Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 27, 2020

Daily Global Market Summary - 27 April 2020

The Bank of Japan started the week on a positive tone after its unexpected announcement of additional aggressive monetary easing to support corporations' financing needs. The BOJ's announcement coupled with the gradual reopening of parts of Europe and the US helped to provide momentum across global markets. However, oil prices came under significant pressure again today as storage capacity is becoming more limited each day while producers are in the process of slowing production to counteract the unprecedented decline in demand.

Americas

- US equity markets closed higher, with small caps having a particularly strong day; Russell 2000 +4.0%, DJIA/S&P 500 +1.5%, and Nasdaq +1.1%.

- 10yr US govt bonds closed weaker at +6bps/0.66% yield.

- By June, the oil market's inventory and supply chain buffers will have largely run out, in IHS Markit's view. This will simplify the world's most traded commodity market - and one of the most financialized and complex - down to microeconomics 101: supply, demand and the equilibrium price. The evaporation of spare global storage capacity and the use of a wide swath of the global tanker fleet for floating storage will create a just-in-time oil market, where each produced barrel of oil will need to be earmarked to refinery demand elsewhere in the world. This forceful balancing of global supply/demand will become the dominant driver of oil markets through the rest of 2020. This forceful market response implies that the rate of US crude stock builds will peak over the next week or two and will then decelerate, although builds are likely to endure through May even as production declines. (IHS Markit Energy Advisory's Roger Diwan)

- The largest oil ETF United States Oil Fund said following its regulatory filing that it would sell over a four-day period all of its futures contracts for the delivery of oil in June, which is approximately 20% of its $3.6bn portfolio. (FT)

- Crude oil closed -24.6%/$12.78 per barrel and was as low as $11.88 at the NY open.

- After weeks of business closures and social-distancing orders in the U.S., states from Mississippi to Tennessee to Colorado began to permit some businesses to reopen Monday, allowing customers back into establishments and some employees to return to work. Over the weekend, some businesses had resumed in Georgia, Oklahoma, Alaska, Texas and South Carolina, with social-distancing measures in place. (WSJ)

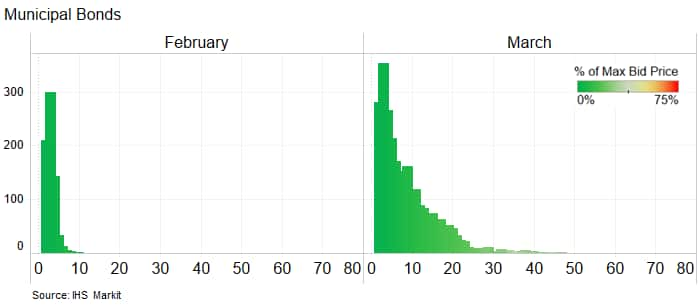

- As a follow-up to last week's charts on leverage loan and US corporate bond price dispersion in March, the below chart compares the highest and lowest municipal bond trades (size ≥$1 million) on individual bonds during the months of February and March. The x-axis indicates the number of individual bonds that had a given max-min bid price range and the color indicates the range's average percentage of the highest bid. Similar to the other two sectors, the data illustrates the unusually high degree of price dispersion that occurred in the municipal bond market last month.

- US retail consumers bought about 44 million gallons of orange juice in the four weeks to April 11 this year, up from just over 30 million gallons in the same period last year. This is the steepest increase that IHS Markit's IEG Vu, which has been charting the A C Nielsen figures supplied to the Florida Department of Citrus (FDOC) has ever seen, and IEG Vu's records go back nine seasons. This is also the second successive increase. It is reasonable to assume that some of the extra sales are due to panic buying and consumers stocking up, but the perceived health benefits of the vitamin C contained in orange juice (and other juices) must also have played a part. (IHS Markit Agribusiness' Neil Murray)

- Pressure mounted on the US meat sector last week as COVID spread through facilities, putting staff out of action. Major meat processor JBS USA announced that it was temporarily closing down a pork processing plant in southwestern Minnesota due to an outbreak of the coronavirus among its employees, adding to the growing list of meatpacking facilities shuttered because of the pandemic. (IHS Markit Agribusiness' Peter Rixon)

- Tyson Foods also announced it would suspend operations at its Waterloo, Iowa pork plant for an indefinite period following cases of COVID-19 among employees.

- The closures of meat plants led three dozen senators to Vice President Mike Pence, Agriculture Secretary Sonny Perdue and other top officials about how they would protect food workers and federal inspectors from COVID-19.

- On Thursday (April 23), the United Food and Commercial Workers (UFCW) International Union said that more than 5,000 of its food processing and meatpacking workers had been sickened by, or exposed to, COVID-19.

- The below is a table of the 2020 Animal Pharmaceutical Global M&A activity tracked by IHS Markit's Animal Pharm research group:

- The U.S. is planning a major expansion of coronavirus testing at retail health locations around the country. CVS Health Corp., the U.S. drugstore chain, said Monday it will open testing sites at 1,000 of its stores. President Donald Trump will be meeting with some of the nation's largest retailers and lab testing companies and other retailers are expected to make similar announcements at the meeting. (Bloomberg News)

- There are 258 vaccines currently in development by biopharmaceutical companies for the treatment and prevention of various diseases, according to the Pharmaceutical Research and Manufacturers of America's (PhRMA) recently issued Medicines in Development for Vaccines 2020 report. Among the vaccines in development, there are 108 for cancer, 125 for infectious diseases, 14 for allergies, and two for Alzheimer's disease (AD), among several others. The report also noted that more than 70 vaccines are currently in the pipeline for coronavirus disease 2019 (COVID-19), including six already in clinical testing and several more in preclinical development, with many planning to commence human testing this year. (IHS Markit Life Science's Margaret Labban)

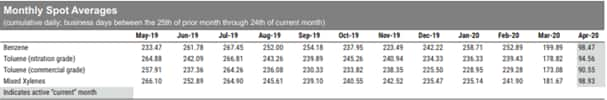

- The below table published on 24 April shows the sharp drop in monthly North American average spot price rates for major aromatic chemicals over the past month (IHS Markit's Kevin Wallman and Shayan Malayerizadeh):

- CNH Industrial Group, which manufactures the Iveco range of light commercial vehicles (LCVs) in Brazil and Argentina, has announced the resumption of production at its six plants in the two countries, reports Automotive Business. (IHS Markit AutoIntelligence's Tarun Thakur)

- IHS Markit has revised Guyana's short- and medium-term rating outlooks from Positive to Stable. Indicators suggest that Guyana's incumbent President David Granger has secured enough votes to win the presidential election held on 2 March. A key concern is that if Granger does win, the opposition party will fail to co-operate (viewing the election as illegitimate) and will block parliament from reopening, therefore, blocking any passage of important hydrocarbon and economic policy. Ultimately, the Guyanese economy is still likely to grow in 2020. However, downside risks are increasing from both domestic and external shocks. (IHS Markit Sovereign Risk's Ellie Vorhaben)

Europe/Middle East/ Africa

- The UK Treasury plans to borrow more aggressively to meet the fiscal implications of the COVID-19 virus, both in terms of financial support measures and increasing automatic stabilizers, with the United Kingdom's economy set for a severe recession in the first half of 2020. (IHS Markit Economist Raj Badiani)

- The Debt Management Office (DMO), as part of the Treasury, plans to raise GBP45 billion (USD55.6 billion) in April and a further GBP180 billion from the start of May to the end of July. The Treasury cited "the temporary and immediate nature of the unprecedented support announced for people and businesses", but said that "this higher volume of issuance is not expected to be required across the remainder of the financial year".

- The DMO had been planning to raise GBP156 billion for the whole 2020-21 to finance gilt redemptions totaling GBP96.1 billion and the central government's net cash requirement of GBP65.3 billion.

- In addition, UK public-sector debt will be more elevated than previously anticipated - probably around 13 percentage points higher to over 94% of GDP during 2020. It is projected to exceed 100% of GDP during early 2022.

- Chinese electric vehicle (EV) manufacture Suda Electric Vehicle Technology has begun exports to Germany as it attempts to build a European sales network, according to an Automotive News Europe (ANE) report. The first batch of 200 of the firm's SA01BC B-segment compact electric sedan are being delivered to the port at Dusseldorf. The vehicle has a range of 305km and a maximum speed of 130kph. Suda will export 12,000 EVs to Germany this year under a contract signed with German distributor DCKD. (IHS Markit AutoIntelligence's Tim Urquhart)

- Ineos, the $60-billion/year chemicals and energy conglomerate two-thirds owned by Jim Ratcliffe, has announced plans to move directly into consumer-facing markets by expanding into international consumer healthcare. Ineos notes that from a standing start, it has set up four hand sanitizer plants, each producing one million standard and "pocket" bottles per month to World Health Organization (WHO) specifications. The factories, which were established in less than 10 days, are located in the UK, northern France, southern France, and Germany on existing Ineos sites, using company personnel. Two additional facilities will come online in the US shortly.

- Bayer's first-quarter net income increased 20.0% year on year (YOY) to €1.49 billion ($1.62 billion) and core earnings per share (EPS) from continuing operations rose 9.9% to €2.67. Group sales rose 4.8% to €12.84 billion. EBITDA before special items increased 10.2% to €4.39 billion, beating analysts' consensus estimate by 7%. The figure includes positive currency effects of €41 million. EBIT jumped 40.4% YOY to €2.50 billion, in part due to a decline in net special charges to €639 million from €1.04 billion a year earlier, Bayer says. The charges relate primarily to legal fees, ongoing restructuring programs, and the integration of Monsanto, which Bayer acquired in 2018. Sales at Crop Science, Bayer's agricultural business, increased 6.1% YOY to €6.83 billion on higher volumes with all regions registering growth. EBITDA before special items at Crop Science rose 13.5% YOY to €2.61 billion. The earnings increase was primarily attributable to advance demand due to COVID-19, higher volumes in all regions, and the realization of cost synergies as the integration of Monsanto progressed.

- On 24 April, Moody's Investors Service changed Romania's sovereign risk outlook to Negative from Stable and affirmed the long-term rating at Baa3 (40 on a generic scale), in line with IHS Markit and the consensus. The pension reform, adopted in June 2019, would raise pension points by 40% from September 2020. Without policy change, pension expenditure is expected to amount to 11.6% of GDP by 2030 compared with previous projections by national authorities of 6.6% of GDP. Moody's would change the outlook to Stable if the country were able to halt deterioration in public finances and reverse it through the medium term. Higher tax collection, lower current expenditure, and a higher share of investments, as well as a decreasing current-account deficit and higher coverage by non-debt-generating flows (FDI and capital-account balance) would be credit-positive developments. (IHS Markit Economist Vaiva Seckute)

- Botswana's finance and economic development minister, Thapelo Matsheka, announced on 24 April that the government expects the economy to contract 13.1% during FY 2020/21 (1 April-31 March). This represents an estimated massive growth markdown from the 4.4% expansion set out in the current budget and a sharper fall than the 5.4% decline recently announced by the International Monetary Fund (IMF). According to the government, the economic slump will be driven by a 33% contraction in the mining sector owing to faltering diamond mining production. (IHS Markit Economist Archbold Macheka)

- IHS Markit has downgraded Chad's medium-term sovereign risk rating to 65 out of 100 on our numerical scale (equivalent to CCC+ on the generic scale) and the short-term sovereign risk rating to 45 (BB+), and kept the ratings' outlooks at Negative. The ratings downgrades were prompted by the sharp decline in global oil prices and the subsequent downward pressures on Chad's foreign-exchange earnings, coupled with the adverse economic impact of the COVID-19 pandemic. Other threats to Chad's rating include the USD1.3-billion non-concessional loan from commodities trader Glencore in 2014, although Chad has negotiated restructured terms that provided much-needed financial relief and aided in the resumption of International Monetary Fund (IMF) aid. (IHS Markit Economist Archbold Macheka)

- Brent Crude closed -7.0%/$23.07 per barrel.

- 10yr European govt bonds closed mixed; Italy -12bps, Spain -6bps, France flat, UK +1bp, and Germany +2bps.

- European equity markets closed higher across the region; Germany/Italy +3.1%, France +2.6%, Spain +1.8%, and UK +1.6%.

Asia-Pacific

- The Bank of Japan has unexpectedly announced additional aggressive monetary easing to support corporations' financing needs. The bank decided at today's meeting to:

- Increase purchases of commercial paper (CP) and corporate bonds from about JPY1.0 trillion (USD9.3 billion) for each category to about JPY7.5 trillion each by September (totaling JPY20 trillion, including the existing amounts outstanding of CP and corporate bonds).

- Extend the maximum remaining maturity of corporate bonds to be purchased to five years.

- Strengthen the special funds-supplying operation to facilitate corporate financing in response to the pandemic by expanding the range of collateral to private debt to include household debt from about JPY8 trillion to JPY23 trillion.

- Lift the upper limit of purchases of Japanese government bonds (JGBs) while keeping the 10-year JGB yield at around zero, although this is not particularly meaningful because the current rise in outstanding JGBs is below the previous upper limit of JPY80 trillion. (IHS Markit Economist Harumi Taguchi)

- 10yr Japanese govt bonds closed -2bps/-0.04% yield and have rallied 13bps since the recent one year high close of 0.09% yield on March 20.

- Chinese industrial profit fell 34.9% year on year (y/y) in March, up 3.4 percentage points from a 38.3% y/y contraction in January and February, according to the release by the National Bureau of Statistics (NBS). The profits in the first quarter declined 36.7% y/y. The sequentially improvement in March profits was largely due to recovery in industrial production, which recorded a 1.1% y/y drop compared with a 13.5% y/y decline in the first two months. However, deepening industrial deflation dragged down the profits. Average profits in manufacturing improved, led by continuous expansion in food and tobacco manufacturing, slower contraction in computer and electronic equipment, transportation equipment, general-purpose equipment, and special-purpose equipment. However, the drop in auto manufacturing profits expanded further. Profits in upstream mining posted deeper contraction with the oil price slump and declining coal prices dragged down profits in utilities. According to the Ministry of Industry and Information Technology (MIIT), work resumption ratio in large industrial enterprises was close to 100% as of 22 April. (IHS Markit Economist Yating Xu)

- The South Korean government will provide subsidies for 8,200 electric light commercial vehicles (LCVs), reports The Korea Herald. It has signed a memorandum of understanding (MOU) with two automakers, Hyundai and Kia, and five logistics firm - CJ Logistics, Hanjin, Lotte Global Logistics, DHL Korea, and Hyundai Glovis - to put more environmentally friendly electric LCVs on the road. Under the MOU, the logistics firms will purchase around 2,800 1-ton trucks out of the 8,200. (IHS Markit AutoIntelligence's Jamal Amir)

- The Reserve Bank of India has unveiled a Rs500bn ($6.6bn) liquidity infusion for mutual funds in an effort to limit contagion across asset managers after Franklin Templeton's Indian arm announced the decision to close several funds that invest in higher risk debt from the region after an uptick in client redemptions, a move that limited the availability of more than $3bn of investor money. (FT)

- The automaker Geely plans to launch two low-orbit satellites this year, in an attempt to enable accurate navigation data for autonomous vehicle (AV) development, reports Gasgoo. These satellites will provide centimeter-accurate positioning services and support the operation of OmniCloud, a new satellite-based artificial intelligence (AI)-based cloud platform developed by GeeSpace. The automaker has announced plans to construct a satellite production and testing centre in Taizhou (China) and expects to make 500 satellites a year by around 2025. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- AutoX has partnered with Alibaba's mobility app operator AutoNavi to launch a robotaxi service in Chinese city of Shanghai's Jiading district, reports the South China Morning Post. The vehicles will be deployed with 5G-based vehicle-to-everything (V2X) communication technology and can run at a maximum speed of 80 km/h on city streets. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- APAC equity markets closed higher across the region; Japan +2.7%, Hong Kong +1.9%, South Korea +1.8%, India +1.3%, and China +0.3%.

In light of current events, IHS Markit is offering complimentary access for qualified market participants to our historical cross asset coverage of global fixed income pricing and liquidity data, as well as OTC Derivatives data via the Price Viewer web-based data portal.

You'll often see screenshots from Price Viewer in this daily report and corporations use the credit default swap and bond price/yield data to identify potential risks to their supply chains. Please contact data.delivery@ihsmarkit.com today for your complementary access.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-april-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-april-2020.html&text=Daily+Global+Market+Summary+-+27+April+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-april-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 27 April 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-april-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+27+April+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-april-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}