Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 27, 2021

Daily Global Market Summary - 27 April 2021

European, APAC, and US equity markets all closed mixed. US and benchmark European government bonds closed lower. European iTraxx and CDX-NA credit indices closed almost flat on the day across IG and high yield. Gold closed lower, while the US dollar, oil, natural gas, gold, and copper all closed higher.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Major US equity indices closed mixed; Russell 2000 +0.1%, DJIA/S&P 500 flat, and Nasdaq -0.3%.

- 10yr US govt bonds closed +5bps/1.62% yield and 30yr bonds +5bps/2.29% yield. Yields for 10s and 30s reached the highest levels in seven days.

- CDX-NAIG closed flat/52bps and CDX-NAHY flat/291bps.

- DXY US dollar index closed +0.1%/90.91.

- Gold closed -0.1%/$1,779 per troy oz, silver +0.8%/$26.41 per troy oz, and copper +1.1%/$4.49 per pound.

- Crude oil closed +1.7%/$62.94 per barrel and natural gas closed +2.4%/$2.94 per mmbtu.

- The US Conference Board Consumer Confidence Index jumped 12.7

points (11.7%) in April to 121.7, adding to an 18.6-point increase

the month before. The index has surged past its March 2020 level

and in April was just 10.9 points beneath the pre-pandemic peak

reached in February 2020. This report is consistent with our

expectation of continued strong growth of real consumer spending in

the second quarter. (IHS Markit Economists David

Deull and James

Bohnaker)

- In contrast to a broad-based March gain, the increase in April was fed almost entirely by the index of views on the present situation, which rose 29.5 points to 139.6. The expectations index rose a mere 1.5 points to 109.8—but was the highest since July 2019.

- Within the present situation index, views on the job market were the key mover. The labor index (the percentage of respondents viewing jobs as currently plentiful minus the percentage viewing jobs as hard to get) rose 16.7 percentage points to 24.7%. The stronger-than-expected employment report for March and continued gradual easing of state containment measures have likely amplified perceptions of improving labor markets.

- The equivalent measure for views on current business conditions, though much improved from -23.6% in February, was still in the red at -1.5%.

- Purchasing plans remained generally elevated in April at or near recent record highs. The share of respondents planning to buy homes in the next six months rose 0.8 percentage point to 8.9%, the highest since August 2002. The share planning to buy autos rose 1.3 points to 14.0%, a 23-month high. The share planning to buy major appliances, however, slipped 3.8 points to 49.8%.

- Americans are still cautious about travel. The proportion of respondents intending to take a vacation in the next six months, at 43.3%, remained beneath the October 2020 level.

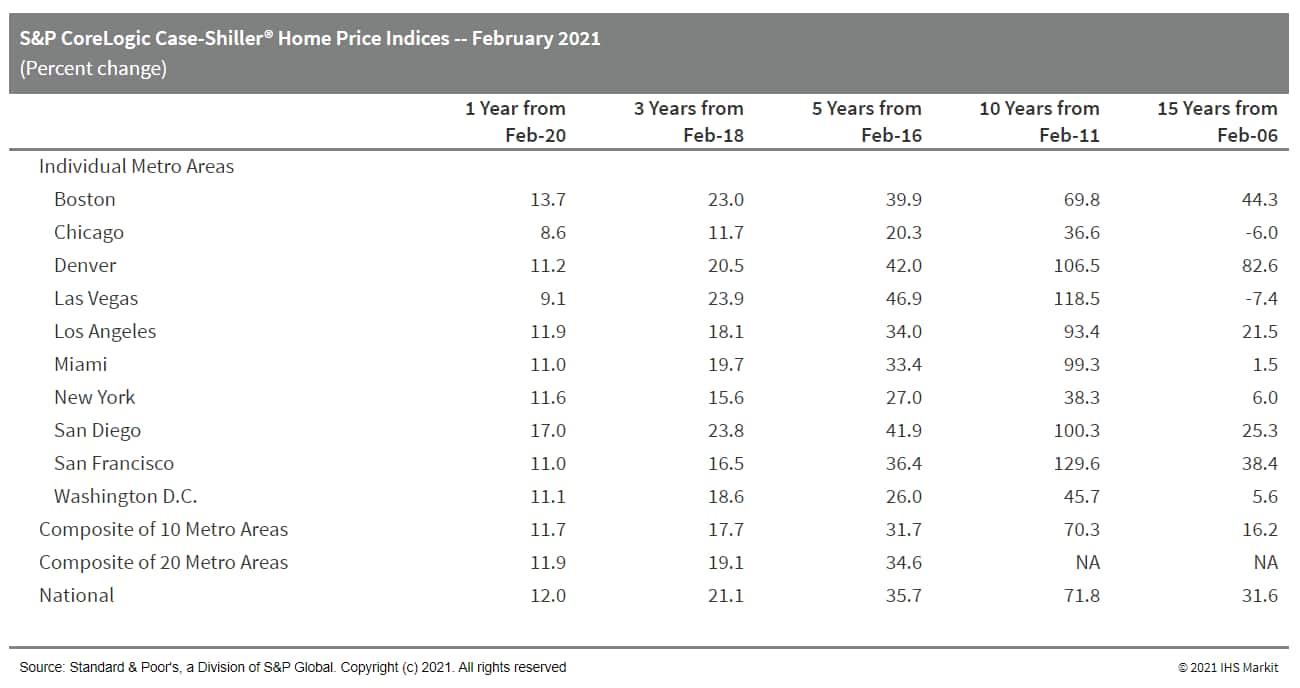

- US monthly home price appreciation remained strong in the

February. The S&P CoreLogic Case-Shiller 10-city index was 1.1%

month over month (m/m) while the 20-city index was up 1.2%. (IHS

Markit Economist Troy

Walters)

- Month-over-month gains in February were again positive in all 20 cities, ranging from 0.8% in Atlanta to 2.2% in San Diego.

- Both the 10-city and 20-city composite indices experienced record growth again in February, beating out the previous month's record gains. The 10-city index was up 11.7% year over year (y/y) while the 20-city index was up 11.9% y/y. In both cases, this was the fastest pace of growth since March 2014.

- Annual price appreciation was positive in all 20 cities covered. Not only that, an unprecedented 18 of the 20 cities were in double-digit territory in January. Phoenix again retained the top spot at 17.4% y/y while San Diego was a very close second at 17.0%.

- Growth in the national index reached 12.0% y/y in January, the

fastest pace since February 2006.

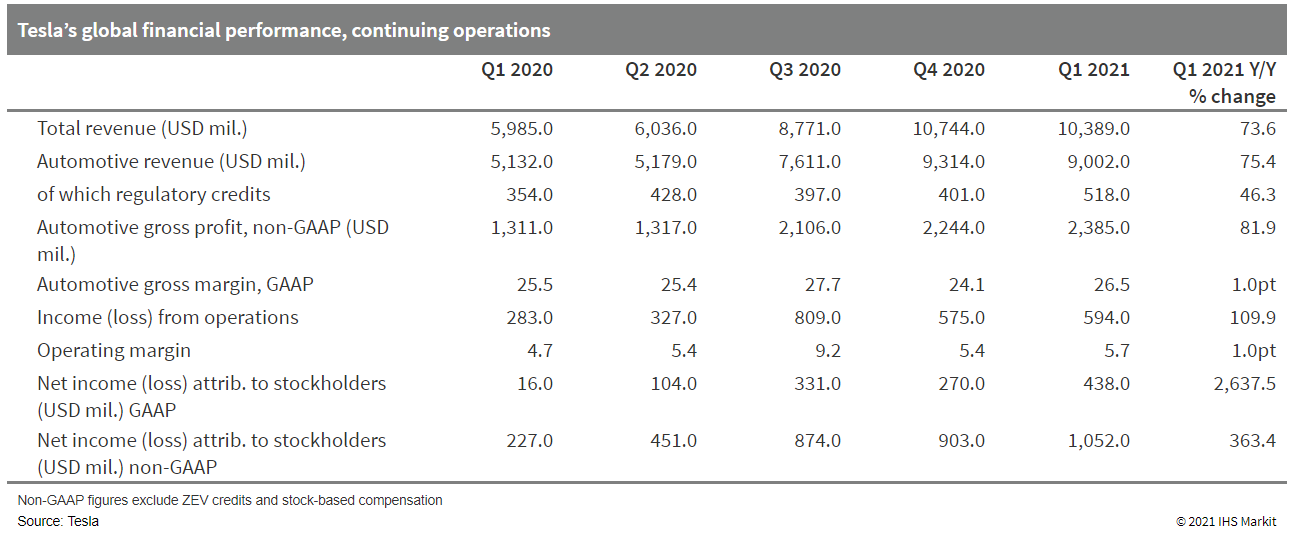

- Tesla returned a seventh consecutive quarterly profit in the

first quarter of 2021, with increased vehicle deliveries compared

with a year earlier assisted by the Shanghai plant and the Model Y,

and despite no production of Model S or X. Tesla reported a net

income increase in the first quarter of 2021 compared with first

quarter 2020, which was when the EV maker was ramping up production

of the Model Y in California and the effects of the COVID-19 virus

outbreak were the beginning. In 2021, quarterly comparisons are

likely to continue to show improvements on the increased production

this year. Tesla was also able to work through headwinds in the

first quarter of 2021, including the global semiconductor shortage

and there being no production of the Model S or X as these models

change over to a new generation. Tesla's profitability continues to

be assisted by increased sales of regulatory credits, as well as

increased production leading to increased vehicle sales. (IHS

Markit AutoIntelligence's Stephanie

Brinley)

- Three US senators are planning to introduce legislation that would require the nation's regulators to mandate installation of driver-monitoring systems, reports Automotive News. Senators Ed Markey (D-Mass.), Richard Blumenthal (D-Conn.), and Amy Klobuchar (D-Minn), expects this measure to be included as part of infrastructure reform legislation to ensure motorists pay attention while using these systems. The measure requires the National Highway Traffic Safety Administration (NHTSA) "to study how driver-monitoring systems can prevent driver distraction, driver disengagement, automation complacency, and the foreseeable misuse of advanced driver-assist systems". (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chemical industry urges veto of state food packaging ban. US chemical trade group is urging Washington Gov. Jay Inslee (D.) to veto a bill (SB 5022) that bans expanded polystyrene (EPS) or Styrofoam packaging in foodservice. Calling the bill's restrictions "misguided," the American Chemistry Council's Joshua Baca said: "If enacted, the ban would force the replacement of EPS with alternatives that are often more costly and have greater environmental impacts." Instead, the state should focus efforts on creating the infrastructure to recycle EPS and help create a more circular economy, he said. "As Washington State recovers from the economic fallout of a debilitating pandemic, the legislature should not be passing legislation that would reduce consumer options and increase financial challenges for consumers, businesses, schools and restaurants," Baca said. The bill, which was sent to the governor this week, would ban three types of EPS: portable containers designed for cold storage (June 2024), foodservice products (June 2024) and void filling packaging products (June 2023). The bill also establishes civil penalties for violations. Beginning January 2022, foodservice businesses would only provide single-use utensils, straws, condiment packaging and beverage cup lids upon request. (IHS Markit Food and Agricultural Policy's Richard Morrison)

- Sherwin-Williams (SW) today reported net income up 27.3%

year-on-year (YOY), to $409.6 million, on net sales up 12.3%, to

$4.66 billion. Adjusted earnings increased 51.5% YOY, to

$2.06/share, easily beating analysts' consensus estimate of

$1.64/share, as reported by Refinitiv (New York, New York). Volumes

grew in each of the company's operating segments, offsetting higher

raw material costs. (IHS Markit Chemical Advisory)

- Americas group net sales grew 8.6% YOY, to $2.50 billion, while segment profit increased 23.6%, to $480.0 million. Higher residential repaint, new residential, and do-it-yourself (DIY) paint sales drove the increases, offsetting higher raw material costs.

- Performance coatings group net sales increased 12.9% YOY, to $1.37 billion, while segment profit was up 26.5%, to $143.8 million. Raw material costs rose, but this was easily offset by selling price increases and higher volumes in most end markets.

- Consumer brands group net sales grew 25.0% YOY, to $778.1 million, while segment profit was up 72.1%, to $143.7 million. Higher volumes and selling price increases, in addition to cost controls, offset increasing raw material costs.

- Ecolab today reported net income down 32% year on year (YOY),

to $193.6 million, on net sales down 4%, to $2.89 billion. Adjusted

earnings totaled 81 cents/share, down 18% YOY, matching analysts'

consensus estimate, as reported by Refinitiv (New York, New York).

(IHS Markit Chemical Advisory)

- Global industrial segment sales were roughly flat YOY, at $1.43 billion, while segment operating income was up 7%, to $218.8 million. Sales growth in paper, and steady sales in water, were offset by declines in the food and beverage and downstream energy businesses, with a particularly large decline in the latter.

- Global institutional and specialty segment sales fell 20% YOY, to $857.4 million, while segment operating income was down 65%, to $63.2 million. Declines narrowed in the institutional division, but this was offset by continued demand pressure in the lodging, restaurant, and entertainment sectors.

- Global healthcare and life sciences segment sales rose 20% YOY, to $292.7 million, while segment operating income was up 102%, to $45.4 million. Demand resulting from the COVID-19 pandemic drove the increase in sales.

- Mexico's monthly index of economic activity (MIEA) declined by

0.3% in February compared with January month on month (m/m),

following a revised 0.1% m/m decline in January previously reported

as a 0.1% m/m increase. In December, MIEA also declined by 0.3%

m/m, although this was originally reported as a 0.1% m/m expansion.

All these figures are based on seasonally adjusted data. (IHS

Markit Economist Rafael

Amiel)

- The outlook for Mexico's economy is one of recovery: this is driven by faster growth in the United States, which, in turn, is driven by sizeable fiscal stimulus and a better-than-anticipated vaccine rollout that will allow the reopening of many activities. This will not only encourage exports of Mexican manufactures, but will also improve the outlook for growth in remittances.

- In 2020, remittances reached an all-time high of USD41 billion, or 5.8% of private consumption, up from USD36 billion in 2019. For 2021, we expect a similar expansion based on additional fiscal stimulus in the US and the country's strong growth - we forecast that US real GDP will increase by 6.2% in 2021 after falling by 3.5% on 2020.

Europe/Middle East/Africa

- European equity indices closed mixed; Spain +0.6%, France flat, Italy -0.2%, UK -0.3%, and Germany -0.3%.

- 10yr European govt bonds closed lower; Italy/Spain/UK +2bps and France/Germany +1bp.

- iTraxx-Europe closed flat/51bps and iTraxx-Xover +1bp/251bps.

- Brent crude closed +1.3%/$65.87 per barrel.

- The UK's Office for National Statistics (ONS) reported that

retail sales (including fuel sales) in volume terms increased for a

second successive month, when rising by 5.4% month on month (m/m)

in March. (IHS Markit Economist Raj

Badiani)

- Despite the strong March figures, retail sales volume still fell by 5.8% quarter on quarter (q/q) in the first quarter. This was because of lower spending in both clothing stores and other non-food stores.

- Retail sales volumes in March stood 1.6% above their pre-COVID-19 virus level in February 2020.

- Clothing stores reported sales grew by 17.5% m/m March, with the ONS reporting that many shoppers appeared to buy new clothing ahead of the easing of the lockdown restrictions. They include the government allowing households in England to meet outside from 29 March, while restaurants and bars can serve up to six outdoors from 12 April.

- Sales in food stores rose by 2.5% m/m in March 2021, with specialist food stores (butchers and bakers) benefitting from the continued closure of the hospitality sector during the Easter period.

- Non-store retailing grew by 1.3% m/m in March, implying that it was 51.5% higher than the February 2020 level. It accounts for 34.2% of all retail spending in March, up from 23.1% a year earlier.

- Fuel sales volumes fell by 11.1% between February and March and remained 18.3% below February 2020's level because of reduced travel due to many working from home during the three national lockdowns in England.

- The main area of weakness in the UK's export underperformance

can be traced to falling exports at smaller firms, as highlighted

by our recent NatWest UK Small Business Recovery PMI. (IHS Markit

Economist Chris

Williamson)

- Whereas small, medium and large sized companies all reported rising exports in the closing months of 2020, in many cases attributed by survey respondents to pre-purchasing of supplies ahead of the introduction of new Brexit-related trade laws on 31st December. markedly divergent trends by company size have been apparent so far this year.

- Looking at the first three months of the year for which data by company size are currently available, small firms have seen a steep decline in exports on average, contrasting with an ongoing sharp increase in exports at larger firms.

- At 44.1, the average PMI new exports orders index for smaller

firms (with less than 50 employees) during the first quarter

compared with 47.6 for medium sized firms and a buoyant 58.9 for

large manufacturers (with more than 250 employees). Any reading

below 50 signals a monthly contraction while readings above 50

signal an increase.

- BP reported first quarter 2021 underlying replacement cost (RC)

profit of $2,630 million, up 232% from $791 million in the same

period in 2020. The increase was driven by an exceptional gas

marketing and trading performance, significantly higher oil prices

and higher refining margins, the company said. BP's profit was

$4,667 million, compared with a loss of $4,365 million a year ago.

Total reported production, including the Rosneft contribution, was

3,268,000 boe/d, down 12% from a year ago. Total hydrocarbon

average realizations were $37.75/boe, compared with $31.80/boe a

year ago. (IHS Markit Upstream Companies and Transactions' Karan

Bhagani)

- Gas & low carbon energy underlying replacement cost profit before interest and tax was $2,270 million, compared with $847 million for the same period in 2020. The result for the quarter mainly reflected exceptionally strong gas marketing and trading results, as well as higher realizations and lower depreciation, depletion and amortization in the gas business, the company said.

- Oil production & operations underlying replacement cost profit before interest and tax was $1,565 million, compared with $895 million for the same period in 2020. The result for the quarter mainly reflected higher liquids and gas realizations and lower depreciation, depletion and amortization, partly offset by lower production, the company said.

- Customers & products segments' underlying replacement cost profit before interest and tax was $656 million, compared with $921 million for the same period in 2020. The result for the quarter mainly reflected a weaker refining result, the absence of earnings from its divested petrochemicals business, continued strong performance from its marketing businesses and a stronger contribution from trading, the company said.

- The Volkswagen (VW) passenger car brand is accelerating development on its forthcoming Project Trinity battery electric vehicle (BEV) technology flagship, which will boast innovative technology and showcase the company's capabilities while pointing the way to its future vehicle plans. According to an Autocar report, the Project Trinity vehicle will take the form of a high-rising sportback style saloon and will be one of the first cars to use the VW Group's Scalable Systems Platform (SSP). It will also have the company's latest digital architecture and operating system, along with next-generation battery technology to offer impressive range capability and fast charging. The real revolution that VW intends to introduce with Project Trinity is that according to the report the car will be sold in largely standardized form with only a few different 'hardware' options, such as color, battery size, and wheel style and size. Buyers will then be able to individually tailor their vehicle to their own needs by buying digital options and applications, which will be downloaded through over the air (OTA) updates. (IHS Markit AutoIntelligence's Tim Urquhart)

- Volvo Group has agreed to acquire a 60% stake in Swiss engineering firm Designwerk Technologies to strengthen its current e-mobility capabilities. Designwerk Technologies develops and sells electromobility products such as customized electric trucks under the brand Futuricum, mobile rapid chargers and high-voltage battery systems, and engineering services. The company will continue to operate as a standalone company. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Autoliv has announced a strong improvement in sales and profitability during the first quarter of 2021. For the three months ending 31 December 2020, its net sales have increased by 21.5% year on year (y/y) to USD2,242 million. By product area, its Seatbelt Products business grew by 21.1% y/y to USD779 million, while its Airbag Products and Other expanded by 21.7% y/y to USD1,463 million. The company also said that its operating income 76.9% y/y has grown by USD237 million, while its adjusted operating income stands at the same level, albeit growing by 74.3% y/y. Its operating margin now stands at 10.6%. Its net income for the quarter has now more than doubled from USD75 million to USD157 million. (IHS Markit AutoIntelligence's Ian Fletcher)

Asia-Pacific

- APAC equity markets closed mixed; India +1.2%, Mainland China flat, Hong Kong flat, South Korea -0.1%, Australia -0.2%, and Japan -0.5%.

- Chinese electric vehicle (EV) startup Hozon Auto has announced the start of its Series D financing on 26 April, according to Gasgoo. It is expected to raise CNY3 billion (USD462.5 million) and is being led by Chinese Internet security company 360. According to the report, after completion of the Series D funding, the internet security company is anticipated to become the second largest shareholder in the EV startup. This is the second funding round by Hozon in the last six months; it is said to have raised CNY2 billion in its Series C round. The company was also granted a credit line of CNY5 billion by China CITIC Bank on 1 March, which it intends to invest in developing technologies related to intelligent cockpit and smart driving. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- The BoJ left its monetary policy unchanged during the 26 and 27 April monetary policy meeting (MPM). The bank will continue quantitative and qualitative monetary easing (QQE) with yield curve control (YCC). The BoJ also maintained its commitment to increase the monetary base until the year-on-year rate of rise in the observed Consumer Price Index (CPI) exceeds 2% and stays above this target in a stable manner. (IHS Markit Economist Harumi Taguchi)

- Toyota Motor, Suzuki Motor, Subaru Corporation, Daihatsu Motor, and Mazda Motor have agreed to jointly develop technical specifications for next-generation vehicle communications devices and to promote the common use of communications systems by using connected services to link automobiles and society, according to a Toyota press statement. Currently, the trend is that individual OEMs are independently developing vehicle communications devices. As per the plan, Suzuki, Subaru, Daihatsu, and Mazda, while incorporating their own technologies into the base vehicle communications technologies developed by Toyota, will together build systems for next-generation connected cars with common connection specifications from vehicles to networks and the vehicle communications device center. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Lyft plans to sell its autonomous vehicle (AV) division to Toyota's Woven Planet division, according to media reports and a statement released on Lyft's Investor Relations website. Reuters reports that the deal will be worth about USD550 million to Lyft, which will allow the company to meet a profitability target one quarter earlier than expected. Rather than develop its own autonomous technology, Lyft is to focus on partnerships with self-driving companies that want to deploy their technology on its platform. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Pangyo, a town district in South Korea, has been designated as a demonstration zone for autonomous vehicle testing, reports Aju Business Daily. The Ministry of Land, Infrastructure and Transport (MOLIT) has selected a 7-km street in Pangyo to demonstrate autonomous technology and related services. The district has installed a control tower and an internet of things (IoT) service network that enables automobiles with vehicle-to-everything (V2X) communication technology to communicate with other vehicles, pedestrians, devices, and roadside infrastructure. Companies can now apply for regulation exemption before rolling out test services for various mobility services in Pangyo. Demonstrations will begin as early as July; they will include autonomous shuttle, premium taxi-hailing, and inter-linked last-mile mobility services that connect public transports. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Ola Electric Mobility (Ola Electric) has announced plans to create charging network in India for its upcoming electric two-wheelers, reports Business Standard. The development of the 'Ola Hypercharger Network' will include installing more than 100,000 charging points over 400 cities in India within five years. Ola plans to begin by rolling out 5,000 charging points in 100 Indian cities in the first year, which the company claims to be "more than double the existing charging infrastructure in the country". Ola plans to invest INR24 billion (USD326 million) in establishing electric vehicle (EV) facility in Tamil Nadu. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Chinese government told Chinese traders to halt importing a

range of Australian commodities such as coal, sugar, barley,

lobsters, wine, copper and so on last year. China has placed high

tariffs on Australian barley and wine. (IHS Markit Food and

Agricultural Commodities' Hope Lee)

- According to the Global Times, a Chinese state-owned press outlet: "The bilateral relations further plunged after Canberra used an anti-China law to tear up agreements signed between the state of Victoria and China regarding the Belt and Road Initiative. China has vowed to take forceful countermeasures but has not announced any so far."

- There are reports on the delay of customs clearance of Australian grapes at Chinese ports. The Global Times cited from its own sources that there are indeed many containers of Australian grapes waiting for inspection and nucleic acid tests at ports. It remains unclear when the backlog can be cleared. Other fruit shipments from Australia are also under inspection.

- Reuters reported (23 April) that Australian table grapes have been experiencing lengthy delays at Chinese ports for the last three weeks. Jeff Scott, chief executive at the Australian Table Grape Association told Reuters there are about 400 or 500 containers that are taking between five and 10 days longer than normal to be cleared.

- Australia sent about USD400 million worth of fresh grapes to China in 2020, up 2% year-on-year. In the first two months of 2021, Australian grapes to China reached USD31 million, up 2% y/y compared with the same time last year.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-april-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-april-2021.html&text=Daily+Global+Market+Summary+-+27+April+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-april-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 27 April 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-april-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+27+April+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-april-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}