Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 04, 2020

Daily Global Market Summary - 4 September 2020

Equity markets closed lower across the globe, as yesterday's US tech selloff carried over into APAC markets today and another sharp decline after today's open of the US markets drove European markets lower on the day. US equities recovered somewhat from the morning's lows of the days, while a better than expected US employment report triggered substantial selling in US government bonds that gained momentum as the day progressed. iTraxx and CDX credit indices were close to flat on the day despite all of the volatility. Oil had a particularly challenging day, with WTI closing below $40 per barrel for the first time in two months. Concerns continue to grow over an uptick in COVID-19 infections after this weekend's US Labor holiday, as crowds travelling/aggregating during May's Memorial Day holiday is getting some of the blame for this summer's increase in infections in many parts of the US.

Americas

- US equity markets closed lower today after a rollercoaster of activity led by tech, with the S&P 500 down 3% at 10:43am EST, near flat at 3:29pm, and then closing at -0.8%. Nasdaq -1.3% and Russell 2000/DJIA -0.6%.

- US government bonds sold off rapidly after the better than expected US non-farm payroll report, with 10yr US govt bonds closing +8bps/0.72% and 30yr bonds +11bps.

- DXY US dollar index closed +0.1%/92.80 after being as high as 93.23 today near the time of the bottom in US equity markets.

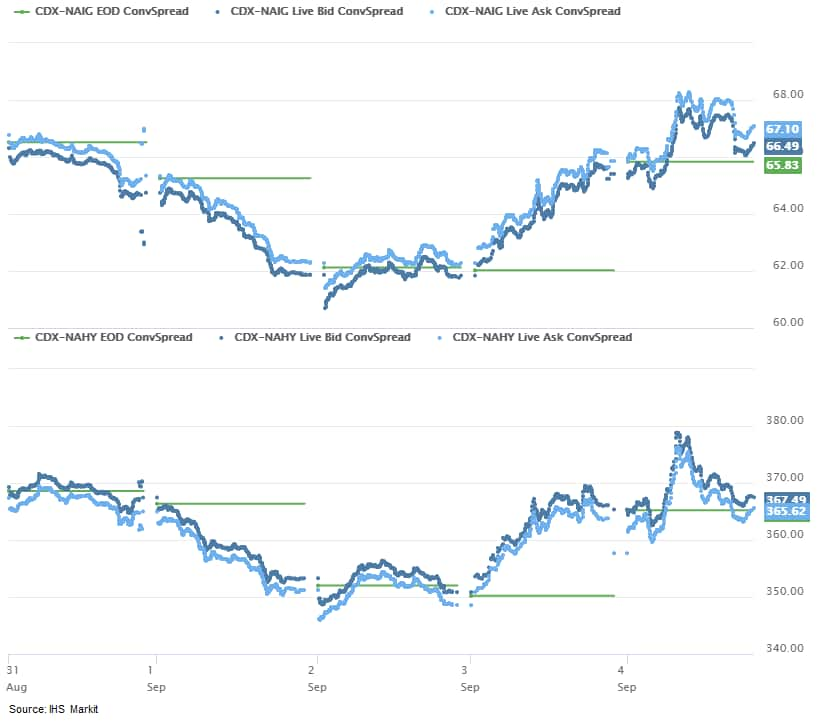

- CDX-NAIG closed +1bp/67bps and CDX-NAHY +1bp/366bps, which is

flat and -1bp week-over-week, respectively.

- Crude oil closed -3.9%/$39.77 per barrel, which is its first close below $40/barrel since 1 July.

- US nonfarm payroll employment rose 1.4 million in August, about

as expected, while the unemployment rate declined 1.8 percentage

points to 8.4%. In response to details in this report that enter

our GDP tracking, we raised our forecast of third-quarter GDP

growth by 0.2 percentage point to a 29.8% annualized rate of

increase. (IHS Markit Economists Ben Herzon and Michael Konidaris)

- The headline increase in payroll employment was boosted by the hiring of 238,000 temporary 2020 Census workers. Private payrolls rose 1.0 million in August.

- The gains in private payrolls have slowed considerably over the last two months, with the level of private employment still well short (10.7 million) of the pre-pandemic (February) peak. This shortfall is most pronounced in leisure and hospitality (4.1 million shy of the February level).

- The unexpectedly sharp decline in the unemployment rate mainly reflected a large, 3.8-million increase in civilian employment that outpaced the increase in payroll employment by about 2.4 million. There has never been a difference in these two measures this large. This partly reflects well known conceptual differences between the two measures.

- Another possible explanation is that businesses that closed in the spring and fell out of the payroll sample reopened in August, boosting civilian employment without affecting payrolls. Also, employees that had been on payrolls thanks to Paycheck Protection Program (PPP) loans, but were not working, may have gone back to work in August, boosting civilian employment but not payrolls.

- If these theories are correct, the gain in civilian employment and the decline in the unemployment rate are likely better indicators of the health of the labor market in August than the slowing in private payroll gains.

- The State University at Oneonta in central New York on Thursday said it's sending students home amid rising Covid-19 rates. The same day, Temple University in Philadelphia called it quits. So did Colorado College earlier in the week. At the University of Alabama, 1,200 of 38,500 students are infected, and the University of South Carolina's positive test rate topped 27%. Even the University of Illinois, a pioneer in saliva testing for students, had to increase patrols to stop large social gatherings after finding more than 700 positive cases. (Bloomberg)

- General Motors (GM) and Honda have announced the signing of an agreement to create a strategic alliance in North America, in a joint statement including letters from the CEOs of both companies. GM and Honda are planning to create a strategic alliance of the companies' businesses in North America. The companies have signed a non-binding memorandum of understanding (MOU) on the alliance, covering "a range of vehicles to be sold under each company's distinct brands, as well as cooperation in purchasing, research and development and connected services". The proposed alliance, according to the statement, will see the two companies collaborate in a variety of vehicle segments in North America, "intending to share common vehicle platforms, including both electrified and internal combustion propulsion systems that align with the vehicle platforms. Co-development planning discussions will begin immediately, with engineering work beginning in early 2021". Currently, only a broad outline of the proposals is available, but we expect the focus in terms of products will be on crossover utility vehicles tailored for demand in the North American market, and battery electric powertrain solutions. This proposed alliance comes after Honda and GM have undertaken several projects together in the past five years, although the two companies also have a longer history of collaborations that include powertrain sharing, as well as Honda using GM's OnStar system in the early days of the technology. In recent years, GM and Honda have worked together on fuel-cell electric vehicles, which was not referred to directly in the statement on the MOU, as well as on the Cruise Origin and EVs. The agreement between GM and Honda to find opportunities to share costs while still competing in the marketplace reflects the pressure the automotive industry is under to invest in new technologies that will not necessarily deliver immediate revenue streams. The industry is also under pressure to invest in more rapid deployment of technologies that will bring immediate revenue streams (such as connectivity), and to continue the development of products that serve a more traditional market. (IHS Markit AutoIntelligence's Stephanie Brinley)

- US solid-state battery company QuantumScape plans to go public through a reverse merger, and plans a joint venture with Volkswagen (VW) Group to produce solid-state batteries in 2024, according to a company statement and media reports. Although QuantumScape, based in Silicon Valley, California (United States), plans to start with a VW JV for battery production, a Reuters report quotes CEO Jagdeep Singh as saying, "Our ambition is to be a [battery] supplier to the industry as a whole." QuantumScape is working with special-purpose acquisition company (SPAC) Kensington Capital Acquisition Corporation to go public, a method recently used by Nikola, Luminar, Canoo, and Fisker. According to the Reuters report, VW has committed more than USD300 million to the battery company and other investors include Shanghai Auto and Continental. Singh also said that QuantumScape's lithium-metal batteries use a solid ceramic electrolyte, eliminating the need for an anode and allowing the battery to charge more quickly and achieve higher energy density. QuantumScape announced its shares would be traded on the New York Stock Exchange with the ticker 'QS'. The battery company has raised USD700 million in funds through the deal, including USD500 million in committed PIPE funds. QuantumScape says the transaction will result in more than USD1 billion in cash and funding commitments, including an earlier Series F financing round. The company expects to close the deal in the fourth quarter of 2020, and it is subject to the approval of Kensington's shareholders and the satisfaction or waiver of some conditions in the definitive documentation. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Daimler Trucks' automated driving company, Autonomous Technology Group, has announced that it will expand its testing to the US state of New Mexico. The company will establish the center in the state's Albuquerque city to test autonomous trucks supported by a safety driver and an engineer. This announcement also marks one year of partnership of Daimler Trucks and it subsidiary Torc Robotics, now a part of Autonomous Technology Group. Chairperson of the board of management of Daimler Truck Martin Daum has said, "After one year of collaboration with Torc, we have successfully deployed trucks with SAE Level 4 intent technology on public roads and expanded our test fleet with trucks, miles and learnings. Partnering with Torc has created a unique and even more powerful team of innovators at Daimler Trucks. We remain fully committed to this collaboration and to focusing on the shared goal of bringing highly automated trucks to series production." Autonomous trucks are gaining a great deal of traction in the logistics industry because of a growing shortage of drivers and because they improve efficiency. In continuing its efforts towards developing autonomous trucks, Daimler has announced the establishment of the Autonomous Technology Group, a global organization for automated truck driving. Daimler Trucks announced in April 2019 an agreement to acquire a majority stake in Torc to commercialize highly automated trucks on US roads - specifically Level 4. In September 2019, the companies began testing of Level 4 autonomous trucks on highways in southwest Virginia. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Canada's Ivey Purchasing Managers' Index (PMI) decreased 0.7

point to 67.8 in August. (IHS Markit Economist Chul-Woo Hong)

- Three sub-indexes including employment, inventories, and prices declined while the supplier deliveries index increased.

- The solid recovery of Canada's PMI measures supports our forecast of the robust rebound in third-quarter real GDP.

- Purchasing managers' spending activity firmly improved in August. Among sub-indexes, the largest mover was the inventories index, plunging 10.8 points to 50.9, indicating a minor increase in spending on inventories.

- The price index fell 2.9 points to 57.6, which likely implies mild inflation pressure.

- The employment index went down 1.5 points to 56.1 as August's labor force survey results showed a solid 245,800 net employment increase.

- The supplier deliveries index mildly improved to 51.3, likely indicating fewer supply disruptions as delivery times were slightly faster than the previous month.

- Canada reported a 245,800 net employment gain and the

0.7-percentage-point reduction in the jobless rate to 10.2%

exceeded IHS Markit expectations as employment gained in most

provinces, with Ontario's sharp jump reflecting the late July

business re-openings in the Toronto region. (IHS Markit Economist

Arlene Kish)

- The outsized 205,800 boost in fulltime positions was more than double from July's lift, and self-employment sank for a second consecutive month, mostly affecting those with no employees.

- The improvement in the labor force participation rate was smaller, with a 0.3-percentage-point uptick to 64.6%. The increase in the labor force for women was double that for men, yet the number of women returning to the labor force still lags men, whose levels are at 99.9% of pre-pandemic levels.

- Given the robust nature of the headline employment gains, most businesses are faring well against a backdrop of elevated global uncertainty with the aid of government financial and COVID-19 policy assistance.

- Most industries had net employment gains. However, a few industries continue to adjust to pandemic demand conditions as employment was down in agriculture, natural resources, finance, insurance, and real estate as well as public administration.

- Despite the monthly movements, tourism-related industries continue to suffer the most as the recovery of employment levels lags even with the 5.3% month-on-month jump in accommodation and food services employment, the fastest-growing industry in August.

- About 1.1 million jobs have yet to be regained. Larger hurdles are expected for fulltime positions, which are at 93.9% of pre-pandemic levels compared with 96.1% for part-time positions. Also, women continue to bear the brunt of the pandemic, with total employment levels at just 93.8% of pre-pandemic levels compared to 94.7% for men. The slower net employment gain increased total hours worked by 2.9% from the previous month.

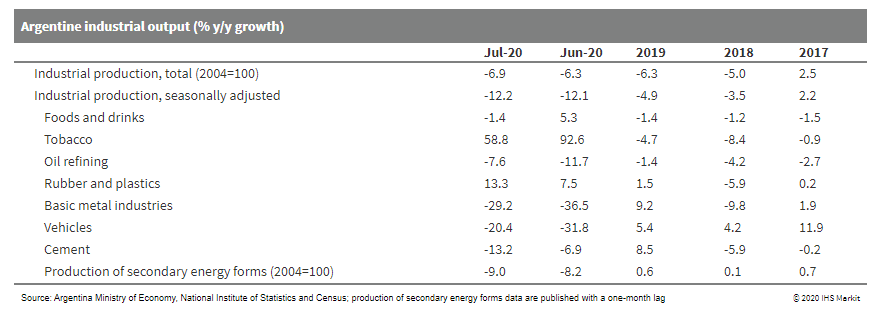

- Argentina's industrial production decreased by 6.9% in July

2020 compared with July 2019; the highly volatile seasonally

adjusted monthly index increased by 2.1% in July compared with

June, indicating that recovery is losing steam with most sectors

still in annual declines. (IHS Markit Economist Paula

Diosquez-Rice)

- Argentina's industrial production posted a 6.9% year-on-year (y/y) decrease in July, according to the National Institute of Statistics and Census (Instituto Nacional de Estadística y Censos: INDEC). The seasonally adjusted data show a 2.1% month-on-month (m/m) rise in July, compared with a 16.5% m/m increase in June (revised figure). The cumulative change for the first seven months of 2020 is a decline of 13.4% y/y.

- The biggest annual decreases were in transport equipment, clothing and apparel, basic metals, vehicle assembly, and other machinery and equipment, among others. Only one sector posted an annual expansion in July - the tobacco product sector.

- A qualitative industrial poll of companies conducted by INDEC shows that 47% of the respondents estimate that demand will deteriorate in August-October compared with the same period in 2019 (down from 58% in the previous month's survey). The percentage of respondents expecting demand to pick up decreased to 17%, while 42% of the respondents expect exports to decrease during the period.

- Construction activity increased by 6.8% m/m in seasonally

adjusted terms in July but dropped by 12.9% y/y; construction

employment in the formal sector, registered, decreased by 28% y/y

in July while the cumulative job losses in the sector was 22.2% in

the first seven months of year. Approximately 43% of the

construction firms that responded to the qualitative survey expect

activity to shrink in the private sector in the next three months,

whereas 37% expect no change in activity.

Europe/Middle East/Africa

- European equity markets begin another sharp sell-off at the US market open and most closed lower on the day; Germany -1.7%, UK/France -0.9%, Italy -0.8%, and Spain -0.2%. Germany's DAX index was down as much 2.3% from the prior day by 10:45am EST (which was also the nadir of the US equity markets).

- 10yr European govt bonds closed lower across the region; Italy/Spain/UK +3bps, Germany +2bps, and France +1bp.

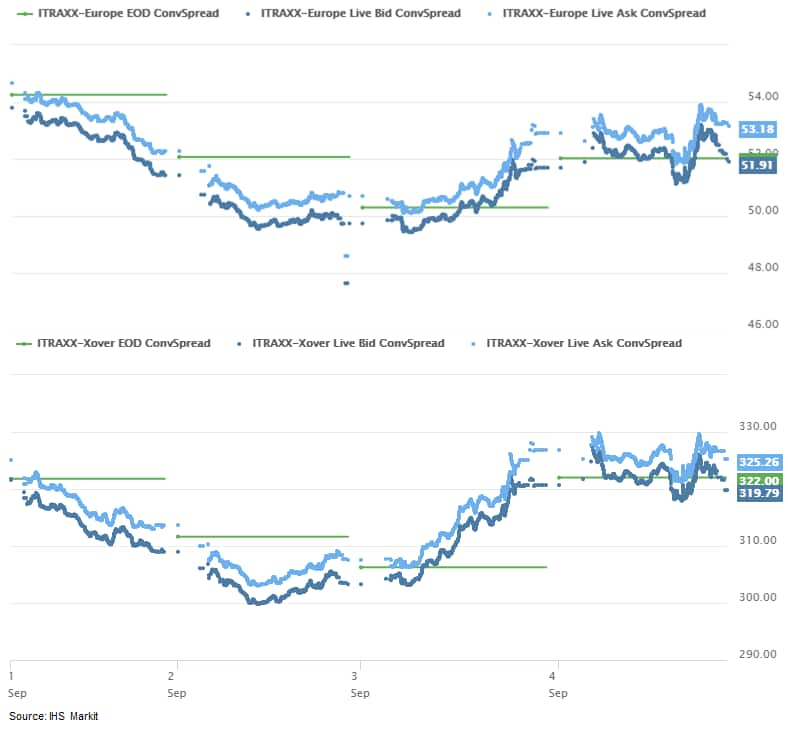

- iTraxx-Europe closed +1bp/53bps and iTraxx-Xover +1bp/323bps,

which is -1bp and +1bp week-over-week, respectively (note the below

graph does not include Monday's UK holiday).

- Brent crude closed -3.2%/$42.66 per barrel.

- The German passenger car market declined 20.0% year on year

(y/y) during August to 251,044 units, according to the latest set

of data released by the Federal State Motor Transport Authority

(Kraftfahrt-Bundesamt; KBA). This came after the rate of

contraction had slowed in July, when the value-added tax (VAT) cut

and the government's low-emission vehicle incentive program had

helped limit the fall in registrations to just 5.4% y/y to 314,938

units. (IHS Markit AutoIntelligence's Tim Urquhart)

- The August data thus indicate that any boost to the market from these initiatives, which were implemented in an effort to mitigate the effects of the COVID-19 virus outbreak, is already waning.

- The August figures leave year-to-date (YTD) sales in the German passenger car market down 28.0% y/y at 1,776,604 units.

- Looking at August's sales result, it was the decline in business registrations that had the most impact on the market; these were down 26.3% y/y, with the sector taking a 61.9% share of the overall market.

- Private registrations fared better as consumers were still relatively eager to take advantage of the incentives on offer; they declined 7.0% y/y to take a 38.1% y/y share of the overall market.

- In terms of brand, the leading Volkswagen (VW) passenger car brand at least managed to beat the overall decline in the market, with a 16.9% y/y fall to 43,842 units. The COVID-19 virus pandemic coincided with two hugely important launches for the brand in the form of the Mark 8 Golf and the new ID.3 electric vehicle (EV), customer deliveries of which are now just beginning. In the first two-thirds of the year, VW witnessed a 28.8% y/y decline in registrations to 326,783 units.

- The second-placed Mercedes-Benz brand recorded a far better performance, fueled by its compact car range, including the new and popular GLB compact sport utility vehicle (SUV), and the company's other SUV models, which continue to enjoy relatively strong demand. As a result, Mercedes-Benz posted a far superior result compared with the overall market, its sales declining by just 3.7% y/y to 27,906 units. In the YTD the brand has also significantly outperformed the market with an 18.8%y/y decline to 179,654 units.

- The star performer of all the big-volume-selling car brands in the German market during August was BMW. The Munich-based brand was third overall with registrations of 21,549 units, which actually represented a 15.2% y/y increase. This performance was influenced by a range of factors, including a low base of comparison for the brand in August 2019, while the company experienced a strong result for its plug-in vehicles. In the YTD, the BMW brand has posted a market-beating decline of 18.6% y/y to 148,660 units.

- August is traditionally a quiet month in all the major Western European passenger car markets in terms of outright volumes as a result of the traditional summer holiday break. However, the 20.0% y/y decline in the German market recorded this August is likely to cause some concern among industry stakeholders and the government in Berlin.

- Tesla CEO Elon Musk has indicated that the electric vehicle (EV) company intends to overhaul its manufacturing process at its new plant under construction in Berlin, Germany, media reports state, citing his comments on site. According to the reports, Musk is shown making the comments to bystanders in a video posted on Tesla fan site Teslarati. Musk reportedly said, "It will be the first time that there will be a transformation in the core structural design of the vehicle. It's quite a big thing. Both manufacturing, engineering and design as well." The CEO also reiterated that Tesla's mission is to help accelerate the transition to sustainable energy, not simply build automobiles. Musk also reportedly said, "The three elements needed for a sustainable energy future are energy generation, energy storage and sustainable transport, electric cars… I think we will be building some batteries and cells and other things here. That will be good for stationary storage of wind and solar." In addition, the CEO reportedly said that the new factory will be a design and engineering center, saying, "We will start off with the factory but we will also do some original engineering and design work. It is going to be, actually to be totally frank, better than the one in the US." Musk's remarks suggest that he is pleased with the factory site's development. The new German plant is scheduled to begin production in mid-2021 and will have a capacity of 500,000 units per annum; however, reportedly, plans for the plant to also build batteries have been scrapped. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The German essential oil and flavor house Symrise has reported its sales rose by 7.6% year-on-year to EUR1.8 billion (USD2.1 billion) in H1 despite a challenging market environment brought on by Covid-19. In organic terms, excluding the portfolio effect of the ADF/IDF acquisition and exchange rate effects, sales were up by 3.4 % and all segments contributed to this positive development. Ebitda rose by 11.9% to EUR393 million and Ebitda margin did that by 21.6% to EUR169 million. The scent and care segment sales grow by 2.6%, enjoying strong demand for consumer fragrant and oral care products. The flavor segment rose by 0.6%, led by strong demand for products for baked goods and cereals. The nutrition segment increased by 10.5% due to the pet food business unit, especially in the US, Mexico, Brazil and Russia. (IHS Markit Food and Agricultural Commodities' Jose Gutierrez)

- Groupe PSA and French petroleum giant Total have signed a joint venture (JV) agreement for the manufacture of automotive battery cells, according to a joint company statement. The proposed JV was first announced in January, and now the two parties have signed a contract to commit to the project. The statement said that, through the partnership, the companies are looking to create "a world-class player in the development and manufacture of high-performance batteries for the automotive industry from 2023". As part of the JV, Total and battery partner Saft will contribute research-and-development (R&D) and industrialization knowledge on battery production, while Groupe PSA will provide knowledge of the automotive market and experience in production. The partnership's R&D center in Bordeaux and the pilot site in Nersac, France, is already developing new high-performance lithium-ion technologies, which planned plant investment will help to bring to production. At the end of the R&D phase, the partners plan to begin production at two "gigafactories" in Douvrin (France) and Kaiserslautern (Germany). The JV project was first mooted at the beginning of the year when all the parties signed a memorandum of understanding (MoU) to form a consortium called the Automotive Cell Company. (IHS Markit AutoIntelligence's Tim Urquhart)

- Czechia's average monthly gross nominal wage rose 0.5% year on

year (y/y) to reach CZK34,271 (USD1,393) in the second quarter,

while seasonally adjusted wages dropped 3.1% quarter on quarter. In

real terms, salaries dropped 2.5% y/y, the first decline since late

2013. (IHS Markit Economist Sharon Fisher)

- Quarantine wage compensation and extra payments for nurses were not included in the wage calculations, signaling that actual income was somewhat stronger.

- The breakdown by sector indicates that the steepest nominal y/y declines occurred in restaurant and hotel services, real estate, and manufacturing. In contrast, rising salaries in the public sector (including healthcare and education), agriculture, and information and communications helped to keep overall nominal wage growth slightly positive.

- The latest data signal rising inequality, with the median wage (at CZK29,123) down 0.2% y/y amid significant differences by gender. Regional imbalances in wage growth also remained elevated, with seven regions reporting y/y declines in salaries.

- In a separate release, the Ministry of Labor and Social Affairs indicated that the registered unemployment rate remained stable at 3.8% in August. Most of the registered unemployed had low qualifications, while the share who were unemployed for more than one year stood at 20.4%.

- The number of vacancies rose 2% month on month in August and remained well above the number of job seekers. More than 73% of vacancies were intended for those with low qualifications, with construction and assembly workers, cleaners, forklift operators, truck drivers, bricklayers, and cooks in especially high demand.

- The scope for significant wage growth remains limited in the

second half, as prospects for more rapid growth depend on a faster

recovery of domestic and external demand. After falling by around

6% y/y in April-May, industrial wages rose in June, but growth was

meagre (at 0.7% y/y) as firms were forced to save on wage

costs.

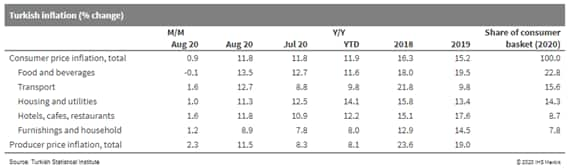

- Turkish annual inflation remained firmly in double-digits in

August, hovering just under 12%, with strong upward pressure on

prices continuing because of recent lira instability. (IHS Markit

Economist Andrew Birch)

- Turkish annual inflation in August stood at 11.8%, little changed from the previous 10 months. Since November 2019, annual consumer price growth has hovered between 11% and 13%.

- Throughout most of that time, annual energy price growth was extremely high, fueling overall inflation. However, in July and August, annual energy inflation has decelerated sharply due to shifting base effects. In its place, food and core inflation has accelerated to keep headline price growth steady.

- Sharp lira losses over the course of August were a big reason for the rise of core inflation, with the lira having depreciated by 5.6% against the US dollar during the month (and by 7.4% against the euro). The higher imported price pressures was particularly prevalent on producer price inflation, which itself is accelerating rapidly in recent months.

- The ongoing instability of the lira continues to exert strong

upward pressure on prices, preventing price growth from falling to

the central bank's latest end-year target of 8.9%. In IHS Markit's

August forecast, we built into our projections a sharp interest

rate hike because we do not believe the current measures will be

enough to stabilize the lira. This continued lira depreciation will

keep inflation from decelerating in line with central bank

expectations.

- Sales in the Turkish passenger-car and light commercial vehicle

(LCV) market increased 134.4% year on year (y/y) to 61,533 units in

August, according to data released by the Automotive Distributors'

Association (Otomotiv Distribütörleri Derneği: ODD). (IHS Markit

AutoIntelligence's Tarun Thakur)

- Of this total, passenger vehicle sales were up by 106% y/y to 44,372 units during the month, while LCV sales stood at 17,161 units, up 265% y/y. The country's light-vehicle market has posted a year-to-date (YTD) increase of 68.4% y/y to 403,002 units, comprising 317,394 passenger vehicles, up 64.2% y/y, and 85,608 LCVs, up 86.1% y/y.

- In the YTD, C-segment vehicles account for 62.7% of total passenger vehicle sales in Turkey, with sedans being the most preferred vehicle type, accounting for 43.8%. In the LCV segment, vans account for 76% of total sales in the YTD, followed by light trucks at 11.1%.

- The significant growth in light-vehicle sales during August is attributable to the removal of the COVID-19 pandemic lockdown in the country and cheap loan campaigns. The automotive industry has resumed production operations in the country following the easing of restrictions imposed in response to COVID-19 pandemic, and the government is pushing the easing of monetary policy.

- IHS Markit forecasts Turkish light-vehicle sales to increase to 669,936 units in 2020, from 479,060 units last year.

Asia-Pacific

- APAC equity market markets closed lower across the region; Australia -3.1%, India -1.6%, Hong Kong -1.3%, South Korea -1.2%, Japan -1.1%, and Mainland China -0.9%.

- Nissan has made a breakthrough in the development of car parts made from carbon-fiber reinforced plastic (CFRP). According to a company statement, the automaker plans to use the new process to mass-produce CFRP parts and introduce them in more cars for customers. The new process can reduce the lead time to develop such components by as much as 50%, and the cycle time for molding by about 80%, compared with conventional methods. The existing method, known as compression resin transfer molding, involves forming carbon fiber into the right shape and setting it in a die with a slight gap between the upper die and the carbon fibers. Resin is then injected into the fiber and left to harden. However, the newly developed method accurately simulates the permeability of the resin in carbon fiber, while visualizing resin flow behavior in a die using an in-die temperature sensor and a transparent die. CFRP is a lightweight yet strong material that can be used to make safer and more fuel-efficient vehicles. To date, the use of CFRP in the manufacture of parts has been quite expensive and difficult. However, with the new approach, Nissan hopes to increase its use. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Grains for human consumption is seen as a frontline of the

trade war; it is secured. Rice, wheat and corn are the most

important grains in China. However, corn for feed and industrial

processing continues to be a challenge, meaning continuous export

opportunities for international growers. The China Starch

Association published (28 August) a report about grain processing

and food security, sourcing Zouchuang's data. Zouchuang is a local

research institute. The diet pattern and habit has influenced the

feed industry. Chinese consumer diet is changing along with the

country's rapid industrialization. There is no doubt that the

continuous growth in demand for meat, dairy and egg will be the key

driver for the feed processing industry. (IHS Markit Food and

Agricultural Commodities' Hope Lee)

- In the rice basket, demand for human consumption is proportionally reducing while the feed and industrial sectors have increased the weighting, rising from 11% in 2015 to 24% in 2019. Some out-of-date and lower graded rice are sold to alcohol and feed processors. This is the norm.

- Zouchuang stated that 83% of wheat were used for flour processing; feed only took 11% of the total in 2019. Demand for flour milling showed slow and moderate growth while feed wheat consumption fluctuated.

- Corn is mainly used for feed and industrial processing, taking 57% and 32% of the total, respectively. In 2019, feed corn consumption dropped proportionally amid ASF while industrial volume rose.

- Total feed output will be 218.6 million tons in 2020, up 1.9%. Pig feed will recover slowly in H2 2020, but, poultry feed will be sluggish due to slow demand from the downstream such as restaurants.

- Corn is the most important industrial grain. China has an annual corn processing capacity of 121 million tons. In 2019/2020, industrial corn consumption will be 72 million tons, up by 6%. The annual industrial consumption will be around 76 million tons in 2023/2024.

- China's Anhui province has opened a 5G-based lane for autonomous vehicle (AV) testing, China Daily reported. The construction of a 4.4 km-long ring road located in the eastern city of Hefei started in August 2019. The road is deployed with 5G network coverage and monitoring devices and has built a cloud platform control center. Hefei city is accelerating its efforts in the field of AVs. The Volkswagen (VW) Group has recently announced plans to roll out 10 units of Audi's autonomous e-tron sport utility vehicles in Hefei. This year, Baidu announced plans to build a 5G-based route deployed with systems such as sensing equipment and a cloud-based control center to support testing of vehicle-to-infrastructure (V2I) application in Hefei. Last year, VW's wholly owned subsidiary, Mobility Asia, teamed up with VW China and JAC Motors on Hefei's smart city program that focuses on developing robo-taxis that incorporate autonomous fleet management. (IHS Markit Automotive Mobility's Surabhi Rajpal)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-september-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-september-2020.html&text=Daily+Global+Market+Summary+-+4+September+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-september-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 4 September 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-september-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+4+September+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-september-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}