Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 26, 2020

Daily Global Market Summary - 24 April 2020

Friday closed out the week on a relatively calm note compared to how it began on Monday, April 20, when May 2020 Crude oil futures closed well below zero. Overall, the week ended only a bit weaker across equity and credit markets, despite the strong headwinds from March's economic data continuing to show the negative impact that the COVID-19 pandemic had on the world economies and corporate earnings.

Americas

- Major US equity markets began to rally from negative territory around noon today and closed higher on the day; Nasdaq +1.7%, Russell 2000 +1.6%, S&P 500 +1.4%, and DJIA +1.1%.

- 10yr US govt bonds closed flat/0.61% yield.

- Crude oil closed +2.7%/$16.94 per barrel today and ended the week -32.3%.

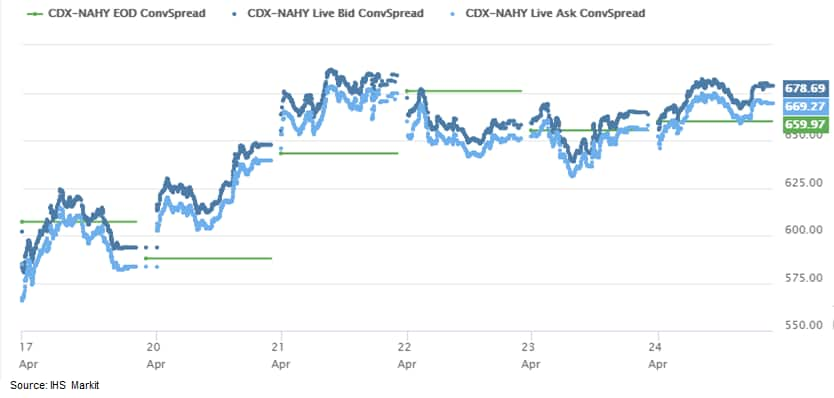

- IHS Markit's CDX-NAHY index closed +14bps/674bps and ended the

week +86bps:

- US manufacturers' orders for durable goods declined 14.4% in March, while shipments fell 4.5%. Inventories of durable goods, on the other hand, rose 0.6%. The decline in shipments was fully accounted for by a sharp decline in shipments of motor vehicles and parts, as auto manufacturers suspended operations over the second half of March in response to concerns over the spread of COVID-19. Roughly two-thirds of the decline in orders was accounted for by nondefense aircraft and parts, where new orders (net of cancellations) turned sharply negative. Indeed, it was reported recently that Boeing customers cancelled orders for 150 737 MAX aircraft in March. Applying an average unit value of $120 million, this would imply cancellations valued at $18 billion, which essentially accounts for the decline in net new orders for nondefense aircraft in March. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- The University of Michigan Consumer Sentiment Index plunged 17.3 points (18.4%) in April to 71.8, the lowest since December 2011 and the largest one-month drop on record (since 1978). The current conditions index fell 29.4 points in April, to 74.3, easily the largest one-month decline on record. The expectations index fell 9.6 points to 70.1. While views on current conditions are usually more favorable than expectations, these two measures aligned closely during and just after the Great Recession in 2009. This April, the difference between the two collapsed from 24.0 points to 4.2, the lowest since November 2009. (IHS Markit Economists David Deull and James Bohnaker)

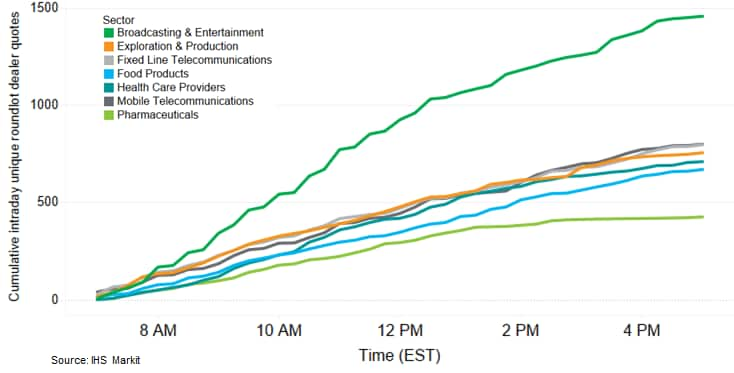

- Parsed dealer quote data from IHS Markit's iBoxx USD Liquid

High Yield Index indicate that today's quote activity in the was

dominated by broadcasting and entertainment issues as indicated by

the graph below. The graph shows the cumulative count of unique

round lot (size ≥$1 million) dealer quotes every 15 minutes during

the trading day. It's not shown in the graph, but Tuesday had the

lowest volume of unique intraday quotes (9,637) across the US high

yield sector and Wednesday had the highest (14,850) this

week.

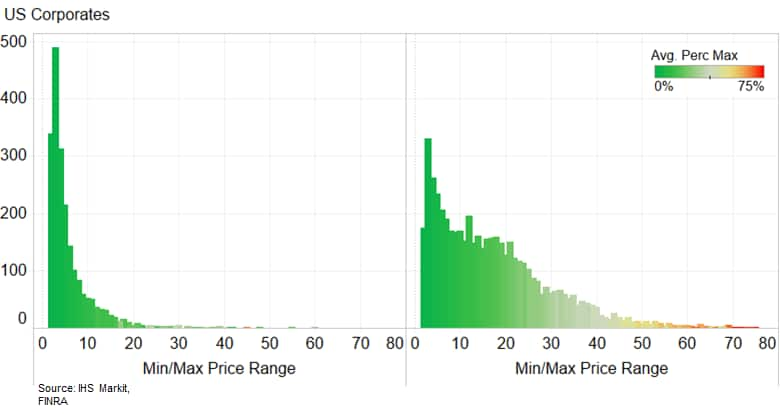

- As a follow-up to Thursday's chart on leverage

loan price dispersion in March, the below chart compares the

highest and lowest US corporate bond trades (size ≥$1 million) on

individual bonds during the months of February and March. The

x-axis indicates the number of individual bonds that had a given

max-min bid price range and the color indicates the range's average

percentage of the highest bid. Similar to leveraged loans, the data

illustrates the unusually high degree of price dispersion that

occurred in the US bond market last month.

- Corn futures had to respond to the welter of bearish news from the crude oil market this week, nearby CBOT futures nudging the psychologically key USD3/bu 'floor' for the first time since 2016. To find prices much below USD3, requires a trip back to 2006 when the market was recovering from a near ten-year stretch nearer USD2 than USD3. Surprisingly, those lows were followed within less than three years by highs in excess of USD8 after some crop failures in the interim. Traders will also be watching export markets, where some key importers, especially South Korea in recent weeks, have been responding to cheap corn offers by stocking up. However, the competition here remains strong from South American producers so the US may still finish the season with less trade and higher starting stocks than expected. (IHS Markit Agribusiness' John Buckley

- Agricultural sciences company FMC says it has increased the maximum leverage allowed under its term loan and credit agreements. The maximum allowable leverage ratio will now be 4.25 through 31 December 2020, 4.0 through 21 March 2021, and 3.5 through 30 June 2021. The previous maximum ratio was 4.0 through 31 March 2020, stepping down to 3.5 through 30 June 2020.

- Toyota, General Motors (GM), and Honda have provided new information on their plans for resuming production in the United States following shutdowns amid the coronavirus disease 2019 (COVID-19) virus outbreak. Toyota plans to slowly begin resuming production in the US on 4 May, while Honda has announced it will push back its US production restart to 11 May. General Motors (GM) has indicated it will begin bringing workers back to US plants during the week beginning 27 April to prepare for the restarting of production. United Auto Workers (UAW) union leaders have criticized plans for an early May restart. (IHS Markit AutoIntelligence's Stephanie Brinley)

- As per IHS Markit's Commodities at Sea, during week-16, coal shipments from Hampton Roads (which mostly ships metallurgical coal for the steel mills) is calculated at 488kt (30-Day PACE of 2.1mt); Baltimore shipments are calculated at 319kt (30-Day PACE of 1.4mt). Coal shipments from both the USEC ports have slowed down significantly in the last four weeks. As per IHS Markit's McCloskey, thermal coal supply impacts in the US coal mines are widespread, with idling due to both COVID-19, inventory management, and weak market conditions. However, most of the impacted mines export little or no thermal coal, so the impact to date is small. However, US exports have been expected to trend down sharply anyway, owing to market conditions before COVID-19, declining demand in Europe. (IHS Markit Maritime & Trade's Rahul Kapoor and Pranay Shukla)

Europe/Middle East/ Africa

- The German headline Ifo index, which reflects business confidence in industry, services, trade, and construction combined, has plunged by another record-breaking margin of 11.6 points to 74.3 in April. This is the lowest level ever measured since the index started to incorporate the service sector in January 2005, and it compares with a long-term average of 97.3 and a series high of 104.9 (January 2018). The manufacturing series, which has a history dating back to 1960, is now only a whisker away from its all-time (post-Lehman) low of March 2009, while the sub-index for expectations in the sector is now 20 points lower than at the previous low point in December 2008. (IHS Markit Economist Timo Klein)

- UK Retail sales (including fuel sales) in volume terms decreased by 5.1% month on month (m/m) in March, which was the largest fall in the survey's history. Excluding fuel, retail sales volumes shrank by 3.8% m/m in March and have now fallen in six of the last nine months. The m/m decline in retail spending in March was due to falling sales in clothing stores (down 34.8% m/m) and of household goods (8.0%) and fuel (18.9%). Food stores and non-store retailing were the only sectors to show growth in the monthly volume series in March, with food stores seeing the strongest growth on record, at 10.4% m/m. (IHS Markit Economist Raj Badiani)

- Air Liquide reports a slight 0.6% rise year on year (YOY) in group sales to €5.37 billion ($5.8 billion) for the first quarter on a comparable basis, in line with consensus estimates. The company does not publish quarterly earnings figures. Revenue growth was "particularly strong" in the healthcare sector, almost 10% YOY to €982 million, the company says. The healthcare business is playing "a major role in the fight" against the coronavirus disease 2019 (COVID-19) pandemic, it says. Air Liquide "is taking an active part in the international support effort, whether this entails supplying healthcare facilities with medical oxygen or ventilators, having committed to producing 10,000 ventilators in 50 days in France," says Benoît Potier, chairman and CEO.

- Eni (Rome, Italy) today reported first-quarter results, recording a net loss of €2.93 billion ($3.15 billion), compared with a net profit of €1.09 billion a year earlier. The company says the loss mainly reflects the alignment of the book value of inventories to market prices current at the end of the quarter. Adjusted net profit was €59 million, down year on year (YOY) from €992 million. In response to market conditions, Eni has announced capital expenditure (capex) curtailments of approximately €2.3 billion for 2020, 30% lower than the initial capital budget, and anticipates further reductions of €2.5-3 billion in 2021, 30-35% lower than original plans. Separately, Eni has acquired a 40% interest in Finproject, a company engaged in high-performance formulated polymer applications, to strengthen the product mix by increasing exposure to products that are more resilient to volatility within the chemical industry. Closing is subject to antitrust approvals.

- According to the latest industrial output data from Statistics Finland, output in February continued to marginally contract in annual comparison, while the moderation in the pace of the slide from January brought the average rate of fall to 1.3% year on year (y/y) in January-February, adjusted for variation in working days. Seasonally adjusted output increased by 0.8% month on month (m/m) in February, following a downward-adjusted contraction of 1.3% m/m in January. In addition to the mining sector, good news for the month was mostly related to the performance in Finland's metal and electronics sectors. However, the chemical field failed to grow production, while contraction was particularly steep in the forest industry. The weak February industrial and external trade results match IHS Markit's expectations. The weakness of forestry-sector output and exports was exacerbated by industrial action during the month, as the important paper union was negotiating over its two-year deal on wages and work conditions. (IHS Markit Economist Venla Sipilä)

- London Electric Vehicle Company (LEVC) has told suppliers that it is to suspend payments in the wake of a production stoppage due to the coronavirus disease 2019 (COVID-19) virus outbreak. Sky News reports that it has seen a letter to component suppliers that said, "Despite LEVC's implementation of measures to minimize the impact of the COVID-19 epidemic/pandemic to maintain production and keep its offices and sites open, the situation has now escalated beyond control". IHS Markit AutoIntelligence's Ian Fletcher)

- Volvo Group' financial performance weakened during the first quarter of 2020. During the three months ending 31 March, the company's sales revenues fell by 14.3% year on year (y/y) to SEK91,449 million. Operating income during this period retreated by 47.9% y/y to SEK7,374 million, with negative currency factors amounting to SEK261 million. However, when one-off items are removed, most notably the sale of its stake in WirelessCar during the first quarter, this fall is 43.8% y/y to SEK7,140 million, with an operating margin falling from 11.8% to 7.8%. Overall, income for this period has risen by 55.7% y/y to SEK4,766 million. (IHS Markit AutoIntelligence's Ian Fletcher)

- IHS Markit's iTraxx-Europe investment grade CDS index closed

+2bps/84bps today to end the week only 2 bps wider:

- Brent crude +16.3%/$24.81 per barrel.

- 10yr European govt bonds closed higher across the region; Italy -11bps, Spain -9bps, France/Germany -5bps, and UK flat.

- European equity markets closed lower across the region; Spain -2.0%, Germany -1.7%, France/UK -1.3%, and Italy -0.9%.

Asia-Pacific

- Kia has announced that its net profit plunged 59.0% year on year (y/y) to KRW266 billion (USD215.78 million) in the first quarter of 2020, down from KRW649 billion during the same period of 2019. Operating profit declined 25.2% y/y to KRW445 billion, while sales revenues totalled KRW14.57 trillion, up 17.1% y/y. Kia's South Korean unit accounted for 21.0% of first-quarter sales revenues, while its North American and European operations contributed around 36.5% and 21.7%, respectively. Separately, Kia plans to temporarily suspend production operations at two of its plants in South Korea to keep inventories at manageable levels amid sluggish global vehicle demand due to the COVID-19 virus pandemic, reports the Yonhap News Agency. (IHS Markit AutoIntelligence's Jamal Amir)

- Japan's Consumer Price Index (CPI) held at the February level on a seasonally adjusted basis, and the year-on-year (y/y) rise remained at 0.4% on a non-seasonally adjusted basis in March. The CPI, excluding fresh food (the core CPI), which is the Bank of Japan (BoJ)'s reference for inflation, fell by 0.1% from the previous month and softened to 0.4% y/y. slack demand because of the effect of the spread of the coronavirus disease 2019 (COVID-19) virus lowered the Services Producer Price Index (SPPI) in March, resulting in a decline of 0.3% month on month (m/m) on a seasonally adjusted basis (calculated by IHS Markit), while y/y growth softened from 2.1% y/y in February to 1.6% y/y. (IHS Markit Economist Harumi Taguchi)

- The municipal government of Shanghai published 12 measures on 23 April, aiming to improve consumer confidence and spur consumption demand. These measures cover five aspects of consumption, including online sales, leisure activities, automobile, information technology, and home improvement. To spur local auto sales, Shanghai eased its purchase curbs by adding 40,000 license plates to the city's annual quota in 2020. This accounts for over a third of the 2019 annual quota of 112,000, according to Caixin. Subsidies will also be offered to car owners who scrap their old cars and purchase new ones with higher emission standards. While the city's real GDP contracted by 6.7% year-on-year (y/y) in the first quarter, its value-added of wholesale and retail sector and catering and accommodation sector reported decline of 19.5% y/y and 40.7% y/y, respectively. (IHS Markit Economist Lei Yi)

- Shanghai has revealed its latest action plan to develop new mobility services, reports Gasgoo. The city aims to launch 1 million vehicles for ride-hailing services by 2025. The action plan also encourages the application of intelligent connected vehicle (ICV) in commercial scenarios and explore new transportation models such as robotaxis. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Tomas Pueyo published his assessment of the global COVID-19 pandemic and included what he believes to be the three key drivers of Singapore's second wave of COVID infections occurring now. He points out that the country was quick to ban visitors from Hubei, when there were 6,000 cases there, by January 29th, but (1) failed to ban travelers from Italy, France, Spain and Germany until March 16th. At that time, those countries together had over 50,000 reported cases. In addition, he highlighted (2) Singapore's very manual and inefficient contact tracing process compared to other countries in the region, as well as (3) waiting until April 3 to recommend that people wear masks. (Medium)

- APAC equity markets closed lower across the region except for Australia +0.5%; India -1.7%, South Korea -1.3%, China -1.1%, Japan -0.9%, and Hong Kong -0.6%.

Complimentary Access to Price Viewer

In light of current events, IHS Markit is offering complimentary

access for qualified market participants to our historical cross

asset coverage of global fixed income pricing and liquidity data,

as well as OTC Derivatives data via the Price Viewer web-based data

portal.

Screenshots from Price Viewer are frequently used in this daily report, and corporations use the credit default swap and bond price/yield data to identify potential risks to their supply chains. Please contact data.delivery@ihsmarkit.com today for your complementary access.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-april-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-april-2020.html&text=Daily+Global+Market+Summary+-+24+April+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-april-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 24 April 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-april-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+24+April+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-april-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}