Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 26, 2021

Daily Global Market Summary - 26 January 2021

Major European equity markets closed higher, while APAC and US indices were lower. US government bonds were almost flat on the day and benchmark European bonds closed mixed. European iTraxx credit indices closed slightly tighter across IG and high yield and CDX-NA was modestly wider. Silver closed higher, while the US dollar, oil, gold, and copper were all lower on the day.

Americas

- US equity indices closed mixed modestly lower; Russell 2000 -0.6%, S&P 500 -0.2%, and DJIA/Nasdaq -0.1%.

- 10yr US govt bonds closed +1bp/1.04% yield and 30yr bonds -1bp/1.79% yield.

- CDX-NAIG closed +1bp/53bps and CDX-NAHY +3bps/310bps.

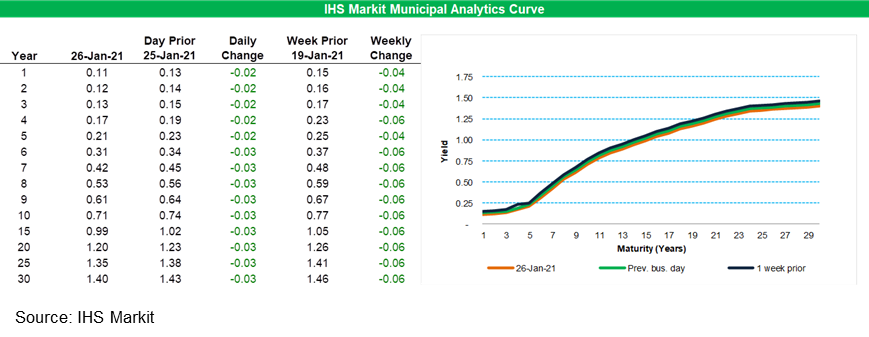

- IHS Markit's AAA Municipal Analytics Curve yields rallied 2bps

for 1- to 5-year maturities and 3bps for 6-year and longer tenors

today.

- DXY US dollar index closed -0.2%/90.17.

- Gold closed -0.2%/$1,851 per ounce, silver +0.2%/$25.54 per ounce, and copper -0.3%/$3.62 per pound.

- Crude oil closed -0.3%/$52.61 per barrel.

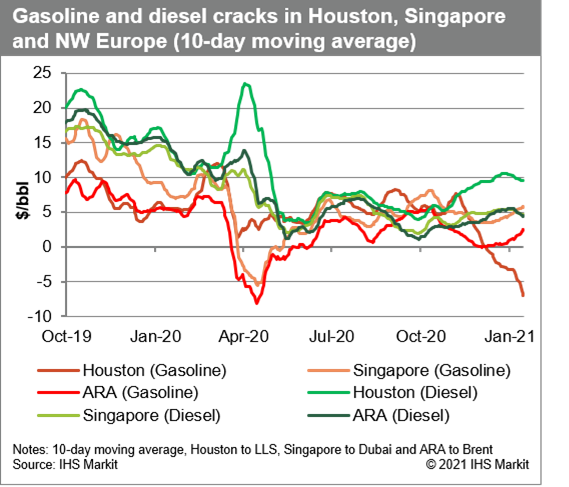

- Global expansion continues to ease middle distillate woe, but

can't offset missing jet fuel demand, as gasoline faces new

slowdowns in the services sector. Continued strength in basic

materials, trade and manufacturing during the latest wave of

coronavirus infections helps support diesel but with air travel

still limited, jet fuel remains down roughly 45%. Middle distillate

stocks remain the most oversupplied product at the outset of 2021,

and slower demand improvement may start feeding back into crude

spreads. High product stocks are contributing to low run rates

especially at European refineries with large middle distillate

cuts, which in turn contributes to a weakening in sales of West

African barrels in general and of Nigerian crude in particular. To

clear, these marginal barrels must now flow to China, where

purchases have been slowing. Physical weakness would appear first

in crude futures time spreads. Days of forward middle distillate

demand cover in the OECD needs to fall another 10 days to approach

pre-pandemic levels, and we are well off this mark. In the less

visible non-OECD, considerable stockpiling in key markets like

India will also need to be absorbed before a full market recovery.

Refined product markets will need to go through the arduous process

of normalizing inventories over the next few months. Recovering

demand will certainly help mop up the excess, but it will still

take time for that process to run its course and unshackle the

recovery in refinery runs, particularly in the Atlantic Basin. (IHS

Markit Energy Advisory's Roger Diwan, Karim Fawaz, Ian Stewart,

Edward Moe, and Sean Karst)

- New York's apartment investors are suddenly waist-deep in distress. By December, they were behind on $395 million of debt backed by mortgage bonds, almost 150 times the level a year earlier, according to Trepp data on commercial mortgage-backed securities. Tenants in rent-stabilized units owe at least $1 billion in rent and wealthier ones are fleeing the city, leaving behind vacancies and pushing newly-built luxury towers into foreclosure. The developers who are in the most trouble pushed hard into Harlem and the Brooklyn hipster hubs of Crown Heights, Flatbush and Bushwick, squeezing out working-class residents by building new expensive units. Now, they're grappling with eviction bans and new tenant protections as rent falls across New York. (Bloomberg)

- The US Conference Board Consumer Confidence Index rose 2.2

points (2.5%) to 89.3 in January after falling 14.3 points over the

prior two months. (IHS Markit Economists David Deull and James

Bohnaker)

- The headline index remained barely above its April 2020 low of 85.7. The still-depressed level of consumer confidence is consistent with our expectation of essentially flat consumer spending in the first quarter of 2021.

- Although new COVID-19 cases skyrocketed during December and January, consumer attitudes were supported by broad strength in equity markets and the fiscal stimulus package enacted on 27 December, which included $600 relief payments for qualifying Americans.

- The January increase in the headline index was driven entirely by expectations regarding conditions over the next six months. The expectations index rose by 5.5 points to 92.5, a three-month high. Meanwhile, the index measuring views on the present situation fell 2.8 points to 84.4, an eight-month low. This contrast suggests that consumers view January as a low point but expect conditions to improve in the coming months.

- The labor index (the percentage of respondents viewing jobs as plentiful minus the percentage viewing jobs as hard to get) fell 1.3 points to -3.2, the lowest since May. The employment report for December showed the first outright decline in payrolls since the recovery began.

- Purchasing plans rose in January. The share of respondents planning to buy autos in the next six months increased 0.9 percentage point to 10.7%, while the share planning to buy homes recovered 1.2 points to 7.2%, indicating a still-hot market. The share with plans to purchase major appliances ticked up 0.1 point to 48.4%.

- Historically, views on the present situation are more closely related to consumer spending trends than expectations. This report suggests that consumer spending will continue to stagnate early in 2021 before (hopefully) thawing in the spring.

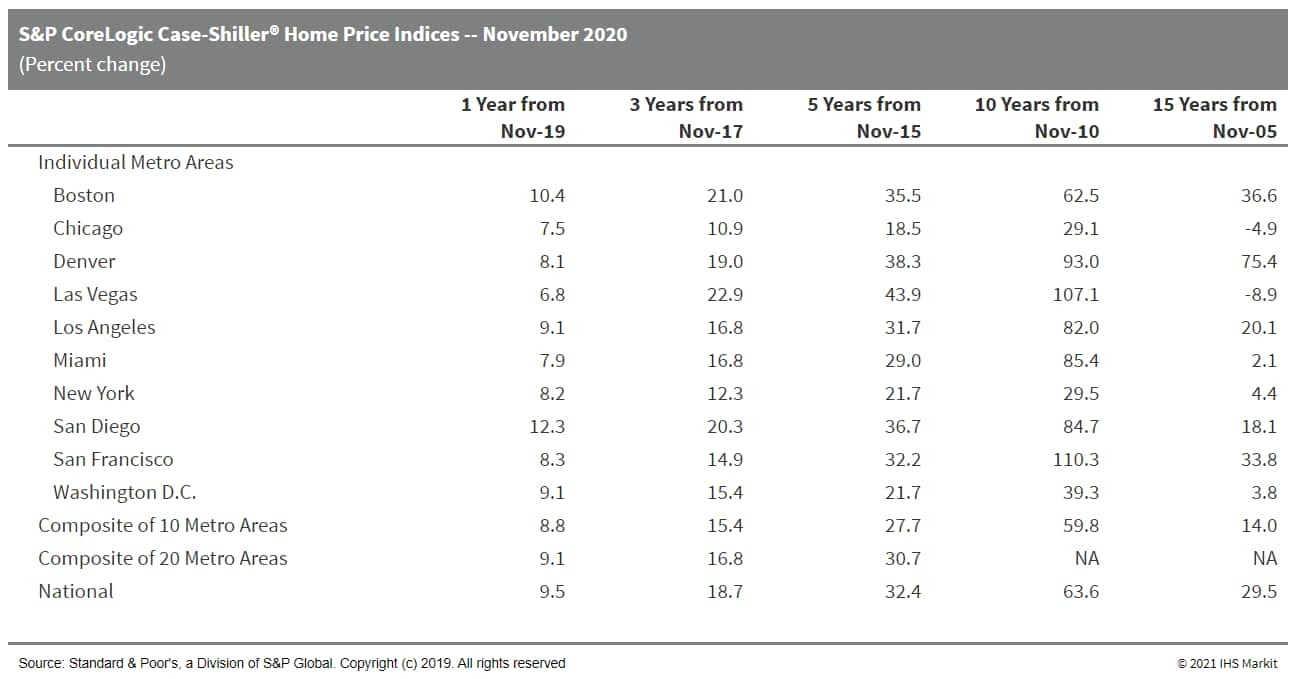

- The S&P CoreLogic Case Shiller indices indicate continued

strength in November as Boston (10.4%), Phoenix (13.8%), San Diego

(12.3%), and Seattle (12.7%) reach double-digit y/y gains. (IHS

Markit Economists Troy Walters)

- For the ninth month in a row, data in November were limited to only 19 cities, as opposed to 20 under normal circumstances. Data for Wayne County, Michigan, were unavailable so there are no data for Detroit in this release. Data for previously missing months (March through October) are now available.

- Monthly home price growth decelerated slightly in November. Both the 10-city and 20-city composite indices were up by a strong 1.4% month on month (m/m) following a 1.6% increase in October.

- Monthly price appreciation was positive in all 19 cities reporting. With the exception of Cleveland and San Francisco, price gains were at the 1.0% mark or higher.

- In year-over-year (y/y) terms, home prices grew at a faster pace in November. The 10-city index was up 8.8% y/y while the 20-city index was up 9.1%.

- Growth in the national index approached double-digit territory in November, at 9.5% y/y.

- According to data for the three months ending in November, US home prices accelerated sharply for the fifth straight month.

- The slight retreat in the pace of monthly appreciation in November did little to slow y/y growth; the national index increased by 9.5% y/y.

- Home prices growth, already strong prior to the onset of the

COVID-19 pandemic because of limited and shrinking inventories,

strengthened considerably in the July-November period. Many sales

that would normally have occurred during the 2020 spring buying

season were delayed until later in the summer because of business

shutdowns and social distancing regulations across the country.

- A Bechtel-Reed & Reed Joint Venture has been selected by Clearway Energy Group to build the Black Rock wind farm in Grant County and Mineral counties, West Virginia. The Bechtel-Reed & Reed JV will engineer, procure, and construct the farm. The project will include 23 Siemens-Gamesa SG 5.0-145 wind turbines on 107.5-meter tall towers, producing 115 MW of electricity at the point interconnection to the First Energy electrical grid. The project is expected to create around 200 jobs in the area during construction, with several permanent jobs when operational. The wind farm is currently scheduled to be operational in late 2021. (IHS Markit Upstream Costs and Technology's Dag Kristiansen)

- Corn put in another strong gains Tuesday. March corn closed 20 3/4 cents higher at $5.32 1/4. The market is now up 32 cents since Friday's close. The price adjustment higher was likely in response to strong US corn export sales to China. USDA announced via the daily export sales reporting system that private exporters reported sales of 1,360,000 tons (53.5 million bushels) of US corn to China and 102,800 tons (4.0 million bushels) to unknown destinations for 2020/21. This was the largest daily sales announcement to China since late July and the 16th largest daily sale on record. Weekly US corn inspections at 54.8 million bushels reported Monday was also supportive as they reminded of strong demand. Funds bought a net 47,500 contracts, traders said. (IHS Markit Food and Agricultural Commodities' Anamaria Martins)

- Specialty chemicals technology firm Atotech (Berlin, Germany),

owned by private equity company Carlyle Group, says it has started

an initial public offering (IPO) in the US that could raise up to

$750 million. (IHS Markit Chemical Advisory)

- The IPO for 34.15 million of its common shares is expected to be at a price range of $19.00-22.00 per share, it says. Underwriters of the offering will also have a 30-day option to buy up to an additional 5.12 million common shares from affiliates of The Carlyle Group, it says. Atotech has applied to list its common shares on the New York Stock Exchange, it adds.

- Citigroup, Credit Suisse, BofA Securities, and J.P. Morgan are lead book-running managers for the proposed IPO, with additional book-running managers including Barclays, Deutsche Bank Securities, Jefferies, RBC Capital Markets, UBS Investment Bank, Baird, BMO Capital Markets, and HSBC. The co-managers are TCG Capital Markets and Mischler Financial Group.

- Atotech, which generated annual sales of $1.2 billion for its financial year ending 30 September 2019, has operations in Europe, the Americas, and Asia, and is a market leader in specialty electroplating solutions, manufacturing chemicals and equipment for technology applications.

- At the top end of the price range, Atotech's market value would be approximately $4.0 billion. Carlyle agreed to acquire Atotech from Total in 2016 in a deal worth $3.2 billion, including debt. Carlyle first began planning a stock market listing for Atotech in August 2018.

- US-based electric vehicle (EV) startup Faraday Future plans to open a new plant in China in a renewed effort to start volume production of its EVs in the country, reports Reuters, citing sources who declined to be named. According to the report, the new plant is to be located in a "tier one Chinese city" and it will have a production capacity of 100,000 vehicle per annum. The report also indicates that Geely is likely to provide contract manufacturing services to the startup company, as well as provide engineering and smart-vehicle technologies, including automated driving functions. Geely and Faraday Future declined to comment on the matter when approached by Reuters. A Reuters report in October last year indicated that Faraday Future intended to work with a contract manufacturer to build its first EV, the FF91, in Asia. Carsten Breitfeld, CEO of Faraday Future, said the company would begin volume production in about 12 months provided a deal was struck. The planned launch of the FF91 has already been delayed by a year due to a series of financing issues. According to a Bloomberg report, Faraday Future is in talks with special-purpose acquisition companies (SPACs) to go public. It is still too soon to tell whether the reported talks with Geely on a contract manufacturing deal will come to fruition; however, Geely does appear to be a possible partner for newcomers entering the EV space. The Chinese automaker intends to share its SEA EV architecture with other automakers or tech companies interested in making their own EVs. Baidu, for instance, is to form a joint venture with Geely to develop EVs in China. New models under the partnership are to be manufactured by Geely. (IHS Markit AutoIntelligence's Abby Chun Tu)

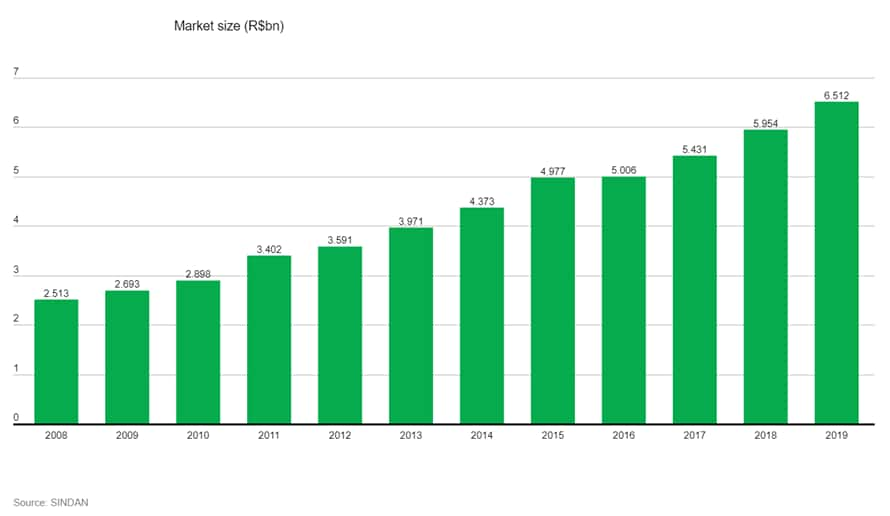

- The Brazilian animal health sector has posted annual sales of

over R$6 billion ($1.2 billion) for the first time. According to

national industry body Sindicato Nacional da Indústria de Produtos

para Saúde Animal (SINDAN), its members posted revenues of R$6.51bn

in 2019. This represented year-on-year growth of 9.4%. SINDAN

members - over 80 of the leading animal health businesses in Brazil

- have collectively recorded annual sales growth in excess of 5% in

all but one of the last 10 years. The average annual growth rate

for the companies over the last decade is just under 10%. In fact,

the size of the Brazilian animal health market has more than

doubled in the last decade. Growth has been fueled by an

increasingly prominent domestic companion animal sector. The

Brazilian animal health sector is heavily weighted towards the

livestock segment, specifically cattle production. However,

companion animal ownership and spending are rapidly expanding in

Brazil. In 2009, pet products represented 11% of sales from SINDAN

members. This proportion doubled to 22% by 2019. The Brazilian

sector has also witnessed higher sales of therapeutics and

biologicals in recent years - at the same time as a decline in

revenues from antimicrobials, supplements and feed additives.

Founded in 1966, SINDAN now represents around 90% of the overall

Brazilian animal health industry. According to Brazil's top

domestic veterinary medicines manufacturer Ouro Fino Saúde Animal,

the country is the world's third-largest animal health market -

behind the US and China, and ahead of France and Germany. (IHS

Markit Animal Health's Joseph Harvey)

Europe/Middle East/Africa

- European equity markets closed higher; Germany +1.7%, Italy +1.2%, France/Spain +0.9%, and UK +0.2%.

- 10yr European govt bonds closed mixed; Italy -4bps, Spain/UK flat, and France/Germany +2bps.

- iTraxx-Europe closed -1bp/50bps and iTraxx-Xover -4bps/260bps.

- Brent crude closed -0.1%/$55.64 per barrel.

- According to the UK's Office for National Statistics (ONS), the

early estimate for December 2020 suggests that the number of

workers on payroll plunged by 2.7%, or 793,000, since December

2019. However, it rose by 0.2% month on month (m/m) after falling

in the previous nine months. (IHS Markit Economist Raj Badiani)

- The new release is based on the experimental data of the number of employees on payroll using the HM Revenue and Customs' Pay As You Earn Real Time Information.

- The claimant count, which measures the number of people claiming benefit principally for being unemployed, increased slightly to 2.6 million in December 2020 and represented an increase of 113.2%, or 1.4 million, since March 2020. The claimant count also includes the increasing number of people becoming eligible for unemployment-related benefit support despite still being employed.

- The ONS also published its traditional headline employment and unemployment data for the three months to November 2020.

- According to the ONS, total UK employment (all aged 16 plus years) shrunk by 88,000 to 32.5 million in the three months to November 2020 compared with the three months to August.

- In annual terms, the number of employed people in the three months to November 2020 was 398,000, or 1.2%, lower compared with a year earlier.

- The number of unemployed people based on the Labour Force Survey (LFS) or the International Labour Organization (ILO) measure increased by 202,000 in the three months to November 2020, standing at 1.724 million.

- The unemployment rate increased to 5.0% in the three months to November 2020, up from 4.5% in June-August. However, governor of the Bank of England Andrew Bailey argues that the rate is higher at 6.5%, or 2.2 million people, but he acknowledges the uncertainty surrounding the number due to shifts in those deemed economically inactive.

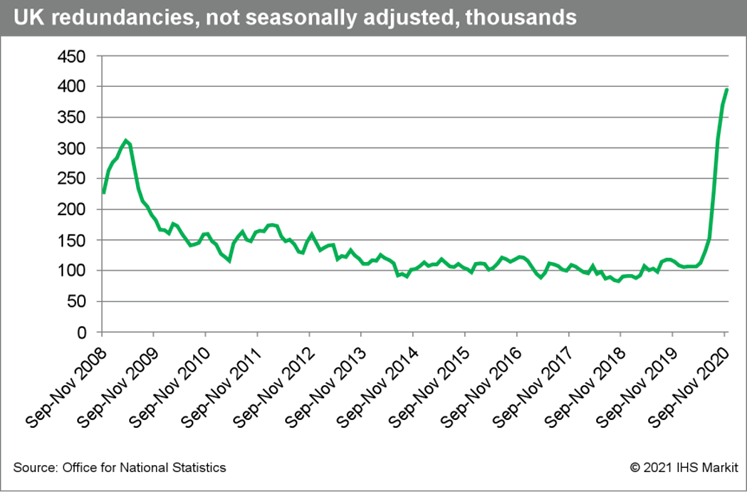

- The pace of job losses remains brisk. Specifically, the number of redundancies increased by 168,000 to an all-time high of 395,000 in September-November 2020 compared with the three months to August (see chart).

- The highest incidence of redundancies fell on the age cohort of 25 to 34, with a redundancy rate of 16.2 per 1,000, which is five times higher than a year ago. This reflects the high incidence of young workers in the most exposed sectors of hospitality and retail to the COVID-19 virus restrictions.

- The number of redundancies could rise after the imposition of tighter COVID-19 virus restrictions across the United Kingdom, which entails the closure of hospitality, accommodation, and entertainment services. Industry body UKHospitality warns that "so many pubs, restaurants, bars, cafes and hotels, having invested so much to make their venues safe, are only just clinging on by the skin of their teeth".

- In addition, the UK is likely to endure a double-dip recession with GDP now likely to shrink in the final quarter of 2020 and the first quarter of 2021.

- However, the rate of job losses is likely to be pushed back by the government's decision to extend the furlough scheme until April 2021. The extended furlough scheme will again pay up to 80% of an employee's wage up to GBP2,500 per month.

- The extended furlough scheme is available to all UK companies

regardless of whether they are open or closed.

- Lotus has revealed that it will end production of its current

range of sports cars. According to a statement, the Elise, Exige

and Evora have all entered their final year of production during

2021. (IHS Markit AutoIntelligence's Ian Fletcher)

- The company added that it is undertaking GBP100-million-worth of investment at its facilities in Hethel (UK) as part of its Lotus Vision80 strategy, to create a way towards their replacements. This will begin with what Lotus is calling the 'Type 131', prototype production of which will start later this year.

- The announcement that it will end production of its current range of vehicles is a huge step to moving the business in which Geely Automotive took a majority stake in 2017 forward.

- The Elise has been the mainstay product of its range for 25 years now. Although it has evolved during this time it has remained broadly on the same architecture, and while enthusiasts are still fond of it, it is showing its age.

- The Evora (12 years old) and Exige (12 years old, shares its platform with the Elise) will also end production.

- The Lotus Vision80 plan was devised in 2018 as a strategy that would take the company through the next decade to its 80th anniversary. Among its key goals are to deliver sales volumes and increase the efficiency of production to make the business more sustainable and enable it to support new program and business growth.

- This has already started to take place; investment at Hethel in recent years has focused both on manufacturing and research and development.

- The company has also now completed the consolidation of production of its lightweight structures and steel fabrication production at a single site in Norwich. This will help support the increase in volumes that Lotus is aiming for as it rolls out its new range.

- The European Commission has said that the EU's free trade agreements (FTAs) with third countries could lead to a significant growth in EU agri-food exports over the next ten years. On 26 January, the EU executive published an analysis of the economic effects of 12 FTAs on the EU's agri-food sector and found that the industry's exports could grow between 25-29% by 2030 - an increase worth around €4.7-5.5 billion. The Commission's Joint-Research Centre (JRC) conducted the study and based its estimates on the FTAs recently concluded or implemented by the EU - including those with Mexico and Vietnam - as well as some yet-to-be ratified agreements, such as the controversial Mercosur deal. The analysis focused on two scenarios for the 12 FTAs: full tariff liberalization of 99.5% and a 50% tariff cut for certain vulnerable goods, and a more conservative approach where full tariff liberalization was set at 97%, with a 25% tariff removal on sensitive products. Agriculture Commissioner Janusz Wojciechowski said at a press conference today: "The study is not forecast, or a prediction of the possible outcome of trade negotiations, [but] it nevertheless provides a growth direction and magnitude of the accumulated impacts of trade agreements on the agricultural sector by 2030." (IHS Markit Food and Agricultural Policy's Steve Gillman)

- Lanxess has provided a trading update based on preliminary and

unaudited figures, and says it estimates that EBITDA pre

exceptionals for the fourth quarter was about €200.0 million

($242.9 million), exceeding average market expectations of €181

million by 10% and ahead of the year-earlier level of €197 million.

(IHS Markit Chemical Advisory)

- The company says its fourth-quarter result was positively influenced by a stronger-than-expected increase in demand especially from the automotive industry, with December the strongest month.

- Lanxess supplies the automotive industry mainly through its engineering materials segment. The advanced intermediates and specialty additives segments also recorded a business development above expectations, the company says. The consumer protection segment performed well, as expected, it says.

- The company notes that these positive developments more than offset the effects of an unplanned production shutdown in Belgium in the engineering materials segment and adverse currency effects from a weaker dollar.

- Lanxess will release its fourth-quarter and full-year 2020 results on 11 March 2021.

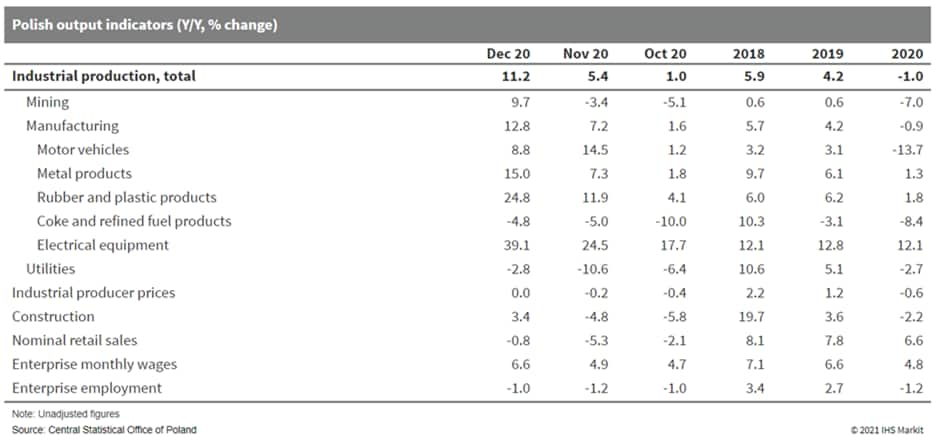

- Driven by working-day effects and a low base, Poland's

unadjusted industrial output growth surprised on the upside in

December 2020, surging by 11.2% year on year (y/y). Seasonally

adjusted growth was more subdued, at 7.1% y/y and 0.5% month on

month (m/m). (IHS Markit Economist Sharon Fisher)

- December 2020 industrial output growth benefitted from the recovery of mining activity, as well as strong y/y gains in a number of key manufacturing branches. Output of coke and refined fuel products continued to decline.

- By industrial grouping, consumer durables and intermediate goods reported double-digit gains, while production of capital goods jumped by 9.8% y/y. Energy production dropped by 2.7% y/y.

- In 2020 as a whole, Polish industrial production fell by just 1.0%, a far better result than in most other European countries. The renewal of COVID-19 virus restrictions had virtually no impact on Poland's manufacturing sector in the fourth quarter of 2020, with unadjusted output up by 6.8% y/y, an improvement over the third-quarter-2020 result.

- The positive results for industry were matched by a surprising upswing in construction activity, which rose by 3.4% y/y in December 2020, thanks to a revival of building construction. Seasonally adjusted output fell by 2.4% y/y but increased by 1.9% m/m.

- In 2020 as a whole, construction activity was down by 2.2% owing to declines in both civil engineering (-2.0%) and building construction (-4.9%).

- Benefitting from the reopening of shopping centers prior to Christmas, the retail trade sector also outperformed expectations in December last year, with sales (including the automotive sector) down by just 0.8% y/y in both real and nominal terms. Seasonally adjusted real sales increased by 2.4% m/m, following three straight months of declines.

- Despite the better-than-expected December results, seasonally adjusted real retail trade (including cars) fell by approximately 2.3% quarter on quarter (q/q) in the fourth quarter of 2020, after surging by 15.6% q/q in the previous quarter. In contrast, both industry and construction recorded significant q/q growth.

- Poland is scheduled to publish preliminary 2020 GDP figures on

29 January, and the latest data indicate that IHS Markit's latest

estimate (at -3.3%) was too pessimistic. Assuming a seasonally

adjusted decline of about 1.0% q/q in the fourth quarter, the

actual result was probably closer to -2.8%.

Asia-Pacific

- APAC equity markets closed lower; Hong Kong -2.6%, South Korea -2.1%, Mainland China -1.5%, India -1.1%, and Japan -1.0%.

- Hefei city government in China is to invest CNY2 billion (USD308 million) in electric vehicle (EV) startup company Leapmotor, according to an Xcar report. However, the reported planned investment by the Hefei authorities has not been confirmed by Leapmotor. Local media reports indicate that Leapmotor plans to go public in China within the year. According to the Xcar report, the investment by the Hefei government is likely to be completed before Leapmotor's initial public offering (IPO). On 8 January, the startup entered into an agreement with the municipal government of Hefei. Under the agreement, Leapmotor will invest in a new manufacturing plant in Hefei, Anhui province, which will be its second production facility in China. The new plant will increase the startup's production capacity by 200,000 units per annum, although much of that added capacity will not be used given Leapmotor's current sales volumes. Leapmotor currently has three models on the market, the S1 electric sedan, T03 mini-EV, and C11 mid-size electric sport utility vehicle. In 2020, Leapmotor sold 11,391 vehicles in China. The T03 made up nearly 90% of its sales last year. (IHS Markit AutoIntelligence's Abby Chun Tu)

- In an attempt to ease the supply shortage of semiconductors adversely affecting operations in the automotive industry, the Japanese government has asked Taiwan to ramp up production of semiconductors. According to a report by Kyodo News, Japanese Economy, Trade, and Industry Minister Hiroshi Kajiyama said, "In coordination with the auto industry, the Japanese government is requesting Taiwan authorities to work for an increase in [semiconductor] output through the Japan-Taiwan Exchange Association." The ministry added that it continues to closely monitor the situation as semiconductors are still short in supply. Taiwan is home to semiconductor giant Taiwan Semiconductor Manufacturing Co Ltd (TSMC). In a previous report by Reuters, Taiwan's Ministry of Economic Affairs confirmed that it had received requests through diplomatic channels to help ease the semiconductor shortage in the automotive sector. It went on to say that it has begun talks with domestic companies in this space in response to these requests and asked to "provide full assistance". Recently, Subaru announced plans to cut its car production in Japan and the United States by 30,000 units in February while Honda announced plans to cut production by around 4,000 units per month, which would mainly affect the Fit, built at its Suzuka facility. (IHS Markit AutoIntelligence's Isha Sharma)

- KBR has been contracted by SK E&S to provide technical advisory solutions for its hydrogen development business in South Korea. KBR will provide technical solutions to support SK's plan to build a 30,000 Mtpa liquefied hydrogen facility and supply liquefied hydrogen to various metropolitan areas in South Korea. The initial phase of the project includes KBR reviewing key licensor technologies. KBR has licensed over 260 syngas projects involving hydrogen production and has completed a large number of projects involving gas compression and cryogenic handling and storage. (IHS Markit Upstream Costs and Technology's Jie Sheng Aw)

- As per IHS Markit's Commodities at Sea, thermal coal imports

into South Korea during December 2020 dropped 26% y/y to 9mt.

Reduced imports were primarily due to government-induced

restrictions on coal-fired generation to improve air quality during

winters. Although during this period, HDDs (benchmark Seoul) were

15% higher y/y. It meant an increase in total electricity demand

and possibly coal burn at the plants during the month. (IHS Markit

Maritime and Trade's Pranay Shukla)

- As per the latest KEPCO data, total electricity generation in South Korea during November 2020 stood at 45TWh, marginally lower from the previous year's level. In terms of fuel mix, electricity generation from coal, gas, nuclear, and renewables stood at 14TWh (down 24percent y/y), 12.8TWh (up 1%), 14TWh (up 37%), and 2.7TWh (up 38%), respectively.

- Overall, during November 2020, the total South Korean electricity generation stood at 62.5GW with the share of coal-fired, gas, nuclear and remaining sources at 19.9GW, 17.8GW, 19.5GW, and 5.3GW, respectively.

- During the full year of 2020, HDD and CDD (benchmark Seoul) were 7% and 11% lower y/y. As per Kepco data, during Jan-Nov 2020, total electricity generation in South Korea stood at 501TWh, down 2% y/y. In terms of fuel mix, there was an increase in electricity generation from nuclear power plants (145TWh, up 8% y/y), Gas (129 TWh, up 0.5%), hydro (6.7TWh, up 16%), and renewables (29.2TWh, up 2%). While generation declined from coal-fired plants (180 TWh, down 13% y/y). The decline in coal-fired generation due to government-led restrictions capping operating capacity at 80% and was quite visible in thermal coal imports into the country.

- Due to government restrictions on coal-fired power plants, during 2020, total thermal coal imports stood at 87.2mt, down 18% y/y. In terms of export countries, there has been a decline in arrivals from Australia (32.7mt, down 13% y/y), Indonesia (22.6mt, down 23%), Russia (17.3mt, down 12%), Canada (6.4mt, down 3%), Colombia (4.6mt, down 15%), and South Africa (1.7mt, down 58%).

- Hyundai has announced an automated customer service robot pilot program. DAL-e is an acronym for Drive you, Assist you, Link with you-experience, the company says. The new robot uses language processing, facial recognition and automated mobility for "seamless wall-to-wall services under COVID-19 situation," the company statement says. Dong Jin Hyun, vice-president and head of Hyundai's robotics lab, said, "The DAL-e is a next-generation service platform that can offer automated customer services anytime. It is expected to become a messenger capable of delivering consistent messages to customers in a more intimate and personal way than conventional robots. With continuous updates and improvements, the DAL-e will provide fresh, pleasant experiences to our valued customers in a contact-free environment. Our objective is to enable the DAL-e to engage in a smooth and entertaining communication with customers and present valuable services to them." The robot was unveiled on 25 January, and started its pilot program the same day at a Hyundai showroom in southern Seoul. Hyundai intends to use the robot at other Hyundai and Kia showrooms over time. Hyundai says its DAL-e is lighter and more compact than other customer service and guide robots in the market. Along with providing information on products and services and responding to verbal and touch screen commands, Hyundai says that if the robot sees a customer come in without a mask, it will advise the customer to wear one. The DAL-e can assist customers who would prefer not to talk to a person or, Hyundai notes, provide assistance to customers during busy peak times. While the DAL-e is first being used at the Hyundai showroom in Seoul, the company plans further optimization, updates and improvements. The effort is part of Hyundai's larger plans for getting further into mobility and robotics services, and follows the company's intent to purchase of Boston Dynamics in 2020. There is significant focus in the pilot program for the opportunity to create an environment where the robot can help customers who are concerned about working with humans during the pandemic, but the company is expecting to increase and perfect is operational capabilities over time. Although there is no indication of when the pilot would be expanded, it is significant for Hyundai's ongoing research efforts. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The Reserve Bank of India (RBI) released a discussion paper on

22 January, entitled "Revised Regulatory Framework for NBFCs - A

Scale-Based Approach", in which the RBI proposes changing the

regulation regarding non-bank financial companies (NBFCs). For the

smallest NBFCs, which make up around 97% of the total NBFC number,

the RBI proposes increasing the net-owned fund floor tenfold to

INR200 million (USD2.7 million) and tightening the

non-performing-loan definition from 180 days to 90 days. The

largest 30 NBFCs will be regulated in a similar way to banks, with

limits to large, single-borrower exposure and a tier-1 capital

ratio minimum of 9%. (IHS Markit Banking Risk's Angus Lam)

- This is a risk-positive development for the financial sector in India. In recent years there have been problems related to loan and debt defaults by a key NBFC that triggered banks' risk averseness towards these companies (see India: 9 October 2018: Indian government's takeover of IL&FS highlights liquidity risks in financial sector, increases likelihood of infrastructure contract reviews).

- Although there have already been some regulation changes in recent years to improve risk oversight of NBFCs, the sector remains largely under-regulated, despite performing a similar function to banks.

- From the banking sector's perspective, the key improvement comes from the tighter regulatory stance on smaller NBFCs because this will bring their loan classification standards in line with those of larger NBFCs and allow banks to better understand the risk of lending to the sector.

- As of November 2020, lending to NBFCs accounts for 8% of total lending, up by 2% from two years ago, and most of this is likely to be to smaller NBFCs as larger ones can obtain funding from elsewhere. However, the higher net-owned fund requirements may result in the sector merging to form larger NBFCs and loans to the economy from NBFCs are likely to fall as a result of tighter regulation - lending by NBFCs had already fallen to around 5% year on year in September 2020. This could lead to lending by banks as the key driver again.

- Sumitomo Corporation has awarded JGC a FEED contract for its hydrogen-related project planned in Gladstone, Australia. This project is part of broader program that aims long term to build local hydrogen production and consumption in Gladstone by producing hydrogen from electrolysis of water using electricity from solar photo-voltaic as the main power source. The planned hydrogen production plant will have an initial capacity of 250-300 metric tons of hydrogen annually. (IHS Markit Upstream Costs and Technology's Jie Sheng Aw)

- New Zealand's headline consumer price index (CPI) rose 0.5% q/q

on a non-seasonally adjusted basis in the December quarter, which

was led by accommodation prices, according to official figures from

Statistics New Zealand. (IHS Markit Economist Andrew Vogel)

- The largest contributor to the uptick in CPI in the fourth quarter was domestic accommodation services prices - including prices for hotels, motels, caravan parks and camping grounds, and privately rented accommodation - which were up 20% q/q (or 6.2% y/y), because the COVID-19 virus pandemic's continued impact on international tourism forced New Zealanders to travel domestically. Similarly, cars (including used cars) and transportation costs were a key contributor to inflation for the quarter.

- Furniture and electronics costs also rose notably owing to fewer holiday discounts for these categories. This was balanced out by a sharp fall in food prices, driven by a 22% q/q fall in vegetable prices.

- Construction costs also rose, with new home build prices rising 1.3% q/q - the largest rise in more than two years. This coincided with an increase in rent prices of 0.5% q/q (or 2.9% y/y).

- The inflation rate of tradeables increased slightly in the December quarter, bringing the annual change to -0.3% y/y, largely driven by lower oil prices. The inflation rate of non-tradeables continued to rise during the quarter due to rising property rates and tobacco prices, and was offset by cheaper telecommunication services costs.

- The inflation result in the December quarter was higher than IHS Markit's forecast of 0.9% y/y, putting annual inflation for 2020 at 1.7%. Barring continued issues with food imports and housing prices, annual average inflation in 2021 is likely to ease to the low 1% range, supported the expected strength of the New Zealand dollar containing tradeables prices.

- Furthermore, we expect continued weakness in consumer demand through the first half of 2021 caused by reduced net inward migration, and weak services exports, contributing to lower employment levels and subdued inflation. In fact, we expect inflation to stay contained well below the bank's informal target of 2.0% (the official target range is 1-3%) into 2023.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-january-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-january-2021.html&text=Daily+Global+Market+Summary+-+26+January+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-january-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 26 January 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-january-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+26+January+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-january-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}