Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 30, 2021

Daily Global Market Summary - 30 August 2021

All major APAC and most European equity indices closed higher, while US markets were mixed. US government bonds closed higher and benchmark European bonds closed mixed. CDX-NA closed almost flat on the day across IG and high yield. Copper and oil closed higher, the US dollar was flat, and gold silver and natural gas closed lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Major US equity indices closed mixed; Nasdaq +0.9%, S&P 500 +0.4%, DJIA -0.2%, and Russell 2000 -0.5%.

- 10yr US govt bonds closed -3bps/1.28% yield and 30yr bonds -2bps.

- CDX-NAIG closed -1bp/46bps and CDX-NAHY -1bp/275bps.

- DXY US dollar index closed flat/92.65.

- Gold closed -0.4%/$1,812 per troy oz, silver -0.4%/$23.96 per troy oz, and copper +1.0%/$4.38 per pound.

- Crude oil closed +0.7%/$69.21 per barrel and natural gas closed -1.9%/$4.31 per mmbtu.

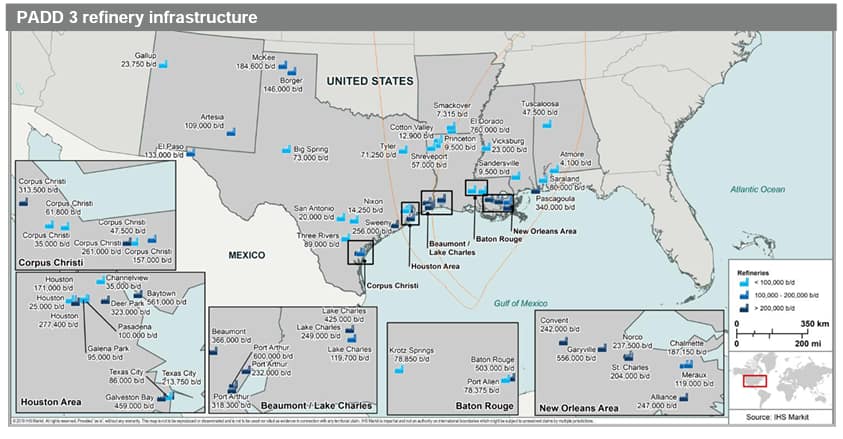

- Hurricane Ida has had a significant impact on US Gulf Coast

refinery runs with many New Orleans refiners shutting down prior to

the storm. In preparation for the hurricane, Phillips 66 took the

precautionary measure of halting operations at its Alliance

refinery on August 27th and Shell shut down its Norco facility on

the same day. Multiple reports have confirmed that Valero shut down

both its St Charles and Meraux refineries as the hurricane made

landfall. Marathon's Garyville refinery has also reportedly shut

down operations. In addition, PBF Energy's Chalmette and

ExxonMobil's Baton Rouge refineries were running at reduced

operating rates. (IHS Markit Energy Advisory's Roger

Diwan and Debnil

Chowdhury)

- Total capacity in Hurricane Ida's path that may have been impacted amounts to 2.7 MMb/d, or 14% of total US refining capacity. The refineries split between the general New Orleans and Baton Rouge regions are facing operational complications from the storm, with multiple closures already confirmed.

- Colonial shut its two main lines that pump gasoline and distillate from Gulf Coast refineries to Greensboro, NC as a precautionary move. Lines 1 and 2, from Houston to Greensboro, are down currently but deliveries are continuing along numerous terminals along the Colonial system.

- Hurricane impacts are expected to disrupt trade flows. Besides

the curtailment of supply to the local PADD 3 market, exports to

Latin America, Europe, and inter-PADD transfers to PADD 1 are also

at risk.

- Hurricane Ida, which struck southeastern Louisiana at noon

Sunday, could have a significant impact on multiple petrochemical

products, notably polyethylene (PE), polypropylene (PP),

polystyrene (PS), and polyvinyl chloride (PVC). After making

landfall near New Orleans with winds up to 150 mph, Ida crept

north-northeast across the state, its eye just east of the

petrochemical corridor that tracks the Mississippi River. By Monday

morning, Ida had weakened to a tropical storm centered over

southwestern Mississippi and heading northeast. Regions further

west such as Lake Charles, Louisiana, and Port Arthur, Texas,

appear to have escaped any significant impact. (IHS Markit Chemical

Advisory)

- As of Monday morning, the extent of shutdowns was unclear. Roughly 16% of US ethylene capacity is in the path of Ida, according to IHS Markit estimates. Shell had shut down its steam crackers in Norco and Nova Chemicals had shut down its cracker in Geismar, according to market sources. ExxonMobil on Sunday reported that its Baton Rouge facilities were "adjusting operations and shutting down some units and equipment." Dow on Sunday said it had "safely shut down its manufacturing operations in Louisiana."

- The vinyls chain has a particularly heavy presence in the parts of Louisiana affected by Ida, with about 4.0 MMt/y of vinyl chloride monomer (VCM) capacity in the area, or 40% of the US total, and 3.7 MMt/y of PVC capacity, or 43% of the US total, according to IHS Markit. Formosa Plastics produces VCM and PVC at Baton Rouge; Shintech produces VCM and PVC at Plaquemine, and PVC at Addis; and Westlake Chemical produces PVC and VCM at both Geismar and Plaquemine. Upstream chlor-alkali production in the region represents about 32% of the US total.

- The area's styrene producers—Americas Styrenics at St. James and Cos-Mar at Carville—together have 2.2 MMt/y of capacity, or 44% of the US total. Total Petrochemicals' 0.6 MMt/y of PS capacity at Carville represents 26% of US capacity.

- About 2.8 MMt/y of methanol capacity, or 32% of the US total, is located in the region. Methanex has 2.2 MMt/y of capacity at Geismar, while Koch has about 0.6 MMt/y at St. James.

- About 14% of US benzene capacity is in the region, with Dow producing at Plaquemine; ExxonMobil at Baton Rouge; PBF at Chalmette; and Phillips 66 at Belle Chasse.

- Municipal bond primary activity remains stable as participants step away for summer vacations after last week's calendar supplied $9.8 billion of muni paper after several large issuers stepped up to the plate and priced new issue bonds. The Pennsylvania Turnpike Commission led last week's primary calendar with a successful pricing of $530 million oil franchise revenue bonds with tighter spreads noted in the intermediate range of the scale, after 2031 maturity spreads landed +19 off the interpolated MAC. The South Carolina Public Service Authority also took advantage of opportunistic pricing levels, selling $430 million tax-exempt revenue bonds with bumps of 2-9 basis points registered across the scale. This week's calendar is slated to taper down to $6 billion ahead of the Labor Day Holiday weekend, with 167 new issues on the roster and noteworthy presence of New York offerings, representing ~25% of total issuance over the week. The New York Transitional Finance Authority (Aa1/AAA/AAA) is set to lead this week's negotiated calendar, offering $950 million future tax secured subordinate bonds spanning 08/2023-08/2048 with the greatest par size presented in the longer-dated maturities. New Hope Cultural Educational Facilities of Texas will also make a debut, selling $500 million senior living revenue bonds on Wednesday across three series, senior managed by Hilltop Securities. This week's competitive calendar will span 86 issues for a total of $1.64Bn, led by the New York Transitional Finance Authority, auctioning $250 million of future tax secured taxable subordinate bonds selling on Wednesday. (IHS Markit Global Market Group's Matthew Gerstenfeld)

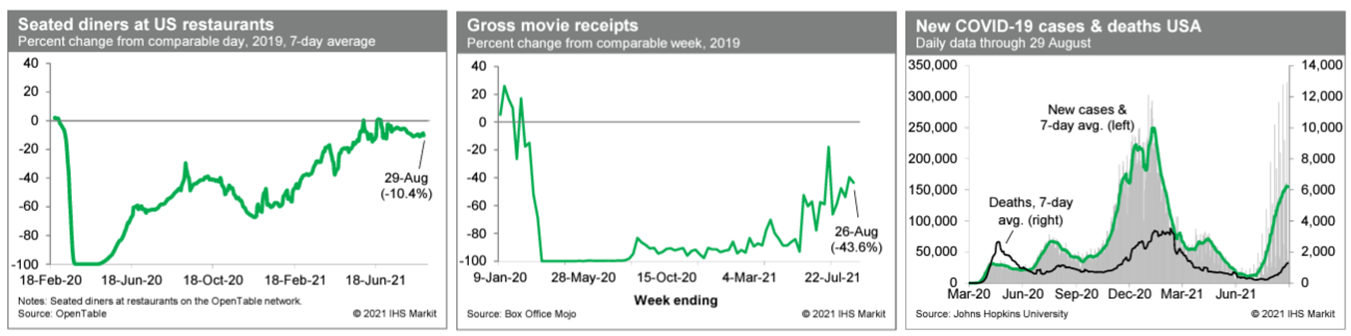

- Averaged over the last week, the count of seated diners on the

OpenTable platform was 10.4% below the comparable period in 2019,

somewhat softer than comparisons from a month or so ago. The recent

surge in new COVID-19 cases has introduced some renewed caution on

the part of diners. Meanwhile, box-office revenues last week were

43.6% below the comparable week in 2019. This is an improvement

over most prior weeks, an indication of gradual recovery in

movie-theater activity. (IHS Markit Economists Ben

Herzon and Joel

Prakken)

- The US Pending Home Sales Index (PHSI) fell 1.8% in July. The

index is down 12% this year and back to pre-pandemic levels. (IHS

Markit Economist Patrick

Newport)

- The index for the West was up from a month earlier; the indexes for the other three regions were down.

- According to Lawrence Yun, the National Association of Realtors' chief economist, "Homes listed for sale are still garnering great interest, but the multiple, frenzied offers - sometimes double-digit bids on one property - have dissipated in most regions. Even in a somewhat calmer market, a number of potential buyers are still choosing to waive appraisals and inspections."

- A second forward-looking housing indicator suggests that sales will continue to sag. The Mortgage Bankers Association (MBA)'s Purchase Index (four-week moving average), down 22% from the start of the year, is back to its pre-pandemic levels.

- Pivotal for sales in the upcoming months are inventories, which remain at historic lows but have edged up in the past five months. Strong demand for houses this year has mostly led to higher home prices—not higher sales—because listings have not picked up.

- The PHSI leads existing home sales by a month or two. The latest two PHSI readings point to flat to declining sales in August and September.

- The index of pending home sales declined in July by more than we expected, implying fewer existing home sales and brokers' commissions in the third quarter relative to our previous forecast. As a result, we lowered our tracking forecast of third-quarter GDP growth by 0.1 percentage point to 4.7%.

- An IHS Markit review of first-half 2021 light-vehicle registrations in the United States indicates that brand loyalty has dropped to a six-year low. Analysis of new vehicle registration data through June indicates that the overall brand loyalty rate of 51% in the US market is the lowest since August 2015. Year on year (y/y), IHS Markit new vehicle registration data indicate that brand loyalty in the US fell by 1.7 percentage points (PP) to 51% in June (versus June 2020). This follows a 2.5 PP drop y/y in May and a 2.8 PP decline in April. The aggregated three-month brand loyalty in 2021 was 51.6%, down from 54% a year ago and 54.1% two years ago. Although consumers are changing brands, body-style loyalty remains strong, increasing slightly - national overall body-style loyalty rose by 1.1 percentage points in June (y/y) to 55.5%. The three dominant body styles, including sedan, pickup, and sport utility vehicle (SUV), all experienced loyalty improvements, with sedan up by 2.4 percentage points, pickup up by half a percentage point, and SUVs up by 0.3 percentage point. These three body styles accounted for 90% of all new vehicle retail transactions in the first six months of the year. "Households with a pickup in the garage like the concept of a pickup, and therefore will acquire another one. But their likelihood of staying loyal to the brand of their pickup has diminished," said Thomas Libby, associate director of loyalty and industry analysis at IHS Markit. The likelihood of a household with a pickup in the garage acquiring another pickup has risen slightly to 50.8%, but the household's loyalty to brand has dropped by 3 PP to 53.3% in the past year. This decline in loyalty is inevitably due, at least in part, to the major declines in dealer inventory stemming from the global microchip shortage. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Rivian has issued a statement announcing that the company has confidentially submitted a draft registration proposing public trading of its common stock with the US Securities and Exchange Commission (SEC). Rivian says that the size and price range for the proposed offering have not yet been determined. Timing for an initial public offering (IPO) is not clear, only that the "offering is expected to take place after the SEC completes its review process, subject to market and other conditions". Rivian's press statement was issued in accordance with SEC rules, which are based on ensuring transparency in the operations and finances of publicly traded companies. According to media company Bloomberg, Rivian is seeking a valuation of around USD80 billion. Bloomberg cites people familiar with the matter as sources; this information is not included in Rivian's press statement. Also citing the same sources, Bloomberg reports that Rivian would like the IPO to take place around 25 November, coinciding with the US Thanksgiving holiday, but also notes that the actual timing is dependent on SEC review and approval. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The body's ability to fight off foodborne illness increases

during the day and subsides at night when exposure is less likely,

according to a study conducted by a team of scientists at the

University of Texas Southwestern Medical Center. (IHS Markit Food

and Agricultural Policy's Margarita Raycheva)

- Findings of the study, which were published late last month in the science journal Cell , indicate that the body's natural defenses against foodborne infections peak at certain times, suggesting researchers in the future might be able to develop timed therapies or vaccination regimens to maximize this immune response.

- "This study shows that our immune systems are not turned on all the time, which is an unexpected result," says study leader John Brooks, a postdoctoral fellow at UTSW, who worked on the study with Lora Hooper, a professor of immunology and microbiology.

- As part of their research, the UTSW team was able to show that in mice the resistance to Salmonella Typhimurium varied according to the mice's circadian cycle and that mice were more successful in fighting off the pathogen at night when they were more active.

- The study results confirm past research suggesting that circadian cycles in animals are linked to health consequences. For instance, research has linked chronic sleep disruption to increased intestinal infection in humans. Circadian cycles play a key role in helping the body anticipate and prepare for changes in the environment, but it has been unclear how and why this occurs.

- The award for the first domestically produced offshore wind farm substation has gone to Kietwit Offshore Services. Wind farm developer Orsted expects the design and fabrication of the South Fork project substation to kick off in November 2021, with completion by the spring of 2023. The substation is estimated to weigh 1,500 metric tons, and measure 18 meters tall. The substation will be built in Kiewit's Ingleside facility in Texas, and loaded out for installation in the summer of 2023. This is contingent on the project receiving its Bureau of Ocean Energy Management (BOEM) record of decision, which is expected in October 2021. Orsted expects the project to be fully permitted in early 2022 and construction activities to commence immediately thereafter. (IHS Markit Upstream Costs and Technology's Melvin Leong)

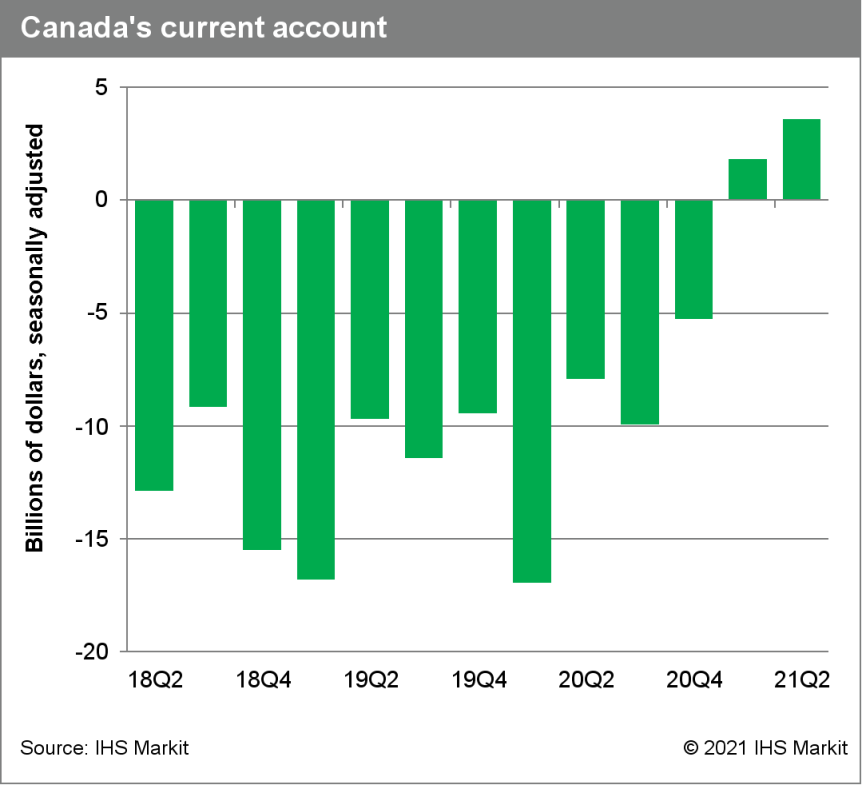

- Canada registered a current-account surplus of $3.6 billion in

the second quarter of 2021. The current-account surplus in the

first quarter was revised up from $1.2 billion to $1.8 billion.

(IHS Markit Economist Evan Andrade)

- After a huge swing to surplus in the first quarter, the goods account surplus widened $484 million to $1.7 billion. The services account surplus narrowed to $136 million, with small contributions from all service sub-accounts.

- The primary income account surplus widened to $3.0 billion. In addition, the initial $53 million deficit in the first quarter was revised to a $1.3 billion surplus. The secondary income account deficit changed little, registering $1.2 billion.

- We expect Canada's current account to remain close to balance—relative to recent history—through the second half of the year, as both domestic and US demand should remain strong. Export competitiveness concerns have abated, with the Canadian dollar depreciating through June and July.

- Total goods exports advanced 0.6% quarter on quarter (q/q),

resulting in a full year of growth. Higher prices helped export

gains of 15.1% q/q in forestry products and building materials and

5.6% q/q in energy products. Goods imports also saw a fourth

consecutive rise, edging up 0.3% q/q. This was aided by a 14.3% q/q

jump in chemical, plastic, and rubber product imports and an 11.0%

increase in metal ores and non-metallic mineral product

imports.

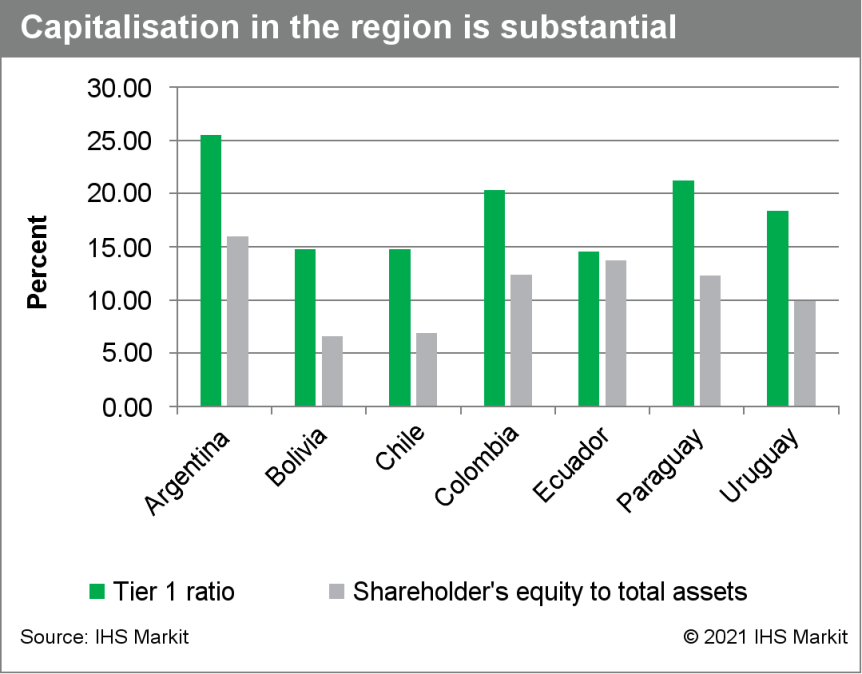

- IHS Markit has analyzed the main banking-sector indicators for

June 2021 of Argentina, Bolivia, Chile, Colombia, Ecuador,

Paraguay, and Uruguay. Our key findings indicate that credit is

still growing in most countries and that profitability has

continued to decline. Meanwhile, non-performing loans (NPLs) are

increasing slowly. All averaged figures presented here are

calculated by simple (non-weighted) averages. (IHS Markit Banking

Risk's

Alejandro Duran-Carrete)

- Credit has grown at a low pace for most of the region. Except for countries with high inflationary environment, such as Argentina, Paraguay, and Uruguay, credit grew at very limited levels. The average growth stayed at 6.3% year over year (y/y), well below the 11.6% y/y displayed at the end of 2019, primarily caused by depressed credit demand following the economic decline in 2020.

- NPLs are slowly rising in most of the countries where forbearance measures are ending. The average NPL ratio of the region moved from 3.1% in the end of 2019 to 3.3% in June 2021. A significant part of this stems from Argentina, which is beginning to return to the pre-pandemic levels of impairment, particularly in the household segment. Countries such as Chile are benefitting from the release of pension funds, which are used to pay outstanding debts.

- All the sectors remain very well-capitalized. With an average capital adequacy ratio (CAR) of 19.1% and an average tier-1 capital ratio of 16.5%, the sectors' capitalization in June 2021 remains robust.

- Liquidity has improved and is likely to return to normal in

2022. Thanks to contained levels of credit growth and a large

increase in deposits, the sectors' liquidity metrics have grown

sharply. Revealing this, the region's average loan-to-deposit ratio

(LDR) went from 89.0% to 78.4%.

Europe/Middle East/Africa

- Most major European equity indices closed higher except for Spain -0.6%; Germany +0.2%, France +0.1%, and Italy +0.1%.

- 10yr European govt bonds closed mixed; France/Spain -1bp and Italy/Germany flat.

- Brent crude closed +0.7%/$72.23 per barrel.

- Reports of EU food imports containing unauthorized pesticide residues soared last year after the bloc introduced stricter rules around the use of agrochemicals. According to the European Commission's latest Rapid Alert System for Food and Feed (RASFF) report, these pesticide residues became the second most hazardous products flagged by national authorities. The report explains that this was because EU authorizations for "several much-used pesticides were not renewed following a precautionary approach" - stemming from plans to prevent any "adverse effects" to public health, the environment and biodiversity. The Commission added that the most reported active substance in 2020 was ethylene oxide (347 notifications), followed by chlorpyrifos (48 notifications), pyridaben (43 notifications) and chlorpyrifos-methyl (41 notifications). In total, there were 667 related notifications made to the RASFF system, which represented a 164% increase compared to 2019. A key factor to this was a major food contamination incident in September when Belgium reported high levels of ethylene oxide in sesame seeds from India that surpassed the 'Maximum Residue Limit' (MRL) of 0.05 ppm - a situation that then went on to affect other EU member states. (IHS Markit Food and Agricultural Policy's Steve Gillman)

- Germany's Federal Statistical Office (FSO) has reported, based

on data from various regional states, that the country's national

consumer price index (CPI) was flat month on month (m/m) in August.

This matches the average for this month in recent years. As base

effects linked to the temporary VAT cut in mid-2020 are still

having a boosting influence, annual inflation increased from July's

3.8% to 3.9% year on year (y/y). (IHS Markit Economist Timo

Klein)

- The EU-harmonized CPI measure increased by 0.1% m/m, its y/y rate thus rising from 3.1% to 3.4% y/y. The current differential between the national and the harmonized measure in y/y terms is linked to the latter using weights derived from the consumer-spending pattern of 2020 rather than 2015. This heavily underweights package tour prices, which regularly spike to much higher levels in July-August than during the rest of the year because of summer holiday travel.

- The detailed breakdown of the German national data will only be published with the final numbers on 10 September, but components are available, for instance, from the largest and most populous state of North Rhine-Westphalia (NRW). CPI in this state posted 0.1% m/m and 4.2% y/y, the latter rising from 4.1% in July.

- In NRW, energy prices were broadly flat at 0.2% m/m in August, which also leaves their annual rate roughly steady at 12.6%. Food prices hardly moved either (-0.1% m/m), keeping their y/y rate at an elevated level of 4.4%. In contrast, the ongoing loosening of restrictions with respect to holiday travel and recreation/entertainment meant that prices fell by less during the month than they usually do, raising the annual rate for package tours from -0.5% to 1.5% and for the overall category of recreation/entertainment/culture from 2.4% to 3.4%.

- Renault Group's Mobilize business has unveiled the Limo, a new battery electric vehicle (BEV) sedan designed to be used by ride hailing services as a taxi and private hire vehicle. According to a statement, the four-door vehicle has been developed in conjunction with Renault Group's Chinese partner Jiangling Motors Group (JMCG). It is said to measure 4.67m long with a 2.75m wheelbase; 1.83m wide; and 1.47m tall, with a design that has a short bonnet and plunging roofline. Other exterior features include flush door handles that unfold when unlocked, and 17-inch wheels. The interior has an easy to clean satin finish, leather-effect upholstery, while the dashboard benefits from a 10.25-inch instrument panel and 12.3-inch central infotainment touchscreen. It also offers passengers in the rear seats 288mm of legroom, with enough space for three people, two USB ports and volume control knobs, adjustable air vents and booklights. The car has a 411-litre boot. The electric motor develops 110kW and 220Nm of torque giving it the ability to accelerate to 100km/h in 9.6 seconds and a top speed of 140km/h. This is combined with 60kWh lithium-ion battery that is said to offer around 450km of range under WLTP. It is also said to be capable of being charged to offer 250km of range within 40 minutes using a fast charger. (IHS Markit AutoIntelligence's Ian Fletcher)

- The latest, preliminary national accounts data from Statistics

Sweden (SCB) show that the Nordic economy in the second quarter of

2021 expanded by 0.9% quarter on quarter (q/q), adjusted for

seasonal variation, growth thus marginally accelerating from the

first quarter. Meanwhile, annual growth improved significantly,

with a calendar-adjusted gain of 9.7% year on year (y/y), following

modest contraction in the first quarter. (IHS Markit Economist Venla

Sipilä)

- Household final consumption rose by 1.0% q/q in April to June, contributing 0.4 percentage point to growth from the first quarter. Household final consumption increased by 9.0% y/y, in what was the first annual expansion since the fourth quarter of 2019. Tourism incomes and recreation and culture services contributed particularly to the strong growth.

- Growth of 0.8% q/q in government spending, driven by increased consumption by local and regional governments, contributed 0.2 percentage point to overall GDP.

- Gross fixed investment recovered to show growth of 3.8% q/q, which marked a GDP contribution of 0.9 percentage point, and more than 10% y/y. Machinery investment provided the greatest positive contribution. Meanwhile, inventories, which had been the leading GDP driver in the first quarter, now only contributed 0.1 percentage point to GDP.

- Meanwhile, exports returned to q/q contraction for the first time since the second quarter of 2020, falling by 1.1% q/q in seasonally adjusted terms, while import growth moderated to 0.7% q/q. These developments left the negative GDP growth contribution from net exports at 0.8 percentage point.

- In a related data release, the SCB reported that the unemployment rate in July was 8.0%, or 9.0% adjusted for seasonal variation. In July, there were a total of 5,257,000 employed people, which brought the employment rate (the share of the employed of those aged 15-74 years) to 70.1%. Seasonally adjusted figures produced an employment rate of 67.6%. The seasonally adjusted and smoothed data suggest an increase in employment and in the employment rate compared with preceding months, although annual comparisons are not feasible because Sweden introduced the Labour Force Survey methodology, compliant with the new EU regulations, only from the beginning of the year.

- The Kyrgyz government's expropriation in May of the operating

contract of the Kumtor gold mine has prompted IHS Markit to revise

its outlook for short-term and medium-term sovereign risks to

Negative. As the country engages in contentious arbitration with

the mine's Canadian operating company, risks of further

expropriation will rise, jeopardizing future capital inflows. A

loss of capital inflow could trigger a deterioration in the

country's external repayment risks, potentially lowering the

overall risk scores in the second half of 2021. (IHS Markit

Economist Andrew

Birch)

- IHS Markit is revising the short- and medium-term outlooks on its Kyrgyzstan sovereign risk ratings from Stable to Negative. The expropriation of the operating contract for the Kumtor gold mine in May by the government was the primary trigger for the move.

- In May, the government approved a law that allowed for the nationalization of any company operating under a concession agreement if the company violates certain standards. Canada's Centerra Gold, which operates the Kumtor gold mine through a subsidiary, is the only company operating in the country under such an agreement. The government then seized operations of the gold mine in May.

- At the beginning of July, Kyrgyzstan's government announced that it was in the process of voiding all contracts related to the Kumtor mine. Centerra has filed for arbitration hearings for unjust contract termination.

- Upon the election of the government at the beginning of the year, the potential for nationalization of the gold mine was high given the nationalistic background of the new Kyrgyz government. The May-July actions have fulfilled these fears.

- The interim results of South Africa's three largest banks -

Standard Bank, Absa, and Nedbank - show an improvement in the

pre-tax return on assets (ROA) in June 2021 (Standard Bank 0.9%,

Absa 1.6%, and Nedbank 1.0%) compared with June 2020 (Standard Bank

0.1%, Absa 0.2%, and Nedbank 0.3%). However, only Absa had

surpassed the pre-pandemic 2019 levels. (IHS Markit Banking Risk's

Ronel Oberholzer)

- Nedbank mentioned in its report that it expects to exceed these levels only by 2023. All three banks' capital adequacy ratios (CAR) improved significantly between June 2020 and June 2021, albeit slightly below the sector's average of 16.9% in March 2021.

- Only Absa surpassed the level at 17.7%. The banks attribute the better CARs to improved organic earnings growth and lower provisioning.

- In 2020, in preparation for the possible losses attributed to the impact of the coronavirus disease 2019 (COVID-19) virus pandemic, Absa provisioned ZAR14.7 billion (USD1 billion), Standard Bank ZAR11 billion, and Nedbank ZAR7.7 billion. The amounts have declined to ZAR4.7 million, ZARR5.8 billion, and ZAR4.5 billion, respectively.

- All three banks have expressed concern about the significant drop in loan growth. Standard Bank and Absa recorded loan growth of only 1.9% and 2.5%, respectively, in June 2021 compared with 10.4% and 5.7%, respectively, in the previous year. Nedbank recorded a contraction in loans of 7.9% compared with 3.5% growth over the same period. Nedbank attributes this drop to clients opting to repay existing commitments rather than acquiring new credit.

- All three banks have reported a lack of demand for corporate loans.

- Asset quality also deteriorated or stayed unchanged during this period. Standard bank's non-performing loans (NPL) ratio worsened from 3.6% in June 2020 to 4.2% in June 2021. Absa's NPL stayed almost unchanged at 5.6% from 5.7% previously. Nedbank's data are not available for this period. However, given the marginal increase in provisioning from December 2020 to June 2021, it is likely that Nedbank's NPL ratio also deteriorated in the first half of 2021.

- Nigeria's real GDP fell by 0.3% quarter on quarter (q/q) during

the second quarter of 2021, from a sharp contraction of 14.1% q/q

in the previous quarter. The low base year of comparison left the

year-on-year (y/y) growth rate up by 5.4% in the second quarter,

from 0.4% y/y in the previous quarter. The Nigerian government had

introduced COVID-19-virus-related restrictions in the second

quarter of 2020 that limited domestic mobility, caused border

closures with close neighbors, and disrupted businesses. (IHS

Markit Economist Thea

Fourie)

- The official GDP produced by Nigeria's National Bureau of Statistics (NBS) shows that crude petroleum and natural gas production fell by 20.3% q/q and 12.5% y/y, respectively, during the second quarter of 2021, while non-oil related GDP rose by 1.7% q/q and 7.1% y/y, respectively

- Non-oil sectors that showed the biggest year-on-year growth during the second quarter included the transport sector (up 76.8% y/y), with both road and rail showing a strong recovery, followed by electricity and water supply (up 56.9% y/y). Wholesale and retail trade recovered by 22.4% y/y, followed by other non-oil related mining activity (up 9.7% y/y). Mining of coal and metals ores reported strong growth during the second quarter.

Asia-Pacific

- All major APAC equity markets closed higher; India +1.4%, Japan +0.5%, Hong Kong +0.5%, South Korea +0.3%, Australia +0.2%, and Mainland China +0.2%.

- Zeekr, the battery electric vehicle (BEV) brand owned by Zhejiang Geely Holding Group and Geely Automobile Holdings Ltd, has announced that it has agreed USD500 million of pre-A funding from several strategic investors. According to a statement, Intel Capital, Intel's investment arm, will be the lead investor in this funding round. It will be joined by battery-maker CATL; online entertainment and content distributor Bilibili; Cathay Fortune Group, which invests, develops, and operates assets in the "new energy sector", as well as being a leading producer of copper and cobalt; and Boyu Capital, a Greater China-focused alternative asset management firm. The statement added that investors are expected to receive an aggregate shareholding equivalent to around 5.6% of the enlarged issued share capital of Zeekr. They are also expected to contribute their expertise in areas such as connectivity, battery technology, raw materials, and new customer groups to supporting the growth of the business. (IHS Markit AutoIntelligence's Ian Fletcher)

- Baidu Apollo has officially begun the automatic driving operation route in the Beijing Sub-Administrative Center, located in Tongzhou District, Pandaily reported. The company has obtained the first batch of test licenses for autonomous driving roads in Tongzhou District and can carry out test operations on 26 roads. The total length of the roads is more than 50 km in the region. The report added that the first batch of routes will cover the surrounding areas of the administration area, with a total of 22 stations. The distance between each station is 600 m. (IHS Markit Automotive Mobility's Isha Sharma)

- Japan's retail sales rose by 1.1% month on month (m/m) and 2.5%

year on year (y/y) in July following a 3.1% m/m rise in the

previous month. Although states of emergency for Tokyo and Okinawa

as well as quasi-states of emergency for six prefectures were

extended, improved consumer confidence, an extra holiday for the

opening of the Tokyo Olympics games, and progress with the vaccine

rollout supported mobility and retail trade. (IHS Markit Economist

Harumi

Taguchi)

- Although sales for the majority of retail store groupings declined, particularly for fabrics, apparel, and accessories; and machinery and equipment, sales of fuel and miscellaneous were major reasons behind the increases. Increased sales of fuel partially reflected higher petrol prices, while the weakness in sales of autos was partially due to negative impacts from semiconductor shortages.

- The July results were better than IHS Markit expected and were additional evidence of resilient private consumption under states of emergency for many prefectures. However, containment measures under Japan's state of emergency are mild and rely on voluntary responses to government requests, with the containment measures themselves having only few penalties. It has been difficult to limit mobility, particularly during the Olympic/Paralympic games and school breaks.

- SsangYong plans to receive acquisition proposals from potential buyers until 15 September, reports the Yonhap News Agency. Around 11 investors from home and abroad have so far submitted letters of intent (LOIs) to take over the struggling South Korean automaker. Major candidates include SM Group, whose businesses range from construction to automotive parts manufacturing, and Edison Motors, which has teamed up with a homegrown equity fund, Korea Corporate Governance Improvement (KCGI), the report highlights. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-30-august-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-30-august-2021.html&text=Daily+Global+Market+Summary+-+30+August+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-30-august-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 30 August 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-30-august-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+30+August+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-30-august-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}