Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 04, 2022

Daily Global Market Summary - 4 January 2022

All major European equity indices closed higher, APAC was mixed, and most US indices closed lower. US government bonds closed lower, while benchmark European bonds were mixed. CDX-NAIG and iTraxx-Europe closed flat, CDX-NAHY was wider on the day, and iTraxx-Xover closed tighter. The US dollar, oil, gold, silver, and copper closed higher, while natural gas was lower.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Most major US equity indices closed lower except DJIA +0.6%, which closed at another all-time high; S&P 500 -0.1%, Russell 2000 -0.2%, and Nasdaq -1.3%.

- 10yr US govt bonds closed +2bps/1.65% yield and 30yr bonds +5bps/2.07% yield.

- CDX-NAIG closed flat/50bps and CDX-NAHY +2bps/294bps.

- DXY US dollar index closed +0.1%/96.26.

- Gold closed +0.8%/$1,815 per troy oz, silver +1.1%/$23.06 per troy oz, and copper +1.2%/$4.48 per pound.

- Crude oil closed +1.2%/$76.99 per barrel and natural gas closed -2.6%/$3.58 per mmbtu.

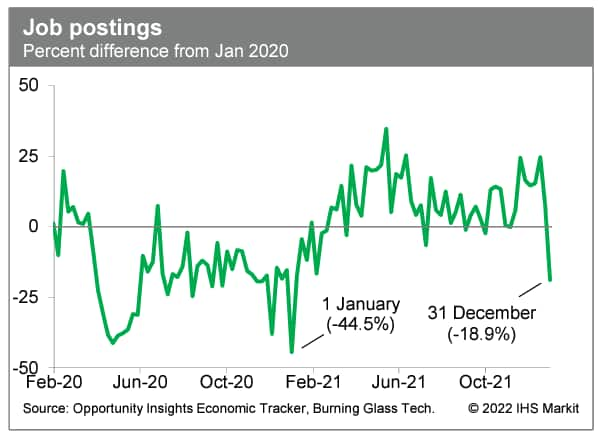

- Job postings fell sharply last week to 18.9% below the January

2020 level, according to the Opportunity Insights Economic Tracker.

This was the lowest level in a year and considerably below the

recent trend. These data are not seasonally adjusted and could

reflect a lull in advertised openings around the holidays. Indeed,

this index exhibited a similar weakening last year at this time.

Next week's reading will clarify whether labor demand has truly

softened. (IHS Markit Economists Ben

Herzon and Lawrence Nelson)

- US job openings fell by 529,000 to 10.6 million between the

last business days of October and November. The job openings rate

dropped four-tenths of a percentage point to 6.6%. (IHS Markit

Economist Patrick

Newport)

- The number of hires moved up by 191,000 to 6.7 million during November; the rate edged up a tick to 4.5%.

- Job separations increased by 382,000 to 6.3 million; the separations rate climbed two-tenths of a percentage point to 4.2%. Separations consist of quits, layoffs and discharges, and other separations.

- Quits accounted for almost all the increase in separations, soaring by 370,000 to a series high of 4.5 million; the quits rate also rose to a series high of 3.0%. Typically, a high quits rate is a good thing, as it indicates that workers can improve their lot by pursuing opportunities elsewhere. In the age of COVID-19, though, quits could rise because workers are leaving unsafe working conditions or eschewing vaccine mandates. (Note: quits exclude retirements.)

- Layoffs and discharges were about unchanged in November at 1.4 million; the rate was unchanged at a series-low 0.9%.

- Other separations moved down by 8,000 to 377,000; the other separations rate was unchanged at 0.3%. Other separations include retirements, deaths, employee disabilities, and transfers to other locations.

- Over the 12 months ending in November, there was a net employment gain of 5.9 million. This compares with payroll and household employment increases of 5.8 million and 5.4 million, respectively, from a year earlier in November.

- There was a record-low 0.7 unemployed worker for every job opening at the end of November.

- Bottom line: The changes in November's numbers were too small to gauge if labor markets were tightening or loosening. It is still a worker's market: quits are high, layoffs are few, and jobs are plentiful. Next month, the effects of the Omicron variant will start showing up in the data.

- The USDA reports that organic apple supplies are tight, pushing

up the wholesale prices amid continuous rising demand in the US. On

25 December 2021, average organic apples were sold for $56.26 per

carton at US wholesale markets tracked by the USDA, 41% higher than

conventional apples on the same day. (IHS Markit Food and

Agricultural Commodities' Hope Lee)

- Size 72 Washington organic gala apples were traded at $36 per carton on 29 December, up slightly from a year ago.

- The national average shipping point price for organic apples on 25 December was $29.65 per carton, just 3% higher than conventional.

- Average retail promoted price for organic apples was $1.81 per pound in early December, up from $1.61/lb in early December 2020.

- The fall in organic apple crop production (just like conventional apples) contributed to the tight supplies and price increase. "As organic apple inventories dwindle, the prices for domestic organic apples could head higher in coming months," a source said.

- In November, the Washington organic apple crop was projected to top 15 million cartons while the Washington state overall crop was projected at 118 million cartons.

- A few sources have seen organic demand for all varieties grow. Some orchards have been positioned to meet the demand. Varietal mixes on the retail shelf are important to sustain consumer interests.

- The City of New York (United States) has furthered an investment towards its target of an all-electric municipal fleet with the announcement of an order for 184 Ford Mustang Mach-E vehicles. According to the city's statement, the vehicles will be used by the New York Police Department (NYPD), New York City Sheriff's Office, the Department of Correction, the Department of Parks and Recreation, the Department of Environmental Protection, NYC Emergency Management, DCAS Police, and the Office of the Chief Medical Examiner. New York City said that it is due to receive its Mach-E vehicles by 30 June, and that they will replace current internal combustion engine (ICE) vehicles in the city's fleet. The city has ordered Mustang Mach-E GT versions, with 270 miles of range, focusing on the vehicle's 27 feet of cargo space for storing critical emergency and law enforcement gear. New York City also said that it will spend USD11.5 million on the initial orders and that the contract will remain in place for five years. It said that it operates a fleet of nearly 30,000 vehicles, with the NYPD operating more than 6,200 and the largest single group. The city is planning to purchase more than 1,250 electric vehicles (EVs) in 2022, as well as expand its charging infrastructure, including fixed charging stations and 180 solar carports and portable chargers. Technology website Engadget has also reported that the city has approved the option of buying up to 250 units of the Tesla Model 3 anytime over the next five years. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Nearly three times more electric vehicle (EV) chargers need to

be installed each quarter along highway corridors or in publicly

accessible spots to meet US President Joe Biden's goal of having

500,000 charging ports in place by 2030, a National Renewable

Energy Laboratory (NREL) report found. (IHS Markit Net-Zero

Business Daily's Amena

Saiyid)

- Released 28 December, the report assessing the state of EV infrastructure across the US in the second quarter of 2021 said an average of 5,322 public EV ports had been installed in each quarter since 2020. But NREL researchers say approximately 14,706 new public installations will be required each quarter for the next nine years to meet the Biden administration's 2030 target.

- When comparing the current rate of deployment, "it is clear that the pace of installations will need to significantly increase," NREL researchers Abby Brown, Johanna Levene, Alexis Schayowitz, and Emily Klotz wrote.

- However, the US can meet Biden's 2030 charger goal much earlier than expected to coincide with surging demand, Mark Boyadjis, IHS Markit global automotive technology lead, told Net-Zero Business Daily 3 January. IHS Markit projects there will be 9.3 million EVs on US roads by 2026, up from 1.5 million EVs in 2020, he said.

- In fact, IHS Markit's automotive team projects an additional 600,000 charging units will be needed in public spaces and workplaces by 2026 to meet EV demand.

- According to NREL, the number of public EV ports in the US increased by 5,006 in Q2, bringing the total to 105,765 and representing a 5.0% increase since the first quarter of 2021.

- The Central Bank of the Argentine Republic (Banco Central de la

República Argentina: BCRA) on 30 December 2021 stated that

peer-to-peer (P2P) payment companies, also known as digital

wallets, will need to fulfil a 100% reserve requirement on the

funds deposited by clients. Prior to this obligation, P2P services

were required to only hold the funds in Argentine banks. The

measure does not apply to interest-earning accounts (often called

investment services) offered by financial technology (fintech)

companies. (IHS Markit Banking Risk's

Alejandro Duran-Carrete)

- The adoption of the measure will represent an additional challenge to fintech businesses to remain profitable despite the fact that most of these companies offer both P2P payment and investment services and that a large proportion of their income comes from investment accounts.

- This is because the enterprises had opted to deposit the P2P service funds into traditional banks, allowing them to earn interest. Given Argentina's highly inflationary environment, not earning interest from the funds - as it will be with the disposition of the BCRA - will represent a substantial loss in real terms.

- This is likely to lead to fintech companies incentivizing the reduction of their clients' holding of money in P2P wallets by increasing the use of investment services.

- In turn, while the traditional banking sector is likely to maintain its relevance over payments market, the measure will likely represent a lost opportunity for the sector to increase their customer base. This is because these digital services are beginning to reduce the use of cash in the country, providing a potential increase in the number of banking customers. Additionally, and from a more structural perspective, it is likely to represent a moderate loss of liquid funds to the banking sector.

Europe/Middle East/Africa

- All major European equity markets closed higher; UK +1.6%, France +1.4%, Germany/Italy +0.8%, and Spain +0.4%.

- 10yr European govt bonds closed mixed; France -1bp, Germany/Spain flat, Italy +2bps, and UK +12bps.

- iTraxx-Europe closed flat/48bps and iTraxx-Xover -2bps/240bps.

- Brent crude closed +1.3%/$80.00 per barrel.

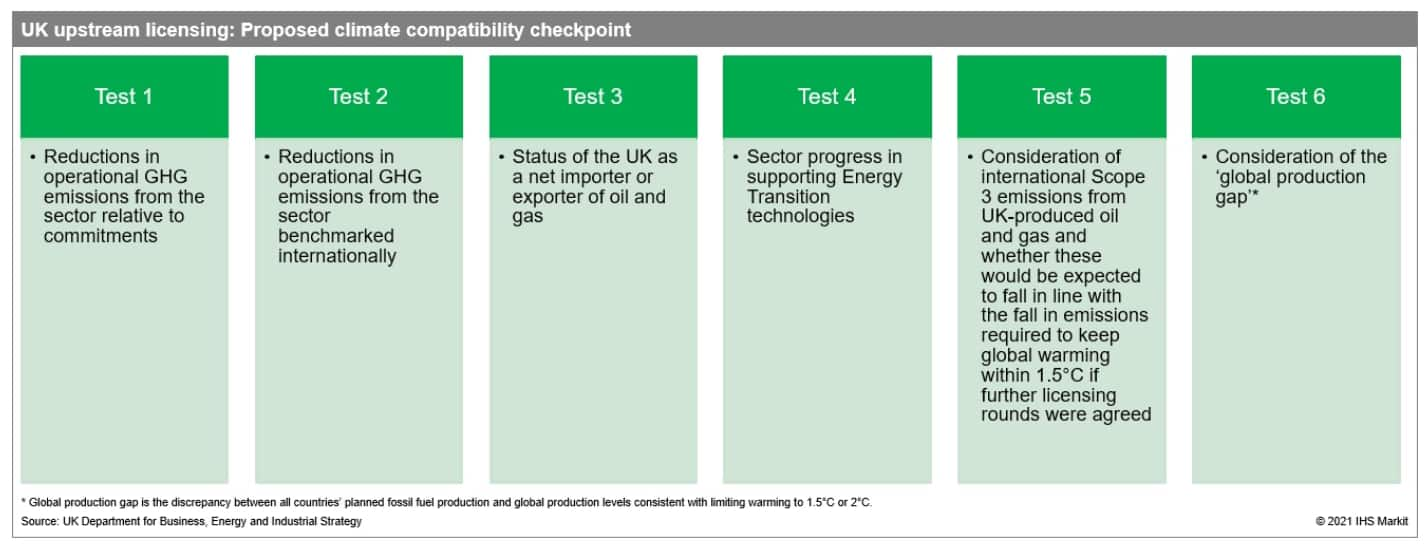

- In late December 2021, the UK government announced public

consultations on its draft climate compatibility checkpoint (the

checkpoint), a series of tests intended to align the existing

upstream licensing framework with the country's 2050 net-zero

emissions target. The proposed criteria range from operational

emissions to investment in low-carbon projects and is intended to

inform the Oil and Gas Authority (OGA)'s decision-making on new

licensing rounds. Public consultations will run through February

2022 and the checkpoint is expected to be finalized before the end

of the year, which is likely to delay any potential bid round until

2023. The checkpoint indicates the UK government's continued

efforts to bolster the oil and gas industry's social license to

operate even as political and public sentiment is shifting towards

a gradual phase-out of hydrocarbon production. The government has

developed the checkpoint as part of its ongoing regulatory overhaul

in the upstream sector, aimed at strengthening environmental

oversight and facilitating the energy transition in the industry.

(IHS Markit E&P Terms and Above-Ground Risk's Aliaksandr

Chyzh)

- Fish producers and processers will be hard pressed to meet a

planned new 0.3 milligrams per kilogram (mg/kg) limit for mercury

in some species of fish, IHS Markit has learned. The new limit

tightening up the maximum authorized amount of mercury in certain

fish and seafood species from the current 0.5 mg/kg, comes in a

draft European Commission implementing regulation to the EU's 2006

regulation on contaminants in food (1881/2006). (IHS Markit Food

and Agricultural Policy's Sara Lewis)

- The draft regulation is currently before the European Parliament and Council for a three-month scrutiny period after receiving the green light from member states at a 30 November meeting of the Standing Committee on Plants, Animals, Food and Feed (SC PAFF) novel foods and toxicological safety of the food chain section.

- The 0.3 mg/kg limit will bring processors "complications depending on the size and maturity of fish," Katerina Sipic, Secretary General of the EU Fish Processors and Traders Association (AIPCE-CEP) told IHS Markit.

- Pierre Commere Delegate General of the AIPCE-CEP's French affiliate noted that the sector does not expect difficulties with the 0.3 mg limit for sardines, anchovies, mackerel, salmon and trout.

- But it will pose a problem for other species. "Generally, mercury has a telluric origin (submarine volcanoes) and follows a process of bioaccumulation and bioconcentration through the trophic chain; this cannot be managed in the wild (capture fish)," Commere explained.

- In answer to our question about monitoring, Commere confirmed that processors would only know that mercury levels were high in individual fish once caught and tested, "but contamination can be monitored on a statistical basis - we build up database with thousands of data which makes predictions highly reliable."

- Asked about whether mercury levels could be monitored in the water where fish were caught, Commere responded: "This has nothing to do with the waters in which the fish are swimming, but rather with their diet. This becomes even more true with highly migratory species."

- Germany's biggest industrial union IG Metall is on a collision course with Tesla CEO Elon Musk as it looks to unionize the company's new plant in Grünheide, according to an Automotive News Europe (ANE) report. The union wants to unionize as many employees as possible at the plant and to this effect has opened an office nearby, according to IG Metall's district leader for Berlin, Brandenburg and Saxony, Birgit Dietze. The union will support the election of a works council and the local office will be on hand to advise on all manner of labor relations issues, including pay, working hours and employment contracts. Dietze also commented that Tesla's plan to offer a significant portion of compensation as stock options depending on performance would not be acceptable to her union. Tesla's management has resisted attempts to unionize at any of the company's other plants, and while it may have more tools at its disposal to do this in the US and China, it will be more difficult in Germany, where co-determination laws ensure strong workers' rights. (IHS Markit AutoIntelligence's Tim Urquhart)

- Mercedes-Benz will focus on styling and aerodynamics as it looks to maximize the efficiency of its electric sport utility vehicles (SUVs), according to an Autocar report. Commenting at the launch of the company's impressive new EQXX concept at the CES in Las Vegas, the company's chief technology officer Markus Schäfer outlined how the company would evolve the styling of its electric SUVs to maximize their efficiency. He said, "Definitely we will see different shapes of SUVs. I truly believe the shape of SUVs will change, at least if efficiency matters to a car company, and it does to us. It has to drop a little bit to the rear of the car, and the width of the front and rear axles might not be the same. There are some slight optimizations that can be done to a vehicle to dramatically change the efficiency and consumption." He added, "But ultimately we have to take the customer into consideration, and the customer loves SUVs, no doubt. They love SUVs and the market share is still rising, but the shape probably will change." By definition, a SUV will never be as aerodynamically efficient as a more conventional, lower-riding passenger car design because they have larger frontal areas, which is a major impact on overall drag co-efficient. However, Schäfer's comments would appear to confirm that OEMs will invest more heavily in aerodynamic research to hone the drag co-efficient factors of BEVs, especially at the higher end of the market, to the greatest possible degree. (IHS Markit AutoIntelligence's Tim Urquhart)

- A tender for multiple renewable energy projects in Russia was

held in September 2021. A total of 2.63 GW of capacity was

awarded—1.85 GW for wind power and 0.78 GW for solar. This

represents the first tender within the framework of the second

government support program to stimulate clean energy growth in

Russia, the new so-called Capacity Supply Agreement (CSA 2.0) for

renewables procurement that went into effect in 2021. Completion of

the new capacities would represent an increase of nearly 40% in

Russia's existing renewable capacity; installed renewable capacity

in 2020 was about 4.3 GW: 1.7 GW of solar and 2.5 GW of wind. (IHS

Markit Executive Briefings: Climate and Cleantech's Andrew Bond, Anna

Galtsova, and Matthew

Sagers)

- Winning bidders were selected based on the lowest levelized cost of electricity (LCOE) generated. Previously, selection was made on the basis of lowest capex per unit of capacity. The government announced in 2020 that compensation would be adjusted, with successful bidders receiving payments under a contract-for-difference mechanism, by which the electricity provider is guaranteed a fixed return regardless of actual power prices.

- The main goal of renewables development in Russia is not decarbonization but manufacturing and technological development. The tender specified fairly high local content requirements, with onerous penalties for non-compliance, with further mandates on domestic manufacturing of the equipment utilized in development.

- Winning bids in the tender were surprisingly low. The prices offered by the bidders were not only low for Russia but low even by global standards. The bulk of the winning bids, for 1.391 GW of wind power, were awarded to Vetroparky FVR. This company is a JV between state-owned Rosnano and Finnish power company Fortum.

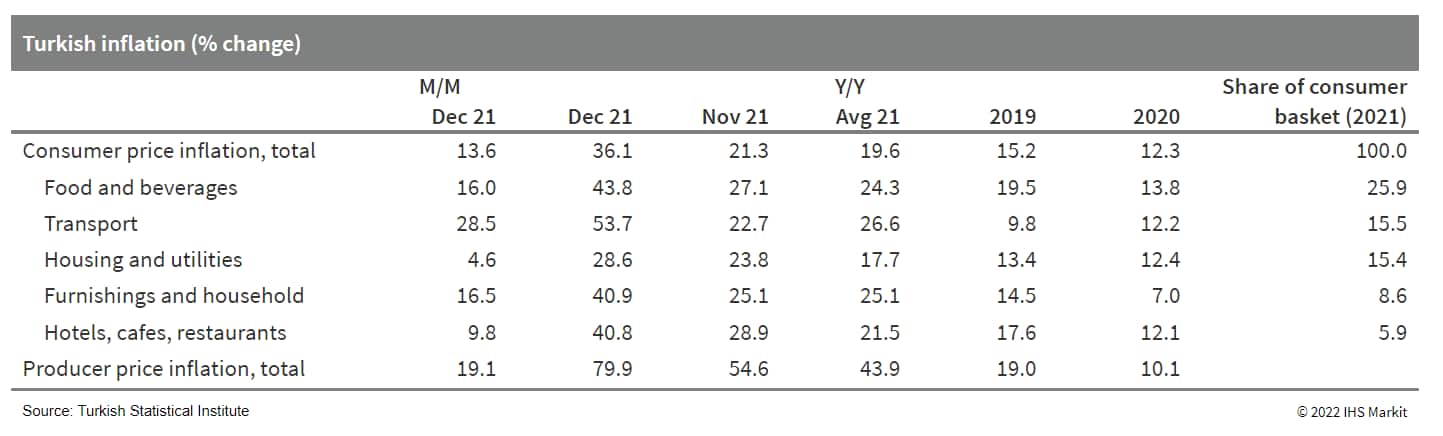

- Turkish inflation soared at the end of 2021, pushing end-year

consumer price growth to above 36%. The sharp depreciation of the

lira - it fell by over 90% against the US dollar in 2021 - was the

overriding impact on inflation. Recent central bank and government

efforts to boost demand for the lira may help to stabilize the

currency, but initial efforts have proven temporary. Given the

impact of lira losses on domestic prices, inflation will remain

extremely high in early 2022, forcing the central bank to pause its

rate cutting cycle. (IHS Markit Economist Andrew

Birch)

- The Turkish Statistical Institute (TurkStat) reported a surge of consumer price inflation in December, with prices jumping by 13.6% month on month (m/m). The end-month rise of prices pushed the end-2021 inflation rate to 36.1%; by far the highest such annual increase since September 2002, immediately following the country's banking crisis. With price growth rising sharply in the final quarter of the year, the annual average inflation rate for 2021 rose to nearly 20%.

- TurkStat also reported that annual "core" consumer price inflation, stripping out more volatile food and energy prices, also surged in December, reaching 31.9%. Şahap Kavcıoğlu, governor of the Central Bank of the Republic of Turkey (TCMB) has stated the core rate is guiding monetary policy decisions. President Recep Tayyip Erdoğan has claimed the core inflation rate would soon decelerate thanks to current interest-rate policies.

- Also in December, the annual producer price inflation rate skyrocketed to 79.9%. Even the annual average producer price inflation rate rose sharply in 2021, reaching nearly 44%, more than quadrupling the rise of prices the previous year.

- Although the December rate of inflation outstripped IHS Markit

expectations, TurkStat is likely still under-reporting price

growth. A local research group, ENAG, that uses a similar basket of

goods determined the actual rate of inflation in 2021 should have

been 82.8% at end-2021. Such outside observations are important to

digest, given that Erdoğan has directly replaced several top

TurkStat managers, raising questions regarding the agency's

independence.

- The Bank of Uganda (BoU) kept its benchmark policy rate at 6.5%

during its monetary policy committee (MPC) meeting on 20 December

2021; it had lowered the central bank rate (CBR) from 7.0% to 6.5%

in June 2021. (IHS Markit Economist Alisa Strobel)

- At its December meeting, the central bank's MPC announced that it was maintaining the CBR at 6.5%, while the economy continued to show a growth momentum during the fourth quarter of 2021.

- The MPC also decided to maintain the target band on the CBR at plus or minus 2 percentage points, while the margin on the rediscount rate and the bank rate was left unchanged at 3 and 4 percentage points on the CBR, respectively. The rediscount rate and the bank rate were maintained at 9.5% and 10.5%, respectively, at the MPC meeting.

- The central bank highlighted that the inflation forecast has been tilted towards the upside, with an expected annual headline inflation of 5% in the next two to three years. Furthermore, high uncertainty suggests that inflation is likely to continue to rise as the economy recovers further and spare capacity is gradually absorbed.

Asia-Pacific

- Major APAC equity indices closed mixed; Australia +2.0%, Japan +1.8%, India +1.1%, Hong Kong +0.1%, South Korea flat, and Mainland China -0.2%.

- Chinese authorities announced the latest program for new-energy vehicle (NEV) subsidies on 31 December 2021. Subsidies on NEVs in public transportation including taxis, city buses, and postal service delivery vans will be reduced by 20% compared with the level of 2021, and those on other NEVs have been reduced by 30%. The subsidy program for NEVs will end by the end of 2022, which means that NEVs registered after 31 January 2022 will no longer receive central-government-funded subsidies. Under the 2022 program, battery electric vehicles (BEVs) with a driving range of 400 km or above will receive a base subsidy of CNY12,600 (USD1,979), while BEVs with a range between 300 km and 400 km are entitled to a subsidy of CNY9,100. The announcement on the subsidy reduction is in line with the government's previous announcements on its intention to phase out subsidies on NEVs. The new subsidy program therefore is unlikely have a major impact on NEV sales, as subsidies on NEVs over the past two years have already been dwindling since 2019 and such changes are well communicated by dealers before the new policy takes effect. (IHS Markit AutoIntelligence's Abby Chun Tu)

- NIO, Xpeng and Li Auto, the three leading startups in China's new energy vehicle (NEV) sector, have all reported strong delivery results for December 2021. Xpeng outsold NIO and Li Auto with 16,000 vehicles delivered, up 181% year on year (y/y). Deliveries in December consisted of 7,459 units of the P7 electric sedan, 5,030 units of the P5 electric sedan and 3,511 units of the G3 and G3i electric sport utility vehicles (SUVs). For the full year 2021, Xpeng's deliveries surged by 263% from a year ago to 98,155 units. Of the total volumes for 2021, 41,751 units were delivered in the fourth quarter of 2021. The P7 was Xpeng's best-selling model in the fourth quarter with a total of 21,342 P7s delivered and for the full-year 2021, cumulative P7 deliveries totaled 60,569 units, accounting for 62% of Xpeng's total deliveries. In a separate statement, NIO announced that it delivered 10,489 vehicles in December, up 49.7% y/y. For the full year 2021, the premium electric vehicle (EV) maker delivered 91,429 vehicles, compared with 43,728 units delivered in 2020. Faced with supply chain constraints, NIO's deliveries still broke records in the fourth quarter of 2021, with 25,034 vehicles delivered in the period, up 44.3% y/y. Li Auto said its deliveries in December 2021 soared 130% y/y to 14,087 units, setting a new monthly record. The strong result in December took Li Auto's fourth-quarter deliveries to 35,221 units, up 143.5% y/y. For the full-year 2021, the company delivered 90,491 vehicles, up 177.4% from a year ago. Despite semiconductor shortages and other supply chain constraints, NIO, Xpeng and Li Auto, the three highest-profile startups in China's NEV market, still managed to ended 2021 with record number of vehicles delivered. The three startups are poised to break their own records in 2022 with new products coming to the market. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Reuters reported on 27 December 2021 that China Huarong Asset

Management Company (AMC) has decided to sell a 70% stake in its

consumer finance unit to Bank of Ningbo for CNY1.1 billion (USD173

million). The deal is subject to regulatory approval and came after

China Huarong and other state-owned AMCs were asked to focus on

their core business. (IHS Markit Banking Risk's Angus

Lam)

- China Huarong faced bond payment difficulties in April 2021 and, as part of the deal to receive support from the authorities, the AMC has been asked to remove non-core assets.

- IHS Markit assesses that by allowing AMCs to focus on their core business, it will improve their capacity to remove bad loans from banks and perform what they had been originally tasked with.

- Furthermore, although not announced, we expect that AMCs will be instrumental in China's plan to remove poor assets. This is likely to take place after a new plan that will push banks to evergreen loans of micro and small enterprises

- Japanese petroleum and energy company ENEOS plans to install 1,000 fast chargers for electric vehicles (EVs) by fiscal year (FY) 2025, reports Japan News. ENEOS president Katsuyuki Ota said, "The number of EVs in Japan is still small, but we want to advance this plan while identifying effective locations." The company plans to set up 100 of these chargers in FY 2022 at its affiliated gas stations. It is also planning on focusing on the development of synthetic fuel made from carbon dioxide and hydrogen. The synthetic fuel can be used in gasoline (petrol)-powered vehicles. ENEOS is a Japanese petroleum company involved in businesses such as the exploration, importation, and refining of crude oil; the manufacture and sale of petroleum products, including fuels and lubricants; and other energy-related activities. In June last year, ENEOS along with US-based EV battery startup Ample collaborated to launch an EV battery swapping service in Japan within this FY ending March 2022. ENEOS will provide logistics, including co-ordination between all the parties, while Ample will operate the facilities such as battery swapping. The companies will also conduct a study where they use the swapping station as a large stationary battery, which will contribute to energy utilization and the ability to use the batteries as an emergency power source. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- VinFast has announced that it will open its reservation portal

for the VinFast VF e35 and VF e36 on 5 January, coinciding with its

CES 2022 expo presentation. According to a statement emailed to IHS

Markit, VinFast will use blockchain technology to certify

reservations, payments and eventually vehicle ownership. The

reservation portal will open for both the US and Vietnamese markets

at the same time, 5PM Pacific time 5 January (8AM 6 January, Hanoi

time). The reservation portal will close on 5 April 2022, with

customers making reservations during that period becoming enrolled

in an exclusive VinFirst 'Pioneer's Gratitude to Pioneers' program.

For customers in the Vietnamese market, the reservation fee for the

VF e35 will be VND15 million (about USD656) for a VND150-million

(about USD6,565) credit toward the purchase price. For the VF e36,

VND20 million will place a reservation and gain a discount of

VND250 million. For the US market, customers who deposit USD200

will receive e-vouchers of USD3,000 for the VF e35 or USD5,000 for

the VF e36. VinFirst members will get a VinFirst NFT (non-fungible

token) certifying their membership; benefits will be transferred

directly to their blockchain wallet based on the NFT. The VinFirst

members are promised to have future benefits and services as a

pioneer member. The blockchain technology, however, will first be

used in the US; other markets may follow in the future. VinFast

also confirmed that all markets will see attractive battery leasing

options and a 10-year warranty. VinFast has been generating a great

deal of news in the second half of 2021 and early 2022 as it

executes expansion plans, although there is still some distance to

go for creating broader awareness with US consumers. VinFast's new

EVs will be among about 15 new electric utilities due on sale in

the US in 2022. (IHS Markit AutoIntelligence's Stephanie

Brinley)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-january-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-january-2022.html&text=Daily+Global+Market+Summary+-+4+January+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-january-2022.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 4 January 2022 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-january-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+4+January+2022+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-january-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}