Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 28, 2021

Daily Global Market Summary - 28 September 2021

All major European and US equity indices closed sharply lower, while APAC markets were mixed. US and benchmark European government bonds closed sharply lower. European Traxx and CDX-NA closed wider across IG and high yield. The US dollar and natural gas closed higher, while oil, gold, copper, and silver were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Major US equity indices closed sharply lower; DJIA -1.6%, S&P 500 -2.0%, Russell 2000 -2.3%, and Nasdaq -2.8%.

- 10yr US govt bonds closed +5bps/1.54% yield and 30yr bonds +9bps/2.09% yield.

- CDX-NAIG closed +1bp/52bps and CDX-NAHY +7bps/299bps.

- DXY US dollar index closed +0.4%/93.77.

- Gold closed -0.8%/$1,738 per troy oz, silver -1.0%/$22.47 per troy oz, and copper -1.0%/$4.25 per pound.

- Crude oil closed -0.2%/$75.29 per barrel and natural gas closed +2.6%/$5.88 per mmbtu.

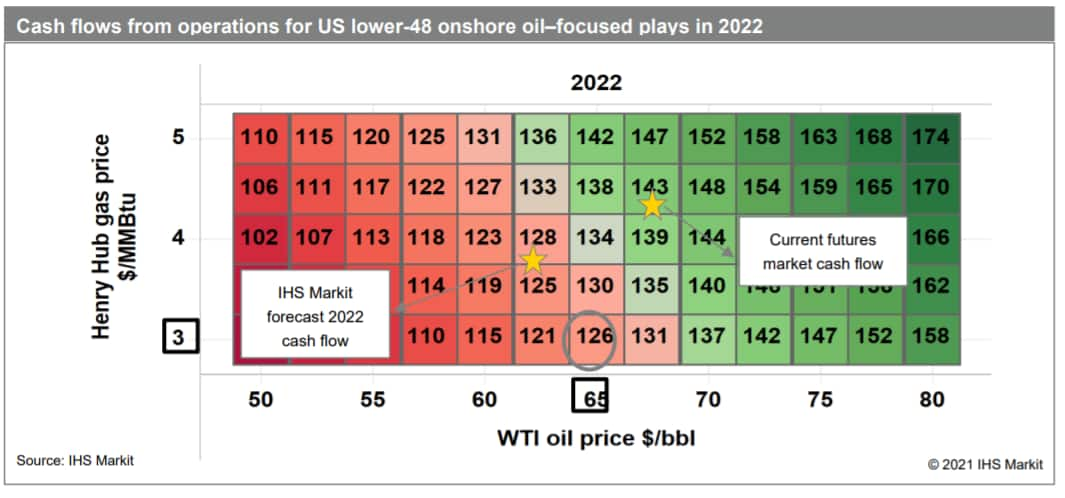

- Rising gas prices will generate significant cash flows for

oil-focused operators who are already benefiting from higher oil

prices in 2021. Tight storage levels and increasing LNG demand have

pressured Henry Hub (HH) to shoot over $5/MMBtu from an average of

$2/MMBtu in 2020. Although gas producers are an obvious

beneficiary, it is important to remember that virtually all oil

producers are also gas producers (the inverse is not true). Given

the (rising) gas-oil ratio and the distribution of activity among

and within oil plays, a good rule of thumb for 2022 is that

$1/MMBtu of Henry Hub is worth about $3/bbl of WTI and generates

about $7.5 billion of incremental cash for oil producers. Cash

flows were good when the WTI price last breached $70/bbl in 2018,

but producers are far better off now, and 2022 promises to move

cash flows into another gear (IHS Markit Energy Advisory's Raoul

LeBlanc and Narmadha

Navaneethan):

- The IHS Markit 2018 cash flow estimate for US lower-48 onshore oil-focused plays (using actual prices of $64.91/bbl WTI and $3.13/MMBtu HH) was $97 billion.

- Commodity prices were similar in 2021, but with higher volumes and lower cash costs forged in the depths of the pandemic, cash flows should improve by 19% versus 2018 to about $115 billion.

- In 2022, cash flows from operations should drive the best

performance in many years owing to the gas price impact, with hedge

expiration and the year-on-year absolute price rise (based on the

current strip) contributing about equally to raise cash flows by

another 22% to top $140 billion.

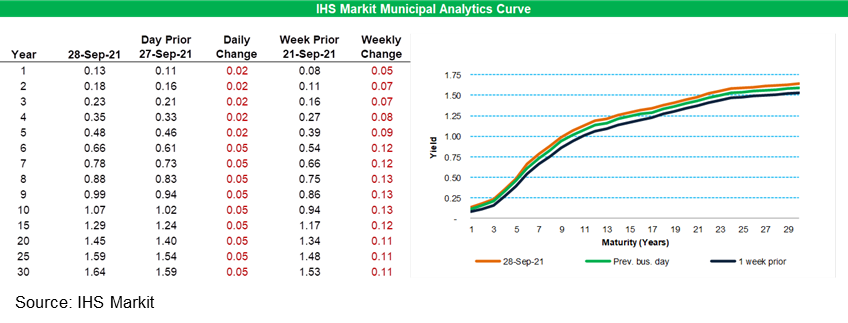

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC)

sold off 5bps for 6-year and longer paper, with that same part of

the curve 11-13bps weaker week-over-week.

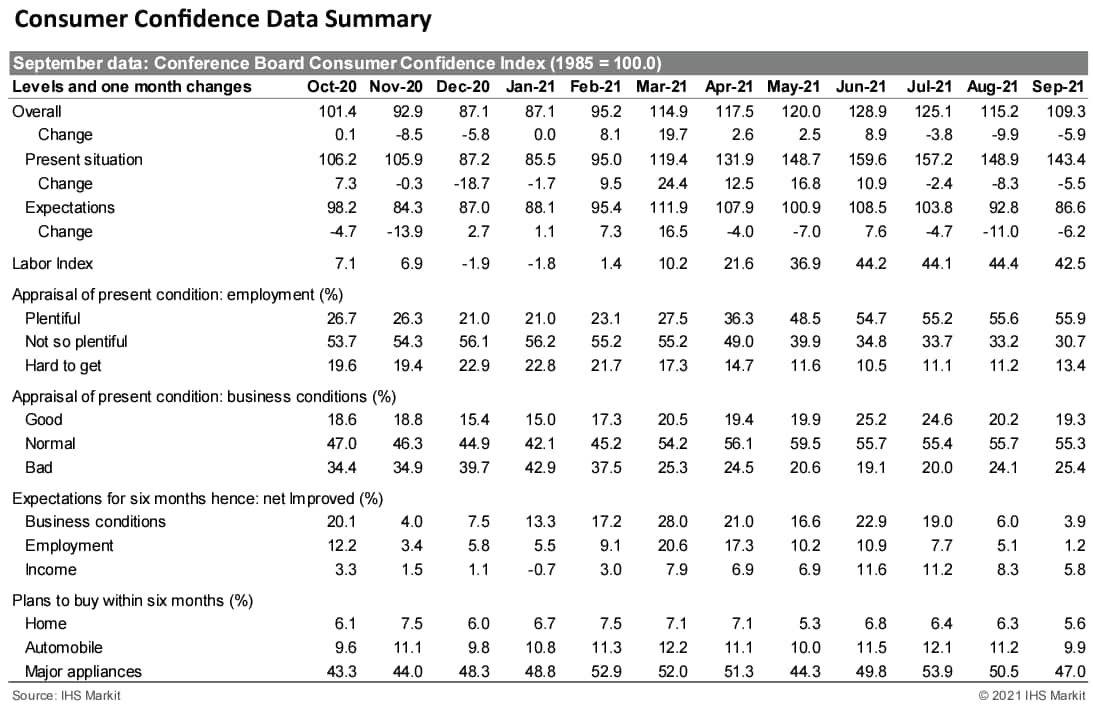

- The US Conference Board Consumer Confidence Index decreased by

5.9 points (5.1%) to 109.3, following declines in July and August.

The index is at its lowest level since February. The index of views

on the present situation declined 5.5 points to 143.4. The

expectations index fell 6.2 points to 86.6. (IHS Markit Economists

James

Bohnaker and William Magee)

- In September, the labor index (the percentage of respondents viewing jobs as currently plentiful minus the percentage viewing jobs as hard to get) decreased 1.9 percentage points to 42.5%, still near its highest levels dating back to 2000.

- Despite the strong job market, consumers are not as optimistic about income growth. The net percentage of respondents expecting higher incomes in the next six months declined 2.5 points to 5.8%, still well below the 15.0% average recorded during the half-year preceding the pandemic.

- Purchasing plans worsened again in September. The share of respondents planning to buy autos in the next six months edged down 1.3 points to 9.9%; the share planning to buy homes fell 0.7 point to 5.6%; and the share planning to buy major appliances declined 3.5 points to 47.0%.

- Survey respondents reported a 6.5% expected year-ahead inflation rate in September, down slightly from the highest reading since 2008 in August (6.7%). Historically, these point estimates bear little resemblance to observed measures of consumer price inflation, but the directional move downward in September could indicate that consumers are becoming somewhat less concerned with inflation.

- The spread of the Delta variant this summer is likely the

primary reason for declining confidence over the past three months.

But with the number of COVID-19 cases in the US peaking in

mid-September, we expect that consumer mood will stabilize in the

next couple months and that consumer spending will continue to

recover, albeit at a slower pace than during the first half of this

year.

- Prices of existing homes in the US set another record for

growth in July; however, a closer look indicates that the pace of

acceleration may be on the decline. Data for the three months

ending in July show that prices were up 19.7% y/y nationwide in

July. Despite yet another record-setting pace, the increase in

growth was considerably less than in any of the previous four

months. (IHS Markit Economist Troy

Walters)

- US monthly home price gains slowed in July. The 10-city composite index was up 1.4% while the 20-city index was up 1.5% month over month. Although still quite strong, this was the slowest pace for both since February.

- Monthly home price changes remained in positive territory in all 20 cities, ranging from 0.7% in Cleveland to 3.2% in Phoenix.

- The 10-city and 20-city composite indices both set yet another new record for year-over-year price growth in July. The 10-city index was up 19.1% year on year (y/y) and the 20-city index was up 19.9% y/y.

- All 20 cities covered in the report experienced home price appreciation in the double digits again in July. Increases ranged from 13.3% y/y in Chicago to 32.4% in Phoenix.

- The national index was up 19.7% y/y in July, the fastest pace on record.

- The US nominal goods deficit widened in August by $0.8 billion

to $87.6 billion, while the combined inventories of wholesalers and

retailers rose 0.7%. We had assumed a stronger trade balance and

weaker inventories. (IHS Markit Economist Ben

Herzon and Lawrence Nelson)

- The modest widening of the goods deficit in August reflected a 0.7% increase in nominal goods exports and a 0.8% increase in nominal goods imports. The increase in imports was in contrast to our assumption of a moderate decline.

- Perhaps relatedly, inventories continued to climb higher at a rapid clip; the strength in imports likely was a direct boost to inventories.

- Supply constraints are continuing to weigh on production. We assume that the pace of production in September will not be sufficient to maintain the August pace of inventory-building and that nonfarm inventory investment slows in September.

- Turning back to trade, in nominal terms, both exports and imports of goods have far surpassed the pre-pandemic (February 2020) levels. After adjusting for price change, though, only imports have surpassed the pre-pandemic level. Real exports of goods have come close to a full recovery but have yet to surpass the February 2020 level.

- US Federal Reserve Chair Jay Powell stated on 22 September that

it was "working proactively to evaluate whether to issue a CBDC,

and if so in what form". He stressed the importance of reaching an

"informed decision… expeditiously". (IHS Markit Economist Brian

Lawson)

- Previous commentary from senior Fed officials has been mixed, with outgoing Vice-Chair for Supervision Randal Quarles questioning the need for a central bank digital currency (CBDC), given the advanced and effective nature of the US's existing electronic bank settlement systems. Conversely, Fed Governor Lael Brainard supports development, arguing that a CBDC would assist the government in distributing payments to the public during periods of economic stress and could benefit financial inclusion (see World: 6 July 2021: Central Bank Digital Currency: Assessing the use case).

- The Boston Fed is already is working with MIT reviewing the merits of a US CBDC, in a two-to-three-year pilot project that was announced in August 2020

- Over 80 countries are considering developing CBDCs, and the Bank for International Settlements is actively involved in several cross-border projects, seeking to improve the cost and speed of remittances and cross-border payments.

- The US Fed first suggested it would investigate the issue in May 2021, making Powell's latest statement a confirmation of prior commitments, rather than a change in stance.

- Ford and SK Innovation announced a massive new investment in US manufacturing, supporting two new complexes, including vehicle assembly, new battery plants, and a supplier park. Ford is providing USD7 billion of the investment, with EV and battery production to start in 2025. It is difficult to underestimate the significance of the announcement of the new investment for Ford's future operations. Along with the scale of production involved, the planned Blue Oval City will involve Ford rethinking its manufacturing processes. In the second quarter of 2021, Ford increased the amount of its planned EV investment by 2025 to USD30 billion, up from USD22 billion previously. Given the USD7 billion price tag of the newly announced projects for Ford, this is where a significant portion of the planned increased funding is going. The scale and cost of the investment program, as well as the plan for the F-Series EV to be the cornerstone of Blue Oval City, indicates Ford's commitment both to its EV transition and to the F-Series. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Ball Corporation is set to build a new aluminum beverage

packaging plant in North Las Vegas, Nevada that is due to start

production late next year and will serve global and regional

customers. The multi-line plant is Ball's latest investment to

serve accelerating demand for the company's portfolio of infinitely

recyclable aluminum containers. (IHS Markit Food and Agricultural

Commodities' Vladimir Pekic)

- Ball said it plans to invest nearly $290 million in its north Las Vegas facility over the coming years. The company stated its new plant will supply a range of innovative can sizes to a variety of beverage customers.

- The new plant is due to come online at a time when sustainability of packaging is becoming an increasingly important factor for the industry that is moving away from environmentally harmful solutions. Aluminum cans, bottles and cups enable a circular economy in which materials can be and actually are used again and again. "In fact, 75% of all aluminum ever produced is still in use today," the company stated.

- Ball said it chose the north Las Vegas location for its new facility due to its proximity to customer can-filling investments, rising regional demand, the infrastructure in place, the regional labour base and the cooperation of state and local officials.

- In a press release, Casey's General Stores, Inc. announced the signing of an agreement to acquire 40 convenience stores from Pilot Corporation for a total cash consideration of $220 million. The transaction is subject to customary closing conditions and regulatory approvals. The convenience stores are located in Tennessee and Kentucky. Casey said the acquisition will be a great fit for its portfolio. Pilot is one of the leading suppliers of fuel and operates travel centers. The company has a network of more than 800 retail and fueling locations in North America. The company is based in Knoxville, Tennessee. (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

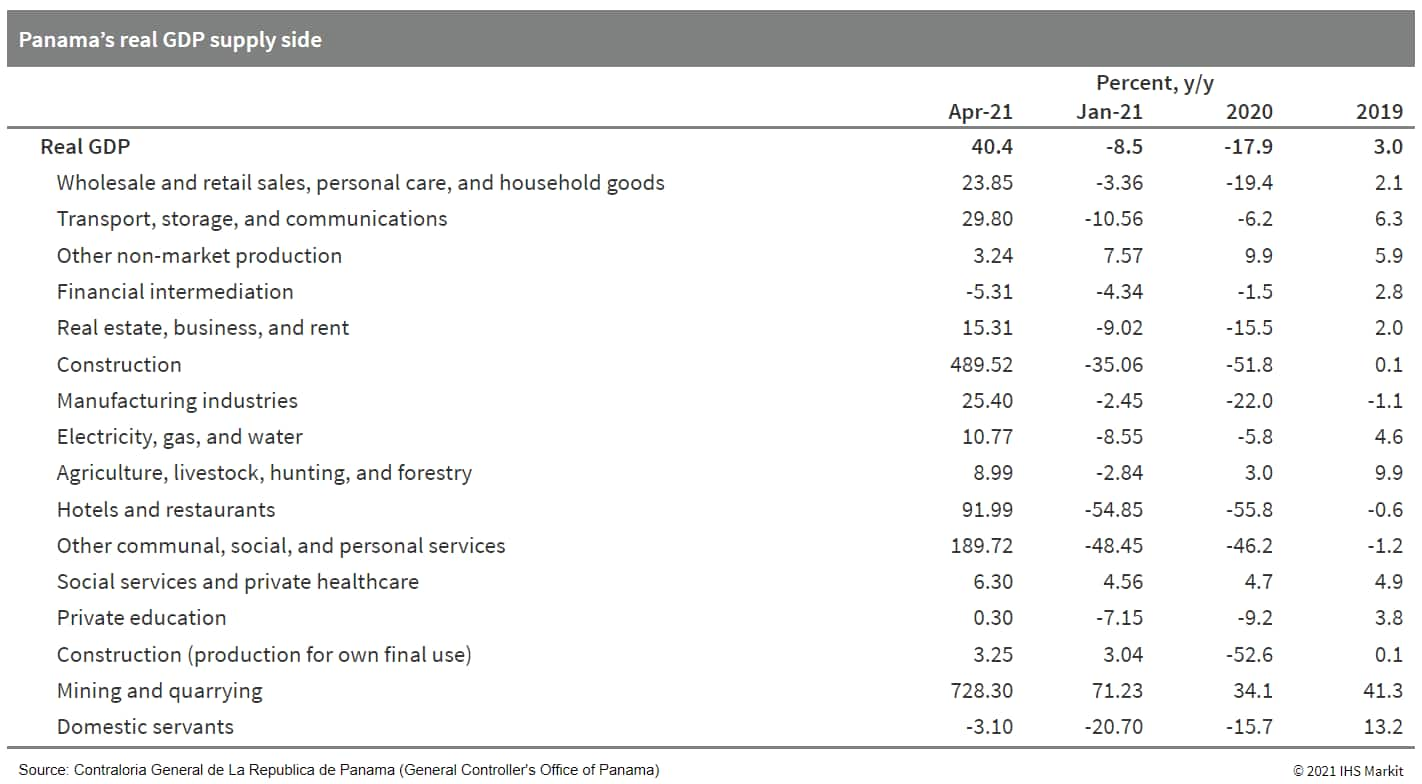

- Panama's real GDP grew by 40.4% year on year (y/y) in the

second quarter of 2021 following an 8.5% y/y decrease in the

previous quarter, according to the country's General Controller's

Office. As a result, the economy expanded by 10% y/y during the

first half of 2021, heavily influenced by the depressed comparison

base in the first half of 2020. IHS Markit estimates that when

correcting for seasonality, GDP during the second quarter rose by

1.4% quarter on quarter (q/q) after rising in the previous three

quarters. (IHS Markit Economist Paula

Diosquez-Rice)

- The sector that recorded the most significant rise was the mining and quarrying sector, well beyond a statistical rebound, and now accounts for over 6% of total GDP. The wholesale and retail sales sector and the transport, storage, and communication sector also recorded strong expansions. Although the construction sector posted a robust rise in the second quarter of 2021, it remains well below its pre-pandemic level.

- The manufacturing sector's annual growth was driven by the food

and beverages production sector (meat processing subsector, dairy,

liquors, etc.) and the construction materials production (cement,

plaster, lime, etc.). In the primary sector, the rise in wheat and

rice production compensated for the decline in fruits for export

(banana and pineapples).

Europe/Middle East/Africa

- All major European equity indices closed lower; UK -0.5%, Germany -2.1%, Italy -2.1%, France -2.2%, and Spain -2.6%.

- 10yr European govt bonds closed sharply lower; Italy +7bps, France/UK +4bps, Spain +3bps, and Germany +2bps.

- iTraxx-Europe closed +1bp/50bps and iTraxx-Xover +6bps/249bps.

- Brent crude closed -0.5%/$78.35 per barrel, but breached an almost three year high at $79.92 at 2:30am ET.

- The UK government announced on 27 September that it would suspend competition law to help address supply problems that led to petrol shortages and long queues at petrol stations in recent days. Kwasi Kwarteng, the government's business secretary, took the measure to help the industry address the challenges caused by a shortage of truck drivers. Supplies to petrol stations are likely to be helped by the move, which will allow sectoral companies to work together, including by sharing information, to target petrol stations. The government has also put armed forces personnel on standby to help bridge the current supply-chain challenge caused by the truck driver shortage. National business association the Road Haulage Association (RHA) has assessed a shortage of an estimated 100,000 drivers, out of about 600,000 drivers before the COVID-19 virus pandemic. The shortages in recent days reflect the challenges caused to various UK sectors by a lack of labor attributable to requirements enacted as part of the Brexit process, a slowdown in training and accrediting drivers because of COVID-19, and drivers leaving the industry over pay and conditions. (IHS Markit Country Risk's Laurence Allan)

- British oil and gas giant BP has received regulatory approval from the European Commission in its bid to acquire a 33.3% in Daimler and BMW's charging infrastructure venture, ChargeNow, according to a DPA news agency report. The companies have not disclosed the price at which the British group will buy that stake, or the conditions of the transaction. The planned transaction does not pose risks to competition as it will have only a limited impact on the market, the EU antitrust regulator said. ChargeNow is one of the biggest charging networks in Europe comprising 228,000 charging stations in 32 countries. The partnership with BP will add 8,700 gasoline (petrol) stations in Europe with the potential real estate to expand the network. BP wants to set up 500 ultra-fast charging points at Aral filling stations in Germany and expand its global network of public charging points to more than 70,000 by 2030 as part of its corporate diversification program. (IHS Markit AutoIntelligence's Tim Urquhart)

- Ride-hailing service FREE NOW has announced that it will start offering electric vehicles (EVs) as its default first option for customers instead of gasoline (petrol) or diesel vehicles, reports Electrive. According to the source, FREE NOW aims for 100% of its trips to be zero-emission by 2030 across all key European cities, while pledging that in the UK, it will be zero-emission capable by 2025, and that taxi services will all be zero-emission capable by 2024. (IHS Markit Automotive Mobility's Tarun Thakur)

- Market volatility in the UK's CO2 market is expected to

continue unchanged for the next two weeks, despite the recent

announcement by CF Industries Holdings that it is restarting

production at its ammonia plant at its Billingham complex in the

UK. (IHS Markit Food and Agricultural Commodities' Vladimir Pekic)

- Fertilizer producer CF Industries Holdings had announced the resumption of production on 21 September, following an interim agreement reached with UK authorities to cover the costs to restart the ammonia plant and produce CO2 for the UK market.

- Food and drink grade CO2 is a by-product of the fertilizer industry, specifically a byproduct of the ammonia production process. Safely restarting the ammonia plant at the Billingham Complex is expected to take several days.

- France's consumer confidence headline index has improved from

99 in August to 102 in September, according to figures released by

the National Institute of Statistics and Economic Studies (Institut

national de la statistique et des études économiques: INSEE). (IHS

Markit Economist Diego

Iscaro)

- The index had declined in the previous two months, and September recorded the highest reading since June. Moreover, the index has now returned to above its long-term average of 100.

- Households were more upbeat about the outlook for their personal finances and the general economy in September, and also reported an improvement in their past standard of living.

- Crucially, the index measuring unemployment expectations fell sharply in September, sitting at its lowest level since February 2020.

- However, the number of households willing to make a major purchase over the coming year fell to a four-month low. This is likely to be linked to higher inflation, as the index measuring households' views on consumer prices over the coming year has risen to its highest level since March 2020.

- Ford Otomotiv Sanayi (Ford Otosan), a joint venture (JV) between Ford Motor Company and Turkey's Koç Holding, has announced the issuance of investment incentives by the Turkish Ministry of Industry and Technology. The incentives include VAT exemption and refund, customs duty exemption, corporate tax reduction, social security premium employer's share support for 10 years without a maximum amount limit, income tax withholding support for 10 years, qualified personnel support, and energy support (50% of energy consumption expenditures not exceeding TRY200 million) for 10 years from the date of commissioning. In December 2020, the Turkish government was to provide incentives to Ford Otosan for the investment, worth around TRY20.5 billion, that is planned to last for six years. (IHS Markit AutoIntelligence's Tarun Thakur)

Asia-Pacific

- APAC equity markets closed mixed; Hong Kong +1.2%, Mainland China +0.5%, Japan -0.2%, India -0.7%, South Korea -1.1%, and Australia -1.5%.

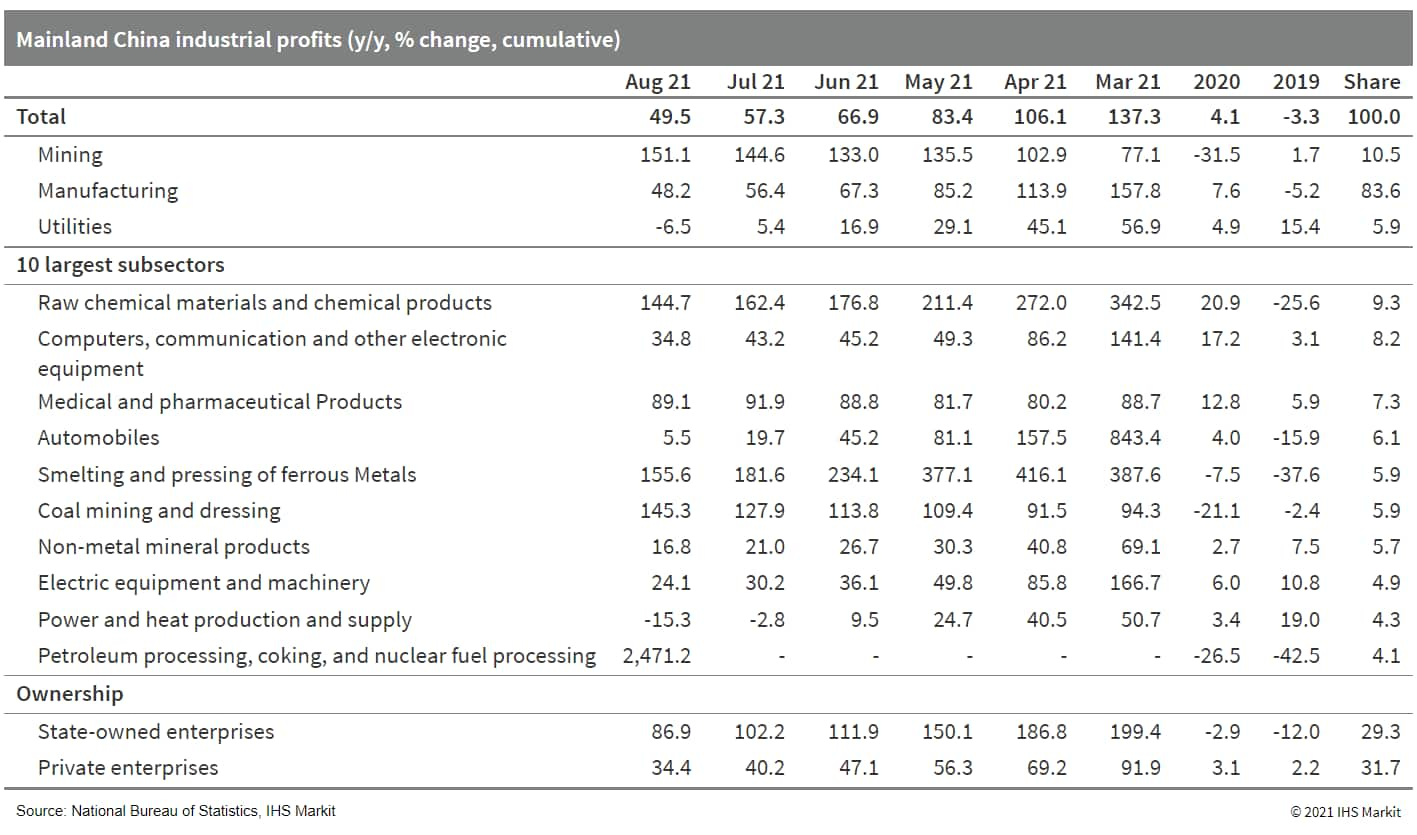

- Mainland China's industrial profits increased by 49.5% year on

year (y/y) through August, down 7.8 percentage points from the

first seven months as the low-base effect continues to diminish. On

a two-year (2020-21) average basis, industrial profits expanded by

19.5% y/y, 0.7 percentage point lower than the July reading. For

August alone, industrial profits grew by 10.1% y/y, or 14.5% y/y on

a two-year average basis -compared with 18.0% y/y in July -

according to the National Bureau of Statistics (NBS). (IHS Markit

Economist Lei Yi)

- The cumulative profitability ratio remained elevated at 7.01% through August, yet this marks the second consecutive month of decline from 7.11% by the end of first half of 2021. The sectoral trend through August was similar to that the month before: the profitability ratio in the upstream mining sector continued to rise, by 0.53 percentage point to 17.90%, whereas the manufacturing and utility sectors registered further decline in profitability ratio, edging down to 6.62% from 6.72% and to 5.52% from 5.90%, respectively.

- Notably, the utility sector registered cumulative industrial profit contraction of 6.5% y/y through August, coming entirely from the 15.3% y/y profit drop in the power and heat production and supply subsector. Soaring coal prices may have been a contributing factor here, given the 57.1% y/y increase in prices in the coal mining and dressing sector, in addition to the 241% y/y rise in the coal industry's profits in August. Other than that, the strength of the high-tech manufacturing sector's profits persisted; consumer goods manufacturing logged a profit growth rate of 14.4% y/y, widening the lead over headline figure from 2.2 percentage points in July to 4.3 percentage points in August.

- The average liability-to-asset ratio of industrial enterprises

came in at 56.4% by the end of August, up 0.1 percentage point from

July, but down by 0.4 percentage point year on year. The inventory

of finished goods increased 14.2% y/y in the first eight months of

2021, up by 1.2 percentage points from the end of July.

- Polestar has announced that it has signed an agreement for a public listing. According to a statement, Polestar Performance AB and its affiliates have entered into a "definitive business combination agreement" with the Gores Guggenheim, a special purpose acquisition company (SPAC) formed by affiliates of The Gores Group and Guggenheim Capital. The deal will create a combined entity that will lead to the battery electric vehicle (BEV) manufacturer becoming a public company on the US-based Nasdaq exchange using the name Polestar Holding UK Limited under the ticker symbol "PSNY". Reports have been surfacing for the past 12 months that have linked Polestar, which has Volvo Cars and Zhejiang Geely Holdings as key shareholders, with a stock listing. Early reports suggested that the business could go through an initial public offering (IPO) process. However, earlier this year it started to become clear that the SPAC route seemed to be the preferred option. This is the route that has become increasingly of interest to companies in the technology space, and especially among startup alternative fuel vehicle manufacturers as it allows them to leverage the benefits of being a listed company, including raising capital, without undergoing the level of scrutiny required for an IPO. (IHS Markit AutoIntelligence's Ian Fletcher)

- Hyundai plans to develop alternative elements to automotive chips in preparation for a prolonged supply crisis that is hindering its operations, reports the Korea Economic Daily. The automaker is considering co-operation with major suppliers such as STMicroelectronics and Renesas Electronics, while seeking long-term contracts to buy chip elements. It has already ordered the components for the next year. As the global semiconductor supply issue continues, Hyundai has decided to suspend overtime works at Ulsan plant in South Korea in the coming weekend. The move will affect all of its five production lines at the plant on 2 October. The Ulsan plant has annual capacity for 1.4 million units and produces the all-electric IONIQ 5, Santa Fe and premium Genesis brand models, among others. (IHS Markit AutoIntelligence's Jamal Amir)

- Samsung is reportedly in talks with Tesla to produce next-generation autonomous chips based on Samsung's 7-nanometer chip production process, reports The Korea Economic Daily. Both companies have discussed chip design and exchanged chip prototypes for Tesla's upcoming hardware 4 (HW.40) autonomous system. Samsung intends to mass produce the Tesla HW 4.0 chip at its main Hwasung plant in South Korea using 7-nanometer processing technology as early as the fourth quarter of 2021. HW 4.0, dubbed the FSD Computer 2, is the successor to the HW 3.0 chip used in Tesla's current vehicles. The HW 3.0 chip was manufactured by Samsung, highlights the report. Samsung is currently the world's second-largest contract chip manufacturer, accounting for 17.3% of the market, while Taiwan Semiconductor Manufacturing Co. (TSMC) dominates with a massive 52.9% market share. (IHS Markit AutoIntelligence's Jamal Amir)

- Sansiri PLC has announced plans to spend THB500 million

(USD14.9 million) to install 1,500 electric vehicle (EV) wall

chargers in Thailand at new housing units being launched in

2021-22, reports the Bangkok Post. The housing units being

installed with an AC EV wall charger will be single detached houses

in the middle-to upper-end segment under the Burasiri and

Setthasiri brands, with unit prices of THB8-20 million. "The wall

charger is faster than a plug at home or only five hours," said

Sansiri chief operating officer Uthai Uthaisangsuk, adding, "All of

the units at the new projects under the two brands will get this

option. We aim to install 1,500 units by the end of 2022". Sansiri

has installed 95 EV chargers in common areas at 28 residential

projects in Greater Bangkok over the past 10 years. (IHS Markit

AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-september-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-september-2021.html&text=Daily+Global+Market+Summary+-+28+September+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-september-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 28 September 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-september-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+28+September+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-september-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}