Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 06, 2020

Daily Global Market Summary - 6 July 2020

Equity markets rallied across most of the globe on the Shanghai Composite's best daily performance since 2015, with the Nasdaq closing at yet another record high. iTraxx and CDX credit indices closed tighter across IG and high yield, while benchmark government bonds and oil were close to unchanged on the day. Markets appear to be gradually shifting attention to Q2 earnings season and assessing the potential market implications of the US presidential election in November, while the rapidly increasing number of COVID-19 cases in the US/Australia and newly announced mandated closures are becoming a growing concern.

Americas

- US equity markets closed higher; Nasdaq +2.2%, DJIA +1.8%, S&P +1.6%, and Russell 2000 +0.8%.

- 10yr US govt bonds closed +1bp/0.68% yield.

- CDX-NAIG closed -3bps/71bps and CDX-NAHY -14bps/503bps.

- Crude oil closed almost flat at $40.63 per barrel.

- In a press release, Berkshire Hathaway, Inc. announced the

signing of an agreement to acquire Dominion Energy's natural gas

transmission and storage business for a total consideration of $9.7

billion, including $5.7 billion of debt. (IHS Markit Upstream

Companies and Transactions' Karan Bhagani)

- The transaction is expected to close in the fourth quarter of 2020. Under the deal, Berkshire will acquire Dominion's interest in Dominion Energy Transmission, Questar Pipeline (including Overthrust and White River Hub), Carolina Gas Transmission, 50% of Iroquois Gas Transmission System, legacy gathering and processing operations and farmout acreage.

- However, Dominion Energy will retain its interest in Atlantic Coast Pipeline. Additionally, the company will acquire 25% interest in Cove Point LNG facility, located in Maryland. Following the closing of the transaction, Dominion will transfer the operatorship of Cove Point LNG to Berkshire and will retain the remaining 50% interest in Cove Point LNG.

- The transaction includes 7,700 miles (12,392 kilometers) of natural gas transmission lines with the transportation capacity of 20.8 Bcf/d and 900 Bcf of operating natural gas storage assets.

- Berkshire said the acquisition will expand its footprint in several Eastern and Western states as well as globally and will diversify its energy portfolio.

- Dominion said the transaction would allow the company to focus on its state-regulated, sustainability-focused utility business.

- Citing ongoing delays and increasing construction cost uncertainty, Dominion Energy and Duke Energy have cancelled the Atlantic Coast Pipeline project. The two companies point specifically to a United State District Court for the District of Montana decision against the Keystone XL pipeline as a key reason for the cancellation. The court overturned long standing federal permit authority used by pipeline companies nationwide to streamline the approval process for water crossings. Without that authority (known as a Nationwide Permit 12 and administered by the US Army Corps of Engineers), new water crossings must be all individually permitted. While the US District Court's decision and subsequent appellate court upholding has the potential to suspended by the Supreme Court, Dominion Energy and Duke Energy believed that permits issued to the Atlantic Coast Pipeline are now at significant risk from legal challenges. A series of legal challenges to its state and federal permits prior to this point has already resulted significant cost increases and timing delays. As a result, public guidance for the cost of the project had ballooned to USD8 billion from the initial USD4.5 to USD5.0 billion. In addition, the most recent in-service estimate of 2022 is an over three-year delay. (IHS Markit Upstream Costs and Technology's Amy Groeschel)

- The seasonally adjusted final IHS Markit US Services Business Activity Index registered 47.9 at the end of the second quarter, up significantly from 37.5 in May and above the earlier released 'flash' figure of 46.7. The marked easing in the rate of output contraction was in part linked to the reopening of service providers and the gradual return of customer demand. The pace of decline was the slowest in the current four-month sequence of decline. (IHS Markit Economist Chris Williamson)

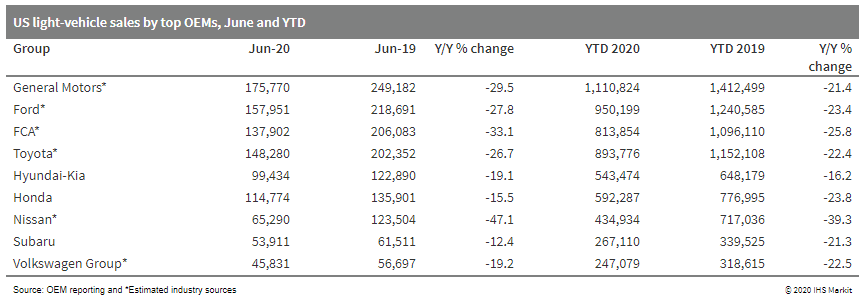

- Light-vehicle sales in the United States dropped 26.4% year on

year (y/y) to 1,111,311 units in June. Nevertheless, US

light-vehicle demand continued to improve in June from the

depressed level in April as online sales and reopening of

activities - especially by auto dealerships - supported sales.

However, over the first half of the year, the market has declined

23.6% y/y to 6,447,864 units. With the rising number of COVID-19

cases in some US states, it will be important to track auto sales

developments over the next few months. (IHS Markit

AutoIntelligence's Stephanie Brinley)

- Tesla has issued a brief statement regarding production and deliveries for the second quarter of 2020. The company delivered approximately 82,272 vehicles, although it calls this estimate "conservative" as it does not count a vehicle as delivered until "it is transferred to the customer and all the paperwork is correct." Tesla says it produced 10,600 Model S and X vehicles and 80,050 Model 3 sedans and Model Y utility vehicles, and delivered 6,326 of the Model S and X, and 75,946 of the Model 3 and Model Y. Tesla did not break out these volumes separately. Tesla began production of the Model Y in January and deliveries in March. This is a decline from 95,365 in the first quarter of 2019, although it was not as severe as the global market given unprecedented conditions in the market. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/ Africa

- Most major European equity markets closed higher; Spain/UK +2.1%, Germany/Italy +1.6%, and France +1.5%.

- 10yr European govt bonds closed mixed; Italy/Spain -2bps, France -1bp, Germany flat, and UK +1bp.

- iTraxx-Europe closed -3bps/61bps and iTraxx-Xover -18bps/354bps.

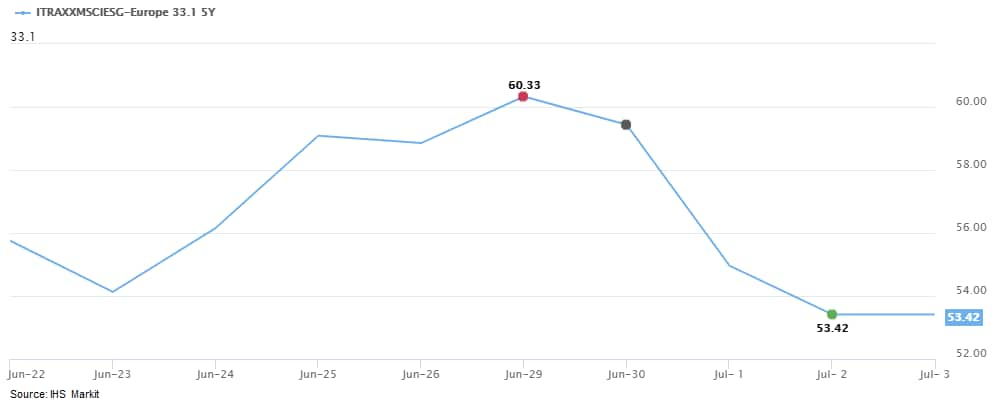

- Last week marked the end of the second week of trading for the

newly launched IHS Markit iTraxx MSCI ESG Screened Europe index.

The index has tightened 2bps since the first trading day on 22 June

to close at 53bps on 2 July.

- Brent crude closed +0.7%/$43.10 per barrel.

- In a press release, Viaro Energy Limited announced the signing of an agreement to acquire RockRose Energy plc for £248 million ($310 million) in equity value. Under the deal, each RockRose shareholder will receive £18.50 ($23.13) per share in cash for each RockRose share. The offer price is a 64% premium to the closing price on 3 July 2020, the last business day prior to the date announcement. The company reported year-end 2019 2P reserves of 60.8 MMboe (UK-50.83 MMboe and Netherlands-9.96 MMboe) and 2C resources of 21.23 MMboe. Rockrose pro forma production averaged 19,356 boe/d (62% oil) in 2019. The acquisition is part of Viaro's strategy to grow as a mid-sized independent oil and gas producer with a long-term production target of 100,000 boe/d and beyond. (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

- May's 17.8% month-on-month (m/m) rise in Eurozone retail sales

is by far the strongest on record but given prior double-digit

back-to-back declines, retail sales remained around 7% below their

February's level. (IHS Markit Economist Ken Wattret)

- In line with the recent indications from member states' data already released, the eurozone's retail sales rebounded very strongly in May, driven primarily by non-food sales (+34.5% m/m).

- Relative to February's level, however, May's non-food sales were down by over 11% (see first chart below). The level of food sales was 1.5% higher in May than in February, despite having fallen back since a stockpiling-driven surge in March.

- May's rebound in non-food sales was broad-based, particularly in the areas hit hardest by the COVID-19 virus restrictions. For example, sales of textiles, clothing, and footwear jumped by 147% m/m. However, given the huge magnitude of the prior declines in March and April, the level of sales remained more than 50% below February's peak.

- Despite m/m increases in May, the level of sales of computer equipment, books and other items (29.9%), electrical goods and furniture (-17.9%), and pharmaceutical and medical goods (-9.1%) were all still well down compared with February, in contrast to a net rise in mail order and internet sales (+20.3%; see second chart below).

- Looking at the larger eurozone member states, sales volumes in May rebounded particularly strongly in France (25.6% m/m) and Spain (18.0% m/m) but in both, sales remained well below their February levels.

- In Germany, however, following a strong m/m increase in May (13.9%) after comparatively small falls in March and April, sales were up by over 3% versus February, reinforcing our expectations that Germany's economy will outperform its peers during 2020.

- Eurostat again did not release retail sales data for some eurozone member states, including Italy.

- The German passenger car market has posted a highly accelerated

decline in registrations during June with a 32.3% year-on-year

(y/y) fall to 220,272 units, according to the latest data release

from the Federal Motor Transport Authority (KBA). (IHS Markit

AutoIntelligence's Tim Urquhart)

- This left the year-to-date (YTD) sales running rate at 1,210,622 units for the first half of the year, which was a 34.5% y/y decline.

- The effect that the COVID-19 virus pandemic has had on consumer confidence was illustrated by the fact that private sales fell at a higher rate than business registrations, with the former declining by 38.2% y/y, while the latter declined by 29.0% y/y.

- On a brand-by-brand basis, the country's best-selling marque Volkswagen (VW) actually experienced an even tougher month than some of its rivals with a June decline of 37.2% y/y to 39,126 units, which was below the overall market performance during the year.

- This comes just as the company restarted customer deliveries of the new Mark 8 Golf following issues with the automatic accident emergency warning system, while it is also preparing to start deliveries of the key ID.3 electric vehicle (EV) in Germany. In the first six months of 2020 the brand's sales fell 35.1% y/y to 223,227 units.

- The strongest performer of all the top-10 manufacturers during June was Mercedes-Benz, which managed to take second place overall with a strong 21,970 units; an 8.7% y/y decline.

- The Italian government's decision to begin an easing of the

COVID-19 virus lockdown measures helped to slow the pace of job

losses during May. (IHS Markit Economist Raj Badiani)

- Specifically, total employment fell by 0.4% month on month (m/m), equivalent to 275,000 jobs, to 24.4 million in May. This was after drops of 1.3% m/m in April and 0.7% m/m in March.

- Total cumulative job losses in March-May stood at 538,000.

- In annual terms, the level of employment was 2.6% lower in May compared with a year earlier, or a loss of 613,000 jobs.

- The unemployment rate rose to 7.8% in May, up from 6.6% in April, the lowest rate since March 2008. It had stood at 9.4% in January.

- The rise in the unemployment rate in May was partly due to the inactivity rate falling, resulting in the labor force expanding by 0.9% m/m or 223,000 m/m.

- Conversely, the lower unemployment rate in both March and April was because of the rising inactivity rate, with an increasing number of people neither working nor looking for work. ISTAT argued that many laid-off workers stopped looking for jobs during the height of the COVID-19 lockdown. Indeed, the size of the labor force contracted by 758,000 between March and April.

- Italian oilfield services company Saipem has won a USD325 million contract from Petrobras for the installation of a rigid riser-based subsea system at the Búzios pre-salt project, in water depths ranging from 1,537 to 2,190 meters, offshore Rio de Janeiro, Brazil. The Búzios-5 overall production system will interconnect 15 wells to the FPSO in two phases. The award includes the engineering, procurement, construction and installation (EPCI) of the Steel Lazy Wave Risers (SLWR) and associated flowlines between all wells and the FPSO. In particular, the scope of work includes five production and five injection risers and flowlines, for a total length of 59 km, plus a 16 km-long gas export line to be connected to an existing pipeline, 11 rigid jumpers, and 21 foundation subsea structures (risers and PLETs). Saipem will deploy its derrick pipelay vessel Saipem FDS for all the subsea works. (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

- Italy's Eni said it will cut up to €4.2bn from the value of its assets, marking the latest warning by an energy company about the long-lasting impact of the coronavirus pandemic on the global economy. (FT)

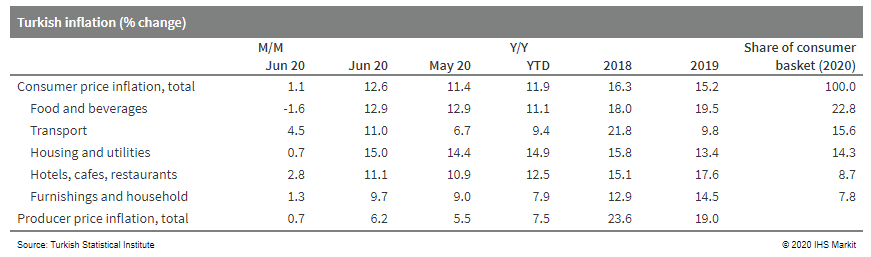

- Turkish annual consumer price inflation continued to accelerate

in June, rising for the second month in a row after ebbing to a

recent trough of 10.9% in April. Previously, inflation had fallen

to as low as 8.6% as of October 2019, at which point the Central

Bank of the Republic of Turkey (TCMB) began pressuring commercial

banks to lower their lending rates to stimulate economic activity.

(IHS Markit Economist Andrew Birch)

- Distressingly, rising core inflation has fueled the reacceleration, pushing up from 9.9% in April to 11.6% in June. Government tax increases also contributed to a sharp jump in alcohol and tobacco prices in June.

- Despite depressed domestic demand, the sharp lira slide in

March-May fueled import prices up significantly. Even with a

stabilization of the lira since mid-May, the currency still traded

9.9% weaker against the US dollar at the end of June than it had at

the beginning of March, and down by 12.1% against the euro.

- The Turkish new light-vehicle market increased by 66.3% year on

year (y/y) in June to 70,973 units, according to data released by

the Automotive Distributors' Association (Otomotiv Distribütörleri

Derneği: ODD). (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Of this total, passenger vehicle sales were up by 58.4% y/y to 57,067 units during the month, while light commercial vehicle (LCV) sales stood at 13,906 units, up by 108.7% y/y.

- The country's light-vehicle market has now posted a year-to-date (YTD) increase of 30.2% y/y to 254,068 units, comprising 203,595 passenger vehicles, up by 30.2% y/y, and 50,473 LCVs, up by 30.2% y/y.

- In the YTD, C-segment vehicles accounted for 60.6% of total passenger vehicle sales in Turkey, with sedans being the most preferred vehicle type, accounting for 44.1%. In the LCV segment, vans accounted for 75.5% of total sales in the YTD, followed by light trucks with 11.6%.

- The significant growth in light-vehicle sales during June can be attributed to a low base of comparison. In June 2019, the Turkish new light-vehicle market was down by 16.4% y/y to 42,688 units.

- Zimbabwe's central bank, the Reserve Bank of Zimbabwe (RBZ),

raised its key interest rate to 35% on 1 July, from 15% previously,

to support its foreign-exchange auction system, while annual

headline inflation reached 786% in May. (IHS Markit Economist Alisa

Strobel)

- The RBZ decided to increase its key interest rate to 35% on 1 July to curb speculative borrowing and support the 8 June updating of the formal market-based foreign exchange (forex) trading system, which came into operation on 23 June.

- Annual headline inflation remains at alarmingly high rates. Despite coming down on a monthly basis to 17.6% in April from 26.7% in March, average annual inflation reached 785.6% in May, up from 765.6% in April and 676.4% in March.

- The aim of the newly introduced foreign-currency auction system is to bring further transparency and efficiency in the trading of forex in Zimbabwe. The goal is to stabilize the Zimbabwean dollar through restoring confidence in the forex market. With all bids in US dollars, the forex sold in the auction system will be used only for the settlement of foreign payments.

Asia-Pacific

- Most APAC equity markets closed higher on the positive momentum from the significant rally in China +5.7%, which was its largest single-day gain since 2015; Hong Kong +3.8%, Japan +1.8%, South Korea +1.7%, India +1.3%, and Australia -0.7%.

- A front-page editorial in the China Securities Journal on Monday said that fostering a "healthy" bull market after the pandemic is now more important to the economy than ever. Chinese social media exploded with searches for the term "open a stock account," with bullish sentiment also boosting the yuan. (Bloomberg)

- Victoria, the second most-populous state in Australia, reported its biggest jump in coronavirus cases since late March on Saturday, leading to the expansion of stay-at-home orders and the complete lockdown of nine public housing towers. As a result of the increases in cases, the border between Victoria and New South Wales, Australia's two most populous states, will close from Tuesday for an indefinite period. (Reuters)

- Nufarm is to end manufacturing of insecticides and fungicides at its Australian Laverton site and restrict the manufacturing of herbicides at its facility in Linz, Austria. The company expects the combined moves to deliver an annual improvement to EBITDA of up to Aus$15 million (US$10.4 million at the current rate), once fully implemented. Managing director and CEO Greg Hunt says that the moves are part of its strategy to improve returns. "The analysis of our manufacturing footprint is well advanced. It shows that our MCPA [herbicide] synthesis and formulation operations remain competitive, however gaps have emerged in the competitive position of our 2,4-D [herbicide] synthesis and insecticide and fungicide formulation." He says that the moves are calculated to strike "the right balance between optimizing sourcing cost and retaining flexibility within our global supply chain". (IHS Markit Crop Science's Robert Birkett)

- Fujitsu Ltd. said it will cut its office space in Japan by 50% over the next three years, encouraging 80,000 office workers to primarily work from home in what it termed a "Work Life Shift for the new normal." (Bloomberg)

- Mainland China's fixed asset investment (FAI) in railway sector

expanded 11.4% year on year (y/y) in the second quarter as the

labor shortage and insufficient supply of raw material as well as

logistics problem had been overcome, which made up for the 21% y/y

decline in the first quarter, according to a release by the China

State Railway Group on 5 July. Railway investment grew 1.2% y/y to

CNY325.8 billion in the first half of the year. (IHS Markit

Economist Yating Xu)

- Meanwhile, the company said government plans to build at least 4,400 kilometers of new railway lines this year, including 2,300 kilometers of high-speed lines. Those targets were around 20% up from what was announced at the beginning of this year. In the first six months, 1178 kilometers of new railway lines had been put into operation, including 605 kilometers of high-speed lines.

- Infrastructure investment is expected to accelerate and be one of the main drivers for China's economic stabilization in the next half. Infrastructure investment (excluding utilities) declined 6.3% y/y through May, compared to 14.8% y/y contraction in manufacturing investment.

- Jiangling Motors Corporation (JMC) has released its sales

results for June, which totaled 39,192 units, an increase of 66.7%

year on year (y/y). (IHS Markit AutoIntelligence's Abby Chun Tu)

- The company's sales of Ford-branded commercial vehicles, including the Tourneo and Transit, totaled 4,880 units in June, up 28.2% y/y.

- JMC's sales of Ford-branded sport utility vehicles (SUVs) rose by 40.2% y/y to 6,922 units in June.

- Sales of JMC's Yusheng brand, which specializes in SUVs, totaled 168 units, compared with 166 units in June 2019.

- Combined sales of JMC-branded commercial vehicles, including pick-ups and trucks, reached 27,013 units, up 86.5% y/y, in June.

- Sales of JMC's heavy trucks totaled 209 units last month, compared with 115 units in June last year.

- In the year to date (YTD), the sales of JMC rose by 3.33% y/y to 141,193 units.

- Japanese automaker Nissan has reported an increase in sales in

China of 4.5% year on year (y/y) to 136,929 units in June, while

the sales of Honda in the Chinese market fell by 4.1% y/y last

month. (IHS Markit AutoIntelligence's Abby Chun Tu)

- In the year to date (YTD), Nissan's Chinese sales decreased 17% y/y to 596,342 units, according to a company statement.

- The sales of Nissan's passenger vehicle joint venture (JV) with Dongfeng, which includes the Nissan and Venucia brands, edged up 0.5% y/y to 111,234 units in June. In the YTD, the JV's sales were 483,425 units, down 18.4% y/y.

- The Chinese sales of Nissan's light commercial vehicles (LCVs), which include those of Dongfeng Automobile Co (DFAC) and Zhengzhou Nissan (ZNA), surged 36.8% y/y to 22,855 units in June, but declined 7.8% y/y to 100,437 units in the YTD.

- DFAC's sales increased 47.0% y/y to 17,797 units in June, while ZNA's sales totaled 5,058 units, up 9.9% y/y.

- Honda's reported 4.1% y/y drop in its Chinese sales during June meant it sold 142,363 units.

- In the YTD, Honda's Chinese sales declined 17.9% y/y to 612,007 units.

- Sales of the Guangqi Honda joint venture (JV) stood at 71,587 units during June, up 9.6% y/y, and 315,032 units in the YTD, down 17.2% y/y.

- The sales of the Dongfeng Honda JV were 70,776 units in June, down 14.8% y/y, and 296,975 units during the YTD, down 18.6% y/y.

- Nissan has experienced consecutive growth in its monthly sales in China since April. The rebound has been on the basis of strong demand for its light commercial vehicles, including logistics trucks and pick-up trucks.

- LG Chem says it intends to achieve carbon-neutral growth by 2050. The company says it is the first South Korean chemical firm to announce plans to be carbon neutral. According to LG Chem, carbon-neutral growth refers to a decrease of net emissions to zero by performing reduction activities equivalent to the increase in carbon emissions caused by business growth. LG Chem has decided to curb annual carbon emissions to 10 million metric tons (MMt) by 2050, which is the level of its emissions in 2019. Considering the current business growth potential, LG Chem forecasts its carbon emissions to be about 40 MMt by 2050, but it intends to cut more than 30 MMt. The company plans to execute the renewable energy 100 program (RE100) at all its business sites worldwide.

- Tesla's sales in South Korea surged to 7,079 units during the first half of 2020, up from just 422 units in the same period last year, reports Yonhap News Agency, citing data released by the automaker. For June, Tesla's sales in the country jumped to 2,827 units, up from just 121 units in June 2019. The report highlights that Tesla ranked fourth in terms of sales among imported passenger vehicle brands in South Korea last month. The top-three spots were taken by Mercedes-Benz with 7,672 units, BMW with 4,069 units, and Audi with 3,401 units, according to data released by the Korea Automobile Importers and Distributors Association (KAIDA). It is important to note that Tesla reports its sales figures to the South Korean Ministry of Trade, Industry, and Energy as it is not a member of the KAIDA. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-july-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-july-2020.html&text=Daily+Global+Market+Summary+-+6+July+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-july-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 6 July 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-july-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+6+July+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-july-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}