Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 04, 2021

Daily Global Market Summary - 4 March 2021

European equity markets closed mixed and all major US and APAC indices closed lower. US government bonds closed sharply lower and European bonds closed higher. European iTraxx was flat across IG and high yield, while CDX-NA was wider on the day. The US dollar and oil closed higher, while gold, silver, and copper were all lower.

Americas

- US equity markets closed lower; Russell 2000 -2.8%, Nasdaq -2.1%, S&P 500 -1.3%, and DJIA -1.1%.

- 10yr US govt bonds closed +7bps/1.56% yield and 30yr bonds +4bps/2.32% yield.

- CDX-NAIG closed +2bps/57bps and CDX-NAHY +9bps/311bps.

- DXY US dollar index closed +0.7%/91.63.

- Gold closed -0.9%/$1,701 per ounce, silver -3.5%/$25.46 per ounce, and copper -3.9%/$3.98 per pound.

- Crude oil closed +4.2%/$63.83 per barrel.

- US seasonally adjusted (SA) initial claims for unemployment

insurance edged up by 9,000 to 745,000 in the week ended 27

February. The not seasonally adjusted (NSA) tally of initial claims

rose by 31,519 to 748,078. Initial claims continue to remain at

historically high levels—the high during the Great Recession

was 665,000. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, fell by 124,000 to 4,295,000 in the week ended 20 February. The insured unemployment rate edged down 0.1 percentage point to 3.0%.

- There were 436,696 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 27 February. In the week ended 13 February, continuing claims for PUA fell by 191,803 to 7,328,311.

- In the week ended 13 February, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) fell by 600,607 to 4,466,916. With the latest extension to 24 weeks for PEUC, eligible recipients can receive up to 50 weeks of unemployment benefits between the regular state programs and PEUC.

- The Department of Labor provides the total number of claims for benefits under all its programs with a two-week lag. In the week ended 13 February, the unadjusted total fell by 1,018,763 to 18,026,537.

- US productivity (output per hour) fell sharply in the fourth

quarter, partially reversing a surge over the prior two quarters

related to disruptions stemming from the pandemic. (IHS Markit

Economists Ken Matheny and Lawrence Nelson)

- Hours rose sharply in the fourth quarter, while compensation per hour posted a small increase. Unit labor costs rose sharply in the fourth quarter.

- Relative to the fourth quarter of 2019, productivity is up 2.4%, a somewhat larger increase than during 2019 (1.9%). Over the same period, compensation per hour has jumped 6.7% as employment in lower-wage sectors remains more severely impacted by the pandemic than employment in higher-wage sectors. Unit labor costs rose 4.2% over 2020, the largest calendar-year increase since 2012.

- We expect growth in compensation per hour to moderate eventually as distortions related to the pandemic ease. We expect productivity growth to remain solid amid strong growth in output, with unit labor costs likely to moderate.

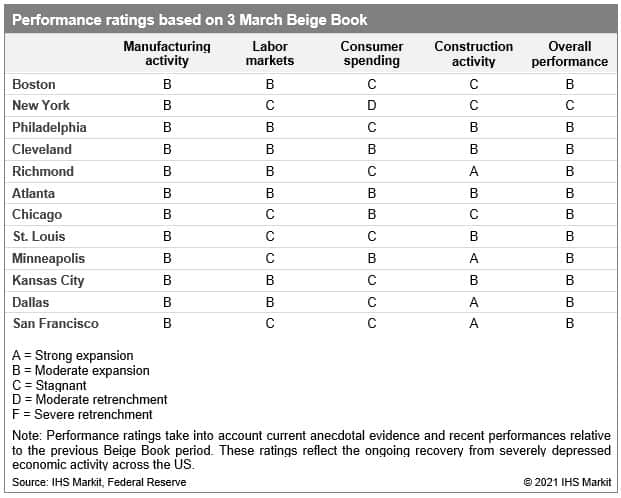

- While ongoing weakness in the leisure and hospitality sector

contributed to slight declines in economic activity in the

Northeast, the broad decline in COVID-19 cases and loosening of

pandemic restrictions in much of the country spurred widespread

modest growth from January to early February according to the US

Federal Reserve's latest Beige Book report, containing anecdotal

information from regional business contacts. (IHS Markit Economist

James Kelly)

- Consumer spending was supported by slightly stronger retail sales early in the year as additional stimulus payments were distributed, with notable increases seen in the West and the Midwest. Most retail growth occurred at home improvement, furniture, and food stores, reflecting more home construction and remodeling activity.

- Labor markets were sluggish in the Midwest and Plains states as harsh winter weather and continuing weakness in leisure and hospitality led to stagnant or declining job counts.

- Manufacturing activity accelerated in most regions, but gains were more modest around the Great Lakes and parts of the South. Labor shortages and supply chain disruptions led to slower production for many manufacturers, while winter storms in Texas resulted in brief shutdowns for some plants.

- Construction activity for single-family homes was robust in the

South from the Carolinas to Texas but was unable to match demand in

much of the region. Inventories remained low with reports of homes

selling "within an hour" and "sight-unseen" in some areas.

- US manufacturers' orders rose 2.6% in January, while shipments

rose 1.9% and inventories rose 0.1%. Orders for core capital goods

rose 0.4% in January, revised somewhat lower from the advance

estimate, and shipments of core capital goods rose 1.8%, also

revised somewhat lower. (IHS Markit Economists Ben Herzon and

Lawrence Nelson)

- The key aspect of today's report is the extent to which orders and shipments have recovered from lows last spring. Both measures have surpassed their pre-pandemic trends: shipments in January were 3.2% above February 2020 and orders were 2.6% above February 2020.

- The manufacturing sector is also being boosted by elevated demand for business equipment, as businesses appear to be optimistic about the near future and are re-engaging investment plans that were put on hold last spring.

- Indeed, informed mainly by the elevated levels of core orders and shipments, we look for equipment spending to grow in the first quarter at an 11.7% annual rate to a level that exceeds the pre-pandemic peak reached in early 2019.

- Motional, a joint venture (JV) between Hyundai and Aptiv, has selected Ambarella's CVflow AI processors for its driverless vehicles. These processors will work in conjunction with Motional's sensor suit to enable safe vehicle operation in diverse and challenging road conditions. Ambarella's CVflow system on chips (SoCs) will be part of driverless vehicles' central processing module to provide image and computer vision processing for cameras. CVflow AI engine will facilitate computer vision tasks, such as object detection, classification, and image segmentation. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Vietnamese automaker VinFast plans to build a vehicle manufacturing plant in the United States with the aim of selling electric vehicles (EVs) in California in 2022, reports the Hanoi Times. The automaker declined to provide details about the investment, timing, and location. However, it will develop high-end models for the market in the immediate term and open 35 showrooms and service centers this year. VinFast joined the automotive market three years ago and has made use of relationships with suppliers and other automakers to develop vehicles quickly. Partners and consultants have included BMW, Magna Steyr, AVL, Pininfarina, Siemens, Bosch, Torino Design, Italdesign, and Zagato. (IHS Markit AutoIntelligence's Jamal Amir)

- K2 Management has been appointed by US Wind as owner's engineer to support with project management for the first 270 MW phase of the MarWind project. The scope also includes design and engineering, package management, tender and negotiation support. The project has been slow to move since US Wind was awarded Offshore Renewable Energy Credits for the first phase in 2017. US Wind holds the rights to the Maryland Wind Energy Area under the Bureau of Ocean Energy Management (BOEM). The area, located up to 48 kilometers offshore the coast of Maryland, spans approximately 80,000 hectares, and can generate up to 1.5 GW of power. (IHS Markit Upstream Costs and Technology's Melvin Leong)

Europe/Middle East/Africa

- European equity markets closed mixed; Spain +0.3%, Italy +0.2%, France flat, Germany -0.2%, and UK -0.4%.

- 10yr European govt bonds closed higher; UK -5bps, Germany -2bps, Spain/France -1bp, and Italy flat.

- iTraxx-Europe closed flat/49bps and iTraxx-Xover +1bp/252bps.

- Brent crude closed +4.2%/$66.74 per barrel.

- UK Finance Minister Rishi Sunak outlined his 2021 budget, which

pledged more resources to combat the COVID-19 virus pandemic and

protect the recovery over the next two years. However, he announced

stark tax rises on companies and households, which will amount to

GBP25 billion by 2025. (IHS Markit Economist Raj Badiani)

- The UK economy is likely to expand by 4.0% (down from the 5.5% published in late-November 2020) in 2021 and 7.3% (up from 6.6%) in 2022. This implies that GDP will return to its pre-COVID-19 levels by mid-2022.

- Unemployment is expected to peak at 6.5% next year, lower than the 7.5% previously predicted. This is well below the last peak of 8.5% in 2011 after the 2008-09 recession.

- The OBR estimates that about 600,000 jobs have been lost during the COVID-19 virus crisis.

- The government will guarantee mortgages where homebuyers can only provide a 5% deposit. The scheme will be available to current homeowners as well as first-time buyers looking to buy a house worth up to GBP600,000.

- The government plans to spend an additional GBP44.3 billion on its COVID-19 support measures, taking a total cost of GBP344 billion.

- The Coronavirus Job Retention Scheme (CJRS; furlough scheme) runs an additional five months to the end of September. The government continues paying 80% of employees' wages for hours they cannot work until employers start contributing 10% in July and 20% in August and September. The number of people on the CJRS had increased from 4.0 million at the end of 2020 to 4.7 million during January.

- The government announced that the personal income tax allowance will be raised to GBP12,570 from April 2022 but then will be frozen until April 2026.

- The 2021 budget plan has a three-fold strategy. First, the government extends its COVID-19 support package until the end of September, which goes beyond the planned end of the restrictions in June. Second, Sunak hopes to encourage companies to invest more before they face higher taxes from April 2023. Third, he has begun the process to repair the fiscal accounts, which will gather significant momentum in 2023-26.

- The OBR notes that the cumulative fiscal tightening is significant during 2023-26, which entails "raising the headline corporation tax rate, freezing personal tax allowances and thresholds, and taking around £4 billion a year more off annual departmental spending plans, raising a total of GBP31.8 billion".

- The United Kingdom's Able Marine Energy Park (AMEP) will be the beneficiary of a GBP75 million (USD104 million) grant from the UK government in its Ten Point Plan that sets aside GBP160 million to support the manufacturing and ports infrastructure to support its offshore wind sector ambitions. The UK government will also sign a memorandum of understanding with Teesworks Offshore Manufacturing Centre to support the development of another hub for the offshore wind sector. AMEP will attract investments of GBP500 million of which more than half will be allocated to land development and acquisition. (Upstream Costs and Technology's Melvin Leong)

- The German passenger car market suffered its worst February performance since 2007 with a 19% year-on-year (y/y) decline in registrations during the month to 194,349 units, according to data from the Federal Motor Transport authority (KBA). This left the year-to-date (YTD) for the first two months of the year substantially down by 25.1% y/y to 364,403 units, with the January sales trend also downward, as a result of the VAT rate returning back to 19% after it was lowered to 16% to boost the economy during the initial response to the coronavirus disease 2019 (COVID-19) virus pandemic. There was a marked split between private and fleet/business registrations during the month. The former declined by 26.8% during February, which perfectly illustrated the impact of the ongoing shutdown of dealerships on the private market. This represented a very low 30% share of the overall market. Fleet and business registrations fell by a lower rate of 15.2% y/y to take a 70% share of the overall market. (IHS Markit AutoIntelligence's Tim Urquhart)

- Evonik Industries expects to complete the carve-out of its superabsorbent polymers (SAP) business by this summer, says chairman Christian Kullmann. Speaking on Thursday at the company's annual results press briefing, Kullmann said that the carve-out is making good progress and on schedule, but that Evonik has not decided on a preferred outcome for the SAP business. "We'll see if a sale or partnership is a better alternative, but we'll find a good safe haven for it," he said. "We are thinking in terms of scenarios and will choose the best option." The separation of the SAP business forms part of Evonik's transformation program to become more focused on specialties. The plan includes the divestment of the company's methacrylates business in 2019. Evonik also reorganized in July 2020 into four operating divisions and designated three of them—specialty additives, nutrition and care, and smart materials—as growth businesses. The other division is performance materials, which currently includes the SAP business. (IHS Markit Chemical Advisory)

- Volvo Autonomous Solutions has formed a partnership with verification expert Foretellix to develop a verification tool for autonomous vehicles (AVs) deployed on highways and in confined areas. To achieve this, the companies will jointly create a Coverage Driven Verification solution that enables massive testing of millions of scenarios, which will validate AVs and machines encountering any type of situation within their specified Operational Design Domain (ODD). Magnus Liljeqvist, global technology manager of Volvo Autonomous Solutions, said, "Volvo Autonomous Solutions believes in a collaborative verification concept, one that uses open standards. The partnership with Foretellix gives us access to the state-of-the-art verification tools and accelerating our time to market." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Framo, a pump supplier widely known for its oil and gas pumping products, has received an order from Saipem for the supply of its marine pumping systems. The equipment will be used on the Seagreen offshore wind project in Scotland for the installation of the suction bucket foundations on the wind turbine monopiles. (IHS Markit Upstream Costs and Technology's Melvin Leong)

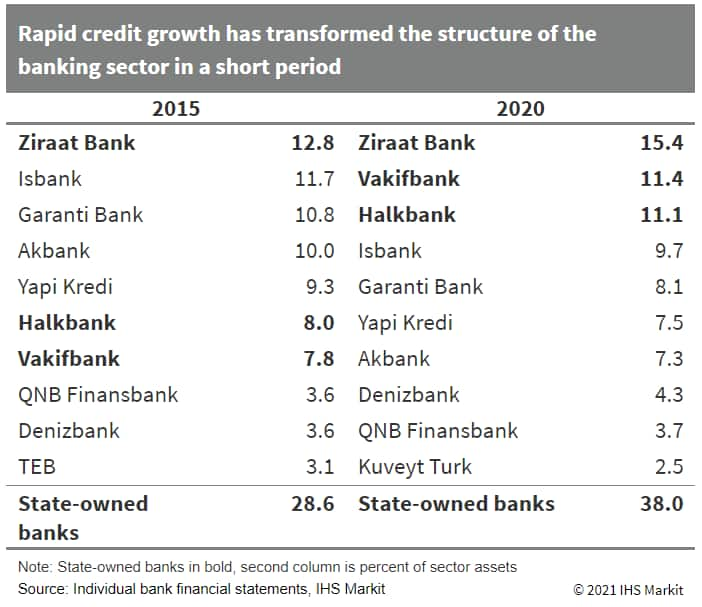

- Nine of Turkey's largest banks released their end of 2020

results in recent weeks, showing moderation in on-paper

non-performing loans (NPLs), increase in precautionary reserves,

higher capital buffers, decline in structural liquidity risks, and

steady but low profitability. Nearly across the board, the results

reflect rapid credit expansion and financial soundness indicators

that are broadly in line with the end of 2019 results in spite of

the COVID-19-virus pandemic. (IHS Markit Banking Risk's Alyssa

Grzelak)

- Rapid credit extension raises already elevated credit risks looking forward into 2021-22. Loose monetary policy prevailed for most of the year, forbearance and other loan stimulus measures had the desired effect of maintaining the flow of credit to the Turkish economy. Overall, bank loans were up by 34.7% year on year (y/y) in 2020, more than triple the 10.9% y/y growth registered in 2019 and marking the highest rate of loan book expansion since 2006.

- The end of 2020 results released by Turkey's largest banks did not show deterioration in major financial soundness indicators, this was expected in light of extensive forbearance measures put in place last year and the outlook for credit risk materialization as support measures diminish remains highly uncertain.

- IHS Markit remains particularly concerned about the outlook for

state-owned banks' asset quality in light of significant government

pressure on these banks to lend in support of economic growth

before and during the COVID-19-virus pandemic.

Asia-Pacific

- APAC equity markets closed lower; Hong Kong -2.2%, Mainland China/Japan -2.1%, South Korea -1.3%, India -1.2%, and Australia -0.8%.

- Dow says that it signed on Thursday a memorandum of understanding (MOU) with the Zhanjiang Economic and Technological Development Zone (Zhanjiang EDZ) administrative committee to build the Dow South China Specialties Hub on Donghai Island at Zhanjiang, China. It is a multiyear project that will provide customers with local access to Dow's portfolio, the company says. The new manufacturing hub would extend Dow's local reach, enhancing supply reliability and responsiveness to market needs as well as customized innovation, and better position customers for success in markets including automotive, pharmaceuticals, cleaning chemicals, apparel, lubricants, and adhesives, Dow says. Further details have not been disclosed. Dow notes that under the terms of the MOU, it would invest approximately $250 million to construct specialty polyurethanes and alkoxylates facilities with a total product capacity of approximately 250,000 metric tons/year. The site also offers the opportunity for future development and expansion, the company says. (IHS Markit Chemical Advisory)

- Chinese electric vehicle startup Xpeng Motors has rolled out LFP-battery-powered versions of the P7 and G3 models. Two new P7 single-motor rear-wheel-drive models featuring LFP batteries entered the market on 3 March. The battery capacity for both models will be 60.2 kWh. The two new models are priced at CNY229,900 (USD35,545) and CNY239,900, respectively, depending on the configurations. Both models can deliver a range of 480 km under the New European Driving Cycle (NEDC) test cycle. Apart from the P7, the G3 also has a new model variant with LFP batteries. The vehicle, priced at CNY149,800, will be powered by a 55.9-kWh battery pack. The driving range of the LPF-battery-powered G3 is estimated at 460 km. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Day three at the 2021 CERAWeek by IHS Markit conference went deep on natural gas markets, but also gave space to a detailed series of discussions on cleantech and energy transition business models. Addressing climate change requires hard tech, and hard tech is hard to do. Experience in creating, tracking, handling, and limiting carbon emissions can be a compelling first-mover advantage for firms willing to redeploy their expertise in fossil fuels to cleantech uses, Mitsubishi Heavy Industries Senior Executive Vice President Tak Ishikawa noted on a cleantech investment strategies panel that closed out the day. As an example, the Japanese infrastructure and industrial services firm has deep expertise in large-scale carbon capture and storage associated with its efforts related to coal-fired power plants, and has begun to rework that same technology at a smaller scale for use in cleantech applications, Ishikawa said. (IHS Markit EnergyView Climate and Cleantech's Peter Gardett)

- The Japan Automobile Importers Association (JAIA) has reported

that imported vehicle sales in the country increased by 19.4% year

on year (y/y) to 30,292 units in February. (IHS Markit

AutoIntelligence's Nitin Budhiraja)

- This figure includes sales of foreign brands' imported vehicles, which fell by 4.4% y/y to 19,843 units last month, and domestic brands' imported vehicles, which increased by 126.1% y/y to 10,449 units.

- By brand, Nissan led the imported market with a 20.8% share during February, with its sales coming in at 6,073 units compared with 756 units in February 2020. Mercedes-Benz followed in the rankings with sales of 3,937 units, down 8.4% y/y, and a market share of 13.0%.

- BMW ranked third with a market share of 10.2% and sales of 3,094 units, up 13.6% y/y. BMW was followed by Toyota and Volkswagen (VW) with sales of 2,620 units (up 18.1% y/y) and 2,244 units (down 42.2% y/y), respectively, equating to market shares of 8.6% and 7.4%.

- HHI is developing ships capable of carrying liquefied petroleum gas (LPG) and carbon dioxide (CO2) at the same time. Simultaneously, the company is also developing ammonia carriers and ammonia-fueled ships. On the other hand, HHI holdings has recently entered a deal with Saudi Aramco on the corporation of a hydrogen project. Under the deal, its refining arm, Hyundai Oilbank, will import LPG from Saudi Aramco to produce blue hydrogen. CO2 captured during the production process will be stored and shipped to Saudi Aramco for the extraction of crude oil from exhausted oil fields. (IHS Markit Upstream Costs and Technology's Jessica Goh)

- India's Ministry of Agriculture and Farmers' Welfare has

amended a 1985 regulatory order on fertilizers to include

biostimulants. The Fertiliser (Inorganic, Organic or Mixed)

(Control) Amendment Order, 2021, has an expanded scope and brings

biostimulants under the government's regulatory ambit. It lays down

rules governing the registration, classification and efficacy

trials of biostimulants intended for use by Indian growers. (IHS

Markit Crop Science's Akashpratim Mukhopadhyay)

- In its order, the Ministry states that biostimulants shall be classified under several categories. These are: botanical extracts, including seaweed extracts; biochemicals; protein hydrolysates and amino acids; vitamins; cell-free microbial products; antioxidants; anti-transpirants; and humic and fulvic acid and their derivatives.

- The new rules would require manufacturers and importers to file a registration application with the Controller of Fertiliser before a biostimulant can be rolled out commercially. The applicant must furnish information pertaining to the chemistry of the formulation, such as its source, product specification, method of analysis to confirm that it adheres to specifications, and shelf life.

- Yinson's 80% subsidiary, Rising Sun Energy K (RSEK) has been awarded a contract from NTPC to develop a 190MW solar photovoltaic grid-connected power project at the Nokh Solar Park in Rajasthan, India. The solar power project will be approximately 30km away from Yinson's existing 140MW Bhadla projects which are currently operated by the company's 95% owned subsidiary, Rising Sun Energy. Following the LOA, RSEK will enter into a Power Purchase Agreement (PPA) to supply 25 years of solar power generated electricity to NTPC. The PPA is expected to be executed after certain process formalities have been completed between the parties. (IHS Markit Upstream Costs and Technology's Kelvin Sam)

- According to the Australian Bureau of Statistics (ABS), prior

to the second half of 2020 the country had never recorded real

(inflation-adjusted) GDP growth of over 3% q/q for two consecutive

quarters. (IHS Markit Economist Bree Neff)

- The strong rebound over the September and December quarters means that economic output as measured by GDP ended down just 1.1% from the pre-pandemic levels recorded in the December quarter of 2019, and Australia is therefore likely to return to pre-pandemic levels of output much sooner than anticipated.

- The recovery in economic activity during the December quarter was clearly led by private consumption, as it contributed 2.3 percentage points to growth, with spending up in real terms across all but two categories: food (-1.8% q/q) and electricity, and gas and fuel (-7.5% q/q).

- The consumption spending surge by households was supported by the full reopening of Victoria as consumer spending in the state surged by 10.4% q/q, led by spending on apparel and motor vehicles.

- Consumer purchases of motor vehicles in real terms leapt 31.8% q/q across the whole of Australia, and spending on operating motor vehicles jumped 12.8% q/q as domestic tourism takes off due to restrictions on international travel related to the COVID-19 virus pandemic.

- To meet consumer demand for vehicles, real imports of non-industrial vehicles surged 32.8% q/q in the December quarter after growing 46.8% q/q in the September quarter, contributing significantly to import growth during the quarter.

The pace of growth during the December quarter outstripped all market expectations and was more than twice the level that IHS Markit had expected. Because 2020 ended on a significantly stronger footing - and COVID-19 measures since the start of 2021 have been typically short-lived and highly localized - an upgrade to our 2021 forecast is expected in our March forecast release. GDP growth is likely to be closer to the low 3% range, and this is with a reversion to more subdued q/q growth rates.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-march-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-march-2021.html&text=Daily+Global+Market+Summary+-+4+March+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-march-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 4 March 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-march-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+4+March+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-march-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}