Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 06, 2021

Daily Global Market Summary - 6 December 2021

All major European and US equity indices closed higher, while APAC markets were mixed. US government bonds closed sharply lower, while most benchmark European bonds were modestly higher on the day. CDX-NA and European iTraxx closed tighter across IG and high yield. The US dollar, oil, and copper closed higher, while natural gas, gold, and silver closed lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher; Russell 2000 +2.1%, DJIA +1.9%, S&P 500 +1.2%, and Nasdaq +0.9%.

- 10yr US govt bonds closed +8bps/1.44% yield and 30yr bonds +9bps/1.77% yield.

- CDX-NAHY closed -2bps/56bps and CDX-NAHY -11bps/318bps.

- DXY US dollar index closed +0.2%/96.33.

- Gold closed -0.2%/$1,780 per troy oz, silver -1.0%/$22.26 per troy oz, and copper +1.7%/$4.34 per pound.

- Crude oil closed +4.9%/$69.49 per barrel and natural gas closed -11.5%/$3.66 per mmbtu.

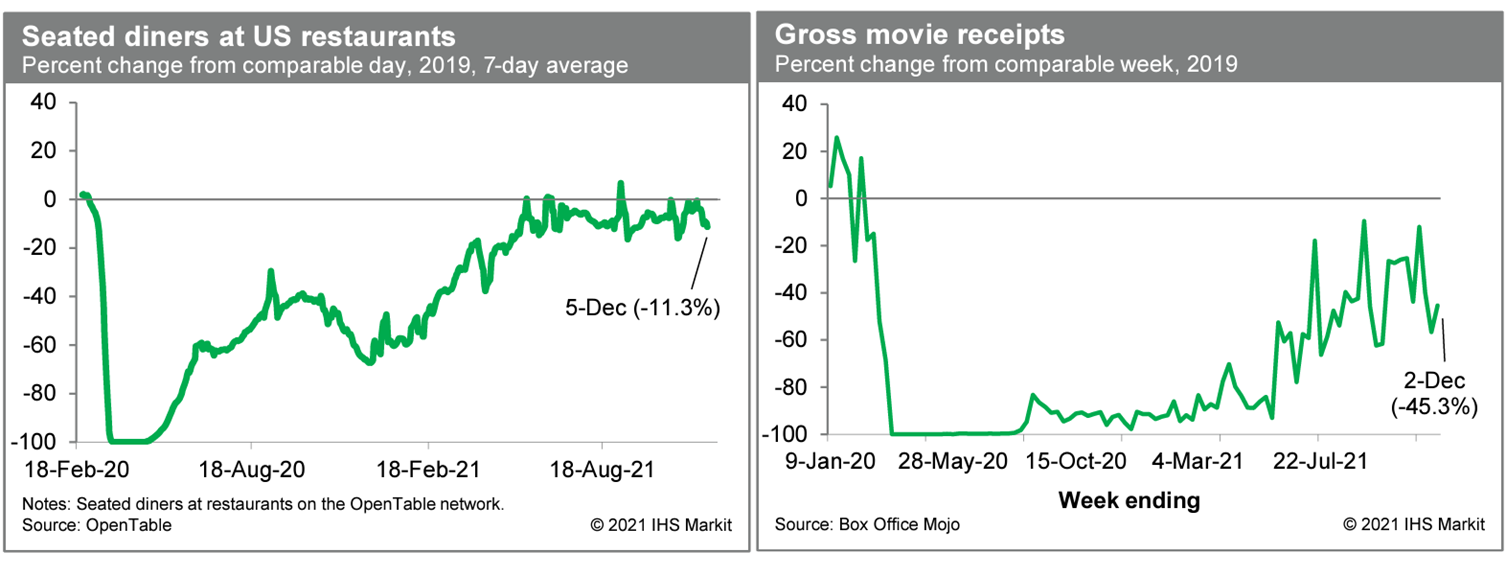

- Averaged over the last seven days, the count of seated diners

on the OpenTable platform was 11.3% below the comparable period in

2019. This is in line with what has been a flat trend for several

months. Meanwhile, box-office revenues last week were 45.3% below

the comparable week in 2019. This is below recent averages,

indicating continued difficulty getting moviegoers back in

theaters. (IHS Markit Economists Ben

Herzon and Joel

Prakken)

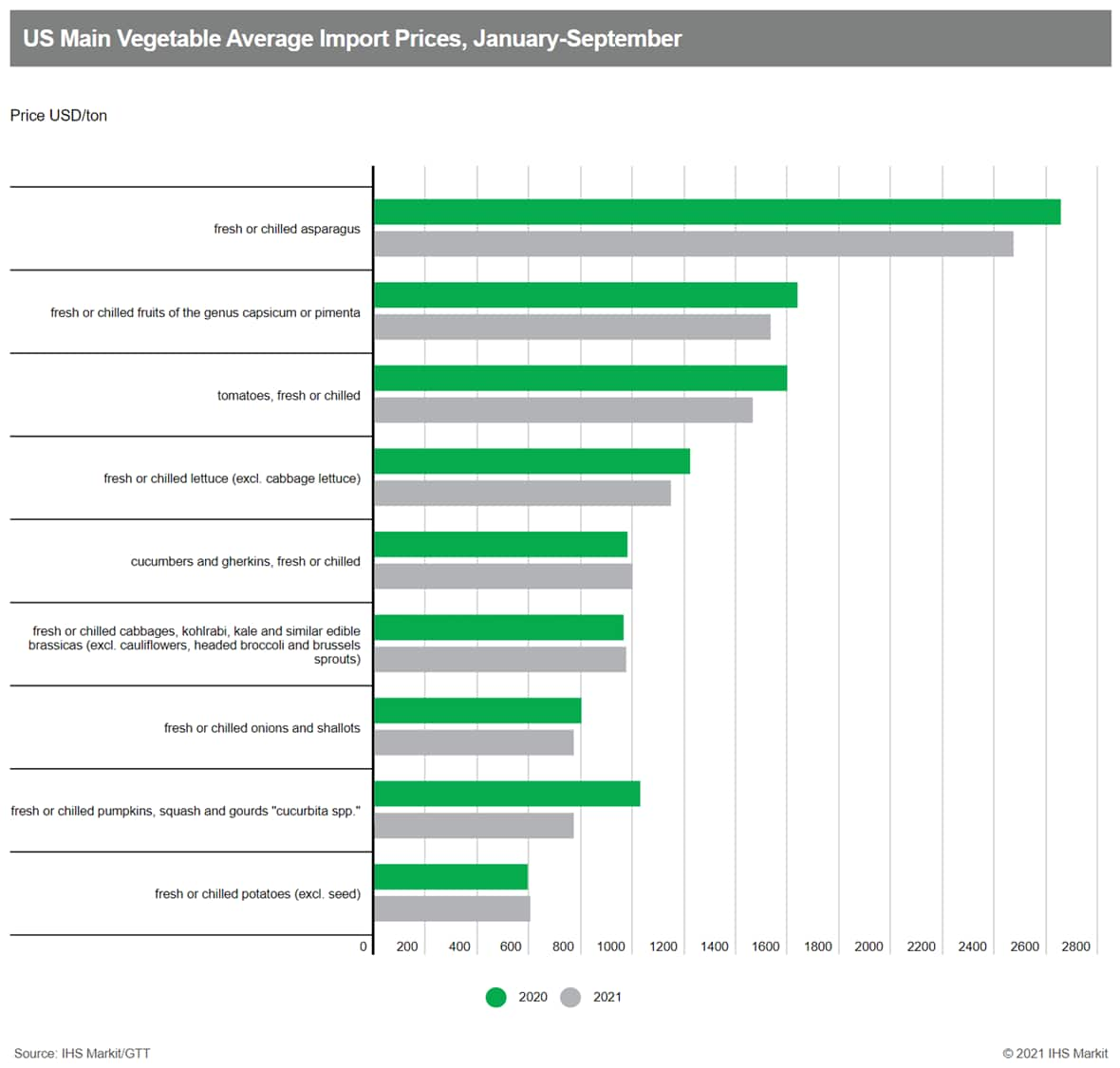

- The US recorded strong increases in main fresh vegetable

imports in January-September 2021 while the average import prices

went down from last year. Mexico and Canada are the main suppliers

in this period. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- Fresh tomatoes were the most imported vegetable in the first nine months of 2021, with 1.5 million tons imported, 8% up y/y. Tomatoes are also the most valuable imported vegetables. Mexico accounted for over 90% of total shipments, followed by Canada. Canada increased its shipments to the US by 13% y/y, at an average price of $2,260 per ton, 14% down y/y. Mexico's prices were also reduced by 8% y/y to $1,370/ton. The USDA report (June 2021) estimated Mexico's 2021 calendar year production is 3.3 million tons, 2% up from 2020.

- US pepper imports climbed by 14% y/y to breach one million tons, of which chili peppers grew by 19% y/y to 371,000 tons. Among top 10 vegetables, peppers ranked second in both volume and value. Mexico accounted for about 86% of total volumes. Greenhouse-grown organic bell peppers saw an import price fall of 18% y/y to $2,950/ton, but, still the highest among all varieties. Greenhouse-grown conventional bell peppers were priced at $2,400/ton, 12% down y/y. Open-field grown organic bell pepper's prices went up by 10% y/y to $2,880/ton.

- Lettuces imports outpaced main vegetables at +29% y/y to 232,000 tons in January-September 2021. Mexico made up over 94% of total imports, followed by Canada; prices from both suppliers fell 5% y/y and 11% y/y, respectively.

- Fresh asparagus ranked fourth by import value to $573 million, 5% up y/y. The import volume increased by 12% y/y to 231,000 tons. Mexico (70%) and Peru (29%) are the main suppliers. The average import price was $2,470/ton, 7% down y/y; asparagus has the highest import price among main vegetables. Mexico's average price was $2,000/ton compared to Peru's $3,370/ton.

- Pumpkins and squash noted a sharp fall of 22% y/y in import value to $294 million, despite a 4% y/y increase in volumes. The category's import price decreased by 25% y/y to $770/ton, the biggest fall among main vegetables. Most varieties saw price decreases; organic squash registered the biggest fall of 25% y/y to $950/ton.

- For a reference point, the US imported over 10 million tons of

fruits and nuts (fresh, dried and frozen) from January-September

2021, 4% up y/y. The average price of the products under one HS

code 08 was $1,440 per ton, 9% up y/y.

- The US is proposing incentives for the purchase of electric vehicles (EVs 0 produced in the US; recently both Canada and Mexico have expressed concerns over the potential incentive, relative to the US-Mexico-Canada Free Trade Agreement (USMCA). The proposed credit is structured to provide a higher incentive for vehicles produced in the US, and another level if that production is at a union-represented plant (see United States: 13 September 2021: US House proposes tax credits for EVs − report and United States: 28 May 2021: US lawmakers advance bill proposing clean-energy tax credits, EV incentives). Mexico's Economy Minister Tatiana Clouthier has called the credit "discriminatory", and says Mexico is reviewing possible legal actions to respond. Clouthier is quoted as saying, "In the past we have imposed tariffs and we would have to do or propose something very important and strategic for those products, in those places where it hurts them… so that the consequences can be felt." The minister also said that tariffs were "not a desirable" course of action, while indicating that Mexico would do everything in its power to safeguard its automotive industry. According to Automotive News, the minister called the proposed US measure "totally contrary to free trade" and said, "The effect on our auto exports would have a very large impact on this sector that creates a lot of jobs… and could even generate additional migratory pressures." In addition, Automotive News Canada has reported that Canada's Trade Minister, Mary Ng, has raised a number of trade disputes with the US, including the proposed tax credit for EVs. Ng took the position that the proposal is counter to the terms of the USMCA. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Electric vehicle (EV) startup Lucid Motors says reservations for the Air sedan have surpassed 17,000 units, although these are not guaranteed sales, reports Automotive News. According to the report, Lucid's senior director of sales and services, Zak Edson, said, "Demand is in great shape, so a lot of what we're doing is executing our plan and ensuring that cars are coming out in sufficient volumes and quality to satisfy that demand." The company is building first the limited-run USD169,000 Dream Edition of the Air sedan and then a USD139,000 Grand Touring version. In 2022, the company plans to add a USD95,000 Touring version and a USD77,400 Pure version. Edson said that the reservations so far are for a mix of trim levels, saying, "We see a strong demand for the Grand Touring. It's definitely not a case where everyone is coming in at the low end." The report highlighted earlier remarks from Lucid CEO Peter Rawlinson, who suggested the company potentially could create a smaller model, given the Air Grand Touring has range of 516 miles with a 112-kilowatt-hour battery pack. Lucid is planning the Gravity sport utility vehicle (SUV) in 2023, production of which is to be at the company's plant in Arizona, United States. According to reports, Lucid says its production capacity will be 34,000 vehicles per year in the current phase and it plans to expand this to 90,000 units when phase two of the plant is completed in 2023. Eventually, Lucid plans a production capacity of 365,000 units per annum at the Arizona plant. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Further to a foundations contract award earlier in October, joint venture partners Ørsted and Eversource have begun construction on a new facility in ProvPort, Rhode Island, United States, to produce advanced foundation components. The partners are investing USD40 million in total and have a Project Labor Agreement in place with the Rhode Island Building and Construction Trades Council, and Dimeo Construction, the project's general contractor, to ensure that all work is undertaken by the unionized local workforce. Earlier in October, the JV partners signed a USD86 million contract with Riggs Distler & Company, a fully owned subsidiary of Centuri Group, for the supply of wind turbine foundations for the Sunrise Wind project in New York. Riggs Distler will be the general contractor to build the prefabricated foundation components at the Port of Coeymans. Sunrise Wind, being developed by Ørsted and Eversource, is undergoing its federal permitting process by the Bureau of Ocean Energy Management (BOEM). The project will see up to 122 offshore wind turbines installed with a total capacity of between 880 to 1,300 MW. (IHS Markit Upstream Costs and Technology's Melvin Leong)

Europe/Middle East/Africa

- All major European equity indices closed higher; Spain +2.4%, Italy +2.2%, UK/France +1.5%, and Germany +1.4%.

- Most 10yr European govt bonds closed higher except for Germany flat; Italy -4bps, Spain -3bps, UK -2bps, and France -1bp.

- iTraxx-Europe closed -1bp/57bps and iTraxx-Europe -2bps/280bps.

- Brent crude closed +4.6%/$73.08 per barrel.

- The UK government is said to be offering Rivian a range of incentives to attract a European vehicle manufacturing site to the country. Sources familiar with the negotiations have told the Financial Times (FT) that government officials have held discussions with representatives of the battery electric vehicle (BEV) manufacturer in recent days with an aim for it to invest at the Gravity business park, a 635-acre site near Bridgwater that is being developed by the Salamanca Group. Incentives on offer include a new junction off the M5 motorway, training facilities, and the reinstatement of an old rail link. The UK is said to be highlighting its "green credentials", with Rivian keen to use electric rail links to transport parts and vehicles. The discussions are said closely involve Prime Minister Boris Johnson, and executives from key shareholder Amazon. The final investment by Rivian could comprise both vehicle and battery manufacturing, but a final decision has yet to be made. (IHS Markit AutoIntelligence's Ian Fletcher)

- Mobility startup Imperium Drive has started trials of an on-demand driverless car-hailing service, named Fetch, in Milton Keynes (United Kingdom). Imperium Drive's car is equipped with its remote driving software and uses 5G network for connectivity and control. Users can book and unlock the car through the Fetch app and the car will be delivered to the customer by a remote operator. Users can drive the car normally to their destination, and after completing the trip the remote operator takes control to drive the vehicle to the next customer in line. The Fetch trial is supported by private investment and is backed by Milton Keynes Council and the government's '5G Create' initiative. Startup accelerator funds Entrepreneur First and Techstars also contributed capital towards the trial. Imperium Drive offers various cars, ranging from a standard sedan to electric microcars. In the next 12 months, the company plans to include public trials. It plans to launch a fully operational remote-operated car-hailing service in the UK in the second half of 2022 and aims to move to fully autonomous vehicles within the next five years. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The EU has vowed to spend billions on international development

finance with a move it compared to China's Belt and Road, but with

"the highest environmental standards." China's Belt and Road

initiative has invested in projects such as roads, power stations,

railways, airports, and ports across Eastern, Southern, and Central

Asia. (IHS Markit Net-Zero Business Daily's Cristina Brooks)

- On 1 December, the European Commission (EC) announced the new strategy, dubbed Global Gateway, through which it will facilitate foreign investments of up to $339 billion (€300 billion) by 2027.

- While China's environmental standards under Belt and Road have been criticized, it recently published green standards for overseas construction.

- The EC responded to the comparison with China by saying it is "offering an innovative choice" and filling an infrastructure finance gap for low- and middle-income countries estimated at over $2.7 trillion in 2019 and worsened by the COVID-19 crisis.

- In particular, the Global Gateway will use the EU's existing European Fund for Sustainable Development+ to offer up to $152.83 (€135 billion) of guaranteed investments for infrastructure in countries in the EU's region and in Africa.

- It will not only provide grants, loans, and budgetary guarantees to de-risk projects like renewables and smart grids, but it will also support what it termed "soft infrastructure" such as health projects, education, and research.

- Its energy investments will include growing hydrogen production through state partnerships, to "promote the creation of competitive markets to enable such hydrogen produced outside the EU to be traded internationally without export restrictions or price distortions."

- It aims these projects in countries where it has existing development partnerships and strategic interests. For example, China's rivals include India and Japan, with which it recently signed pacts to cooperate on cleantech and connectivity.

- The EU will pour funds into its neighbors to the east, including Albania, Bosnia and Herzegovina, North Macedonia, Montenegro, Serbia, Kosovo Armenia, Azerbaijan, Belarus, Georgia, the Republic of Moldova, and Ukraine.

- Denmark's recent offshore wind farm tender highlighted a "pay

to play" trend first seen in the UK, signaling developers' hunger

to build offshore wind. (IHS Markit Net-Zero Business Daily's

Cristina Brooks)

- German utility and developer RWE is set to build the 1 GW Thor wind farm in the North Sea west of Nissum Fjord by December 2027.

- RWE's company Thor Wind Farm I/S won the tendered concession after an unusual lottery process following identical bid amounts, Danish Energy Agency said on 1 December. UK utility and developer SSE Renewables was the other bidder at the identical amount.

- The agency said the deal marked the world's first offshore wind farm to be constructed with revenue payments to the state, although the UK has similarly charged for seabed leases.

- The winning bidder will have to pay some of the electricity revenues to the state whenever the average spot price for electricity in western Denmark rises above its near-zero bid during the 20-year symmetrical Contract-for-Difference (CfD) contract. After that, the wind farm will run on commercial terms for the rest of its lifetime.

- As Holger Nikolaj Jensen, a senior manager for financial services firm KPMG Denmark's energy advisory explained to NZBD, this means that the concession deal both subsidizes and requires payments.

- If the average spot price in a quarter is below the bid price of $0.000015 per kWh (kr0.0001 per kWh), RWE receives the difference as a subsidy until it reaches a $988 million (kr6.5 billion) cap, whereas if the average spot price is above the bid price, RWE must pay the difference back to the state in 'negative subsidy' until a cap of $430 million (kr2.8 billion) is reached, he said.

- Finnish autonomous technology company Sensible 4 has partnered with sustainable transport solution provider MOOVE GmbH, according to a company statement. Under this partnership, Sensible 4 will integrate its automated technology into MOOVE's PeopleMover, a customized vehicle that can carry up to 19 passengers. In February 2022, trials with the automated PeopleMover will begin in Aachen (Germany). The companies also plan to jointly develop a new all-weather SAE Level 4 autonomous shuttle bus for the European market in 2023. The shuttle bus will not require a safety driver on board. Harri Santamala, CEO of Sensible 4, said, "We are thrilled to announce our collaboration with MOOVE. With their strong German manufacturer knowledge combined with our technology, we are challenging the traditional automotive companies bringing new competitive solutions to the market". Sensible 4 specializes in developing autonomous technologies for harsh weather conditions. It has developed an autonomous shuttle, the Gacha, with Japanese lifestyle brand Muji. (IHS Markit Automotive Mobility's Surabhi Rajpal)

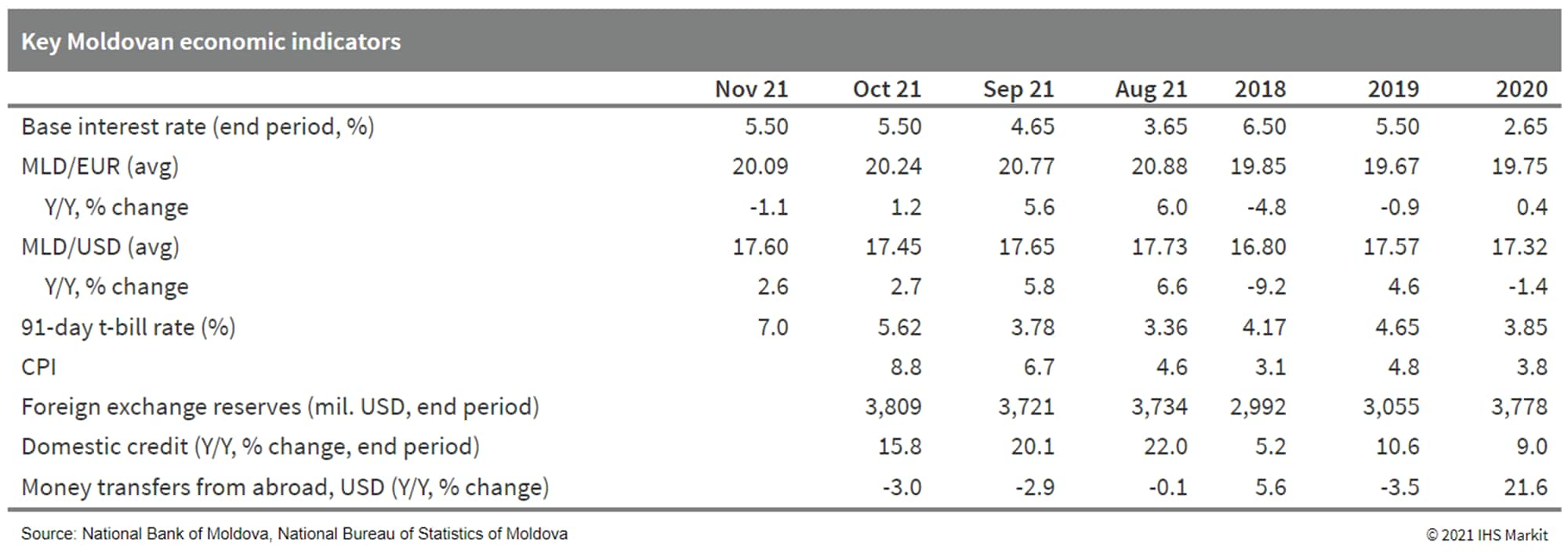

- At its session on 3 December, the National Bank of Moldova

(NBM) raised the policy interest rate by another 100 basis points,

marking the fourth increase of 2021. That follows a pause at 5.5%

during the previous session on 29 October, when the NBM highlighted

the uncertainty associated with the global energy crisis and the

potential negative impact on domestic demand. (IHS Markit Economist

Sharon

Fisher)

- At the December session, the NBM also raised the interest rates on overnight loans and deposits by 100 basis points, to 8.5% and 4.5%, respectively. The level of required reserves remains unchanged.

- Rising inflation was the main justification for the December interest rate hike. In October, consumer prices jumped 8.8% year on year (y/y), boosted by double-digit growth in both food and non-food goods prices. The NBM's inflation target currently stands at 5.0%, with a range of +/-1.5%.

- Salary pressures in Moldova are currently very strong, with the average monthly nominal wage up 13.6% y/y in the third quarter, marking the fourth straight period of double-digit growth. The sectors with the fastest y/y growth were healthcare, IT, finance, and agriculture. In real terms, third-quarter wages jumped 8.3% y/y, helping to support household consumption.

- In other economic news, the improved 2021 harvest is supporting

agricultural and industrial output as well as exports. In the third

quarter, agricultural production jumped 30.9% y/y, while goods

exports jumped 36.0% y/y in US dollar terms (versus import growth

of 25.6%). In September alone, soaring output of food products (up

42.5% y/y) helped drive up industrial production by 13.7% y/y.

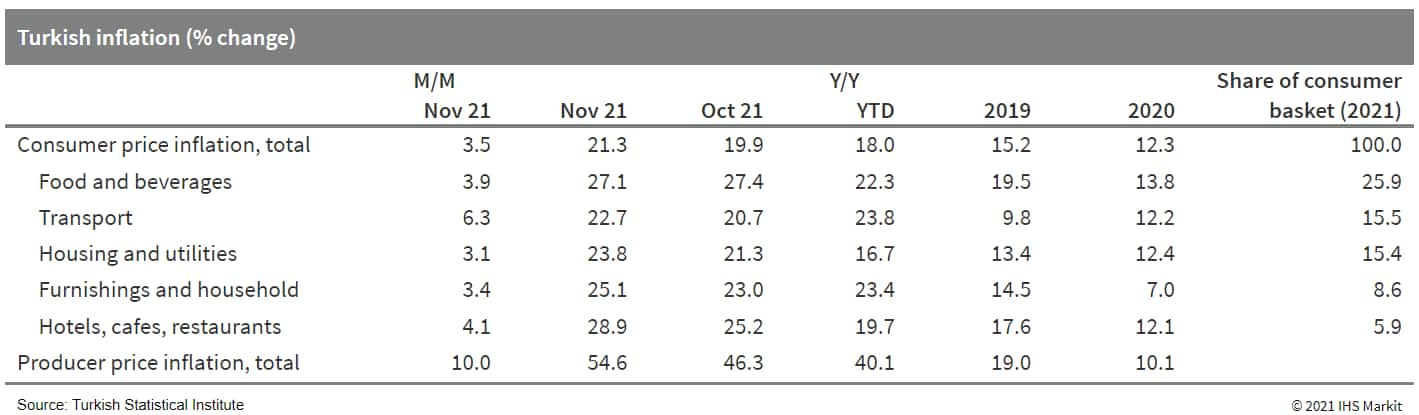

- Turkish annual inflation - both headline and core - continued

to rise in November, exacerbating the disruption of the current

rate cutting cycle to market stability. With inflationary pressures

still building, although we still expect another rate cut on 16

December, it may be moderated from our previous expectation. Sharp

lira losses and high inflation will continue through early 2022,

particularly following the recent resignation of a trusted economic

minister. (IHS Markit Economist Andrew

Birch)

- In November 2021, annual consumer price inflation continued to rise, to 21.3% according to data from the Turkish Statistical Institute (TurkStat). Inflation has steadily risen for over a year, standing more than seven percentage points higher than it had been a year earlier.

- President Recep Tayyip Erdoǧan and Central Bank of the Republic of Turkey (TCMB) Governor Şahap Kavcıoğlu had pointed to a modest month-on-month (m/m) decline of inflation from September to October as justification for the last cut of the one-week repo rate. After that modest m/m decline from 17.0% to 16.8%, annual core inflation re-rose in November, to 17.6%.

- TurkStat also reported annual producer price inflation of 54.6% in November 2021, surging upwards from 46.3% the previous month. The impact of high global commodity prices, the sharp lira losses, and supply-chain problems has been particularly substantial on producer price inflation, more than doubling its level over the past 12 months.

- Sharp lira losses were extremely inflationary through the first 11 months of 2021. Through 23 September, the lira had already depreciated by nearly 23% against the US dollar, pushing import prices higher.

- The beginning of the current rate cutting cycle at the

September TCMB policy meeting, the lira losses were enflamed. As of

3 December, the lira had depreciated by 95.8% against the US

dollar.

- Saudi Aramco, a Saudi Arabian public petroleum and natural gas company announced the signing of five agreements with French companies, including an agreement to explore a hydrogen-powered vehicle business with Gaussin, a French technology company, reports Reuters. According to the source, "The agreement between Aramco and Gaussin aims to establish a modern manufacturing facility for on-road and off-road hydrogen powered vehicles in the Kingdom of Saudi Arabia." The other agreements span the areas of carbon capture technology, artificial intelligence and local manufacturing. The signing of the event was held in Jeddah (Saudi Arabia). Aramco will also sponsor a hydrogen-fueled racing truck developed by Gaussin to compete in the 2022 Dakar Rally in Saudi Arabia. Saudi Aramco CEO Amin Nasser said, "It represents an opportunity to promote hydrogen as a low-carbon solution, not just for motorsport, but eventually for mass transportation as well. Such collaboration helps us to advance economic growth in the Kingdom as part of the Namaat industrial investment program and takes us a step closer to our shared vision of a more sustainable future." Gaussin is engaged in zero-emission, smart and connected vehicles for freight transportation and people mobility. The recent agreement aims to establish a modern manufacturing facility for on-road and off-road hydrogen powered vehicles in Saudi Arabia. (IHS Markit AutoIntelligence's Tarun Thakur)

- Israel and Jordan in November signed what the countries'

governments called "the largest-ever cooperation agreement" between

the nations, which could result in a new solar PV power plant in

Jordan that will generate electricity for Israel, while Israel will

sell Jordan additional clean water from desalination plants. (IHS

Markit Net-Zero Business Daily's Keiron Greenhalgh)

- The solar PV plant will have a capacity of 600 MW. Israel will supply up to 200 million cubic meters of desalinated water per year to Jordan under the deal, doubling the amount of water it currently has promised to sell to Jordan.

- For both countries, the deal helps solve climate change problems: energy in Israel, and water in Jordan.

- Climate change is exacerbating an immense water resources problem in Jordan, said Minister of Water and Irrigation, Mohammad Al-Najjar at the signing event at the Dubai Expo in the United Arab Emirates (UAE). "Climate change and the influx of refugees have further exacerbated Jordan's water challenges, however, there are many opportunities for regional cooperation to help increase sustainability in the sector," he said.

- Energy ministries of both countries could not be reached by Net-Zero Business Daily for further information on how the power-for-water swap might work, nor any further details on a timetable.

- "The benefit of this agreement is not only in the form of green electricity or desalinated water, but also the strengthening of relations with the neighbor that has the longest border with Israel," Israel's Energy Minister Karine Elharrar said at the signing ceremony.

- The agreement was brokered by the UAE, and a UAE firm will build the PV plant in Jordan, she added.

Asia-Pacific

- Major APAC equity indices closed mixed; South Korea +0.2%, Australia +0.1%, Japan -0.4%, Mainland China -0.5%, India -1.7%, and Hong Kong -1.8%.

- The Premier Li Keqiang stated in a meeting on 3 December with

the International Monetary Fund (IMF) chief that mainland China

will cut RRR in a timely way to support the real economy,

especially small and micro firms, reports Xinhua News Agency. (IHS

Markit Economist Yating

Xu)

- The premier also said that mainland China will implement steady economic policies and make policies more targeted and effective while maintaining prudent monetary policy and keeping liquidity reasonably ample. However, the central bank has not responded to the statement and there is no specific time for the expected RRR cut yet.

- On the same day, the Guangdong local government agreed to parachute a team of officials into Evergrande as the developer warned it might not be able to meet its financial obligations and planned to restructure its offshore debt. Meanwhile, government departments including the central bank, China Banking and Insurance Regulatory Commission, China Securities Regulatory Commission, etc. all expressed the determination to stabilize the financing of developers.

- Chinese electric vehicle (EV) startup NIO has begun to provide its customers the option of upgrading their vehicle batteries through a monthly subscription program. Customers can upgrade the 70-kWh battery pack or the 75-kWh battery pack in their existing NIO vehicles to the larger 100-kWh battery pack for a fee of CNY880 (USD138) per month. The 100-kWh battery was previously offered to NIO customers through a leasing program, with a minimum subscription period of one year. NIO's 100-kWh battery pack is compatible with all of its models currently on the market. This flexible battery configuration allows NIO to explore new revenue opportunities through its battery leasing program. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Baidu has started commercial operation of autonomous buses in Southwest China's Chongqing municipality. The company has deployed three autonomous buses, named Robobus, which are equipped with Level 4 automation technology and will run on a round trip of nearly 10 km. Residents can use facial recognition, IC cards or Alipay to take the bus, reports China Daily. Baidu has tested its robotaxi service in five Chinese cities: Beijing, Shanghai, Guangzhou, Changsha, and Cangzhou. To date, Baidu's Level 4 autonomous test vehicles have completed over 10 million miles, and says its robotaxi service, Apollo Go, will be available in 65 cities by 2025 and 100 cities by 2030. It has also developed an autonomous minibus, named Apolong, which has been in production since 2018. The minibus has been deployed in 22 urban parks in Chinese cities and has served 120,000 users while travelling a total of 120,000 km. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Japan's Suntory Group has successfully prototyped a

polyethylene terephthalate (PET) bottle made from 100% plant-based

chemicals, the company announced last Friday. (IHS Markit Chemical

Market Advisory Service's Chuan Ong)

- The company said that the prototype PET bottle uses plant-based terephthalic acid (PTA) and monoethylene glycol (MEG), and is fully recyclable. The PTA is produced from plant-based paraxylene (PX) derived from wood chips, utilizing new techniques from technology company Anellotech. Suntory used MEG derived from molasses.

- Suntory believes its prototype PET bottle is a crucial step towards its aim of producing 100% sustainable PET bottles by 2030, and net-zero greenhouse gas emissions across its entire value chain by 2050. The company said the new PET technology is significant as its PTA is produced using non-food biomass, which avoids competition with the food chain, while its MEG is derived from non-food grade feedstock.

- The beverage maker believes Anellotech's PX technology enjoys process efficiency, using a single-step thermal catalytic process by going directly from biomass to aromatics benzene, toluene and xylene. This process generates required energy from the biomass feedstock itself, and may allow significant reductions in greenhouse gas emissions compared to fossil-derived PX, according to a Suntory source.

- The South Korean government plans to increase the number of electric vehicle (EV) chargers at highway service areas across the country to over 1,000 by the end of 2022, reports the Yonhap News Agency. Currently, there are 435 EV chargers at the country's highway rest stops. The government plans to increase the number to 730 by the end of this month and then add more than 300 chargers next year, according to the South Korean transport ministry. During January-October, the number of highway EV charger users came to 872,000, already exceeding the 700,000 users for all of 2020, added the ministry. The move is in line to meet growing demand for EVs and charging infrastructure in the country. As reported earlier, sales of alternative-powertrain vehicles in South Korea surged by 61.4% year on year (y/y) in October to 34,137 units, marking the 21st consecutive month of growth. Sales of hybrid vehicles in the country during the month grew by 27.9% y/y to 20,413 units, plug-in hybrid vehicle sales jumped by 93.3% y/y to 1,850 units, EV sales surged by 204.1% y/y to 10,934 units, and fuel-cell electric vehicle (FCEV) sales expanded by 46.9% y/y to 940 units. (IHS Markit AutoIntelligence's Jamal Amir)

- Vietnamese conglomerate Vingroup is planning to list its car

unit, VinFast, on the US stock market in the second half of next

year, in an offering expected to raise at least USD3 billion,

reports Reuters. VinFast is currently working with leading

international investment banks to prepare for the initial public

offering (IPO). In a statement released on 3 December, Vingroup

said its board of directors approved the transfer of the entire

contributed capital (51.52%) in VinFast Trading and Production

Limited Liability Company, headquartered in Dinh Vu Economic Zone,

Vietnam to VinFast Trading and Investment Pte. Ltd., a subsidiary

of Vingroup with head office in Singapore. Following the

restructuring, Vingroup and existing VinFast Vietnam shareholders

will own 100% of the shares of VinFast Singapore, which owns 99.9%

of VinFast Vietnam, and so Vingroup continues to own 51.52% of

VinFast Vietnam. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-december-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-december-2021.html&text=Daily+Global+Market+Summary+-+6+December+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-december-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 6 December 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-december-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+6+December+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-december-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}