Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 27, 2021

Daily Global Market Summary - 27 January 2021

APAC equity markets closed mixed, while the US and European indices were lower. US government bonds closed modestly higher and benchmark European bonds were mixed. European iTraxx and CDX-NA closed wider across IG and high yield. WTI and the US dollar closed higher, while Brent, gold, silver, and copper closed lower.

Americas

- US equity markets closed sharply lower and near the nadir of the session; S&P 500/Nasdaq -2.6%, DJIA -2.1%, and Russell 2000 -1.9%.

- Major stock indexes suffered their sharpest one-day losses since October on Wednesday amid concerns about COVID-19 vaccine distribution, while traders were also captivated by the frenzied trading in GameStop and other heavily shorted stocks. GameStop surged $199.53, or 135%, to $347.51 and AMC Entertainment Holdings soared $14.94, or 301%, to $19.90, part of a battle between day traders and short sellers. Both stocks are up more than 800% in January. Until Wednesday, the broader market's moves had been relatively muted in recent sessions, despite the wild swings in a handful of individual stocks. (WSJ)

- 10yr US govt bonds closed -2bps/1.02% yield and 30yr bonds -1bp/1.78% yield, with both bonds' yields slightly below the 6 January closing levels (which was the day after the dual democrat victories in the US Senate run-off elections in Georgia).

- The Federal Open Market Committee (FOMC) concluded its scheduled two-day policy meeting this afternoon (27 January). The statement released at the conclusion of today's meeting contained no surprises. There was unanimous support among the 11 voting members for the current stance of policy, which includes maintaining the target for the federal funds rate at a range of 0.00-0.25% and continuing large-scale asset purchases at a rate of approximately $120 billion per month. The Committee met amid concern about near-term weakness related to the intensification of the COVID-19 pandemic and cautious optimism for a stronger recovery in the second half of the year as efforts continue toward widespread vaccination. (IHS Markit Economists Ken Matheny and Kathleen Navin)

- CDX-NAIG closed +3bps/55bps and CDX-NAHY +10bps/320bps.

- DXY US dollar index closed +0.5%/90.65.

- Gold closed -0.3%/$1,845 per ounce, silver -0.6%/$25.39 per ounce, and copper -1.7%/$3.56 per pound.

- Crude oil closed +0.5%/$52.85 per barrel.

- Global renewable energy capital expenditure is set to increase

14% in the five years ending 2025, compared with spending in the

2015-2019 period, according to IHS Markit. At the same time,

overall global energy sector capex is set to decrease 8%, research

published in January shows. (IHS Markit Climate and Sustainability

News' Keiron Greenhalgh)

- Renewables' share of energy sector capex will average about 20% over the forecast period, in line with 2020 levels, but an increase of 4 percentage points compared with 2015-2019.

- "The renewables investment boom is reshaping the global power landscape. We expect combined global wind and solar PV installed capacity to surpass global installed natural gas-fired capacity in 2023 and coal-fired capacity in 2024," said Roger Diwan, IHS Markit vice president, research and analysis, adding that cost deflation is super-charging that boom.

- "Policy choices in the near term can boost these numbers. Countries and companies are accelerating their renewables ambitions, often anchored in net-zero emission targets, and a number of key countries are likely to focus post-COVID crisis spending on new green initiatives," said Diwan, one of the analysts behind the research.

- In 2021-2025, IHS Markit expects global energy sector capex to nudge slightly higher than 2020 levels, reaching around $1.3 trillion/year over the period.

- The decrease in overall capex in 2021-2025 relative to 2015-2019 is predicated on a slump in spending across the fossil fuel sector, with investment in the upstream and downstream oil and natural gas sectors, coal mining, and fossil fuel-fired power generation (coal and gas) in the 2021-2025 period declining 20% compared with 2015-2019 levels, according to the analysis.

- With renewable generation and related industries becoming more attractive than the oil and gas sector for investors, the energy transition is poised to speed up, a trend illustrated by stock market valuations.

- Over the past five years, the stock price of Florida-based generator and utility owner NextEra Energy has trebled to more than $80/share. Its market capitalization is now above $160 billion, surpassing ExxonMobil's at one point in 2020. Although ExxonMobil re-asserted its position as the US' largest energy company in recent months, with its share price hovering either side of $50 in recent days after falling below $32 in late October, that is still just over half the $95 valuation seen in July 2016 and nearly $90 as recently as January 2018.

- Fossil fuel demand is estimated to have dropped by about 7% in 2020 compared with 2019, with oil demand alone falling 10%, according to IHS Markit data.

- Still, the picture is not all gloom and doom for hydrocarbon producers, with stronger-than-expected oil and gas investment in the near-term remaining plausible, especially as a price increase to the $60-$70/bbl range for Brent in 2023-2024 is possible, the analysts say.

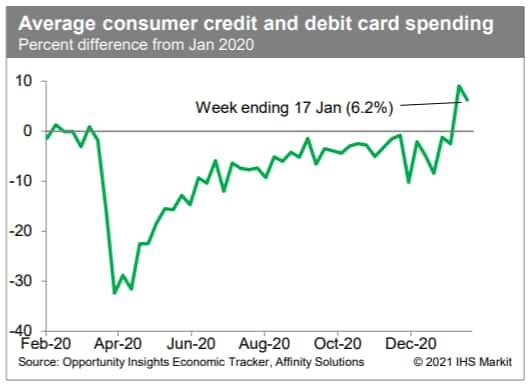

- Average consumer credit- and debit-card spending surged during

the first half of January, according to the Opportunity Insights

Economic Tracker. The jump in spending corresponded to, and was

likely driven by, the second round of economic stimulus payments,

disbursements of which began 4 January. Meanwhile, the IHS Markit

GDP-weighted US weekly containment index declined this week by 2.1

points to 49.7, as several states eased restrictions on social and

economic activity (California, Illinois, Ohio, Michigan, and

Oregon). (IHS Markit Economists Ben Herzon and Joel Prakken)

- US manufacturers' orders for durable goods rose 0.2% in

December following a run of solid increases in recent months that

has raised orders back to the pre-pandemic trend. Shipments of

durable goods rose 1.4% in December, while inventories of durable

goods declined 0.2%. (IHS Markit Economists Ben Herzon and Lawrence

Nelson)

- Orders and shipments of core capital goods continued to push higher through December. They have both shot past their pre-pandemic trends, suggesting robust growth of equipment spending in both the fourth and first quarters; we estimate 25.1% annualized growth in the fourth quarter and 10.9% annualized growth in the first quarter.

- This projection would leave equipment spending in the first quarter roughly 6% above its level at the close of 2019. Businesses appear to be catching up on equipment investment that was put on hold during the early stages of the pandemic.

- Resumed deliveries of Boeing's 737 MAX line of aircraft in December boosted overall shipments. Following an extended suspension, Boeing delivered 27 of these aircraft to US and overseas customers in December.

- Relatedly, inventories of durable goods declined 0.2% in December. This was more than accounted for by a sharp decline in inventories of civilian aircraft, reflecting resumed 737 MAX deliveries at Boeing.

- We had assumed a deceleration in inventories, but not a decline, lowering our estimate of fourth-quarter inventory investment.

- US President Joe Biden has issued an executive order aimed at more stringent adherence to 'Made in America Laws' applicable to federal government purchases, as well as changes to processes for waivers and increased transparency. The president said that he would like to see the full government fleet move to zero-emission alternatives and EVs. While the executive order sets the policy and direction and is likely to have an impact on sourcing decisions at the federal level, it does not specify new waiver requirements. The president did not set any particular timeframe for the shift to EVs within the government fleet. A barrier for a quick shift to EVs is that the current federal fleet mix by vehicle type is not aligned with available EV alternatives. (IHS Markit AutoIntelligence's Stephanie Brinley)

- As per IHS Markit's Commodities at Sea, total agribulk

shipments from the USA during December 2020 stood at 17mt (versus

9.1mt during December 2019). For the said period, shipments from

USG, WC North America, and EC North America stood at 12mt (versus

6mt during December 2019), 4.7mt (versus 3mt), and 0.2mt (versus

0.1mt), respectively. (IHS Markit Maritime and Trades' Pranay

Shukla)

- Soybeans exports from the USA terminals continued their strong momentum for the fourth consecutive month and during December shipments stood at 9.1mt (up 106% y/y). Shipments of corn and wheat stood at 3.2mt (up 80% y/y) and 1.2mt (down 9%), respectively.

- In terms of import countries, USA agribulk shipments to China during December 2020 stood at 8.7mt (up 238% y/y) and was largely responsible for strong monthly exports from the country.

- Overall, during full 2020, USA agribulk shipments stood at 134.5mt (up 29% y/y). In terms of regions, from USG, WC North America and EC North America shipments stood at 90.9mt (up 36% y/y), 41.7mt (up 18% y/y), and 1.9mt (up 28% y/y), respectively.

- In terms of agribulk cargoes, during 2020, shipments of soybeans, corn, and wheat stood at 51mt (up 35% y/y), 41.7mt (up 40%), and 20mt (at almost the previous year levels), respectively.

- In terms of import countries, USA agribulk shipments to China during the full year 2020 stood at 47mt (up 118% y/y) and comprised 35% of all agribulk exports from the country (versus 21% during 2019).

- Qualcomm Technologies will supply a range of chips for General Motors's (GM)'s next-generation vehicles to power digital cockpits, telematics systems, and advanced driver assistance systems (ADAS). GM will use Qualcomm's third-generation Snapdragon Automotive Cockpit Platforms to enable artificial intelligence (AI)-powered capabilities such as in-car virtual assistance and natural interactions between the vehicle and driver. Separately, Qualcomm has signed a collaboration deal with Veoneer to develop a software and chip platform for ADAS. Veoneer has announced the launch of Arriver, a software unit for the development of perception and drive policy software stack, which will be integrated with Qualcomm's Snapdragon Ride Platform. Nakul Duggal, senior vice-president and general manager of automotive at Qualcomm Technologies, said, "This collaboration expands our joint value proposition and focuses on solving the increasing complexity of ADAS and autonomous driving platform deployment faced by automakers and Tier-1 suppliers." Qualcomm is best known for its support of mobile-phone applications, but the company is expanding its footprint to the automotive industry. Its expertise in wireless technologies through its 9150 C-V2X chipsets enables an enhanced vehicle-to-everything connectivity experience, according to the company. Last year, Qualcomm unveiled a new platform, Snapdragon Ride, which supports functions for all levels of automated vehicle operations. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Cargill has added to its value-added protein portfolio with the acquisition of ProPortion Foods - a manufacturer of cooked meat products, along with plant-based proteins. The purchase, which closed in December, gives Cargill two more further-processed protein plants in Round Rock, Texas and Vernon, California. "Our agreement with ProPortion Foods is an exciting next step as we continue to execute our growth strategy and build our value-added cooked business," said Rob Stewart, managing director for growth ventures in Cargill's North American protein business. In 2019, ProPortion Foods made and sold protein products including beef, pork, chicken, turkey, and plant-based proteins. The facilities capabilities range from single-serve and family-sized, ready-to-cook and ready-to-eat meals to value-added proteins for quick-service, casual-dining, and other national and regional restaurant chains. Cargill has a long history of operating in both California and Texas. In California, the company's Fresno-Sanger complex produces beef, ground beef, case-ready protein solutions and pet treats. In Texas, Cargill's Fort Worth facility has both cooked and grind capabilities along with a cooked facility in Waco and a primary processing facility in Friona. (IHS Markit Food and Agricultural Commodities' Max Green)

- General Motors (GM) issued a statement announcing it will begin a new round of investment into its Brazilian facilities. Specifically, the company will invest BRL10 billion in the São Caetano do Sul and São Jose dos Campos plants. According to a GM statement, the investment supports unnamed new vehicles as well as expanding deployment of OnStar and Wi-Fi connectivity in its Brazil-market vehicles. GM's announcement is a counterpoint to Ford's decision earlier in January to exit manufacturing in Brazil. In 2020, Chevrolet was Brazil's best-selling car brand, and the Chevrolet Onix the best-selling vehicle. Overall, however, Fiat Chrysler Automobile (FCA; now Stellantis) is the top automaker in the country, with success from Jeep and Fiat brands. IHS Markit forecasts that the São Caetano do Sul plant will build a new generation of Chevrolet Montana in 2022 as well as a new Spin; both are set to shift to GM's VSS-F B/C architecture. Production of the Tracker at this plant, on the same platform, started in early 2020. The São Jose dos Campos plant produces the Colorado and Brazil-market Trailblazer, with minor changes anticipated. Although GM's output in 2020 fell, like all other automakers, on the coronavirus disease 2019 (COVID-19) virus pandemic and ongoing effects, IHS Markit forecasts that Chevrolet's Brazil production will break the 500,000-unit mark again as soon as 2022. In 2019, Chevrolet produced 509,601 vehicles in Brazil; in 2022 this is forecast to reach 526,000 units. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The government of Colombia expects the first quarter of 2021 to

see a significant ramping up of the country's energy transition,

with details of its latest renewable energy auction on the way

before the end of March, as well the unveiling of a 30-year

hydrogen roadmap, a senior official said 20 January. (IHS Markit

Climate and Sustainability News' Keiron Greenhalgh)

- Speaking at the Davos Energy Week 2021 conference, Minister of Mines and Energy Diego Rosa said the government's clean energy 2021 focus will include hydrogen, offshore wind and battery storage. The Marquez administration will also launch energy efficiency policies, he said.

- Colombia wants to be Latin America's energy transition leader, raising renewable energy's share of the country's generation mix to 12% from about 1% currently, a target set during Mesa's time as deputy energy minister between 2018 and 2020. The country's target is 2.5 GW of operating renewable capacity by 2022.

- Details of the 2021 renewable generation tender will be published within the "next two months," Rosa said during a webcast presentation.

- In 2019, Colombia held what Rosa called the first "double-sided" auction for renewable capacity, offering standard 15-year power purchase agreements in an effort to attract investment and interest in the tender. The tender price was 35% below the existing level, which Rosa said was a surprise to oil and natural gas companies, which had expressed concern that prices would rise.

- Rosa expects 2021's auction-the country's second-to be similar, although "obviously we have some refinements because we also had some lessons learned from 2019, but we're still in the process of developing" such changes.

- By the end of Q1 2021, the government will also have laid out the plans for the first large-scale battery capacity auction in Latin America, Rosa said.

- Along that same timeline, the government will have issued the 30-year hydrogen roadmap.

- Colombia is looking into both green and blue hydrogen development, Rosa said, which he believes will be "key for our transportation sector." Other countries in Latin America have expressed interest in importing hydrogen from Colombia, he said.

- The country has agreed a green hydrogen research program deal with Chile. Columbia's neighbor to the south wants to produce the cheapest green hydrogen in the world by 2030 and to be among the world's three largest hydrogen exporters by 2040.

- Columbia is in the process of formalizing a deal with Germany and is working with the European nation on the roadmap. The government is also working on a hydrogen deal with the country's largest oil and gas company, Ecopetrol, he added.

Europe/Middle East/Africa

- European equity markets closed lower; Germany -1.8%, Italy -1.5%, Spain -1.4%, UK -1.3%, and France -1.2%.

- 10yr European govt bonds closed mixed; Italy +1bp, Spain/UK flat, and Germany/France -1bp.

- iTraxx-Europe closed +2bps/52bps and iTraxx-Xover +9bps/269bps.

- Brent crude closed -0.2%/$55.53 per barrel.

- HSBC has issued a green trade finance facility raising USD48 million for Lamprell's fabrication work on the Seagreen Offshore Wind Farm project off the coast of Scotland. This is a first green guarantee in the MENA region and is also in line with Lamprell's recently announced reorganization to focus on renewables. Lamprell is a subcontractor on the Seagreen Offshore Wind Farm project in the North Sea in Scotland and it is mandated to deliver 30 of the 114 jackets and suction base foundations for the generators. (IHS Markit Upstream Costs and Technology's Neeraj Kumar Tiwari)

- Germany is the world's second-largest organic market with good prospects for US organic products, such as tree nuts, fruits and vegetables, and processed food products, according to the latest USDA report. Germany's organic food sales increased rapidly in recent years, to EUR12 billion (USD15 billion) in 2019. The government reported that sales reached EUR14 billion in 2020. This represents about a third of the EU's total organic food sales and 6% of Germany's total food sales. Organic food sales tripled between 2000 and 2020. Consumer demand far exceeds domestic supplies, which has led to higher imports. The USDA reported that imported organic food is taking a rising market share in German total food imports. Conventional product prices are increasing along with the rising land prices and lingering uncertainty about the financial support for organic farming. German consumers' organic purchase rose 17% year-on-year through September 2020. Foodservice closures partially drove organic retail sales. The country is Europe's largest organic producer and consumer. There are insufficient domestic supplies for potatoes, fruits, vegetables, dairy products and meat. The German agriculture ministry has developed a strategy to grow its organic sector further by aiming to convert 20% of its agricultural land to organic by 2030, which includes 24 actions across the supply chain. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- The German used car trading platform AUTO1 is launching an initial public offering (IPO) which it hopes will raise in the region of EUR1.5 billion (USD1.83 million), according to a Reuters report. The company, which is Germany's biggest used car trading platform, said it would issue 31.25 million new shares, worth at least EUR1 billion, and will invest 75% of that into its Autohero brand, which it wants to expand into becoming Europe's leading digital car selling platform. The subscription period for the offer starts tomorrow (28 January) and runs until 2 February, opening this year's IPO market in Germany. AUTO1's first day of trading on the Frankfurt Stock Exchange will be 4 February. The European used car market is set to undergo significant changes over the next few years as the market adjusts to the residuals offered by the increasing number of alternative powertrain vehicles on the second-hand market and a changing retail model, which will gradually reduce the number of physical dealers. AUTO1 wants to be at the forefront of driving this change in the second-hand market. (IHS Markit AutoIntelligence's Tim Urquhart)

- Electric vehicle (EV) charging network provider Ubitricity has announced that energy company Shell has agreed to acquire the business. According to the statement, if the deal is completed, Ubitricity will become a wholly owned subsidiary of Shell. The deal is subject to regulatory clearance, but is expected to be completed later this year. Since its founding in Berlin (Germany), Ubitricity has broadened its reach in to several European markets, including the UK, where it says it is the largest public EV charging infrastructure provider in the country with 2,700 points or a 13% market share. Ubitricity's business model is to work with local authorities to integrate EV charging into existing street infrastructure, such as lamp posts and bollards. This solution helps customers without a private driveway to transition to the plug-in EV technology. Ubitricity also provides private charging capability for fleet customers. The deal will be a big step for Shell, which is better known for its traditional fuel stations. It has already had an eye on the transition to plug-in vehicle technologies though, with the provision of over 1,000 ultra-fast and fast charging points at approximately 430 Shell retail sites, as well as offering customers worldwide access to over 185,000 third-party EV charging points through partnerships and affiliation at a range of public locations including forecourts, motorway service stations, and destinations. Shell's backing is likely to help accelerate Ubitricity's model and support more customers in moving to electrification. (IHS Markit AutoIntelligence's Ian Fletcher)

- Morocco's High Planning Commission (HCP) has published its

provisional economic budget for 2021, highlighting its expected

economic performance for 2021. (IHS Markit Economist Ralf Wiegert)

- After a steep economic contraction of 6.9% year on year (y/y) in 2020 with the collapse of tourism revenue, lower exports of manufactured goods, and a poor agriculture harvest, the budget projects that GDP will grow by 4.6% y/y in 2021, slightly more positive than the World Bank's economic forecast of 4.0%.

- In value terms, GDP is forecast to register growth of 5.8% y/y as inflation will be picking up at 1.1% in 2021, from -0.1% in 2020. The value added in the non-agriculture sector is expected to increase to 3.6% in 2021 after a projected downturn of 6.6% in 2020, while the primary sector (agriculture) is expected to expand to 11% in 2021 after a 7.1% contraction projected for 2020.

- Domestic demand should rebound by 5% y/y in 2021 after it sharply declined by 6.7% y/y in 2020, with a positive contribution of 5.4% to economic growth instead of a negative contribution of 7.3% in 2020.

- Exports of goods and services in volume terms are expected to grow 7.6% and imports of goods and services are expected to improve by 8.0%, compared to a sharp decline of 12.2% in 2020. Thus, net external demand should entail a negative contribution of 0.7 point, marking a decline of one point compared to its contribution in 2020.

- The budget deficit should reach 6.4% of GDP, after 7.4% estimated for the year 2020. The domestic government debt stock should increase by nearly 0.6 point as a percentage of GDP, to reach 78.3% of GDP following 77.7% of GDP in 2020. Including the external debt stock, total government debt would amount to 95.6% of GDP after 94.6% in 2020.

- IHS Markit expects slightly slower GDP growth of 4.2% in 2021 owing to weaker expected performance in the agricultural sector. We expect the fiscal deficit to narrow to 5.4% of GDP in 2021 as revenue recovers, although the deficit will not return to pre-crisis (2019) levels of 3.7% of GDP until 2024.

- The International Monetary Fund (IMF) expects Central African

regional GDP to rebound in 2021, growing at 2.7%. Adverse COVID-19

virus-related impacts are likely to have long-lasting economic

effects, with medium-term economic growth forecast at just 3.5%, as

reforms targeted to improve governance and the business environment

begin to yield positive results. (IHS Markit Economist Archbold

Macheka)

- After deteriorating to an estimated deficit of 6.5% of GDP in 2020, the external current-account gap is forecast to improve to around 4.8% of GDP in 2021, driven by the anticipated pick-up in oil exports. The IMF expects that a sustained recovery in oil exports and imports substitution measures will help bring the current-account deficit back to around 3% of GDP by 2023.

- Reserves are projected to be rebuilt at a slower pace than previously envisaged but should reach the equivalent of 5 months of imports by 2025. Annual inflation in the region is expected to accelerate to an average of 2.8% in 2021, driven by both demand and supply side pressures on the back of COVID-19 virus-related disruptions.

- The IMF envisages that fiscal consolidation efforts, mostly through expenditure compression, would support the reduction of the overall fiscal deficit to 3.4% of GDP (excluding grants) in 2021. In the medium term, it foresees balanced consolidation efforts to increase non-oil revenues and contain expenditure. Accordingly, the IMF expects the public-debt-to-GDP ratio to gradually fall to about 50% of GDP in 2024.

- The Economic and Monetary Community of Central Africa (Communauté Économique et Monétaire de l'Afrique Centrale: CEMAC) region's economy continues to be significantly affected by the COVID-19 virus pandemic, with a second wave of infections currently hitting most member countries. The regional macroeconomic outlook through the short term remains challenging, with substantial risks emanating from the economic and social impacts caused by the pandemic.

- IHS Markit expects growth for the region to come in at around 3.4% in 2021, constrained by COVID-19 virus-related containment measures, as well as the sluggishness of investment in a context of economic uncertainty and softer commodity prices, particularly for oil. We expect growth to remain lethargic in the medium term and well below its potential level as member countries embark on fiscal consolidation policies to curtail public-debt growth.

Asia-Pacific

- APAC equity markets closed mixed; India -1.9%, Australia -0.7%, South Korea -0.6%, Hong Kong -0.3%, Mainland China +0.1%, and Japan +0.3%.

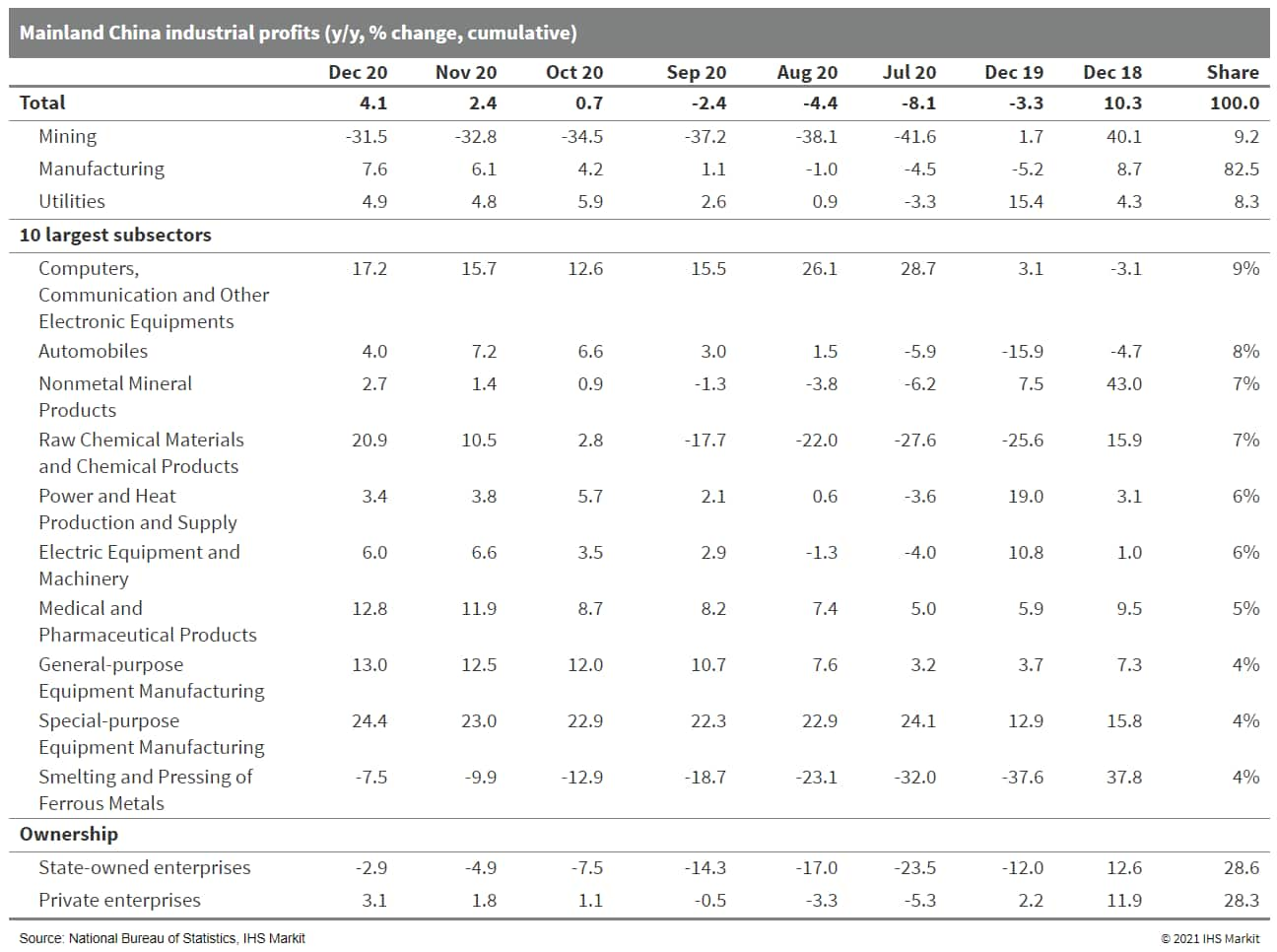

- Mainland China's industrial profits registered growth of 20.1%

year on year (y/y) in December 2020, up by 4.6 percentage points

from November, according to the data released from the National

Bureau of Statistics. Accompanied by the continued recovery in

operating revenue and profitability, industrial profits managed to

sustain the double-digit rate of expansion for the seventh

consecutive month. Cumulatively, full-year industrial profits for

2020 increased by 4.1% y/y, faster than the 2.8% y/y expansion in

industrial value-added and the 1.8% y/y deflation in producer price

index (PPI). (IHS Markit Economist Lei Yi)

- By sector, the manufacturing sector continued to lead the headline improvement in profits. While the strength in equipment manufacturing sustained, the recovery in global commodity prices also accelerated profits recovery in industries relating to raw materials like chemicals and metal processing. Meanwhile, high-tech manufacturing maintained faster-than-average growth and profits in consumption-related manufacturing continued to recover. However, profits in the auto sector decelerated in December on moderated sales. Profits improvement of the mining sector remained sluggish, with the 83.2% y/y contraction in petroleum and natural gas exploration sector being the major drag.

- By ownership, private firms reported 3.1% y/y increase in profits through December, accelerating from 1.8% y/y a month ago. Contraction in profits of state-owned enterprises (SOEs) narrowed to 2.9% y/y by year-end, partially due to a disproportionate share of upstream mining companies. Average liability-to-asset ratio reached 56.1 by the end of 2020, down by 0.5 percentage point from year-ago.

- By the end of 2020, inventory of finished goods had been up by 7.5% y/y, edging up from 7.3% y/y at November end.

- As nationwide economic recovery gathers momentum entering 2021,

rising producer prices and the low base effect are expected to

further sustain the recovery in industrial profits. Global vaccine

rollout could also add tailwinds for overseas demand, therefore

sustaining the exports strength in the near term and help balance

domestic supply and demand.

- China's Ministry of Industry and Information Technology (MIIT) has urged electric vehicle (EV) manufacturers in the country to address consumer complaints over range loss in winter conditions. According to MIIT spokesperson Huang Libin, the ministry recently organized expert panels to discuss the issue and called on automakers and their battery suppliers to work together to improve EV battery performance in cold weather conditions. The ministry also asked EV manufacturers to offer consumers specific guidance for winter driving and said that regulators would accelerate the rollout of related standards and technology requirements. The MIIT's comments come amid surging complaints regarding substantial range loss for EVs during low temperatures. The problem has affected a wide range of electric models on the market, although some suffer less from the issue than others. The shortened driving range of EVs in cold conditions causes consumers to doubt the practicality of EVs as it means that the driver has to charge the battery more frequently than usual. If not addressed properly through technology improvements and clear technology standards, this issue may hinder EV adoption in northern Chinese cities where temperatures can drop below 15˚C in winter. (IHS Markit AutoIntelligence's Abby Chun Tu)

- BlackBerry expands partnership with Baidu to power connected autonomous cars in China. Under this partnership, Baidu's high-definition maps will be integrated into Blackberry's QNX Neutrino Real-Time Operating System (RTOS). The system will be embedded, and mass produced in the upcoming GAC New Energy Aion models from the electric vehicle (EV) arm of GAC Group. Dhiraj Handa, vice-president of BlackBerry Technology Solutions APAC, said, "We look forward to continuing to work closely with Baidu to help develop and deploy leading edge autonomous driving and connected vehicle technologies to meet the ever increasing mission-critical and security requirements of the automotive industry." This partnership builds on the two companies' January 2018 agreement to make BlackBerry QNX operating system the foundation for Baidu's autonomous vehicle (AV) platform, Apollo. Baidu has launched version 5.5 of Apollo, which has attracted more than 200 partners. The company has obtained more than 190 licenses to test AVs and has conducted road tests in 27 cities, covering more than 7 million km. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Didi Chuxing's (DiDi) on-demand logistics service unit, known as Didi Freight, is reportedly close to raising USD1.5 billion in funding. Temasek Holdings Pte, Yunfeng Capital, and IDG Capital will join the financing for Didi Freight. Other investors include the investment arm of real-estate giant Country Garden Holdings Company, a unit of CITIC and Hidden Hill Capital, reports Bloomberg. Last month, Didi Freight was reported to be seeking a debut funding round, with plans to raise capital of between USD300 million and USD400 million. If this deal is realized, the total funding amount will easily exceed the company's target. DiDi launched on-demand trucking services in June 2020 in a bid to seize opportunities from growing demand for logistics services due to the COVID-19 virus pandemic in China. The company's logistics services are currently available in eight cities, serving more than 100,000 orders each day on average. (IHS Markit Automotive Mobility's Surabhi Rajpal)

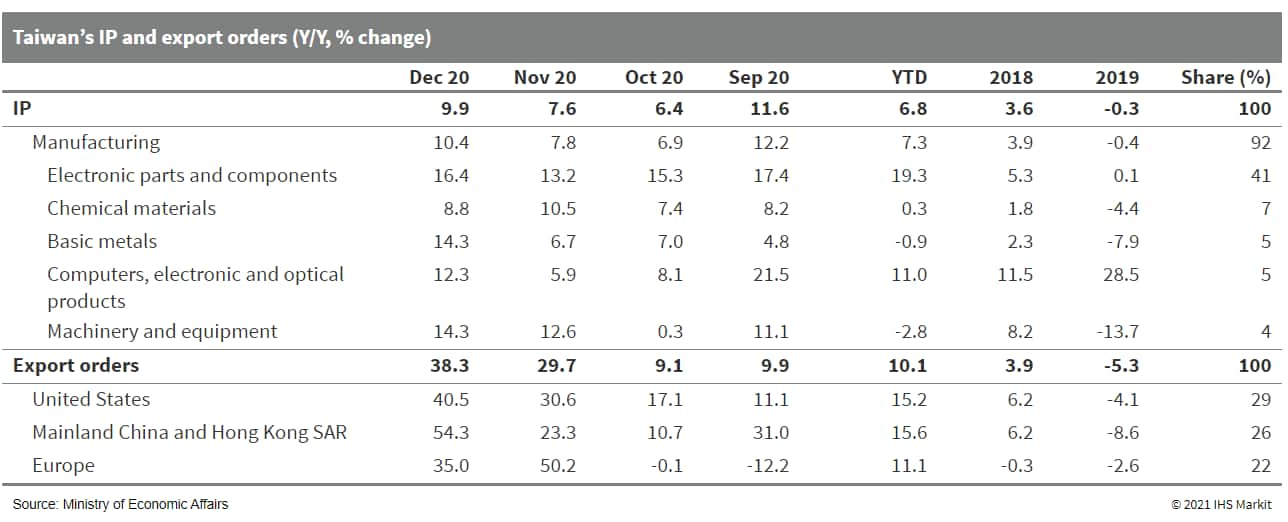

- Taiwan's export orders, representing a leading indicator of

actual exports, surged 38.3% year on year (y/y) in December,

accelerating from an already-strong 29.7% y/y increase in November.

The rate of gain was the fastest since March 2010 when export

orders jumped 43.7% y/y. The strong readings in the final two

months brought the average growth to 25.3% y/y in the fourth

quarter and to 10.1% y/y for 2020 as a whole. This reversed a 5.3%

drop posted in 2019. (IHS Markit Economist Ling-Wei Chung)

- Export orders from all major markets recorded sharp surges in December 2020, led by a 54.3% y/y jump in orders from mainland China and Hong Kong SAR as orders of electronic products from there soared 93.7% y/y during the month, marking the strongest gain since January 2010. Orders from mainland China and Hong Kong were also boosted by strong expansions in orders of transport equipment, machinery, electrical machinery, and optical products, ranging from about 30% y/y to 70% y/y.

- Export orders from the US strengthened further, surging 40.5% y/y in December 2020, marking the seventh straight month of double-digit expansions. Although decelerating from a 50.2% y/y jump in November, orders from Europe remained strong (up 35% y/y). Orders from ASEAN and Japan both jumped about 31% y/y in December. Strong orders from these markets were driven by surging demand for information and communication products and orders of electronics products.

- By products, electronic products and information and communication products remained the pillar of export orders. Electronics orders continued to surge at the double-digit pace for 11 consecutive months (up 58.4% y/y), boosted by surging demand for smartphones and computers amid the application of 5G communication and other technology innovations.

- Orders of information and communication products climbed 38.2% y/y, bolstered by demand related to remote working and learning. Supported by increasing panel demand, orders of optical products jumped 37.7% y/y. With the boost of strong growth during the final four months, optical orders returned to growth with a 7.5% increase in 2020 as a whole, after contracting for two straight years.

- Orders of non-technology products also improved with overseas demand recovering and commodity prices rebounding. After contracting for two straight years, orders of chemicals resumed growth in December 2020 for the first time since November 2018, up 15.4% y/y. Coupled with double-digit expansions in orders of machinery, plastics, and base metal, they helped offset the continued plunge in orders of mineral products (down 46.7% y/y).

- Industrial production (IP) increased by 9.9% y/y in December, accelerating from a 7.6% y/y gain in November. For 2020 as a whole, IP expanded 6.8%, reversing a 0.4% fall in 2019. The key driving force continued to come from surging technology production, while production of non-technology production also returned to growth.

- Output of the electronic component industry climbed 16.4% y/y in December, marking the 13th consecutive month of the double-digit increase. It was mainly bolstered by a 19.1% y/y jump in production of integrated circuits amid demand related to 5G application and high-performance computing. Increasing demand for laptops, tablets, and televisions also boosted panel output by 24.9% y/y in December.

- Export orders and IP concluded 2020 on a surprisingly strong

footing as they shrugged off the adverse effect of the pandemic and

the dampening effect of mainland China-US tensions in previous

years. After hitting the bottom in the first quarter of 2020

because of the global pandemic-related lockdowns, export orders

resumed growth in the second quarter and the recovering pace has

since accelerated.

- Nissan plans to electrify all of its new vehicle offerings in key markets such as Japan, China, the United States, and Europe by the early 2030s, with a broader aim to achieve carbon neutrality in the entire vehicle lifecycle by 2050, according to a company statement. In order to achieve this goal, the automaker plans to focus on innovation in battery technology, including all-solid-state batteries, for the development of more cost-competitive and efficient electric vehicles (EVs); development of a new e-POWER system with further improved energy efficiency; development of a battery ecosystem that contributes to distributed power generation using renewable energy; strengthening co-operation with the energy sector, contributing to the decarbonization of the power grid; and promoting innovations that improve production efficiency when assembling vehicles, such as the Nissan Intelligent Factory. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Beximco Pharmaceuticals (Bangladesh), a manufacturer of generic pharmaceuticals and active pharmaceutical ingredients, has entered into a binding commitment to acquire a 54.6% stake in Sanofi (France)'s subsidiary in Bangladesh, Sanofi Bangladesh. The acquisition has reportedly been agreed for USD48.48 million, and the deal comes after Beximco was selected as the preferred bidder in a competitive process. The remaining 45.4% stake in the former Sanofi subsidiary is owned by the government of Bangladesh through the Bangladesh Chemical Industries Corporation and the Ministry of Industries. The acquisition will further strengthen Beximco's prominent position in the domestic pharmaceutical sector by expanding its manufacturing capabilities and product portfolio. The acquisition deal comes after Sanofi initially announced plans to wind up its Bangladesh operations in 2019. (IHS Markit Life Sciences' Sacha Baggili)

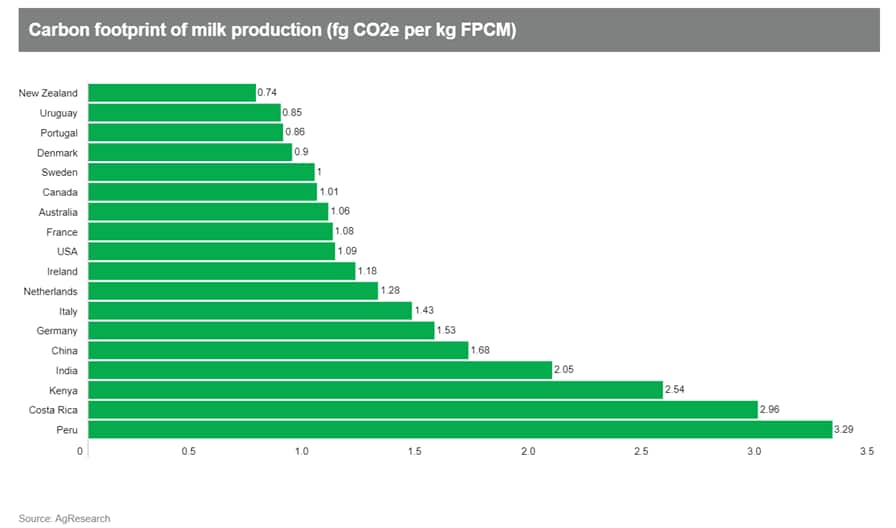

- New research shows New Zealand dairy industry has the world's

lowest carbon footprint - at nearly half the emissions of other

international dairy hubs. AgResearch analysis confirmed New Zealand

retained first position in low-emission dairy milk production, with

an on-farm carbon footprint of 46% less than the average of 18

countries studied. The research analyzed 55% of global milk

production, including major milk-producing countries. New Zealand

was the most efficient producer at 0.74 kg CO2e per kg FPCM (fat

and protein corrected milk). The average was 1.37 kg CO2e per kg

FPCM. New Zealand was followed by Uruguay at 0.85 kg CO2e per kg

FPCM, Portugal at 0.86, Denmark at 0.9 and Sweden at 1. Peru

clocked in as the highest emissions producer among the studied

countries, at 3.29 kg CO2e per kg FPCM. Peru was followed by Costa

Rica at 2.96 and Kenya at 2.54. The carbon footprint was measured

in total greenhouse (GHG) emissions per kg of product. The research

compared carbon dioxide equivalent (CO2e) emissions per kilogram of

milk (fat and protein corrected milk - the nutritional content

recognized in the study as CO2e per kg FPCM). The countries

selected had published research that enabled a like-for-like

comparison. Commissioned by DairyNZ, the study was independently

produced by AgResearch and peer-reviewed by an international

specialist in Ireland. (IHS Markit Food and Agricultural

Commodities' Jana Sutenko)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-january-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-january-2021.html&text=Daily+Global+Market+Summary+-+27+January+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-january-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 27 January 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-january-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+27+January+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-january-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}