Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 26, 2022

Daily Global Market Summary - 26 January 2022

All major European equity indices closed sharply higher, APAC markets were mixed, and most US indices closed lower post-FOMC meeting. US and benchmark European government bonds closed lower. European iTraxx closed tighter across IG and high yield, while CDX-NA closed wider on the day. The US dollar, natural gas, oil, and copper closed higher, while silver and gold closed lower.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- In the statement issued at the conclusion of its two-day policy meeting that ended this afternoon (26 January), the Federal Open Market Committee (FOMC) all but guaranteed that it would begin to raise interest rates at the next meeting, on 16 March. The Committee asserted that "[w]ith inflation well above 2 percent and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate." This is about as clear as FOMC signaling gets when it comes to an imminent adjustment in the stance of monetary policy. Also at this meeting, the FOMC affirmed its existing Statement on Longer-Run Goals and Monetary Policy Strategy. It also set forth broad principles for normalizing its balance sheet that are consistent with IHS Markit analysts' expectations. (IHS Markit Economists Ken Matheny and Lawrence Nelson)

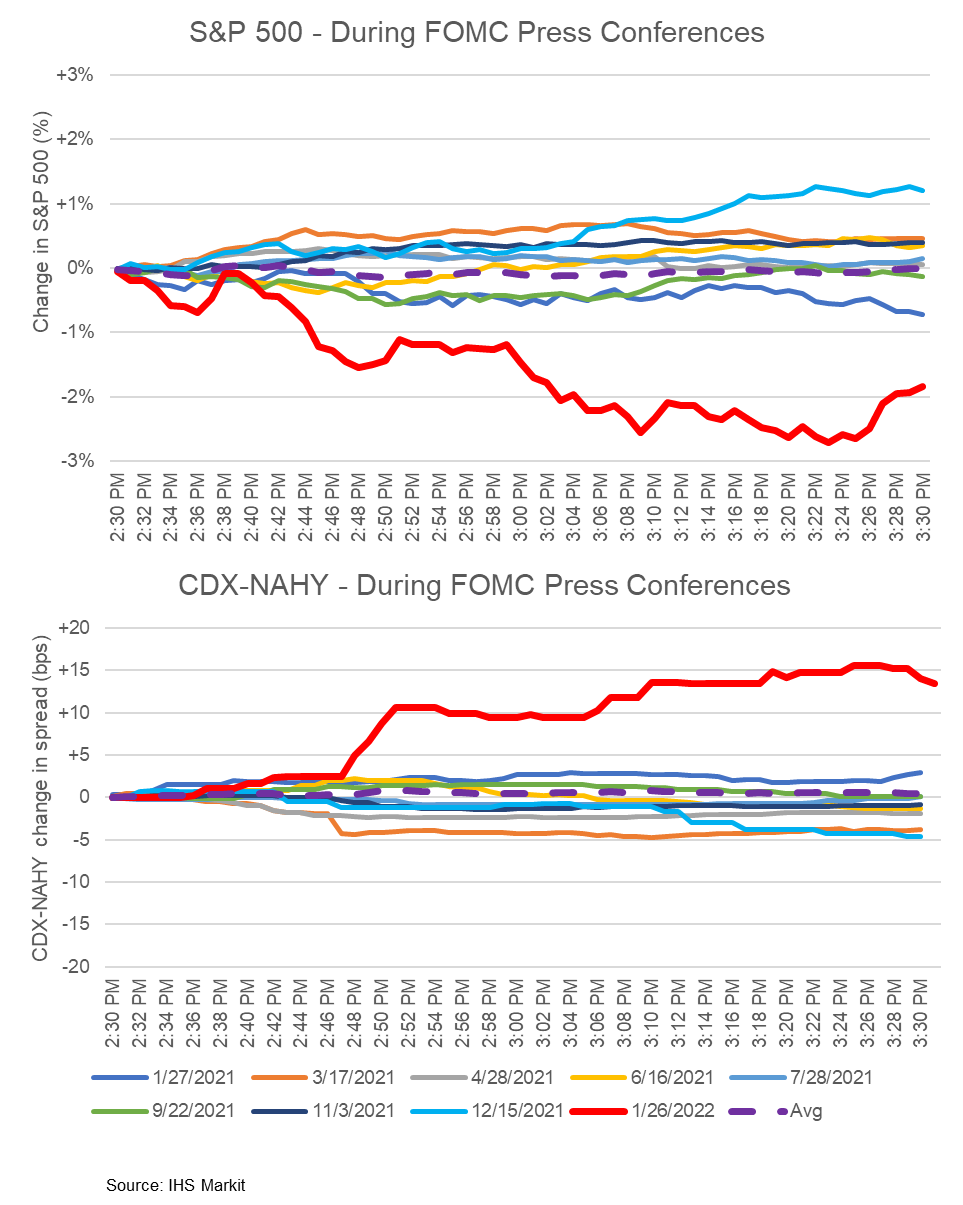

- The graphs below show the S&P 500 and CDX-NAHY intraday

reaction to every 2021-present Fed Chairman Powell FOMC press

conference, with performance indexed to the start of the session.

The S&P 500 declined as much as 2.7% and CDX-NAHY widened out

as much as 15bps during today's press conference, which is by far

the worst reaction to any FOMC press conference over the past

year.

- Most major US equity indices closed lower except for Nasdaq flat; S&P 500 -0.2%, DJIA -0.4%, and Russell 2000 -1.4%.

- 10yr US govt bonds closed +9bps/1.87% yield and 30yr bonds +5bps/2.17% yield.

- CDX-NAIG closed +1bp/60bps and CDX-NAHY +7bps/338bps, with the latter widening 10bps between 2:35-2:50pm ET.

- DXY US dollar index closed +0.5%/96.39, surging +0.4% from the 2:00pm ET release of the FOMC statement to 4:00pm ET.

- Gold closed -1.2%/$1,830 per troy oz, silver -0.4%/$23.81 per troy oz, and copper +1.5%/$4.52 per pound.

- Crude oil closed +2.0%/$87.35 per barrel and natural gas closed +3.6%/$4.04 per mmbtu.

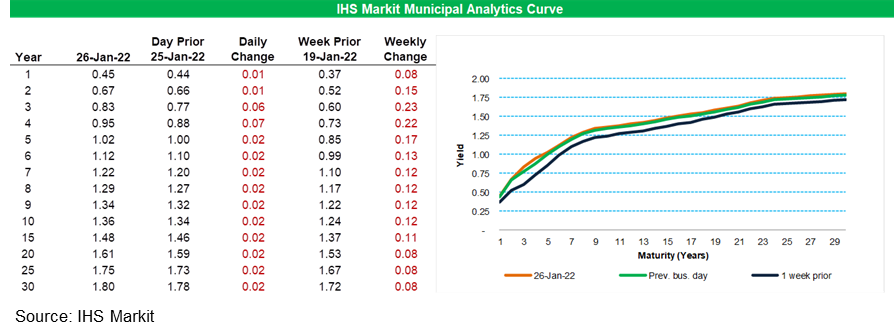

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC)

sold-off 6-7bps across 3- and 4-year maturities and was 1-2bps

weaker across the rest of the curve, with the curve 8-23bps worse

week-over-week.

- The combined inventories of US wholesalers and retailers rose

3.1% in December. In data going back four decades, there has never

been a one-month increase even close to that. (IHS Markit

Economists Ben

Herzon and Lawrence Nelson)

- Meanwhile, the nominal goods deficit widened in December by $3.0 billion to $101.0 billion. Both IHS Markit analysts and the Bloomberg consensus had expected a narrowing.

- The big news was on inventories. Large gains were posted at both the wholesale and retail levels. To be sure, some of the strength reflected price gains, but those have been accounted for in the processing of the data, and this morning's (26 January) report suggests that real nonfarm inventories accumulated in December at about a $350 billion annual rate.

- When combined with large increases in imports of goods over November (5.0%) and December (2.0%), this suggests that business may have been late last year bringing products to market.

- Patterns within retail sales late last year, including a sharp decline in December, suggest some early holiday shopping, and today's (26 January) report suggests that businesses, delayed by bottlenecks at ports and by supply constraints more generally, were about a month or so late stocking their shelves.

- In any event, the good news from this report is that December saw a healthy pace of domestic production, even if it was largely to restock inventories.

- The bad news, though, is that the inventory-building that took place late in 2021 was probably at the expense of some production in 2022.

- US new home sales increased 4.2% in the fourth quarter, the

first increase in the third quarter of 2020. Builders sold 762,000

new homes in 2021, down from 822,000 in 2020. Annual sales fell in

all four regions. This release gives a complete first full picture

of the fourth quarter and of 2021. (IHS Markit Economist Patrick

Newport)

- The annual drops are mainly payback for strong sales in 2020.

- The median and average new home prices soared 14.3% and 19.4%, respectively, from a year earlier in the fourth quarter. From 2016 to just before the pandemic struck in early 2020, new home prices hardly budged.

- Meanwhile, builders' costs have also soared. The Census's construction cost index for homes under construction (the three-month average), which came out today (26 January), was up 16.8% in December—which means that builders' margins have narrowed to almost nothing.

- Inventory—the number of homes for sale at the end of the month—increased by 10,000 in December to a 13-year-high 403,000. Only 39,000 homes classified as inventory were completed; inventory units still in the planning stage were 101,000.

- New home sales shot up 11.9% in December to an 811,000-unit seasonally adjusted annual rate. A double-digit sales increase sounds impressive. This one is not because it was not statistically significant.

- Avocadoes, seedless grapes Red Globe, mangoes and blueberries

are among those fresh fruit with steep increases in retail price

compared to the same week last year during the week beginning from

15 January, according to the USDA's report: Specialty Crops at

Major Retail Supermarket Outlets (21 January 2022). (IHS Markit

Food and Agricultural Commodities' Hope Lee)

- On national weighted average in supermarkets, Hass avocado prices rose 11% w/w to $1.5 each, a 52% y/y increase from the same week last year. Various Greenskin varieties showed no price change from last week at $2.0 each, but 160% y/y increase; it was $0.77 each at the same week last year. Most produce are Mexico origins; some are from the Dominican Republic.

- Mangos weakened 1% w/w to $1.2 each, but, 50% up y/y. Main origins are Mexico, Ecuador, Brazil, Peru. Other suppliers include Puerto Rico, Guatemala and Vietnam. Both India and Colombia have obtained market access to the US mango market recently.

- For w/w comparison, blueberries packaged in various sizes showed different price fluctuations. Blueberries in 6 oz package rose 4% w/w to $2.98, 20% up y/y; fruits in 18 oz package were flat w/w, but, 31% up y/y. Fruit packaged in 1 pint went down 6% w/w to $2.91, 21% up y/y. Main origins are Mexico, Chile, Peru, Florida and California.

- Selected grape prices rose w/w and y/y significantly for this week. Red Globe rose 105% w/w to $2.99 per pound, 39% up y/y. Black Seedless grew 8% w/w to $2.94 lb, 32% up y/y. Red Seedless rose 23% w/w to $2.87 lb, 25% y/y. Peru and Chile are the main origins.

- Red raspberries in 6 oz package decreased 14% w/w to $2.39 lb, 21% down y/y. Mexico is the key origin.

- Strawberries in 1 lb package increased 8% w/w to $3.07 lb, 3% up y/y. Fruit in 2 lb package weakened by 21% w/w to $5.27 lb, 12% up y/y. Strawberries are mainly from California, Florida and Mexico.

- The National Marine Fisheries Service (NMFS) will announce in

the January 27 Federal Register that it is taking comments on

proposed authorization and possible renewal of a permit related to

impacts on marine mammals during exploration work by Atlantic

Shores Offshore Wind LLC. NMFS has received a request from Atlantic

Shores Offshore Wind for authorization to take marine mammals

incidental to marine site characterization surveys off New Jersey

and New York in the area of Commercial Lease of Submerged Lands for

Renewable Energy Development on the Outer Continental Shelf Lease

Area OCS-A 0499. Comments will be taken for 30 days after January

27. (IHS Markit PointLogic's Barry Cassell)

- On August 16, 2021, NMFS received a request from Atlantic Shores for an incidental harassment authorization (IHA) to take marine mammals incidental to marine site characterization surveys occurring in three locations. NMFS deemed the application adequate and complete on December 13, 2021. Neither Atlantic Shores nor NMFS expects serious injury or mortality to result from this activity and, therefore, an IHA is appropriate. NMFS previously issued two IHAs to Atlantic Shores for similar work, in April 2020 and April 2021.

- As part of its overall marine site characterization survey operations, Atlantic Shores proposes to conduct high-resolution geophysical (HRG) surveys in the Lease Area (OCS)-A 0499 and along potential submarine cable routes (ECRs North and South) to a landfall location in either New York or New Jersey. The purpose of the proposed surveys are to support the site characterization, siting, and engineering design of offshore wind project facilities including wind turbine generators, offshore substations, and submarine cables within the Lease Area and along export cable routes (ECRs).

- As many as three survey vessels may operate concurrently as part of the proposed surveys. Underwater sound resulting from Atlantic Shores' proposed site characterization survey activities, specifically HRG surveys, has the potential to result in incidental take of marine mammals in the form of behavioral harassment.

- The estimated duration of the surveys is expected to be up to 360 total survey days over the course of a single year within the three survey areas. As multiple vessels (i.e., three survey vessels) may be operating concurrently across the Lease Area and two ECRs, each day that a survey vessel is operating counts as a single survey day.

- General Motors (GM) is investing USD7 billion in electric vehicle (EV) battery and vehicle production in the US state of Michigan, including transitioning the Orion assembly plant to full-size EV pick-up production. Although such a move had been rumored, GM's plan is more ambitious than early reports suggested. This latest investment will bring GM's North American EV capacity to 1 million units in 2025, including 600,000 full-size pick-ups. This is the largest single investment GM has made in Michigan. This investment supports GM's aggressive zero-emission targets, including its aim for 100% of its US sales to be zero-emission vehicles in 2035; the investment is part of the USD35 billion that GM has committed to EVs and autonomous vehicles (AVs). Furthermore, GM has confirmed again that it plans to convert 50% of its North American assembly capacity to EV production by 2030. With this latest announcement, GM is well on the way to reaching that target - and there will be more announcements to come. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Previously, the Bank of Canada outlined the steps it would take

when stimulus was no longer needed. The initial step was announced

in October as quantitative easing ended and the Bank moved to the

reinvestment phase. The next step, announced today (26 January),

was the removal of the extraordinary forward guidance once

estimates indicated excess capacity was absorbed. The next step

will be the increase in interest rates to control inflation.

Supply-side factors such as reduced production, labor absenteeism,

and shipping and delivery delays are significantly impacting

prices. The Bank is forecasting that inflation will head higher

than December's 4.8% year-on-year (y/y) rate going into the first

quarter. IHS Markit analysts agree. (IHS Markit Economist Arlene

Kish)

- The Bank of Canada kept the overnight rate at the lower effective bound of 0.25%.

- It is estimated that the economic slack has been absorbed and as such the Bank dropped its extraordinary forward guidance on the policy rate.

- The Bank's new real GDP growth forecast for Canada was revised down to 4.0% (down 0.3 percentage point) for 2022, and 3.5% (down 0.2 percentage point) for 2023.

- Inflation is expected to be markedly higher at 4.2% (up 0.8 percentage point) this year. The outlook for 2023 inflation is unchanged at 2.3%.

- This is a "significant shift" in monetary policy that will change the forecast. The stage is set for policy rate increases. Once monetary policy tightening begins, look for the Bank to reduce the size of its financial balance sheet assets by letting Government of Canada bonds roll off and not be replaced.

- Look for the Bank to tighten monetary policy in March or April at the latest. More interest rate hikes are expected this year to control inflation and bring it back to the 2.00% target.

- Mexico's National Statistics Office of Mexico (Instituto

Nacional de Estadística y Geografía: INEGI) reported that the MIEA

went up by 0.3% in November 2021 compared with October (month on

month, m/m), based on seasonally adjusted data. Although the

agriculture and industry sectors posted expansions, they were

partially offset by the decline in the industry. (IHS Markit

Economist Rafael

Amiel)

- Detailed information on industrial production shows that manufacturing is flat, while construction and utilities continue on a downward trend. Mining has expanded, driven by higher output of liquefied natural gas.

- Data from the all-important automotive sector shows that production of new vehicles in the full-year 2021 amounted to 2.981 million units, down by 1.9% from 2020, and significantly lower than the 3.811 million units produced in 2019 before the COVID-19 pandemic. This is explained by the global shortage of semiconductors and supply chain disruption.

- November's results for the MIEA breaks three consecutive monthly declines but does not change the downward trend that began at the end of the first quarter of 2021 (see graph below). Mexico's economy is stagnating, while the US economy - its main trading partner - is still growing at relatively strong rates.

Europe/Middle East/Africa

- All major European equity markets closed higher; Italy +2.3%, Germany +2.2%, France +2.1%, Spain +1.7%, and UK +1.3%.

- Most 10yr European govt bonds closed lower except for Germany flat; France +1bp, UK +3bps, Italy +4bps, and Spain +5bps.

- iTraxx-Europe closed -1bp/56bps and iTraxx-Xover -5bps/271bps.

- The Law Commission of England and Wales and the Scottish Law Commission have jointly proposed recommendations for the roll out of higher levels of autonomous systems, according to a range of media reports. The proposed "Automated Vehicles Act" would result in a legal reform that would mean the person in the driving seat of a car using "self-driving features" would "no longer be responsible for how the car drives", and would be immune from prosecution. The plan would see the company or organization that obtained authorization for the technology would face sanctions in cases of accidents or malfunctions. However, the person in the driving seat would remain responsible for the other aspects of using the vehicle, such as insurance, checking loads and ensuring children in the car wear seat belts. The Law Commissions have also recommended that passenger services that use autonomous vehicles are accessible especially to older and disabled persons. On the announcement, Scottish Law Commissioner David Bartos, said that the proposal is focused on "ensuring safety and accountability while encouraging innovation and development". It is important to stress that this is still only a proposal put forward by the law commissioners; fully autonomous vehicle technologies are not yet legal, but are being tested in controlled circumstances. It will also be for the UK, Scottish and Welsh governments to decide whether the accept the report's recommendations. However, the proposal goes some way to delineate the current grey areas for when the technology is ready to be introduced. Most notably, it places accountability on the autonomous operation systems when the person in the driving seat is relying on the technology to respond to what is taking place on the road. (IHS Markit AutoIntelligence's Ian Fletcher)

- The United Kingdom Business, Energy and Industrial Strategy

(BEIS) has awarded GBP31.6 million (USD42.7 million) of grants to

fund eleven projects related to floating offshore wind. The largest

award of GBP10 million (USD13.5 million) was awarded to SENSE Wind

to design, install, and test a self-erecting nacelle and service

(SENSE) system on the Pelastar design tension leg platform (TLP).

In addition to these two technologies, the TLP will feature two

additional innovations for high vertical load anchors and synthetic

mooring tendons. (IHS Markit Upstream Costs and Technology's Melvin

Leong)

- Another major recipient, is for a GBP9.7 million (USD13 million) grant for the Integrated Floating Offshore Wind Demonstrator (INFLOAT) project. The project seeks to demonstrate and address competition technology challenges through integration with the Pentland Demo Project, where a 15-18 MW class floating platform based on Steisdal Offshore Technologies's TetraSub design will be deployed. The project will study the use of nylon mooring lines, dynamic cable protection, modular industrialized components and assembly methodology, and the use of digital twins and advanced monitoring systems.

- A novel concept, the Trivane trimaran floating barge platform, received a grant of GBP3.3 million (USD4.4 million) for the fabrication and deployment of a demonstrator. The awards covered a range of technologies complementary to floating wind deployment and include awards to JDR Cable Systems for dynamic high-voltage cables; London Marine Consultant (LMC) for a disconnectable buoy mooring system; Reflex Marine for deep set tensile anchors; AWC Technology for the demonstration of its articulated wind column concept, which is a buoyant column connected to a gravity base anchor; Buoyant Production Technologies for the deployment of a passive ballast spar buoy; Aker Solutions for its subsea substation; Marine Power Systems for its integrated wave energy system; and Cerulean Winds for its floating wind accelerator demonstration project.

- In an unusual strategy, Stellantis is planning to begin

exporting production of light commercial vehicles (LCVs) from its

plant in Kaluga (Russia) to the European market, according to a

Reuters report. Exports will begin with the company's three sibling

mid-sized vans that are built at the plant; the Peugeot Expert, the

Opel Vivaro and the Citroën Jumpy, with shipping expected to begin

in February. (IHS Markit AutoIntelligence's Tim Urquhart)

- The Russian output of these models would combine with output from European production sites in Valenciennes (France) and Luton (UK), to help meet growing demand to Western Europe for medium and light delivery vans, mainly as a result of the boom in online shopping since the onset of the COVID-19 virus pandemic in March 2020.

- Output of LCVs at the Kaluga plant has doubled in 2021, according to Stellantis, and the spare capacity will now be used to serve the European market as well as the domestic Russian market. Production of vans began at Kaluga in 2017, which was originally established as the PSMA joint venture (JV)) between PSA and Mitsubishi to build passenger cars for the Russian market.

- There are also plans to add other programs at the plant for export, including plans to build the new Fiat Scudo (a version of the aforementioned mid-sized Peugeot, Citroën and Opel vans) for export at the end of 2022. There is also a plan to start production of diesel engines and manual transmissions for export, as well as to add the production of compact vans for a number of Stellantis brands.

- This is an unusual step as the majority of Russian production by foreign OEMs is generally targeted at the domestic Russian market. Over the last two decades, a large number of major global non-Russian OEMs have established their own production presence in Russia, with hopes that it would eventually overtake Germany to become the biggest in the wider European region, with volumes of over 3 million units in the latter part of the last decade forecast at the time.

- The Russian light-vehicle market closed the gap significantly to the German market on a number of occasions, most notably in 2008 just prior to the financial crisis, when the Russian LV market hit 2.96 million units and the German market was at 3.34 million units, and then following the recovery in 2012 when Russia returned to 2.94 million units, which would turn out to be its historical peak so far. However, it suffered a gradual decline in 2013 and 2014 before lower oil and gas prices hit the valuation of the ruble in the second half of 2014.

Asia-Pacific

- Major APAC equity indices closed mixed; Mainland China +0.7%, Hong Kong +0.2%, and South Korea/Japan -0.4%.

- Jidu Automotive, an electric vehicle (EV) startup backed by Chinese search engine giant Baidu and Chinese carmaker Geely Auto, has said that it raised nearly USD400 million in its A round of financing from Baidu and Geely. Jidu says that it will begin deliveries of its mass-produced "robot" cars in 2023, reports Reuters, citing a company statement. Reuters reported in April 2021 that Jidu expected to raise a total of CNY50 billion (USD7.9 billion) to develop its intelligent EVs, which the company is calling "robot" cars. The USD400 million the startup has just raised will mainly go towards the research and development of its first model, which will be unveiled in April at the Auto China 2022. Expectations for Jidu's first model are quite high as its parent company Baidu is a leading player in the development of Level 4 autonomous technology and artificial intelligence (AI) solutions. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Real GDP for South Korea accelerated in the fourth quarter,

increasing by 1.1% quarter on quarter. It was the sixth consecutive

quarter of growth after the COVID-19 pandemic-induced decline in

the first half of 2020. (IHS Markit Economist Dan Ryan)

- The largest contribution to growth came from private consumption. This was surprising since a resurgence of the pandemic led to stricter social restrictions in the fourth quarter of 2021. However, this can be explained by the increased purchases of goods, rather than services, by at-home consumers.

- The next largest contribution came from fixed investment, making up 0.4 percentage point out of the 1.1% total. This category had shrunk in the prior two quarters, but rose in the fourth quarter thanks to residential investment and to a lesser extent intangibles (intellectual property). Capex on equipment fell for the second consecutive quarter, suggesting that manufacturers were less eager to invest.

- Net exports increased, yielding 0.25 percentage point to growth. Government consumption also rose, thereby keeping it slightly above the long-term uptrend that it has been on for several years. Inventories decreased, but this is probably a good thing as it lowers the excess inventory levels left over from the initial pandemic.

- Virtually all growth was generated by three categories: manufacturing, construction, and services. As mentioned above, the strength of services is surprising given the COVID-19 upsurge and concomitant movement restrictions in the fourth quarter of 2021.

- Korea Floating Wind (KF Wind), a joint venture between Ocean Winds (a joint venture between EDP Renewables and ENGIE) and Aker Offshore Wind, has obtained its first Korean Electric Business License (EBL) for a capacity of 870 MW. The company is expecting a second EBL for 450 MW to follow. The EBLs are key to KF Wind building the world's largest commercial-scale floating wind farm. The 1.2 GW wind farm, which is likely to be built across three sites offshore the City of Ulsan could potentially yield up to 1.5 GW of capacity. KF Wind is majority (66.7%) owned by Ocean Winds, with the remaining shares by Aker Offshore Wind. The project will utilize Principle Power's WindFloat floating foundation technology. Principle Power is 47% owned by Aker Offshore Wind. Other shareholders include Ocean Wind owner EDPR, and EDP Ventures and Tokyo Gas. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- The Indian Ministry of Heavy Industries said that it has received bids from 10 companies under the 'Advanced Chemistry Cell (ACC) Battery Storage Programme', which aims to create a large-scale electric vehicle (EV) battery manufacturing ecosystem in the country. The Ministry had released a request for proposals under its ACC Battery Storage Programme on 22 October 2021; it was open for receiving applications from interested companies until 11:00:00 hours IST on 14 January 2022. Technical Bids were opened on 15 January 2022, it said, adding that companies would be required to set up battery production plants within two years. "The incentive will be disbursed thereafter over a period of five years on sale of batteries manufactured in India," said the Indian government in a press release. It had previously approved the Production Linked Incentive (PLI) scheme for the National Programme on Advanced Chemistry Cell (ACC) Battery Storage, to achieve manufacturing capacity of 50 GWh of ACCs, with the intent to enhance the subcontinent's manufacturing capabilities with a budgetary outlay of INR181 billion (USD2.42 billion). "Under the said initiative the emphasis of the government is to achieve greater domestic value addition, while at the same time ensure that the levelized cost of battery manufacturing in India is globally competitive," it said. According to the government's note, the 10 companies that are interested in setting up battery manufacturing plants under the ACC PLI scheme are Reliance New Energy Solar Ltd, Hyundai Global Motors Company Ltd, Ola Electric Mobility Private Ltd, Lucas-TVS Ltd, Mahindra & Mahindra Ltd, Amara Raja Batteries Ltd, Exide Industries Ltd, Rajesh Exports Ltd, Larsen & Toubro Ltd, and India Power Corporation Ltd. The government note also said that the program is technology-agnostic, and the beneficiary firm would be free to choose the most suitable advanced technology and the corresponding plant and machinery, raw materials and other intermediate goods it needs for setting up cell manufacturing facility to cater to any application. (IHS Markit AutoIntelligence's Jamal Amir)

- A power overload occurred on the 500 kW North-East-South Kazakhstan electricity transmission line, on 25 January at midday local time, according to the press service of Kazakhstan's Prime Minister's Office. This led to power outages affecting the largest city Almaty, Shymkent, Taraz, and other areas across southern Kazakhstan. In Almaty alone 28 traffic incidents were registered between 12:00 and 15:00 due to non-functioning traffic control systems. The overload in Kazakhstan had a severe impact on neighboring Uzbekistan and Kyrgyzstan, which since Soviet times have maintained an integrated regional electricity grid. Uzbek authorities temporarily had to suspend all airport operations, leading to flight cancellations. The electricity blackout forced closure of the subway system in the Uzbek capital Tashkent. In Kyrgyzstan both the capital Bishkek and the second largest city Osh were severely affected with traffic control systems shutting down and Manas airport switching to alternative energy sources. Turkmenistan and Tajikistan were not affected, having left the regional energy grid in 2003 and 2009 respectively. The situation has since stabilized in all three countries. A trilateral intergovernmental commission has been established to investigate the unprecedented power blackout, according to Kyrgyz Energy Minister Doskul Bekmurzayev. The vulnerability of the regional electricity grid is likely to have increased following the recent influx of electricity-intensive cryptocurrency mining businesses to Kazakhstan from neighboring China, where cryptocurrency mining was banned in September 2021. (IHS Markit Country Risk's Alex Melikishvili)

- Australia's headline consumer price inflation rose 1.3% quarter

on quarter (q/q) in non-seasonally adjusted terms - the fastest

quarterly increase in inflation since the September quarter of 2012

- representing 3.5% year-on-year (y/y) growth. The country's

measures of core inflation (trimmed mean and weighted median) also

reached seven-year highs due to the broad-based nature of price

increases. In fact, the only major sub-component of the consumer

price index (CPI) to record a decline in the December quarter was

the health component, which fell by 0.3% q/q. (IHS Markit Economist

Bree

Neff)

- According to the Australian Bureau of Statistics (ABS), the key driver of the upside surprise in inflation was "non-discretionary" inflation - the price increases on goods and services for which households have relatively inelastic demand, such as food, automotive fuel, housing, and healthcare. Non-discretionary inflation was up 4.5% y/y in the December quarter, whereas discretionary inflation was up only 1.9% y/y, according to the ABS.

- Contributing heavily to non-discretionary inflation - and the transportation component of the CPI - automotive fuel prices alone rose 6.6% q/q during the December quarter, and were up by 32.3% y/y. This was the highest annual increase in fuel prices since 1990. Furthermore, the housing component of the CPI was boosted by a second consecutive quarter of rapid price growth for new dwelling purchases, up 4.2% q/q and 7.5% y/y, marking the largest annual increase since Australia introduced its Goods and Services Tax (GST) in 2000. According to the ABS, the increase was driven by continued shortages of materials and workers, as well as the end of the government's HomeBuilder subsidy, making home buyers ineligible for the reductions in home prices that the subsidy offered.

- The ABS reported the previous week that the unemployment rate plunged to a seasonally adjusted 4.2% in December 2021, as the economy added further jobs and the labor force participation rate remained steady at an elevated 66.1% for a second consecutive month. This puts the unemployment rate at a level not seen since 2008, and is approximately at the rate that the RBA considers to be full employment.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-january-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-january-2022.html&text=Daily+Global+Market+Summary+-+26+January+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-january-2022.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 26 January 2022 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-january-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+26+January+2022+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-january-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}