Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 24, 2021

Daily Global Market Summary - 24 September 2021

Most major European equity indices closed lower, while US and APAC markets were mixed. US and benchmark European government bonds closed lower for the second consecutive day. CDX-NAIG and iTraxx-Europe closed almost flat on the day, while iTraxx-Xover and CDX-NAHY was modestly wider on the day. Oil, natural gas, copper, and gold closed higher, while the US dollar and silver were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Major US equity indices closed mixed; S&P 500 +0.2%, DJIA +0.1%, Nasdaq flat, and Russell 2000 -0.5%.

- 10yr US govt bonds closed +2bp/1.46% yield and 30yr bonds +4bps/1.99% yield, which is +8bps week-over-week for both tenors.

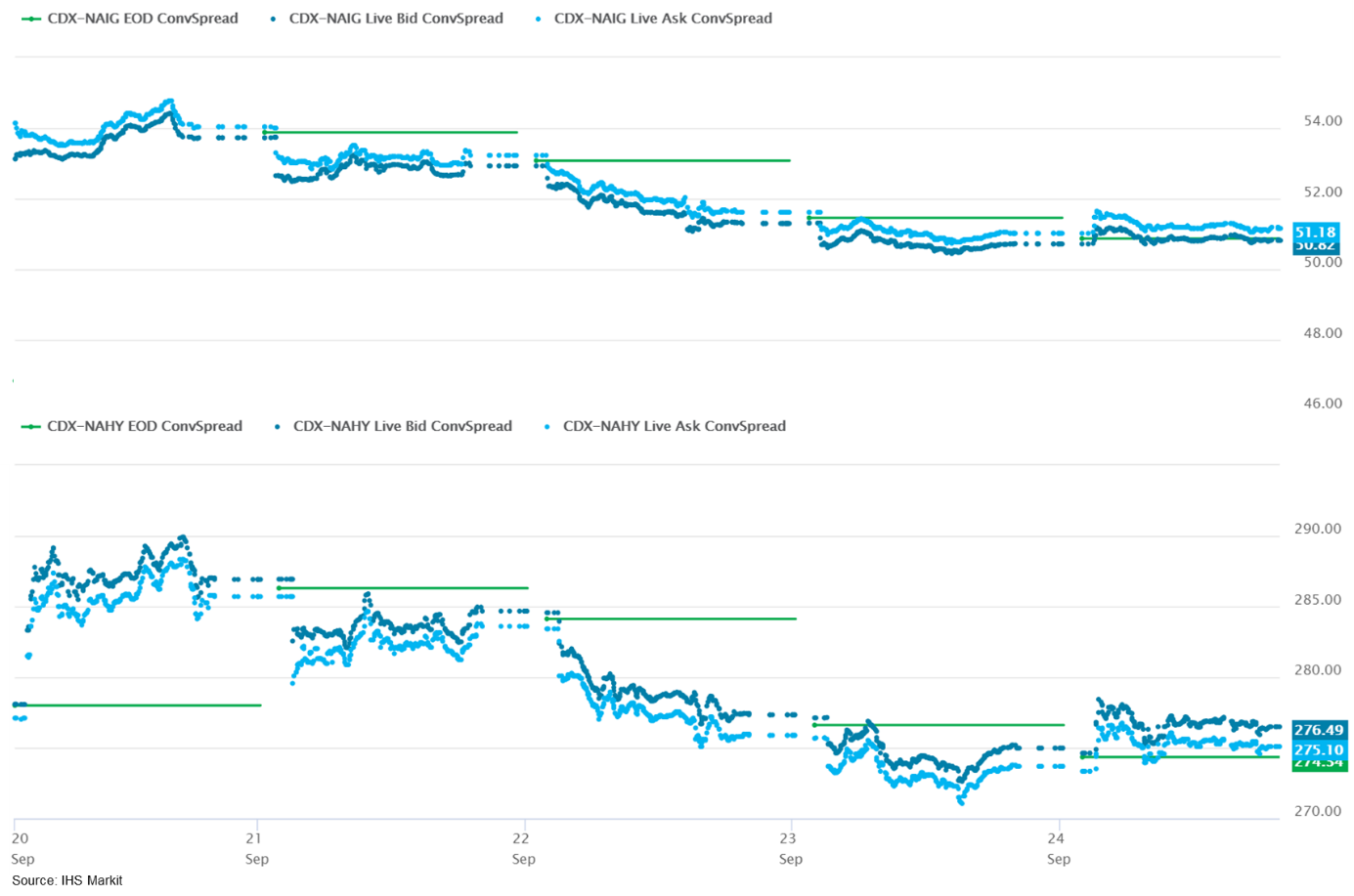

- CDX-NAIG closed flat/51bps and CDX-NAHY +2bps/276bps, with the

latter being -2bps week-over-week (CDX-NAIG 37.1 began trading this

week, so there is no week-over-week comparison).

- DXY US dollar index closed -0.1%/93.33.

- Gold closed +0.1%/$1,752 per troy oz, silver -1.1%/$22.43 per troy oz, and copper +1.3%/$4.29 per pound.

- Crude oil closed +0.9%/$73.98 per barrel and natural gas closed +3.1%/$5.20 per mmbtu.

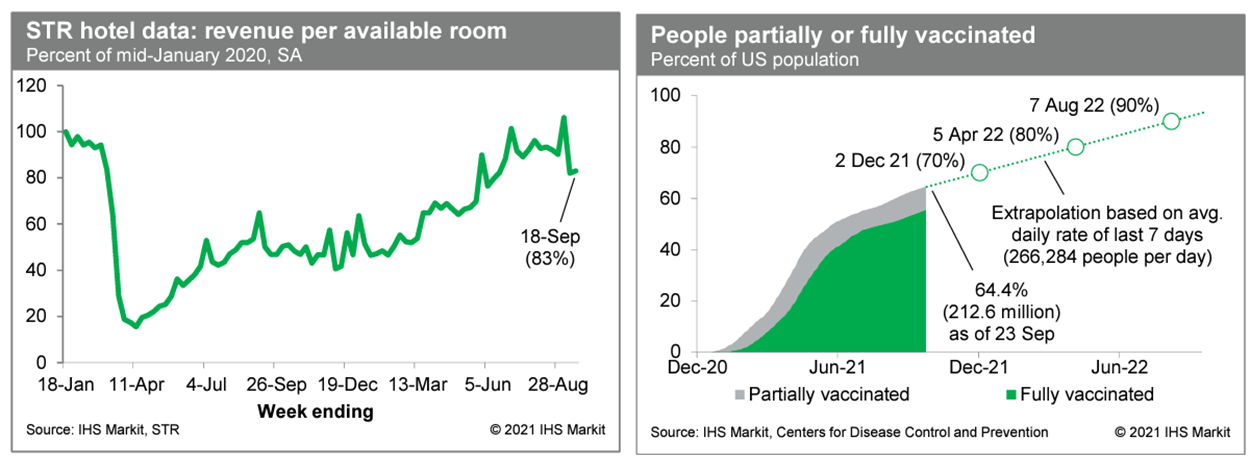

- Revenue per available room at US hotels last week, after

seasonal adjustment, was 83% of the mid-January 2020 level,

according to our estimate based on weekly data from STR. This is

close to the prior week's reading and down materially from levels

in August. Together with readings on airport passenger traffic from

the Transportation Security Administration (TSA), this is pointing

to rising caution on the part of would-be travelers in response to

the Delta surge of new infections. Meanwhile, averaged over the

last seven days, about 266,000 people per day received a first (or

only) dose of a COVID-19 vaccination, down from about 342,000 per

day the prior week. As of yesterday, 212.6 million US residents, or

about 64.4% of the population, were at least partially vaccinated

against COVID-19. (IHS Markit Economists Ben

Herzon and Joel

Prakken)

- US new home sales edged up 1.5% (plus or minus 15.1%; not

statistically significant) in August to a 740,000-unit seasonally

adjusted annual rate. Sales are at pre-pandemic levels but down

from January's 993,000 cyclical high. (IHS Markit Economist Patrick

Newport)

- Only 22% of new homes sold in August were completed—the lowest percentage since January 2005; not-started homes accounted for 36% of homes sold—the highest percentage since December 2005. These two data points suggest that demand is solid and that sales have been dropping this year because builders have been unable to meet demand.

- Sales for May through July were collectively revised up by 18,000 units. Note: about one-fourth of new home sales are imputed; these consist of homes sold before a permit is issued and account for the lion's share of data revisions.

- The median and average new home prices in August were up 15% and 20%, respectively, from a year earlier. From 2016 to just before the pandemic struck in early 2020, new home prices hardly budged.

- Meanwhile, builders' profit margins thinned: the Census's construction cost index for homes under construction, which also came out today (24 September), was up 13.6% from a year earlier in August—its fastest year-on-year pace since July 1978.

- Inventory—the number of homes for sale at the end of the month—rose by 12,000 units to 378,000. Only 36,000 of homes classified as inventory were completed; inventory units still in the planning stage were 105,000.

- A record 31% of new homes sold in August went for $500,000 or more; this is up from 18% in 2019; 9% sold for more than $750,000, also a record.

- Over the next few weeks, Democrats will begin voting on a

series of measures related to the USD1.2-trillion bipartisan

infrastructure bill, the USD3.5-trillion American Families Plan, a

continuing resolution to fund the government, and an extension of

the debt ceiling. (IHS Markit Country Risk's John

Raines)

- Ideological splits between the Democrats are increasing the difficulty to pass legislation. Although Democrats enjoy majorities in both the House of Representatives and in the Senate, their margins are minimal, implying that losing any support jeopardizes the passage of legislation. The tiny majorities increase the power of individual members and small groups, who can block bills unless they obtain their preferred outcomes.

- Currently, the House is set to vote upon the USD1.2-trillion bipartisan infrastructure package on or around 27 September. While several Republicans are likely to back the bill, significant numbers of progressive Democrats, who are needed for its passage, have stated their opposition unless they receive a guarantee from Senate Democrats that they would also pass a separate USD3.5-trillion "social" infrastructure bill aiming to provide a substantial expansion of the country's healthcare, childcare, and education systems, and additional funds for climate change initiatives. That proposal has faced criticism from moderate (more conservative) Democrats owing to its size and scope. Indeed, prominent moderates like Senator Joe Manchin (Democrat-West Virginia) have suggested postponing the legislation until 2022, a move that would almost certain to cause some progressive Democrats to abandon the smaller bipartisan infrastructure bill, at least for now.

- Despite these major differences, IHS Markit expects that both bills will eventually pass, although the social package is likely to be reduced. Both proposals enjoy wide popular support within the Democratic base, and congressional Democrats are likely to seek to avoid popular perceptions prior to the 2022 mid-term elections that they are unable to pass major legislation despite having majorities in both congressional chambers. However, owing to the wide ideological differences within the party, delays in adoption and passage could easily occur, with the bipartisan bill postponed for days or weeks, and the social infrastructure package unlikely to be finalized until late October at the earliest.

- Publicly traded companies received a "clear and unambiguous

warning" from the US Securities and Exchange Commission (SEC) to

follow decade-old guidelines for voluntary disclosures of

climate-related risks to income, strategy, and operations even as

it crafts a new proposed rule to mandate such reporting. (IHS

Markit Net-Zero Business Daily's Amena

Saiyid)

- The SEC Division of Corporate Finance (DCF) alerted companies 22 September to expect a sample letter "regarding their climate-related disclosure or the absence of such disclosure" if it is not in line with the 2010 Guidance Regarding Disclosure Related to Climate Change.

- In that non-binding guidance, the agency deemed climate impacts to be a material risk, but has just started to scrutinize the reports, given the complaints it has received from investors over inconsistent disclosure.

- The SEC agrees that investors need climate risk reports that are consistent, comparable, and reliable so they can use them to price risk and allocate capital, and cast a proxy vote.

- Attorneys who had viewed the SEC alert told Net-Zero Business Daily that they see it as a warning to companies that might have become complacent about disclosure as they wait for the proposed rule, which is due out at the year's end. They say the SEC is warning companies about the quality of climate risk disclosures, which investors have long complained is inadequate and inconsistent.

- Electric vehicle (EV) maker Rivian is to invest USD4.6 million in its new Service Support Operations Centre near Detroit, Michigan, United States, to support business-to-business and customer services. Automotive News reports that Rivian's planned investment in the center in Plymouth was indicated in a statement by the Michigan state governor, Gretchen Whitmer. The governor's statement said the Rivian investment would create 100 jobs and would receive support from the Michigan Economic Development Corporation (MEDC). (IHS Markit AutoIntelligence's Stephanie Brinley)

- Autonomous vehicle (AV) company Motional has invested in Las Vegas operations to expand testing and research and development (R&D) capabilities, according to a company statement. Motional did not disclose the financial details of its plans, but said this represents its largest operations investment in the Las Vegas area to date. The company plans to triple the size of its closed-course testing facility, double its operations center, and hire over 100 new employees. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- With inflation increasing and approaching 10%, the Central Bank

of Brazil (Banco Central do Brasil: BCB) continues to aggressively

tighten monetary policy. It has just increased the policy rate and

hinted at a similar move for its next meeting. (IHS Markit

Economist Rafael

Amiel)

- At its 22 September policy meeting, the bank increased the policy rate from 5.25% to 6.25%, in response to accelerating inflation: as of the end of August, inflation amounted to 9.7%, well above the central banks' target (3.75% +/- 1.5 percentage points) and very high by most standards.

- Inflation has increased in most parts of the world and Brazil is not an exception: among the global factors pushing up consumer prices are higher commodity prices, supply-chain disruptions, higher oil prices, and increased demand on the rebound of the economy.

- Inflation in Brazil is also due to higher electricity tariffs, as a severe drought has hit the country and reservoir levels of hydropower plants are at critically low levels. The depreciation of the local currency and the pass-through into consumer prices are also factors behind the higher inflationary expectations and inflation itself.

- With inflation above target, the BCB started rising the policy rate in March when it was at 2.0%. This was the fifth time in as many meetings that the BCB increased the rate. The monetary authority assesses that high inflation is temporary but too high to risk a dovish policy, and wants to make sure that it keeps inflationary expectations well anchored.

- Brazilian MPs from the lower house Chamber of Deputies are debating proposed controls on the approval of pesticides and tax exemption on pesticide products in the country, the Parliament's news agency, Agência Câmara de Notícias, reports. The Chamber's Financial Supervision and Control Committee is holding an open hearing this week on proposals that it and the federal court of auditors (TCU) control the release of products and control their tax emptions. The debate was requested by center left Workers Party MP Jorge Solla. Mr Solla voices concern at "the considerable increase" in pesticide registrations in recent years. "Many of these products have already been banned in the EU for almost two decades, for proven harm to human health and the environment," he says. "In 2018, Brazil reached the title of the largest adopter of pesticides on the planet by using about 550,000 tons of active ingredients," he adds. (IHS Markit Crop Science's Robert Birkett)

Europe/Middle East/Africa

- Most major European equity indices closed lower except for Spain flat, UK -0.4%, Italy -0.4%, Germany -0.7%, and France -1.0%.

- 10yr European govt bonds lower; UK +2bps, Germany +3bps, France/Spain +4bps, and Italy +6bps.

- iTraxx-Europe closed flat/49bps and iTraxx-Xover +4bps/243bps

(first week of trading the new 36.1 series, so there is no

week-over-week comparison).

- Brent crude closed +1.0%/$77.23 per barrel.

- The BoE's Monetary Policy Committee (MPC) voted unanimously to

maintain the Bank Rate at 0.1% at its meeting that ended on 22

September. (IHS Markit Economist Raj

Badiani)

- The MPC also voted unanimously to maintain the stock of sterling non-financial investment-grade corporate bond purchases at GBP20 billion (USD28 billion), financed by the issuance of central bank reserves.

- The MPC voted by a majority of 7-2 to continue with the BoE's existing program of UK government bond purchases, financed by the issuance of central bank reserves, maintaining the target for the stock of these government bond purchases at GBP875 billion to be achieved by end-2021.

- As of 22 September, the total stock of assets held in the Asset Purchase Facility (APF) stood at GBP852 billion, including GBP108 billion of the GBP150-billion program of UK government bond purchases announced on 5 November 2020.

- CPI inflation breached the BoE's 2% target for a fourth successive month when rising to 3.2% in August, while core inflation increased to 3.1% in the same month, its highest rate since November 2011.

- The BoE had expected overall CPI inflation to peak at a higher 4% by the final quarter of this year, largely driven by higher energy prices and accumulating global input cost pressures. It now fears that CPI inflation could remain above 4% into the second quarter of 2022.

- In its August update, the BoE expects its policy rate to rise from the current 0.1% to 0.2% and 0.5% by the second quarters of 2022 and 2024, respectively, which is conditioned on the market path for interest rates.

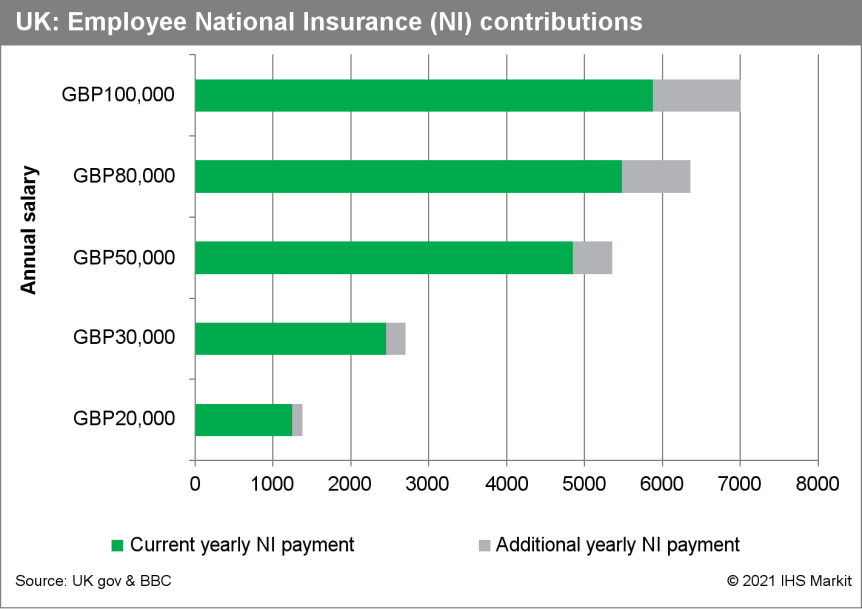

- Higher household tax burdens alongside increasing food and

energy prices represent a damaging rise in the cost of living for

many UK households. This is a risk to our narrative that consumer

spending will drive the post-COVID-19 recovery. (IHS Markit

Economist Raj

Badiani)

- The UK government plans to introduce a new health and social care tax to finance the overhaul of the social care system and to allocate more resources to NHS England to help deal with the backlog of non-COVID-19 cases.

- The plan entails a 1.25-percentage-point rise in the National Insurance (NI) rate during the 2022-23 financial year (from April 2022 to March 2023), paid by both employers and workers. Thereafter, the planned increase will exist as a new tax on earned income from April 2023, appearing as a separate calculation on employees' payslips.

- Currently, workers pay 12% NI on earnings between GBP9,564 and GBP50,268, and a rate of 2% is then applied to earnings above GBP50,268.

- All working adults, including employed pensioners, are liable to pay the new tax, and the revenue raised is to be "legally ring-fenced" to cover health and social care costs.

- Chancellor of the Exchequer Rishi Sunak has already announced plans to raise corporation and income tax by GBP25 billion in his March 2021 budget. The Office for Budget Responsibility (OBR) estimates that the planned personal and corporate tax changes proposed in the March 2021 budget increase the tax burden by 1 percentage point to 35% of GDP in 2025-26, its highest level since 1969-70.

- The government announced that the personal income tax allowance will be raised to GBP12,570 from April 2022 but then will be frozen until April 2026.

- The higher rate income tax threshold will be frozen at

GBP50,270 from 2022 to 2026.

- Uber has said it will start rolling out its pension plan to all eligible drivers in the UK, reports the Economic Times. The company will pay 3% of a driver's earnings into a pension plan, and drivers have the option of contributing a minimum of 5% of their qualifying earnings. Uber drivers will be automatically enrolled in a pension plan provided by NOW: Pensions and administered by Adecco. Jamie Heywood, an executive for Uber's northern and eastern European region, said, "I am extending an invitation to work with operators such as Bolt, Addison Lee and Ola to create a cross-industry pension scheme. This will enable all drivers to save for their futures whilst working across multiple platforms". (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The headline German Ifo index, which reflects business

confidence in industry, services, trade, and construction combined,

has declined moderately from 99.6 (revised up from 99.4) in August

to 98.8 in September. Importantly, this still exceeds the

pre-pandemic level in February 2020 (96.1) and also the long-term

average of 97.1. The Ifo institute points to procurement problems

for raw materials and intermediate products and consequently states

that "manufacturing is experiencing a bottleneck recession". (IHS

Markit Economist Timo

Klein)

- Business expectations have dipped for the third month in succession in September, but only from 97.8 (revised up from 97.5) to 97.3. This signals a stabilizing tendency, supported by solid gains against the general trend in the service and construction sectors. Even in manufacturing, the worst-performing sector, expectations have worsened by a smaller margin than during July-August, and to a much lesser extent than current conditions in this sector during September. That said, only the stock of orders in manufacturing is still healthy - orders inflow has weakened lately, partly in reaction to steep input price increases.

- The assessment of current conditions has deteriorated for the first time since January, the sub-index declining from its August 27-month high of 101.4 to 100.4. This represents a return to July's level and still exceeds the pre-pandemic reading of 99.0 in February 2020.

- Mercedes-Benz has announced that it is taking an equity stake in newly established European battery cell manufacturer Automotive Cells Company (ACC). ACC was initially established by Stellantis and Total Energies but since the initial announcement both companies have been clear about their intent to potentially welcome new partners. Initially ACC was a consortium which had the Total petroleum company, represented by its battery company Saft, and Groupe PSA and Opel as its partners. The Total/Saft part of the entity has been consolidated into a new unit called TotalEnergies, while the merger of PSA and FCA made Stellantis the main automotive partner, and Mercedes-Benz has now joined as the third partner with an equal third share in the business. Mercedes-Benz's investment will support its plans to become a full battery electric vehicle (BEV) brand by the end of the decade, supported by investing in 200 Gigawatt hours of annual battery production by 2030; which will be realized by a pledge to build eight cell factories worldwide together with partners, four of which will be based in Europe. The acquisition of one-third of ACC is a logical move for Mercedes-Benz as it ramps up its plans for cell production in order to secure sufficient battery capacity to become a fully BEV brand by 2030. ACC has been born out of PSA and Opel both starting battery partnerships with Total-Saft, and was one of the projects that were allocated funding by the European Union's plans to support automotive battery manufacturing in the bloc in order to ensure supply security and lessen the dependence of the European carmakers on foreign suppliers and technology. (IHS Markit AutoIntelligence's Tim Urquhart)

- Volvo Cars has confirmed that it is moving away from using leather to upholster its premium interiors. The automaker said in a statement that beginning with the upcoming C40, "all new fully electric Volvo models will be completely leather-free". It adds that with its plans to launch a complete family of battery electric vehicles (BEVs) by 2030, it expects all its vehicles to be "leather-free" at this point. It said that as part of its steps to replace this material, it is "working actively to find high-quality and sustainable sources for many materials currently used in the wider car industry" and that by 2025, around 25% of the material used in its vehicles will consist of "recycled and bio-based content". (IHS Markit AutoIntelligence's Ian Fletcher)

- The Turkish central bank cut its main policy rate by 100 basis

points at its September meeting. Although the bank had given signs

of an imminent easing of monetary policy, the move came

unexpectedly early, and threatens to trigger sharp lira losses over

the remainder of 2021. The more-aggressive-than-expected loosening

of monetary policy raises inflation and lira depreciation

expectations and raises external financing risks. (IHS Markit

Economist Andrew

Birch)

- At its regularly scheduled, 23 September monthly rate-setting meeting, the Monetary Policy Committee of the Central Bank of the Republic of Turkey (TCMB) cut its main policy rate - the one-week repo rate - by 100 basis points to 18.0%. It was the first interest rate change under the current governor, Şahap Kavcıoğlu, appointed to his position in March.

- In the press release alongside the move, the TCMB argues that central banks in advanced economies are viewing global inflationary pressures as temporary and that, accordingly, are continuing their supportive monetary stances. Moreover, the Bank states that its tight monetary policy is having a greater-than-anticipated impact on the contraction of commercial loans, necessitating the rate cut.

- Kavcioǧlu has been telegraphing the action since early in September, shifting focus in his public discourse on interest-rate decisions from the headline annual inflation rate to the annual core inflation rate; 19.3% versus 16.8% as of August 2021, respectively. While IHS Markit correctly identified this change in rhetoric as a risk-negative development regarding interest rates, we had forecast that the rate-cutting cycle would not begin until the fourth quarter, after shifting base effects allowed the steady climb of inflation to stall.

- The rate cut had an immediate impact on the lira, which fell to TRY8.666/USD1 by the close of the day, once again approaching the historical low point - TRY8.758/USD1 - reached in late June following President Recep Tayyip Erdoǧan's public demand that the TCMB cut interest rates.

- The interest-rate cut undercuts any confidence in the TCMB as an independent institution, free from political influence. Upon Kavcioǧlu's installation as governor, expectations were that a rate cutting cycle would immediately commence given the new appointee's close ties with President Erdoǧan and his disdain for high interest rates.

Asia-Pacific

- APAC equity markets closed mixed; Japan +2.1%, India +0.3%, South Korea -0.1%, Australia -0.4%, Mainland China -0.8%, and Hong Kong -1.3%.

- Chinese authorities are asking local governments to prepare for the potential downfall of China Evergrande Group, according to officials familiar with the discussions, signaling a reluctance to bail out the debt-saddled property developer while bracing for any economic and social fallout from the company's travails. The officials characterized the actions being ordered as "getting ready for the possible storm," saying that local-level government agencies and state-owned enterprises have been instructed to step in to handle the aftermath only at the last minute should Evergrande fail to manage its affairs in an orderly fashion. (WSJ)

- China Evergrande Group 8.75% 6/2025 closed at a price of 26.75

today, which is a 68% decline from this year's highest close of

84.19 on 26 May.

- The likely expansion of production cuts in order to meet energy

use reduction targets will weigh on economic growth for

manufacturing bases and mainland China as a whole in the second

half of the year. (IHS Markit Economist Yating

Xu)

- Mainland China's eastern coastal province Zhejiang ordered a wide range of companies to halt production over 21-30 September to reduce power usage, as the province struggles to meet its energy consumption reduction targets this year, according to a report from Caixin Global, citing a community official's statement in Shaoxing, a prefecture-level city in northeastern Zhejiang.

- About 160 energy-intensive companies - mainly in the textiles, dyeing, and chemical fiber industries - in Shaoxing city have been affected, according to Caixin Global. In addition, steel companies in Zhejiang have also recently been ordered to reduce output.

- Zhejiang's move to implement production cuts to meet its carbon emissions reduction commitments is in line with our expectations (see mainland China: 14 September 2021: Mainland China's Yunnan Province tightens aluminum production curbs to further green goals; move expected to weigh on local industrial production). Neighbouring province Jiangsu, home to several major petrochemical producers, has also announced steel production cuts.

- Zhejiang is one of mainland China's major manufacturing hubs, with the textile base in Shaoxing accounting for 30% of total national capacity. The broad-based production cut in Zhejiang, and a potential expansion of curbs to other manufacturing bases, will weigh on industrial production and investment in related regions and nationwide in the second half of the year.

- Volkswagen (VW) is building a new battery system factory in Hefei City (China), to start operations in 2023. The company plans investment of EUR140 million in the facility through 2025. According to a VW statement, the facility will deliver more than 150,000 battery systems per year for the VW Anhui all-electric models. The facility will be operated as VW Anhui Components Company and will be wholly owned by the VW Group in China, as China allows more wholly owned enterprises, although the components factory will support VW Anhui, which is VW's first majority-owned joint venture (JV) in China for all electric vehicles. The new plant will be located at a supplier park near the VW Anhui EV production site, where vehicles are also due to see production in 2023; it will be a 45,000-square-metre site and employ about 200 workers at start of production. VW says the new plant will leverage existing synergies from its existing battery plants and workshops in Braunschweig (Germany), and Tianjin (China), and enhance ties with the MEB battery plants of VW Group's China JVs. Employees will be trained at the Group's Component Education Academy at the Tianjin plant, including virtual reality training for efficiency. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Logistics service provider SF Express has unveiled its Level 4 autonomous delivery vehicle in the Chinese city of Suzhou, Jiangsu Province. The vehicle, which has all-around video monitor and a cloud-based management system, is equipped with a smart cargo container, intelligent interactive terminal, and intelligent acousto-opto-electronic technology. It can provide intelligent logistics services for users in different scenarios such as campuses, scenic spots, housing estates, and industrial parks. SF Express's driverless delivery vehicle supports 5G connectivity and China's BeiDou Navigation Satellite System, allowing accurate detection of its surrounding environment. A face recognition system, voice interaction system, interactive screen, and QR code-based programs are also installed in the vehicle, reports Gasgoo. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese ride-hailing platform T3 has reportedly completed a new round of funding worth more than CNY5 billion (US755 million). This financing round was led by CITIC Group in participation with previous investors, reports Pandaily. T3 was established by three major Chinese automakers - FAW Group, Dongfeng Group, and Changan Auto - along with technology giants Tencent and Alibaba. In April 2019, T3 received CNY5 billion from its angel investors and the platform went online three months later. The new investment comes at a time when Chinese ride-hailing giant Didi Chuxing (DiDi) is undergoing a data security investigation following its IPO in the United States. China's cyberspace regulator earlier this year ordered the removal of DiDi's app from app stores. (IHS Markit Automotive Mobility's Surabhi Rajpal)

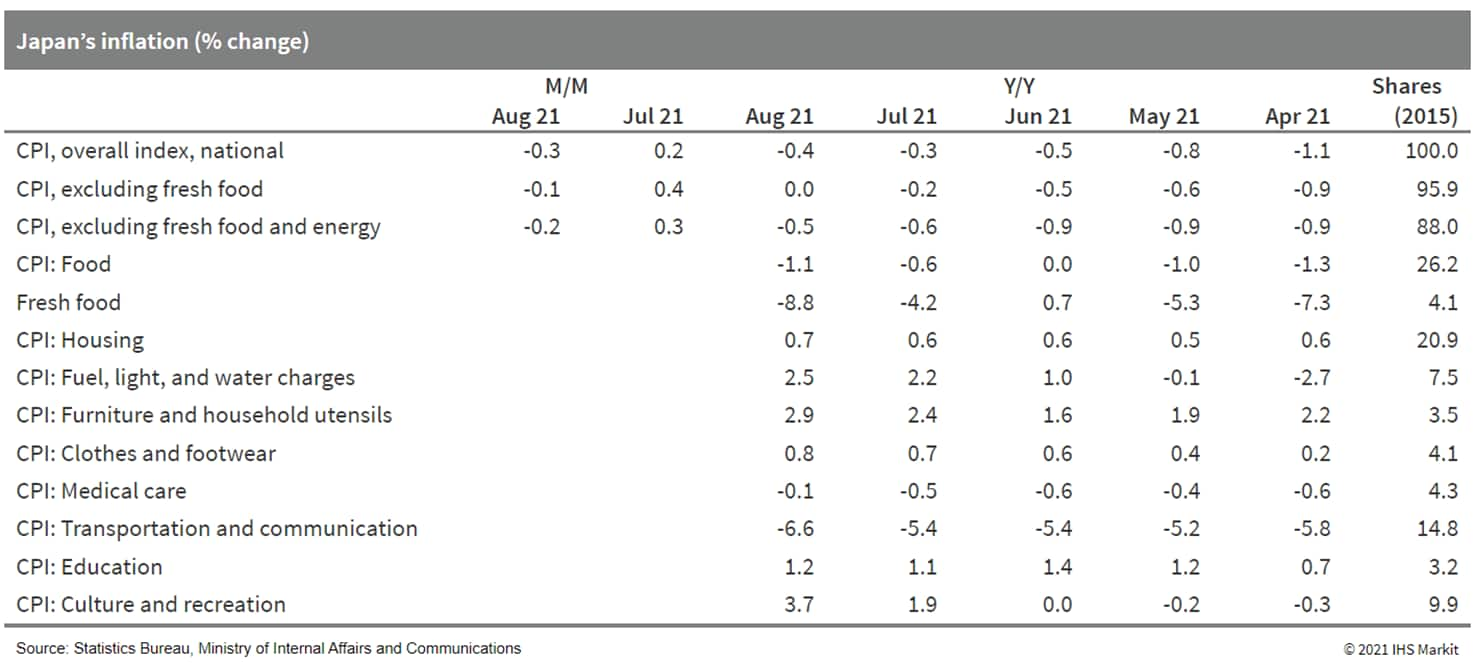

- Japan's CPI fell by 0.3% month on month (m/m) on a seasonally

adjusted basis and by 0.4% year on year (y/y) in August. The CPI,

excluding fresh food (the core-CPI), declined by 0.1% m/m, but the

y/y figure held at the year-earlier level in August (up from a 0.2%

y/y drop in July). The CPI, excluding food and energy (the

core-core CPI), dropped by 0.2% m/m in August, but deflation

softened to a 0.5% y/y decrease from a 0.6% y/y contraction in the

previous month. (IHS Markit Economist Harumi

Taguchi)

- The reasons behind the faster y/y decline in the CPI reflected weaker fresh food prices and lower mobile-phone charges. However, these weaknesses were largely offset by increases in energy prices and culture and recreation, particularly for accommodation fees, which lifted y/y figures for the core and the core-core CPIs from the previous month. Although COVID-19 containment measures continued to suppress spending on culture and recreation, greater demand for accommodation during the Olympic/Paralympic games and increased mobility during vacation season thanks to the progress in vaccine rollout helped lift accommodation fees.

- Bad harvests because of unusual heavy rainfalls in August and

higher energy prices are likely to lift the y/y changes of the CPI

into positive territory in the coming months. The resumption of

economic activity thanks to a decline in new confirmed COVID-19

cases and progress in vaccine rollout will also help lift the CPI

gradually.

- Vietnamese automaker VinFast plans to expand its presence in Europe in 2023 beyond a planned debut in Germany, France, and the Netherlands next year, reports Reuters. The automaker is considering Italy, Scandinavia, Switzerland, and Austria as a second step in its European strategy, according to VinFast B2B sales vice-president Emiel Hendriksen. Earlier this year it was reported that VinFast parent company Vingroup JSC was considering listing its car-making unit in the United States, which could value VinFast at about USD60 billion. The debut was originally expected to take place in the second quarter of this year, but it has been delayed. Any IPO decision is up to the automaker's headquarters in Vietnam, according to VinFast Europe CEO Bich Tran, adding, "Our European plans are independent from any IPO. We're carrying on with our plans, everything in Europe is moving as planned." (IHS Markit AutoIntelligence's Jamal Amir)

- Sembcorp Marine entered into a Memorandum of Understanding

(MOU) with Big Data Exchange (BDx) and National University of

Singapore's Faculty of Engineering (NUS Engineering) to jointly

study the development of offshore data centers. BDx is a Pan-Asian

data center cluster with sites throughout Hong Kong, mainland China

and Singapore. Under the MOU, each partner will leverage on their

expertise and contribute in the following areas (IHS Markit

Upstream Costs and Technology's Jessica

Goh):

- Sembcorp Marine will provide an offshore platform solution;

- NUS Engineering will supply its cooling technology;

- BDx will provide the data center arrangement as well as technical proposal and operational strategy.

- Indonesia's three-year moratorium on new oil palm plantation

permits expired on 19 September with no decision on whether to

extend or end it. Indonesia is the world's biggest exporter of palm

oil, and palm oil is one of Indonesia's most valuable exports

(worth USD23 billion in 2020). (IHS Markit Country Risk's Anton

Alifandi)

- The moratorium reflected the government's intent to reduce deforestation and improve governance of the palm oil industry. President Joko "Jokowi" Widodo had pledged to freeze the issuance of new oil palm plantation permits following large forest fires in Sumatra and Kalimantan in 2015 that led to protests from Singapore and Malaysia. In 2018, he issued a Presidential Instruction on the "postponement and evaluation of oil palm plantation permits and the increase of oil palm plantation productivity".

- The goals of the moratorium were to improve the governance and sustainability of oil palm plantations, provide greater legal certainty, reduce greenhouse gas emissions, improve the welfare of oil palm farmers, and increase plantation productivity.

- Official figures show that Indonesia's deforestation rate has continued to decline since 2014 and in 2020 reached its slowest level since recording began in 1990, an outcome that the government attributes largely to its policies including ending permits to clear primary forests and peatlands, and the oil palm moratorium. Independent Indonesian environmental groups have acknowledged the contribution of government policy in reducing deforestation, but also pointed out to the La Niña weather system, which brings more rain.

- The moratorium of the past three years will probably lead to the legalization of plantations that are currently located in various categories of forest land. Government figures show that more than 3.37 million hectares of Indonesia's oil palm plantations (out of 16.37 million hectares) operate in four forest categories under varying degrees of legality. The existence of plantations in forests reportedly arose from overlapping permits between the central and regional governments, overlapping maps, and corruption.

- Beyond the current legalization program, the government is

unlikely to issue new plantation permits even if the moratorium is

not extended. The government's focus is to increase the

productivity of existing oil palm plantations, particularly those

owned by smallholders that make up 41% of oil palm plantation

acreage.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-september-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-september-2021.html&text=Daily+Global+Market+Summary+-+24+September+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-september-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 24 September 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-september-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+24+September+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-september-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}