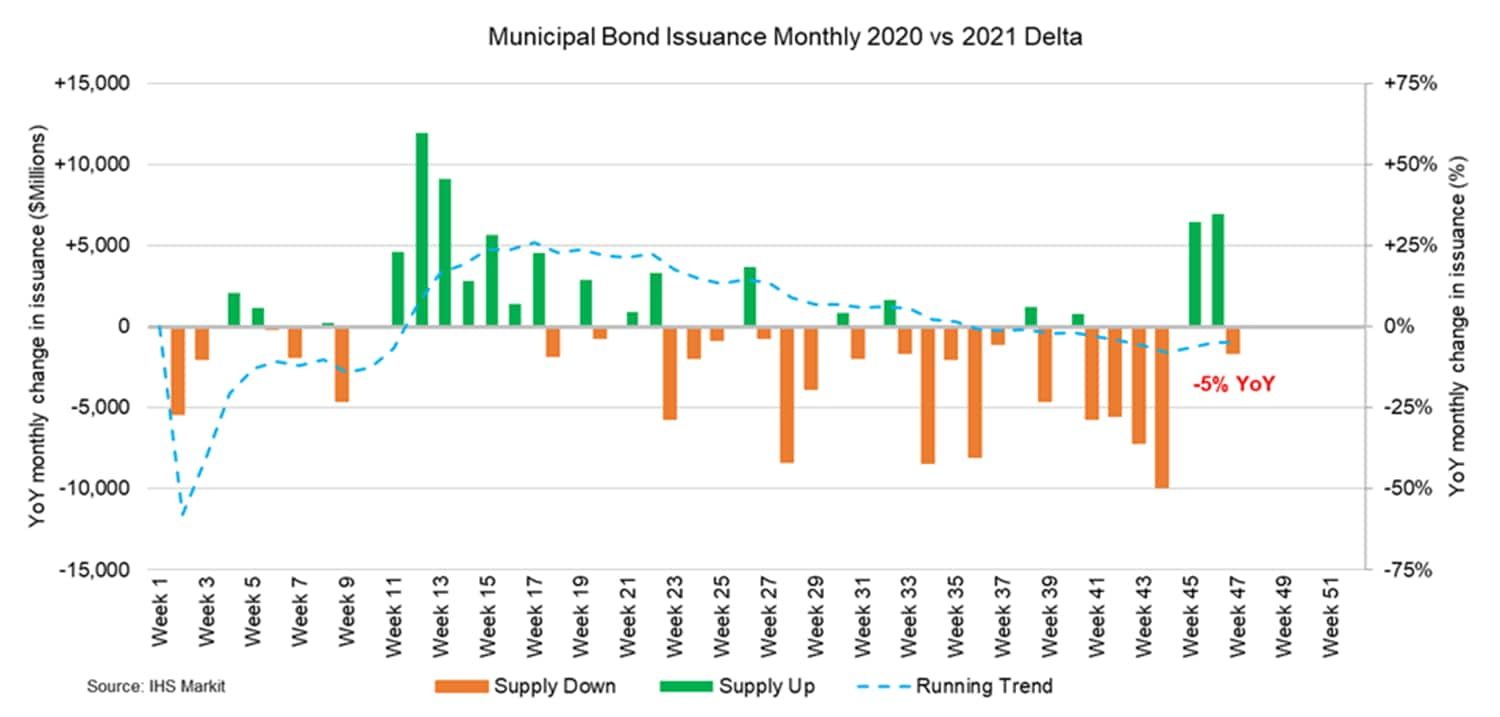

- Strong demand from institutional and retail accounts

complimented last week's sizable municipal bond calendar which

supplied $16.7 billion, presenting par focused investors greater

opportunity after the State of California dominated the majority of

the calendar, representing $5.4 billion of last week's issuance.

The California Health Facilities Financing Authority (Aa3/AA-/AA-)

priced $1 billion of revenue bonds with proceeds designated for

Cedars-Sinai Health System with investor interest suppressing

yields by 3-6bps across the scale, and the 2040 maturity falling

+50bps off the interpolated MAC. The State of Mississippi

(Aa2/AA/AA) also experienced a successful pricing after selling

$965 million taxable general obligation bonds spanning

10/2022-10/2032 with significant bumps across the curve, ranging

from 5-20bps with the 2036 maturity registering a 20bp bump or

+95bps spread to the 10YR UST following robust order flow. This

week's Thanksgiving holiday-shortened calendar will provide $1.4

billion spanning across 53 new issues with the Desert Community

College District (Aa2/AA/-/-) leading the negotiated calendar

offering $292 million of general obligation bonds spanning across

three series with maturities ranging from 08/2022-08/2051. The

Massachusetts Housing Finance Agency (Aa1/AA+/-/-) will also step

up to the plate to price $71 million single family housing revenue

bonds selling today 11/22, senior managed by Citi. This week's

competitive calendar will span across 19 new issues for a total of

$114 million with Andrews County Hospital District, TX (A3/-/-)

leading the auction schedule to sell $27 million general obligation

refunding bonds. (IHS Markit Global Market Group's Matthew

Gerstenfeld)

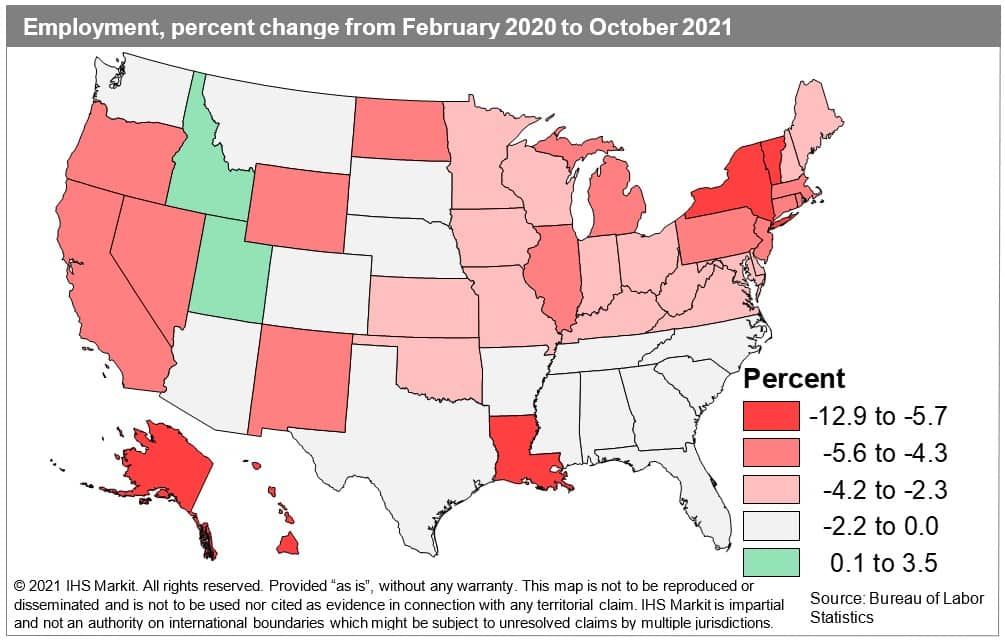

- Job growth around the US accelerated for a second consecutive

month in October as state labor markets continue to move past the

effects of the Delta variant surge over the summer. Total private

nonfarm employment gains kicked up another notch in every region

with the South and West leading the country. The recent quick

expansion in the South was driven by solid expansions in business

services, leisure/hospitality services, and a recovery from

Hurricane Ida in Louisiana. The Midwest found momentum in its

business services and hospitality industries but was restrained by

sluggish education and healthcare hiring. The Northeast and West

have maintained their lead in 2021 with stronger overall job

recoveries fueled by deeper job deficits over the course of the

pandemic. Steady job gains in business services, financial

activities, healthcare, and hospitality in states like California,

New York, and New Jersey have powered these regions over the past

months. (IHS Markit Economist James

Kelly)

- Much of the South, including Texas, Florida, and Georgia, benefited from robust increases in service-sector employment. Hiring in business services, education/healthcare, and leisure/hospitality services rose broadly throughout the region. Louisiana saw the nation's strongest annualized gain in October thanks to the expected recovery from Hurricane Ida. Much of the region also saw moderate increases in trade, transportation, and utilities employment as logistics and e-commerce activity continue to boom. Manufacturing hiring was more mixed, with some of the largest gains in South Carolina, Alabama, and Tennessee.

- Michigan and Illinois led the Midwest to a stronger expansion on solid growth in professional/business and leisure/hospitality services. Most parts of the region saw stagnant to slight expansions in educational and healthcare services with notable declines in Wisconsin, Ohio, and Indiana. As consumer activity in the leisure and hospitality services sector continued to climb, fueled by confidence in COVID-19 vaccinations and lower caseloads, employment at restaurants, hotels, and other hospitality businesses rose solidly in many states.

- The Northeast saw more moderate employment gains in many

states, but still accelerated in October. Sluggish gains or

declines in the financial activities and business services sectors

affected Pennsylvania and New York and held back a more robust

expansion. Massachusetts led the region with notable increases in

business services and hospitality employment. California and Nevada

experienced some of the strongest gains in the West supported by

leisure/hospitality and professional/business services while

Washington and Oregon experienced similar momentum in service

sector hiring.

- Tesla is planning to invest more than USD1 billion in its new vehicle manufacturing plant in Austin, Texas (United States), and plans to complete construction by the end of this year, reports Reuters. Tesla detailed its planned investment in various production capabilities at the Austin plant in filings submitted to the Texas Department of Licensing and Regulation on 19 November. The electric vehicle (EV) maker expects to complete the construction of its general assembly, paint, casting, stamping, and body-shop facilities by 31 December. The five facilities would span over an area of almost 4.3 million square feet and would cost USD1.06 billion, highlight the filings. The Texas Department of Licensing and Regulation is responsible for licensing and regulating a wide range of businesses, facilities, and equipment. The Tesla submissions were filed under the agency's architectural barriers project, which examines and inspects construction projects to verify they meet Texas's accessibility regulations. (IHS Markit AutoIntelligence's Jamal Amir)

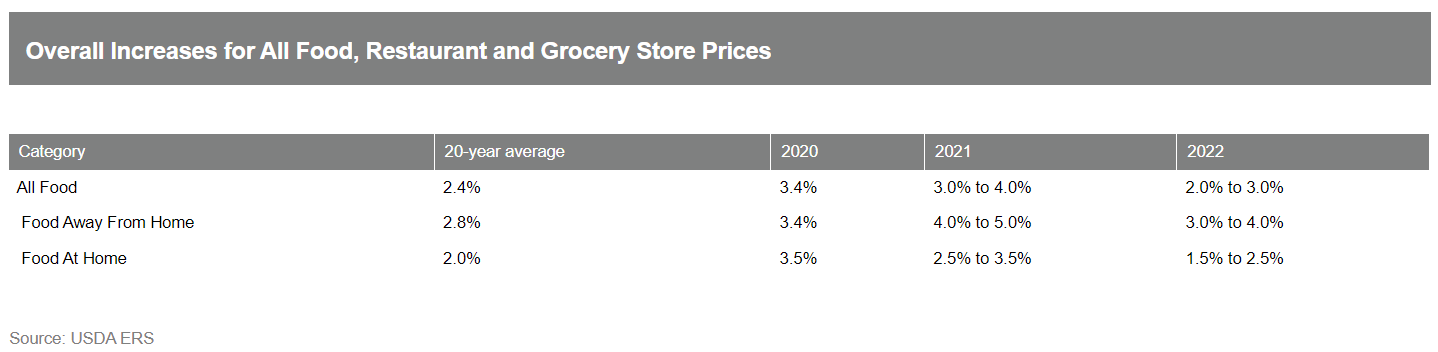

- The USDA's Economic Research Service (ERS) expects overall food

price inflation at 3.0% to 4.0% in 2021, with grocery store prices

(food at home) up 2.5% to 3.5% and restaurant (food away from home)

prices up 4.0% to 5.0%. Restaurant prices are on the only overall

category to be revised higher this month, previously having been

forecast to increase by 3.5% to 4.5%. (IHS Markit Food and

Agricultural Policy's Roger Bernard)

- But the increases for 2021 are coming after similar boosts in 2020—overall food prices rose 3.4%, restaurant prices rose 3.4% and grocery store prices rose 3.5%. All of those levels are above the 20-year averages of 2.4% for all food prices, 2.8% for restaurant prices and 2.0% for grocery store prices.

- If the current forecast levels hold, 2021 overall food price

inflation and grocery price increases are the highest since 2020

while restaurant prices will have risen the most since 1990 when

they rose 4.7%.

- General Motors (GM) has purchased a 25% stake in Pure Watercraft, valuing the electric boat startup at USD600 million, reports Reuters. The automaker is paying USD150 million in cash and payment-in-kind, which includes access to GM's components and manufacturing support, according to Pure Watercraft. Pure Watercraft, based in Seattle, manufactures electric motors for boats driven by lithium-ion batteries, with a plug-and-play design that allows the motors to be used on any boat hull. GM said that it would reveal any products developed from the partnership with Pure Watercraft at a later date. (IHS Markit AutoIntelligence's Jamal Amir)

- Entergy Louisiana LLC applied November 9 with the Louisiana

Public Service Commission for approval of four new solar

photovoltaic resources with a combined nameplate capacity of 475

MW. The four projects up for approval are (IHS Markit PointLogic's

Barry Cassell):

- Elizabeth - This is a 125-MW (ac) solar resource located in the village of Elizabeth in Allen Parish. ELL proposes to enter into a 20-year power purchase agreement with the developer of this facility. Under the PPA, ELL will purchase an expected 125 MW of must-take, unit-contingent, as-available energy, environmental attributes, and other electric products (voltage support or ancillary services).

- St. Jacques - This is a 150-MW (ac) facility that will be constructed in St. James Parish. Upon achievement of mechanical completion, and the fulfillment of certain other contingencies, ELL will acquire the facility from the developer under a Build-Own-Transfer agreement.

- Sunlight Road - This is a 50-MW (ac) solar resource located in Washington Parish. ELL proposes to enter into a 20-year PPA with the developer. Under the PPA, ELL will purchase an expected 50 MW of must-take, unit-contingent, as-available capacity, capacity-related benefits (including all Midcontinent ISO Zonal Resource Credits associated with the facility), environmental attributes, energy, and other electric products (voltage support or ancillary services).

- Vacherie - This is a 150-MW (ac) solar resource located in St. James Parish in the unincorporated community of Vacherie. ELL proposes to enter into a 20-year PPA with the developer. Under the PPA, ELL will purchase an expected 150 MW of must-take, unit-contingent, as-available capacity, capacity-related benefits (including all MISO ZRCs) associated with the facility, environmental attributes, energy, and other electric products (voltage support or ancillary services).

Europe/Middle East/Africa

- Most major European equity indices closed lower except for UK +0.2%; Spain -0.1%, France -0.9%, Germany -1.1%, and Italy -1.6%.

- 10yr European govt bonds closed sharply lower for a second consecutive day; UK +7bps, Germany/France +8bps, Spain +9bps, and Italy +11bps.

- iTraxx-Europe closed +2bps/52bps and iTraxx-Xover +7bps/260bps.

- Brent crude closed +3.3%/$82.31 per barrel.

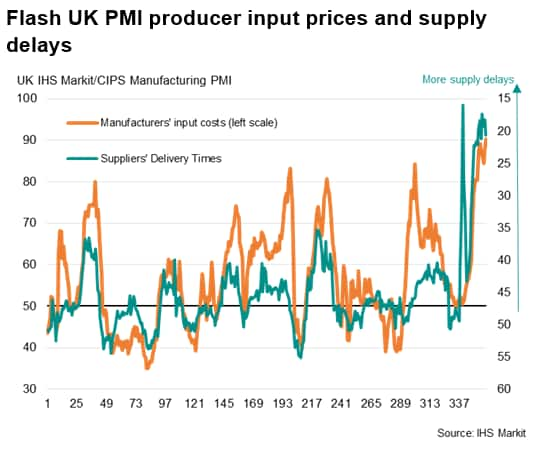

- UK output growth across manufacturing and services measured by

the PMI surveys came in slightly faster than expected in November.

The IHS Markit/CIPS composite PMI output index registered 57.7

according to the preliminary 'flash' reading, down from 57.8 in

October but remaining well above the 50.0 neutral level to indicate

a robust expansion of the economy. The latest reading was above the

consensus of a slightly stronger pull-back to 57.5. (IHS Markit

Economist Chris

Williamson)

- The news was by no means all positive, notably with growth once again heavily skewed towards the service sector. Solid service sector growth that far exceeded the pre-pandemic long-run average contrasted with only modest production growth in the manufacturing sector. The rate at which production expanded was the third lowest since February, albeit up slightly on October's low.

- Supply shortages remained widespread, with suppliers' delivery times lengthening at a rate once again far exceeding anything recorded prior to the pandemic, albeit with the incidence of delays easing in November to the lowest since July. The ongoing sellers' market created by the supply constraints alongside solid demand for materials led to another unprecedented rise in price pressures, with costs in both manufacturing and services rising at the steepest rates since comparable data were first available in January 1998.

- Employment meanwhile rose for the ninth successive month in

November, according to the flash PMI data, rising at the slowest

rate since April yet remaining far above the survey's long-run

average. Firms continued to hire staff to meet rising demand and

help reduce backlogs of work that continued to accumulate in

November. Jobs growth remained robust in both manufacturing and

services.

- The UK government has approved new regulations that will require electric vehicle (EV) charge points to be installed at new building developments in England. In a statement published by Prime Minister Boris Johnson's office, new homes and buildings such as supermarkets and workplaces will be required to install chargers from 2022. Furthermore, these regulations will also include existing buildings that are undergoing major renovations that will leave them with more than 10 parking spaces. The statement added that this is expected to lead to 145,000 more charge points being installed across the country each year. The government is also said to have consulted with industry to make it "easier and simpler for people to pay for charging whilst travelling, such as contactless, at all new fast and rapid charge points." Separately, the Competition and Markets Authority (CMA) has announced that it has reached an initial agreement with Gridserve to increase competition in public charging infrastructure. According to a statement, the company that owns Electric Highway has offered two "legally binding assurances". These are "not to enforce exclusive rights" in its agreements with the Extra, MOTO or Roadchef roadside service stations after 2026. Furthermore, it will also not enforce exclusive rights at any Extra, MOTO or Roadchef sites that have been "granted funding under the UK government's Rapid Charging Fund (RCF)". (IHS Markit AutoIntelligence's Ian Fletcher)

- The headline IHS Markit Eurozone Composite PMI rose for the

first time in four months in November, climbing from 54.2 in

October to 55.8 according to the 'flash' reading*. Although

indicating an improvement in the rate of growth from October's

six-month low and remaining above the survey's pre-pandemic

long-run average of 53.0, the average reading for the fourth

quarter so far, at 55.0, is substantially lower than the 58.4

average seen in the third quarter, pointing to a weakening of

economic growth in the closing quarter of 2021. (IHS Markit

Economist Chris

Williamson)

- By sector, services outperformed manufacturing for a third straight month, recording the strongest growth of activity for three months. Growth also picked up in manufacturing, though remained the second-weakest seen over the past 17 months. In manufacturing, growth was held back in particular by a third successive monthly drop in production in the autos sector. More positively, especially robust expansions were seen for tech equipment, food & drink and household goods.

- Especially weak factory output growth was again seen in Germany alongside a subdued service sector expansion, though in both sectors, the rate of growth improved on October.

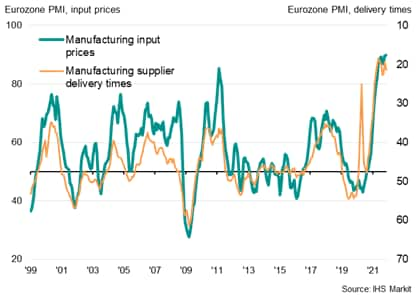

- Weak factory output growth was again commonly attributed to supply constraints. Suppliers' delivery times continued to lengthen at one of the steepest rates seen over more than two decades of survey history, easing only modestly compared to October, amid ongoing supply shortages and transport problems.

- Shortages were meanwhile once again seen as a principal driver

of higher prices for many goods and services, alongside higher

shipping costs, rising energy prices and increases in staff costs.

November consequently saw a survey record increase in firms' input

costs for a second successive month, with unprecedented rates of

inflation recorded in both manufacturing and services.

- EasyMile has received a permit from France's Ministry of Transport and Ministry of Ecological Transition to test Level 4 autonomous vehicles (AVs) on public roads in the country, according to a company statement. With this, EasyMile claims to be the first driverless solutions provider in Europe to operate at Level 4, without any human attendant on board, in mixed traffic on a public road. Benoit Perrin, general manager at EasyMile, said, "This is an important step towards real commercialization of autonomous driving, both on large private sites, as well as on public roads. The applications for our technology to move people and goods continue to grow, especially in locations like campuses, business parks, industrial sites, and master planned communities. I'm excited about the future as more and more adopt intelligent, shared transport." EasyMile has developed autonomous mobility solutions that include intelligent navigation software, a range of latest-generation sensors, and a fleet management system. The company has also built the EZ10, a fully electric shuttle bus that is capable of Level 4 autonomous operation and is deployed with LiDAR, cameras, and GPS to ensure safety. It claims to have a 60% share of the autonomous shuttle market and has deployed these shuttles in nearly 300 locations to improve last-mile transportation. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Iveco has announced that it plans to supply 1,064 S-Way trucks powered by compressed natural gas (CNG) to online retailer Amazon's European operations. According to a statement, the first batch of 216 vehicles have already been delivered, and 848 more units will begin being delivered in mid-2022. The designated CEO of Iveco Group, Gerrit Marx said in a statement, "We have been pioneering gas propulsion technology for 25 years, developing solutions that allow operators to make significant reductions in emissions right now… Iveco Group will continue leading the way in combustion engines running on renewable fuels, the only viable solution already available at scale on the market to reduce emissions". Truck electrification is starting, but is still in its infancy due to the high cost, impact on payload and range and infrastructure issues. As such, Iveco is pushing its long-standing interest in CNG as an effective short-term low emission alternative to traditional diesel powertrains. In his statement, Marx suggests that a "CNG truck powered by bio-methane can cut CO2 [carbon dioxide] emissions by up to 95% from a well-to-wheel CO2 measuring approach". The vehicles specified by Amazon are equipped with FPT Industrial Cursor 13 Natural Gas engines and equipped with 1,052-litre CNG tanks which are expected to yield a range of 620 km between refueling. (IHS Markit AutoIntelligence's Ian Fletcher)

- Vestas was struck by cyber security incident on 19 November

2021, triggering the company to execute its crisis management plan.

The company immediately shut down its IT systems across multiple

business units and locations to contain the issue and has been

working together with its external partners to contain the

situation and re-establish the integrity of its IT systems. (IHS

Markit Upstream Costs and Technology's Melvin Leong)

- The company has revealed preliminary findings whilst in the midst of its investigations. The company stated that parts of its internal IT infrastructure had been impacted and that data has been compromised, but added that there was no indication that third part operations, including customer and supply chain operations, has been impacted.

- The company's manufacturing, construction, and service teams are continuing operations, although some IT systems have been shut down as a precaution. A gradual and controlled reopening of IT systems is underway.

- The Bank of Ghana's Monetary Policy Committee (MPC) has

announced an increase in the policy rate by 100 basis points to

14.5%. The rate increase was the first since November 2015 and

unwound part of the 250 basis points easing since 2020, which

formed part of the country's forbearance measures to mitigate the

impact of the COVID-19 virus pandemic. The MPC cited "significant"

inflation risks that required prompt policy action to anchor

inflation expectations. Headline inflation in Ghana reached 11% in

October as food and non-food price pressures mounted. Increasing

global energy prices and rising global inflation were cited in the

report as the primary inflation risks. (IHS Markit Banking Risk's

Ronel Oberholzer)

- For the last half of the year, banking-sector figures are pointing to sluggish credit growth. The MPC press release highlights a slowdown in private-sector credit growth to 10.1% year on year (y/y) in October, compared with growth of 13.4% y/y a year earlier. Moreover, the increase in interest rates is likely to stem credit growth in 2022, lowering our forecast to 8.0% from 8.2%, previously rising to 11.1% over the rest of the forecast period.

- The non-performing loan (NPL) ratio stood at 16.4% in October, slightly improved from August's 17.3 % but still reflecting the ongoing pandemic-induced repayment and loan-recovery challenges. With borrowers' debt-servicing ability under pressure from increased interest rates, we now expect the NPL ratio to stand at 16.5% for 2022, from the previous forecast of 16.4%, averaging 13.4% for the rest of the forecast period. For now, the MPC will keep the macroprudential policy measures and regulatory relief measures to support the economy's recovery, which is likely to prevent the ratio from deteriorating even further.

- Mozambique's real GDP fell by 6.5% quarter on quarter (q/q)

during the third quarter, but the low base year of comparison

resulted in a year-on-year (y/y) growth rate of 3.4% over the

period. Headline GDP growth averaged 1.8% during the first three

quarters of 2021, from a 1.0% contraction during the same period

last year. (IHS Markit Economist Thea

Fourie)

- Output increases were recorded for all sectors in the Mozambican economy during the third quarter, with the biggest annual growth reported for the hotels and restaurants sub-sector, up 5.1% y/y, from 4.0% y/y in the second quarter. This sub-sector was followed by mining, up 5.0% y/y, from 0.8% y/y in the previous quarter, and agriculture and fishing, up 4.7% y/y, from 1.7% y/y in the second quarter.

- Real wholesale and retail trade sales - a proxy for household spending - increased 2.0% y/y during the third quarter. Wholesale and retail sales have not yet recovered fully from the impact of the COVID-19 pandemic and are at only 95% of the pre-COVID-19 pandemic sales level.

- The services sector (including government services) remains the largest contributor to overall economic activity in the Mozambican economy, accounting for 34% of real GDP in the third quarter. This sector is followed by agriculture and fishing at roughly 25% of GDP and the transport and storage sector, contributing 11% of GDP.

Asia-Pacific

- Major APAC equity indices closed mixed; Australia +0.8%, India +0.3%, Mainland China +0.2%, Japan flat, South Korea -0.5%, and Hong Kong -1.2%.

- The People's Bank of China (PBOC) has signaled a possible shift

toward more supportive measures as the economy faces increasing

downward pressure in its third-quarter monetary policy report

published on 19 November. (IHS Markit Economist Yating

Xu)

- For economic development, the key phrase "steady and improving" cited in previous reports was dropped, with the latest report stating that the economic recovery is facing restrictions from temporary, structural, and cyclical factors, and that it is becoming more difficult to maintain a stable economy.

- For the real estate sector, the report stated that the PBOC will work with local governments to maintain "stable and healthy development" of the market and protect consumers' rights. Meanwhile, the report emphasized preventing secondary financial risk from the property market de-risking campaign. However, the report reiterated that the property market will not be used to stimulate economic growth.

- For monetary policy, the key phrases "control the money supply" and to not "flood the economy with stimulus" were dropped from the report.

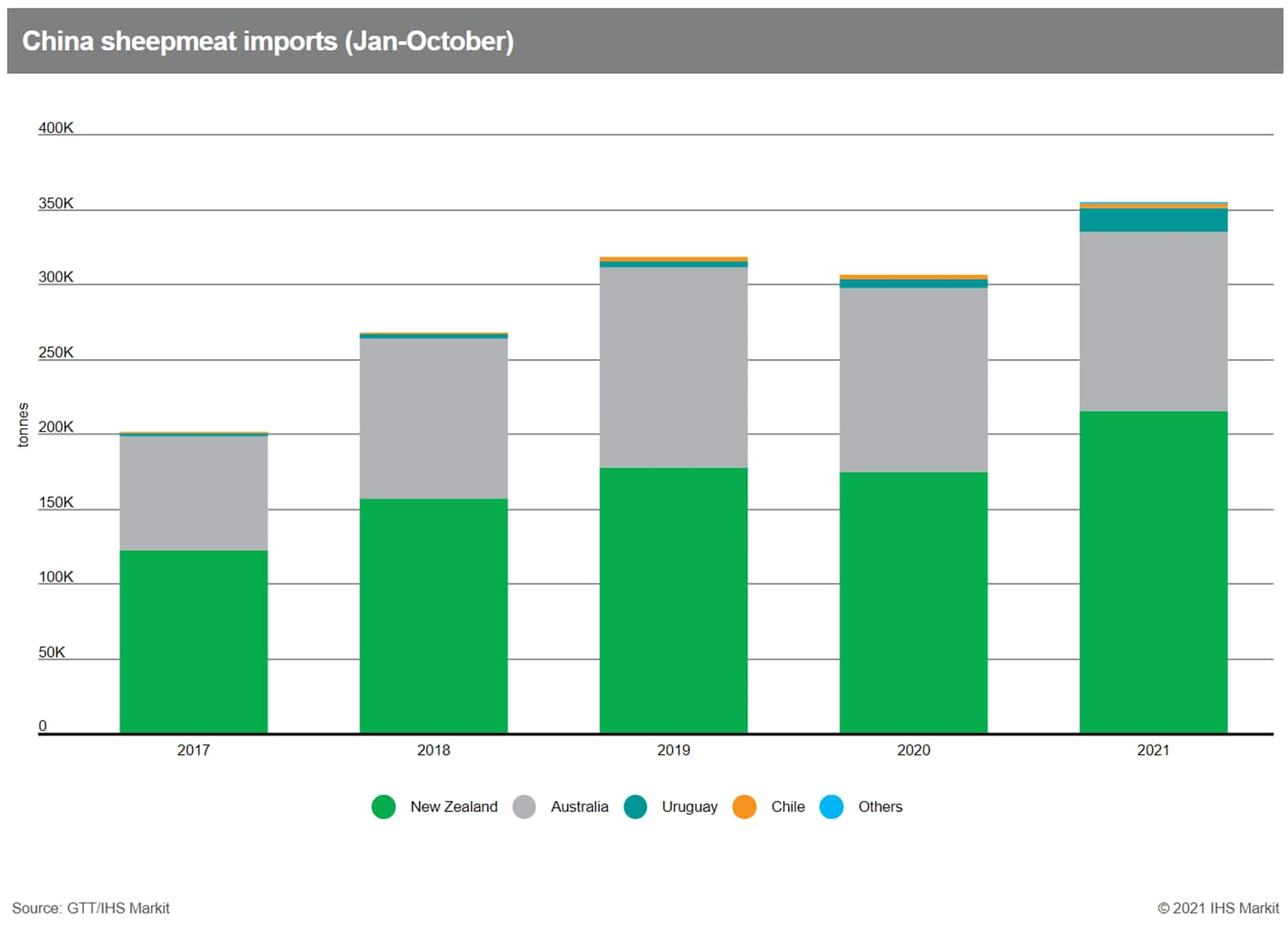

- China strengthened its position as the world's leading buyer of

sheepmeat in the first ten months of this year as the country

brought in imports worth more than $2 billion. (IHS Markit Food and

Agricultural Commodities' Max Green)

- Chinese customs data shows that imports in the January-October period amounted to 354,249 tons, up 16% y/y. These lamb and mutton shipments were valued at $2.01 billion - an increase of 38% y/y.

- To put these figures in context, China's average monthly spend on sheepmeat imports has risen roughly tenfold over the past ten years and by almost 100 times over the past two decades.

- More than 90% of Chinese sheepmeat imports still come from New Zealand and Australia. There has been a big shift in the relative share of these two countries however, with higher imports from New Zealand more than offsetting a drop in purchases from Australia.

- In the first ten months of 2021, imports from New Zealand rose by 23% y/y to reach 214,550 tons, but imports from Australia dropped by 3% y/y to 119,998 tons.

- The only other countries providing China with significant

volumes of sheepmeat are Uruguay and Chile. Chinese imports from

Uruguay surged to 16,396 tons in the Jan-October period - up 178%

y/y. In contrast, imports from Chile were down 10% y/y at 2,438

tons.

- Chinese electric vehicle (EV) ride-hailing firm BMKP Technology is planning to go public in the United States through a merger with a special-purpose acquisition company (SPAC), according to a company statement. The company is expected to be to be valued at USD1 billion and to be listed on the NASDAQ stock exchange by March 2022. In the booming mobility service market, EVs are deemed to be a natural fit. A fundamental reason is that EVs generally have lower operating costs than ICE vehicles and, generally, EVs in mobility services are driven more miles per year than personal vehicles. BMKP Technology has 252 ride-hailing service licenses in China and the company has established more than 300 subsidiaries. The company would become the second Chinese ride-hailing service provider to be listed on the US stock market after Didi Chuxing (DiDi). (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Panasonic Corporation is planning to launch a security system that it has developed for automakers to prevent cyber attacks amid an increase in the number of models that are connected to the internet, reports Kyodo News. The security system will enable software installed in internet-connected cars to detect abnormalities, while dedicated teams at Panasonic and automakers will keep a check on the cars around the clock. A Panasonic company official said, "If the computerized control is taken over during driving, it leads to fatal accidents. Practically, abnormalities need to be detected at a much earlier phase." Cyber safety is a crucial consideration in the emerging connected car industry; with the increase in the number of high-tech cars, vehicles are likely to become the targets of dangerous hackers. In order to ensure passenger safety, countries have been setting up cyber security guidelines. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Nitin Gadkari, Union Minister of Road, Transport and Highways (MoRTH), said that electric vehicle (EV) prices will be the same as gasoline (petrol) and diesel vehicles by 2024, reports The Times of India. He said, "The cost of EVs is high because their number is less. But India is awaiting an EV revolution with 250 startup companies engaging in innovation of EV technology in the most cost-effective manner. Moreover, big auto manufacturers have also entered the competition to reduce the cost of EV manufacture." He added, "We are not stopping anything. We are only encouraging green vehicles and green fuels so that we fulfil our commitment in COP26, Glasgow this year. We are putting maximum impetus on the diversification of our energy sector, which has hitherto been dominated by fossil fuel. Besides, EV, bio-LNG, green hydrogen, CNG and bio-ethanol have great prospects. I will request the industry people to invest more and more in future clean technologies." The National Highways Authority of India (NHAI) has also announced a target to install charging stations at every 40-60 km on national highways and planning to cover 35,000-40,000 km of national highways with charging stations by 2023. (IHS Markit AutoIntelligence's Tarun Thakur)

- The Bank of Thailand (BoT) announced on 22 November that it

will expand the debt consolidation policy. According to a press

release, the latest development is an amendment of the previous

scheme, which only allowed borrowers to consolidate unsecured loans

into secured loans, such as mortgages, with the same bank. The

latest arrangement will allow borrowers to consolidate their loans

from several banks into one bank account. Borrowers can choose a

completely new bank, or port over the unsecured loans into the bank

that holds the borrower's mortgage. Similar to the original scheme,

the maximum interest rate chargeable will be 2% on top of the home

loan. The BoT expects banks to start announcing the product by the

end of 2021, and borrowers will have until the end of 2023 to apply

for the scheme. (IHS Markit Banking Risk's Angus

Lam)

- The scheme was first introduced in September 2020 and allows unsecured loans to be converted into performing secured loans, such as mortgages (see Thailand: 2 September 2020: Thailand allows borrowers to convert unsecured loans into secured loans, reducing banks' profits but curbing NPL uptick).

- Initial reports on the reopening of the tourism sector suggests that the economy is likely to be boosted in the short run. It will potentially improve borrowers' ability to repay loans; however, the prolonged positive impact is still too early to confirm. Overall, IHS Markit expects the non-performing loan (NPL) ratio to remain at around 3% in 2021.

- Autonomous vehicle (AV) startup MooVita has secured an undisclosed amount of investment funding from 1Derlife Growth and SEEDS Capital, according to a company statement. The capital received is part of the company's Series A fundraising round. MooVita plans to use the proceeds to accelerate the rollout of its driverless solutions in Singapore, Malaysia, and beyond. Derrick Loh, co-founder of MooVita, said, "MooVita is pleased to have a successful capital investment round with strategic investors who share our long-term vision and goals of improving urban life. Mr. Gregory Lee of 1Derlife Growth and SEEDS Capital will be significant partners to have on this journey." (IHS Markit Automotive Mobility's Surabhi Rajpal)

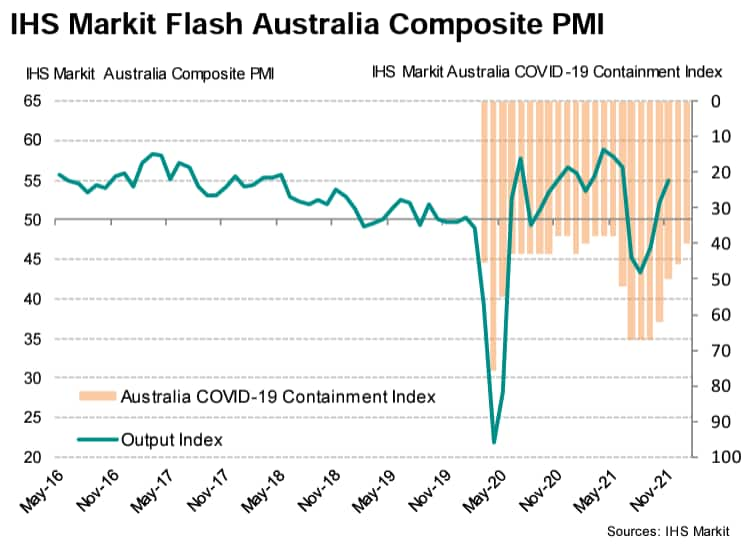

- The latest IHS Markit Flash Australia Composite PMI™* revealed

that growth momentum in the private sector accelerated in November,

with economic confidence and activity boosted by the further

reopening of the Australian economy. This is consistent with the

trend observed from the IHS Markit Australia COVID-19 Containment

Index, which pointed to the lowest degree of restrictions since

May. (IHS Markit Economist Jingyi Pan)

- Both manufacturing and services output growth were comparable in November, rising in each case to the fastest since June, which was prior to the latest COVID-19 Delta wave hit to the economy. Growth momentum was also shown to have yet to peak at the current juncture.

- Business confidence notably also improved to signal rising expectations among private sector firms for output and activity to continue expanding in the coming 12-months, according to the Future Output sub-index indication.

- Employment levels rose in tandem with demand and output into

November, with services employment growth outstripping that of

manufacturing in line with reopening trends.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-november-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-november-2021.html&text=Daily+Global+Market+Summary+-+23+November+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-november-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 23 November 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-november-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+23+November+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-november-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}