Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 23, 2021

Daily Global Market Summary - 23 September 2021

All major US and European equity indices closed higher, while APAC was mixed. US and European benchmark government bonds closed sharply lower. European iTraxx closed slightly tighter across IG and high yield, CDX-NAHY was tighter, and CDX-NAIG was almost flat on the day. Oil and natural gas closed higher, the US dollar was flat, and gold, copper, and silver were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher; Russell 2000 +1.8%, DJIA +1.5%, S&P 500 +1.2%, and Nasdaq +1.0%.

- 10yr US govt bonds closed +13bps/1.44% yield and 30yr bonds +13bps/1.95% yield.

- CDX-NAIG closed flat/51bps and CDX-NAHY -3bps/274bps.

- DXY US dollar index closed flat/93.46.

- Gold closed -1.6%/$1,750 per troy oz, silver -1.0%/$22.68 per troy oz, and copper -0.5%/$4.23 per pound.

- Crude oil closed +1.5%/$73.30 per barrel and natural gas closed +3.9%/$5.04 per mmbtu.

- Adjusted for seasonal factors, the IHS Markit Flash U.S.

Composite PMI Output Index posted 54.5 in September, down from 55.4

in August and much lower than May's record high. The rate of output

growth was the softest since September 2020, amid a notable

slowdown in the pace of expansion in service sector activity

compared to earlier in the year. (IHS Markit Economist Chris

Williamson)

- Challenges finding suitable candidates and difficulties retaining employees were reflected in firms reporting only a fractional rise in employment for a second month. Backlogs of work rose strongly due to the resulting pressure on operating capacity. The rise in outstanding business was the second-fastest in over 12 years of data collection, with a record increase seen in manufacturing.

- On the price front, input costs rose at a sharper pace during September. The rate of cost inflation was the quickest for four months, and the second-highest on record, as supply chain disruptions and material shortages pushed prices and transportation costs up. Meanwhile, output charges continued to increase markedly, continuing to rise at a pace far outstripping anything seen in the survey's history prior to May, as firms sought to pass on higher costs to clients where possible.

- Seasonally adjusted US initial claims for unemployment

insurance increased by 16,000 to 351,000 in the week ended 18

September. Despite edging higher last week, claims show no signs of

a new round of layoffs in response to the fourth wave of COVID-19.

The not seasonally adjusted (NSA) tally of initial claims rose by

40,307 to 306,209. California reported an increase of 24,221 in

initial claims, accounting for more than half of the change in the

national level of NSA initial claims in the week ended 18

September. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs) rose by 131,000 to 2,845,000 in the week ended 11 September. The insured unemployment rate inched up 0.1 percentage point to 2.1%.

- In the week ended 4 September, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) fell by 161,240 to 3,644,555.

- In the week ended 4 September, continuing claims for Pandemic Unemployment Assistance (PUA) fell by 591,108 to 4,896,125.

- Pandemic-related federal unemployment benefits expired on 5 September—benefit payments will not be made for weeks of unemployment after 5 September. As a result, almost nine million people claiming benefits under PUA and PEUC will lose access to benefits entirely and individuals claiming regular state benefits will see their weekly checks reduced by $300.

- In the week ended 4 September, the unadjusted total of continuing claims for benefits in all programs fell by 856,440 to 11,250,287.

- As the Good Food Institute's (GFI's) annual conference on

alternative proteins kicked off on Wednesday (September 21),

participants heard from one US lawmaker─House Appropriations

Committee Chair Rosa DeLauro (D-Conn)─working to generate support

and direct funding into the alternative protein sector. (IHS Markit

Food and Agricultural Policy's Margarita Raycheva)

- A long-time supporter of alternative proteins, DeLauro spoke at the opening of day of the three-day annual global Good Food Conference, praising the efforts of all who work to advance the alternative proteins sector ─ a sector that she believes is capable of offering solutions to the twin global emergencies of climate change and public health.

- Noting significant progress in the sector, DeLauro outlined her own work on advancing alternative proteins, including by pushing forward a proposal to allocate $5 million for much-needed research into the sector.

- "This Congress I am chair of the House Appropriations Committee and one of my main priorities was to include for the first time dedicated funds for alternative proteins research in the spending bill that will fund the US Department of Agriculture next year," DeLauro told participants in the GFI event.

- If enacted, USDA would receive $5 million to collaborate with government agencies like the National Science Foundation (NSF) and advance research on developing, manufacturing and promoting alternative proteins, DeLauro explained.

- Aurora, in collaboration with Paccar, will launch a commercial pilot of autonomous trucks hauling goods for package delivery firm FedEx, according to a company statement. Paccar trucks equipped with Aurora's autonomous technology will haul FedEx loads between Dallas and Houston, a 500-mile round trip, along the I-45 corridor. The trucks will operate autonomously, with a backup safety driver. Aurora has previously partnered with Paccar to provide autonomous solutions for the commercial trucking industry. Aurora, working with partners PACCAR and Volvo Group, aims to launch its autonomous system in heavy-duty trucks without a safety driver in late 2023. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Electric vehicle (EV) startup Electric Last Mile Solutions (ELMS) has announced that production of its first electric van started on 20 September and that it has received a binding order for 1,000 units of the delivery van. The order was placed by the company's strategic distribution partner, Randy Marion Automotive Group. ELMS plans to ship the first vehicles on 28 September. The production start date of 20 September was in line with the company's plans announced in March and puts it just ahead of Ford and General Motors (GM), although both of those are due to start production of their electric vans by the end of 2021. Getting to market first may not make a significant difference over time, in part as GM and Ford have much deeper distribution networks and existing customer bases. ELMS aims to send out the first few vans by the end of September, but it has not provided a timeline as to when it will deliver the first complete order. (IHS Markit AutoIntelligence's Stephanie Brinley)

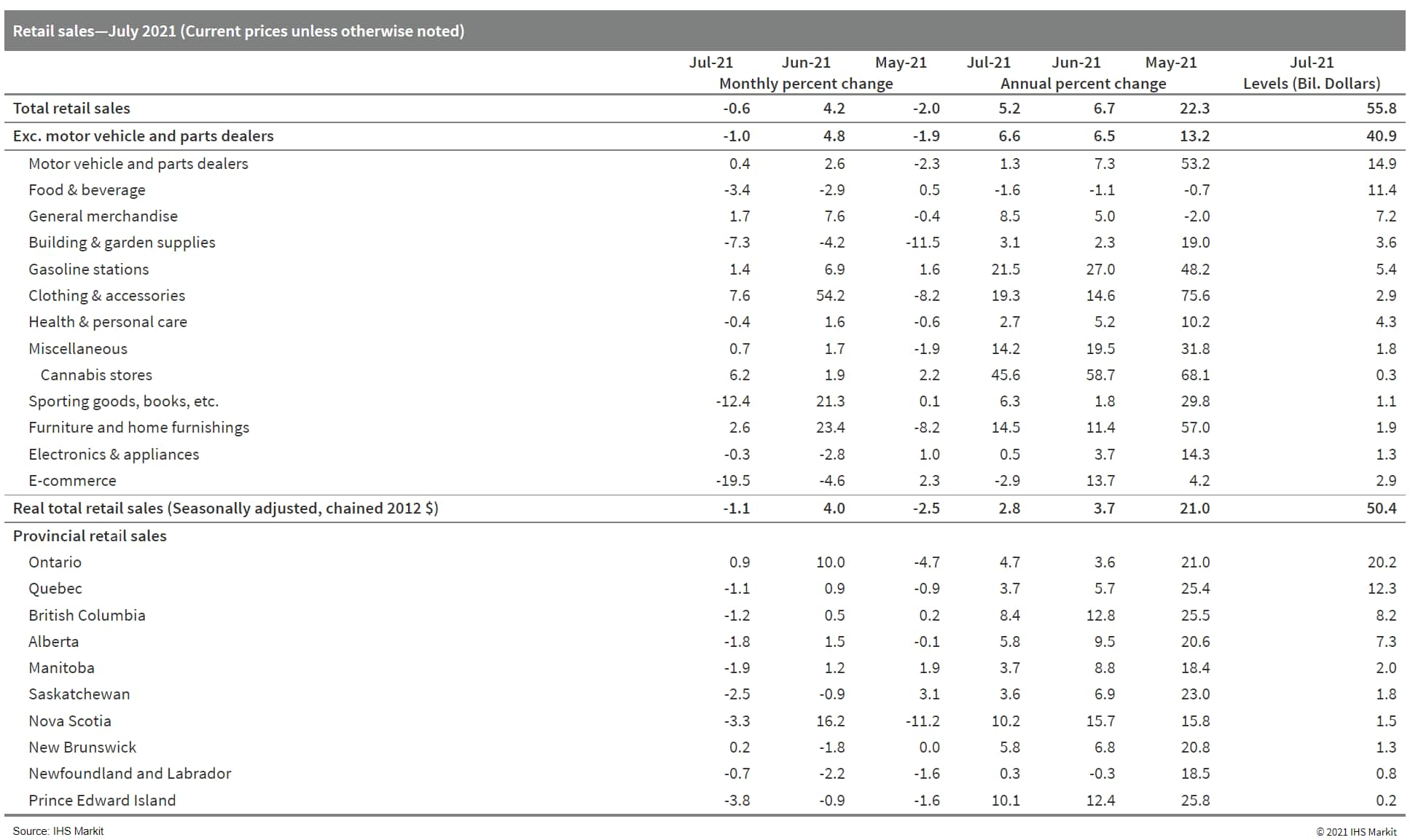

- Canada's July retail sales performance was mixed, with 5 of 11

retail sectors seeing a decline. The largest contributor to the

decline was a 3.4% m/m drop in food and beverage store sales. This

was likely a reflection of consumers substituting further toward

in-person food services (up 11.0% m/m in July), which are not

included in retail sales. Sales of building materials and garden

equipment plunged for a fourth consecutive month, coinciding with a

broader pullback in housing activity. With a similar pattern in

constant dollar terms, this was not just a reflection of falling

softwood lumber prices. Sporting, hobby, and bookstore sales fell

12.4% m/m, giving up some of the large gains in June, and continued

to experience highly volatile month-to-month sales swings. (IHS

Markit Economist Evan Andrade)

- Nominal retail sales fell 0.6% month on month (m/m) to $55.8 billion in July.

- Excluding the positive contributions from sales at gasoline stations and of motor vehicles and parts, core retail sales fell 1.3% m/m to $35.4 billion.

- Considering goods inflation, retail sale volumes were down 1.1% m/m.

- The advance estimate from Statistics Canada reported a sales

gain of 2.1% m/m in August.

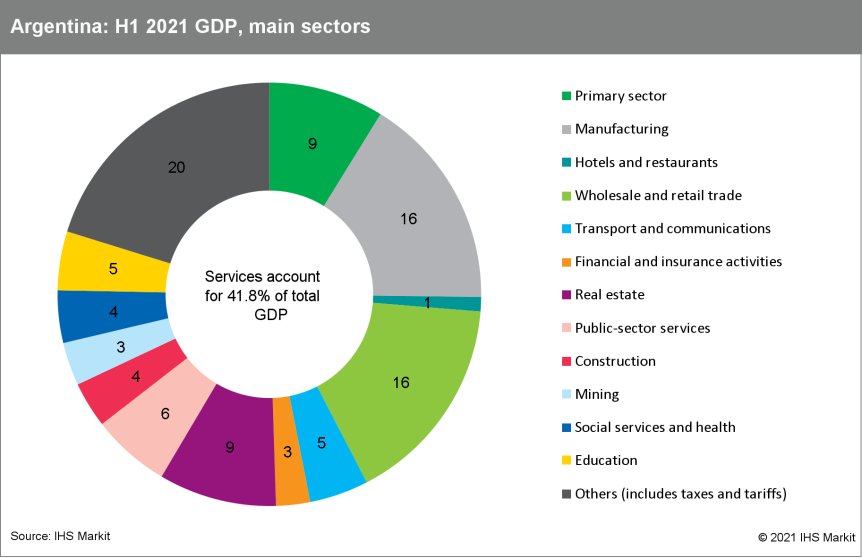

- The latest data from Argentina's National Institute of

Statistics and Censuses (Instituto Nacional de Estadística y

Censos: INDEC) show that GDP decreased by 1.4% quarter on quarter

(q/q) in the second quarter. The expected sudden increase in

public-sector spending to gain the population's trust before the

November 2021 mid-term elections should have a marginal bump in GDP

in the last quarter of the year. (IHS Markit Economist Paula

Diosquez-Rice)

- Correcting for seasonality, GDP during the second quarter decreased by 1.4% q/q after rising by 2.8% q/q in the previous quarter, according to the revised figures. The annual rate points to a 17.9% year-on-year (y/y) rise in April-June (GDP shrunk by over 19% y/y in the second quarter of 2020 owing to the COVID-19 response and extreme lockdown).

- The estimate for the GDP deflator in the second quarter shows a rise of 64% y/y, while the private-sector consumption deflator increased at a higher rate of 53% y/y during the same period.

- By sector, the GDP data show only one annual decline in the

second quarter: the primary sector. Moreover, only very few sectors

post annual growth rates in the single digits: education, financial

intermediation, and real estate and business services.

Europe/Middle East/Africa

- Most major European equity indices closed higher except for UK -0.1%; Italy +1.4%, France +1.0%, Germany +0.9%, and Spain +0.8%.

- 10yr European govt bonds closed sharply lower; Italy/Spain +6bps and France/Germany +7bps.

- iTraxx-Europe closed -1bp/49bps and iTraxx-Xover -3bps/239bps.

- Brent crude closed +1.4%/$76.46 per barrel.

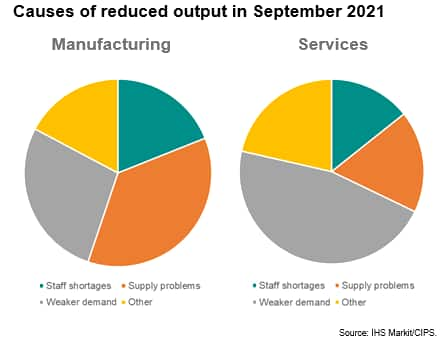

- A fourth successive monthly slowing of UK business activity has

taken the pace of expansion to its lowest since January's lockdown,

according to the flash PMI for September, while at the same time

average prices charged for goods and services are rising at the

fastest rate in at least 22 years. (IHS Markit Economist Chris

Williamson)

- The IHS Markit/CIPS Flash Composite PMI Output Index, covering both services and manufacturing, fell further in September from its all-time high in May, down to its lowest since the economy revived from January's COVID-19 lockdown.

- The fourth-successive monthly slowdown has occurred despite virus related restrictions being eased in the UK to the lowest since the pandemic began. However, at the same time virus case numbers have risen amid the spread of the Delta variant, causing disruptions to supply chains and the labor market, as employees have needed to isolate, while also dampening demand.

- A lack of staff and components were especially widely cited as key causes of an overall fall in output within the food, drink and vehicle manufacturing sectors. Similarly, many hospitality and consumer-facing service providers reported a slowdown in new order inflows after August's revival, and were often impeded by a lack of staff or high COVID-19 infection rates, curbing the overall rate of expansion alongside a broader slowdown which has hit demand for business and financial services.

- Shortages are meanwhile seen as a key factor driving up prices

at unprecedented rates, as firms pass on higher supplier charges

and increases in staff pay. The flash Composite PMI Prices Charged

Index rose to a level surpassing anything seen since comparable

data on selling prices were available in 1999, accompanied by

another month of near-record input cost inflation.

- UK-based startup Wayve has partnered with supermarket giant Asda to conduct autonomous grocery delivery trial, according to a company statement. The pilot, which is scheduled to begin next year, will run for 12 months under the supervision of a Wayve safety driver. The companies plan to integrate autonomy into the online grocery space to support Asda's last-mile delivery operation. Wayve was founded in 2017 and focuses on artificial intelligence (AI) and machine learning to train systems for autonomous vehicles (AVs), rather than sensors and hand-coded rules. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Petrofac has signed a strategic partnership with Protium, a leading green hydrogen energy company from the United Kingdom. The partnership will provide clients with access to Protium's green hydrogen expertise, in combination with Petrofac's EPC capability and experience, for future green hydrogen projects. The two companies will leverage Petrofac's technical engineering expertise during the early phases of Protium's projects with the aim of delivering the full EPC offering to shared clients. This includes projects involving the development of renewable energy assets, green hydrogen production facilities and downstream hydrogen equipment. Protium and Petrofac are already actively pursuing a number of commercial green hydrogen projects around the UK, as well as jointly bidding on multiple government-funded programs to demonstrate the technical and commercial effectiveness of green hydrogen solutions. Petrofac has already established a foothold in the green hydrogen space after being awarded a FEED contract for Infinite Blue Energy Group's (IBE) Arrowsmith Hydrogen Project in Australia in October 2020. (IHS Markit Upstream Costs and Technology's William Cunningham)

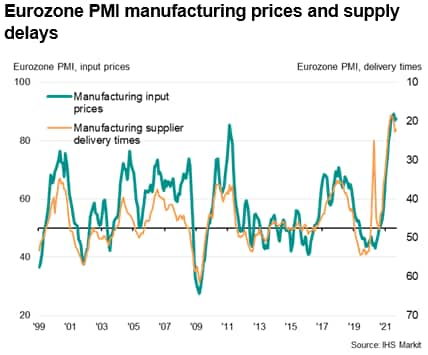

- The headline IHS Markit Eurozone Composite PMI® fell sharply in

September, dropping from 59.0 in August to 56.1 to indicate a

further cooling of the rate of expansion from July's 15-year high,

according to the 'flash' reading, which is based on around 85% of

usual replies. (IHS Markit Economist Chris

Williamson)

- The latest increase in business activity was the smallest since April, albeit still well above the survey's pre-pandemic long-run trend (the index averaged 53.0 prior to COVID-19) to signal another month of above-average strong growth.

- Suppliers' delivery times, a key gauge of supply chain delays in the manufacturing sector, lengthened at an increased rate in September, continuing to extend to a degree greatly exceeding anything seen prior to the pandemic.

- Higher costs were commonly passed on to customers. Measured

overall, selling price inflation accelerated in September, rising

to the third-highest rate seen over the past two decades, exceeded

only by the increases seen in June and July.

- BMW and Audi are continuing with hydrogen fuel-cell passenger car research and development (R&D) programs despite an increasing weight of opinion from other German industry players doubting the commercial viability of the technology. Hydrogen fuel cell vehicles have been developed by OEMs as experimental prototypes for more than three decades now. The prospect of a zero-tailpipe emission vehicle powered by hydrogen has long been attractive to engineers, although the practical challenges of making it commercially viable in a real-world environment remain significant. This is especially the case when there is a such a strong direction of travel for the dominant future zero-emissions powertrain technology to be battery electric vehicles (BEVs); billions of dollars of R&D resources have been committed and a large number of vehicles are already on the global market. When BMW announced the iX5 fuel cell vehicle would be demonstrated at the IAA Mobility its press materials contained the following statement: "Provided the hydrogen is produced using renewable energy and the necessary infrastructure is available, this technology can complement the BMW Group's electrified drive train portfolio." These two questions are always the crux of the hydrogen debate. Hydrogen requires a lot of energy to produce and if the source of this energy is not renewable, any environmental benefits are minimal. In addition, the storage and refueling infrastructure is expensive to build and maintain. BMW's fuel cell program has been a major component of its alliance with Toyota, which is arguably the world leader in fuel cell research for passenger cars. (IHS Markit AutoIntelligence's Tim Urquhart)

- France's business sentiment index stands at 111 in September,

slightly above 110 in August (which had been its lowest level in

three months). The index has rebounded strongly since the start of

the year as the economy has gradually reopened and the COVID-19

vaccine rollout has picked up momentum, and it stands well above

its long-term average of 100. (IHS Markit Economist Diego

Iscaro)

- September's improvement in the headline index has been exclusively driven by a somewhat more upbeat assessment in the service trade sector. The related index has risen slightly, mainly due to improving expectations about future activity and demand.

- On the other hand, the confidence index in the manufacturing sector has deteriorated from 110 to 106. This is the first decline in manufacturing confidence since November 2020, and the index now stands at its lowest level since April this year.

- Manufacturing firms have reported falling past production and order books (particularly from abroad), as well as a more downbeat assessment of their personal production expectations. On a more positive note, their views on the general economic outlook and expected workforce size have improved in September.

- Three Nordic companies have collaborated to launch an autonomous public transport service in February 2022 in Norway. Two fully electric Toyota Proaces integrated with Sensible 4's all-weather autonomous software and Holo's data and supervision platform will be deployed in Bodø city in Northern Norway. Mobility Forus will operate the vehicles, which will travel along a 3.6-km route in the city center to support public transportation system. The vehicles will have a safety driver on board to take over operations if necessary. The aim of the project is to examine autonomous shuttle operations in challenging weather conditions as February is the coldest month of the year in Bodø. Sensible 4 specializes in developing autonomous technologies for harsh weather conditions. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Russian government-backed arms manufacturer Almaz-Antey has announced that it is working on a new hydrogen fuel cell passenger car, according to a RBC news report. The new car has the preliminary E-NEVA nameplate, while the company will also develop a compressed natural gas (CNG) powered version of the same design. The hydrogen fuel cell version will have a 52-litre gas fuel system, according to the report, coupled with a 70 kW battery. This will give the vehicle a range of 810 km and it can recharge from the mains electricity supply. The company also provided projected performance figures with acceleration to 100 km/h in 8.5 seconds, with a maximum speed of 180 km/h. (IHS Markit AutoIntelligence's Tim Urquhart)

Asia-Pacific

- Most APAC equity markets closed higher except for South Korea -0.4%; India +1.6%, Hong Kong +1.2%, Australia +1.0%, and Mainland China +0.4%.

- General Motors (GM) has said that it will invest USD300 million in Chinese autonomous vehicle (AV) startup Momenta, reports Reuters. This investment is a strategic partnership that will support GM in building autonomous technologies for future models in China, in collaboration with Momenta. Momenta uses cameras, GPS, and inertial measurement units (IMUs) to generate HD maps by integrating technologies such as deep-learning-based perception and simultaneous localization and mapping (SLAM). The startup has already developed technologies to enable AV operation on highways and city roads and to realize functions such as automatic parking. It has been granted a license to test its robotaxi fleet, which does not require any human input, in Suzhou, Jiangsu province. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Energy trader Vitol has formed a USD250-million joint venture (JV) with Chinese automaker BYD, reports Bloomberg. The JV will offer electric-car fleet services and charging infrastructure in selected markets. Global energy players are looking to diversify their businesses and react to lower demand for fossil fuels that greater electric vehicle (EV) demand will bring. Vitol has invested over USD1 billion in solar and wind energy and other, cleaner fuels. The company has already deployed over 300 electric buses in Bogota (Colombia) and is looking for more opportunities in South America. BYD is currently among the largest manufacturers of battery electric vehicles (EVs) in China. The automaker recently announced plans to build a major plant in China's eastern province of Anhui, which is to have a capacity to assemble 400,000 EVs annually, to help cater to the growing demand for BYD vehicles. The new facility will also produce electric motors, electric control systems, and other key components of EVs. (IHS Markit AutoIntelligence's Surabhi Rajpal)

- DSME has developed a technology to store CO2 captured in ship engines emissions. The company aims to commercialize this technology as soon as possible to help ships in operation to reduce their CO2 emissions. (IHS Markit Upstream Costs and Technology's Jessica Goh)

- Bank Indonesia (BI) has left the policy interest rate - the

seven-day reverse repurchase (repo) rate - unchanged for the

seventh consecutive month at 3.50%. The bank aims to support the

country's economic recovery in the wake of the Delta variant-driven

wave of COVID-19 infections, and to ensure that the Indonesian

rupiah remains stable as the US Federal Reserve Bank gears up for

tapering its quantitative easing programs. (IHS Markit Economist Bree

Neff)

- With inflation remaining below the central bank's 2-4% target range in August and core inflation easing further, the rupiah appreciating modestly alongside healthy foreign-exchange reserves, and reported daily COVID-19 infection rates hitting lows not witnessed for over a year, BI officials felt it prudent to stay the course with monetary policy settings. Therefore, the bank left the primary policy rate unchanged and announced no further major macroprudential policy adjustments, maintaining its focus on ensuring rupiah stability as well as providing liquidity to the economy including through its prime lending transparency program.

- The BI flagged improved mobility measures and rising payment transactions as positive high-frequency data for the short-term economic outlook, with COVID-19 containment measures being progressively unwound as the pace of new daily infections receded in August. As a result, the bank maintains its real GDP growth forecast range of 3.5-4.3% for 2021.

- According to a separate report from Reuters from late August,

the debt monetization arrangement between the BI and the government

- where the central bank agreed to share the burden and forgo

interest payments on a portion of the debt - has been extended into

2022. The BI will buy IDR215-trillion (USD15.1 billion) worth of

bonds in 2021 and IDR224 trillion in 2022, forgoing interest

payments on IDR58-trillion worth of bonds in 2021 and IDR40

trillion in 2022.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-september-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-september-2021.html&text=Daily+Global+Market+Summary+-+23+September+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-september-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 23 September 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-september-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+23+September+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-september-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}