Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 05, 2021

Daily Global Market Summary - 5 May 2021

All major European equity markets closed higher, while US and APAC markets closed mixed. US government bonds closed higher, while benchmark European bonds closed lower. European iTraxx indices closed slightly tighter across IG and high yield, while CDX-NA closed flat. Brent and gold closed higher, copper and the US dollar were flat, and WTI, silver, and natural gas were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Major US equity indices closed mixed; DJIA +0.3%, S&P 500 +0.1%, Russell 2000 -0.3%, and Nasdaq -0.4%.

- 10yr US govt bonds closed -2bps/1.58% yield and 30yr bonds -2bps/2.24% yield.

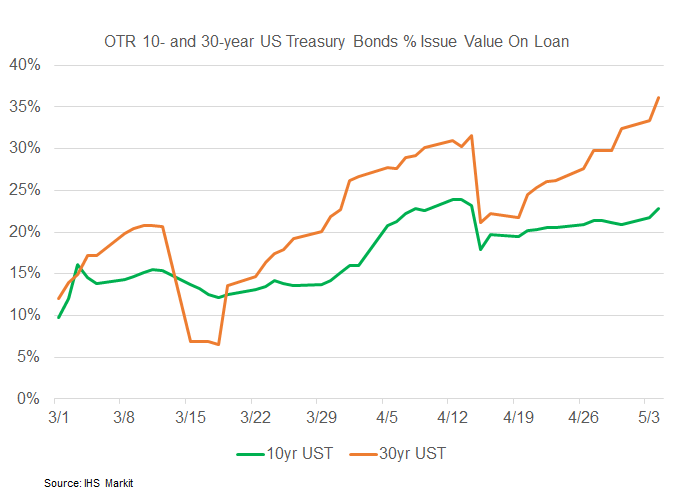

- The below chart of IHS Markit's securities lending data

indicates that the percentage of issue value on loan for the

on-the-run 10- and 30-year US Treasury bonds has been gradually

increasing since the sharp decline on 15 April, with levels for the

OTR 30-year bond at the highest level of this year.

- CDX-NAIG closed flat/51bps and CDX-NAHY flat/288bps.

- DXY US dollar index closed flat/91.31.

- Gold closed +0.5%/$1,784 per troy oz, silver -0.1%/$26.52 per troy oz, and copper flat/$4.52 per pound.

- Private payrolls rose by 742,000 jobs last month, the largest gain since last September, the ADP National Employment Report showed. Companies hired 565,000 workers in March. Economists polled by Reuters had forecast private payrolls would increase by 800,000 jobs in April. (Reuters)

- The Biden administration said it would back a proposal at the World Trade Organization to waive intellectual property protections for COVID-19 vaccines to help speed up global production. The waiver is also supported by more than 100 members of Congress. Pharmaceutical companies and other business groups have opposed the waiver, however, saying it wouldn't supply short-term supply production problems because contract producers lack certain needed technical knowledge. (WSJ)

- Rents are soaring in many U.S. cities as the economy rebounds, squeezing the budgets of tenants who also face increased risk of eviction after courts overturned a pandemic-era ban today. The median monthly charge on a vacant rental jumped by $185 in March from a year earlier, according to the U.S. Census Bureau. A national index compiled by Apartmentlist.com shows that rents rose 1.9% in April alone, the most in data going back to 2017. (Bloomberg)

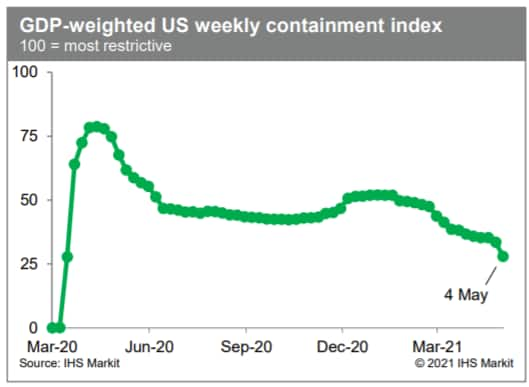

- The IHS Markit GDP-weighted US weekly containment index dropped

5.5 index points to 28.0, the largest decline so far in this easing

cycle. The decline reflected easing restrictions in recent days in

26 states, with the largest contributions originating in Florida,

New York, and California. (IHS Markit Economists Ben

Herzon and Joel

Prakken)

- The seasonally adjusted final IHS Markit US Services PMI

Business Activity Index registered 64.7 at the start of the second

quarter, up from 60.4 in March and higher than the earlier released

'flash' figure of 63.1 to signal a marked increase in service

sector business activity. The robust upturn in output was the

sharpest since data collection began in late-2009. (IHS Markit

Economist Chris

Williamson)

- On the price front, input costs faced by service sector firms increased at an unprecedented rate in April. The substantial rise in cost burdens was often linked to hikes in supplier prices and greater transportation fees. Companies particularly noted higher costs of plastic, packaging, PPE and fuel.

- The rate of output price inflation accelerated for the fourth month running and was the steepest since data collection for the series began in October 2009.

- Vacating EPA's approval of sulfoxaflor would cost US farmers billions of dollars and force many to rely on more environmentally harmful insecticides, according to the American Farm Bureau Federation, the National Cotton Council and other major ag industry groups. The combined value of crops included in the sulfoxaflor registrations at issue in the underlying litigation is "staggering," the groups say in a filing with the US Court of Appeals for the Ninth Circuit. "These crops are worth approximately $123 billion each year - nearly two-thirds of total crop production in the United States." (IHS Markit Food and Agricultural Policy's JR Pegg)

- Argo AI, the autonomous vehicle (AV) startup backed by Ford Motor Company and Volkswagen (VW) Group, has developed LiDAR technology that will support commercialization of autonomous transportation, according to a company statement. The LiDAR has a sensing range capability of 400 meters, with high-resolution photorealistic quality, and the ability to detect dark and distant objects with low reflectivity. The company says that the LiDAR is based on "Geiger-mode" sensing technology, which allows it to detect the smallest particle of light. The company says the LiDAR operates at a wavelength above 1,400 nanometers, which allows the sensor to have unique capabilities, including longer-range, higher-resolution, lower-reflectivity detection, and a 360-degree field of view. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- GM Defense, a subsidiary of General Motors (GM), has opened a production facility in North Carolina, United States, and has appointed a new president. GM refurbished an existing property in North Carolina (United States) for the production of the Infantry Squad Vehicle (ISV), based on the Chevrolet Colorado ZR2 mid-size truck architecture, which has now opened. GM Defense states that the facility was developed, from the start of construction to start of vehicle production, in just over 90 days. The facility supports a US Army contract award worth USD214.3 million, with the Army having an acquisition objective of 2,065 vehicles. Although the ISV is a traditional ICE vehicle and has 90% commercial off-the-shelf parts, GM has also been working with the US Army on the potential application of fuel-cell technology and the automaker included a fuel-cell with potential military use in its electrification plan in 2017. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Mexico's National Institute of Statistics and Geography (Instituto Nacional de Estadistica y Geografia: Inegi) has published brand-level sales data for April, showing total sales of 83,612 units during the month. Compared with April 2020, which was the low point for vehicle sales and production during the first wave of the COVID-19 pandemic, this is a 139.6% improvement. Mexico started enforcing business restrictions and social-distancing measures in April 2020, which pulled down sales that month to 34,903 units. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Brazil's National Federation of Motor Vehicle Distributors (Federação Nacional da Distribuição de Vehiculos Automotores: Fenabrave) has reported its accounting of April registrations. Compared with a heavily pandemic-restricted April 2020, registrations are up 219% y/y. However, compared with March 2021, light-vehicle registrations contracted 7.5%. Fenabrave reported registrations of 163,902 light vehicles in April, compared with only 51,344 in April 2020 and 177,097 in March 2021. IHS Markit's April 2021 forecast projects an increase of 16.2% in Brazilian light-vehicle sales to 2.275 million units in 2021; this has been revised downward from the March forecast. Effects of a second wave of COVID-19 cases in South America, as well as a semiconductor shortage due to supply chain disruptions are causing further uncertainties in 2021. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/Africa

- All major European equity indices closed higher; Germany +2.1%, Italy +2.0%, UK +1.7%, Spain +1.6%, and France +1.4%.

- 10yr European govt bonds closed lower; Italy +4bps, Spain/UK +2bps, and German/France +1bp.

- iTraxx-Europe closed -1bp/50bps and iTraxx-Xover -3bps/251bps.

- The European Commission is close to authorising the EU's first insect as a novel food after member states cleared a proposal to approve dried yellow mealworm - larvae of the beetle Tenebrio molitor -on 4 May. National representatives in the Standing Committee on Plants, Animals, Food and Feed (PAFF) novel foods and toxicological safety section cleared dried yellow mealworm for use as whole insects in snacks or as an ingredient, such as flour, in foods like protein products, biscuits or pasta. The Commission said in a statement that it would now adopt a decision formally authorizing yellow mealworm within in a few weeks. The imminent authorization for the insect follows a positive opinion from the European Food Safety Authority (EFSA) in response to an application from the French producer SAS EAP Group Agronutris. (IHS Markit Food and Agricultural Policy's Sara Lewis)

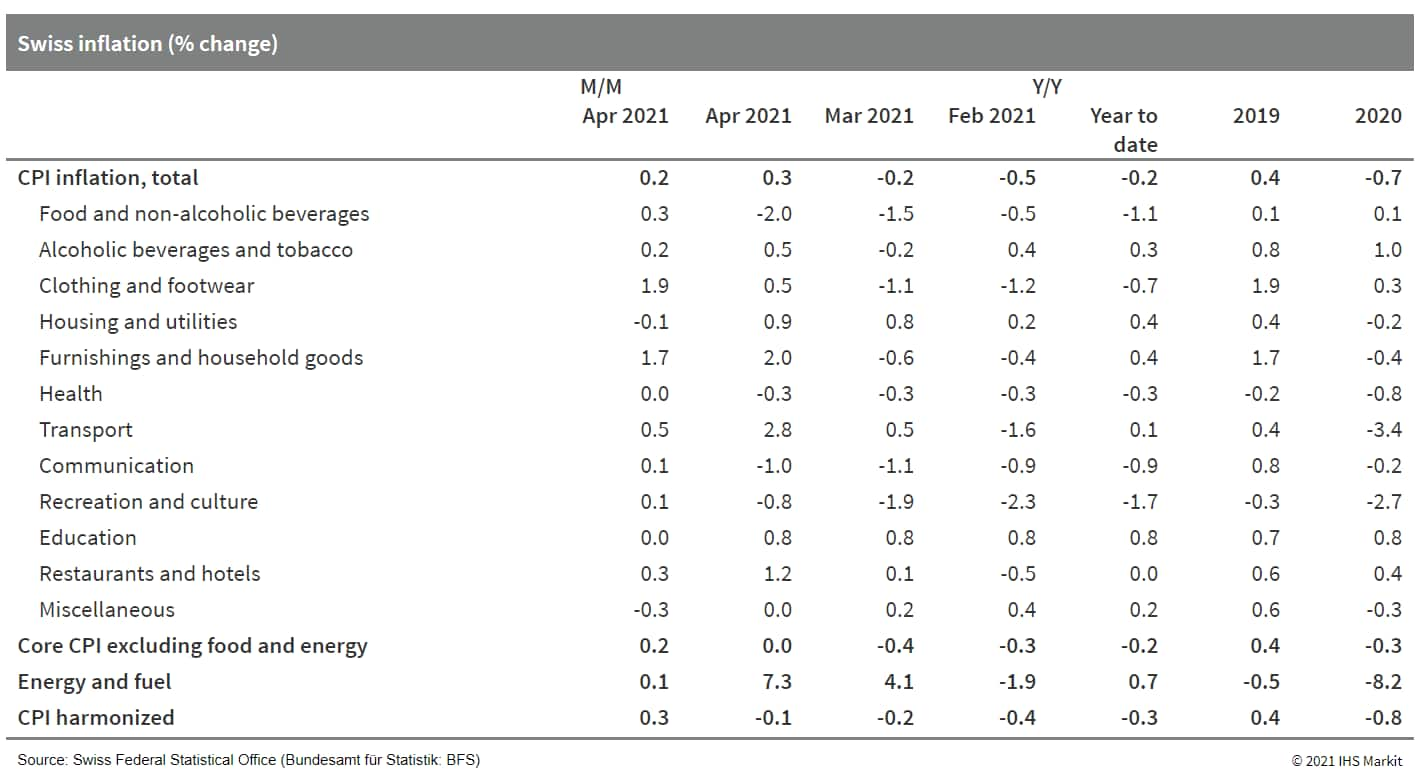

- According to the Swiss Federal Statistical Office (SFSO), Swiss

consumer prices increased by 0.2% month on month (m/m) in April,

which is 0.2-0.3 percentage point higher than the long-term average

for this month. Exacerbated by a base effect, the annual inflation

rate thus rose from -0.2% in March to 0.3%, returning to positive

territory after a 14-month period of deflation. (IHS Markit

Economist Timo

Klein)

- Ride-hailing firm Uber, shared transport company BlaBlaCar, Renault mobility division Mobilize, and the Autonomous Administration of Parisian Transport (RATP) have joined Boston Consulting Group to create 'Mobilité 360', a project that focuses on revolutionizing urban transport. The aim of the project is to create new infrastructure to increase the adoption of green and shared transportation and explore the development of first- and last-mile on-demand shared mobility services. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Italian energy company ENI is considering spinning off its combined retail power and renewable energy activities through a public listing next year or selling a minority stake in them to capitalize on buoyant market conditions, it said 30 April in its quarterly earnings. The announcement comes less than a year after ENI said the company's operations would be split into two units, one focused on oil and natural gas, and another on renewables and power. If the spinoff occurs, ENI will take a similar path to energy service firm Aker Solutions, which created an energy transition-focused spinoff last year, and then this spring announced it was creating a hydrogen pure-play spinoff company. In another indication of the interest in renewables, in February 2021, Spanish oil company Repsol said it too was considering a spinoff of its renewables business. (IHS Markit Climate and Sustainability News' Kevin Adler)

- On-demand mobility player Bolt has announced plans to launch car-sharing service Bolt Drive in Europe, reports CNBC. This will allow users to rent a car for a brief period through the Bolt app. The company will invest EUR20 million (USD24 million) in launching Bolt Drive in Europe this year, starting with a pilot in the Estonian capital of Tallinn. The pilot will feature 500 vehicles including electric cars such as the Volkswagen ID.3. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Saudi budget deficit narrowed to just SAR7.4 billion in the

first quarter of 2021, according to the Saudi finance ministry, a

fraction of the planned SAR141-billion deficit for the full year

2021 in the medium term budget review. (IHS Markit Economist Ralf

Wiegert)

- Oil revenues in the first quarter were lower than a year ago as the voluntary production cuts of Saudi Arabia pledged in accordance with the OPEC+ production quota had their impact; revenues equaled SAR116.6 billion, or 9% below the same period of the previous year.

- Meanwhile, non-oil revenues increased steeply in annual comparison. Thanks to the increase of the VAT rate from 5% to 15% as of July 2020, tax revenues on goods and services rose by 75% to SAR53.7 billion.

- The low budget deficit in the first quarter is reassuring as Saudi Arabia's finances appear on solid consolidation track.

- Saudi food giant Almarai is to invest SAR6.6 billion (USD1.8 billion) to expand its poultry business with the aim of doubling its market share in the sector. The company's board of directors this week approved the investment, which will be implemented in several phases over a period of five years, Almarai said in a filing on Monday (3 May). The project includes the development of grandparent farming and production facilities to enable full vertical integration of the poultry supply. (IHS Markit Food and Agricultural Commodities' Max Green)

Asia-Pacific

- APAC equity markets closed mixed; India +0.9%, Australia +0.4%, and Hong Kong -0.5%.

- Chinese electric vehicle (EV) startup Xpeng has reported sales of 5,147 vehicles during April, up 285% year on year (y/y). According to a company press statement, Xpeng's sales during April comprised 2,995 P7 sedans and 2,152 G3 sport utility vehicles (SUVs). In the year to date (YTD) in April, Xpeng's sales stood at 18,487 units, up 413% y/y. The company has expanded its product portfolio and started to deliver the P7 Wing edition and the lithium-iron-phosphate-(LFP)-battery-powered G3 in April. Deliveries of the LFP-battery-powered P7 are due to start in May. Xpeng has recently partnered with Zhongsheng Group, a leading automobile dealership group in China, to expand its sales and services network in the country. Zhongsheng Group is to invest in and operate authorized Xpeng-branded dealership outlets in China in 2021, starting with the tier-1 and high-potential cities. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Chinese electric vehicle (EV) manufacturer NIO delivered 7,102 vehicles during April, an increase of 125.1% year on year (y/y), according to a company statement. The deliveries include 1,523 units of the ES8 sport utility vehicle (SUV), and a combined 5,579 units of the ES6 SUV and EC6 SUV. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- The delivery of OIM Wind Ltd's newbuild wind turbine installation vessel (WTIV) has been delayed and is now expected in early 2023, according to market sources. The Norwegian company and its partners signed an EPC contract with CIMC Yantai Raffles Offshore shipyard in China in September 2020 for construction of the BT-220IU wind installation unit, with an option for another unit of the same design. Delivery was originally expected in 2022; however it is understood delays with long-lead items are likely to push back delivery until early 2023. The unit will be capable of carrying up to four 15 MW turbine sets, with a total deck area of 4,500 square meters. It will be equipped with a Huisman heavy lift crane with a lifting capacity of 2,600 metric tons. (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

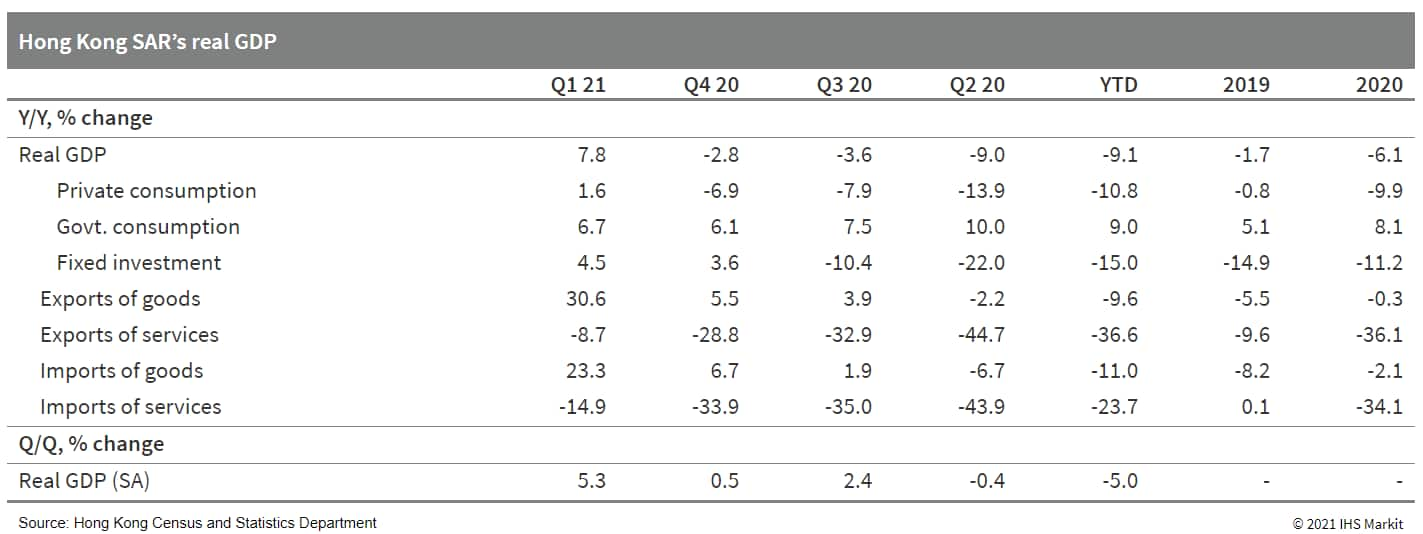

- Preliminary data show that Hong Kong SAR's real GDP jumped 7.8%

year on year (y/y) in the first quarter of 2021, reversing a 2.8%

y/y drop in the fourth quarter of 2020. This was the first

expansion since the second quarter of 2019 and was the fastest GDP

growth since the first quarter of 2010. (IHS Markit Economist Ling-Wei

Chung)

- Exports of goods rebounded for the third straight quarter, surging 30.6% y/y in the first quarter of 2021, strengthening sharply from a 5.5% y/y expansion in the fourth quarter of 2020. Exports to all major markets picked up the double-digit pace in the first quarter of 2021, except Japan and Singapore.

- A 39.8% y/y surge in shipments to mainland China, accounting for about 60% of total exports, continued to drive the rebound in Hong Kong's export demand. The revivals in the regional economies also provided strong support, led by a 49.1% y/y surge in shipments to Taiwan and about 30% y/y jumps in exports to South Korea and Vietnam. Shipments to the US climbed 19.5% y/y, and shipments to Europe also turned stronger, led by a 130.2% y/y surge in those to the UK.

- Fixed investment expanded for the second straight quarter (up

4.5% y/y) in the first quarter of 2021, after resuming growth in

the fourth quarter of 2020 for the first time since the third

quarter of 2018.

- The Delhi government has announced plans to introduce an interest subsidy of up to 5% on purchases of electric vehicles (EVs) in New Delhi, reports ET Auto. Delhi Transport Minister Kailash Gahlot said, "[A] Subvention of 5% [will] be provided through Delhi Finance Corporation (DFC) to ensure an easy financing option for vehicle owners to convert their fleet to electric." He added, "We are at an advanced stage of drafting this proposed scheme and it will be announced soon. This scheme can be availed by all range of vehicles and will ensure easy access of finance to those companies who are willing to upgrade their fleet to electric." According to the source, the transport minister urged commercial vehicle owners to convert half of their fleet to EVs by 2023, adding that these electric commercial vehicles will be given permission to travel on restricted roads and also beyond the fixed time barriers. (IHS Markit AutoIntelligence's Tarun Thakur)

- Although settings were left unchanged by the Reserve Bank of

Australia's (RBA) monetary policy board for this month - the policy

interest rate and the yield target for three-year Australian

Government Securities (AGS) were both kept at 0.10% - the

post-decision statements from Lowe explicitly indicated that status

updates are likely for the RBA's extraordinary program in July. The

RBA will then announce whether it will extend the yield-targeting

program to the next maturity - the November 2024 bond.

Additionally, the RBA will decide at that time whether to extend

its government bond-buying program, although Lowe's statements

indicated that the RBA is prepared to continue the program, given

its focus on returning the economy to full employment. (IHS Markit

Economist Bree

Neff)

- However, because the domestic financial markets are functioning well, the RBA decided not to extend the Term Funding Facility beyond its current end date of 30 June 2021. That means that authorized deposit-taking institutions (ADIs) will no longer be able to access new funds from this program after that date.

- The RBA also announced revised economic forecasts, which will be published in full at the end of the week. The RBA now expects real GDP growth of 4.75% for 2021 - up from 3.5% previously - and revised down the unemployment rate forecast to 5.0% at year-end 2021, from 6.0% previously. For inflation, Lowe indicated the bank's baseline forecast is that underlying (core) inflation would come in at 1.5% in 2021, slightly higher than the previous forecast, and would reach 2% by mid-2023.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-may-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-may-2021.html&text=Daily+Global+Market+Summary+-+5+May+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-may-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 5 May 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-may-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+5+May+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-may-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}