Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 28, 2021

Daily Global Market Summary - 28 May 2021

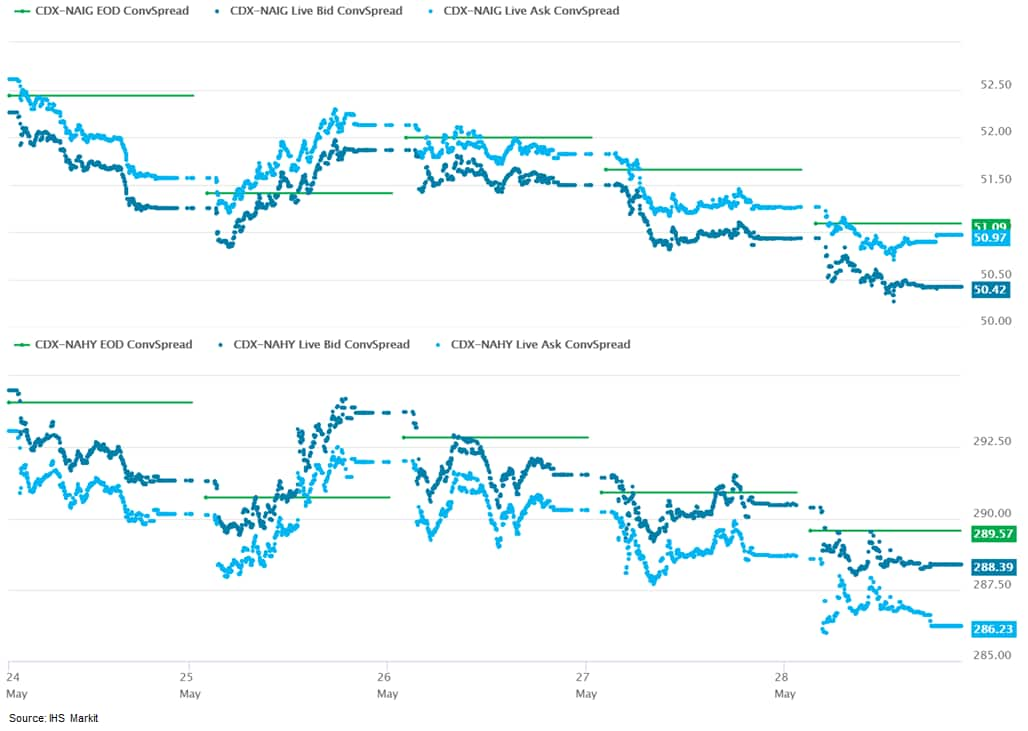

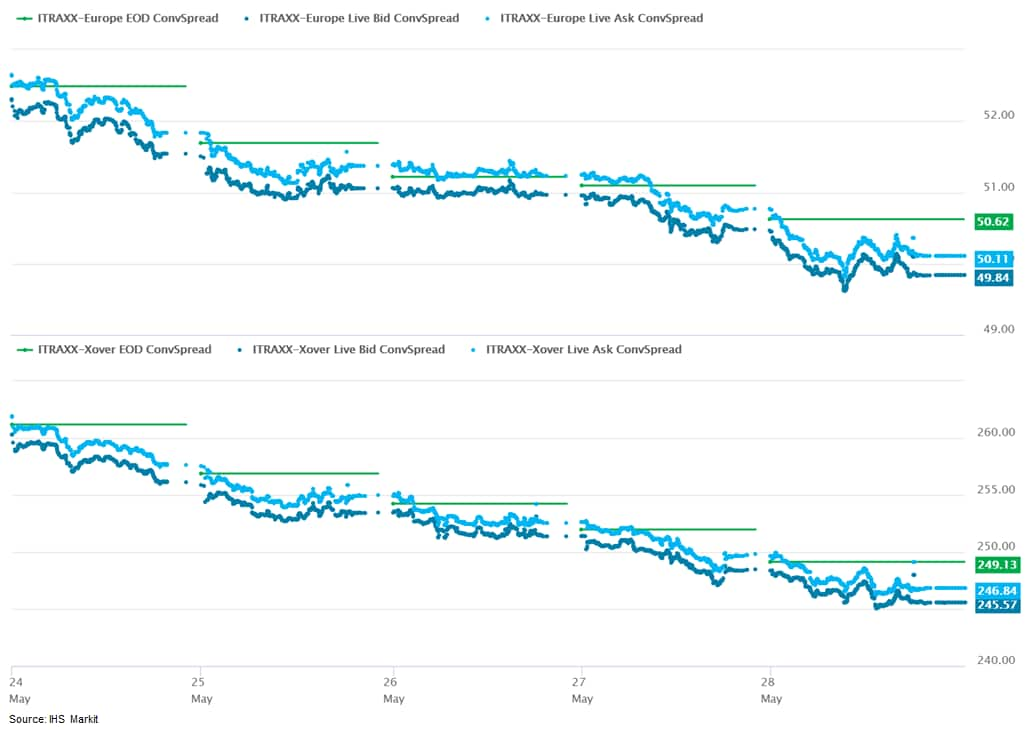

Most major US and European equity indices closed higher, while APAC was mixed. US and benchmark European government bonds closed higher. European iTraxx closed tighter across IG and high yield, with CDX-NAIG closing flat and CDX-NAHY tighter on the day. The US dollar, natural gas, gold, copper, and silver closed higher, while oil was lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Most major US equity indices closed higher except for the Russell 2000 -0.2%; DJIA +0.2%, Nasdaq +0.1%, and S&P 500 +0.1%.

- US bond markets closed at 2:00pm ET ahead of the Memorial Day holiday weekend, with 10yr US govt bonds closing -2bps/1.58% yield and 30yr bonds -2bps/2.26% yield.

- CDX-NAIG closed flat/51bps and CDX-NAHY -2bps/287bps, which is

-2bps and -7bps week-over-week, respectively.

- DXY US dollar index closed +0.1%/90.03.

- Gold closed +0.4%/$1,905 per troy oz, silver +0.3%/$28.01 per troy oz, and copper +0.3%/$4.68 per pound.

- Crude oil closed -0.8%/$66.32 per barrel and natural gas closed +0.9%/$2.99 per mmbtu.

- US personal income decreased 13.1% in April and real disposable

personal income (DPI) declined 15.1%. (IHS Markit Economists James

Bohnaker and David

Deull)

- The decline in personal income primarily reflects lower levels of economic impact payments (stimulus checks) distributed through the American Rescue Plan (ARP) Act. Economic impact payments were an estimated $57 billion (not annualized) in April, down from $337 billion in March.

- Personal income excluding transfer receipts increased 1.1%, reflecting strong gains in compensation (0.9%), dividend income (1.0%), and proprietors' income (3.2%)—the latter of which was boosted by subsidies in the form of forgiven PPP loans authorized by ARP.

- Real personal consumption expenditures (PCE) edged down 0.1% in April as spending on goods cooled 1.3% while that for services increased 0.6%. Real PCE came in somewhat below our assumption for April, implying less PCE in the second quarter; real PCE growth was revised down 0.8 percentage point to 13.7%. Although the level of PCE was lower than expected, improving vaccination rates, easing containment measures, and high-frequency card data imply a rebound in May.

- The core PCE price index increased 0.7% in its largest one-month percent change since 2001, bringing the 12-month change in the index to 3.1%. The price index for durable goods surged 1.4% in April. The unprecedented price increase for used vehicles in recent months is the major disruptor, but prices for many other types of durable goods also accelerated in April. We expect these price pressures will ease over the next several quarters.

- The US University of Michigan Consumer Sentiment Index fell 5.4

points (6.1%) from its April level to 82.9 in the final May

reading. This was a mere 0.1 point higher than in the preliminary

reading, indicating a stable outlook among consumers after the

moderate decline through mid-May. (IHS Markit Economists James

Bohnaker and David

Deull)

- The May decline in consumer sentiment was fed by both subindices. The index measuring views on the present situation fell 7.8 points to 89.4, while the one-year expectations index fell 3.9 points to 78.8. Relative to the mid-month reading, however, views on the present situation worsened slightly while expectations improved.

- Similarly, consumer sentiment fell across the income distribution, but there was a shift during the month. The index of sentiment for households earning more than $75,000 a year fell 7.4 points to 86.9, while sentiment for households earning less than $75,000 a year fell 2.9 points to 79.3. This represented a narrower gap between the two than recorded previously.

- The expected one-year inflation rate vaulted 1.2 percentage points in May to 4.6%, the highest since August 2008. The expected 5- to 10-year inflation rate rose 0.3 percentage point to 3.0%. Consumers appear to view price increases as more of a short-term phenomenon. Though the reading on longer-term inflation expectations was a recent high (seen last in 2013), it was 0.1 percentage point lower than in the preliminary reading for May.

- Views on buying conditions plunged in May amid rising prices. The index of buying conditions for large household durable goods fell 15 points to 111, while that for vehicles fell 18 points to 100. The index for homes dove by 24 points to 90. Each was lower than recorded two weeks earlier.

- The index of buying conditions for vehicles was the lowest since 2008, while that of homes was the lowest since 1982. The May decline in these measures was consistent with lower levels of purchasing plans recorded in the Conference Board's Consumer Confidence survey and supports our expectation for a shift toward spending on services in the near term.

- Offshore wind development in California received not one, but two, shots in the arm this week as efforts to kickstart the sector on the US West Coast and provide support for states' renewable generation targets ramped up. On 25 May, the federal US government designated two areas off the state's Pacific coast for development after overcoming long-standing Department of Defense (DOD) objections. The designation sets the areas on the path to a lease auction by mid-2022, according to the Department of the Interior (Interior). Two days later, on 27 May, a bill that would set state offshore wind capacity targets and arrange a procurement program passed the lower chamber of the state legislature. The bill, AB 525, won overwhelming support in a 71-1 Assembly vote. Lead sponsor Assemblyman David Chiu said he expects the state Senate to take up the bill in the next couple of months. California's waters are deeper than those on the US East Coast-until now the hub of the nascent American offshore wind sector-so the moves are a significant boost for floating wind advocates as well as overall US ambitions. Floating wind accounts for 60% of US offshore wind potential, Department of Energy Principal Deputy Secretary for Energy Efficiency and Renewable Energy Kelly Speakes-Backman told an industry conference 26 May, so the importance of the nascent technology for reaching the Biden-Harris administration's 30 GW by 2030 target, which was announced 29 March, but especially the 110 GW of offshore wind by 2050 goal, cannot be overstressed. (IHS Markit Climate and Sustainability News' Keiron Greenhalgh)

- In further pursuit of an antitrust investigation of the

meatpacking industry, Sen. John Thune (R-SD) now has requested an

oversight hearing by the Senate Judiciary Committee, which is

chaired by Sen. Richard Durbin (D-Ill). (IHS Markit Food and

Agricultural Policy's William Schulz)

- "As you know, the four largest meatpacking companies in the United States control more than 80 percent of our nation's beef processing capacity," Thune tells Durbin in a May 26 letter. "There have been multiple instances in recent years in which concerns have been raised that these entities could be engaging in anticompetitive behavior."

- For example, Thune said, "boxed beef prices have again increased significantly, and, as a result, consumers are experiencing higher costs in grocery stores. Cattle prices have not responded accordingly, and the ability of cattle producers to continue operating is again in question. As a result, meatpackers are experiencing exceptionally high profit margins at the expense of consumers and cattle producers."

- Thune and other farm-state legislators suspect that the highly concentrated meatpacking sector could be "inappropriately influencing the marketplace [raising] serious concerns that warrant the Senate Judiciary Committee's attention. Given the confidential nature of the DOJ's investigation, a hearing would serve as a public forum to gather information needed as Congress considers such this important issue."

- US regulatory agency the National Highway Traffic Safety Administration (NHTSA) has changed its labelling of the Tesla Model 3 and Model Y electric vehicles (EVs) in terms of recommended safety technologies. This follows the automaker's announcement that it would no longer build the models with radar at its plant in California, expecting its Autopilot advanced driver-assistance system to work better with cameras only. Tesla announced it was shifting from using radar systems on 26 May, according to a Bloomberg report. Following the change by Tesla, the NHTSA, which regulates and enforces vehicle safety system rules, has updated its website to show that Model 3 and Model Y EVs produced after 27 April "do not have NHTSA's check mark for recommended safety technologies: forward collision warning, lane departure warning, crash imminent braking and dynamic brake support". (IHS Markit AutoIntelligence's Stephanie Brinley)

- Rivian will begin deliveries of its R1T Launch Edition electric pick-up trucks from June to July, according to Automotive News. The report cites an emailed statement it received from Rivian, saying the delay is the result of a number of issues, including the global semiconductor chip shortage, but also delays on shipping containers and difficulties setting up vehicle servicing. However, Automotive News says Rivian noted it has not faced some of the more significant chip-related shortages of other automakers. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Mexico's National Institute of Statistics and Geography

(Instituto Nacional de Estadística y Geografía: INEGI) has released

its first revision of GDP figures for the first quarter of 2021,

showing a relatively sizeable increase in the growth rate. In

January to March, GDP grew by 0.8% with respect to the final

quarter of 2020; this was previously reported as 0.4%. (IHS Markit

Economist Rafael

Amiel)

- The industry, previously reported as completely flat, is now reported to have grown by 0.5% quarter on quarter (q/q); growth in services was also upgraded (from a 0.7% q/q expansion to 0.9% q/q). All these figures are based on seasonally adjusted data.

- In an annual comparison and based on unadjusted data, GDP fell by 3.6% compared with the first quarter of 2020; this was previously reported as a 3.8% contraction.

- The National Treasury of Brazil reported that the primary

balance (fiscal balance before accounting for interest payments on

debt) of the central government amounted to BRL16.5 billion, which

compares favourably to the BRL93-billion deficit of April 2020,

when the government not only executed sizeable fiscal stimulus but

also suffered from poor collection because of the lockdowns and

restrictions implemented during the pandemic. (IHS Markit Economist

Rafael

Amiel)

- This year's surplus was also better than in April 2019. Moreover, in January-April the cumulative primary surplus was BRL41 billion, compared with a deficit of BRL2 billion in 2019.

- The improvement in public finances, when compared with 2019, reflects both better tax collection and a decline in spending. Revenue grew 6.3% in real terms in the two-year period between the first four months of 2019 and January-April 2021; meanwhile spending declined 3.7% in real terms. Payroll outlays were almost flat in nominal terms (down 8.3% in real terms or after discounting for inflation)

- Argentine real retail sales decreased by 8.8% year on year

(y/y) in supermarkets, but rose by almost 60% y/y in shopping

centers in March, as these were shut down by the strict lockdown in

March-June 2020. In terms of supermarket sales, less than 4% were

online purchases; the main drivers of sales were electronic items

and appliances, apparel, shoes and home textiles. Sales of pantry

goods, dairy, and cleaning products posted the steepest drops in

real terms. (IHS Markit Economist Paula

Diosquez-Rice)

- The economic activity index increased by 11.4% y/y in March, while the seasonally adjusted data showed a 0.2% m/m decline during the month. For the first three months of 2021, the annual declines in January-February drove down the cumulative figure to 2.4% (economic activity declined 4.4% y/y in the first quarter of 2020).

- By sector, the economic activity index data showed mostly expansions in March. There were robust increases in the construction sector, the manufacturing sector, the wholesale trade sector, and the real estate sector. On the other hand, the mining, hospitality and restaurants, utilities, and transportation and communication sectors posted annual declines in activity.

Europe/Middle East/Africa

- Most major European equity indices closed higher except for UK closing flat; France +0.8%, Germany +0.7%, Italy +0.5%, and Spain +0.4%.

- 10yr European govt bonds closed higher; Italy/Spain/UK -2bps and France/Spain -1bp.

- iTraxx-Europe closed -1bp/50bps and iTraxx-Xover -3bps/246bps,

which is -2bps and -15bps week-over-week, respectively.

- Brent crude closed -0.7%/$68.72 per barrel.

- The "headline" economic sentiment indicator (ESI) for the

eurozone has risen by another four points in May, to 114.5,

comfortably surpassing the market consensus expectation (of 112.1,

according to Reuters' survey) for the third consecutive month. (IHS

Markit Economist Ken

Wattret)

- The ESI is now more than 14 points above its long-run average since 2000 (100.0), 10 points above its pre-pandemic level in February 2020 (104.0), and just a whisker shy of the cycle peak prior to the COVID-19 shock (115.2 in December 2017).

- The historic high for the eurozone ESI stands at 118.2, set in May 2000.

- The breakdown of May's ESI data by sector again highlights the outperformance of eurozone industrial sentiment, which has reached a record high (of 11.5).

- The latest month-on-month (m/m) increase (0.6) is the lowest of the year-long rebound to date, and with forward-looking elements of the industrial survey such as production expectations slipping back in May, it looks like momentum in the industrial sector is now topping out.

- In contrast, services sentiment is rocketing, albeit from a much weaker level. Following a record double-digit increase in April, sentiment in services has surged by another nine points in May (to 11.3), surpassing its long-run average (by over five points) for the first time since the pandemic struck.

- The eurozone construction, retail, and consumer sentiment indices have all improved in May, with sentiment in financial services soaring (although the latter is not included in the ESI).

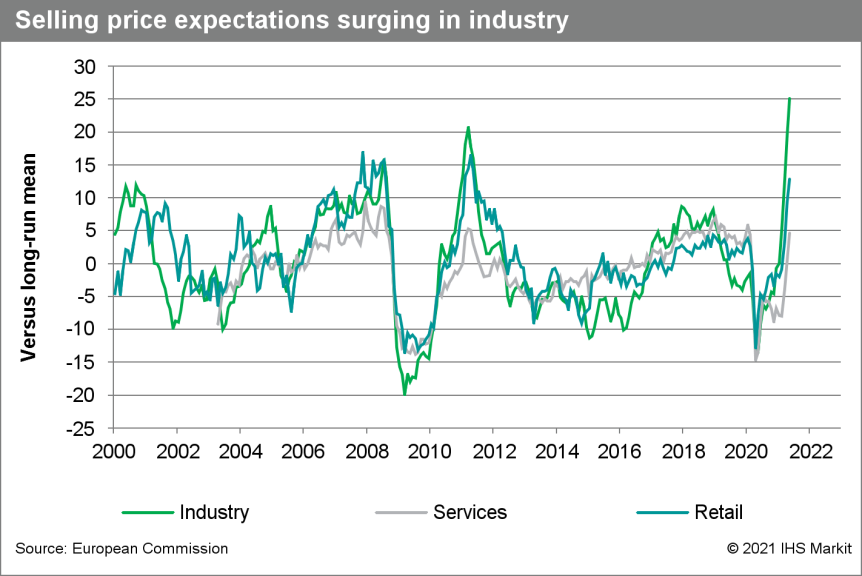

- Switching to inflation developments, surveys of firms' pricing

intentions have risen markedly again in May, led again by the

industrial sector, where the index has hit a record high.

- Skoda has become the second VW Group brand in a week after Audi to announce a charging station concept using second-life automotive batteries as an energy storage solution. Audi's charging station concept combines high-end design values coupled with second-life battery energy storage to create a premium charging experience. Second-life battery storage is seen as an efficient and cost-effective charging technology, and VW is seemingly keen on rolling out the technology across brands. (IHS Markit AutoIntelligence's Tim Urquhart)

- Vestas has been awarded by Iberdrola the contract for the supply, service, and maintenance of 50 V174-9.5MW offshore wind turbines for the 476MW Baltic Eagle project in Germany. The project is the second major offshore wind project by Iberdola in Germany, after the successful installation of the 350 MW Wikinger wind farm in 2017. On commissioning of Baltic Eagle, Iberdrola's total installed capacity in the country will be 826 MW, representing investments of around USD3 billion. The company plans to increase its capacity to more than 1.1GW by the end of 2026. The Baltic Eagle project, located 30 kilometers off Rugen Island in the Baltic Sea and 75 kilometers off the coast, covers an area of over 40 square kilometers. It will be connected to the Lubmin substation through two new high voltage cables to be laid by transmission operator 50Hertz. The Vestas V174-9.5MW wind turbine has a 174-meter rotor blade diameter and a hub elevation of 107-meter above sea level. Wind turbine installation is expected to begin in the first quarter of 2024. (IHS Markit Upstream Costs and Technology's Monish Thakkar)

- France's National Institute of Statistics and Economic Studies

(Institut national de la statistique et des études économiques:

INSEE) has marginally revised its estimate for 2020, when the

economy is now estimated to have declined by 8.0%, as opposed to

8.2%. On a year-on-year (y/y) basis, GDP grew by 1.2% during the

first three months of this year, revised down from 1.5% y/y in the

"flash" release. (IHS Markit Economist Diego

Iscaro)

- The first-quarter revision is particularly acute for domestic demand, which is now estimated to have made a marginal contribution to growth. Both private consumption (+0.2% q/q, revised from a previous estimate of +0.4% q/q) and fixed investment (+0.2% q/q, previously +2.2% q/q) are now estimated to have grown at a weaker pace.

- Although the contribution of net foreign trade has been left unchanged, the components have been revised sharply. Exports of goods and services are now estimated to have declined by 0.2% q/q (-1.5% q/q in the flash estimate), while imports are now seen as having risen by 1.1% q/q (-0.1% q/q in the flash release).

- CGG and Geoptic have signed an R&D collaboration agreement to jointly research and evaluate a novel borehole solution to keep a track on the spread of CO2 subsurface storage sites for Carbon Capture & Storage (CCS). The agreement focuses on the development of a new version of Geoptic's DIABLO muon tracking tool, certainly for CCS applications. Geoptic deploys DIABLO as part of its pioneering use of cosmic ray muons and has also attained award winning experience in utilizing muon technologies for subsurface surveys. Building upon this, Geoptic is on its way to develop muon sensors suitable for use down boreholes for the imaging of CCS projects, especially because they can be helpful to the environmentally sensitive areas. Applications of these sensors can range from surveying construction sites, structural monitoring to other subsurface monitoring arenas. (IHS Markit Upstream Costs and Technology's Lopamudra De)

- Scania's corporate venture capital-fund has invested EUR7.5 million (USD9.1 million) in LiDAR startup Scantinel, according to a company statement. Scania Growth Capital's investment will support Scantinel in financing its frequency-modulated continuous wave (FMCW) LiDARs, which are a prerequisite in reaching a higher level of automation in vehicles. Christian Zeuchner, partner at the Scania Growth Capital management company, said, "The future performance and safety of autonomous vehicles is based on unique FMCW LiDAR sensor technology. We see Scantinel as the technology leader in its field and are excited to follow the development at a close range". (IHS Markit Automotive Mobility's Surabhi Rajpal)

- SberAutoTech has unveiled a prototype of its autonomous vehicle (AV) for future mobility, FLIP, according to a company statement. The company describes the vehicle as a "taxi of the future" which has met the maximum requirement of international automated driving standards. FLIP features a combination of LiDARs, radars, and cameras as well as supports vehicle-to-everything (V2X) communication technology. It is the size of a conventional passenger car but has no traditional control panels and can carry six people. FLIP's electric platform is driven by an electric motor powered by a replaceable battery module and can also harness the power of alternative fuels such as natural gas and hydrogen. (IHS Markit Automotive Mobility's Surabhi Rajpal)

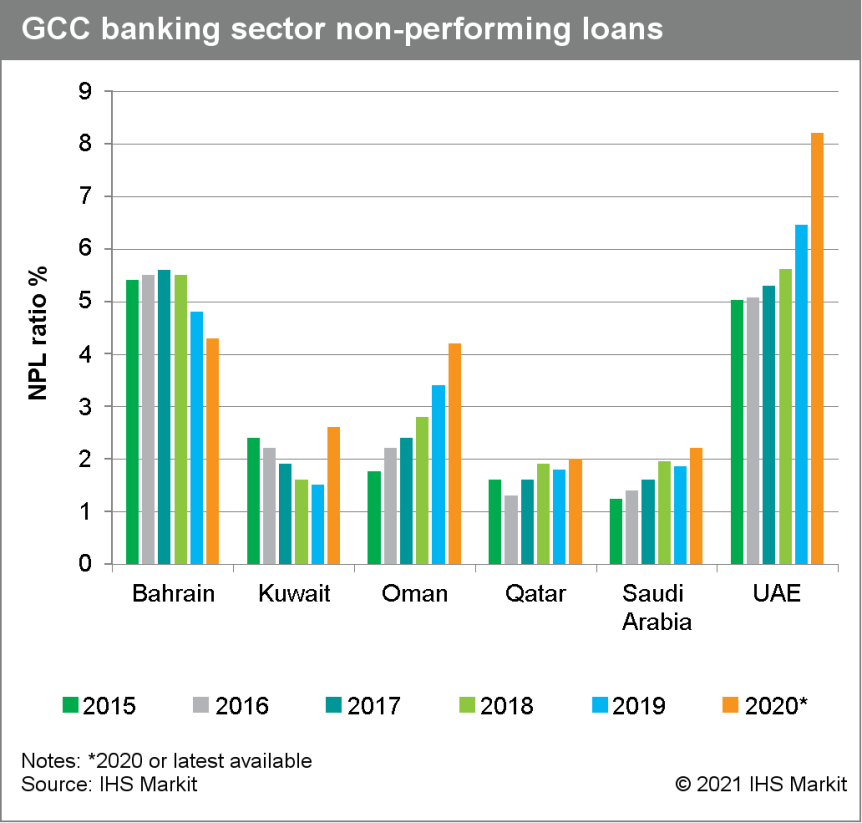

- Newly released figures for Gulf Cooperation Council (GCC)

banking sectors show that credit provision slowed in the first

quarter of 2021 compared with the end of 2020 in all countries

except Saudi Arabia. In fact, the United Arab Emirates recorded a

slight credit contraction. This signals that government support may

no longer be stimulating enough to prop up credit growth to

pre-COVID-19-virus levels. Deposit mobilization was much more of a

mixed bag, with average deposit growth for the region remaining on

pace with year-end 2020. Non-performing loans (NPLs) edged up

significantly, but capital buffers remained supportive. (IHS Markit

Banking Risk's Gabrielle

Ventura)

- Credit growth slowed in all but one GCC banking sector in the first quarter of 2021. After picking up pace in 2020 compared with 2019, credit growth slowed significantly in the first quarter of 2021 across the GCC, falling back to 5% year on year (y/y).

- Asset quality will remain a lingering concern, although GCC

banks maintain ample capital cushions. New end-2020 data released

by the region's regulators show that NPL ratios edged up across the

GCC, with the exception of Bahrain. The largest increase was in the

UAE, where the NPL ratio increased by 1.74 percentage points to

8.2%.

Asia-Pacific

- APAC equity markets closed mixed; Japan +2.1%, Australia +1.2%, South Korea +0.7%, India +0.6%, Hong Kong flat, and Mainland China -0.2%.

- Days after Tesla announced that it has set up a local data centre to store data from its vehicles sold in China, other automakers have reported similar moves. Ford Motor said that it established a data centre in China in the first half of last year and was storing all vehicle data locally. Meanwhile, BMW and Daimler stated that they have dedicated local data centres in China but did not comment on when those were set up, reports Reuters. However, Renault confirmed that it does not have any such arrangement yet, while Nissan and Stellantis said they would comply with rules in China, without divulging any details. General Motors (GM), Toyota, Honda, and Hyundai have not responded or declined to comment on how they manage their data from Chinese vehicles. Tesla announced that it has set up a data center in China to enable it to store locally the data it collects from vehicles sold in the country. This move was in line with the draft rules announced by the Chinese government to ensure that the data generated by connected vehicles are secure. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- A Level 3 automated FAW J7 truck has completed a 4,000-mile journey on the Silk Road in a round trip between the Chinese cities of Suzhou and Dunhuang. The truck is deployed with Plus's autonomous system, PlusDrive, and always had a professional operator on board. The truck encountered varied scenarios and challenging situations, including S-curve turns, undivided highways, a six-mile long tunnel, heavy rain, a sand storm, and haze. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Siemens Gamesa has signed a new preferred supplier agreement (PSA) for the Hai Long 2B and 3 projects in Taiwan. The PSA covers the supply and servicing of Siemen Gamesa's flagship SG 14-222 DD offshore wind turbines for the combined project capacity of 744 MW. A previous agreement was signed in 2019 with consortium partners, Canadian independent power producer Northland Power Inc. and Taiwan-based developer Yushan Energy, for the 300 MW Hai Long 2A for the same wind turbines. The agreement is subject to the final investment decision from the consortium partners, which is expected to be some time in 2022. (IHS Markit Upstream Costs and Technology's Melvin Leong)

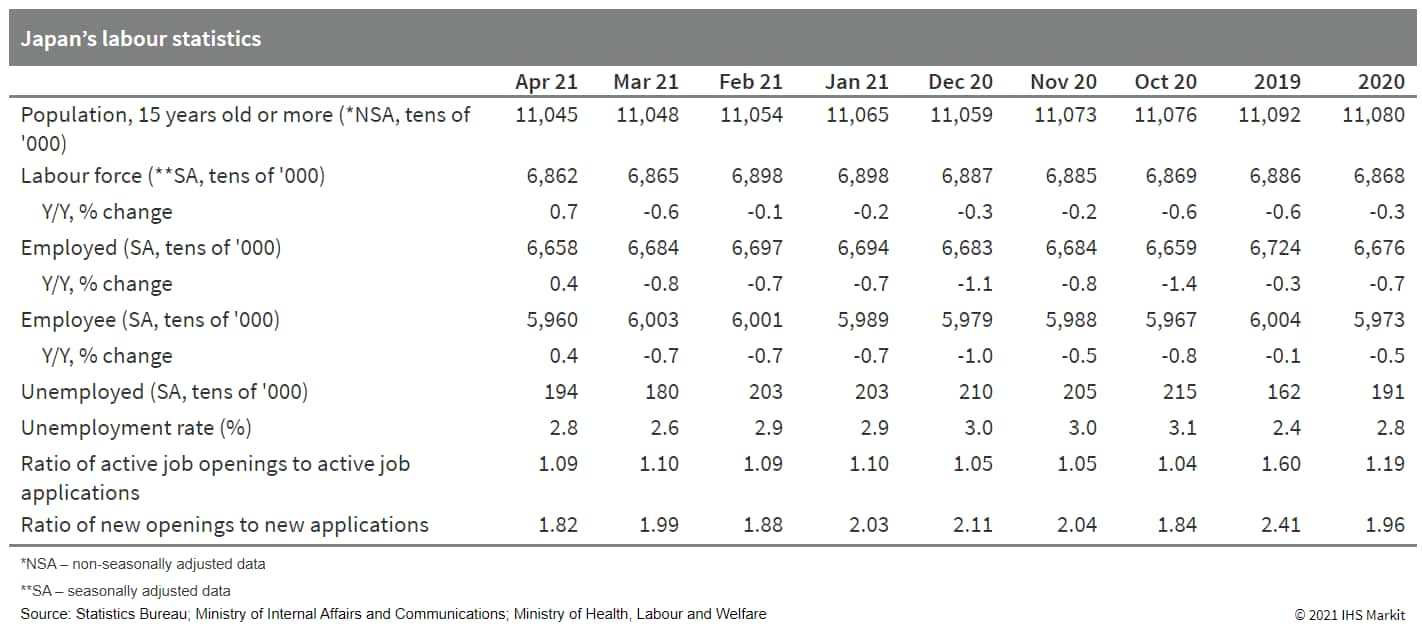

- Japan's unemployment rate rose by 0.2 percentage point to 2.8%

in April, as the number of employees fell by 260,000 from the

previous month while labor declined by 30,000 to partially mitigate

the increase in the unemployment rate. The second consecutive month

of decline in the number of employees - although year-on-year (y/y)

growth turned positive - reflected stricter containment measures

under the third state of emergency in several prefectures. (IHS

Markit Economist Harumi

Taguchi)

- Prolonged sluggish business conditions prompted the number of regular employees to drop by 450,000 from the previous month. This was partially offset by an increase of 240,000 in the number of non-regular employees. A decline in the number of furloughs may be explained by shifts to unemployment to some degree.

- Containment measures also weakened labor demand, while the number of job seekers increased. Although base effects lifted y/y growth of new job openings to positive levels, the ratio of active job openings to active job applications and the ratio of new openings to new applications notched down to 1.09 and 1.82, respectively.

- The ratio of active job openings to active job applications was

particularly weak in Tokyo (0.82) and Osaka (0.91), major

commercial areas, and Okinawa (0.78), a popular tourist

destination.

- Toyota Group's overseas production increased for the eighth consecutive month in April, while its domestic output grew for the second consecutive month. The Group's global output totaled 895,678 units last month, including 361,829 units in Japan and 533,849 units in overseas markets. The significant increase in production last month can be attributed to a low base of comparison as output in several markets was zero in April 2020 as a result of the lockdowns imposed in response to the COVID-19 pandemic. According to IHS Markit's latest production forecasts, Toyota Group's light-vehicle output (including the Hino, Daihatsu, Toyota, and Lexus brands) is expected to reach around 10.36 million units in 2021. At its Japanese plants, light-vehicle production during 2021 is expected to total around 4.05 million units. (IHS Markit AutoIntelligence's Isha Sharma)

- POSCO and Orsted signed an agreement to collaborate on Orsted's 1.6GW Incheon offshore wind power project in South Korea. The offshore project is expected to commence operations in 2026 and will be South Korea's largest till date. Orsted and POSCO will also collaborate to build a green hydrogen facility at the site. POSCO will supply steel for the project whereas its subsidiaries POSCO Engineering & Construction will build the offshore wind power structures, and POSCO Energy will be working on green hydrogen storage and hydrogen power generation. Previously, POSCO has supplied 100,000 metric tons of steel for Orsted's existing offshore wind farm projects such as Hornsea 1 and 2 in the United Kingdom. (IHS Markit Upstream Costs and Technology's Amey Khanzode)

- The latest GDP statistics for the first quarter of 2021 showed

that the Philippines economy contracted by 4.2% year-on-year, the

fifth consecutive quarter of recession. This follows a severe

contraction in GDP in the 2020 calendar year, with the Philippines

economy having contracted by 9.6% year-on-year. This was the

largest annual decline ever recorded since National Accounts data

series for the Philippines commenced in 1946. (IHS Markit Economist

Rajiv

Biswas)

- Household final consumption expenditure fell by 7.9% y/y in calendar 2020, while gross capital formation contracted by 34.4% y/y. Some sectors of the economy recorded severe declines in output, with the transport and storage sector recording a 30.9% y/y decline in output in 2020, while accommodation and food services output slumped by 45.4%.

- In the first quarter of 2021, the pace of contraction in household final consumption expenditure moderated to a decline of 4.8% year-on-year, while gross capital expenditure contracted by 18.3% y/y. Strong growth in government final expenditure, which expanded by 16.1% y/y in the first quarter of 2021, helped to mitigate the net impact of these declines.

- Although the severity of the economic contraction has moderated during the second half of 2020 and during the second half of 2020, with positive quarter-on-quarter GDP growth recorded in the fourth quarter of 2020, the new Covid-19 pandemic wave that gathered momentum since March 2021 has dampened near-term recovery prospects.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-may-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-may-2021.html&text=Daily+Global+Market+Summary+-+28+May+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-may-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 28 May 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-may-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+28+May+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-may-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}