Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 26, 2021

Daily Global Market Summary - 26 October 2021

All major European equity indices closed higher, while US and APAC market closed mixed. US government bonds closed higher, while benchmark European bonds were mixed. European iTraxx closed tighter across IG and high yield, CDX-NAHY was also tighter, and CDX-NAIG was flat on the day. The US dollar and oil closed higher, while natural gas, gold, silver, and copper were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Major US equity indices closed mixed; S&P 500 +0.2%, Nasdaq +0.1%, DJIA flat, and Russell 2000 -0.7%.

- 10yr US govt bonds closed -3bps/1.61% yield and 30yr bonds -5bps/2.04% yield.

- CDX-NAIG closed flat/51bps and CDX-NAHY -3bps/298bps.

- DXY US dollar index closed +0.1%/93.95.

- Gold closed -0.7%/$1,793 per troy oz, silver -2.0%/$24.09 per troy oz, and copper -0.9%/$4.49 per pound.

- Crude oil closed +1.1%/$84.65 per barrel and natural gas closed -0.3%/$5.88 per mmbtu.

- As the US Congress continues its work on reconciling House and

Senate versions of the FY2022 budget, members of the oil and gas

industry remain concerned that a fee on methane emissions remains

on the agenda, at least for Democrats. (IHS Markit PointLogic's

Kevin Adler)

- The American Gas Association (AGA), American Petroleum Institute (API), Independent Petroleum Association of America (IPAA), and Interstate Natural Gas Association of America (INGAA) issued a joint statement on 26 October saying that they are opposed to the fee.

- The Methane Emissions Reduction Act, introduced in both the House and Senate, sets a price of $1,800 per metric ton on methane emissions, which is far above the approximate $20-30/metric ton for carbon that is found in state-led carbon emissions trading programs today. It would begin in FY2023.

- The bill requires Secretary of the Treasury to "levy a fee on methane emissions from oil and gas facilities," using formulas be based on "excess emissions" above a statutory amount, which is 0.1%-0.2% of oil and gas produced, depending on which formula is used.

- The trade groups argued that market forces are driving voluntary actions by oil and gas producers and midstream companies to down methane emissions, and that US EPA regulations on methane from new and modified oil and gas wells that are expected to be published this week will further address methane emissions. At other times, they have pointed out that the formulas are confusing and do not necessarily reflect an accurate way to calculate emissions impacts.

- "This tax on natural gas is not about reducing emissions—it's about forcing American families, regardless of their income level, to help fund the reconciliation package through higher utility bills," said Amy Andryszak, president and CEO of INGAA.

- "With one-third of households already facing challenges affording their energy needs, Congress should not add a new tax on natural gas. Our analysis indicates that the proposed tax could increase natural gas bills from 12% to 34%, depending on the variation of the proposal assessed," said Karen Harbert, president and CEO of AGA.

- A study in the research journal "Proceedings of the National

Academy of Sciences" on 26 October found that methane and ethane

emissions from the gas distribution lines in the Boston metro area

are 3x higher than reported by pipeline operators who are basing

leak estimates on gas usage rates. (IHS Markit PointLogic's Kevin

Adler)

- Using data collected by mounted spectrometers from five sites, the researchers from Boston University and the University of Texas found that the midstream leakage rate of methane and ethane is 3.3% to 4.7%, or much higher than the figures estimated by the US EPA of 1.4% or reported by individual operators, some of which say they have reduced their leakage below 1%.

- Just as significantly, the researchers said that their eight years of data (2012-2020) show "no change in emissions … despite efforts from the state to address natural gas pipeline leaks." This includes approving reimbursement for LDCs to replace cast-iron gas distribution lines, which are common in an older city such as Boston, and new leak-detection-and-repair programs instituted by LDCs.

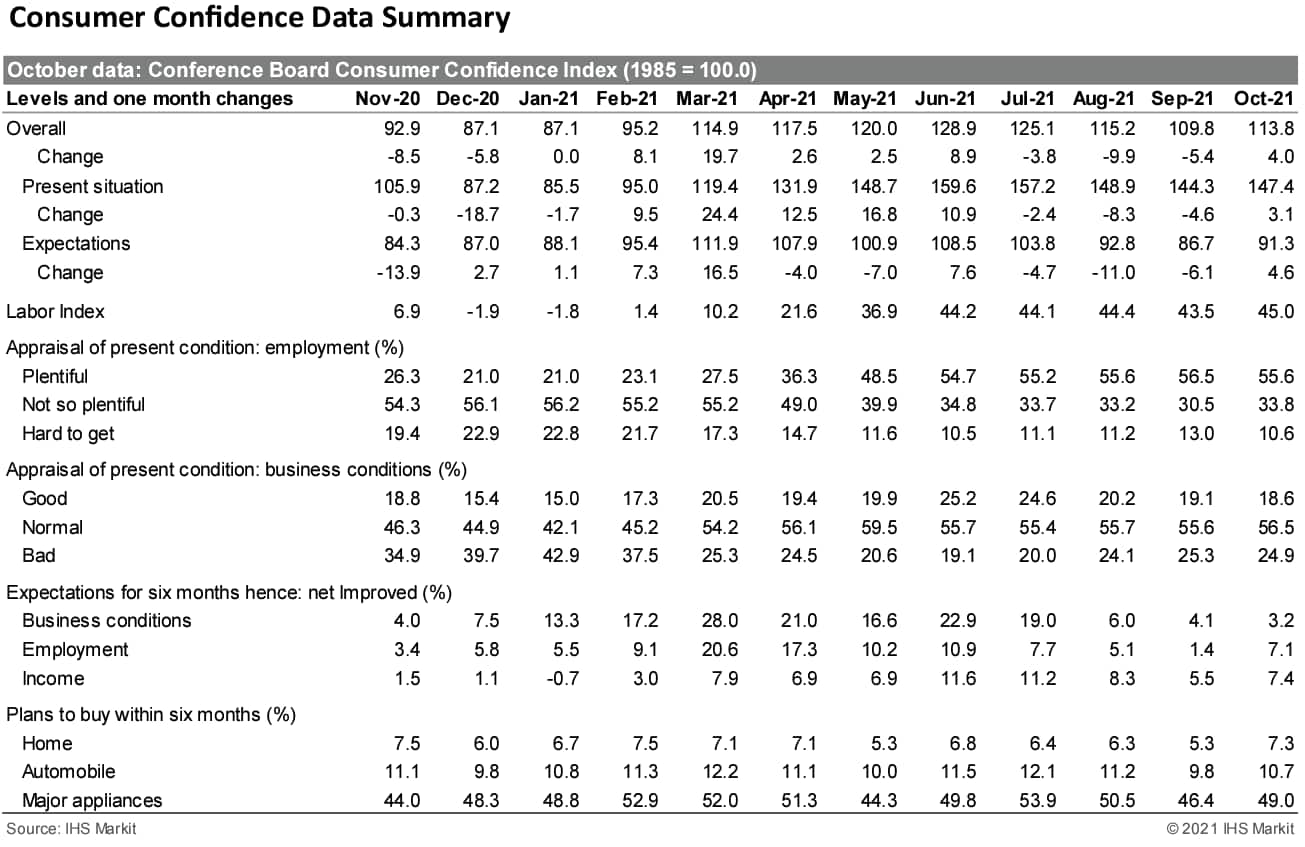

- The US Conference Board Consumer Confidence Index increased by

4.0 points to 113.8 in October, following declines in the previous

three months. The index sits 12% lower than its June peak. (IHS

Markit Economist James

Bohnaker and William Magee)

- The index of views on the present situation increased 3.1 points to 147.4. The expectations index rose 4.6 points to 91.3.

- In October, the labor index (the percentage of respondents viewing jobs as currently plentiful minus the percentage viewing jobs as hard to get) increased 1.5 percentage points to 45.0%, among its strongest readings dating back to 2000.

- In addition to improved views on job availability, consumers were also more optimistic about income growth. The net percentage of respondents expecting higher incomes in the next six months increased nearly two percentage points to 7.4%.

- Consumers expected improved buying conditions going forward. The share of respondents planning to buy a home in the next six months improved to its highest mark since February; the share planning to buy automobiles and major appliances increased as well. However, supply-chain disruptions and high prices will likely remain headwinds for some time, particularly in the auto sector.

- Additionally, nearly half of all respondents (48%) reported plans to take a vacation in the next six months, which is the highest proportion since February 2020. The declining number of COVID-19 cases over the course of the month likely supported more positive attitudes regrading travel.

- The spread of the Delta variant was the primary reason for

depressed confidence this summer, but consumers are beginning to

feel more optimistic now that the number of new cases is on a

declining trend. This report supports IHS Markit analysts'

expectation for a rebound in personal consumption expenditures

(PCE) growth in the fourth quarter after spending growth stalled in

the third quarter.

- US new home sales jumped 14.0% (plus or minus 17.9%; not

statistically significant) in September to an 800,000-unit

seasonally adjusted annual rate. (IHS Markit Economist Patrick

Newport)

- Third-quarter sales averaged 738,000, about unchanged from the second quarter. Quarterly sales cyclically peaked at a 973,000 rate in the third quarter of 2020.

- Sales for May through July were collectively revised down by 52,000 units. Note: about one-fourth of new home sales are imputed; these consist of homes sold before a permit is issued and account for the lion's share of data revisions.

- The median and average new home prices in the third quarter soared 21.0% and 15.7%, respectively, from a year earlier. From 2016 to just before the pandemic struck in early 2020, new home prices hardly budged.

- Meanwhile, builders' costs also soared: the Census's construction cost index for homes under construction, which also came out today (26 October), was up 12.9% in the third quarter from a year earlier —its fastest year-on-year pace since the fourth quarter of 1978.

- Inventory—the number of homes for sale at the end of the month—was unchanged in September at 379,000. Only 36,000 of homes classified as inventory were completed; inventory units still in the planning stage were 106,000.

- The Census Bureau also released the state housing permits estimates for September today. These show that five southern states—Texas, Florida, North Carolina, South Carolina, and Georgia—have largely powered the surge in new home construction since the pandemic struck. Collectively, these states accounted for half of the year-to-date increase in permits through September—even though they accounted for 23% of the housing stock in April 2020.

- According to data from S&P CoreLogic Case-Shiller, the

recent spate of rapidly accelerating home price growth may be at an

end. Although the pace of appreciation in the US remains strong,

August data show a deceleration in that pace for the first time in

more than a year. Monthly growth slowed in both the 10-city and

20-city index for the second month in a row while the annual rate

of appreciation slowed in both indices for the first time since

June of 2020. (IHS Markit Economist Troy

Walters)

- Monthly home price gains slowed again in August. The 10-city composite index was up 0.9% month over month (m/m) while the 20-city index was up 1.2%.

- Monthly home price changes remained in positive territory in all 20 cities, ranging from 0.4% m/m in New York to 2.5% in Tampa.

- The 10-city and 20-city indices both decelerated in annual terms. The 10-city index slowed to 18.6% year on year (y/y) while the 20-city index slowed to 19.7%. This was the first time since June of 2020 that year-on-year home price appreciation slowed relative to the previous month.

- Despite slowing, all 20 cities covered remained in double-digit territory. Gains ranged from 12.7% y/y in Chicago to 33.3% in Phoenix.

- The national index was up 19.8% y/y in August, tying July for the fastest pace on record. This was the first month since June of 2020 that national prices did not accelerate.

- Electrify America and Polestar have agreed to provide owners of the all-electric Polestar 2 fastback with 30-minute charging sessions at no cost, according to a press release by Electrify America. The new and existing Polestar 2 drivers will receive the free electric vehicle (EV) charging facility starting two years from vehicle handover. Volkswagen-backed EV charging network provider Electrify America is one of the largest open ultra-fast DC charging networks in the United States. In a statement, Electrify America said, "Charging benefits for 2021 and 2022 Polestar 2 owners will be accessed through Electrify America's industry-leading mobile app, which was recently redesigned to provide electric vehicle (EV) drivers with a simple and inclusive 'one stop' solution for all their charging needs." The statement added that the benefits to the Polestar owners would include a streamlined account creation process, optimized contactless payment, and the ability to locate a charger and track a charging session. Electrify America president and CEO Giovanni Palazzo said, "At Electrify America, we are constantly challenging ourselves to propel the EV industry forward. With expanding EV offerings, it is more important than ever to instill a sense of confidence in new and prospective drivers, and we are excited to work with a like-minded company like Polestar to provide high-quality, accessible charging." (IHS Markit AutoIntelligence's Jamal Amir)

- Sherwin-Williams (SW) today reported third-quarter net income

down 28.8% year on year (YOY), to $502.2 million, on net sales up

0.5%, to $5.15 billion. Adjusted earnings totaled $2.09/share, down

24.2% YOY and slightly short of analysts' consensus estimate of

$2.10/share, as reported by Refinitiv (New York, New York). "Raw

material availability issues negatively impacted quarterly sales by

an estimate high-single-digit percentage," SW says. (IHS Markit

Chemical Advisory)

- Demand remains solid, but raw material availability and costs continue to cut into sales and reduce profits, according to SW chairman and CEO John Morikis. "Demand remains strong across our pro architectural and industrial end markets; however, results in the quarter were significantly impacted by ongoing and industry-wide raw material supply chain challenges," Morikis says. "Consolidated net sales increased less than 1%, as raw material availability negatively impacted total sales by a high-single-digit percentage, of which approximately 75% of the impact was in the Americas group. The raw material availability challenges combined with higher raw material costs significantly pressured gross margins in the quarter."

- The Americas group segment sales declined 0.4% YOY, to $2.97 billion, while segment profit was down 15.5%, to $631.5 million. Lower volumes and higher raw material costs drove the decreases, though this was partly offset by higher selling prices.

- Performance coatings segment sales increased 17.4% YOY, to $1.53 billion, while segment profit was down 28.9%, to $110.4 million. Higher volumes and selling prices boosted sales, but profits were squeezed by higher raw material costs.

- Consumer brands segment sales fell 22.8% YOY, to $646.7 million, while segment profit declined 61.8%, to $75.8 million. Lower volumes due to raw material availability issues, supply chain constraints, and a divestiture drove the declines.

Europe/Middle East/Africa

- All major European equity indices closed higher; Germany +1.0%, Spain +0.9%, France +0.8%, UK +0.8%, and Italy +0.6%.

- 10yr European govt bonds closed mixed; UK -3bps, France -1bp, Germany flat, Spain +1bp, and Italy +2bps.

- iTraxx-Europe closed -1bp/49bps and iTraxx-Xover -7bps/253bps.

- UK company Ivy Farm Technologies argues that backing cultivated

meat would bring huge benefits to the British economy. The company,

which is aiming to be UK's first commercial producer of cultivated

meat, recently published a report with Oxford Economics. It found

that (IHS Markit Food and Agricultural Commodities' Max Green):

- The cultivated meat sector would account for roughly 12% of consumer demand for meat in 2030.

- New figures show lab-grown 'cultivated meat could add £2.1bn to the UK economy by 2030 - 13% of the UK's agriculture sector.

- The British cultivated meat industry could support up to 16,500 jobs across the UK in 2030 - up to 8,300 workers (50%) employed directly by the cultivated meat industry and the rest in the supply chain.

- The industry would also boost tax coffers by £523m - but only if UK regulator the Foods Standards Agency (FSA) rubber stamps its approval for sale in the UK by the end of next year.

- The UK risks losing out to countries such as US, Singapore, and Israel, who are proactively supporting this new industry.

- Nutreco and Mosa Meat have secured EU funding to support their

joint 'Feed for Meat' project, which aims to advance cellular

agriculture and bring cultivated beef to the EU market.

Netherlands-based Nutreco said the two companies were awarded a

grant of almost €2 million under the bloc's REACT-EU recovery

assistance program. (IHS Markit Food and Agricultural Commodities'

Max Green)

- The funds are to be used for research into lowering the costs of cell culture media, the most expensive step in the process of cultivating beef. The focus will lie on developing lower-cost and sustainable nutrients for the "basal'' or base media in which the beef cells grow.

- "By replacing pharma-grade ingredients with food-grade ingredients, our team predicts cost reductions in the order of 100 times. Support from the government is a great contribution in bringing cultivated beef to the European market," said Peter Verstrate, Mosa Meat cofounder and chief operating officer.

- Nutreco highlighted the results of an independent Life Cycle Analysis study, which projects that cultivated beef production will reduce climate impact by 92%, air pollution by 93%, use 95% less land and 78% less water when compared to industrial beef production.

- Italian farming organization Coldiretti is unimpressed however, releasing a statement this week saying it is 'unacceptable' to use EU funds to finance private work on 'test-tube meat'.

- It notes that Nutreco and Mosa Meat have already received backing for their cultivated meat project from US actor Leonardo DiCaprio, and says they 'certainly do not need the money of European citizens'.

- Daimler has taken a decision to move to more expensive automotive semiconductors in operationally critical areas where shortages are causing bottlenecks, while it has announced it will sell the second-generation EQC in the US. The move to source chips that are more expensive shows that the OEMs are looking at every avenue in terms of mitigating the crisis, although it remains to be seen how this will affect showroom prices, while Mercedes-Benz dealers in the US have been key to the reversal of the decision to sell the EQC there. (IHS Markit AutoIntelligence's Tim Urquhart)

- Banque de France (BdF) and debt-management agency Agence France

Trésor (AFT) have published a joint report on a central bank

digital currency (CBDC) trial involving French government debt

securities. (IHS Markit Economist Brian

Lawson)

- The report was written together with French government bond dealers and debt custodians BNP Paribas, BNP Paribas Securities Services, Crédit Agricole, HSBC and Société Générale, along with Euroclear and IBM as technology partner.

- The scheme relates to pilot work conducted since March 2020. The pilot scheme was adjusted from an account-based to a "token-based" process, under which AFT issued OAT securities tokens and BdF distributed tokens for CBDC, with the consortium members then simulating trading in OAT government bonds by the exchange of CBDC and OAT tokens during a four-day period involving hundreds of transactions.

- These included normal "Delivery versus Payment" transactions, deals where one or the other side failed to deliver, unmatched trades and "recycled" instructions. Additional testing replicated a cross-platform repo cycle involving a securities transfer to BdF in the Target2-Securities system and a CBDC payment to the counterparty's digital wallet.

- Russian car-sharing company Delimobil is planning to raise as much as USD240 million in its US-based initial public offering (IPO). This will represent the company's valuation at more than USD900 million, reports Reuters. The company intends to sell 20 million American Depositary Shares (ADSs) at a price range between USD10 and USD12 apiece. Each ADS represents two ordinary shares. Delimobil expects to be listed on the New York Stock Exchange (NYSE) under the ticker symbol "DMOB". BofA Securities, Citigroup, and VTB Capital are the lead underwriters for the offering. Delimobil was established in 2015 and currently has a fleet of more than 18,000 vehicles, with more than 1 million members. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- According to Nigeria's Premium Times, in the week ending 22

October, the second-quarter financial statements of the five

largest banks in Nigeria reflected a struggling economy amid the

ongoing COVID-19 virus pandemic. The top-five banks - FBN Holdings,

United Bank for Africa (UBA]), Guaranty Trust Holding Company

(GTCO), and Zenith, commonly known by their initials FUGAZ - which

make up around 67% of total sector assets (at the end of 2020),

recorded asset growth of 13.1% in June 2021 from six months

earlier. (IHS Markit Banking Risk's Ronel Oberholzer)

- Access Bank overtook FBN Holdings as the largest bank in terms of assets, mainly based on its acquisitions in Africa earlier in the year.

- Combined loan growth slowed from 5% quarter on quarter (q/q) at the end of 2020 to 2.8% q/q in the first quarter and 2.5% q/q in the second quarter of 2021. FBN recorded the most significant increase in loans at 10.4% q/q, followed by Access Bank (8.5% q/q), while the other three banks experienced a contraction in loans.

- As measured by the non-performing loan (NPL) ratio, the collective asset quality improved from 5.5% in 2020 to 5.2% in June 2021. The UBA recorded the most significant improvement in the NPL ratio, from 4.7% to 3.5%.

- In comparison, GTCO registered the most significant jump in the NPL ratio, from 5.9% to 6.6%, over the same period.

- All five banks were adequately capitalized, but earnings growth as measured by the average pre-tax return on assets (ROA) slowed continuously from 3.4% at the end of 2020 to 2.5% in the first quarter of 2021 to 2.1% in the second quarter of 2021. GTCO registered the most significant slowdown in ROA (6.6% in December 2020 to 3.3% in June 2021), followed by Access Bank (3.5% to 0.8%). FBN Holdings registered a slight improvement (1.1% to 1.3%) over the same period.

- Loan growth in the Nigerian banking sector is expected to slow in 2021 compared with 2020, pick up moderately in 2022, but only surpass the pre-COVID-19 levels by 2023 as the structure of the loan book affects the recovery. Almost one-third of banking-sector loans directed towards oil and gas are exposed to defaults by large corporate borrowers.

- Zambia's public-sector debt holdings (including arrears) were

USD26.96 billion (estimated to be 106.2% of GDP) in July 2021, a

statement by the Zambian National Treasury shows. External debt

makes up the bulk of the overall public-sector debt holdings, at

USD16.86 billion (or 62.5% of total public-sector debt). The

central government's external debt (including state guarantees) was

USD13.4 billion, followed by external debt holdings by state-owned

entities (SOEs), making up the remaining USD3.48 billion. (IHS

Markit Economist Thea

Fourie)

- Local currency debt accounts for the remaining 39% of total public-sector debt and includes government securities, SOEs' local currency debt, and government arrears to contractors.

- Private creditors (USD3-billion Eurobond) followed by China Exim Bank (USD2.8-billion bilateral loan), the International Development Association (IDA; USD1.8-billion multilateral loan), and the African Development Fund (USD506-million multilateral loan) are currently the Zambian government's largest lenders, the Zambian National Treasury statement reports.

- An earlier statement by the Zambian National Treasury reported that the total public-sector external debt owed to China was USD6.6 billion, of which most was attributed to central government debt (USD4.47 billion), followed by state-owned guarantees awarded to SOEs (USD1.34 billion), and state-owned power provider ZESCO (USD140 million). The National Treasury statement shows that the Zambian government has built up payment arrears with most Chinese lenders.

Asia-Pacific

- Major APAC equity indices closed mixed; Japan +1.8%, South Korea +0.9%, India +0.6%, Australia 0%, Mainland China -0.3%, and Hong Kong -0.4%.

- Mainland China' top legislature, the Standing Committee of the

National People's Congress (NPC) on 23 October announced a

five-year pilot program for property tax reforms, reports Xinhua

News Agency. According to the program, property tax should be

levied on all types of residential and non-residential property in

pilot areas, while lawfully-owned rural homesteads and houses built

on them are excluded. (IHS Markit Economist Yating

Xu)

- The program will be carried out by the State Council in some regions, while the list of pilot areas and start date of the program are yet to be decided. The Ministry of Finance (MOF) and the State Taxation Administration will draft the measures for piloting the property tax.

- The program is in line with the 14th Five-Year Plan to promote property tax legislation. Compared with the pilot in Shanghai and Chongqing in 2011, this five-year property tax pilot program was authorized by the Standing Committee of NPC, which is mainland China's second-highest legislature after the NPC.

- Tesla has inaugurated its research and development (R&D) center and a gigafactory data centre in Shanghai, reports the Shanghai Daily. Tesla China president Zhu Xiaotong said, "The center will boost Tesla's localized process in China, train local talent and further accelerate the prosperity of China's intelligent car research ecosystem". The Shanghai center is said to be Tesla's first overseas R&D center based on vehicle development with 28 labs and will focus on sectors such as software, hardware, electronics, materials, and power and energy engineering. Setting up a local design center in China will help Tesla regain Chinese consumers' confidence; it came under scrutiny earlier this year for not releasing accident data to a customer who said a crash occurred because the brakes failed. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Chinese autonomous vehicle (AV) solutions provider JIMU Intelligent has completed the C1 round of financing worth CNY200 million (USD31.3 million). This round was jointly led by Forebright Capital and SDIC Unity Capital, in participation with institutions such as AVIC Pingshan, Founder H Fund, MY Tsinghua Capital, and UMC Capital, among others. The company plans to use the infused capital to further increase its research and development (R&D) investment in intelligent driving, connectivity, and autonomous operation in specific scenarios. It will use the investment to continue expanding its customer base and accelerate mass production of high-level intelligent driving technologies, reports Gasgoo. JIMU Intelligent, which was founded in 2011, is focused on developing intelligent driving solutions based on multi-sensor fusion and domain controllers for global OEMs and tier-1 suppliers. To date, the company has obtained several advanced driver-assistance systems (ADAS) projects for passenger cars. It is supplying solutions to more than 80% leading bus makers and more than 60% leading truck manufacturers in China. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Xpeng has announced an 800-volt high-voltage mass-production SiC platform with new-generation "X-Power" superchargers. According to the announcement during Xpeng's Tech Day virtual briefing on 24 October, the superchargers can charge the electric vehicle (EV) battery for a range of up to 200 kilometers in just 5 minutes. The automaker also plans to introduce lightweight 480-kW high-voltage supercharging piles with IP67 protection, and safety monitoring. Obtaining a range of 200 km from 5 minutes of charging could be a major breakthrough in the EV segment. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- The Reserve Bank of India (RBI) on 22 October introduced a

scale-based regulation for non-bank financial companies (NBFCs)

that will be effective from October 2022. According to the rule,

NBFCs will be regulated based on their classifications, which have

been revised to four layers: base layer (smallest), middle layer,

upper layer, and top layer (largest and "potential" systemically

important"). The base layer will include peer-to-peer lending

platforms, while the top layer will be empty for now; the upper

layer will include the top-10 largest NBFCs. From a risk

perspective, the key changes include a new non-performing loan

(NPL) classification norm: from March 2024, loans that are overdue

by more than 150 days will be classified as non-performing, while

from March 2025, it will be tightened to 120 days, and from March

2026 onwards, it will be further tightened to 90 days. For NBFCs in

the upper layer, they will need to adhere to the minimum common

equity tier-1 capital ratio of 9%. (IHS Markit Banking Risk's Angus

Lam)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-october-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-october-2021.html&text=Daily+Global+Market+Summary+-+26+October+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-october-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 26 October 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-october-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+26+October+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-october-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}