Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 26, 2021

Daily Global Market Summary - 26 November 2021

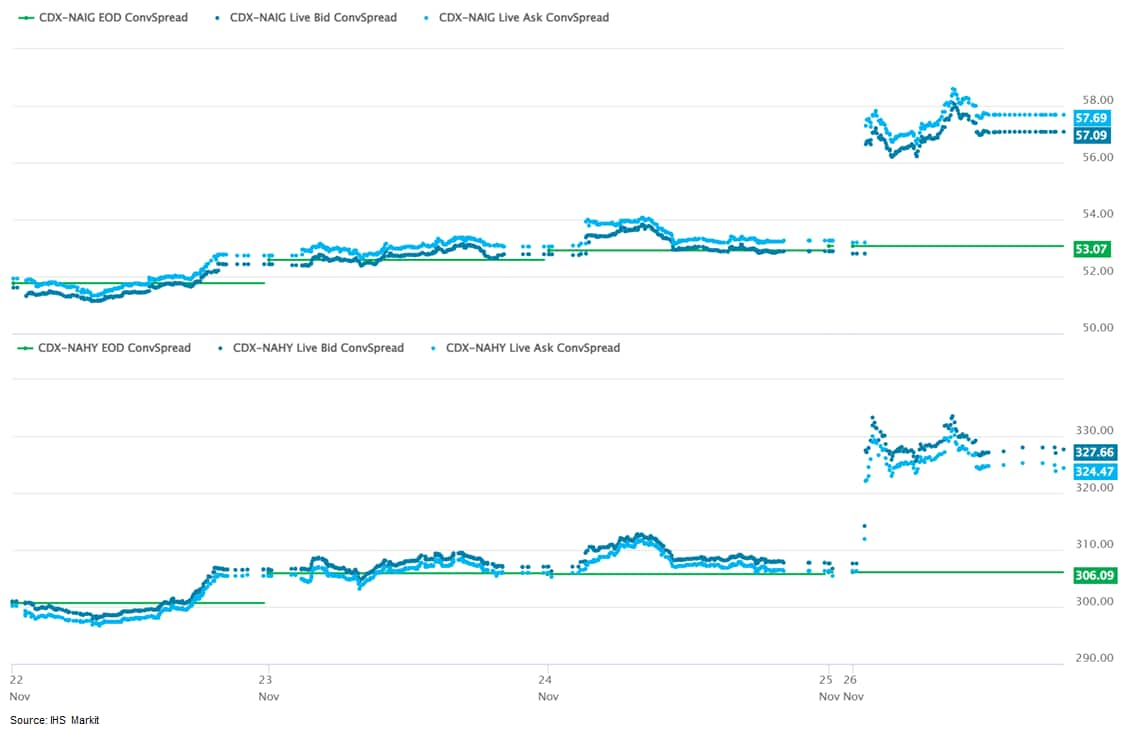

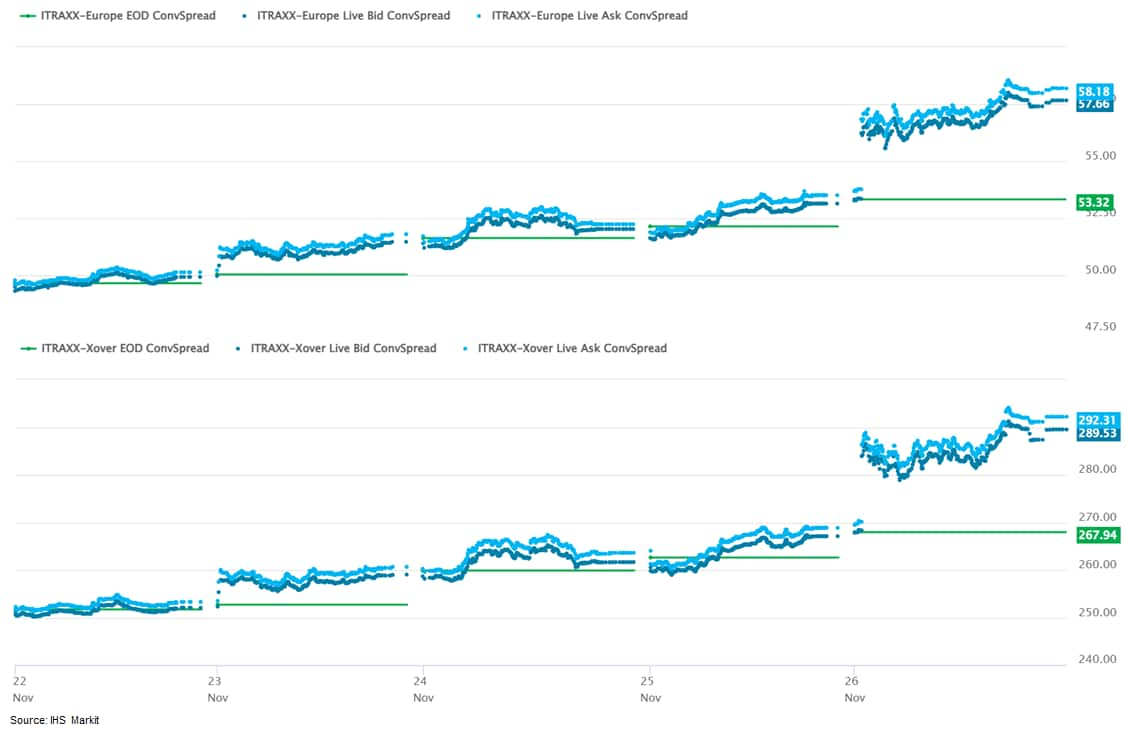

All major US, APAC, and European equity markets closed significantly lower on growing concerns over the new Omicron COVID-19 variant. US and benchmark European government bonds closed sharply higher. European iTraxx and CDX-NA closed wider on the day across IG and high yield. Natural gas and gold closed higher, while the US dollar, oil, copper, and silver closed lower.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower; Nasdaq -2.2%, S&P 500 -2.3%, DJIA -2.5%, and Russell 2000 -3.7%. US equity and bond markets closed early given the prior day's Thanksgiving holiday.

- 10yr US govt bonds closed -16bps/1.48% yield and 30yr bonds -14bps/1.83% yield.

- CDX-NAIG closed +4bps/57bps and CDX-NAHY +20bps/325bps, which

is +5bps and +25bps week-over-week, respectively.

- DXY US dollar index closed -0.9%/96.04.

- Gold closed +0.1%/$1,786 per troy oz, silver -1.7%/$23.11 per troy oz, and copper -3.9%/$4.28 per pound.

- Crude oil closed -13.1%/$68.15 per barrel and natural gas closed +7.1%/$5.48 per mmbtu.

- Anthony Fauci, President Joe Biden's chief medical adviser, said COVID-19's omicron variant may well already have arrived in the U.S. "I would not be surprised if it is," Fauci said on NBC's "Weekend Today" on Saturday. "We have not detected yet," but when a virus shows "this degree of transmissibility" it "almost invariably ultimately is going to go essentially all over," he said. "It seems to have spread rather rapidly in South Africa," Fauci said. "Its ability to infect people who have recovered from infection and even people who have been vaccinated makes us say this is something you have to pay really close attention to and be prepared for something that's serious." (Bloomberg)

- Electric vehicle (EV) maker Rivian has started notifying customers who have reserved the R1S electric sport utility vehicle (SUV) of delivery delays, according to Reuters, citing news from unnamed media outlets. The delivery window for the R1S has been changed to between May and July at the earliest, according to the report. The company had earlier said R1S would begin production at the Normal (Illinois, US) plant in December, with the first deliveries expected that month. Reuters said it could not independently verify the information. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Joint venture partners Ørsted and Eversource have obtained its Record of Decision (ROD) from the US Department of the Interior's Bureau of Ocean Energy Management (BOEM) for their 132 MW South Fork project offshore Rhode Island. The BOEM approved the construction of no more than 12 offshore wind turbines for the project, located 19 miles southeast of Block Island, New York. Before construction can take place, Sotuh Fork Wind must submit a facility design report and a fabrication and installation report. The reports will provide specific details for how the facility will be fabricated and installed according to the approved construction and operations plan. South Fork Wind has stated that it remains on track to be fully permitted by 2022 and expects to commence operations at the end of 2023. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Wallbox launched the Eco-Smart and Power Boost charging home energy management solutions, which is now available for electric vehicle (EV) drivers in the US, according to a company statement. Both the solutions come standard with Pulsar Plus which is the smallest available smart home EV charger in North America and capable of 48Amp (11.5 kW) charging. "These latest features represent a leap forward in how EV owners can charge their vehicles at home," said Wallbox North America general manager Douglas Alfaro. "With the release of Eco-Smart and Power Boost, we have reimagined the way in which energy is monitored, used, accessed and optimized for EV owners throughout the home. As energy costs and demand are expected to continue to rise, intelligently managed EV chargers will become not only a cost-savings measure, but a way to facilitate the transition to clean energy in the future". Eco-Smart functions with the help of a power meter to measure the energy from a rooftop solar system mounted at home to charge an EV in the most possible efficient and sustainable manner. Eco-Smart can be accessed through the myWallbox app if the homeowner prefers to switch to all-grid power. This feature gives homeowners a choice of power source and power is delivered in two modes: full-green mode detects when there is enough surplus green energy available from the home solar system to charge an EV, so that the EV uses only renewable energy in the process; and eco mode leverages grid energy and excess green energy from the home solar panels thereby maximizing charging speed while making use of available power from the home solar system. Power Boost can measure the household's real-time energy usage and can dynamically adjust EV charging power letting users install a more powerful EV charger. The system regulates power supply based on the appliances running. Pulsar Plus is compatible with all EVs, including Tesla with the J1772 adapter. Features include flexible amperage setting, Bluetooth and Wi-Fi connectivity, charge scheduling, power sharing, the myWallbox app, and voice control via Amazon Alexa and Google Home. (IHS Markit AutoIntelligence's Jamal Amir)

- Vietnamese automaker VinFast plans to start sales of its VF e35 and VF e36 all-electric sport utility vehicles (SUVs) in Canada in the second quarter of 2022, reports the Vietnam News Brief Service, citing VinFast Auto Canada chief growth officer Hans Ulsrud. The Vietnamese automaker aims to introduce its electric vehicles (EVs) in the three most dynamic markets in Canada, the provinces of Quebec, Ontario, and British Columbia. (IHS Markit AutoIntelligence's Jamal Amir)

Europe/Middle East/Africa

- All major European equity indices closed significantly lower; UK -3.6%, Germany -4.2%, Italy -4.6%, France -4.8%, and Spain -5.0%.

- 10yr European govt bonds closed sharply higher; UK -14bps, Italy -10bps, Germany -9bps, and France/Spain -8bps.

- iTraxx-Europe closed +5bps/58bps and iTraxx-Xover

+23bps/291bps, which is +8bps and +39bps week-over-week,

respectively.

- Brent crude closed -11.5%/$71.59 per barrel.

- The U.K. and Italy became the latest countries to detect the Omicron variant of the coronavirus, as other European nations investigate suspected cases of a strain that health authorities say could be more transmissible and has been driving a jump in infections in South Africa. The U.K. government tightened restrictions, including imposing new mask mandates and PCR tests for travelers, after testing identified the first two cases of the variant in the country, connected to South African travel. The individuals have been told to self-isolate along with their households. (WSJ)

- Near-term inflation projections will be revised up at

December's meeting but the medium-term assessment is likely to

remain consistent with a cautious withdrawal of policy

accommodation. Recent European Central Bank (ECB) communications

have been notably dovish against a backdrop of soaring inflation.

(IHS Markit Economist Ken

Wattret)

- The ECB's most recent policy-setting meeting took place on 27-28 October, prior to the pronounced deterioration in coronavirus disease 2019 (COVID-19) trends across many member states of the eurozone. To some extent, therefore, the published account of October's policy meeting has been overtaken by events.

- Nonetheless, regarding inflation developments, prospects, and related risks, the account offers some insight into how the debate within the ECB is evolving. In short, although concerns were expressed by some Governing Council members about persistent recent underestimation of inflation rates and upside risks, the tone of the account overall is supportive of IHS Markit's assessment that the ECB will be very cautious in removing its policy accommodation.

- Indeed, significant concern was expressed at the meeting that financial markets, by bringing forward expectations of policy rate lift-off to late 2022, had not correctly interpreted the ECB's modified forward guidance, including the 'troika' of inflation conditions that would need to be met for a policy rate tightening cycle to begin.

- Although the current phase of higher inflation was projected to last longer than originally anticipated, inflation was still expected to decline during 2022. The upswing largely reflected three factors: the sharp rise in energy prices, a reopening-driven recovery in demand outpacing supply, and base effects related to 2020's value-added tax (VAT) cut in Germany. Members said the influence of all three would ease or fall out of the year-on-year inflation calculation in 2022.

- Reference was made to the recurrent underestimation of headline and underlying inflation rates, corroborating earlier conjectures that the risks around the September 2021 ECB staff projections had been tilted to the upside. Members said it was likely that in December 2021's Eurosystem staff projections, the shorter-term inflation outlook would once again be revised upwards.

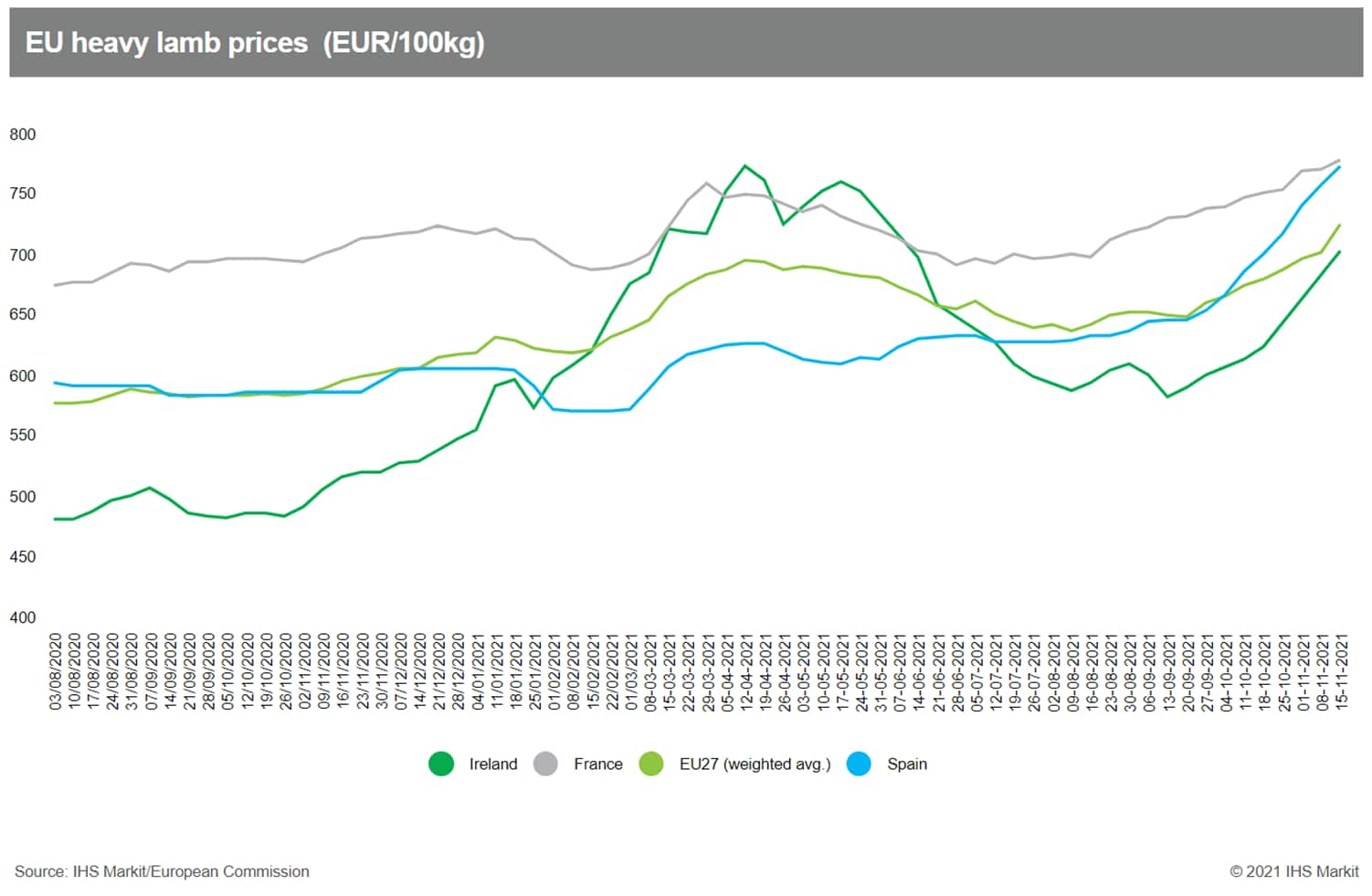

- European lamb prices have surged upwards over the past week to

fresh record high levels, as the squeeze on available supplies

becomes increasingly acute. Production volumes within the EU are

low at a time when imports from both the UK and New Zealand are

constrained - for differing reasons - and when the approaching

Christmas season is leading to an upturn in demand. (IHS Markit

Food and Agricultural Commodities' Chris Horseman)

- The EU average price for heavy lambs in the week ending 21 November was EUR731.06 per 100kg, a jump of 3.3% on the previous week. This index has now risen by 11.5% in just the past two months.

- But although this is a new record high level for EU lamb, prices may still have further to rise.

- In the UK, lamb throughput is currently 11% below the levels seen last year, and this in turn is stimulating import demand from Ireland, where the market price has jumped by 12% over the past month.

- Volumes of lamb from Spain are also falling back, and this is pulling up prices not only within Spain, but also in France.

- In Germany, prices are dropping as a result of a surplus of

unsold lambs in the north of the country - but in Belgium the past

week has seen a 7.4% jump in the official reference price.

- Electric vehicle (EV) charging infrastructure company Ionity has announced that it has raised a further EUR700 million. According to a statement, part of this has come from its existing shareholders, including BMW Group, Ford, Hyundai Motor Group with Kia, Mercedes-Benz, and Volkswagen Group with Audi and Porsche. The shareholders have also been joined by BlackRock's Global Renewable Power platform. Ionity said that the funds will be used to drive its growth and network expansion plans in Europe, with aims to lift the number of 350-kW charging points to around 7,000 kW by 2025. These are planned not only for motorways, but also near major cities and along major trunk roads. The company also noted that future locations will have between 6 and 12 charging points installed, and that existing sites will be upgraded with additional charging points if there is demand. (IHS Markit AutoIntelligence's Ian Fletcher)

- The employment barometer for the third quarter, published by

the Swiss Federal Statistical Office (SFSO), reveals a strong

increase that puts employment about 1% above its pre-pandemic level

in late 2019. The so-called BESTA statistic - based on a

comprehensive picture of the corporate landscape, using pension

system statistics that also include many 'micro firms' and

employees with fewer than six weekly work hours - shows that

seasonally adjusted employment increased by 1.0% quarter on quarter

(q/q) in the third quarter, following the previous quarter's

initial rebound of 0.3% q/q. In level terms, this means that an

all-time high of 5.15 million in early 2020 was followed by an

interim dip to 5.11 million in the second quarter of 2020 and now

an increase to 5.19 million in the third quarter of 2021. (IHS

Markit Economist Timo

Klein)

- In year-on-year (y/y) terms, employment growth advanced to 1.5% at the current data edge, which broadly corresponds to the annual average pace in 2019 and compares with -0.6% y/y only two quarters ago. It should be noted that the nadir during the global financial market crisis in 2009 had been lower at -1.2% y/y.

- The third-quarter breakdown by economic sector of the seasonally adjusted data reveals that industrial sector employment has curtailed its underperformance versus the service sector most recently but has not been able to unwind any of its relative losses sustained during the pandemic. The loosening of restrictions during the second and third quarters therefore benefited service-sector jobs even more than employment in industry, for instance with respect to the entertainment/recreation and hospitality sectors.

- Differences between individual branches of the economy remained large in the third quarter, however. Looking at q/q rates, employment in the chemical industry (including oil processing) gained 2.8% during the quarter, followed by jobs in the electrical equipment sector (up 2.5%). In contrast, pharmaceutical employment declined by 2.1% q/q and employment in the mining industry fell by 1.6% q/q. Among services, it cannot come as a surprise that the largest quarterly gains were observed in the hotel/restaurant sector (8.3% q/q) and that employment also increased strongly in the health sector (2.9% q/q). At the other end of the spectrum was shipping and aviation (-2.2% q/q) as international travel and cargo transport continued to be hampered by direct and indirect effects of the pandemic. This also applies to the temporary provision of workers (-2.2% q/q), as firms remain more focused on reducing short-time work arrangements for their permanent employees.

- GreenMobility plans to expand its electric vehicle (EV) sharing service to the Netherlands by signing a term sheet to acquire Fetch Carsharing, according to a company statement. GreenMobility is considering integrating Fetch Carsharing's fleet and local team into its operations in the coming months and providing its EV sharing service to customers in Amsterdam. Fetch Carsharing, which was founded in 2019, operates around 100 shared Renault Zoe electric cars across Amsterdam. With this acquisition, GreenMobility will expand its fleet to 150 EVs and expects an additional DDK10 million (USD1.5 million) of revenue in 2022. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Uber Technologies has said that it would halt operations in Belgian capital Brussels from 26 November following a court ruling, reports Reuters. The ruling by the Brussels Court of Appeal mentioned that a 2015 ban on private individuals offering taxi services also applies to professional drivers. Uber said that this decision will affect around 2,000 drivers, and it has urged the Belgian government to quickly change taxi service laws. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Volvo Cars has announced that its venture capital investment arm has invested in Israel-based Spectralics, an optical and imaging technology startup. According to a statement, the company has created "state-of-the-art imaging and optical infrastructure spanning materials, hardware and software, enabling a wide variety of advanced optical capabilities". It added that investment by the Volvo Cars Tech Fund will give it "access to promising technology at an early stage of development that could contribute to making cars safer and revolutionize in-car user experience." Volvo is eyeing a number of technologies that Spectralics has under development at the moment that could potentially be used in its vehicles. One is a multi-layered thin combiner (MLTC). This is a new type of thin optics 'film' applicable to transparent surfaces of all shapes and sizes. When integrated into a car's windscreen or windows, "the technology could be used to overlay imagery on the glass". It notes this "could create a wide field of view 'heads-up display' that can instill a sense of distance as virtual objects are superimposed onto the real-world environment for a safe and immersive experience". Other potential uses that Volvo sees for this technology include "advanced filters for various applications, in-cabin sensing, blind-proof front-looking cameras and digital holographic projections". The investment will fit well with the fund's ambitions to back companies with technologies in areas such as artificial intelligence, electrification and autonomous vehicle operation. (IHS Markit AutoIntelligence's Ian Fletcher)

- South Africa has asked Johnson & Johnson and Pfizer to delay delivery of COVID-19 vaccines because it now has too much stock, health ministry officials said, as vaccine hesitancy slows an inoculation campaign. About 35% of South Africans are fully vaccinated, higher than in most other African nations, but half the government's year-end target. It has averaged 106,000 doses a day in the past 15 days in a nation of 60 million people. (Reuters)

- In a surprise move, the Bank of Zambia (BoZ) hiked its key

policy rate, the Bank of Zambia policy rate, by 50 basis points to

9.0% during its latest monetary policy committee (MPC) meeting held

on 22-23 November. The policy rate increase follows in the wake of

the BoZ's upward adjustment to short-term inflation expectations.

Although the central bank expects headline inflation to trail down

over the next eight quarters, the BoZ believes it will remain well

above the inflation target range of 6-8%. The BoZ expects headline

inflation to average 15% in 2022 and 9.3% in 2023. (IHS Markit

Economist Thea

Fourie)

- The high base year of comparison and the lagged impact of the stronger exchange rate of the Zambian kwacha are likely to suppress inflationary pressures in the economy, the BoZ reports. Risks to this inflation outlook remain elevated, nonetheless.

- Zambia is currently negotiating an International Monetary Fund (IMF) support program, which could require the lifting of fuel and electricity subsidies to rationalize government spending commitments and allow for public-sector debt sustainability over the medium term. Higher fuel and electricity costs will keep headline inflation above the central bank's 6-8% objective in the near term. Ongoing supply chain disruptions due to the evolving coronavirus disease 2019 (COVID-19) pandemic add to the near-term inflation concerns.

- Economic growth is expected to benefit from stronger output in the finance and insurance, information and communication, wholesale and retail trade, and mining sectors during 2022. The BoZ expects Zambia's GDP to grow by 3.5% in 2022, from 3.3% in 2021. The central bank forecasts GDP growth at 3.7% in 2023.

Asia-Pacific

- All major APAC equity indices closed lower, with South Korea -1.5% being the only major market in the world that was higher at any point of the trading day; Mainland China -0.6%, Australia -1.7%, Japan -2.5%, Hong Kong -2.7%, and India -2.9%.

- Tesla plans to invest up to CNY1.2 billion (USD187.91 million) to expand production capacity at its Shanghai factory, reports Reuters, citing information from state-backed Beijing Daily newspaper. The newspaper attributed the information to documents Tesla filed with the Shanghai government. The filing showed that expansion will allow Tesla to add 4,000 staff, taking the number of people the plant can employ to 19,000. The document did not specify how much production capacity will be increased. Tesla's Shanghai factory will continue to play a central role in the electric vehicle (EV)-maker's manufacturing network. At this stage, the Model Y and Model 3 produced in Shanghai will supply both Chinese and overseas markets. Operating at the current rate, the Shanghai factory will be able to make full use of the designed capacity of 450,000 vehicles this year. IHS Markit expect Tesla to start production of a new model in Shanghai as early as 2022. (IHS Markit AutoIntelligence's Abby Chun Tu)

- NIO and Shell have signed a strategic co-operation agreement on the development of co-branded battery swap stations. According to a statement from Shell, the co-operation in China will start with two pilot sites and this is aimed to reach 100 sites by 2025. Under the agreement, Shell will offer Shell Recharge high-speed charging at NIO locations and make battery swap available at select Shell locations. Co-operation in Europe will start from exploring pilots in 2022. The NIO-Shell co-operation will pave the way for NIO to expand to European markets. The electric vehicle (EV) startup has already begun deliveries of its flagship ES8 electric sport utility vehicle (SUV) in Norway. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chinese regulators have urged top executives of ride-hailing giant DiDi Global Inc. (DiDi) to devise a strategy to delist from the New York Stock Exchange (NYSE). Amid concerns about leaking of sensitive data, China's tech watchdog is urging the management of DiDi to take the company off the US stock market. Proposals under consideration include a straight-up privatization or a share float in Hong Kong SAR followed by delisting from the United States. If the privatization goes through, shareholders will be offered at least USD14 per share, since a lesser offer so soon after the June initial public offering (IPO) might result in lawsuits or shareholder resistance, reports Reuters. In June, DiDi launched its IPO in the US that valued the company at USD67.5 billion. Following this, China's cyberspace regulator - the Cyberspace Administration of China (CAC) - ordered the removal of DiDi's app from app stores to protect "national security and the public interest", after finding that the ride-hailing giant had illegally collected users' personal information. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Food and drink manufacturers exporting to China are struggling to meet the 1 January 2022 deadline for registering their businesses with the Chinese General Administration of Customs (GACC), risking seeing their products barred entry. GACC registration has long been a requirement for manufacturers of edible bird's nest, meat products, fish and seafood, as well as dairy products, including infant formula. However, under a 13 April GACC decree, overseas manufacturer registration is required for all food and drink exports to China (except some food additives) from 1 January 2022, giving less than eight months for companies and regulators in exporting countries to comply. Decree 248 sets out 18 categories of 'high risk' products, which manufacturers have to register through the national regulator in the country where they are based, and other 'low risk' food and drinks where they have to self-register. (IHS Markit Food and Agricultural Policy's Sara Lewis)

- Delhi Transport and Environment Minister Kailash Gahlot has clarified that there will be no ban on the entry of private vehicles running on gasoline (petrol) or diesel into the state from 27 November until 3 December, reports the Economic Times Auto. Gahlot said on social media platform Twitter that "restrictions apply to entry of trucks carrying non-essential goods". Yesterday, Delhi Minister for Environment, Forest and Wildlife, Development, and General Administration Gopal Rai announced a temporary ban on gasoline and diesel vehicles entering the state from 27 November until 3 December in a bid to curb air pollution, allowing only compressed natural gas (CNG) vehicles and electric vehicles (EVs), as well as vehicles engaged in essential services. The overall Air Quality Index (AQI) for Delhi stands at around 433, which puts it in the 'Severe' category; this is mainly caused by stubble burning by farmers in areas adjoining Delhi, vehicular effluents, household pollution, industrial pollution, construction, waste burning, and road dust. The state is looking to take advance measures to deal with the air quality crisis. (IHS Markit AutoIntelligence's Tarun Thakur)

- Petrofac has signed a memorandum of understanding (MoU) with Boya Energy, a majority Aboriginal-owned Western Australian renewable energy project developer. The working arrangement supports the parties to collaborate on future renewable energy projects in Australia's resources, energy and industrial sectors. The arrangement allows the parties to work together in a collaborative manner to identify potential opportunities for projects that are of mutual beneficial interest. Boya will provide its experience, local market knowledge and experience in developing, building and delivering renewable energy assets. Both parties anticipate that Petrofac will provide certain services and support to Boya including front-end engineering and design services, business development activities, operations, management and maintenance. The MoU represents a key step in Petrofac's continued expansion into new and renewable energy, while building new energy capability and capacity in Australia. (IHS Markit Upstream Costs and Technology's William Cunningham)

- The Reserve Bank of New Zealand (RBNZ) has raised the official

cash rate (OCR) by another 25 basis points, in line with IHS Markit

analyst expectations and consistent with signals from the bank over

the past couple of quarters. This is likely to be just the second

step of several in the RBNZ's medium-term monetary tightening

agenda, particularly if the strong price pressures and high

employment continue. (IHS Markit Economist Andrew Vogel)

- During its 24 November meeting, the RBNZ's Monetary Policy Committee (MPC) decided to raise the OCR by another 25 basis points to 0.75% - its second consecutive move - citing the need to maintain price stability and maximum sustainable employment. There were no changes to the RBNZ's alternative monetary policy tools such as the Large Scale Asset Purchase (LSAP) programme or the Funding for Lending Programme (FLP).

- The MPC noted that the global economic recovery is continuing, but also slowing due to COVID-19 uncertainties. The easing of public health restrictions (such as New Zealand's 'zero-COVID' policy) will help with such economic growth by improving mobility, spending, and investment, particularly as vaccinations increase and health authorities learn to manage future COVID-19 issues. It also means sharp contractions caused by restrictions will be less common or impactful, although the MPC points out the economy remained relatively strong despite the most recent August lockdowns.

- The RBNZ is projecting that headline CPI will rise above 5% in

the near term before returning towards the informal 2% target in

the next two years.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-november-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-november-2021.html&text=Daily+Global+Market+Summary+-+26+November+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-november-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 26 November 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-november-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+26+November+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-november-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}