Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 25, 2021

Daily Global Market Summary - 25 June 2021

All major APAC and most European equity indices closed higher, while US markets were mixed. US and benchmark European government bonds closed sharply lower. European iTraxx was close to unchanged across IG and high yield, and CDX-NA was modestly tighter on the day. Copper closed lower, the US dollar was flat, and natural gas, oil, gold, and silver were higher on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Major US equity indices closed mixed, with the S&P 500 +0.3% closing at another new all-time high; DJIA +0.7%, Russell 2000 flat, and Nasdaq -0.1%.

- 10yr US govt bonds closed +4bps/1.53% yield and 30yr bonds +5bps/2.15% yield.

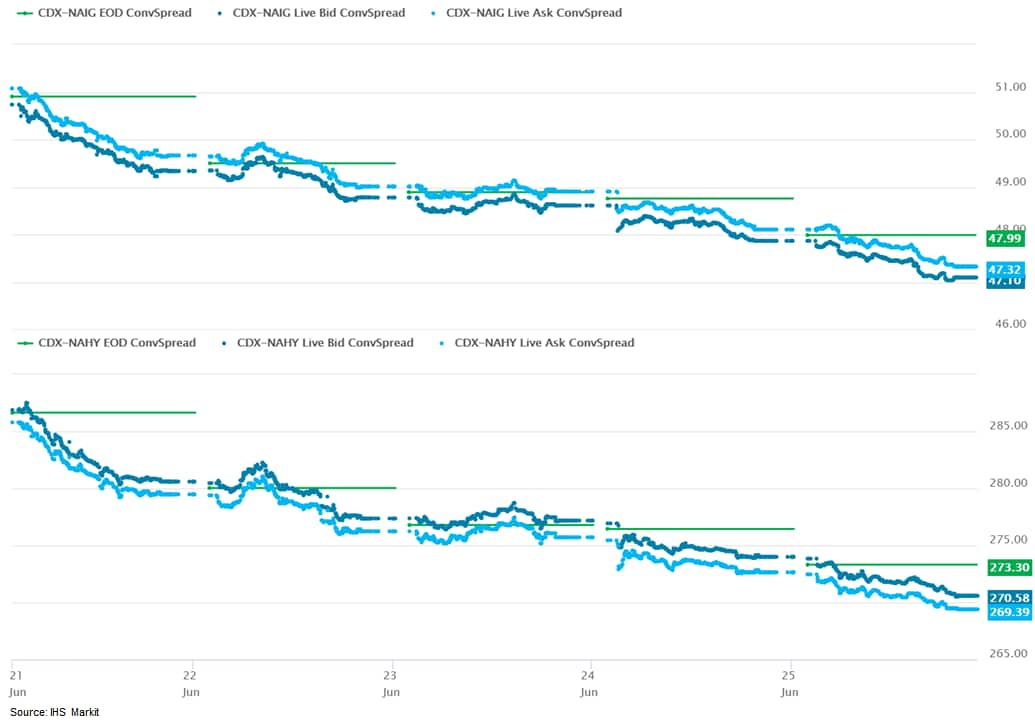

- CDX-NAIG closed -1bp/47bps and CDX-NAHY -3bps/270bps, which is

-4bps and -17bps week-over-week, respectively.

- DXY US dollar index closed flat/91.85.

- Gold closed +0.1%/$1,778 per troy oz, silver +0.1%/$26.09 per troy oz, and copper -0.4%/$4.29 per pound.

- Crude oil closed +1.0%/$74.05 per barrel and natural gas closed +2.4%/$3.52 per mmbtu.

- US personal income decreased 2.0% in May and real disposable

personal income (DPI) declined 2.8%. The decrease in personal

income for May reflected declines in economic impact payments

(stimulus checks) distributed through the American Rescue Plan

(ARP) Act. Economic impact payments were an estimated $11 billion

(not annualized), down from $57 billion in April and $337 billion

in March. (IHS Markit Economists James

Bohnaker and David

Deull)

- Unemployment insurance receipts also decreased, but the decline was not yet reflective of states' early termination of their participation in pandemic-related emergency unemployment programs. This will reduce personal income beginning in June and July.

- Real personal consumption expenditures (PCE) declined 0.4% in May in contrast to our expectation for a small gain. We revised down our estimate for second-quarter growth in real PCE 1.7 percentage points to 10.5%.

- Real PCE for durable goods eased 4.3% in May as consumers pulled back on purchases of vehicles, recreational goods, furniture, and other household goods.

- The core PCE price index increased 0.5% in May, following strong gains of 0.4% in March and 0.7% in April. We expect that recent price pressures, particularly for certain goods where supply-chain disruptions have resulted in higher consumer prices, will ease over the next several quarters. Commodity prices are already retreating; the IHS Markit Materials Price Index declined for the fifth consecutive week during the week beginning 14 June.

- The US University of Michigan Consumer Sentiment Index rose 2.6

points (3.1%) from its May level to 85.5 in the final June reading.

This was a modest 0.9 point beneath the preliminary reading for the

month. The level of the index has been largely stable since a

sizable increase in March. (IHS Markit Economists James

Bohnaker and David

Deull)

- The June increase in consumer sentiment was driven by expectations, the index for which rose 4.7 points to 83.5, a new pandemic-era high. In contrast, the index measuring views on the present situation fell 0.9 point in June to 88.6. This represented a pivot from the preliminary reading, when a small increase in the present situation index was recorded.

- The headline increase was driven mainly by upper-income households. The index of sentiment for households earning more than $75,000 a year rose 2.9 points to 89.8, while sentiment for households earning less than this rose 0.3 point to 79.6.

- Supporting the increase in expectations was a record high (56%) in the proportion expecting a decline in the unemployment rate in the next year.

- The expected one-year inflation rate stepped back to 4.2% from a reading of 4.6% the prior month, but was 0.2 percentage point higher than in the preliminary reading. This within-month shift aligned with the fall in the present situation index, suggesting that inflation is a major factor in consumers' views on current conditions. Net negative references to prices of homes, autos, and durable goods were again the greatest since 1974.

- Views on buying conditions for big-ticket items worsened to multi-decade lows in June and fell more as the month progressed. The index of buying conditions for large household durable goods rose 1 point to 111, but that of vehicles fell 13 points to 87, while that of homes dove 16 points to 74. Both were the lowest since 1982.

- Still, the survey suggests that consumers expect the surge in inflation to be transitory. In June, the expected 5-10-year inflation rate fell 0.2 percentage point to 2.8% and was unchanged through the end of the month.

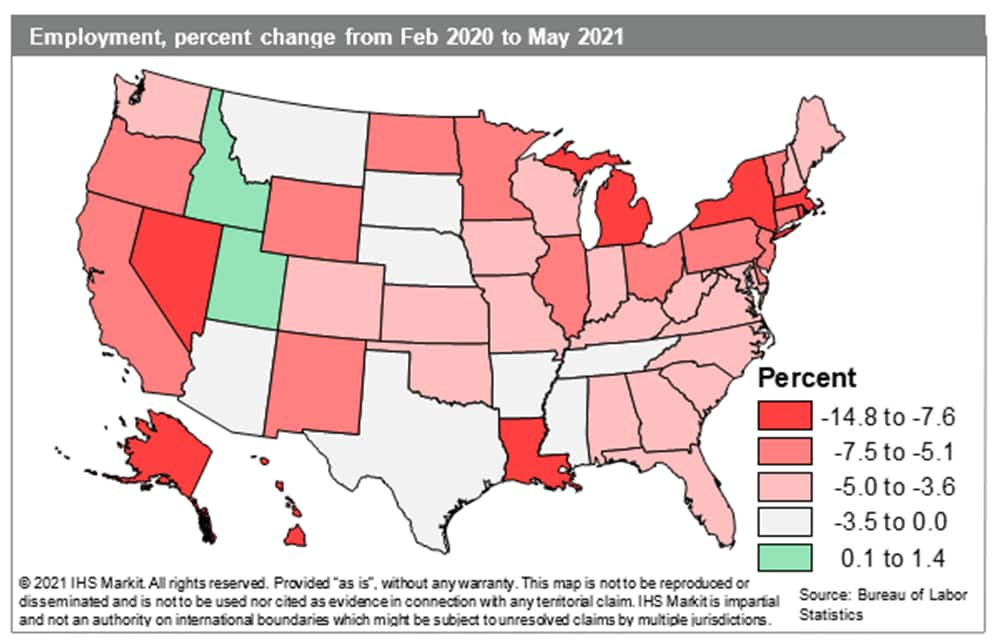

- US states in the West and Northeast accounted for most of the

country's nonfarm payroll employment growth again in May 2021 as

pandemic business restrictions were eased. The South had dominated

job growth over the final four months of late 2020 as state leaders

began removing containment measures on an earlier timeline, but the

South fell behind the Northeast and West in early 2021. Meanwhile,

the job recovery in the Midwest stalled out over April and May with

modest declines in both months. Nationally, growth over April and

May represented a downshift from the pace over the first three

months. All regions, except for the West, have seen growth

decelerate over the last two months relative to the first three

months of 2021, with the West far outpacing the other regions

during this time. (IHS Markit Economist James

Kelly)

- Ford Motor Company chief technology officer (CTO) Ken Washington is to leave the automaker on 16 July to take up the post of vice-president of software engineering at Amazon. Automotive News reports the move, citing an internal Ford memo. The report states that Jim Buckowski, director of electrical and electronics systems research and innovation, is oversee Ford's research and advanced engineering team until a replacement is named. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Local Motors and Protean Electric have entered a three-year supply agreement worth USD7.3 million, according to a company statement. Under this deal, Protean Electric will supply thousands of its ProteanDrive in-wheel motors (IWMs) to power Local Motors' Olli 2.0 electric autonomous shuttles. The use of in-wheel motors is expected to maximize passenger space, vehicle range and platform reliability, while unlocking cost benefits. This partnership is also expected to accelerate the rollout of the Olli 2.0 around the world. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- BMW's investment arm, BMW i Ventures, has invested an undisclosed amount in autonomous truck startup Kodiak Robotics, according to a company statement. Kodiak will use the injected capital to expand its workforce and fleet, as well as continuing to improve its autonomous technology for long-haul freight transport. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Biden administration placed extensive import and export restrictions on producers of polysilicon products in the Xinjiang region of China on 24 June, saying there is compelling evidence they are using forced labor involving the region's ethnic Uyghur population. The affected firms are Hoshine Silicon Industry, Daqo New Energy, East Hope Nonferrous Metals, GCL New Energy Material Technology, and XPCC. The US banned imports of goods or materials produced or derived from silica-based products made by Hoshine, a manufacturer of polysilicon used to produce solar panels. It also placed XPCC and the Xinjiang operations of Hoshine, Daqo, East Hope, and GCL on what is known as the entity list, meaning US firms seeking to export, re-export, or engage in in-country transfers of technology and goods must first get the green light from the Department of Commerce. (IHS Markit Climate and Sustainability News)

- Led by soaring sales of hybrid vehicles, the overall share of electrified light-duty vehicles hit a record 8.4% in the US in April, according to data from IHS Markit. As recently as December 2020, the share was below 5%. In April, hybrids accounted for 6.1% of all new vehicles registered and EVs accounted for 2.4%. While not offering zero emissions in the manner of a pure electric vehicle (EV), IHS Markit analysts said the vehicles powered by a combination of gasoline and batteries provide consumers with the comfort level of using a familiar technology, while enabling them to purchase a car with better mileage and lower emissions. (IHS Markit Climate and Sustainability News' Kevin Adler)

- Eisai (Japan) and Biogen (US) have jointly announced that the US FDA has granted breakthrough therapy designation to their investigational anti-amyloid beta protofibril antibody, lecanemab (BAN2401), for the treatment of Alzheimer's disease (AD). The breakthrough therapy designation was based on recently published results from a Phase IIb clinical study (Study 201) of 856 patients with mild cognitive impairment (MCI) due to AD and mild AD with confirmed presence of amyloid build-up. A pre-specified analysis from the study had shown a consistent reduction of clinical decline across several clinical and biomarker endpoints at lecanemab's highest doses. (IHS Markit Life Sciences' Milena Izmirlieva)

Europe/Middle East/Africa

- Most major European equity indices closed higher except for France -0.1%; UK/Italy +0.4%, Spain +0.2%, and Germany +0.1%.

- 10yr European govt bonds closed sharply lower; France/Italy/Spain +5bps and UK/Germany +4bps.

- iTraxx-Europe closed flat/46bps and iTraxx-Xover -2bps/225bps,

which is -3bps and -15bps week-over-week, respectively.

- Brent crude closed +0.8%/$75.38 per barrel.

- The BoE's Monetary Policy Committee (MPC) voted unanimously to

maintain the Bank Rate at 0.1% at its meeting that ended on 23

June. (IHS Markit Economist Raj

Badiani)

- The MPC also voted unanimously to maintain the stock of sterling non-financial investment-grade corporate bond purchases at GBP20 billion (USD28 billion), financed by the issuance of central bank reserves.

- However, the MPC voted by a majority of 8-1 to continue with the BoE's existing program of UK government bond purchases, financed by the issuance of central bank reserves, maintaining the target for the stock of these government bond purchases at GBP875 billion and hence the total target stock of asset purchases at GBP895 billion.

- The dissenting voice remained the outgoing chief economist Andy Haldane, who was attending his last meeting. He continued to argue that inflation could spiral upwards and stay too high. He wants to reduce the target for the stock of the government bond purchases from GBP875 billion to GBP825 billion.

- As of 22 June, the total stock of the Asset Purchase Facility (APF) was GBP823 billion. The BoE reports that GBP78 billion of the planned purchases of GBP150 billion of assets in 2021 had been completed. The BoE said in its previous meeting that it was ahead of target for the year, and "the pace of these continuing purchases could now be slowed somewhat".

- According to the UK Office for National Statistics (ONS), the

number of payrolled employees increased for the sixth consecutive

month, up by 197,000, or 0.7% month on month (m/m), in May to 28.5

million. Nevertheless, it remained 553,000 below the levels seen

before the COVID-19 virus pandemic. (IHS Markit Economist Raj

Badiani)

- The ONS reported that total UK employment (all aged 16 plus) increased by 113,000 quarter on quarter (q/q), or 0.3% q/q, to 32.5 million in the three months to April 2021, compared with the three months to January 2020.

- The number of unemployed people based on the Labour Force Survey (LFS) or the International Labour Organization (ILO) measure decreased by 90,000 in the three months to April, standing at 1.675 million.

- The UK unemployment rate stood at 4.7% in the three months to April, down from 5.0% in the three months to January. The drop in unemployment was because of rising employment, while the economic inactivity rate was largely unchanged on the previous quarter at 21.0%.

- The pace of job losses continued to slow. The number of redundancies decreased by 42,000 to 111,000 in February-April, compared with the three months to January. This represents a redundancy rate of 4.0 per 1,000, down from 11.0 in November 2020-January 2021.

- Furthermore, the number of vacancies continued to recover, averaging 758,000 over the three months to May; the ONS's experimental monthly vacancy statistics for April itself were "at near pre-pandemic levels".

- The ONS reported that the redundancy and hiring rates are back to their pre-pandemic levels in most sectors.

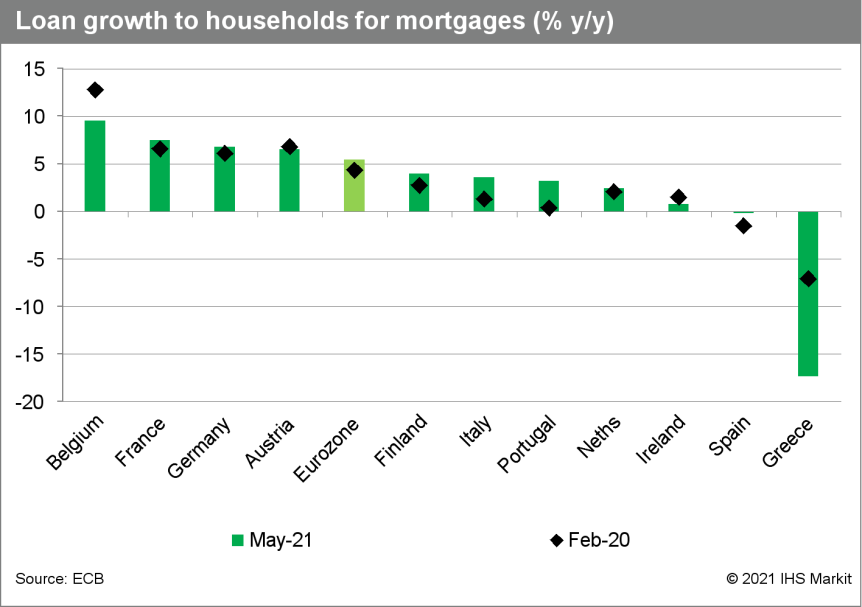

- A plunge in loan growth to businesses contrasts with strong

household mortgage lending, although monetary and credit data are

complicated by the COVID-19 shock and related policy responses. The

key points from the European Central Bank's (ECB) latest release of

monetary developments data, for May, are below (IHS Markit

Economist Ken

Wattret):

- Looking at May's figures in more detail, the year-on-year (y/y) rate of growth in eurozone M3 decelerated for the fourth straight month, down to 8.4%, a 13-month low and a little over four percentage points below its January 2021 peak.

- The growth rate remains elevated and has been well above the ECB's former reference value (of 4.5%) throughout the period since the initial COVID-19 shock in March 2020.

- The y/y rate of growth in M1 also continued to slow. Although it remained in double digits for the 15th straight month, May's 11.6% rate was around five percentage points lower than its January 2021 high and the lowest rate for 14 months.

- Switching to the counterparts to eurozone money growth, credit to governments (up 15.4% y/y in May) remained the main driver of overall credit growth (6.7% y/y), fueled by the huge expansion of the ECB's asset purchases during the pandemic.

- Growth in credit to the private sector was less elevated, decelerating to 3.5% y/y in May.

- By type of loan, May's figures showed a continuation of the recent sharp deceleration in the growth rate for loans to NFCs. May's y/y growth rate of 1.9% was the lowest for almost five years, well down from the peak of 7.2% in August 2020.

- By type of loan, a divergence of household lending trends is

also evident. The y/y rate of growth in loans for house purchases

has been picking up for some time and, at 5.4% in May, matched its

highest level since 2008.

- Proposed EU approvals for products from two genetically modified soybean lines and two GM maize lines should be withdrawn, says the European Parliament's Environment Committee. It voted in June in favor of objections to: Corteva Agriscience's insect-resistant Conkesta (DAS81419) soybeans; a stack of Conkesta with herbicide-tolerant Enlist E3 (DAS44406); and the company's insect-resistant and herbicide-tolerant maize combining Herculex (1507) with Syngenta's Viptera (MIR162) and Bayer legacy company Monsanto's MON810 and NK603 traits. The fourth objection is to the renewal of approval for Syngenta's insect-resistant Agrisure CB/LL (Bt11) maize. EU member states recently failed to return qualified majority votes either in favor or against the European Commission's proposals to approve the soybean and maize lines. The proposals are to be presented for a second vote at an appeal committee in July. If that also returns a "no opinion", the Commission can go ahead with the approvals, based on the positive safety assessments concluded by the European Food Safety Authority (EFSA). (IHS Markit Crop Science's Jackie Bird)

- The Volkswagen (VW) Group has confirmed that it is interested in acquiring a controlling stake in European car hire business, Europcar, according to a Bloomberg report. The VW Group is looking to acquire the company as part of its long-term mobility strategy. In an emailed statement VW said that negotiations are at an early stage and that no final decision has been taken. This statement came after Bloomberg reported that VW had lodged a EUR2.2 billion (USD2.6-billion) bid together with Attestor and Pon Holdings. The VW statement said, "A potential transaction could generally be attractive for VW. It represents one of several options to give VW access to a platform that would support VW's long-term mobility vision and strengthen VW's spectrum of products and services." (IHS Markit AutoIntelligence's Tim Urquhart)

- Vestas has secured a firm order to deliver 27 V174-9.5MW turbines, along with a 15-year service agreement, for the 257MW Arcadis Ost 1 offshore wind project in the German Baltic Sea. The turbines will be installed without a jackup vessel. The wind farm, located 19 kilometers off the coast of the Island of Rugen, suffers from challenging seabed and soil conditions, thus requiring the use of an innovative floating installation method for the wind turbines. Instead of a jack-up vessel which requires contact with the seabed, a floating dual-crane vessel operated by Heerema Marine Contractors, will be used to perform dynamic lifts at sea. (IHS Markit Upstream Costs and Technology's Monish Thakkar)

- Volvo says that its next-generation electric vehicle (EV) will have LiDAR technology and an "AI-driven super computer" as standard equipment. The next EV is the successor to the Volvo XC90, due to be revealed in 2022. Volvo says the equipment will help save lives and set a new benchmark for automotive safety. Luminar also issued a press release announcing that will provide its Iris LiDAR and perception from its Sentinel solution. According to the Luminar website, Iris is configured in a slim design for roofline integration and is an auto-grade, low-cost solution developed for scalability and flexibility; it is also capable of supporting over-the-air updates. Volvo's subsidiary Zenseact and its partnership with Luminar is part of the solution, as well as the NVIDIA Orin system-on-a-chip solution. (IHS Markit AutoIntelligence's Stephanie Brinley)

- In early June, Norway's Conservative-led minority government published its Energy White Paper, a comprehensive report that outlines long-term policy priorities in the energy sector, including the oil and gas and low-carbon industries. The government is not expected to introduce any major fiscal or regulatory changes in the upstream sector as a result of the report, but it is likely to make minor ad hoc adjustments that factor in Norway's climate goals. The industry is also likely to face increased climate scrutiny of hydrocarbon operations, increasing the regulatory burden for offshore players. The recently published report highlights the Norwegian oil and gas sector's stable policy and regulatory environment, a key feature of the country's upstream regime over the past eight years. The government reaffirmed its commitment to offering prospective acreage on the Norwegian continental shelf (NCS) as part of regular licensing rounds and maintaining the existing fiscal and regulatory framework to facilitate long-term offshore hydrocarbon production. The ruling coalition is seeking to align ongoing exploration & production (E&P) activity with its target of carbon neutrality by 2050 and will continue to support the electrification of platforms through direct funding and/or tax incentives, underscoring a collaborative approach towards energy transition in the upstream industry. (IHS Markit E&P Terms and Above-Ground Risk's Aliaksandr Chyzh)

- Russian car-sharing firm Delimobil's founder Vincenzo Trani said the company is considering expanding into markets in developing countries and in selling local franchises. He also said Delimobil was in talks with Qatar to open a franchise of its Anytime Prime service, which provides long-term car rentals. Trani added that Uzbekistan has also expressed interest in a traditional car-sharing franchise. He stated that countries in Asia and North Africa are interested in franchising, or in Delimobil establishing its own local business. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Intel Corporation subsidiary Mobileye has announced the advanced trials of its robotaxi (self-driving taxi) project, which will use NIO's ES8 electric sport utility vehicles (SUVs) on the roads of Tel Aviv (Israel), reports Trend News Agency. According to the news source, the first consignment of NIO electric vehicles (EVs) for the trials will reach Israel in a few days, with the advanced trials beginning only in 2022. Mobileye is to install its Level 4 autonomous driving kit in the NIO EVs in Israel. In the preliminary trials, the autonomous vehicles will drive around central Tel Aviv on a 15-kilometer route with no passengers and only a test officer in the car. In the later stages of the trial, the routes are to be expanded to include 33 km of roads. In the pre-commercial stage, the routes are to be increased to include 111 km of roads. In the commercial stage of the trials, scheduled to happen in 2023, passengers are to be transported to their destinations. According to the report, Mobileye has been given a temporary license by the Ministry of Transport to import the NIO vehicles into Israel. (IHS Markit AutoIntelligence's Tarun Thakur)

- Namibia's real GDP fell by 9.3% quarter on quarter (q/q) and

6.5% year on year (y/y) during the first quarter of 2021. Most

sectors in the economy failed to grow from a year ago, with the

exception of the electricity and water sector (up 7.7% y/y), real

estate and business services (up 4.6% y/y) and public

administration, education and health services (up 1.7% y/y). (IHS

Markit Economist Thea

Fourie)

- An increase in the water supply to farmers for irrigation balanced less electricity consumption, particularly from the mining sector, during the first quarter of the year. The positive performance in the real estate and business services sector is mainly attributed to a rebound in the real estate activity following an increase in the stock of houses and the low interest rate environment which prevailed over the period.

- Subsectors in the economy which recorded the steepest decline from a year ago included the construction sector (down 23.9% y/y), manufacturing (down 22.3% y/y) and mining and quarrying (down 19.0% y/y).

- The poor performance in the construction sector could be mainly attributed to reduced construction work by the central government. "The contractionary performance in the [manufacturing] sector is attributed mainly to the substantial declines in the subsectors of basic metals, beverages and other food products that registered massive reductions of 89.3 percent, 28.4 percent and 24.8 percent during the first quarter of 2021," the Namibia Statistical Agency (NSA) reported. Weak global demand, particularly for diamonds and metal ores, left output levels in the mining and quarrying industry lower by 19.0% y/y.

Asia-Pacific

- APAC equity markets closed higher; Hong Kong +1.4%, Mainland China +1.2%, Japan +0.7%, South Korea +0.5%, Australia +0.5%, and India +0.4%.

- Chinese ride-hailing giant Didi Chuxing (DiDi) has filed an updated F-1 prospectus with the US Securities and Exchange Commission (SEC), reports CNBC. The filing reveals that the company plans to list 288 million American Depository Shares, which is the equivalent of 72 million shares of Class A common stock, on the New York Stock Exchange. The listing shares' price is expected to range between USD13 and USD14 a piece, valuing DiDi at more than USD60 billion. At the upper end of the range, DiDi expects to raise a little more than USD4 billion in its initial public offering (IPO). (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Prices of pork and live pigs have fallen further in China over the past week, raising concerns over the effectiveness of government stabilization measures. Wholesale prices fell to CNY21 per kg in the third week of June - down by 50% since mid-February, according to data from the Chinese Commerce Ministry. Figures from the Agriculture Ministry shows the national live pig price falling to CNY15.13 per kg, a decrease of 7% w/w and down 51% year-on-year. Shocked by recent market developments, many farmers have responded by selling off overweight pigs, further pressuring prices, and raising concerns that the sell-off will setback China's herd rebuilding efforts. (IHS Markit Food and Agricultural Commodities' Max Green)

- Triton, a US-based electric vehicle (EV) manufacturer, has announced investment of INR21 billion (USD283 million) in the state of Telangana (India) for setting up an EV manufacturing unit, reports The Times of India. Triton has signed a memorandum of understanding (MoU) with the Telangana government for establishing a manufacturing unit for EVs at the National Investment and Manufacturing Zone (NIMZ) in the town of Zaheerabad, wherein 150 acres of land (as sought by the company) for the establishment will be provided through the Telangana State Industrial Infrastructure Corporation (TSIIC). According to the source, the automaker will manufacture 50,000 vehicles in the first five years, including semi-trucks, sedans, luxury sport utility vehicles (SUVs) and rickshaws, while creating 25,000 jobs. According to the source, the state government will help Triton to get the required approvals and applicable incentives. (IHS Markit AutoIntelligence's Tarun Thakur)

- US-based semiconductor manufacturer GlobalFoundries will build a new fabrication plant in Singapore to meet the unprecedented global demand for chips, reports Reuters. The new facility will be built in collaboration with the Singapore Economic Development Board and with co-investments from committed customers. According to the company, more than USD4 billion will be invested in the development. "Our new facility in Singapore will support fast-growing end-markets in the automotive, 5G mobility and secure device segments with long-term customer agreements already in place," said GlobalFoundries CEO Tom Caulfield. (IHS Markit AutoIntelligence's Jamal Amir)

- Keppel O&M and Sembcorp Marine are in discussions for a potential merger after Keppel Corporation (Keppel Corp) and Sembcorp Marine inked a non-binding memorandum of understanding (MOU). Upon completion of the merger, a combined entity will be established between Sembcorp Marine and Keppel O&M. The entity will be a listed entity with Sembcorp Marine's shareholders holding shares in it, while Keppel Corp will receive shares and a cash consideration of up to USD372 million (SGD500 million). As part of the discussions, both companies will also work with workplace unions on future labor force plans including workforce development and training, and higher valuer-adding jobs creation. Under the MOU, it is envisaged that Keppel Corp will enter into a 50-50 strategic partnership joint venture with the combined entity. Under the strategic partnership JV, the combined entity will be the preferred EPC partner for Keppel Corp's relevant projects, subject to regulatory review. (IHS Markit Upstream Costs and Technology's Jessica Goh)

- An investigation by the United States International Trade Commission (USITC) has determined that imports of passenger light-vehicle and light-truck tires from South Korea, Thailand, and Thailand are to be subject to antidumping duties. The investigation determined that tires from these countries are "sold in the United States at less than fair market value", while imports from Vietnam are subsidized by the government of Vietnam. However, the USITC also determined that the imports from Vietnam were negligible and terminated the investigation into Vietnam. (IHS Markit AutoIntelligence's Stephanie Brinley)

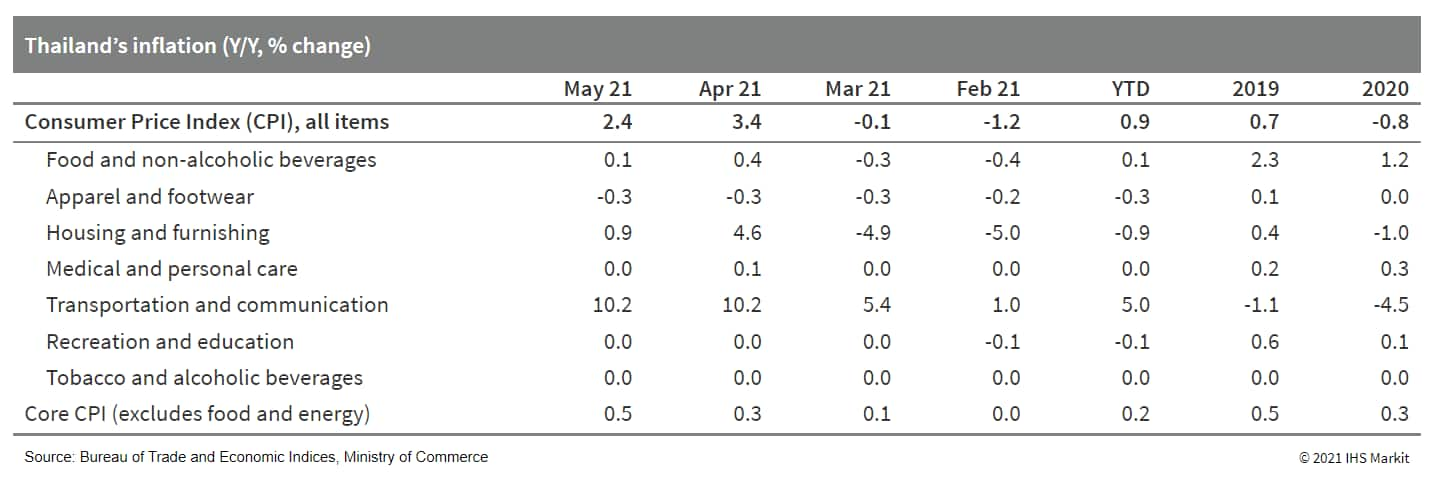

- During the Bank of Thailand's (BoT) monetary policy meeting on

23 June, the bank held the one-day bond repo rate (the main policy

rate) steady at 0.5%. The rate has remained at a historically low

level since the 25-basis-point rate cut in May 2020. (IHS Markit

Economist Jola

Pasku)

- The policy rate has been kept unchanged, despite an uptick in inflation to 3.4% year on year (y/y) in April 2021, although still within the 1-4% target band set by the BoT. Rising global commodity prices and supply-chain disruptions have created upward inflationary pressure on Thailand's consumer prices during the second quarter. Even still, headline inflation is contained and has averaged at 0.9% y/y in the first five months of the year. Core inflation, which excludes volatile energy and raw food prices, edged up slightly to 0.5% y/y in May, indicating subdued, albeit accelerating, inflationary pressures.

- The BoT commented in a statement published after the session

that the current inflationary pressures are temporary and driven by

the low base effect from 2020. Meanwhile, the committee expressed

concern that short-term growth will remain lackluster because of

the third wave of the coronavirus disease 2019 (COVID-19) pandemic.

Growth projections for 2021 and 2022 were trimmed to 1.8% and 3.9%,

respectively, down from 3.0% and 4.7% previously.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-25-june-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-25-june-2021.html&text=Daily+Global+Market+Summary+-+25+June+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-25-june-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 25 June 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-25-june-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+25+June+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-25-june-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}