Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 07, 2021

Daily Global Market Summary - 7 April 2021

Equity markets closed mixed across the US, APAC, and Europe. US government bonds closed lower and benchmark European bonds closed mixed. European iTraxx and CDX-NA closed flat across IG and high yield. The US dollar, oil, natural gas, and silver closed higher, while gold and copper were lower on the day.

Americas

- US equity indices closed mixed, with the S&P 500 +0.2% closing at a new record high; DJIA +0.1%, Nasdaq -0.1%, and Russell 2000 -1.6%.

- 10yr US govt bonds closed +1bps/1.67% yield and 30yr bonds +4bps/2.36% yield.

- CDX-NAIG closed flat/52bps and CDX-NAHY flat/294bps.

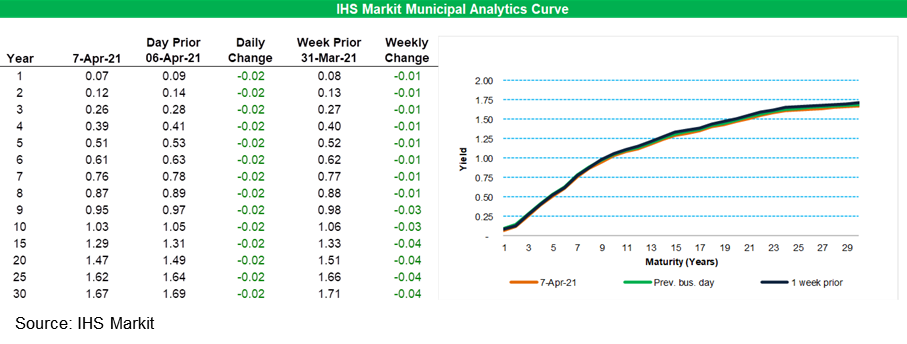

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC)

rallied 2bps across the curve today, with maturities 15-years and

longer 4bps better week-over-week.

- DXY US dollar index closed +0.1%/92.46.

- Gold closed -0.1%/$1,742 per troy oz, silver +0.1%/$25.25 per troy oz, and copper -1.5%/$4.06 per pound.

- Crude oil closed +0.7%/$59.77 per barrel and natural gas closed +2.6%/$2.52 per mmbtu.

- Minutes from the meeting of the Federal Open Market Committee (FOMC) held on 16 and 17 March were released this afternoon. At that meeting, the Committee kept the target for the federal funds rate at a range of 0% to 0.25%; repeated its promise to keep the target rate at this near-zero setting until attaining maximum employment and 2% inflation, with confidence that inflation will rise moderately above 2%; and reiterated its commitment to continue large scale asset purchases (LSAPs) at approximately current rates until "substantial further progress" was made toward its inflation and employment goals. Commitment to maintaining a highly accommodative stance for monetary policy was not affected by recent developments related to the virus, vaccination, and fiscal stimulus that support a re-energized economic recovery. (IHS Markit Economists Ken Matheny and Chris Varvares)

- The US trade deficit widened by $3.3 billion in February to a

seasonally adjusted record $71.1 billion as exports fell more than

imports. (IHS Markit Economist Patrick Newport)

- The goods deficit increased $2.8 billion to a seasonally adjusted record $88.0 billion; the services surplus shrank by 0.5 billion to a seasonally adjusted $16.9 billion. Note that the records are for the seasonally adjusted estimates; February's not seasonally adjusted goods deficit was $77.8 billion, far below the 2018 October record of $89.0 billion.

- For the first time in 14 months, the US imported more petroleum products than it exported. The value of petroleum exports dropped sharply in February despite higher oil prices. The drop in volume may have been related to cold weather in Texas.

- Seasonally adjusted imports from Mexico and mainland China fell 9.2% and 3.5%, while exports to mainland China plunged a record 30.4%, suggesting that cold weather in the South and the Chinese Lunar year, which began on 11 February, suppressed trade. A large share of consumer goods comes from mainland China, and a large share of auto imports comes from Mexico. Combined, auto and consumer goods imports plunged by $6.1 billion, more than the $1.7-billion drop in total imports.

- A subsidiary of oil giant Occidental Petroleum is teaming up

with Houston-based Cemvita Factory, a bio-engineering firm, to

demonstrate that ethylene can be made from harnessing sunlight and

capturing CO2 like plants. (IHS Markit Climate and Sustainability

News' Amena Saiyid)

- Oxy Low Carbon Ventures (OLCV) announced 6 April a plan to design and construct a pilot plant in Houston that will start producing bio-engineered ethylene in early 2022 using a technique Cemvita has patented.

- Plants use photosynthesis, meaning they harness energy from sunlight, draw water from the soil, and absorb carbon dioxide from the air, to make glucose and complex nutrients to survive. Cemvita is mimicking the plants' approach to produce bio-ethylene, a building block for everyday plastics and other commonly used goods.

- Occidental, which is currently the world's third-largest supplier of polyvinyl chloride and other products that use ethylene as a building block, pledged in 2020 to reach net-zero carbon emissions not only for its operations as early as 2040, but also to reduce emissions for consumers that use its products as early as mid-century.

- US retail sales of plant-based foods continued gaining momentum

in 2020, rising by 27% and therefore bringing the total market

value to USD7 billion, according to the latest data released by the

Plant Based Foods Association (PBFA) and The Good Food Institute

(GFI). The growth was consistent across the whole country, with

more than 25% growth in every US census region. (IHS Markit Food

and Agricultural Commodities' Jana Sutenko)

- The plant-based food market grew almost twice as fast as the total US retail food market, which increased 15% in 2020 as COVID-19 shuttered restaurants and consumers stocked up on food amid lockdowns.

- It is estimated that 55% of US households now purchase plant-based foods, up from 53% in 2019. COVID-19 gave retail sales of plant-based foods an extra boost at a time when interest in the sector was already surging, driven by a focus among consumers on personal health, sustainability, food safety, and animal welfare. These factors will continue to propel consumption of plant-based foods far into the future.

- Milk alternative sales last year have reached USD2.5 billion and they now account for 35% of the total plant-based food market.

- Isuzu North America and autonomous tech company Gatik have formed a strategic partnership for medium-duty trucks. According to a statement on 6 April, the two will work together on a project "to develop and evaluate fully autonomous medium-duty trucks." The companies characterize the partnership as an industry first in the medium-duty category. Gatik's autonomous technology will be integrated into several Isuzu medium-duty N-Series trucks. The result will be SAE Level 4 delivery vehicles with redundant systems, with the first vehicles to be deployed later in 2021. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Canada's Ivey Purchasing Managers' Index (PMI) surged for the

second consecutive month, up 12.9 points to 72.9 in March. (IHS

Markit Economist Chul-Woo Hong)

- Except for the prices index falling for two successive months, all remaining sub-indexes jumped in the month.

- March's overall purchasing managers' spending activity soared, likely reflecting the improved business conditions partly due to the vaccine optimism.

- The employment index significantly jumped to the highest level since November 2007, supporting our forecast of solid net job gains in the month.

- The inventories index increased 3.9 points to 61.7, showing strong business spending on inventories accumulation.

- While the supplier deliveries index continued to increase for a third consecutive month, edging up 1.0 point to 39.6, it still indicated severe supply-chain pressures, including the global shortage of semiconductor chips for motor vehicle production.

- Meanwhile, the prices index fell 5.1 points to 75.1, which was the second decrease after reaching the highest level in January. Inflationary pressures were reduced in the month but remained strong.

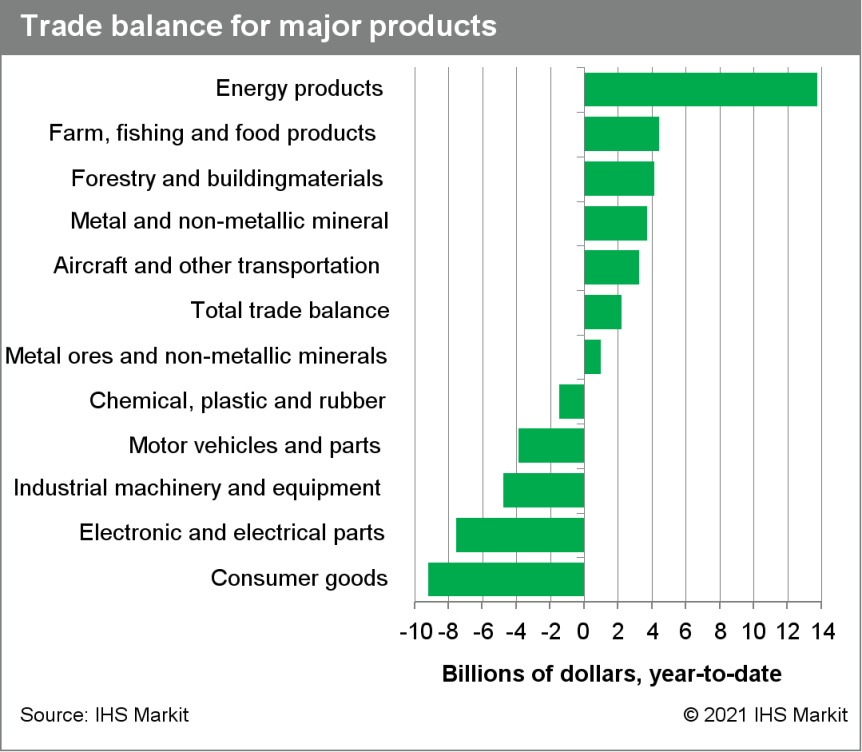

- Canada's merchandise trade surplus narrowed to $1.0 billion in

February, after registering a surplus of $1.2 billion in January.

(IHS Markit Economist Evan Andrade)

- Exports fell 2.7% month on month (m/m) to $49.9 billion and imports fell by 2.4% to $48.8 billion.

- The drop in exports was considerably larger in real terms as export volumes fell 5.0% m/m while import volumes fell 3.0% m/m.

- Canada's service trade reached a small $79-million surplus,

with exports falling 1.6% m/m and imports down 4.9% m/m.

- Stellantis is partnering with TIM Brazil, the Brazilian subsidiary of Telecom Italia, an Italian telecommunications company, to enhance the connectivity of its vehicles, reports Telecompaper. The Jeep Renegade will be first vehicle to implement this connectivity functionality using Stellantis's Adventure Intelligence Platform and an eSim from TIM Brazil to access the native Wi-Fi on board. TIM Brazil will offer three data packages of 5 GB, 10 GB, and 40 GB and priced at between BRL30 (USD5.30) and BRL100 per month. The packages have the option to share internet connectivity with up to eight devices, with the 10 GB and 40 GB packages offering zero-rated data for Waze navigation. (IHS Markit AutoIntelligence's Tarun Thakur)

Europe/Middle East/Africa

- European equity indices closed mixed; UK +0.9%, France flat, Italy -0.1%, Germany -0.2%, and Spain -0.4%.

- 10yr European govt bonds closed mixed; Italy/Spain +1bp, France/Germany -1bp, and UK -2bps.

- iTraxx-Europe closed +1bp/51bps and iTraxx-Xover +3bps/248bps.

- Brent crude closed +0.7%/$63.16 per barrel.

- British oil and gas giant BP is looking to partner with BMW and Daimler in their ChargeNow charging application, according to a report by the German DPA news agency. The reported plan is for BP to acquire one-third of the shares in ChargeNow's parent DCS. The companies have agreed not to disclose the price at which the British group will buy that stake, or the conditions of the transaction. ChargeNow is one of the biggest charging networks in Europe comprising 228,000 charging stations in 32 countries. The partnership with BP will add 8,700 gasoline (petrol) stations in Europe with the potential real estate to expand the network. (IHS Markit AutoIntelligence's Tim Urquhart)

- Stellantis is to introduce light commercial vehicles (LCVs) that use fuel cells as part of their powertrain during 2021, reports Autocar. The vehicles, which will be sold by the Citroën, Peugeot, Opel, and Vauxhall brands, will be based on the Jumpy, Expert, and Vivaro mid-size vans. The powertrain will comprise a 4.4kg hydrogen storage tank under the cargo floor that can offer a range of around 250 miles, while the fuel cell and a motor developing 134 bhp and 192 lb/ft of torque are installed under the bonnet. The powertrain also features a 10.5kWh battery under the seats which can be recharged via an electric socket and can offer a battery only range of up to 30 miles. The vehicle is said to accelerate to 62mph in 15 seconds and on to a top speed of 81mph. (IHS Markit AutoIntelligence's Ian Fletcher)

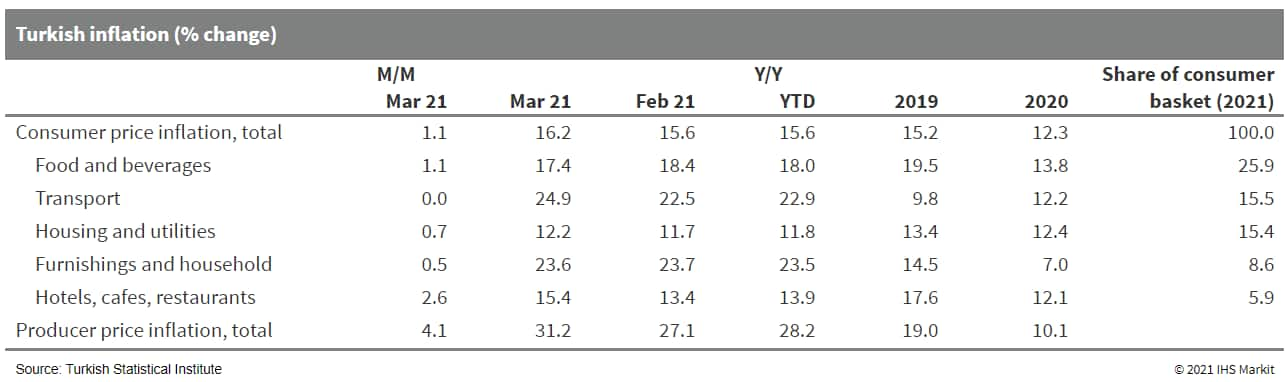

- In March 2021, the Turkish Statistical Institute (TurkStat)

reported annual consumer price inflation of 16.2%. The annual

inflation rate has marched steadily upwards since September 2020,

with sharp lira depreciation driving up supply-side prices and

loose monetary policy keeping demand-side pressures high. (IHS

Markit Economist Andrew Birch)

- Core inflation - omitting volatile prices such as on energy and gold - has surpassed headline inflation rates throughout the first quarter of 2021, suggesting that upward pressure on the headline rate continues. The global uptick of energy prices and still high agricultural prices are also all inflationary.

- Meanwhile, annual producer price inflation soared to 31.2% as

of March 2021. Producer price inflation has soared above consumer

price inflation since the third quarter of 2020.

- Saudi Arabia's government plans to facilitate investment of SR250 billion (USD66.67 billion) in healthcare infrastructure in the period to 2030, according to Arab News. The investment plans are reportedly outlined in a new Gulf Cooperation Council (GCC) report published by the UAE's Mashreq Bank and international research firm Frost & Sullivan. It is reported that the Saudi government also plans to boost private sector participation in the healthcare sector from a current level of 40% to 65% by 2030. The report projects that current levels of investment in infrastructure and innovation will see Saudi Arabia establish itself as a regional hub for medical consumables by 2023. (IHS Markit Life Sciences' Sacha Baggili)

- Botswana's real output continued to recover in the fourth

quarter of 2020, contracting by 4.1% y/y, compared with a decline

of 6.0% y/y recorded in the third quarter. The improvement is

attributed to ongoing efforts to reopen businesses and economic

activities that were postponed or restricted owing to the pandemic.

(IHS Markit Economist Archbold Macheka)

- In 2020, the contraction in economic activity was most pronounced in the mining sector, which shrunk by 26.2% y/y, driven by the reduction in the real value added of diamond, soda ash, and coal by 28.8% y/y, 10.1% y/y, and 8.7% y/y, respectively. COVID-19-related restrictions, including a ban on alcohol sales, regional and global travel restrictions, longer curfew hours, and business closures, left output in the trade and hotels and restaurants industry down by 14.8% y/y.

- Construction activity, which comprises buildings construction, civil engineering, and specialized construction activities, fell by 11.0% y/y.

- The Namibian government has secured USD270.8 million financing

under the IMF's RFI to address urgent balance of payment and fiscal

financing needs stemming from the COVID-19 virus pandemic. (IHS

Markit Economist Thea Fourie)

- Namibia's GDP contracted by 7.2% in 2020, while only a mild recovery in growth of 2.1% is assumed for 2021, IMF estimates show. The RFI emergency funding will allow the Namibian government to mitigate the impact of the pandemic in the short term.

- Efforts will be directed towards procuring and rolling out COVID-19 vaccines; stepping up spending on health and education; strengthening the domestic social safety net, particularly for those most affected by the pandemic; and supporting the private sector, which will allow for job retention.

- Medium-term debt sustainability remains essential and the Namibian government remains committed towards fiscal consolidation to achieve this.

Asia-Pacific

- APAC equity markets were closed mixed; India +0.9%, Australia +0.6%, South Korea +0.3%, Japan +0.1%, Mainland China -0.1%, and Hong Kong -0.9%.

- Outside Yunnan Province, economic recovery is continuing

elsewhere in mainland China, as tourism demand during the three-day

Tomb Sweeping Day holiday (3-5 April) narrowed the pandemic-induced

contraction. Note that delayed family reunions—owing to the

government's "stay-put" advisory during the Lunar New Year

holiday—may have also contributed to the improvement in travel

activity. (IHS Markit Economist Lei Yi)

- The number of tourists totaled 102 million nationwide during the long weekend, a year-on-year (y/y) increase of 144.6%, or 94.5% of the comparable 2019 level, according to estimates by the Ministry of Culture and Tourism. Tourism revenue amounted to CNY27.17 billion over the weekend, up by 228.9% y/y, but only reaching 56.7% of the pre-pandemic level.

- The number of tourists at 182 major tourist sites in Beijing reached 6.1 million, up by 400% from 2020 and reaching 98.7% of the 2019 level. Tourism revenue over the three-day weekend topped CNY290 million, up by 930% from 2020 and 8.7% from 2019.

- Offline retail sales in Shanghai amounted to CNY25.7 billion during the holiday, rising by 35.3% y/y and by 5.6% compared with the 2019 level, with catering sales basically recovering to the comparable 2019 level while hotel sales exceeded the pre-pandemic (2019) level by 29.6%.

- Cumulative passenger trips amounted to 145 million during the long weekend according to the Ministry of Transport, up by 142.4% y/y. Notably, passenger trips by rail and air surged by over 200% y/y but were down by 8% and 10.7% compared with 2019, respectively.

- Box office sales hit a record high during the 2021 Tomb Sweeping Day holiday, surpassing CNY820 million, according to the China Movie Data Information Network.

- An Iberdrola-led consortium became the latest developer to add to the pipeline of proposed Japanese offshore wind projects ahead of a capacity auction later in 2021 or in 2022. The 600-MW Seihoku-oki wind project would be built off the northwest coast of Japan by the Spanish renewables giant, Cosmo Eco Power, and engineering firm Hitachi Zosen. The announcement of the project followed swiftly behind the unveiling of plans by Japan's largest power provider, JERA, to develop its own 600-MW offshore wind project in waters off the northern tip of the country's main island of Honshu. (IHS Markit Climate and Sustainability News' Bernadette Lee)

- Honda has announced its March sales results for the Chinese market. The automaker's Chinese sales totaled 151,218 units last month, up 150.2% year on year (y/y). Sales of the Guangqi Honda joint venture (JV) totaled 76,203 units during the month, compared with 32,205 units in March 2020, while sales of the Dongfeng Honda JV totaled 75,015 units, compared with 28,236 units in March 2020. Combined sales of Honda's hybrid vehicles in March totaled 21,662 units. In the year to date (YTD; January-March 2021), Honda's Chinese sales are up 75.8% y/y at 390,231 units. Sales of Guangqi Honda have increased by 54.8% y/y in the YTD to 180,110 units, while the Dongfeng Honda JV's sales are up 98.9% y/y at 210,121 units. (IHS Markit AutoIntelligence's Abby Chun Tu)

- A court-led restructuring of SsangYong is expected to begin this week after US-based automotive distribution company HAAH Automotive Holdings - the sole potential investor in the company - did not submit a letter of intent (LOI) to acquire the financially troubled South Korean automaker, reports the Yonhap News Agency. SsangYong's Indian parent company, Mahindra & Mahindra (M&M), had been in talks with HAAH Automotive to sell its majority stake in SsangYong as part of its global reorganization plan amid the COVID-19 virus pandemic. The Seoul Bankruptcy Court demanded that HAAH Automotive submit an LOI through SsangYong by 31 March, but the latter did not send the documents. The court has now asked SsangYong's creditors, including its main creditor the Korea Development Bank (KDB), to express their opinions on whether to begin the court-led debt rescheduling process for the automaker. (IHS Markit AutoIntelligence's Jamal Amir)

- Following its 6 April meeting, the Reserve Bank of Australia's

(RBA) monetary policy board left the policy interest rate and the

yield target for three-year Australian Government Securities both

unchanged at 0.10%. The central bank also left its bond purchase

program and Term Funding Facility unchanged. (IHS Markit Economist

Bree Neff)

- The RBA stayed the course on monetary policy, reiterating that it does not expect to raise interest rates until 2024 when it expects headline inflation to settle sustainably within the bank's 2-3% inflation target.

- Key economic data continued to point to recovering domestic demand, but will need close monitoring in the next few months as a few key fiscal stimulus measures were unwound as of 1 April.

- The statement highlights that the bank expects above-trend GDP growth for 2021 and 2022, and that the bank believes household and business balance sheets are in good shape, supporting the recovery, but not near-term monetary policy tightening.

- One key area where Lowe's April statements deviated modestly related to the labor market. He acknowledged the fall to a seasonally adjusted 5.8% for the unemployment rate in February was part of a stronger-than-expected economic recovery.

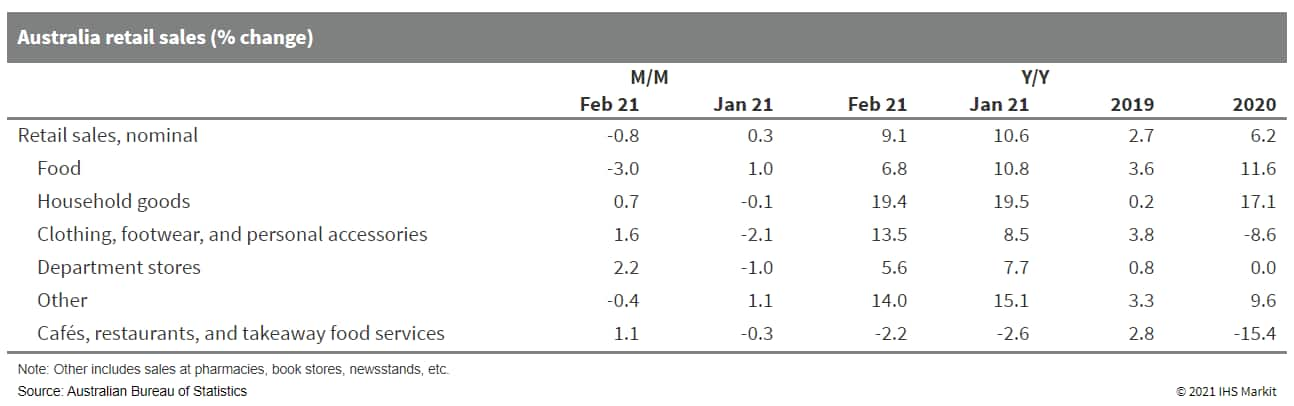

- Retail sales for February declined modestly in seasonally adjusted terms according to the Australian Bureau of Statistics (ABS) led by consumers pulling back from shopping at food retailers after strong sales during much of 2020.

- The decision by the RBA to leave monetary policy settings

unchanged was not a surprise. The mounting concerns arising from

home prices, is unlikely to trigger monetary policy tightening,

instead we are likely to see a return of macroprudential

regulations such as loan-to-value ratios (LTVs), limits on

interest-only mortgages, and limits on investor housing loan growth

announced by APRA as were seen in 2014-17.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-april-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-april-2021.html&text=Daily+Global+Market+Summary+-+7+April+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-april-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 7 April 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-april-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+7+April+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-april-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}