Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 04, 2022

Daily Global Market Summary - 4 February 2022

Most major APAC and US equity indices closed higher, while all European markets were lower. US and benchmark European government bonds closed sharply lower. European iTraxx and CDX-NA closed wider across IG and high yield. The US dollar, oil, gold, silver, and copper closed higher, while natural gas was lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher except for DJIA -0.1%; Nasdaq +1.6%, Russell 2000 +0.6%, and S&P 500 +0.5%.

- 10yr US govt bonds closed +8bps/1.92% yield and 30yr bonds +6bps/2.22% yield.

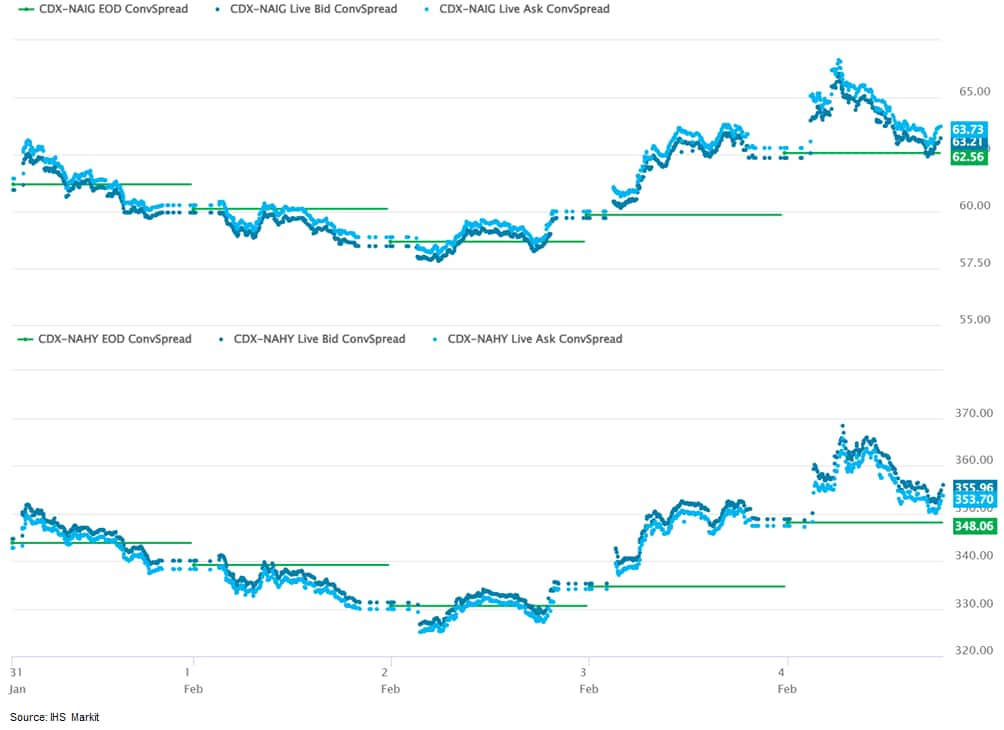

- CDX-NAIG closed +1bp/64bps and CDX-NAHY +7bps/355bps, which is

+2bps and +11bps week-over-week, respectively.

- DXY US dollar index closed +0.1%/95.49.

- Gold closed +0.2%/$1,808 per troy oz, silver +0.4%/$22.48 per troy oz, and copper +0.4%/$4.49 per pound.

- Crude oil closed +2.3%/$92.31 per barrel and natural gas closed -6.5%/$4.57 per mmbtu.

- US nonfarm payroll employment rose 467,000 in January,

considerably stronger than the consensus estimate. Meanwhile, the

unemployment rate rose 0.1 percentage point to 4.0%. (IHS Markit

Economists Ben

Herzon and Michael

Konidaris)

- The solid gain in payrolls was surprising, in light of (1) a substantial rise in initial claims through mid-January, (2) a previously reported surge in early January in the number of persons away from work because of COVID-19, (3) a widely reported private-sector estimate of a large decline in payrolls, and (4) general concern about the possible effect of Omicron on employment.

- Omicron did show up in this morning's report, but not in employment; it showed up in hours worked. In the payroll survey, a person is counted as employed if they worked or received pay for any portion of their pay period that includes the 12th of the month, even if it was for just one day.

- Roughly one-third of private-sector employees are on weekly payrolls, with the balance on pay periods at least two weeks in length, making it unlikely that, say, a five-day quarantine could register as a hit to payroll employment.

- A five-day quarantine would, however, show up as a reduced average workweek. Indeed, the private workweek showed a sharp decline in January. This likely will have some impact on private wages and salaries. As we get past the Omicron wave, we believe the private workweek will rebound.

- Average hourly earnings likely were also affected by Omicron. The 0.7% increase in January was the largest since December 2020. While tight labor markets generally are boosting wage gains, the unusually large increase in January likely reflected the effect of salaried employees, whose hours may have been reduced because of Omicron but whose pay was not.

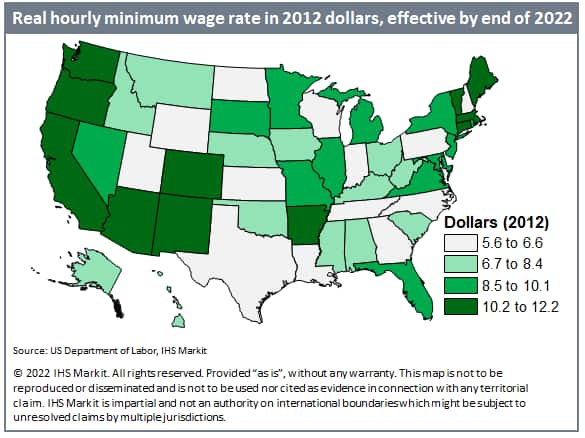

- By the end of 2022, 24 states plus the District of Columbia

will have increased their minimum wages, thanks to recently passed

laws, ballot measures, inflation indexing, or cost-of-living

adjustments. The District of Columbia will have the highest minimum

wage in the country by July 2022, increasing 20 cents to

$15.20/hour. Following the nation's capital, California

($15.00/hour), Washington ($14.49/hour), Massachusetts

($14.25/hour), Connecticut ($14.00/hour), Oregon ($13.50/hour), New

York ($13.20/hour) and New Jersey ($13.00/hour) will have the

highest minimum wage rates in the country by the end of 2022. On 1

May 2022, Virginia will enact the nation's largest minimum wage

increase, of $1.50, although that will still only raise its total

to $11/hour. California, Connecticut, Florida, Illinois, New

Jersey, and New Mexico are on a similar path, increasing their

minimum wage rates by $1 this year. Of the 26 states that will not

increase the minimum wage in 2022, 20 of them are still at the

federal minimum of $7.25/hour. Many of those states are in the

southern part of the US, but they also include Idaho, Utah, North

Dakota, Minnesota, Wisconsin, and Pennsylvania. (IHS Markit

Economist Steven

Frable)

- Looking at states' minimum wages in real terms (2012 dollars), the highest minimum wage rate will be Washington ($12.19/hour), followed by the District of Columbia ($11.46/hour). Connecticut, California, and Oregon round out the top five.

- By the end of 2021, there will be 15 states where the minimum wage is $10 or more in real terms.

- At the bottom of the list are Wisconsin ($5.64/hour), New Hampshire ($5.81/hour), Utah ($6.03/hour), Texas ($6.07/hour), and Pennsylvania ($6.21/hour), where higher costs of living mute the value of their federal minimum wage.

- Interestingly, it became clear in 2021 that even rising minimum

wages cannot always increase real incomes. Indeed, the 2021 minimum

wage increases in Colorado, the District of Columbia, Michigan, and

Minnesota amounted to essentially zero dollars in real terms,

indicating that in those states, wage increases were unable to

outpace the rising cost of living.

- Grid-scale energy storage systems are unlikely to see any price

declines until 2024, when manufacturing of lithium-ion batteries

scales up to meet the increase in demand from automakers, according

to an IHS Markit analysis of clean technology trends. Released 3

February, the analysis finds that prices for lithium-ion batteries

rose 10%-20% to $110 per kWh in the latter half of 2021,

predominantly for LFP (lithium iron phosphate) cells, which is the

favored technology for grid-energy storage. (IHS Markit Net-Zero

Business Daily's Amena

Saiyid)

- However, IHS Markit analysts say these price hikes, which are driven by soaring raw material costs and demand from automakers, will be tempered by the anticipated rise in the global LFP cell production capacity.

- Announced expansion plans currently suggest that LFP cell capacity across the globe will reach 330 GWh annually in 2025, compared with less than 200 GWh in 2020.

- LFP batteries have been the choice of technology for the grid-scale energy storage industry in recent years due to their lower cost and better safety track record in comparison to the main alternative, NMC (lithium nickel manganese cobalt oxide) batteries, which automakers favored for EVs until 2020.

- As automakers seek to ramp up their EV fleets in response to the net-zero pledges made by countries where they have a large market presence, such as China, Europe, and the US, they are seeing the value of LFPs. Last year, Ford took a cue from Tesla and indicated it would consider LFP cells for EVs.

- Tesla announced in December it would begin offering its LFP-powered "standard range" models globally, rather than only in China as it had before. The EV giant already has positioned itself as the third largest energy storage integrator globally, holding 11% of the energy storage market.

- But with automakers getting into the demand mix, the ample supply of LFP batteries that the energy storage industry enjoyed until 2020 is no longer the case, Wilkinson wrote.

- The availability of LFP batteries depends on the pace at which automakers manufacture EVs using these cells as opposed other types of lithium-based batteries. In 2021, the automotive and transportation sector accounted for 80% of lithium-ion battery demand, a figure IHS Markit estimates is set to rise to 90% by the middle of the decade.

- Amazon disclosed in a security filing that it holds 5.2% stake in Aurora Innovation, a company that specializes in autonomous vehicle (AV) technology for cars and trucks. In 2019, Aurora raised more than USD530 million in Series B funding round from multiple investors including Amazon. Amazon now owns 35,239,761 shares of Class B common stock of Aurora. Amazon is stepping up its efforts in the AV sector, as eliminating the cost of a human driver could make delivery services far cheaper. Last year, Amazon placed an order for 1,000 autonomous systems from technology startup Plus. In 2020, Amazon acquired AV technology startup Zoox, which plans to develop fleets of small, on-demand AVs that do not have a steering wheel or interior controls. In 2019, Amazon announced that it was using automated trucks developed by Embark to haul cargo on the I-10 highway in the United States. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- After plunging to 45.0, Canada's Ivey Purchasing Managers'

Index (PMI) jumped 5.7 points to 50.7 in January. Purchasing

managers' spending activity marginally increased in January after

showing a mild decrease in the previous month. The increase was

likely due to the higher spending on inventories. Given the

continued slower supplier deliveries, purchasing managers keep

investing in inventories to prevent a possible production

disruption caused by inventories' shortage. Combined with a

continued supply chain disruption and high raw material prices

including energy prices, the surge in the price index likely

indicates stronger upward pressure on inflation. (IHS Markit

Economist Chul-Woo

Hong)

- The employment index lowered to 49.1, which was the first contraction since January 2021, indicating a net job loss. This coincides with the steep 200,100 net employment plunge as reported by the Labour Force Survey in the month.

- While the supplier deliveries index dipped further to 24.1, the lowest level since April 2020, the inventories index rebounded to 54.2.

- The price index surged 14.6 points to 92.2, a record-high level.

- As regional restrictions are gradually eased, real GDP growth starting in February will be solid in the coming months.

- Despite the severe temporary job loss, Canada's employment did

not fall below pre-pandemic levels. The implementation of public

health measures negatively affected women and youths as their

jobless rates jumped the most. Youth employment dropped enough to

raise the jobless rate to an eight-month high. Pandemic policies

were swift to reverse many of the job gains since the September

2021 recovery. The rapid spread of the Omicron variant resulted in

a higher-than-usual absenteeism rate because of sickness or

disability in the month, at 10%. This was also a record-high rate

since the start of the pandemic. Plus, there were about 620,000

more employees who worked fewer than half their usual hours. This

was an increase of 66.1% month on month, the biggest jump since

March 2020. These employment losses resulted in a sharp 2.2%

monthly decline in total hours worked. (IHS Markit Economist Arlene

Kish)

- Net employment plunged by 200,100 in January as public health measure policies reintroduced shutdowns or reduced capacity for many hard-to-distance businesses.

- Losses were widespread among full-time (down 82,700) and part-time (down 117,400) positions within the private (down 205,900) and public (down 7,500) sectors. The only bright spot was the gain in self-employment (up 13,200).

- The jobless rate popped to 6.5%, the highest since October 2021 and the first increase since April 2021.

- The modestly shrinking labor force lowered the participation rate 0.4 percentage point to 65.0%.

- The setback in labor market conditions is temporary. Easing of public health measures will drive the comeback from youths' and adult women's downturns as economic conditions support robust job demand.

- The monetary policy committee (COPOM) of The Central Bank of

Brazil (Banco Central do Brasil: BCB) during its 2 February meeting

decided unanimously to raise the policy rate by 150 basis points,

from 9.25% to 10.75%. This is the eighth time in as many meetings

that the monetary authority has increased the policy rate in

response to high inflation. (IHS Markit Economist Rafael

Amiel)

- As of mid-January, annual inflation amounted to 10.2%, well above the bank's target of 3.5% +/- 1.5 percentage points. Although half of this has been driven by the energy components of the Consumer Price Index (CPI), there has been second-round effects or contagion into other products. Core inflation, which excludes items in the food and energy categories, i.e., those with high price volatility, amounted to 7.6%, and inflation in the services category reached 4.8% at the end of 2021.

- As it is customary in its communiques, the central bank highlighted risks to inflation; the announcement was also similar to the ones made in October and December 2021. The monetary authority stated that the possibility of lower commodity prices, coupled with an appreciation to the local currency, may reduce inflationary pressures.

- Further extensions of fiscal policy responses to the COVID-19 pandemic that increase aggregate demand and deteriorate the fiscal path may pressure the country's risk premium. Moreover, despite the recent improvement in fiscal accounts, the government's announcement that it would extend and increase emergency aid through cash transfers through 2022 poses risks of fiscal mismanagement, especially given that such spending would breach a constitutionally mandated budget cap that was approved in 2016.

- Demand for poultrymeat remains surprisingly low in Brazil

despite recent price falls making it more affordable when compared

to other meats. High rates of unemployment and inflation are

further squeezing the purchasing power of Brazilian consumers. (IHS

Markit Food and Agricultural Commodities' Ana

Andrade and Max

Green)

- On the plus side, Brazilian chicken meat exports have got off to a strong start to the year, with shipments averaging 15,761 tons/day in the first three weeks of January. This is up 17% y/y but down 5.5% m/m. Average export prices for unprocessed chicken were up 15% y/y at $1,679/ton.

- Prices on the domestic market are moving in the opposite direction: wholesale chicken meat prices in the state of Paraná decreased by a further 6% w/w in the week ending 28 January to BRL5.60 ($1.04)/kg. Wholesale prices in the state of São Paulo slipped by 4% w/w to BRL5.55 ($1.03)/kg. The price of live birds remained flat at BRL5.00 ($0.93)/kg in Paraná and BRL4.90 ($0.91)/kg in São Paulo. The relative stability of live bird prices reflects the poultry sector's ability to quickly adjust to falls in demand, which is not so easy for other meats.

- While Brazilian exporters may be benefiting from avian flu outbreaks in other parts of the world, the industry as a whole is keen to see improvements in domestic demand - as this will be key to maintaining margins at a time when production costs are high.

- The production cost of live broiler chicken in the state of Paraná rose to BRL5.21 ($0.98)/kg in December 2021, up by a further BRL0.07/kg when compared to November, according to Brazil's public agricultural research corporation (Embrapa).

- The Central Bank of Chile (Banco Central de Chile: BCC) has

reported that the country's unadjusted monthly economic activity

indicator - a proxy for GDP - decelerated again in December 2021 to

10.1% year on year (y/y), from 14.3% y/y during November 2021. The

large number resulted from a very low negative comparison base in

December 2020, while December 2021 had an additional of one working

day. (IHS Markit Economist Claudia

Wehbe)

- Unadjusted services had the largest annual contribution with a 12.6% gain, especially entrepreneurial and personal services such as healthcare, followed by contributions in restaurants and hotels, and transportation, mainly reflecting household-support measures, eased constrains on mobility, and increased reopening of the economy.

- Unadjusted commerce was the second-largest contributor, while gaining 14.8% on an annual basis, fueled by wholesale sales of materials, food, beverages, and tobacco, and machinery and equipment, as well as retail sales of apparel and shoes and household appliances. Meanwhile, a 3.3% gain in the production of goods category was propelled by construction, manufacturing, and mining activity.

- In seasonally adjusted terms, mining was down by 6.2% m/m, driving the negative 0.4% m/m overall result during December 2021. Industries and commerce were down by 1.4% m/m.

Europe/Middle East/Africa

- All major European equity markets closed lower; UK -0.2%, France -0.8%, Spain -1.2%, and Germany/Italy -1.8%.

- 10yr European govt bonds closed sharply lower for a second consecutive day; UK +4bps, Germany/France +6bps, and Italy/Spain +10bps.

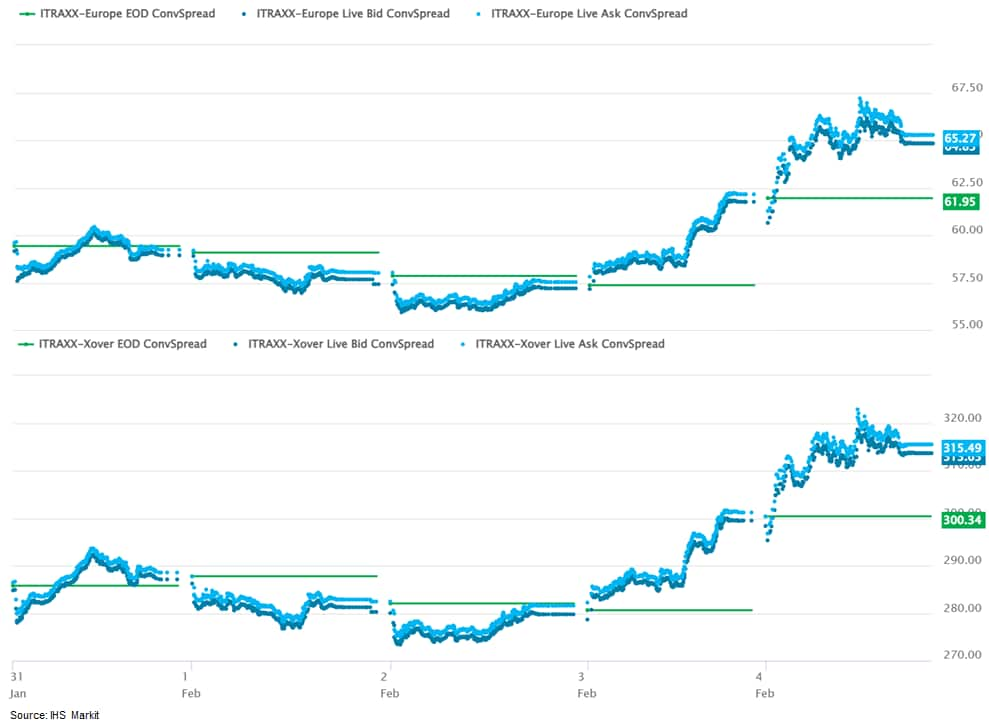

- iTraxx-Europe closed +3bps/65bps and iTraxx-Xover

+14bps/315bps, which is +6bps and +29bps week-over-week,

respectively.

- Brent crude closed +2.4%/$93.27 per barrel.

- The Bank of England (BoE) announced its first back-to-back

interest rate rise in 17 years at its February meeting. The BoE

expects an even higher inflation peak in early 2022, prompting its

Monetary Policy Committee (MPC) to embrace a more hawkish stance,

suggesting that it will accelerate the pace of interest rate

normalization. (IHS Markit Economist Raj

Badiani)

- The BoE's MPC voted 5-4 to increase the Bank Rate by 25 basis points (bp) to 0.5% at its meeting that ended on 2 February. This marked the first back-to-back interest rate rise since 2004 after the MPC raised the Bank Rate by 15 bp to 0.25% at its December 2021 meeting.

- The dissenting voices favored increasing the Bank Rate by 50 bp, to 0.75%. The four members wanting a larger rise were Dave Ramsden, one of the deputy governors, as well as Jonathan Haskel, Catherine Mann, and Michael Saunders.

- They pushed for a higher interest rate rise to provide some insurance should the BoE repeat its inflation forecasting errors in 2021. They also pointed to emerging signs that companies expect prices to rise significantly and that workers want larger pay rises, suggesting more persistent inflationary pressures.

- Meanwhile, the MPC voted unanimously for the BoE to begin quantitative tightening, or to reduce the stock of UK government and corporate bond purchases, namely ceasing to reinvest maturing assets (including a program of corporate bond sales).

- As of 2 February, the total stock of assets held in the Asset Purchase Facility (APF) was GBP895 billion (USD1.2 trillion), comprising GBP875 billion of UK government bond purchases and GBP20 billion of sterling non-financial investment-grade corporate bond purchases.

- Specifically, the BoE will not reinvest the proceeds of GBP70 billion of government bonds maturing during 2022 and 2023. The process begins as soon as March 2022, with the BoE not reinvesting the cash flow generated by the redemption of gilts totaling GBP27.9 billion.

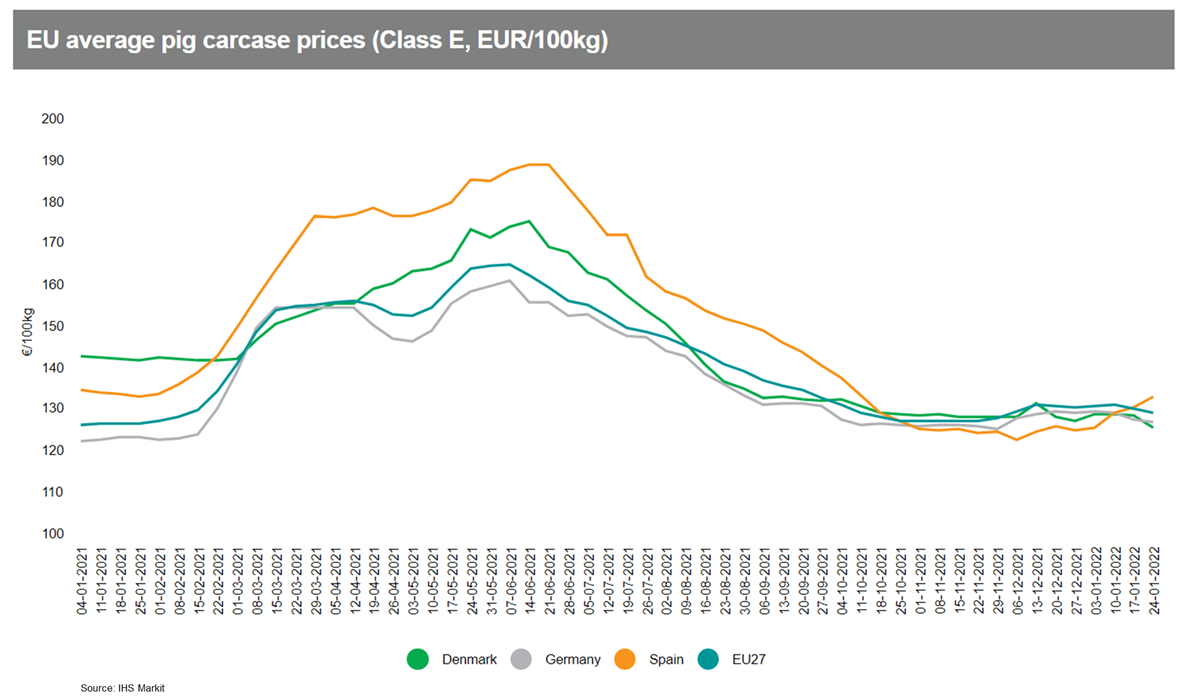

- European pig prices fell back once again over the past week,

with a slack market offering little in the way of encouragement to

under-pressure pig producers. Prices have in fact seen little real

change since October - but over that period, costs and expenses for

producers have continued to soar. (IHS Markit Food and Agricultural

Commodities' Chris Horseman)

- In December 2021, the Commission assessed the 'remainder' for EU pig producers - the nominal gross margin per animal after deduction of feed and replacer costs - at just EUR 10. This is the lowest figure recorded since at least 2013, and compares unfavorably with the long-term EU average of around EUR 48 per animal.

- It is also far short of remainders of upwards of EUR 70 which farmers were achieving for much of 2019.

- Markets signals are however offering little respite at present, with consumption still on the low side, and exports still constrained by weak demand from China, and by tight restrictions on exports from Germany and other countries affected by African Swine Fever.

- The EU average price for Class E pigs in the week ending 30 January was EUR130.36 per 100kg, down by 0.9% on the previous week.

- Spain is bucking the European trend with a pattern of strengthening prices. The average Spanish price was up by 1.9% week-on-week to EUR134.44 per 100kg, capping a rise of 6% over the past three weeks.

- But there were substantial week-on-week price reductions in Poland (-3.8%), Denmark (-2.2%), Belgium (-1.3%) and Germany (-0.5%).

- Italian prices are not routinely communicated to the

Commission, but they have fallen sharply since ASF was discovered

there several weeks ago.

- Diesel's share of the passenger car market in the European Union fell below 20% for the first time in more than three decades last year, according to data from the ACEA. Given that diesel accounted for around half of the overall European market less than a decade ago, it shows how the popularity of this fuel type - which was once the darling of EU regulators because of its ability to lower carbon dioxide (CO2) emissions - has waned in the wake of the Volkswagen (VW) 'dieselgate' affair and as industry electrification accelerates. The fuel type's 19.6% share in 2021 was exactly matched by hybrid vehicles. Registrations of hybrid electric cars increased by a very robust 60.5% year on year (y/y) last year, marking the first time that hybrid electric vehicle sales (at 1,901,239 units) overtook those of diesel vehicles in the EU, by just 40 units. Combined sales of what ACEA refers to as electrically chargeable vehicles, which comprise PHEVs and pure BEVs, took an 18% share of the overall EU market in 2021. However, it should also be noted that gasoline (petrol) was still the dominant fuel type overall in the EU last year with a 40% overall market share. This meant that conventionally powered non-hybrid gasoline and diesel models still accounted for the majority of passenger car sales in the EU during the year with a combined share of 59.6%. (IHS Markit AutoIntelligence's Tim Urquhart)

- Automotive software company TTTech Auto has raised USD285 million in its latest funding round from Aptiv and Audi, according to a company statement. Aptiv is investing USD228 million, while Audi is investing USD57 million, giving the software company a valuation of USD1 billion. TTTech Auto plans to use the capital to expand its product portfolio and its presence internationally, as well as to extend its capabilities through merger and acquisition and product investments. TTTech Auto CEO Georg Kopetz said, "The next few years will be critical for the entire industry in the transition from automation to semi-autonomous driving and the software-defined vehicle. With MotionWise, we are supporting this industry transformation as an independent company with the most advanced safety software platform on the market. This funding will strengthen our position as a leader in automotive safety software and significantly increase our global footprint." TTTech Auto, a provider of safety solutions for the development of automated driving, was formed in 2018 by TTTech Group, Samsung, Audi, and Infineon. The company develops software that can manage data from sensors and safety systems which are used to automate driving. TTTech Auto's safety software platform MotionWise, which is currently used in about 2 million vehicles, helps manufacturers in shortening the development cycles for software defined cars. In 2018, BMW teamed up with TTTech Auto to develop highly automated driving functions. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Autonomous vehicle (AV) firm EasyMile is expanding its presence in Germany by opening a new office and garage at Berlin's former Tegel Airport, according to a company statement. The premises in the new Urban Tech Republic research and industrial park, which covers more than 200 hectares and is dedicated to advancing urban technologies, is in addition to EasyMile's corporate German headquarters. Gudrun Sack, managing director of Tegel Projekt GmbH, said, "The Urban Tech Republic focuses on technologies for the growing metropolises of the 21st century. Intelligent and clean mobility solutions, which are conceived, developed, tested or produced here, in the research and industrial park at the former Tegel Airport, play a central role for us. As a supplier of electric and automated transport solutions, EasyMile fits perfectly into the innovative profile of the Urban Tech Republic. We are therefore delighted to welcome EasyMile on board as one of our first tenants". EasyMile has developed autonomous mobility solutions that include intelligent navigation software, a range of latest-generation sensors, and a fleet management system. The company has also built the EZ10, a fully electric shuttle bus that is capable of Level 4 autonomous operation and is deployed with LiDAR, cameras, and GPS to ensure safety. It claims to have a 60% share of the autonomous shuttle market and has deployed these shuttles in nearly 300 locations to improve last-mile transportation. Recently, EasyMile claimed to be the first driverless solutions provider in Europe to operate at Level 4, without any human attendant on board, in mixed traffic on a public road. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Volvo Cars and Northvolt have announced that they have chosen Torslanda, Gothenburg (Sweden), as the location where they will establish a new battery manufacturing facility. According to a statement, construction of the joint venture (JV) factory is due to begin in 2023 and production operations are to begin in 2025. Eventually, the plant is to have a production capacity of 50 GWh of battery cells per annum, capable of supplying up to 500,000 passenger cars. In addition, the companies expect to create 3,000 jobs at the facility, and large-scale recruitment of operators and technicians is to begin in late 2023. (IHS Markit AutoIntelligence's Ian Fletcher)

- Macquarie's Green Investment Group and Agder Energi, a power utility company, are partnering to submit a bid for a floating wind project in the Utsira Nord area in Norway. The 1.5 GW capacity area is one of two offshore wind areas designated by the Norwegian Government opened to licensing applications. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- During its 3 February session yesterday, the Czech National

Bank's (CNB) monetary policy council raised the base interest rate

by 75 basis points (bp), to 4.5%. The discount and Lombard rates

now stand at 3.5% and 5.5%, respectively. Five board members voted

in favor of the latest decision, while two preferred to leave rates

unchanged. (IHS Markit Economist Sharon

Fisher)

- The latest monetary policy move was slightly stronger than IHS Markit analysts had assumed in our January forecast. Indeed, we had expected the base rate to reach 4.25% in February and 4.75% at the session on 31 March, before gradually easing from late 2022.

- With the aim of fighting inflation and anchoring inflation expectations, Czechia's policy interest rate has been increased by 425 bp since June 2021. Inflation jumped to 6.6% year on year (y/y) in December and 3.8% in 2021 as a whole, far above the CNB's 2% target. Inflation would have been considerably stronger in late 2021 if not for temporary tax changes aimed at easing the pain for consumers.

- In recent months, CNB board members have emphasized their aim of tightening monetary policy aggressively in an effort to curb inflation as quickly as possible and to avoid being behind the curve. Nevertheless, the CNB does not want to expose the economy to high interest rates for long and intends to ease borrowing costs as price growth returns to the target.

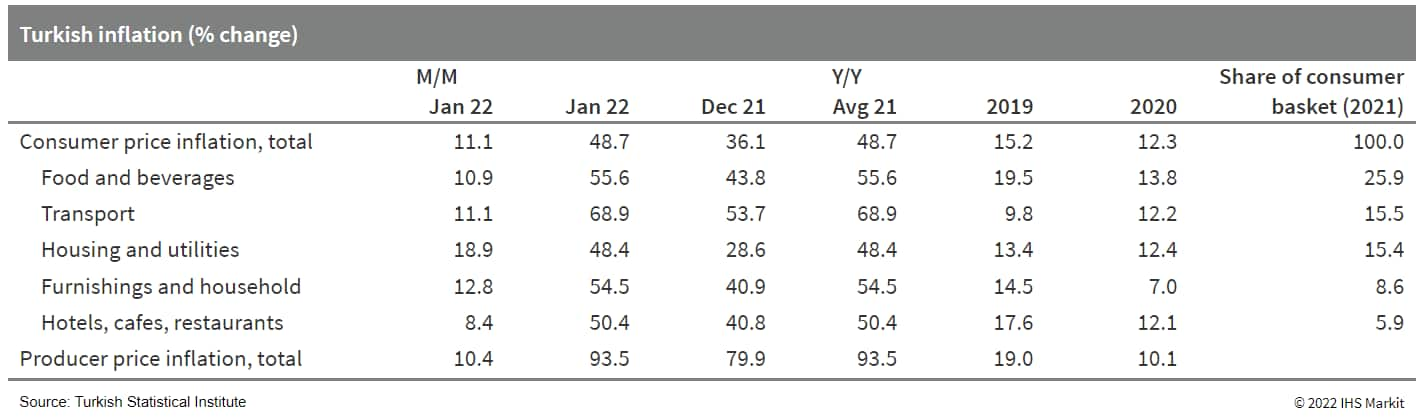

- Turkish annual consumer price inflation continued to surge

upwards in January, nearing 50%, a nearly two-decade high. Along

with the negative impact of the lira's late-2021 plunge, huge

utility price adjustments at the beginning of the year drove up the

headline inflation rate. Annual price growth will remain above 45%

throughout the first part of the year, presumably preventing the

central bank from resuming its rate cutting cycle. (IHS Markit

Economist Andrew

Birch)

- The Turkish Statistical Institute (TurkStat) reported that consumer prices in the country grew by 11.1% over the course of January. Just after midnight on New Year's Eve, Turkey's state-run energy company BOTAŞ increased natural gas prices by 15-50% and the Energy Market Regulatory Authority increased electricity prices by 52-130%. Correspondingly, housing and utility prices grew by 18.9% month on month (m/m).

- The resulting annual inflation rate rose to 48.7% as of January 2022, the highest it has been since April 2002. Annual consumer price inflation is now 3,470 basis points above the main policy rate, the one-week repo rate, of the Central Bank of the Republic of Turkey (TCMB).

- High inflation is drawing up commercial bank interest rates, even as the government holds the one-week repo rate steady. Average commercial lending rates for personal loans were over eight points higher as of late January than they had been in early November. Commercial lending rates were up more moderately, but still nearly five points higher. Lending for housing was little changed due to heavy government subsidization. These higher interest rates are compounding the impact of higher inflation on consumers.

- Sharp lira losses from mid-November to mid-December 2021 intensified the acceleration of inflation in January, driving up prices on import goods. The impact on producer prices was even more dramatic, as that annual price index soared to 93.5% as of January 2022.

- The impact of the government's adjustments on natural gas and

electricity price sent the annual price increase on energy goods

surging in January as well, to 76.6% from 34.2% the previous

month.

Asia-Pacific

- Most major APAC equity markets closed higher except for India -0.2%; Hong Kong +3.2%, South Korea +1.6%, Japan +0.7%, and Australia +0.6%.

- New vehicle registrations in South Korea fell by 9.0% year on year (y/y) to 1.74 million units in 2021 from 1.92 million units in 2020, reports the Yonhap News Agency, citing data released by the South Korean Ministry of Land, Infrastructure and Transport (MOLIT). Of the total, locally produced passenger vehicle registrations declined 11.0% y/y to 1.43 million units last year from 1.60 million units in 2020, while imported passenger vehicle registrations grew by 1.9% y/y to 314,000 units. It is important to note that new vehicle registrations include commercial vehicle registrations. As of the end of 2021, the total number of vehicles registered in South Korea stood at 24.91 million units, up 2.2% from 24.36 million units at the end of 2020, thanks to increased sales of alternative-powertrain vehicles and sport utility vehicles (SUVs). Registrations of vehicles produced by the country's five domestic automakers - Hyundai, Kia, General Motors (GM) Korea, Renault Samsung, and SsangYong - accounted for 88% of total registrations, and imported-brand models accounted for the remainder. (IHS Markit AutoIntelligence's Jamal Amir)

- P Anbalagan, Maharashtra Industrial Development Corporation (MIDC) CEO said that the Indian state of Maharashtra is looking at an investment of INR1 trillion (USD13.3 billion) in the next 10-12 years in the electric vehicle (EV) manufacturing sector, reports The Times of India. According to the source, the main investments in this sector would include the cities of Nashik, Aurangabad, Pune, Nagpur, as well as Mumbai. P Anbalagan said, "Petrol and diesel vehicles cause 70% of the air pollution. There is a need to promote electric vehicles. The automobile companies will have to shift to EV manufacturing gradually over the next few years. There is huge potential and we are eying INR1 trillion investment in this sector over the next 10-12 years." He added that MIDC has allotted 75 acres to a US-based EV manufacturing firm in Pune, and the firm will be investing around INR30 billion. (IHS Markit AutoIntelligence's Tarun Thakur)

- Taiwan's Foxconn will build electric vehicle (EV) batteries and electric motors, and relocate its telecommunication spare part manufacturing facilities from China to the Batang integrated industrial area in Central Java, in a move estimated to bring around IDR114 trillion (approximately USD8 billion) direct investment to Indonesia, reports The Jakarta Globe, citing Indonesian Investment Minister and head of the Investment Coordinating Board (BKPM) Bahlil Lahadalia. Indonesia's aim to develop a global-scale EV industry and attract more investment to its shores will receive a significant boost from Foxconn's investment. The BKPM aims to attract IDR1,200 trillion in domestic and foreign investment this year, up 33% from IDR901 trillion last year, highlights the report. (IHS Markit AutoIntelligence's Jamal Amir)

- Location technology provider what3words has announced in a

press release that the Vietnamese automaker VinFast has integrated

its solution across its entire battery electric vehicle (BEV)

line-up. Vinfast says that the collaboration is in line with its

"Technologies for Life" approach of offering its customers exciting

experiences and optimal utilities to enhance their lives. "It can

be a frustrating experience putting an address into a navigation

system. Even if you have a building number, address and postal

code, you can still be left driving around trying to work out

exactly where the entrance is. Now, when a VinFast driver enters a

what3words address, they can be confident that the location is

accurate to 10ft, every time," said what3words CEO and co-founder

Chris Sheldrick. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-february-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-february-2022.html&text=Daily+Global+Market+Summary+-+4+February+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-february-2022.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 4 February 2022 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-february-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+4+February+2022+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-february-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}