Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 24, 2021

Daily Global Market Summary - 24 February 2021

Major US and European equity indices closed higher on the day, while most APAC markets were lower. US and European government bonds closed sharply lower. European iTraxx and CDX-NA closed slightly tighter across IG and high yield. Tax exempt US municipal bond yields increased for the seventh consecutive day on growing concerns over rising rates. Gold closed lower, the US dollar was flat, and silver, copper, and oil were higher on the day.

Americas

- US equity markets closed higher and the DJIA +1.4% closed at a new all-time high; Russell 2000 +2.4%, S&P 500 +1.1%, and Nasdaq +1.0%.

- 10yr US govt bonds closed +3bps/1.38% yield and 30yr bonds +6bps/2.24% yield, with yields on 10s being as high as 1.43% and 30s as high as 2.30% at 9:40am EST. 10s traded above 1.40% for the first time since 21 February 2020.

- CDX-NAIG closed -1bp/52bps and CDX-NAHY -6bps/292bps.

- DXY US dollar index closed flat/90.18.

- Gold closed -0.4%/$1,798 per ounce, silver +0.6%/$27.86 per ounce, and copper +2.6%/$4.29 per pound.

- Crude oil closed +2.5%/$63.22 per barrel, which is only pennies away from the highest closing price ($63.27 per barrel) in 2020 reported on 6 January that year.

- <span/>Introducing a national US carbon emissions trading system (ETS) would do little to decarbonize high-emission sectors like the steel and cement industries, Microsoft founder and philanthropist Bill Gates said this week at a virtual event hosted by Harvard Book Store to promote his new book on tackling climate change. Gates was asked by OPIS during the 22 February event's question and answer session if the US should follow the lead of the European Union and most recently China in creating an emissions trading system and a US carbon price to try to drive emissions lower. "A national carbon price is a tool and it alone doesn't solve the problem, because we have things like cement and steel where the green premium is way above your dollars per ton in your carbon market," said Gates, whose green premium concept refers to the cost difference between a product that involves emitting carbon and a zero-carbon alternative. Gates will be discussing his book as well as his latest venture, Breakthrough Energy, on 1 March with IHS Markit Vice Chairman Daniel Yergin at the upcoming annual CERAWeek event, which this year is being held virtually. (IHS Markit Climate and Sustainability News' Anthony Lane)

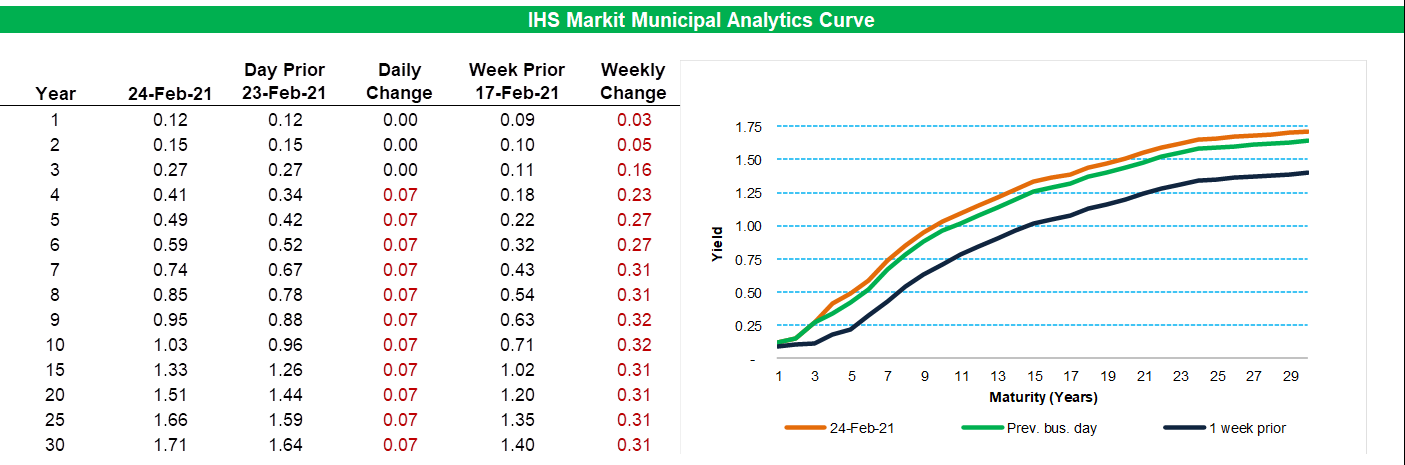

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC)

yields increased for the seventh consecutive day today, closing

+7bps for 4yr and longer paper and is now over +30bps

week-over-week for ≥7yr paper.

- Puerto Rico moved closer to resolving the largest municipal-debt default in U.S. history as creditors owed $11.7 billion coalesced around a settlement, the most Wall Street support yet amassed for a restructuring of the territory's core public debts. Creditors agreed to cut $18.8 billion in general obligation debt by around three-fifths to $7.4 billion, wagering that booming market demand for risky municipal debt will help generate profits for them while easing Puerto Rico's exit from bankruptcy. (WSJ)

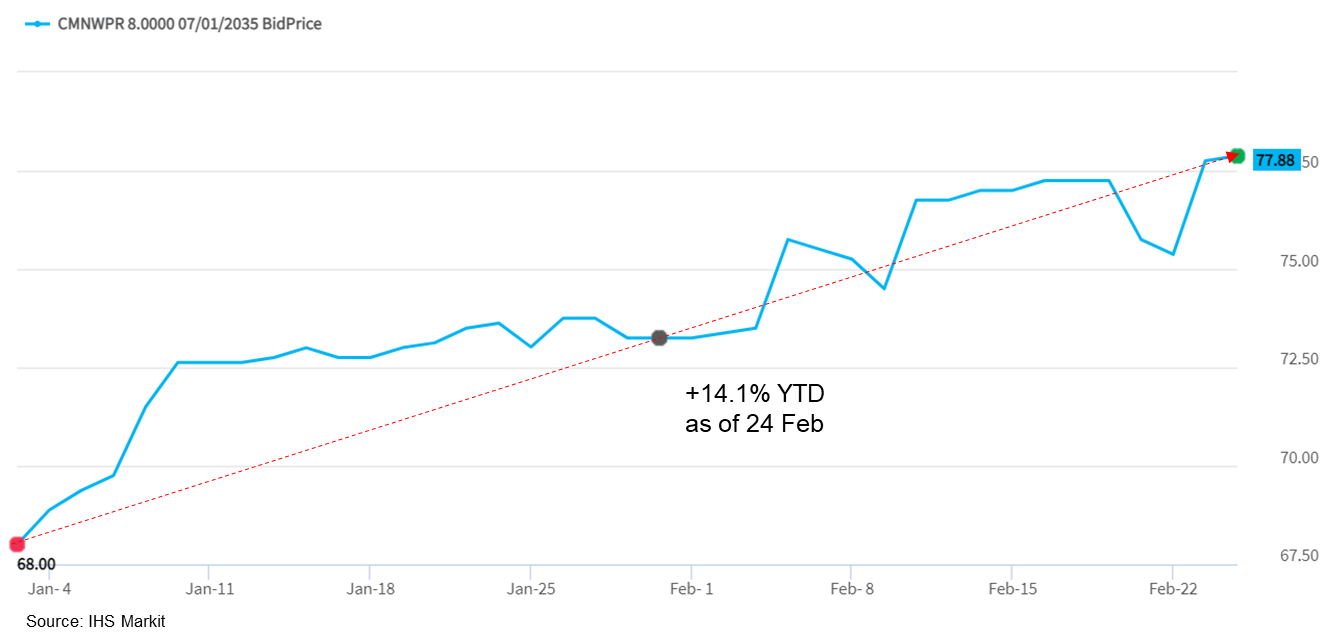

- The Commonwealth of Puerto Rico General Obligation 8.00% 7/2035

benchmark issue closed at a 77.875 price today, which is a price

improvement of +14.1% YTD.

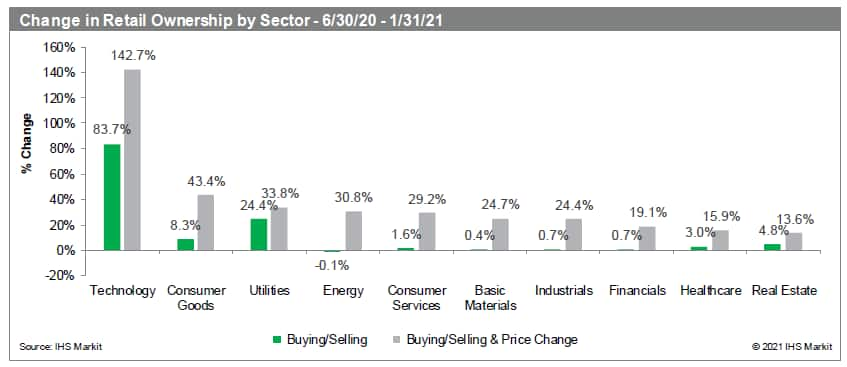

- The last seven months showed a surprising level of consistency

for the online/no-fee retail community in terms of average % of

volume across the $17T in equities IHS Markit advise. (IHS Markit

Global Market Intelligence's Christopher Blake, Brian Manalastas,

and Richard Harrisberg)

- Despite the headlines in the press, the growth in net ownership across almost all sectors largely accounts for just 3-4% of daily trading volume. Worth highlighting, we saw the impact to volume remain pronounced for Small/Micro Cap companies over time.

- Simultaneously, the data shows increasing ownership for the group across almost all market segments on a variable price basis (buying/selling combined with price change), indicating the group were net buyers and consistent with activity during the first half of 2020. This has led the cohort to become relatively larger owners of the market while still having a limited impact to pricing in a broad respect.

- From a pure buying/selling perspective, retail investors were net buyers across almost all major sectors, showing a clear preference for Tech stocks with an overall ownership increase of an astounding 83%, while Utilities (+24.4%) and Consumer Goods (+8.3%) trailed a distant second and third, respectively.

- Note: the percent of volume was calculated looking at daily

ownership changes at no-fee/online brokers. Value does not account

for intraday netting out (buying/selling the same security at the

same broker on the same day) but provides insight into the volume

impact from overall changes in retail ownership.

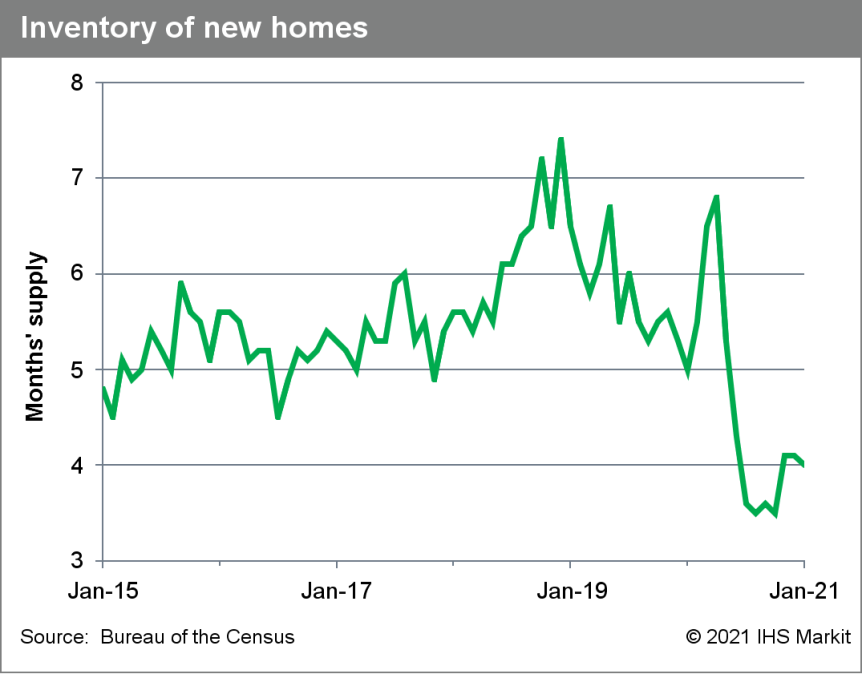

- US new home sales increased 4.3% in January (±18.1%, not

statistically significant) to a seasonally adjusted annual rate of

923,000. (IHS Markit Economist Patrick Newport)

- Sales for the previous three months were revised up 69,000. (Note: About one-fourth of new home sales are imputed—these are homes sold before a permit is issued. Imputed sales account for most of the data revisions to new home sales.)

- The three-month average—882,000 units—is edging down. (Note: The three-month estimates are more informative than the monthly estimates because averaging reduces statistical noise.)

- After hardly any growth since 2017, new home prices are edging up. The three-month average median price was up 6.4% from a year earlier; the average price (three-month average) was 4.4% year on year higher. The monthly average price climbed to a record $408,800.

- The Census Bureau's monthly construction cost index (three-month average) was up 5.5% in January—so builders' profit margins in a red-hot market are not rising—according to Census Bureau data.

- On 24 February, the Census Bureau also released housing permits

data at the state level for January. In the past six months,

builders have taken out 532,000 permits for single-family homes.

Five states accounted for 45% of the total: Texas (16.0%), Florida

(12%), California (6.3%), North Carolina (5.6%), and Georgia

(4.8%).

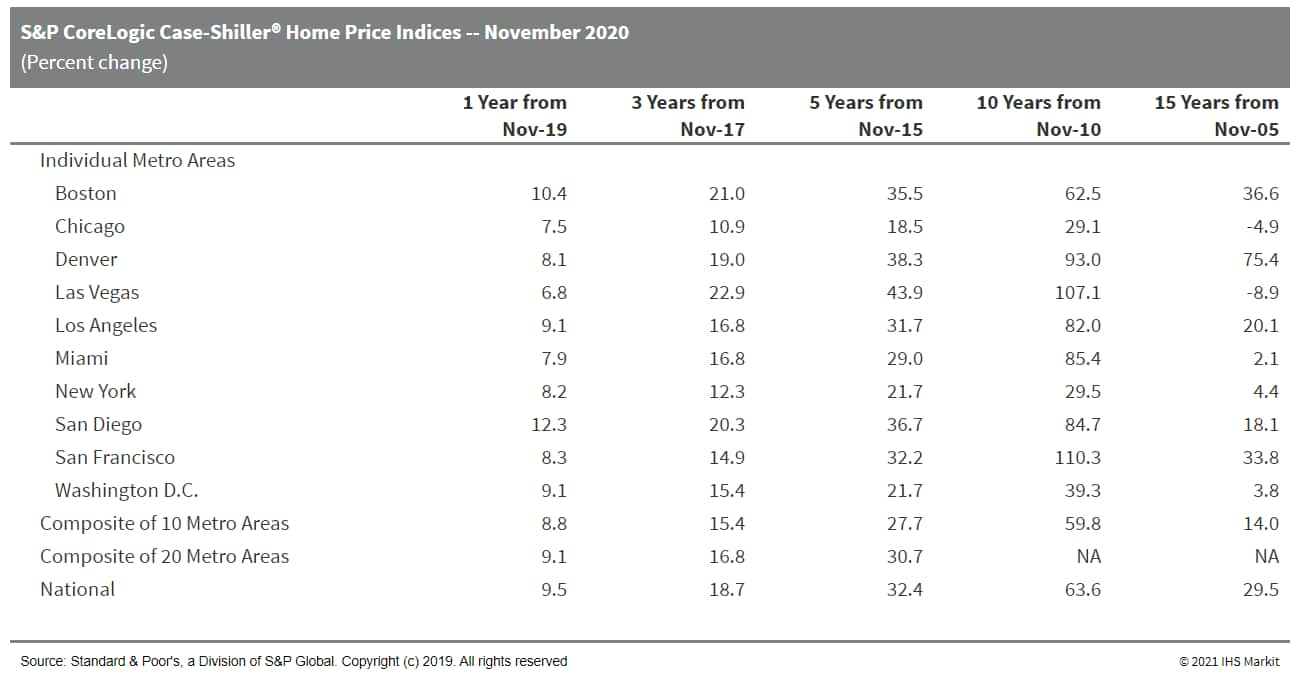

- According to S&P CoreLogic Case Shiller indices, monthly US

home price growth decelerated slightly in December but remained

extremely strong. The 10-city index was up 1.2% month on month

(m/m) in December, while the 20-city index was up 1.3% m/m. (IHS

Markit Economist Troy Walters)

- Monthly price appreciation was again positive in all 19 cities reporting. With the exception of Portland and San Francisco, price gains were at the 1.0% mark or higher.

- In year-over-year (y/y) terms, home prices grew at a faster pace in December, with gains in both indexes at or near double digits. The 10-city composite index was up 9.8% y/y. The 20-city index was 10.1% higher than one year earlier.

- Annual price appreciation was positive in all 19 cities covered. Gains are in double-digit territory in Boston (11.4%), Washington DC (10.3%), Charlotte (10.2%), Tampa (10.7%), Cleveland (11.5%), Minneapolis (10.2%), Seattle (13.6%), Phoenix (14.4%), and San Diego (13.0%).

- Growth in the national index reached 10.4% y/y in December

- The United States Postal Service (USPS) has awarded a 10-year contract for postal delivery vehicles to Oshkosh Defense. According to a statement from the USPS, Oshkosh will finalize the design of the new vehicle and then deliver between 50,000 and 165,000 units over the course of a decade. The first batch of vehicles is expected to be on the postal delivery fleets in 2023. The vehicle gets a generic and purposeful name: Next Generation Delivery Vehicle (NGDV). The contract has an initial investment of USD482 million, which will include plant tooling and build-out for the facility where final assembly will occur. The propulsion system does not appear to be finalized. According to the USPS, the NGDVs will have either fuel-efficient internal combustion engines or battery electric propulsion systems, and "can be retrofitted to keep pace with advances in electric vehicle technologies". (IHS Markit AutoIntelligence's Stephanie Brinley)

- Magna will build a new USD70-million plant in the US state of Michigan to support production of battery enclosures. According to Magna's company announcement, the plant will support production of General Motors' (GM) upcoming new Hummer by GMC full-size electric truck and SUV. The plant will be located in St Clair (Michigan), and named Magna Electric Vehicle Structures. Over five years, the company expects to bring more than 300 jobs to the plant. Magna notes that the enclosure contributes to structural and safety of the vehicle's frame and protects the high-voltage batteries from damage and water. Although the initial production is for GM's new full-size truck, Magna says it can develop the advanced assemblies in steel, aluminum, and multi-material configurations, suggesting that the investment is expected to have opportunity to support other projects at GM or other automakers. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Nikola has outlined its latest plans for its North American medium and heavy hydrogen fuel-cell electric vehicle (FCEV) truck line-up, including plans for the Nikola Tre FCEV Cabover and Nikola Two FCEV Sleeper. The introduction of the Tre FCEV and Two FCEV is expected to follow the launch of North American production of the Tre battery electric vehicle (BEV). Nikola also notes that it expects the Two FCEV Sleeper to provide a range between 300 and 900 miles, providing best-in-class efficiency for long-haul freight solutions. The company said that the Two FCEV Sleeper will be based on a new custom chassis designed for the North American long-haul routes; it expects to launch it in late 2024. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Frozen food sales rose 21% year-on-year to USD65.1 billion in 2020 across the US with all meal occasions and categories contributing to the impressive growth, according to a report released by the American Frozen Food Institute (AFFI) and FMI—the Food Industry Association. During the early weeks of the pandemic in mid and late March, frozen food sales nearly doubled. In subsequent months, sales tracked 30% to 40% ahead of a year ago. Gains have slowly tapered off to around 15-20% above 2019 levels in the fourth quarter of 2020 — continuing to be well ahead of most other categories. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

- Peru's economy ended 2020 with a stronger-than-anticipated

fourth quarter, fueled by fiscal stimulus and led by government

consumption and fixed investment. Quarterly output was just 1.7%

lower than in 2019, helping to lift the economy out of a historic

downturn. (IHS Markit Economist Jeremy Smith)

- Exports improved the least among all aggregate demand categories, remaining 11.2% below 2019 levels. Although copper prices soared in the second half of the year, bolstering government revenues and the current-account balance, copper exports fell by 9.7% y/y in real terms because of lower volume.

- Imports recovered to -5.2% y/y, making net exports a drag on growth in the fourth quarter.

Europe/Middle East/Africa

- European equity markets closed modestly higher; Germany +0.8%, Italy +0.7%, UK +0.5%, France +0.3%, and Spain +0.2%.

- 10yr European govt bonds closed lower; Italy +5bps, Spain +3bps, and France/Germany/UK +2bps.

- iTraxx-Europe closed -1bp/49bps and iTraxx-Xover -3bps/251bps.

- Brent crude closed +2.6%/$66.18 per barrel.

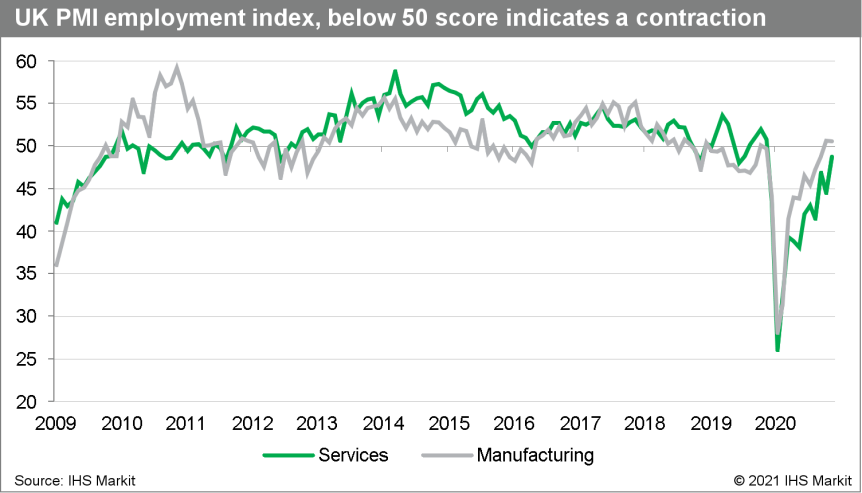

- According to the UK's Office for National Statistics (ONS), the

early estimate for January 2021 suggests that the number of workers

on payroll plunged by 2.7%, or 726,000, since February 2020. The

highest incidence of job losses during the COVID-19 virus crisis

involved workers younger than 25 years, estimated at 425,000. (IHS

Markit Economist Raj Badiani)

- More encouragingly, the number of payrolls rose for a second successive month when it increased by 0.3% month on month (m/m) or 83,000 m/m in January after falling in the previous nine months.

- The claimant count, which measures the number of people

claiming benefit principally for being unemployed, increased to 2.6

million in January, representing an increase of 109.4%, or 1.36

million, since March 2020. The claimant count also includes the

increasing number of people becoming eligible for

unemployment-related benefit support despite still being

employed.

- Kia Motors has launched an integrated public charging service for electric vehicles (EVs), called KiaCharge, in the UK. The service gives owners of Kia's BEVs (battery electric vehicles) and PHEVs (plug-in hybrid electric vehicles) access to more than 13,900 charge points across the UK, including more than 1,300 rapid chargers. This service covers around 68% of public chargers and gives access to range of charging networks including bp pulse, Pod Point, IONITY, Source London, Chargepoint, NewMotion, Char-gy, and ESB, from a single account. The scheme also allows drivers to use more than 178,000 additional charging points across 28 other European countries. (IHS Markit Automotive Mobility's Surabhi Rajpal)

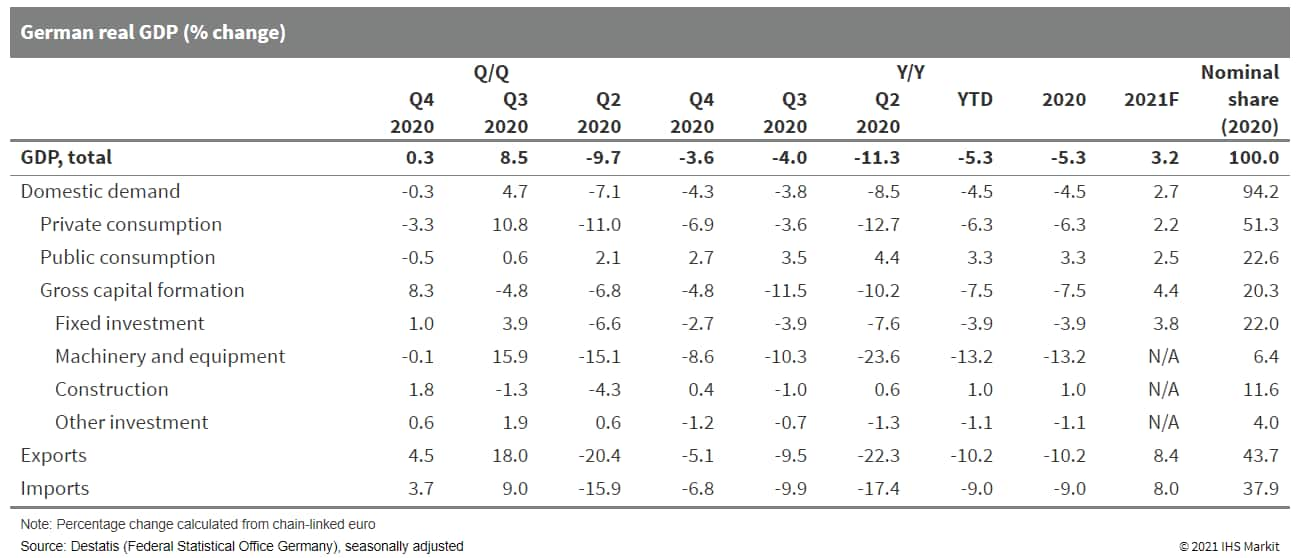

- German GDP increased by 0.3% q/q in the fourth quarter of 2020,

revised up from an initially released 0.1% q/q and extending the

third-quarter rebound of 8.5%. This means that about two-thirds of

the plunge in GDP during the first half of 2020 was recouped in the

second half of the year. In 2020 overall, GDP contracted by 5.3% in

calendar-adjusted terms and by 4.9% in non-adjusted terms. (IHS

Markit Economist Timo Klein)

- German automotive industry supplier ZF Friedrichshafen, in partnership with Chinese automaker Dongfeng Motor, has launched its Level2+ semi-automated driving system, called coASSIST. The system, which is integrated on the 2020 Dongfeng Aerolus Yixuan, meets Euro NCAP 2025 test protocols. The system uses camera technology from Mobileye and short-range radars from Hella to enable functions such as adaptive cruise control, traffic sign recognition, lane change assist, and lane keeping assist. In future, the coASSIST system will also be equipped with ZF's medium-range Gen21 radar. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Continental has acquired a stake in German-US startup Recogni, which is working on a new chip architecture for object recognition in real time based on artificial intelligence (AI), according to a company statement. Recogni is developing technology that serves as what is described by Continental as an 'ultra-economical data booster': with minimal energy consumption, they enable vehicle computers to gain a detailed sense of a vehicle's orientation and surroundings. (IHS Markit AutoIntelligence's Tim Urquhart)

- France's business sentiment index has fallen by 1 point to 90 in February, reaching its lowest level in three months. Sentiment had been very volatile during the fourth quarter of 2020, declining from 90 in October to 79 in November as COVID-19 virus-related restrictions were tightened. Confidence subsequently recovered to 91 in December following the unwinding of some of the measures in late November. The index remains well below its long-term average of 100. (IHS Markit Economist Diego Iscaro)

- Gaussin has partnered with Bluebus to develop autonomous vehicles (AVs) for on-road applications. Under this partnership, Gaussin has purchased 10 units of Bluebus' 6-metre electric vehicle (EV), to transform them into AVs. The Bluebus 6-metre, which is a passenger transport solution, has capacity for 22 people and is integrated with lithium metal batteries. Gaussin also announced that it has completed acquisition of the autonomous control system from an undisclosed automotive engineering giant. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- South Africa's unemployment rate increased to 32.5% in the

fourth quarter of 2020, the highest reading since the inception of

Statistics South Africa's (Stats SA)'s Quarterly Labour Force

Survey in 2008. (IHS Markit Economist Thea Fourie)

- A marginal rebound in the 333,000 jobs (formal and informal) created during the fourth quarter of 2020 was not enough to offset the expansion of South Africa's labor force and job losses incurred during the previous quarters of the year. Overall, the number of employed people went down by 1.4 million during 2020.

- All sectors in the South African economy reported job losses during 2020 with the biggest cuts made in the finance (256,000), community and social services (241,000), trade (186,000), and construction (184,000) sectors. The agriculture (75,000), mining (46,000), and utilities (21,000) sectors recorded the smallest job losses during the year.

Asia-Pacific

- Most APAC equity markets closed lower except for India +2.1%; Hong Kong -3.0%, South Korea -2.5%, Mainland China -2.0%, Japan -1.6%, and Australia -0.9%.

- NIO has completed validation and started testing its second-generation battery swapping stations, reports Gasgoo. The startup is expected to begin launching these new service stations across China in April. NIO revealed its plan to launch its second-generation battery swapping station in January during the unveiling of the ET7 sedan. The new battery swapping system does not require the driver to leave the vehicle, and the vehicle can also automatically park into the service area, ensuring fast service. (IHS Markit AutoIntelligence's Abby Chun Tu)

- SsangYong has again extended a production suspension at its Pyeongtaek plant owing to a lack of parts from suppliers. Production at the facility will remain suspended on 25 and 26 February, reports the Yonhap News Agency. The automaker already halted operations at its plant for two days in December 2020 and for 14 days this month after its subcontractors refused to deliver parts because of outstanding payments. The automaker will continue to negotiate with subcontractors to resume the halted supply of components. As 1 March is a public holiday in South Korea, SsangYong aims to resume operations at the plant on 2 March. (IHS Markit AutoIntelligence's Jamal Amir)

- Hyundai Motor Group has selected China's CATL and South Korea's SK Innovation as suppliers of batteries for its electric vehicles (EVs), reports Business Korea Daily News. The two companies will supply batteries for EVs based on the E-GMP platform, which Hyundai and Kia will launch after 2023. The total value of the contract is around KRW9 trillion (USD8.1 billion). CATL took more than half of the order volume, according to the report. Hyundai Motor Group plans to expand its EV line-up from the current 8 models to 23 by 2025 and aims to sell 1 million EVs annually in global markets. In December 2020, Hyundai said that it would invest KRW60.1 trillion (USD54.1 billion) by 2025 to strengthen its EV line-up, and that it aimed to capture an 8-10% share of the global EV market by 2040. (IHS Markit AutoIntelligence's Jamal Amir)

- Hyundai Mobis has developed a new rear lamp system called "HLED", which can be bent like a thin film, according to a company press release. Hyundai Mobis claims to be the first company in the world to have developed such a system that can serve as both tail lamp and stop lamp simultaneously. The new HLED generates a bright and uniform stop light even when it is bent by emitting light in five different directions. As a result, the rear lamp will be more visible to the drivers of vehicles approaching from the rear and side. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-february-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-february-2021.html&text=Daily+Global+Market+Summary+-+24+February+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-february-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 24 February 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-february-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+24+February+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-february-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}