Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 24, 2021

Daily Global Market Summary - 24 June 2021

All major European and US equity indices closed higher, while APAC markets closed mixed. US government bonds closed mixed and most benchmark European bonds were higher. European iTraxx and CDX-NA closed slightly tighter across IG and high yield. Oil and natural gas closed higher, the US dollar was flat, and gold, copper, and silver were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Major US equity indices closed higher, with the Nasdaq +0.7% and S&P 500 +0.6% closing at new all-time record highs; Russell 2000 +1.3% and DJIA +1.0%.

- 10yr US govt bonds closed +1bp/1.49% yield and 30yr bonds -1bp/2.10% yield.

- CDX-NAIG closed -1bp/48bps and CDX-NAHY -3bps/276bps.

- DXY US dollar index closed flat/91.81.

- Gold closed -0.4%/$1,777 per troy oz, silver -0.2%/$26.05 per troy oz, and copper -0.5%/$4.31 per pound.

- Crude oil closed +0.3%/$73.30 per barrel and natural gas closed +2.5%/$3.44 per mmbtu.

- President Biden and a group of centrist senators agreed to a roughly $1 trillion infrastructure plan Thursday, securing a long-sought bipartisan deal that lawmakers and the White House will now attempt to shepherd through Congress alongside a broader package sought by Democrats. With $579 billion of spending above expected federal levels and a total of $973 billion of investment over five years and $1.2 trillion if continued over eight, the agreement will make new investments in the electrical grid, transit, roads and bridges and other forms of infrastructure. (WSJ)

- The Senate today (June 24) overwhelmingly approved a bipartisan climate bill to create a USDA-certification program to help farmers enroll in carbon markets and ensure the ag sector is rewarded for adopting climate-friendly practices. The Growing Climate Solutions Act passed by a vote of 92-8, the strong support for the measure a rare sign of bipartisanship touted by proponents. The potential financial benefits of carbon credits "hold a great deal of promise, however, producers and landowners must navigate a complex and costly landscape in order to access these markets," said Boozman, a co-sponsor and ranking member of the Senate Ag Committee. "The Growing Climate Solutions Act provides a framework for producers to access technical assistance, guidance and resources in these emerging markets as they investigate whether to pursue this new opportunity." (IHS Markit Food and Agricultural Policy's JR Pegg)

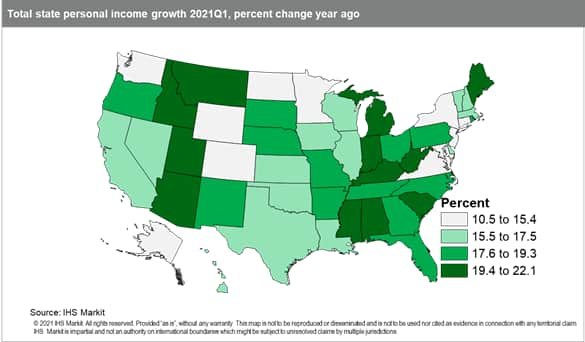

- The first quarter of 2021 saw record-shattering growth in total

state personal income with an unprecedented 59.7% annualized rate

of expansion, topping the prior record of 35.8% set in the second

quarter of 2020. A 548% surge in transfer payment income was the

dominant factor, accounting for 92.6% of the total increase in

state personal income levels. The increase in transfer payments

during the first quarter resulted from the $600 economic impact

payment that was part of the Coronavirus Response and Relief

Supplemental Appropriations (CARES) Act, along with the $1,400

impact payment and temporary increase of $300 per week to state

unemployment insurance that were part of the American Rescue Plan

Act. Net earnings increased a modest 4.4% q/q, while dividends,

interest, and rents were unchanged from the prior quarter. Personal

income grew the fastest in Mississippi (89.3% quarter on quarter

[q/q]), West Virginia (88.3% q/q), and Kentucky (83.4% q/q) where

transfer payments make up a large portion of total income. Growth

was the slowest in the District of Columbia (31.1% q/q),

Connecticut (42.0% q/q), and California (42.8% q/q). (IHS Markit

Economist Alexander Minelli)

- US seasonally adjusted (SA) initial claims for unemployment

insurance fell by 7,000 to 411,000 in the week ended 19 June.

Pennsylvania (up 21,905), California (up 15,131), and Kentucky (up

9,172) were the largest contributors to initial claims in the week

ended 19 June; these states were also the three largest

contributors in the prior week. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs) fell by 144,000 to 3,390,000 in the week ended 12 June, the lowest level since the week ended 21 March 2020. The insured unemployment rate edged down 0.1 percentage point to 2.4%.

- In the week ended 5 June, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) rose by 107,931 to 5,273,180.

- There were 104,682 unadjusted initial claims for PUA in the week ended 19 June. In the week ended 5 June, continuing claims for Pandemic Unemployment Assistance (PUA) dropped by 175,357 to 5,950,167.

- US manufacturers' orders for durable goods rose 2.3% in May,

more than reversing an April decline and continuing along a firming

trend. Shipments of durable goods rose 0.4% in May, and inventories

rose 0.7%. (IHS Markit Economists Ben

Herzon and Lawrence Nelson)

- Each of these indicators reinforces the notion that the goods sector remains hot. Orders and shipments of durable goods remain well above their pre-pandemic levels, and inventories are climbing.

- Spending on goods, more generally, has replaced spending on some services, as households have been cautious about participating in socially dense, service-sector activities.

- As vaccination rates increase, and as local authorities continue to relax restrictions on various social and economic activities (these restrictions are in fact nearly gone), spending on services will firm and spending on goods will retreat. In the meantime, manufacturers are doing all they can to keep pace with elevated demand for goods.

- Manufacturers' inventories were revised higher for April and rose in line with our assumption for May. This added about $5 billion to our second-quarter forecast of inventory investment.

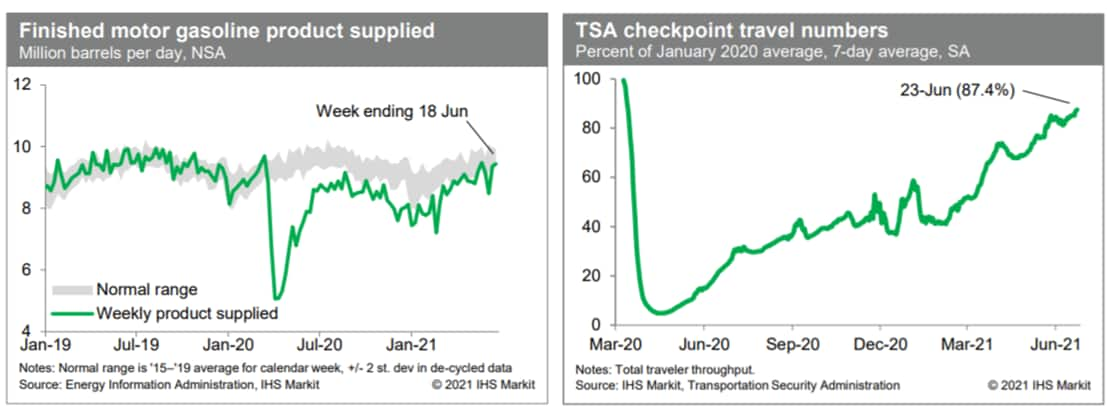

- Consumption of gasoline edged up last week and remains within

the lower portion of a range that we would consider to be normal

for this time of year. This indicates nearly full recovery in

internal mobility. Meanwhile, passenger throughput at US airports

in recent days, seasonally adjusted, has been running at about 87%

of the January 2020 level. Recovery in air travel is nearly

complete. (IHS Markit Economists Ben

Herzon and Joel

Prakken)

- General Motors (GM) and Shell are launching a pilot program to expand access to renewable energy, including providing free charging to owners of GM electric vehicles (EVs) using renewable energy. According to a joint statement from the two companies, the program is to be available to certain customers in Texas, United States, through a wholly owned subsidiary of Shell called MP2 Energy. The statement said that the collaboration would "provide comprehensive energy solutions programs to GM's customers and supply chain partners, including fixed-rate home energy plans backed by 100 percent renewable energy resources". In addition, in mid-2021, owners of EVs from GM brands are to be able to select a home-energy plan including an option of free overnight hours of EV charging. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Motional has introduced an extended public dataset of autonomous vehicle (AV) testing, named nuPlan. The company calls this the world's first benchmark for AV planning, as it includes a large-scale machine-learning dataset and a "virtual driving test" that measures the performance of vehicle planning methods. An expanded version of Motional's nuScenes, which was published in March 2019, nuPlan is to be available to the public later this year. NuPlan's data is not annotated by people and is performed by machines, and the quality is almost same. Furthermore, the collection represents a significant expansion, containing around 500 million pictures and 100 million LiDAR scans. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Embark Trucks is going public through a reverse merger agreement with Northern Genesis Acquisition Corp II, a special-purpose acquisition company (SPAC). The combined entity's value by equity and enterprise is expected to reach about USD5.16 billion and USD4.55 billion respectively. As part of the agreement, Embark Trucks will receive an injection of around USD614 million in gross cash proceeds, including USD414 million from the SPAC and USD200 million from private investment in public equity (PIPE) funding. Mergers with SPACs have become a common way for companies to go public during the COVID-19 virus pandemic, which has badly hurt automotive and mobility businesses. Autonomous vehicle (AV) companies are looking to public markets for financial support as they plan to launch their technology at a commercial scale. Embark takes a different approach to autonomous trucking than other tech firms as it provides AV software as a service, rather than building and running a fleet of trucks itself. Carriers and fleets can pay a per-mile subscription fee to access Embark's services. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The latest data from Argentina's National Institute of

Statistics and Censuses (Instituto Nacional de Estadística y

Censos: INDEC) show that GDP increased by 2.5% year on year (y/y)

in the first quarter of 2021. Correcting for seasonality, GDP

during the first quarter of 2021 increased by 2.6% quarter on

quarter (q/q) after rising by 4.4% q/q in the previous quarter (IHS

Markit Economist Paula

Diosquez-Rice)

- A few sectors recorded a rise in annual terms: activity increased in the construction and wholesale and retail sectors; the most dynamic sector was the financial intermediation sector, which increased by 10.6% y/y.

- GDP data shows significant annual declines in the first quarter for some sectors; for example in mining; utilities; transport and communication; non-profit and social services; education services; and the health sector. The hospitality and restaurants sector posted a decline of 35.5% y/y.

Europe/Middle East/Africa

- Major European equity indices closed higher; Italy +1.4%, Spain +1.3%, France +1.2%, Germany +0.9%, and UK +0.5%.

- Most 10yr European govt bonds closed higher except for France flat; UK -4bps, Italy -3bps, Spain -2bps, and Germany -1bp.

- iTraxx-Europe closed -1bp/46bps and iTraxx-Xover -3bps/227bps.

- Brent crude closed +0.4%/$74.81 per barrel.

- The Renewable Infrastructure Group (TRIG) has partially suspended operations at the 396MW Merkur wind farm pending further investigations into signs of stress fatigue suffered by its GE Haliade-X 160-6MW turbines. According to TRIG, routine inspections discovered; the issue on certain areas of the support structure of the helihoist on some of the turbines. Operations were partially suspended as part of a precautionary measure, with some of the turbines now back online. As the turbines are under warranty, the lost revenue experienced during the downtime will be protected, subject to a cap, and TRIG is not expecting that the cap will be exceeded. The turbines, supplied by GE Renewable Energy, have a 10-year operations and maintenance (O&M) service agreement. GE has acknowledged the issue but pointed out that the affected areas are not part of the primary nacelle frame. (IHS Markit Upstream Costs and Technology's Monish Thakkar)

- SAIC Maxus, a wholly owned subsidiary of SAIC Motor, is shipping 750 electric vans to delivery company DPD in the UK, according to China Daily. The order includes 500 units of 3.5-tonne vans and 250 units of smaller ones. These vans will double DPD's fleet of battery vehicle to 1,500, out of the total number of 8,000 vehicles in its fleet. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- A regulation allowing insect processed animal protein (PAP) to be used for pig and poultry feed will open up 65% of the EU's €50 billion compound feed market, according to the International Platform of Insects for Food and Feed (IPIFF). The European Commission is due to adopt the regulation updating an annex (IV) to a 2001 law to allow insect PAP in pig and poultry feed this autumn, after the regulatory scrutiny period ends in the European Parliament and Council. Insect PAP was already authorised for feed used in aquaculture in 2017 and now it is to be rolled out to pigs and poultry. (IHS Markit Food and Agricultural Policy's Sara Lewis)

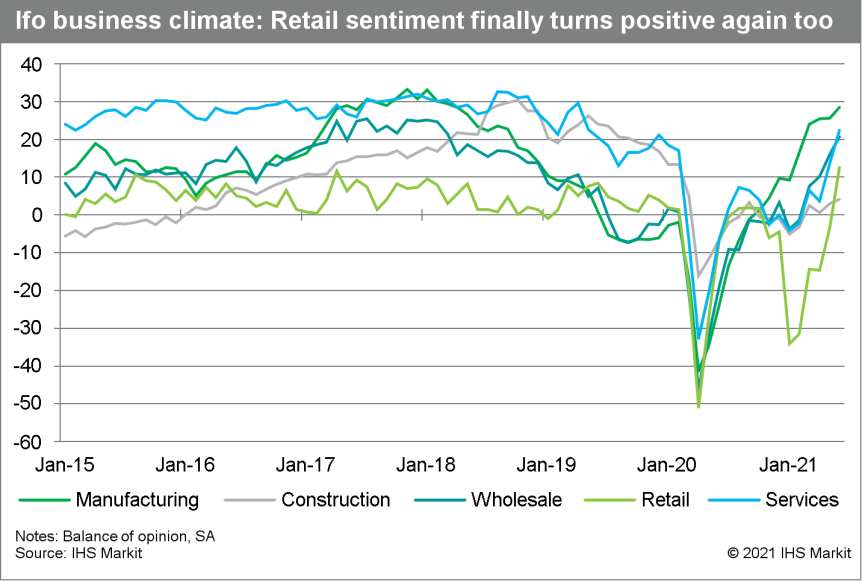

- German business confidence has picked up anew owing to a

substantial loosening of COVID-19-related restrictions. In June,

the headline Ifo index, which reflects business confidence in

industry, services, trade, and construction combined, improved

markedly further from 99.2 to a two-and-a-half year high of 101.8.

(IHS Markit Economist Timo

Klein)

- Improvements were most pronounced in the retail and services sectors, as was to be expected because of the lifting of many restrictions for stores, hotels/restaurants, and the tourism business in response to rapidly declining COVID-19 cases.

- Expectations in the manufacturing and construction sectors improved only slightly, as supply-chain bottlenecks are of increasing concern, either owing to actual shortages of materials or associated large input price increases.

- Business expectations advanced anew from 102.9 to 104.0, with

the pace of improvement thus slowing down. This should not

surprise, as this is a 10-year high already and the series high of

106.1 (November 2010) is coming into sight.

- After media reports on the subject, Audi issued a statement clarifying its intent to release only battery electric vehicles (BEVs) on the global market beginning in 2026, and that it plans to phase out production of its last internal combustion engines (ICEs) by 2033. The statement did not set out specifics of the product plans, but clarified some of Audi's direction. Audi also confirmed that production of its "final completely newly developed combustion engine model will start in just four years. And beginning in 2026, the premium brand will only release new models onto the global market that are powered purely by electricity." However, Audi did not detail when it expects to discontinue production of ICEs or models that use them. The company also notes that it sees demand for combustion engine models in China beyond 2033, and "there could be a supply of vehicles there with combustion engines manufactured locally." (IHS Markit AutoIntelligence's Stephanie Brinley)

- France's business sentiment index has risen by 5 points to 113

in June, reaching its highest level since mid-2007. The index had

rebounded strongly from 96 to 108 in May, as COVID-19-related

restrictions were eased. (HIS Markit Economist Diego

Iscaro)

- June's rise in the composite index has been mainly driven by improved sentiment in the service sector. The service sector confidence index has risen from 107 to 113, boosted by respondents' more upbeat view on the general economic outlook, and more positive expected activity.

- Service-sector firms' expected selling prices also rose sharply in June, standing above their long-term average for the second consecutive month. Confidence has improved among all the service sub-sectors, although it increased particularly sharply in accommodation/food.

- The easing of restrictions also led to a sharp increase in sentiment in the retail sector. The index has stood at 113, its highest level since the beginning of the series in 1991.

- Confidence in the manufacturing sector has remained stable in June, following five successive increases. While manufacturers reported improved order books and brighter general economic expectations, their assessment of their past activity was less positive than in May.

- The 1,400-metric-ton substation topside for RWE's 342 MW Kaskasi wind farm development in the German North Sea has arrived at Bladt Industries Aalborg, Denmark site for further outfitting with the electrical equipment. The substation topside was shipped from Energomontaz-Pólnoc Gdynia's (EPG) assembly yard in Gdynia, Poland. Bladt was awarded the turnkey engineering, procurement, construction, and installation (EPCI) contract for the substation in April 2020, with the offshore installation scheduled in the first half of 2022. The contract is being executed in cooperation with Semco Maritime and ISC Engineering. RWE (ex-Innogy) also awarded Bladt a contract for the fabrication and design of the 38 monopile turbine foundations to be installed on the development. (IHS Markit Upstream Costs and Technology's Jie Sheng Aw)

- The Monetary Policy Committee of the National Bank of Georgia

(NBG) in its June monetary policy meeting decided to leave the

refinancing interest rate unchanged at 9.5%. Before this, it had

increased the policy rate by 100 basis points in May and by 50

basis points in April, in a monetary tightening turn following the

cumulative rate cuts of 100 basis points during 2020. (IHS Markit

Economist Lilit

Gevorgyan)

- The latest inflation from the National Statistical Service of Georgia (GeoStat) show that consumer prices in May increased by 7.7% year on year (y/y), after rising by a sharply accelerated rate of 7.2% y/y in both March and April. The surge of over 17% y/y in transport service prices contributed 2.1 percentage points to the annual inflation rate, while the growth of both utility and food prices had around a 1.1-percentage-point impact.

- The MPC also notes signs of significant recovery of aggregate demand, supported by accelerating credit growth and continuing fiscal stimulus.

- However, the central bank adds that the recently increased external foreign currency inflows are counterbalancing the above factors, by contributing to "positive dynamics in the foreign exchange market". Thereby they undoubtedly reference the recent strengthening of the lari, which suppresses the risk of imported inflation, given that the pass-through of depreciation to inflation is still very direct in Georgia, due to the country's high dependence on imports for both consumption and investment goods.

- Israelis can expect to start donning masks again and the country has put off the reopening of its borders to foreign tourists, after its bid to return to a post-Covid normal was hobbled by a surge in infections linked to the highly transmissible delta variant. New cases were down to the single digits in mid-June, but this week topped 100 for three days straight. Most of the new cases have been unvaccinated children and people returning from abroad. Some of the sick had been fully vaccinated with the Pfizer-BioNTech vaccine. (Bloomberg)

- South Africa's headline inflation rate accelerated to 5.2% y/y

in May from 4.4% y/y in the previous month, meaning that the

official inflation rate is now well above the mid-point of the 3-6%

target range of the central bank. (IHS Markit Economist Thea

Fourie)

- The transport component added a full 2.0 percentage points to the annual rise in headline inflation, followed by food and non-alcoholic beverages at 1.2 percentage point and the alcoholic and tobacco category at 0.7 percentage point.

- The steep drop in global oil prices during April-May 2020 left the base of comparison for fuel prices in April-May 2021 exceptionally low. As a result, transport costs increased by 15.3% y/y in May.

- 'Core' inflation, excluding food, fuel, and energy, showed no month-on-month change and averaged 3.1% y/y during May.

Asia-Pacific

- APAC equity markets closed mixed; India +0.8%, South Korea +0.3%, Hong Kong +0.2%, Mainland China/Japan flat, and Australia -0.3%.

- On 21 June China's central bank, the People's Bank of China,

issued a notice restricting the ability of China's financial sector

to conduct activities related to cryptocurrency. (IHS Markit

Economists Brian

Lawson and David Wilson)

- It stated that virtual currencies "disrupt the normal economic and financial order", since they "breed the risk of illegal cross-border transfer of assets, money laundering and other illegal and criminal activities".

- It specified that they also "seriously infringe the people's property safety", stating that banks and the Alipay payment system must not provide "account opening, registration, and registration for related activities" involving cryptocurrencies.

- In response China's Postal Savings Bank banned use of its accounts to provide "token issuance financing and "virtual currency transactions".

- South Korea's market for carbonated water has grown nearly 29% over the past five years amid growing consumer interest in low-calorie drinks, a state food trade firm said Wednesday. The country's Yonhap news agency says that 24.3 million liters of bottled water were sold in South Korea in 2020, up 28.6% from five years earlier, according to Euromonitor. Euromonitor has projected local sales of carbonated bottled water to reach 28.8 million liters in 2025, up 18.5% from 2020. Last year, Ilhwa Co.'s Chojung Sparkling Water was the top-selling brand with a market share of 30.9%, followed by Lotte Chilsung Beverage Co.'s Trevi with 29.9%. South Korean sales of carbonated soft drinks were 1.27 billion liters last year, up 20.3% from 2015, and the market is expected to reach 1.41 billion liters in 2025. Coca-Cola was the most popular brand with a market share of 23.2%, followed by Chilsung Cider with 17.5% and Pepsi with 7.0%. (IHS Markit Food and Agricultural Commodities' Neil Murray)

- The Urban Air Mobility (UAM) division of Hyundai Motor Group has partnered with ANRA Technologies - a leading international provider of end-to-end drone operations and traffic management solutions for unmanned system operators and airspace managers - to begin developing the operating environment for the advanced air mobility (AAM) industry, according to a company statement. "We are pleased to partner with ANRA Technologies to begin building toward the safe and efficient integration of AAM into existing airspace," said Hyundai Motor Group's UAM division chief operating officer Pamela Cohn, adding, "As an emerging mobility solution, it is critical diverse parties work together to co-create the AAM ecosystem, including its necessary digital and physical infrastructure. ANRA brings a unique background of operational history in the drone services sector that will help define the operating environment for all AAM vehicles". (IHS Markit AutoIntelligence's Jamal Amir)

- Tata Motors has announced three financing solutions for passenger vehicle finance, according to company sources. They are the Red Carpet, the Prime Vishwas, and the Low EMI Scheme, which are designed for use by urban and rural customers who are salaried, self-employed, or have no income proof. These solutions have optional tenure periods depending on the vehicle model chosen by the customer. The Red Carpet plan is for customers with income proof and funds up to 90% of the on-road price with a loan tenure of up to seven years (and pre-payment and part payment facility). The Prime Vishwas plan is for customers with no income proof and provides up to 90% of ex-showroom funding with a loan tenure of up to five years (with an assessment of the person's assets). The Low EMI Scheme is for self-employed and salaried customers and offers 50% low equated monthly instalments (EMIs) for the first three months of vehicle purchase and up to 80% of the on-road price of the vehicle. (IHS Markit AutoIntelligence's Tarun Thakur)

- The Philippine's current account balance returned to a deficit

in the first quarter of 2021, amounting to USD614 million. It

reversed sharply from a surplus of USD4.2 billion posted during the

fourth quarter of 2020 and was also a turnaround from the surplus

of USD225 million recorded during the same quarter a year earlier.

In 2020 as a whole, the current account posted a surplus of USD13

billion, the highest level on record, which was prompted by a sharp

moderation in goods trade shortfall as the plunge in imports

outpaced the drop in exports. (IHS Markit Economist Ling-Wei

Chung)

- Goods imports increased by 10% year on year (y/y) in the first quarter, boosted by higher government spending and stronger international oil and commodity prices. It reversed a 22.9% y/y plunge in 2020 as a whole when the pandemic took a heavy toll on domestic sentiment and spending.

- Imports of capital goods jumped 18.1% y/y in the first quarter of 2021, driven by a 50% y/y surge in telecommunications equipment and electrical machineries as well as a 19.7% y/y increase in manufactured goods. Imports of raw material and intermediate goods jumped 17.7% y/y, and imports of consumer goods expanded by 10.3% y/y.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-june-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-june-2021.html&text=Daily+Global+Market+Summary+-+24+June+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-june-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 24 June 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-june-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+24+June+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-june-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}