Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 29, 2021

Daily Global Market Summary - 29 January 2021

Major equity indices closed lower across the globe today. US government bonds and most benchmark European bonds also closed lower. European iTraxx and CDX-NA credit indices were close to flat for both IG and high yield. The US dollar, gold, and silver closed higher, while oil/copper were lower.

Americas

- All major US equity indices closed lower; DJIA/Nasdaq -2.0%, S&P 500 -1.9%, and Russell 2000 -1.6%. The S&P 500 closed -3.3% week-over-week.

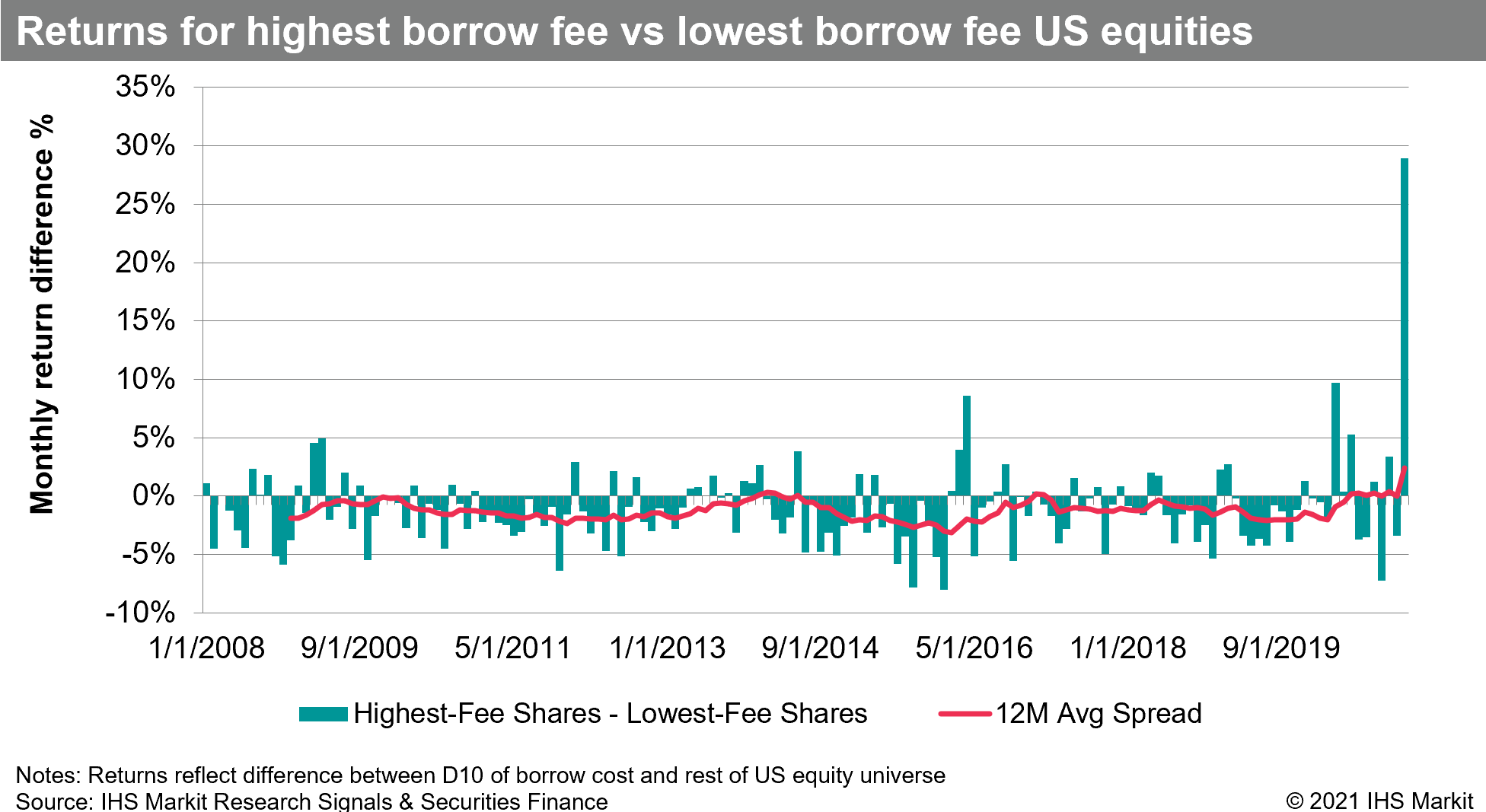

- The January 2021 short squeeze may go down as the most

significant ever, given the soaring share prices of highly shorted

US equities. The performance of short interest factors - that is

methods of ranking stocks by most to least shorted with the aim of

going long the least-shorted and short the most-shorted - are on

pace to suffer their worst month on record in January. (IHS Markit

Securities Finance's Sam Pierson)

- The most heavily shorted firms, per the exchange short interest, outperformed the least shorted by 23.9% MTD through January 28th. The nearest competition for "worst month for short factors" consists of April 2009 when the most shorted outperformed +15%, and April 2020 (most shorted outperformed by +21%), per the IHS Markit Research Signals database. Ranking by the percentage of shares on loan yields a similar result for January, with most-borrowed outperforming by 23.6% MTD.

- Even more stark is ranking by borrow cost, where the most expensive to borrow US equities outperformed the least expensive to borrow by 29% MTD, also a record. It's worth bearing in mind the breadth of these results: Even if the heralds of the short squeeze, GameStop and AMC, were removed from the analysis, the relative outperformance of high-fee US equities would still be more than 25% for MTD January as compared with the lowest-fee shares.

- The surge in prices for highly shorted US equities in the early

going of 2021 was partly set up by the 2020 year-end positioning,

which saw an all-time record for debit balances in margin accounts

and short interest value. The December 2020 margin statistics from

FINRA shows a record for debit balances in margin accounts, $778bn.

The December 31st short interest observation set a record with

$915bn in short positions reported (subsequently dethroned by Jan

15th observation at $946bn). It's interesting to contrast these

balances with year-end 2019, when short interest positions were

valued at $860bn (then a record) while debit balances were $579bn

(-13% compared with May 2018 record).

- 10yr US govt bonds closed +1bp/1.06% yield and +2bp/1.83% yield.

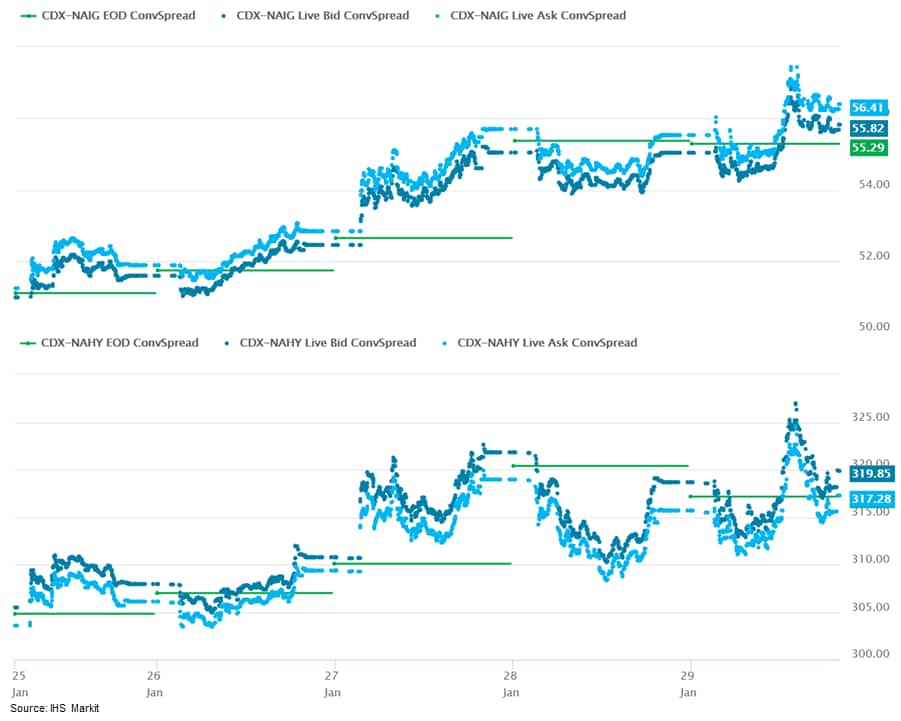

- CDX-NAIG closed +1bp/56bps and CDX-NAHY +1bp/319bps, which is

+5bps and +14bps week-over-week, respectively.

- DXY US dollar index closed +0.1%/90.58.

- Gold closed +0.7%/$1,850 per ounce, silver +3.8%/$26.91, and copper -0.6%/$3.56 per pound.

- Silver futures prices and shares of silver miners climbed Thursday after a user in Reddit's popular WallStreetBets forum posted about executing a "short squeeze" in the notoriously volatile precious metal (WSJ)

- Crude oil closed -0.3%/$52.20 per barrel.

- In a press release, Chevron Corporation reported fourth quarter

2020 net loss of $665 million, compared with a loss of $6,610

million in the fourth quarter of 2019. Fourth quarter of 2020

earnings include a charge of $120 million associated with Noble

Energy acquisition costs. Adjusted loss was $11 million, compared

with adjusted earnings of $2.8 billion in the fourth quarter of

2019. Foreign currency effects decreased earnings in the 2020

fourth quarter by $534 million. (IHS Markit Upstream Companies and

Transactions' Karan Bhagani)

- Worldwide production was 3.28 MMboe/d, up 6% from a year ago. The increase was primarily due to the Noble Energy acquisition, partially offset by production curtailments, the company said.

- US upstream operations reported earnings of $101 million, compared with a loss of $7.47 billion a year earlier, primarily due to the absence of fourth quarter 2019 impairments of $8.2 billion, partially offset by lower crude oil realizations, the company said. The US production was 1.2 MMboe/d in fourth quarter 2020, up 197,000 boe/d from a year earlier, reflecting 231,000 boe/d production increase from the Noble Energy acquisition.

- Additional production increases from shale and tight properties in the Permian Basin were more than offset by normal field declines, weather effects in the Gulf of Mexico and a 25,000 boe/d decrease related to the Appalachian asset sale. Fourth quarter net liquids production increased 14% to 880,000 b/d and net gas production increased 39% to 1.89 Bcf/d from a year ago.

- International upstream operations earned $400 million in fourth quarter 2020, compared with $731 million a year ago, primarily due to the absence of a 2019 gain of $1.2 billion on the sale of the UK Central North Sea assets, lower crude oil and natural gas realizations and lower crude oil sales volumes, the company said.

- International downstream operations reported a loss of $164 million, compared with earnings $184 million a year earlier. The decrease was largely due to lower margins on refined product sales, partially offset by lower operating expenses, the company said.

- Chevron added 832 MMboe of proved reserves in 2020. The largest net additions were from the acquisition of Noble Energy and from assets in Kazakhstan. The largest net reductions were from assets in Australia, Venezuela, and the Permian Basin and asset sales in Appalachia.

- In December 2020, the company announced its 2020 organic and exploratory capital budget of $14 billion, which remains flat with the revised 2020 capital budget of $14 billion. The 2021 budget allocates $11.5 billion to the upstream, with $5 billion for the US upstream and $6.5 billion for the international upstream.

- Johnson & Johnson's one-shot vaccine generated strong protection against COVID-19 in a large, late-stage trial, raising hopes that it can rapidly reshape a stumbling immunization campaign. In a study of more than 43,000 people, the vaccine prevented 66% of moderate to severe cases of COVID-19, according to a company statement Friday. And it was particularly effective at stopping severe disease, preventing 85% of severe infections and 100% of hospitalizations and deaths. (Bloomberg)

- US personal income rose 0.6% in December after declining in the

two prior months. Increases in compensation (up 0.5%), dividend

income (up 4.6%), and transfer receipts (up 2.3%) more than offset

a decline in proprietors' income (down 4.5%). (IHS Markit

Economists James Bohnaker and David Deull)

- The Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act enacted on 27 December reintroduced supplemental $300 weekly payments to unemployment beneficiaries. These payments added $48.3 billion (annual rate) to personal income in December. Recovery rebate checks also authorized in the CRRSA Act will lift personal income in January.

- The decline in proprietors' income was primarily a result of fewer Paycheck Protection Program (PPP) loans to businesses, which reduced proprietors' income by $54 billion (annual rate).

- Real personal consumption expenditures (PCE) decreased 0.6% in December, which was a smaller decline than expected, implying better momentum for spending in the first quarter. As a result, we raised our forecast of first-quarter PCE growth by 1.3 percentage points to 1.5%.

- The core PCE price index (excluding food and energy) increased 0.3% in December after stalling in the previous two months. The 12-month increase in the index edged up 0.1 percentage point to 1.5%.

- Although PCE ended 2020 on a down note, high-frequency data indicate that newly arrived fiscal stimulus is supporting a January resurgence. Additionally, a lower number of COVID-19 cases and more lenient containment measures than we had assumed are favorable for the near-term outlook.

- The US Employment Cost Index (ECI) increased 0.7% for the

three-month period ended in December 2020 (the reference day is the

pay period that includes the 12th day of December). (IHS Markit

Economist Patrick Newport)

- Year-over-year (y/y) growth was 2.5%, up from the September 2020 reading of 2.4%.

- Year-over-year real growth was 1.3%, up from the 0.7% y/y reading of December 2019 (the Bureau of Labor Statistics calculates real growth using the consumer price index as the price deflator).

- Wages and salaries (about 70% of compensation costs) rose 0.9% for the three-month period ended December 2020 and 2.6% y/y; benefits (about 30% of compensation) increased 0.6% for the three-month period ending December 2020 and 2.3% y/y.

- Private industry compensation grew 2.6% y/y, wages and salaries (about 70% of compensation costs) rose 2.8%, and benefits (about 30% of compensation) grew 2.1%.

- This is the third pandemic reading. At 2.6%, the private industry index is growing at about the same rate as it was just before the pandemic. During the Great Recession, the employment cost index slowed from 3.0% in the second quarter of 2008 to 1.2% five quarters later. The milder response this time can be considered a good thing if it is validated by stronger productivity growth. But if it results from sticky wages, as it likely has, employers will slow hiring, slowing the decline in the unemployment rate.

- State and local government compensation increased 2.3% y/y; for this sector, wages and salaries (about 62% of compensation costs) rose 1.8% and benefits (about 38% of compensation) grew 3.1%.

- The index measuring how much private industry health benefits cost employers rose 1.9% y/y, down from 2.2% y/y in December 2019.

- Response rates were "comparable with prior releases," according to the report.

- The US University of Michigan Consumer Sentiment Index fell 1.7

points (2.1%) to 79.0 in the final January reading. (IHS Markit

Economists David Deull and James Bohnaker)

- The index was 22.0 points beneath its pre-pandemic February high and 7.2 points above its April trough. Sentiment has remained depressed despite substantial economic recovery following the initial phase of the COVID-19 pandemic. The January reading is consistent with our expectation of a modest increase in consumer spending in the first quarter of 2021.

- The final January reading was a marginal 0.2 point beneath the preliminary reading, indicating that consumer sentiment was essentially stable in the latter half of the month.

- The January decline was led by worsening views on current conditions as the number of new infections and hospitalizations peaked during the month. The present situation index fell 3.3 points in January to 86.7, while the expectations index slipped 0.6 point to 74.0.

- As increased containment measures impacted employment mainly for lower-wage workers, the measure of consumer sentiment among households earning less than $75,000 a year fell 1.8 points to 74.5, but among households with earnings above that threshold, sentiment fell 0.7 point to 83.3.

- The expected one-year inflation rate jumped 0.5 percentage point to 3.0% in January, a five-month high, and the expected five-year inflation rate rose 0.2 percentage point to 2.7%.

- Views on buying conditions worsened in January. The index of buying conditions for large household durable goods fell 4 points to 115, and that for vehicles fell 4 points to 117, a nine-month low. The index of buying conditions for homes fell 8 points to 126, an eight-month low.

- The University of Michigan Consumer Sentiment Index moved closer into sync with the Conference Board's Consumer Confidence Index in January, as the latter rose slightly but remained barely above its April bottom.

- The US Pending Home Sales Index (PHSI) fell for the fourth

straight month in December, edging down 0.3% to a still-solid

125.5, which was up 21.4% from its year-earlier reading. (IHS

Markit Economist Patrick Newport)

- The index for the Midwest fell 3.6%, the South and West were flat, and the Northeast moved up 3.1%.

- All four regional indexes, mirroring the national index, plunged in March and April, shot up over May and August, and have edged down since, but remain more than 10% above their year-earlier level.

- "Pending home sales contracts have dipped during recent months, but I would attribute that to having too few homes for sale," wrote Lawrence Yun, the National Association of Realtors' chief economist.

- Demand is also down because rising home prices have eroded savings from lower mortgage rates.

- Applications to buy homes—particularly high-end homes—remain strong: the Mortgage Bankers Association's Purchase Index is currently 16% higher than a year earlier.

- The PHSI leads existing home sales by a month or two, according to the National Association of Realtors. Expect solid but flat-to-declining existing home sales in January or February or both.

- Pending homes sales declined in December by less than we had assumed, implying somewhat more brokers' commissions in the first quarter. After rounding, this left our forecast of first-quarter GDP growth unrevised at 3.2%.

- US spice processor McCormick reported that its net sales grew by 5% year-on-year to USD1.55 billion in Q4 FY2020 (December-November), bringing seasonal sales to USD5.6 billion, 4.7% more y-o-y. McCormick's brands Lawry's, Frank's RedHot, French's, Zatarain's, Simply Asia and Thai Kitchen co-led sales. Flavor segment net sales rose by 3% to USD534 million in Q4 and fell by 4% in FY2020, due to rising operating costs as a consequence of the Covid-19 pandemic. McCormick expects that its FY2021 net sales may by 7-9% higher than in the previous year, led by rising incomes in consumer and flavor solutions segments. Spices are experiencing a global consumption hiccup, relying on home cooking and flavorful trends. The COVID-19 pandemic has strengthened this long-term trend and many spice processors are leading acquisitions, such as McCormick with Cholula (sauces) and FONA (flavors). (IHS Markit Food and Agricultural Commodities' Jose Gutierrez)

- Faraday Future will merge with Property Solutions Acquisition Corp (PSAC); after the merger, Faraday will trade on the NASDAQ under stock ticker FFIE, according to a statement released by Faraday. Faraday describes itself as a "California-based global shared intelligent mobility ecosystem company" and expects the deal will deliver about USD1.0 billion in gross proceeds. This includes USD230 million in cash held by PSAC in trust and a USD775 million fully committed common stock PIPE (private investment in public equity) at USD10 per share. Faraday expects this will fully fund production of the FF91 (see United States: 4 January 2017: CES 2017: Faraday Future reveals FF91) within 12 months, and that it also supports future development of its "IAI system (internet, autonomous driving, intelligence)." Faraday will build at its Hanford (California) facility (see United States: 17 July 2018: Faraday Future gains certificate at US production site), and through a contract manufacturing partner in South Korea. This structure is aimed at developing a capital light business model. China manufacturing through a joint venture (JV) is being explored. The common stock PIPE includes more than 30 leading long-term institutional shareholders from the US, Europe and China. "Anchor investors" include a top-three Chinese OEM and long-only institutional shareholders. "PIPE investors include partners that will help support FF91 production and the development and delivery of future vehicle models. FF's strategic partners include one of China's top three OEMs and a key Chinese city, which the company believes will help establish FF's presence in the Chinese vehicle market, further solidifying FF's unique US-China dual home market advantage," Faraday wrote. Faraday has ambitious goals, and expects cumulative production of more than 400,000 units of its four vehicles in the next five years. However, between the reveal of the FF91 in 2017 and going public in 2021, the landscape has changed somewhat and Faraday will have more competition than if it had remained on schedule. Its California facility will have initial production capacity of about 10,000 vehicles per year, with the contract manufacturing in South Korea providing another 270,000 units of annual capacity. (IHS Markit AutoIntelligence's Stephanie Brinley)

- LyondellBasell (Houston, Texas) reports fourth-quarter net

income of $855 million, up 40% year-over-year (YOY) from $612

million on higher polyolefin volumes and margins. A $147 million

non-cash, lower-of-cost-or-market (LCM) inventory valuation benefit

increased net income by $119 million, or $0.36 per share. Sales

totaled $7.937 billion, down 3.0% YOY from $8.179 billion. Adjusted

earnings per share of $2.19 increased 15% YOY from $1.91 and beat

the consensus of $1.31 as compiled by Zacks Investment Research.

(IHS Markit Chemical Advisory)

- The olefins & polyolefins (O&P) -- Americas segment turned in EBITDA of $722 million, up 45% YOY from $498 million. Revenue totaled $2.21 billion, up 6.6% YOY. Olefins results increased $65 million on higher ethylene volumes from increased demand, partially offset by lower margins. Polyolefin results increased $140 million driven by increased demand. Margin improved due to an increase in the price of polyethylene and an increase in polyolefin volumes.

- The O&P - Europe, Asia, International segment turned in EBITDA of $304 million, up 591% YOY from $44 million, on revenue of $2.459 billion, up 14% YOY. Olefins results increased $25 million driven primarily by increased margins and volumes. Margins were higher driven by lower feedstock prices partially offset by lower ethylene prices. Combined polyolefins results increased more than $20 million on higher polyolefin volumes and polyethylene margin, partially offset by a lower polypropylene spread. Joint venture equity income increased $65 million, driven by Bora.

- The intermediates and derivatives segment turned in EBITDA of $262 million, down 20% YOY from $329 million, on revenue of $1.804 billion, down 1.5% YOY. Results decreased approximately $55 million YOY owing to LIFO inventory changes. Propylene oxide & derivatives results increased approximately $40 million as margins and volumes increased on strong Asia demand and market tightness. Intermediate chemicals results increased about $50 million driven by improved volumes and higher margins, primarily in styrene. Volumes increased due to higher demand for most products. Oxyfuels & related products results decreased $175 million as reduced gasoline prices and lower octane blend premiums cut into margins.

- Advanced polymer solutions turned in EBITDA of $152 million, up 181% YOY from $54 million, on revenue of $1.108 billion, up 3.8% YOY. Compounding & solutions results were relatively unchanged as higher volumes tied to automotive recovery were offset by lower margins. Advanced polymers results were flat.

- Refining EBITDA came to a $72 million loss, down from a gain of $22 million in the year-ago period, on revenue of $1.259 billion, down 39% YOY. Technology EBITDA totaled $45 million, down 67% YOY, on revenue of $167 million, down 18% YOY.

- Canada's real GDP by industry output gained 0.7% month on month

(m/m) in November, surpassing market expectations. Output gains in

the goods-producing industries (up 1.2% m/m) more than doubled the

lift in the services-producing industry (up 0.5% m/m). (IHS Markit

Economist Arlene Kish)

- Industrial production output was a star performer, jumping 1.9% m/m, from solid gains in natural resources and manufacturing.

- Statistics Canada estimates December's real GDP by industry output increased about 0.3% m/m. Fourth-quarter real GDP growth should advance around 1.9% from the previous quarter.

- Temporary weakness at the start of the year will be followed by quick gains, resulting in moderate real GDP growth near 4% in 2021.

- Natural resources production was the growth leader in November after a temporary lull in the previous month. Solid international demand for goods boosted mining and quarrying output by 6.1%, reversing the three-month decline with substantial rebounds in potash and non-metallic mineral mining.

- Non-conventional oil extraction was up sharply as production restarted at many facilities. This, combined with the hefty gain in support activities for the industry, reflects the boost in natural resources employment and total hours worked during the month. December total hours worked retreated, so lower output is anticipated.

- The gains in manufacturing were generally robust as inventories continue to build. Notably, wood product manufacturing's six-month winning streak ground to a halt from a large decline in veneer, plywood, and engineered wood product manufacturing. The loss could be due to the reduction in construction spending in the month, particularly residential and renovation output. Most transportation equipment manufacturing categories were down in the month as well.

- Although services-producing industry output growth was weaker

than the goods-producing industry output growth, the gain in

services contributed the most to the overall output. There were

substantial jumps in transportation and warehousing, finance and

insurance, retail trade, and wholesale trade.

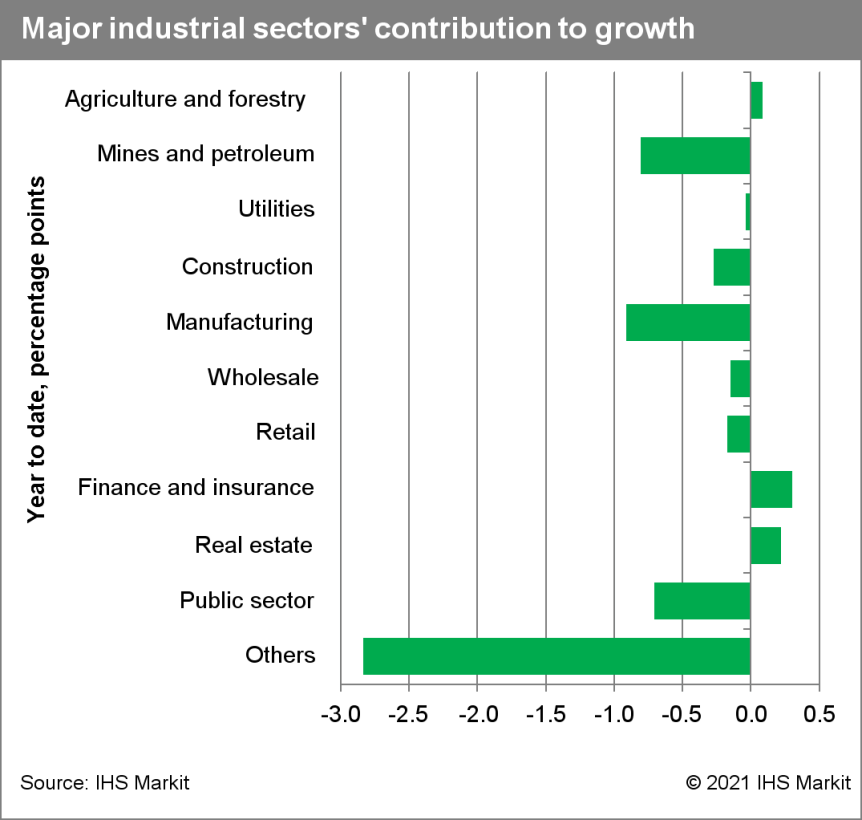

- According to Bolivia's National Institute of Statistics

(Instituto Nacional de Estadística: INE), the country's monthly

index of economic activity grew by 2.1% on a seasonally adjusted

monthly basis in November 2020. The index of economic activity from

January through to November 2020 was 8.2% below the level in the

same period of 2019. (IHS Markit Economist Jeremy Smith)

- As expected, Bolivia's economic recovery continued its steady but decelerating trend in November 2020. The monthly activity index actually rose by 5.8% year on year (y/y), but this results partly from the statistical effect of a lower base in November 2019, when social unrest following the presidential election caused economic disruption.

- Unlike many other countries in the region, where services have been the hardest hit, in Bolivia industrial sectors such as mining (-29.9% y/y during January-November 2020), manufacturing (-9.1% y/y), and construction (-27.2%) were the greatest drag on growth in 2020. Nonetheless, the service sector was by no means unscathed, particularly transportation and storage (-16.5% y/y). From January through to November 2020, the only sectors to grow were communications and agriculture, livestock, forestry, hunting, and fishing.

- The fifth amendment to Bolivia's natural gas supply contract with Argentina, signed on 31 December 2020, further lowers the price and volume of Bolivia's exports for 2021. Natural gas exports are a vital source of foreign-exchange earnings and government revenues for Bolivia, but the sector is in decline amid weak prices and efforts by Brazil and Argentina, Bolivia's sole export markets, to reduce natural gas imports. However, a new gas discovery announced in December 2020 raised the country's proven reserves by 11%.

- A continued drop in hydrocarbon exports will exacerbate the gradual depletion of Bolivia's stock of foreign-exchange reserves, which by November 2020 had dipped below USD3 billion (excluding gold) for the first time since 2006. This in turn complicates the Central Bank of Bolivia's (BCB)'s defence of the boliviano, currently pegged at a rate of BOB6.91:USD1, which IHS Markit considers to be overvalued. The timing of a devaluation would ultimately be a political decision, and in December 2020 the BCB and the Ministry of Economy and Public Finance each issued statements reaffirming their commitments to the exchange rate stability.

- Moreover, the reserve drawdown also increases the government's financing needs for 2021. The 2021 government budget establishes an expected deficit of 9.7% of GDP this year after a deficit above 12% in 2020. Bolivia is preparing to place bonds worth USD3 billion in international markets.

Europe/Middle East/Africa

- European equity markets closed lower; Spain -2.1%, France -2.0%, UK -1.8%, Germany -1.7%, and Italy -1.6%.

- Most 10yr European govt bonds closed lower except for Italy flat; UK +4bps, Spain +3bps, and France/Germany +3bps.

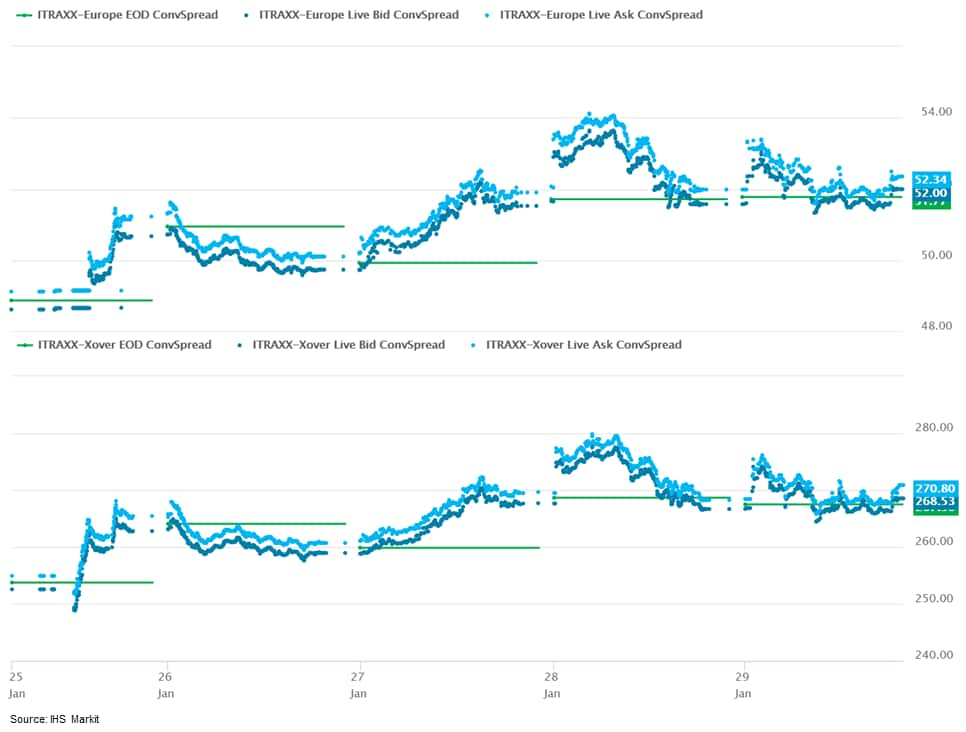

- iTraxx-Europe closed flat/52bps and iTraxx-Xover +2bps/270bps,

which is +3bps and +16bps week-over-week, respectively.

- Brent crude closed -0.1%/$55.04 per barrel.

- Volta Trucks has announced that it has raised another USD20 million in its latest round of fundraising. According to a statement, the convertible debt fundraising was led by US-base Luxor Capital, which already has interests in a range of automotive and alternative energy companies. Coinciding with the fundraising, Luxor Capital's Sharp McGivaren has been appointed to Volta's board of directors. Volta has also announced that its order book now stands at over USD260 million, and that a substantial number of customer orders are expected to be announced in the coming weeks. The latest round of funding for this startup battery electric truck firm is intended to allow the company to expand its engineering team and increase its headcount in other roles as it continues vehicle development and moves towards its industrialization. In its latest announcement, the company has said that it plans for its Zero to begin operating with customers during late 2021. (IHS Markit AutoIntelligence's Ian Fletcher)

- According to data from the Irish Central Statistics Office

(CSO), retail sales bounced back strongly in December 2020 after a

large drop in November. This is in line with the pattern of

COVID-19 virus-related restrictions, with a strict national

lockdown in place throughout November followed by a significant

easing of measures in early December. (IHS Markit Economist Daniel

Kral)

- The overall retail sales index in December was almost 10% higher than in January 2020, and almost 13% higher when excluding motor trades, automotive fuel, and bars. However, despite a broad-based rebound, the performances of the different sub-categories in December were highly uneven.

- The largest gains in the index were related to home improvement sub-categories, with hardware, paint, and glass sales up 30.7% and household equipment sales up 15.9% compared with January. Other sub-categories that posted large, consistent gains throughout 2020 include pharmaceuticals (14.7%) and food (12.1%).

- Several sub-categories remained below their January 2020 level, despite the rebound in December. The most affected categories were bars (down more than 60%), bookshops and stationery (down almost 10%), and department stores (down 4%).

- In a separate release, the CSO shows that the adjusted unemployment rate, which includes recipients of a special COVID-19 virus-related unemployment benefit, stabilized at just over 20% in December. The adjusted unemployment rate was significantly higher among 15-24-year-olds, at almost 45%.

- The unemployment data reveal the highly uneven impact of the pandemic, with the youngest members of the workforce, who are most likely to work in the worst-affected industries such as hospitality or retail, hit the hardest. However, the Irish government has extended various income support schemes throughout 2021.

- The strict Level 5 (out of 5) lockdown in Ireland has been extended to 5 March. This means that people are advised to stay at home, while hospitality and non-essential services remain closed and gatherings are banned. The government intends to gradually reopen schools throughout February, starting with children with special needs and primary schools.

- French GDP declined by 1.3% quarter on quarter (q/q) during the

fourth quarter of 2020, according to figures released by the

National Institute of Statistics and Economic Studies (Institut

national de la statistique et des études économiques: INSEE).

Output had increased by 18.5% q/q during the third quarter of 2020,

following contractions of 13.7% q/q and 5.9% q/q during the second

and first quarters, respectively. (IHS Markit Economist Diego

Iscaro)

- Real GDP declined by 5.0% year on year (y/y) during the fourth quarter and by 8.3% in 2020 as a whole.

- While the fall in private consumption was in line with projections, investment performed better than expected. Changes in stocks also made a positive contribution to quarterly growth (0.4 percentage point) during the final three months of 2020.

- Tighter coronavirus COVID-19 virus-related restrictions, particularly in November 2020, resulted in private consumption falling by 5.7% q/q in the fourth quarter following a rise of 18.8% q/q during the previous quarter. Private consumption had declined by 13.7% q/q during the second quarter.

- Consumption of food rose by 1.1% q/q during the fourth quarter (it declined 3.3% q/q during the previous quarter), but spending on manufactured goods (-8.5% q/q) and services (-7.4% q/q) fell sharply. Consumption of energy also declined sharply (-3.9% q/q) as restrictions on movement led to lower spending on fuel.

- Meanwhile, fixed investment rose by 2.4% q/q during the fourth quarter. This contrasts with a sharp decline during the first lockdown earlier in the year (it had fallen by 13.7% q/q during the second quarter).

- Investment by households was particularly robust, led by strong activity in the real-estate sector. Investment by non-financial corporations also rose by 1.5% q/q (following an increase of 20.6% q/q during the third quarter), while public-sector investment declined by 0.8% q/q. Investment spending stood 3.2% below its level during the fourth quarter of 2019.

- As expected, net foreign trade made a positive contribution to the economy during the fourth quarter, although the increase in exports was stronger than expected. Exports of goods and services increased by 4.8% q/q, while imports rose by a lesser 1.3% q/q.

- The contraction in activity during the fourth quarter was more modest than IHS Markit had expected and the consensus forecast (-4.0% q/q, as reported by Reuters). The figures were also substantially less downbeat than the latest projections by the French government.

- Part of the reason why the economy contracted substantially less than in early 2020 is that the COVID-19 virus-related restrictions implemented during the fourth quarter were not as stringent as the measures in place earlier in the year. However, the figures suggest that improving external demand and firms' investment behavior (possibly influenced by positive news on vaccine developments) also played a role.

- The outlook for the first quarter of 2021 is highly uncertain and will depend in no small part on whether the authorities go ahead with an expected tightening of containment measures. Health Minister Olivier Véran said yesterday (28 January) that the current measures are not enough to stop the spread of the COVID-19 virus, but no decision has been taken so far.

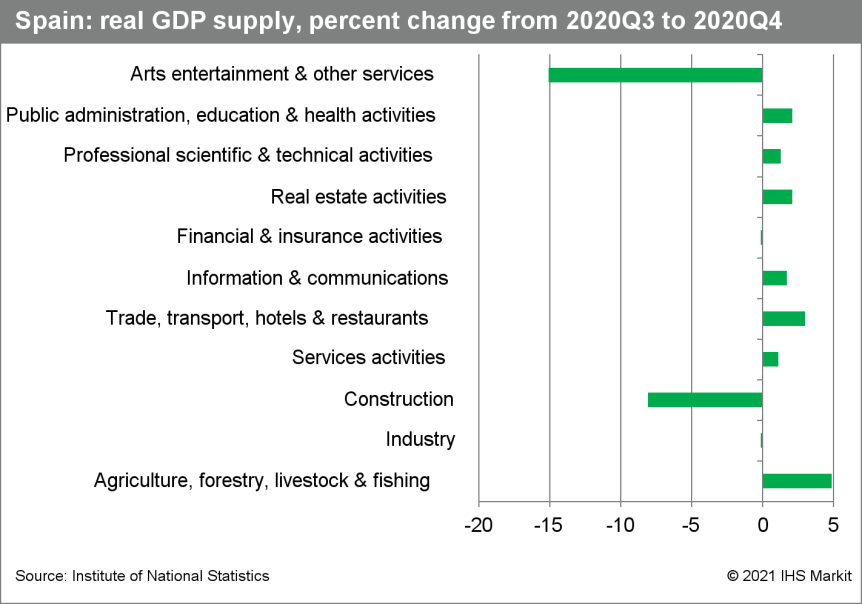

- With GDP posting a surprise gain in the final quarter of 2020,

Spain will avoid a double-dip recession at the start of this year.

Nevertheless, Spain is still likely to endure a fresh contraction

in the first quarter of 2021. (IHS Markit Economist Raj Badiani)

- The Spanish economy was more resilient than expected in the final quarter of 2020 in the face of rising COVID-19 virus infections and tighter restrictions.

- The national statistical office (INE) reports that GDP grew by 0.4% quarter on quarter in the fourth quarter, after a downwardly revised 16.4% q/q gain in the third quarter.

- This outperformed our estimate of a 0.8% q/q contraction while a Reuters poll of economists expected a sharper drop of 1.5% q/q.

- In annual terms, the economy shrunk by 9.1% year on year (y/y) in the final quarter, implying a 11.0% contraction in the full-year 2020. This was the sharpest decline since the Second World War and dwarfed the 3.8% contraction during the financial crisis in 2009.

- Our gloomier assessment of GDP developments in the final quarter was partly due to Spain imposing a national curfew in place and regional restrictions, and continued suppression of Spain's vital tourism sector.

- Spain implemented a nationwide curfew on 25 October after the government declared a new state of emergency. People in all regions (with some minor regional variations) must stay at home between 2300 and 0600.

- In addition, the latest survey pointed to service-sector activity appearing to contract throughout the fourth quarter. Specifically, the headline index from the IHS Markit Purchasing Managers' Index (PMI) survey for services shows that the business activity index stood at 39.5 in November and 48.0 in December, with a sub-50 score signifying contraction.

- Still, the resilience of the economy was partly attributable to the manufacturing, education, and construction sectors remaining open.

- Consumer spending increased by 2.9% q/q during the final quarter after a 14.3% q/q gain in the third quarter. In annual terms, consumer spending was 8.3% lower than a year ago, implying it fell by 12.4% in the full year 2020.

- According to the January forecast, GDP is likely to contract by 0.3% q/q in the first three months of 2021. In addition, the balance of the risks is tilting to the downside.

- The fear is that the latest spike in infections could prompt

ever tighter national and regional restrictions during January and

February. Currently, we assume that the latest COVID-19 containment

measures are likely to remain in place into early 2021 to contain

the latest spike in new infections. Spain is under pressure to

enforce a second national lockdown, but the preferred option could

be layers of increasingly stronger containment measures.

- Volvo Group has announced that it has set up a new business unit designed to support its electrification drive. According to a statement, Volvo Energy will provide batteries and charging solutions to the company's other divisions, as well as offering used, remanufactured and refurbished batteries to customers for use across different applications. In addition, it will also underpin the company's responsibilities for hydrogen infrastructure solutions for fuel cell electric vehicles (FCEVs). The company said that the business area will have full profit and loss responsibility within its Truck business. Leading the new business area from February 2021 will be Joachim Rosenberg, member of the Volvo Group Executive Board and chairman of UD Trucks, who will undertake the role while preparing to transfer the ownership of the latter to Isuzu Motors. Although the business falls under the purview of its Truck unit at the moment, the new unit will have a high degree of influence across its business. (IHS Markit AutoIntelligence's Ian Fletcher)

- Valmet Automotive has announced that it has signed a second battery manufacturing contract that will support its Uusikaupunki (Finland) location. According to a statement, the deal has been reached with an unnamed "major automotive OEM". Valmet has also confirmed that construction at the site is continuing as planned, with a launch scheduled for the second half of 2021. It added that it will start recruitment of around 200 production staff during the first half of this year, while "several experts and managers have already been recruited". Valmet started battery assembly at a site in Salo (Finland) in November 2019. However, strong demand has led it to transition part of its Uusikaupunki facility to batteries which will undergo some extra construction to support this expansion. The company has said that the decision to use this site enables closer co-operation of the business line organizations for both batteries and vehicle manufacturing that also takes place at the site. It added that in several functions, such as support functions, maintenance and logistics, teams will effectively support both business lines. (IHS Markit AutoIntelligence's Ian Fletcher)

- Better Juice Ltd, an Israeli sugar-reduction foodtech start-up, has announced collaboration with Düsseldorf, Germany-based GEA Group AG to scale up and expand its global footprint. Better Juice's technology reduces all sugars in orange juices. The company has already agreed to form a pilot plant with Citrosuco. Better Juice and GEA have agreed to construct, install and market the system globally. GEA will engineer, design, manufacture and install the bioreactor that reduces sugars via Better Juice's proprietary enzymatic process. Better Juice will produce the immobilized microorganisms for the enzymatic process. The technology uses all-natural ingredients to convert fructose, glucose and sucrose into prebiotic dietary fibers and other nondigestible molecules, and reduce up to 80% of sugars in orange juice to naturally create a low-calorie, reduced-sugar product without sweeteners or other additives used to replace the sugars. GEA will design three instruments with small, medium and large production capacities within several months to address various requirements of juice companies. The 200-litre unit will launch within a few months. Each device will be customized to the manufacturer's needs and limitations, with Better Juice and GEA providing full-service support. (IHS Markit Food and Agricultural Commodities' Neil Murray)

- The Reserve Bank of Malawi kept its key interest rate unchanged

at 12.0% in its January monetary policy meeting, despite

anticipating rising inflation expectations. The liquidity reserve

requirement (LRR) ratio on domestic- and foreign-currency deposits

was maintained at 3.75% and the Lombard rate was held at 20 basis

points above the policy rate. (IHS Markit Economist Archbold

Macheka)

- According to the Malawian central bank's monetary policy committee (MPC), the latest policy decision was viewed as appropriate "to contain the impending inflationary pressures while at the same time providing space for supporting recovery of the economy in the wake of the second-wave of the COVID-19 pandemic".

- The MPC also noted that there was a need to allow the effect of the last rate cut to diffuse through the economy. The key rate was last revised in November 2020, when a 150-basis-point cut was implemented to support economic recovery and job creation.

- Headline inflation accelerated marginally with a 7.6% print in December 2020, from 7.3% in the previous month, thanks to relatively higher food and non-food prices. Non-food inflation ticked up in the quarter ending December 2020 "due to effects of the upward adjustment in domestic fuel pump prices effected in mid-December 2020". Overall, the Reserve Bank of Malawi projects headline inflation to average 7.8% in 2021.

- The acceleration in inflation in the latest data matches our expectations, given the depreciation of the Malawian kwacha in the second half of 2020 and the implied upward impact of this on imported inflation. Recovering global oil prices coupled with the upward adjustment in domestic fuel pump prices drive our rising inflation expectations for 2021. Furthermore, an expansionary fiscal policy to aid the economy's recovery from the impact of the COVID-19 pandemic will also be inflationary.

Asia-Pacific

- APAC equity markets closed lower; South Korea -3.0%, Japan -1.9%, India -1.3%, Hong Kong -0.9%, and Mainland China/Australia -0.6%.

- Chinese ride-hailing giant Didi Chuxing (DiDi) has raised USD300 million in funding for its autonomous vehicle (AV) unit, reports Reuters. The fundraising was led by investment firm IDG Capital, with participation from CPE, the Russia-China Investment Fund, Guotai Junan International, and CCB International. DiDi has been working on AV technologies since 2016. It launched a trial run of robotaxi service on designated test roads in Shanghai, allowing users to hail an AV ride for free through DiDi's mobile app. DiDi is eligible to carry out AV road tests in Beijing, Shanghai, Suzhou, Hefei, and California (United Stets). Last year, it secured its first external investment of USD500 million for its AV division. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Asia paraxylene (PX) contract price (ACP) February was settled at $705/mt CFR on Friday, marking the first settlement since September 2019, according to IHS Markit data. There was not a single settlement in 2020. Parties involved in the major settlement include: SK Global Chemical and Yisheng Petrochemical; ExxonMobil and OPTC as well as Reliance Industries and Sheng Hong Petrochemical. Parties close to the negotiation process said that recent disruption to PX production has crimped output and pushed buyers to secure cargoes in the spot market. This helped to improve conditions for negotiation as bids climbed higher to meet offers. Initial ACP offers ranged from $750-790/mt CFR against bids at $590-620/mt CFR. With regard to production issues, China's Zhejiang Petrochemical has cut PX operation rate at its 2 million mt/year unit for some time now and was heard to have cut term contract volumes to customers this week. This followed Ningbo Zhongjin Petrochemical delaying the restart of its 1.6 million mt/year unit from January to February, and Brunei Hengyi which lost about 50% of its 1.5 million mt/year production capacity for the past week due to reformer issues. Tight prompt supply led to five spot deals done in the open market on Friday, all for March arrival molecules ranging from $704-705/mt CFR. This is also the first time PX spot price managed to cross the $700/mt CFR mark since March 2020. PX is a key raw material used in the production of purified terephthalic acid (PTA) and dimethyl terephthalate (DMT), which are used almost exclusively in the production of polyethylene terephthalate (PET) polymer for the production of polyester fibers, PET solid-state resins, and PET film. (IHS Markit Chemical Advisory)

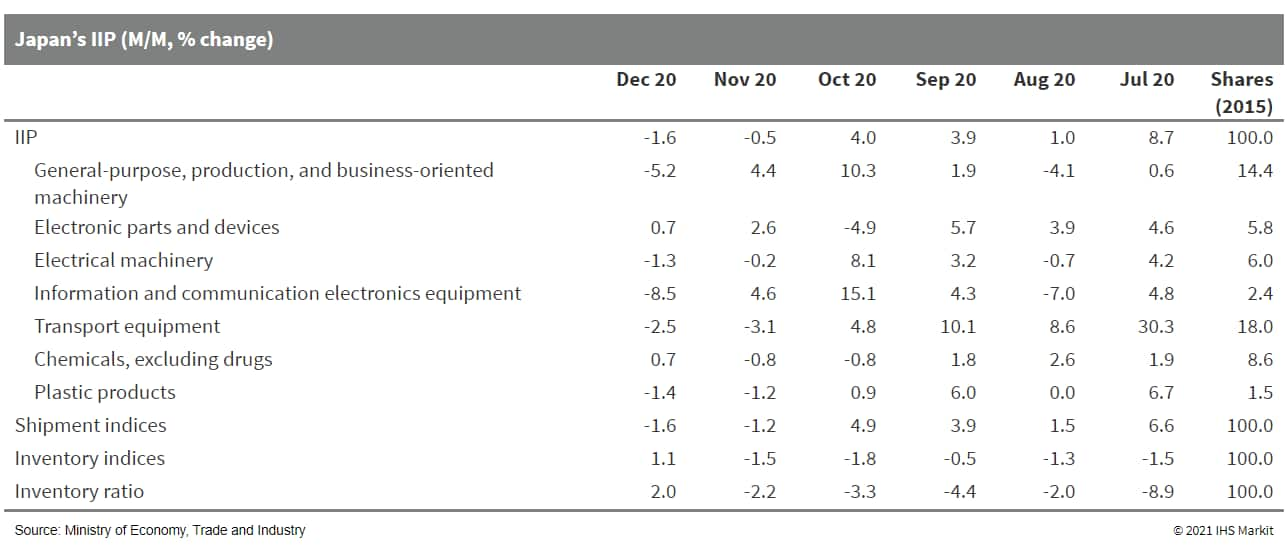

- Japan's index of industrial production (IIP) fell by 1.6% month

on month (m/m) for the second consecutive month of decline in

December, which made for a 10.1% drop in 2020. A continued fall in

manufacturers' shipments (down 1.6% m/m) and the first rise in nine

months for inventories (up 1.1% m/m) led to a 2.0% m/m increase in

the index of inventory ratio. (IHS Markit Economist Harumi Taguchi)

- While production in a broad range of industry groupings began declining following increases, the major factors behind the weakness were declines in general-purpose machinery, autos, and information and communication electronics equipment. Although declines in production lowered inventories in many industry groupings, the overall increase in inventories was due largely to rises in inventories of autos and petroleum and coal products. Upward momentum behind domestic and external demand, particularly for autos, eased in line with the resumption of economic activities following lockdowns in the second quarter of 2020.

- The December results were slightly weaker than IHS Markit expected. A continued quarter-on-quarter (q/q) rise in industrial production for the fourth quarter of 2020 (up 6.2%) and the first q/q increase in shipments of capital goods (up 11.8%; excluding transport equipment) since the third quarter of 2019 suggest continued growth for real GDP and a recovery in fixed investment in the fourth quarter of 2020 (which will be released on 15 February 2021).

- The uptrend for industrial production starting from June 2020

is likely to continue over the short term. The industry anticipates

an 8.9% m/m increase in January 2021 before a 0.3% decline in

February, driven by increased production of electric parts and

devices, production, and general-purpose machinery. Although

industry outlooks seem overestimated, the robust outlook reflects

front-loaded demand ahead of the Lunar New Year holidays and

recoveries in demand for capital goods in Japan's trade partners in

Asia.

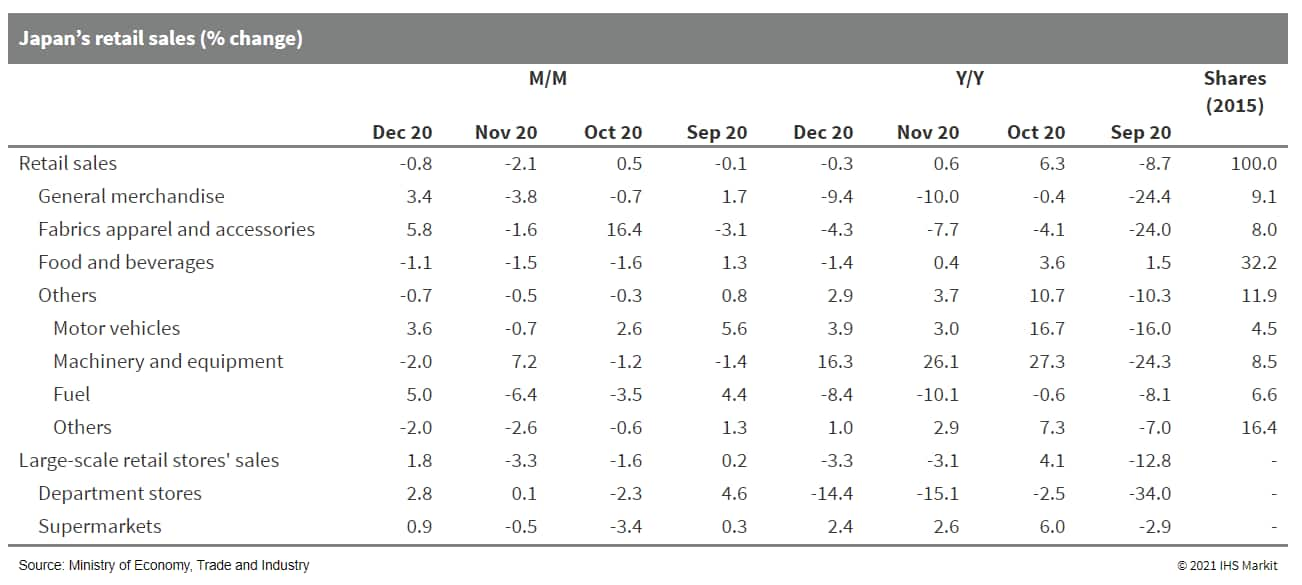

- Rising new confirmed coronavirus disease 2019 (COVID-19) cases

weakened Japan's retail sales and employment moderately in December

2020. A weaker consumer confidence index (CCI) signals further

softening in retail sales and employment in the coming months. (IHS

Markit Economist Harumi Taguchi)

- Japan's retail sales fell by 0.8% month on month (m/m) and 0.3% year on year (y/y) in December. The weakness largely reflected continued declines in sales of food and beverages and other miscellaneous retailers. Sales of machinery and equipment also declined by 2.0% m/m. While a continued decline in fresh food weighed on sales, the resurgence of COVID-19 made consumers cautious about going out.

- The resurgence of COVID-19 also weighed on the labor market. Although the unemployment rate remained at 2.9% in December, the number of unemployed rose due largely to an increase in the number of unemployed females. Although this was due partially to people leaving employment to find better jobs or newly seeking jobs, the decline in the number of part-timers, particularly for wholesale and retail sales, accommodation, and eating/drinking services, reflected cuts in operating hours and weaker businesses conditions.

- The CCI fell by 2.2 points to 29.6 in January 2021, the lowest level since May 2020. The second consecutive month of contraction reflected declines in all component indices, particularly for the employment index. The surge in new confirmed COVID-19 cases in early January 2021 and the state of emergency for 11 prefectures fueled consumers' concerns about employment and wages.

- The December results suggested that retail sales were relatively resilient in the fourth quarter of 2020. Despite modest containment measures compared with those implemented in April and May, the government's requests for cuts in business hours after 8:00 pm and suspension of travel subsidies could have major effects on retail sales of non-essential goods and accommodation and eating/drinking services, which could increase the unemployment rate.

- High frequency point-of-sales data did not signal significant

changes in trends for sales of larger retailers since the initial

declaration of a state of emergency for four prefectures in early

January 2021. That said, IHS Markit expects a decline in private

consumption to shrink real GDP in the first quarter of 2021. Rising

concerns about new COVID-19 infections and weak labor conditions

could weigh on private consumption over the short term.

- Executives at Hyundai Motor are divided over a potential tie-up with Apple, reports Reuters. One of the main concerns at this stage is that Hyundai may end up becoming a contract manufacturer for the US tech giant. Earlier in January, the South Korean automaker was reportedly in preliminary talks with Apple on a business partnership to make electric vehicles (EVs) and batteries. "The Group is concerned that the Hyundai brand would become just Apple's contract manufacturer, which would not help Hyundai in its effort to build a more premium image with its Genesis brand," one of the insiders familiar with the internal discussion at Hyundai was quoted as saying. Another person familiar with the matter said that Apple would prefer to source major components of its own design - frames, bodies, drive trains, and other parts - from a variety of places and rely on Hyundai or Kia for a final assembly site. None of the companies involved have commented on the reports. Recent reports on Apple's intention to make inroads into the EV sector have attracted a lot of attention both in the automotive and high-tech sectors. The reported internal discussions at Hyundai shed a light on how the potential deal may look like and each party's role in the partnership. Apple has never offered any information regarding its talks with either Hyundai or other automakers over a tie-up to make EVs. However, given the company's strong in-house technology development capacity, it is not hard to believe that it would want to have a greater say in the partnership in areas of advanced technologies, especially vehicle connectivity and automated-vehicle-related solutions. (IHS Markit AutoIntelligence's Abby Chun Tu)

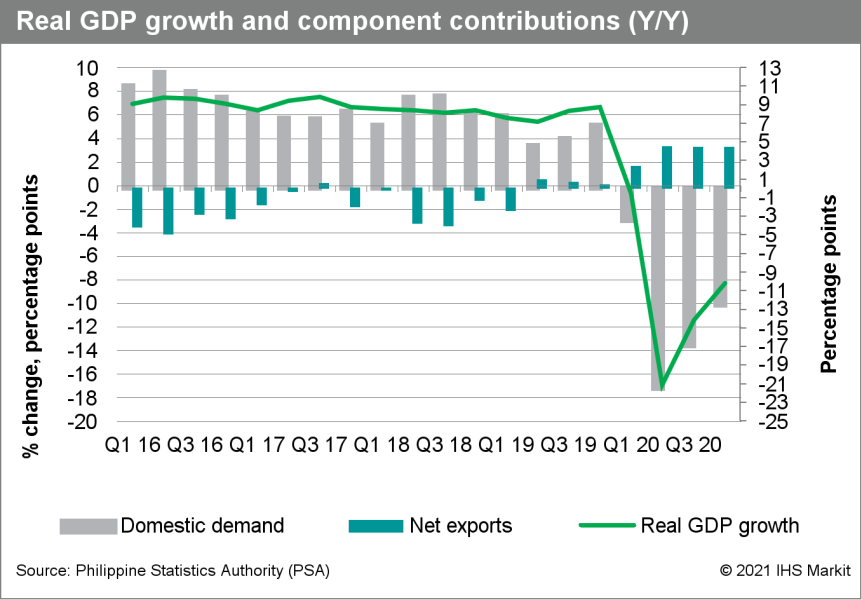

- Philippines real GDP contracted by 8.3% year on year (y/y) in

the fourth quarter, although the rate of decline moderated from the

16.9% y/y and 11.4% y/y plunges posted in the second and third

quarters, respectively. The second-quarter result represented the

economy's worst slump in history. Despite the moderation in

contraction during the second half of the year, the economy still

tumbled 9.5% in 2020 as a whole, highlighting the dire effect of

the pandemic. (IHS Markit Economist Ling-Wei Chung)

- In seasonally adjusted quarter-on-quarter (q/q) terms, the economy continued to pick up the momentum. Real GDP increased 5.6% from the previous quarter, although the gain moderated from an 8% expansion in the third quarter. They reversed a 14.9% plunge in the second quarter.

- Domestic demand - once a key driver of growth before the pandemic - continued to plunge at a double-digit pace and stayed as the main drag on overall economic momentum during the fourth quarter, despite some improvement. It shrank 11.1% y/y and subtracted 12.5 percentage points from the fourth-quarter GDP, although the drag narrowed from the record 21.5-percentage-point deduction posted in the second quarter.

- Net exports continued to provide positive contribution to economic performance during the fourth quarter as imports slumped further, which continued to outpace the contraction in exports, reflecting the slow recovery of domestic demand from the brunt of the pandemic and virus containment measures.

- Although the gradual reopening of business activities has lifted domestic sentiment to some extent, investment spending has remained weak as the business operating environment remained difficult because of lingering virus containment measures. Limited mobility and prolonged travel restrictions have continued to restrain activities from domestic workers and experts from other countries. The adverse effect was especially severe in the construction sector.

- Gross investment spending slumped 29% y/y in the fourth quarter of 2020, although moderating from the 40-50% y/y plunges in the second and third quarters, which represented the worst contraction since the third quarter of 1985. Within that, fixed investment contracted 28.6% y/y in the fourth quarter of 2020, after slumping about 37% y/y in the second and third quarters. A 34% y/y plunge in total construction investment remained the key drag as construction spending by financial and non-financial corporations slumped 48% y/y and household-related construction investment declined 32.2% y/y.

- Public construction investment dropped by 15.2% in the fourth quarter, smaller than a 28% y/y slump in the third quarter. The all-important infrastructure projects have been disrupted by virus containment measures, while related government spending was also affected by the realignment to the pandemic disbursement. The government also blamed a high comparison base - pushed up by the catch-up spending amid a budget delay last year - for the plunge in infrastructure spending. Infrastructure spending slumped 32.5% y/y in the fourth quarter, despite being 10% higher than the government's target levels.

- Government consumption continued to expand in the fourth quarter, although the gain decelerated further. Government consumption rose by 4.4% y/y, slowing from a 5.8% y/y increase in the third quarter. The increase was supported by the government's fiscal stimulus from Bayanihan II, which distributed PHP109 billion (USD2 billion) by end-2020, although a high base effect restrained the y/y gain.

- Household consumption contracted further in the fourth quarter but at a slower pace. Accounting for about 70% of real GDP, household consumption dropped 7.2% y/y in the fourth quarter, although it moderated noticeably from the record 15.3% y/y slump in the second quarter.

- On the external front, total exports maintained a double-digit contraction in the fourth quarter, although at a slower pace than the previous two quarters. Supported by the recovery in neighboring economies, especially mainland China, Taiwan, and Vietnam, merchandise exports have been improving since September, although the recovery remained uneven. Goods exports fell 2.1% y/y in the fourth quarter, similar to the 2.0% y/y decline in the third quarter. This came despite around 13% y/y expansions in exports to mainland China and Taiwan and a 30.5% y/y jump in shipments to Vietnam during the fourth quarter.

- The economy ended 2020 with another slump in the fourth quarter as the recovery has remained slow, restrained by subdued improvement on the domestic front and the uneven recovery in the overseas markets. Additional brunt to the economy came from unexpected natural disasters amid a series of devastating typhoons, just when domestic demand began to improve. This added to the effect from the volcano eruption in early 2020.

- There is still a long way for the economy to regain footings,

and the economy is not expected to reach pre-pandemic levels until

2022. The economy's recovery ahead will hinge on the improvement of

domestic demand - being the key driver of the economy - after

leading the downturn in 2020. This in turn will depend on the

government's ability to contain the outbreak, further reopen

business activities, carry out fiscal spending plans, and roll out

mass vaccinations.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-january-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-january-2021.html&text=Daily+Global+Market+Summary+-+29+January+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-january-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 29 January 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-january-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+29+January+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-january-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}