Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 07, 2020

Daily Global Market Summary - 7 December 2020

APAC equity markets closed mixed, while UK and US tech were the only major markets to close higher across Europe and the US. US/European benchmark government bonds closed sharply higher and European iTraxx/CDX-NA closed modestly wider across IG and high yield. The US dollar closed higher, oil lower, gold/silver higher, and copper was flat on the day.

Americas

- Most US equity markets closed lower today except for Nasdaq +0.5%; DJIA -0.5%, S&P 500 -0.2%, and Russell 2000 -0.1%.

- 10yr US govt bonds closed -4bps/0.93% yield and 30yr bonds -6bps/1.68% yield.

- CDX-NAIG closed +1bp/51bps and CDX-NAHY +2bps/293bps.

- DXY US dollar index closed +0.2%/90.86.

- Gold closed +1.4%/$1,866 per ounce, silver +2.2%/$24.79 per ounce, and copper flat/$3.52 per pound.

- Crude oil closed -1.1%/$45.76 per barrel.

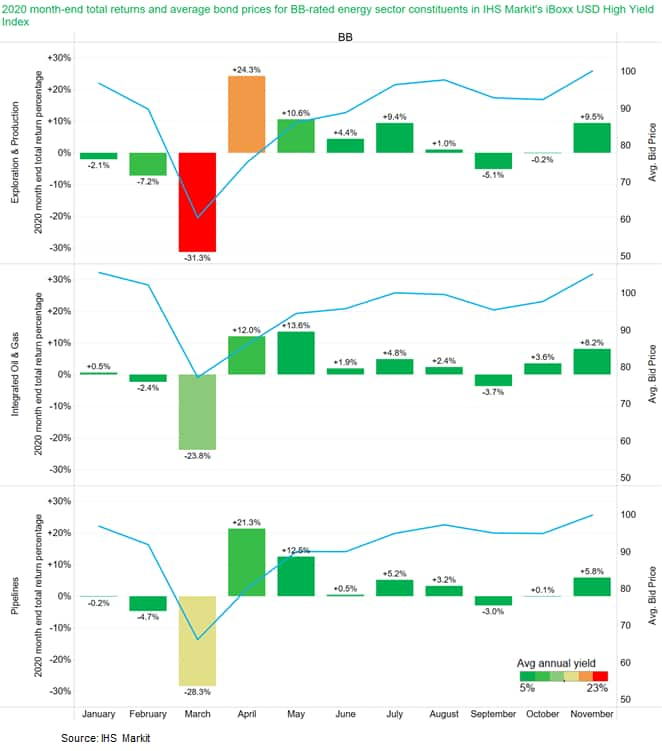

- The chart below shows the 2020 monthly average total returns,

bond prices, and yields for BB-rated energy sector constituents in

IHS Markit's iBoxx USD High Yield Index. BB-rated integrated oil

& gas company's debt performed the best of the three subsectors

in March, only declining 23.8% on average that month versus -31.3%

for E&P debt and -28.3% for pipelines. Average bond prices were

near 100-00 for all subsectors as of 30 November, with E&P

prices recovering from a low of 60.48 (23.4% yield) on 31 March to

100.18 (5.2% yield) on 30 November (+66% from the March low).

- With Republican and Democratic negotiators struggling to reach an agreement on both a mammoth government spending bill and COVID-19 relief, lawmakers are set to postpone what had been a Friday night deadline for passing a bill. Talks over a $908 billion pandemic relief plan have slowed, with negotiators still working to resolve key details on state and local aid as well as liability protections for businesses. Lawmakers are also still wrangling over a $1.4 trillion omnibus bill to fund the government into 2021, to which the Covid-19 package would be attached. (Bloomberg)

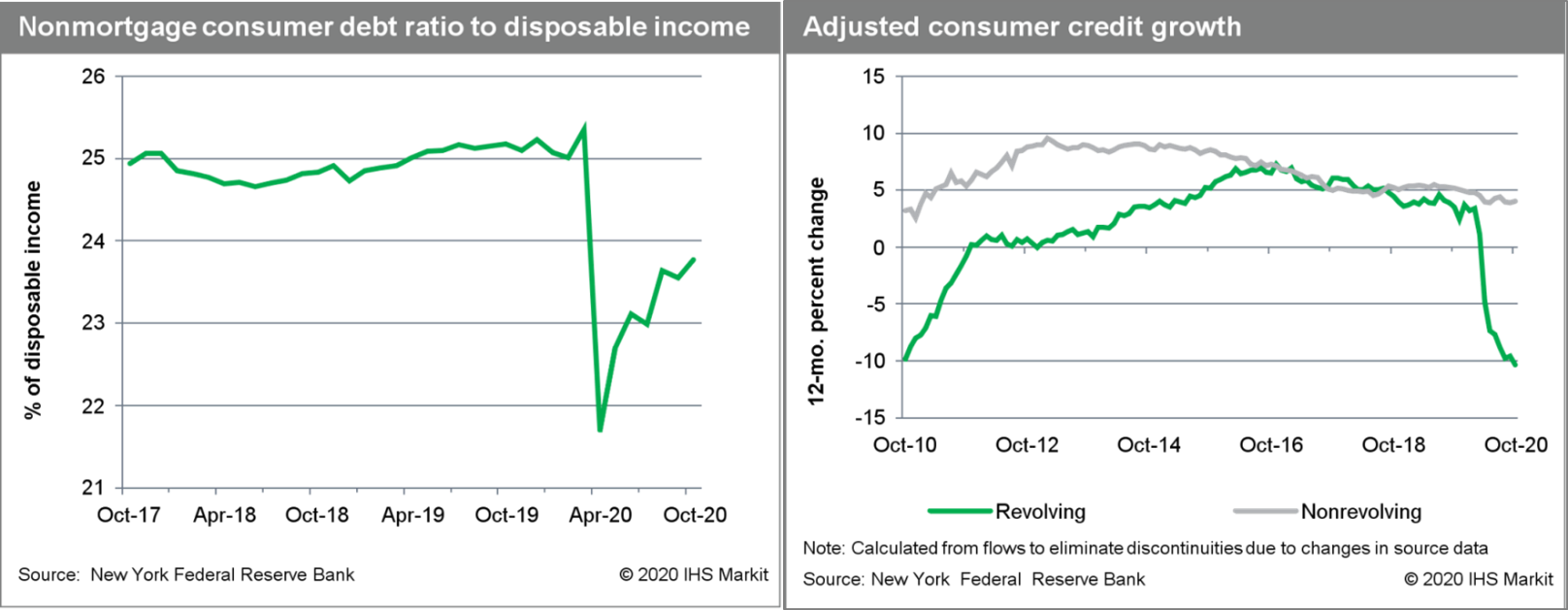

- Outstanding US nonmortgage consumer credit rose by $7 billion

to $4.16 trillion in October after a $15 billion increase in

September. (IHS Markit Economist David Deull)

- The 12-month change in outstanding consumer credit slipped 0.2 percentage point to 0.3%.

- Revolving (mostly credit card) consumer credit returned into negative territory, falling $5 billion after a cumulative $114 billion decline during the prior seven months. The 12-month growth rate of this category was -10.0%, a new record low.

- Nonrevolving credit increased $13 billion in October, and its 12-month growth rate edged up 0.1 percentage point to 4.0%. This category includes student and auto loans, and the growth of these types of obligations has remained steady.

- The ratio of nonmortgage consumer credit to disposable personal income rose 0.2 percentage point to 23.8%.

- During the COVID-19 episode thus far, reduced opportunities to

spend, less willingness to finance spending with debt, and fiscal

stimulus have combined to drive down the level of outstanding

revolving consumer credit. As fiscal stimulus wanes and

labor-market conditions slowly normalize, credit-card balances are

likely to continue creeping back up.

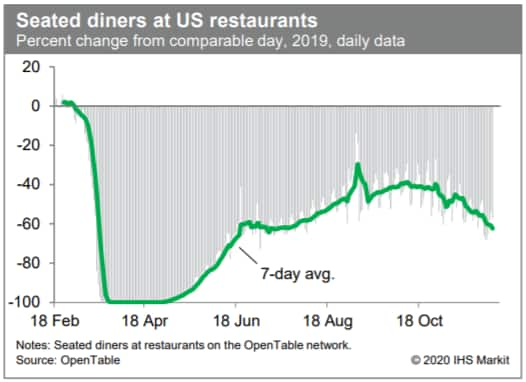

- The count of seated diners at US restaurants (OpenTable)

compared to year-ago levels has been trending sharply lower in

recent weeks, as containment measures intensify and as

opportunities for outdoor seating dwindle with cooling

temperatures. (IHS Markit Economists Ben Herzon and Joel

Prakken)

- Following reports of dropping sales and stalled employment

recovery this fall, the US restaurant industry is looking to the

incoming Biden administration for relief. The National Restaurant

Association (NRA) on Friday released preliminary data from the

Bureau of Labor Statistics (BLS) indicating the eating and drinking

places - which represent the bulk of the US restaurant industry -

lost a net of 17,400 jobs in November on a seasonally adjusted

basis. (IHS Markit Food and Agricultural Policy's Margarita

Raycheva)

- The numbers apply to eating and drinking establishments, which are the primary component of the total foodservice industry. Before the pandemic, those establishments employed 12 million of the 15.6 million in the US restaurant and foodservice industry.

- While concerning, the new numbers do not come as a surprise to the industry, which last month reported its first monthly decline in sales since the end of the spring pandemic-related lockdowns around the country. According to NRA, sales for eating and drinking places slipped from $55.7 billion on seasonally adjusted basis in September to $55.6 billion in October. This comes after the industry has been trying to rebound since sales at eating and drinking places plunged to just $30 billion in April due to the pandemic.

- Despite being on a path to slow recovery over the summer months, the restaurant industry has reported that sales remained nearly $10 billion - or 15% - below their pre-coronavirus levels in January and February.

- The new fall declines are raising concerns for the NRA, which now says the industry remains 2.1 million jobs below its pre-coronavirus level and "there doesn't appear to be a significant catalyst for a resumption of restaurant job growth in the immediate future."

- The NRA survey also found that full-service restaurant operators were much more likely (58%) than their limited-service counterparts (40%) to say they expect to reduce staffing levels during the coming months.

- In his analysis of the BLS data, NRA's Grindy also noted that the BLS numbers might not represent the full picture of lost restaurant jobs that month, because the BLS only bases employment reports on the payroll period up to the middle of each month.

- ICE Benchmark Administration (IBA), administrator of LIBOR

rates, is currently holding consultations on extending provision of

key dollar LIBOR rates until mid-2023 from end-2021. (IHS Markit

Economist Brian Lawson)

- On 30 November, it announced proposals to end provision of one-week and two-month dollar LIBOR as originally planned, but to keep the dollar LIBOR panel operative for other rates until 30 June 2023.

- By contrast, on 18 November it confirmed plans to end provision of euro, pound sterling, Swiss franc and yen LIBOR from end-2021.

- The dollar-related move was welcomed by Randal Quarles, Federal Reserve Vice Chair for Supervision, who claimed it helped ensure that "the transition away from LIBOR will be fair and orderly for everyone".

- The IBA consultation indicates that the key one, three and six-month dollar rates would remain available for an additional 18 months.

- This represents a significant reversal of prior regulatory efforts to move to new dollar reference rates by end-2021.

- The replacement of LIBOR is a long-established global regulatory goal, reflecting its often subjective nature, past misconduct in rate-setting and the reduced pool of transactions on which LIBOR rates are based.

- The Federal Reserve's support for the longer timetable almost certainly reflects growing concern over the limited preparedness of US firms for migration, and a large population of legacy contracts still awaiting restructuring or refinancing.

- In November, the Commodities Futures Trading Commission reported that only 400 of 2,800 corporate groups studied had integrated fallback language for the ending of dollar LIBOR into their contracts, while the Financial Times (FT) claimed that, in October, under 10% of new dollar interest-rate swap contracts used the replacement SOFR reference rate - versus 40% use of SONIA in the sterling sector.

- Further indicators of migration difficulty include Barclays estimates that only 41% of existing dollar floating rate notes mature by end-2021, while 80% are due before the revised deadline (and 72% of the residual already apply fallback language, further reducing migration risks).

- Lastly, according to the Loan Syndications and Trading Association, 90% of outstanding US leveraged loans mature after 2023.

- Overall, the adjusted proposal implies "buying more time" for adjustment, while reducing litigation risks.

- Huntsman (The Woodlands, Texas) has agreed to acquire specialty chemicals firm Gabriel Performance Products (Akron, Ohio) for $250 million in cash from Audax Private Equity. Gabriel, a manufacturer of specialty additives and epoxy curing agents for the coatings, adhesives, sealants, and composite end markets, has three manufacturing facilities located in Ashtabula, Ohio; Harrison City, Pennsylvania; and Rock Hill, South Carolina. Gabriel's 2019 revenues were about $106 million, according to Huntsman, which says the purchase price is about 11x adjusted EBITDA, or 8x pro forma after accounting for synergies. Huntsman expects to close the deal in the first quarter of 2021. Scott Wright, president of Huntsman's advanced materials division, says the acquisition will broaden Huntsman's specialties portfolio and complement the recent acquisition of CVC Thermoset Specialties. "Gabriel makes highly specialized toughening and curing agents and other additives used in a wide range of composite, adhesive, and coatings applications," he notes. "We expect that the Gabriel business will strengthen our North America footprint and provide significant commercial synergies as we expand and globalize their specialty products across our global footprint and customer base." Huntsman acquired CVC for about $300 million in May 2020. Peter Huntsman, chairman, president, and CEO, says the purchase of Gabriel concludes a series of strategic initiatives in the advanced materials division that began in 2019. Combined, the three transactions will add approximately $57 million of adjusted EBITDA pro forma for synergies to the advanced materials division at a cost of less than 5x EBITDA, says Huntsman. (IHS Markit Chemical Advisory)

- Approximately 17% of Cadillac's US dealers may stop selling the brand's vehicles rather than shift to electric vehicle (EV) sales, according to a Wall Street Journal (WSJ) report. WSJ reports that Cadillac has 880 dealers in the United States and that, currently, about 150 have said they will take up Cadillac's offer to separate from the brand rather than invest in shifting to sales of EVs. In late November, Cadillac indicated that it would offer a buyout to dealers not interested in the change to EV sales. WSJ reports that Cadillac's US dealers were offered the options of accepting a buyout or investing USD200,000 to support EV sales. That investment figure included items such as charging stations and repair tools. WSJ reports that buyout figures offered ranged from USD300,000 to US1 million, although these figures were not confirmed by official sources. The report also says that most dealers who have opted out also own one or more other GM franchises and sell only a few Cadillac vehicles per month. Changing to EV sales in the immediate term may not be in the best interests of every Cadillac dealer in the US, as some are in locations where consumer demand for EVs could take longer to develop. In addition, as WSJ reports, some dealers' sales volumes of Cadillac vehicles are low enough that the investment in the shift to EVs would take years to pay off. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Einride, a Swedish transportation company focusing on autonomous electric trucks, has announced that its next-generation Pods will use NVIDIA's autonomous vehicle (AV) computing platform, DRIVE AGX Orin. Einride's next-generation autonomous electric transport (AET) vehicles are capable of the SAE Level 4 autonomous operation and would help businesses reduce transport costs by up to 60% and CO2 emissions by 90%. The company's smaller Pods - the AET 1 and AET 2 - are suitable for fenced facilities and the AET 3 and AET 4 are well-suited to long-distance highways and use in large distribution centres. The autonomous operation will be enabled by NVIDIA's Orin system-on-a-chip (SoC) architecture, which is capable of 200 trillion operations per second and has a processing performance seven times higher than the company's previous SoC, Xavier. Pär Degerman, chief technology officer at Einride, said, "Safety and functionality in autonomous drive are achieved in two ways: diversity and redundancy. To capture and account for the diversity in a myriad of operational scenarios, and to develop the redundancy necessary to improve functionality, we need the most advanced processors possible, and that's where NVIDIA Orin comes in." Einride focuses on designing and building technologies for freight mobility. The company recently raised USD10 million in funding, bringing its total capital to USD42 million. It has begun building a more traditional type of truck with human drivers as part of the transition to full autonomy. This move is in line with the company's belief that the shift to autonomous transport may take longer than had been predicted. Einride has recently partnered with Lidl and Oatly to provide electric trucks with an initial focus on electrification, with automation coming later. NVIDIA plans to start shipping Orin samples in 2021, with the earliest installation possible in vehicles at around the end of 2022. Orin is capable of supporting Level 2+ automated to Level 5 fully autonomous vehicles. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Canada's Ivey Purchasing Managers' Index (PMI) fell 1.8 points

to 52.7 in November, indicating purchasing managers' spending

activity marginally increased. (IHS Markit Economist Chul-Woo Hong)

- The employment and supplier deliveries index plummeted while the prices and inventories index surged.

- As overall business conditions worsened, real GDP output will modestly increase in the short term.

- The Ivey PMI continued its downward trend in November; it has declined for four of the previous five months. After the small jump in October, the employment index pulled back 8.0 points to 48.1, which was the first contraction reading since May 2020. The supplier deliveries index plunged 10.5 points to 34.3, indicating significant supply chain pressures due to the COVID-19 second wave. The inventories index jumped 3.8 points to 49.3. Meanwhile, the price index increased for the third consecutive month, up 3.1 points to 66.1, which was the highest level since October 2018, implying increasing inflation pressures.

- The Ivey PMI is trending lower, following patterns similar to other leading business indicators. Meanwhile, the IHS Markit manufacturing PMI edged up in November, showing solid improvement in manufacturing business conditions. As overall business sentiment pointing to weak growth momentum—mainly due to the renewed operating restrictions in major provinces in an effort to decrease the surging COVID-19 cases—real GDP growth is expected to significantly decelerate in coming months.

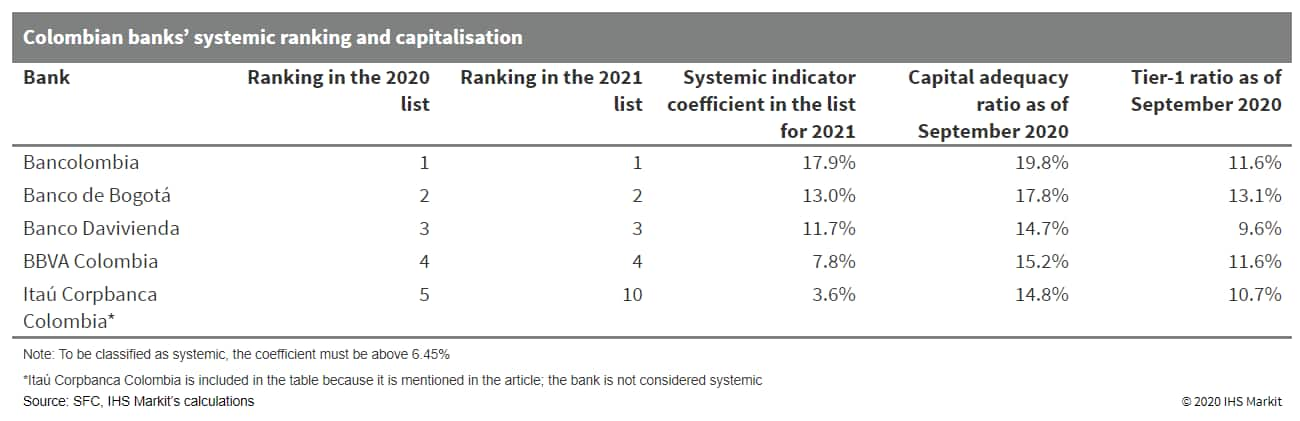

- The Financial Superintendence of Colombia (Superintendencia

Financiera de Colombia: SFC) published on 2 December its list of

domestic systemically important banks (D-SIB). Bancolombia, Banco

de Bogotá, Banco Davivienda, and BBVA Colombia have been included

to the list. By regulation, these banks must hold extra capital

requirements, equivalent to 1% of the risk-weighted assets (RWA)

coefficient. The SFC emphasizes that the classification of a bank

as systemic is not a risk rating assessment of financial entities.

(IHS Markit Banking Risk's Alejandro Duran-Carrete)

- The year 2021's list looks similar to the one that was published for 2020. Therefore, the aforementioned institutions are likely to be already compliant with the capital requirements imposed by the regulation, as suggested by their capital ratios being significantly above the regulatory requirements of 11.5% of RWA (already taking into account the systemic requirement). This is risk positive considering a likely complicated environment through 2021, where banks' capacity will be limited in terms of adding capital to their balance sheets.

- The calculation of the systemic importance of a bank is made according to Basel III standards, which take into consideration the size of the bank, its interconnectivity with the financial system, its substitutability with other institutions, and its complexity in terms of operations.

- In addition, the SFC has published a table detailing the

calculations of the systemic importance coefficient of all banks in

the Colombian sector. Overall, most institutions remain at similar

positions within the classification, compared with 2020. However,

Itaú Corpbanca Colombia has fallen in the ranking of systemic

importance because of its reduction in size and loss of

interconnectivity within the sector. This is consistent with the

results of the bank, which has been deleveraging over the last

year, resulting in a reduction of assets of almost USD1 billion

between September 2019 and September 2020.

Europe/Middle East/Africa

- Most European equity markets closed lower except for UK +0.1%; France/Spain -0.6%, Italy -0.3%, and Germany -0.2%.

- 10yr European govt bonds closed higher; UK -7bps, Germany/France -4bps, Spain -3bps, and Italy -2bps.

- iTraxx-Europe closed +2bps/47bps and iTraxx-Xover +9bps/243bps.

- Brent crude closed -0.9%/$48.79 per barrel.

- The European Institute of Innovation and Technology (EIT) published a new report on the impact of the COVID-19 pandemic on consumer behavior and found that lasting changes have been made to the way the public thinks about purchasing and eating their food. A survey of 5,000 consumers in ten European countries showed lockdown measures sparked a greater emphasis on local produce, packaging, freshness, avoiding additives, and searching for value. This was accompanied by an increase in cooking and experimenting with recipes, a reduction in using ready-made meals, and a shift towards regular mealtimes with other household members. Professor Klaus Grunert from Aarhus University, who coordinated the study, said COVID-19 appears to have made a lasting change to shopping patterns, meal preparation and eating habits, and that this could offer future value to agri-food businesses. The largest behavioral shift was found in the way consumers shop, with nearly half of respondents saying they have bought more online (45%), bought in bulk (47%), and carefully planned trips to the store (45%). The effect of the lockdowns on consumer behavior was also found to likely continue after the restrictive measures are lifted across Europe. Nearly a third of consumers said it will be more important for them to have home-made meals (27%) and to continue eating more varied foods (30%) after the pandemic. EIT Food also called on "the food system and policy makers" to enable accessible and affordable solutions that focus on health and sustainability. Their study found that a third of respondents (34%) lost part or all their income during the pandemic and more than half (55%) said they found it difficult to financially survive every month. Going forward, 32% said that access to food at low prices will remain a priority, which they believe should not come at the cost of their health and nutrition. COVID-19 also saw almost half of consumers (49%) state that being in good health will be more important to them in the future. (IHS Markit Agri-Food Policy and Sustainability's Steve Gillman)

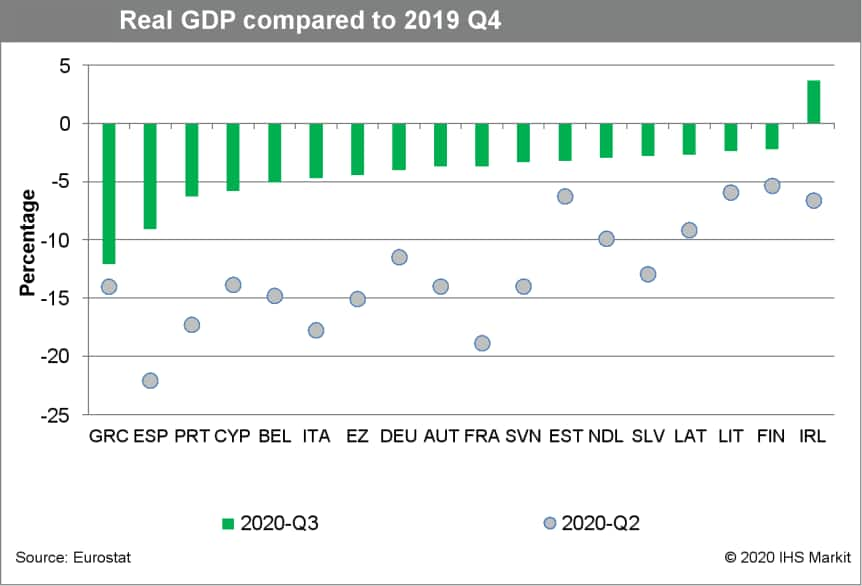

- The Irish economy is the only one in Europe to be larger in the

third quarter of 2020 compared with the final quarter of 2019,

although underlying activity is still below the peak. We expect a

new contraction in the fourth quarter owing to the impact of the

six-week national lockdown between late October and early December,

as the adjusted unemployment rate has shot up again. (IHS Markit

Economist Daniel Kral)

- Based on data from the Irish Central Statistics Office (CSO), on a seasonally adjusted basis, real GDP grew by 11.1% quarter on quarter (q/q) and 8.1% year on year (y/y) in the third quarter, the only economy in Europe to surpass the pre-COVID-19 virus GDP level. In the third quarter, the Irish economy was 3.7% larger than prior to the pandemic as all other European economies were between 2% and 10% smaller.

- However, the gross national product (GNP), which measures net income earned by Irish residents and, thus, excludes income earned by foreign-owned multinationals, dropped by 1.9% q/q and 4.4% y/y, reflecting significant profit repatriation. GNP was 9.3% lower compared with the pre-COVID-19 virus peak.

- Among the main sub-components, private consumption rebounded by 21.3% q/q but was still 5.4% below the pre-COVID-19 virus peak, while government consumption was largely flat at 0.1% q/q but 10.7% above the pre-pandemic peak. Exports of goods and services were also up by 3.4% compared with the end of 2019. The recent quarterly path for fixed investment and imports has been severely distorted owing to the relocation of intellectual property products (IPPs), rendering any comparisons to the pre-pandemic level not useful.

- Modified final domestic demand - an indicator of domestic demand that excludes the impact of trade in aircraft by aircraft leasing companies, as well as trade in research and development (R&D)-related IPP service imports - rebounded by 18.7% q/q, driven by the increase in domestic capital formation by 34.4% and personal consumption by 21.3%. However, it was still almost 1.5% lower compared with the pre-pandemic peak.

- The international accounts data, released together with national accounts, show another large current-account surplus of 12.8% of GDP in the second quarter. On a four-quarter rolling basis, the current account was in a deficit of 5.1% of GDP because of IPP-related distortions in previous quarters.

- In a separate release, the CSO reported that the Irish labor market further deteriorated in November owing to the six-week national lockdown that lasted from late October until early December. The COVID-19 virus-adjusted unemployment rate, which includes recipients of the temporary more generous unemployment benefit, climbed to 21.0%, up from 20.2% in October and 15.9% in September.

- The significantly stronger-than-expected headline GDP in the third quarter will result in a better 2020 performance in the December forecast round. On a cumulative basis, the Irish economy was 3.0% larger in the first nine months of 2020 than in the corresponding period in 2019.

- However, owing to the six-week lockdown, we expect the economy to contract in the final quarter of 2020, although the rate of contraction is likely to be much milder than in the second quarter. Owing to the positive effect of the easing of restrictions on activity in December, we expect the economy to grow in the first quarter of 2021.

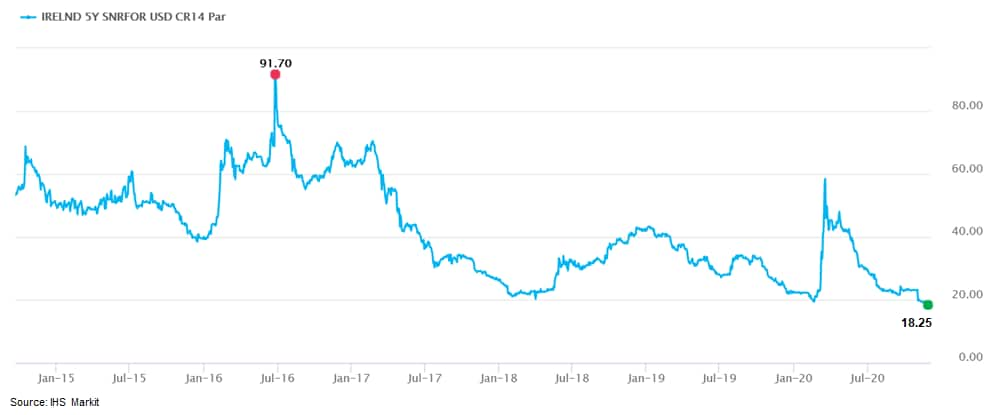

- The Republic of Ireland's 5yr CDS closed at 18.25bps today,

which is the tightest level in over six years.

- Seasonally and calendar-adjusted German industrial production

excluding construction increased by 3.4% month on month (m/m) in

October, reflecting another acceleration of the recovery following

a temporary halt in August. The cumulative rebound during

May-October is 32.0%. Although this figure exceeds that of the

March-April plunge (-28.5%), differences in the base level that

these percentages refer to mean that October's production level was

still around 6% below February's pre-pandemic level and equally the

2019 average. (IHS Markit Economist Timo Klein)

- Total production including construction increased 3.2% m/m in September, as construction output alone increased by a more limited 1.6% m/m. Nevertheless, given the much smaller decline in construction than in manufacturing during the second quarter, October building output already exceeded the average of the fourth quarter of 2019 by 3.2%.

- Unlike in September, when (non-durable) consumer goods production outperformed the rest, this category declined in October whereas intermediate and investment goods output rose strongly (details see table below). A different split according to industrial branches shows that October production was boosted the most by the automobile sector (9.9% m/m), which had suffered the most back in March-April. Computers/electrical equipment (5.1% m/m) and metals (3.0%) also contributed strongly to the recovery at the data edge. The latest level of automobile production now falls short of February's pre-pandemic level by only about 6%.

- Meanwhile, manufacturing orders advanced by an equally encouraging 2.9% m/m in October, helped to some degree by an above-average number of big-ticket items. The series excluding big-ticket items nonetheless did increase by a solid 1.7%, and this only partly corrects for its major outperformance of the headline series in September. Both series now reflect higher demand levels than in late 2019 or in February just before the pandemic struck. Orders improved the most among investment goods, followed by intermediates, whereas consumer goods orders corrected after their strong August-September increases, which could be a foreshadowing effect of the looming second lockdown in November. Growth in domestic and foreign orders was relatively similar in October, but demand from abroad was concentrated among non-eurozone countries (4.8% m/m, their sixth consecutive increase) whereas eurozone orders only increased 0.5% m/m.

- The orders breakdown by industrial branch show that the machine-building sector more than made up for their September setback, surging by 11.1% m/m to a level that exceeds February's pre-pandemic level, or that of the 2019 average for that matter. Orders increased in all major industries, with the exception of the metal processing sector. The latter's stagnation needs to be seen against the background of an especially pronounced rebound in the preceding months, however.

- Germany's industrial sector recovered further in October, hardly impacted yet by the looming second lockdown that was only implemented in November. November manufacturing PMI data - headline index down from 58.2 to 57.8, output and orders sub-indices down by between three and four points to 62.2 and 62.4, respectively) suggest there will be a downward correction during November-December, but its likely extent must not be overstated because the lockdown has not had any direct dampening influence on industrial activity and only limited indirect impact (thus schools and childcare facilities largely have been kept open). In contrast to the service sector, industrial demand is at or even above its pre-pandemic levels again.

- Volkswagen (VW) Group CEO Herbert Diess has said that the company expects autonomous cars to be ready for sale between 2025 and 2030. Diess said factors such as improved performance of computer chips as well as advances in artificial intelligence technology are supporting the faster development of autonomous cars, reports Reuters. VW is accelerating its efforts towards connected mobility and has conducted automated and connected driving in Hamburg (Germany) with a fleet of five e-Golf cars. VW signed a co-operation arrangement with Ford focusing on autonomous technology. In 2019, VW and Qatar agreed to integrate Level 4 autonomous electric shuttles and buses into the public transport network by 2022 for Qatar's capital city Doha. The automaker has also announced plans to test its first fleet of autonomous cars in China's eastern city of Hefei. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Danish government has reached an agreement that has secured financing to support the registration of at least 775,000 "green" passenger cars by 2030. According to an announcement by the finance ministry, the aim of the deal made with the Radikale Venstre, Socialistisk Folkeparti, and Enhedslisten parties is to have 1 million "green" passenger vehicles on the country's roads within the same timeframe. To finance this, the government will set aside DKK2.5 billion (USD407 million), an amount to be reviewed in 2025. There will also be support for the introduction of "green fuels" such as "Power-to-X and more advanced biofuels", which it has said is an important element in the transition towards phasing out fossil-fuel cars. It also stated that the government will also work at an EU level to stop the sales of gasoline (petrol) and diesel passenger cars in 2030. The agreement reached between the Danish government and other political parties in the country follows the publication of a report in September. This was intended to look at ways to stimulate demand for BEVs and increase the number on the country's roads and help drive down its CO2 emissions by 70% by 2030. No specific details of the measures have been released, and despite the earlier report focusing heavily on BEVs, the announcement seems to have left the door open to hybrids, and specifically plug-in types, given the use of "green" in the text and a mention of charging hybrids. (IHS Markit AutoIntelligence's Ian Fletcher)

- Ziton is understood to be raising USD42.5 million (EUR35 million) in bonds to acquire Vroon's wind jackup unit Wind Enterprise, after closing in on a new long-term charter with Siemens Gamesa Renewable Energy (SGRE). Ziton has had the unit on bareboat charter since May 2019; the agreement ran until March 2021 and included options to purchase before 20 December 2020, which Ziton has taken up. The Danish contractor has been selected as the preferred supplier for a three-year and eight-month wind farm service deal with SGRE. Under the contract, Wind Enterprise is expected to commence a fixed charter around 1 March 2021. Securing ownership of the unit is a pre-requisite to sign the SGRE contract, Ziton said. Media reports suggest the agreement will net a USD31,525 (EUR26,000) day rate for the jackup. The sale price is understood to be agreed at USD51.5 (EUR42.5 million). In addition to bond financing, Ziton intends to complete an external equity raise of USD12.1 million (EUR10 million). Prior to the commencement of the new charter, the Wind Enterprise will undergo additional upgrades and maintenance at a cost of USD1.9 million (EUR1.6 million). (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

- Volvo Truck North America's new VNR Electric semi-truck has been developed for the US and Canada, and will be produced in the US in early 2021, supported by investment announced in 2019. The VNR Electric has been certified by both US Environmental Protection Agency and California Air Resources Board for sale in all 50 US states. The VNR Electric is based on the VNR diesel chassis, which from a customer view creates familiarity, maneuverability and ease of service. The Electric version is also, however, about 4,000 pounds heavier due to the batteries. Volvo Trucks has been aggressive in developing for battery-electric solutions in the medium and heavy commercial vehicle sector, as well as for fuel-cell battery solutions. The VNR Electric becoming available for truck customers in early 2021 was developing in part through an ongoing demonstration program in California, which not only gave Volvo Trucks North America opportunity to learn and develop the vehicle, but also a proof point to show customers. In terms of the EV-specific financing options and expanded uptime support, these efforts should pay off in making the EV an easier transition for customers; and are not unlike a host of solutions that traditional light-vehicle automakers have developed for their key new EV launches. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Greece's GDP rose by 2.3% quarter on quarter (q/q) during the

third quarter, according to seasonally adjusted figures. Its GDP

had declined by 14.1% q/q during the second quarter. (IHS Markit

Economist Diego Iscaro)

- The country's statistical office revised the national account figures from 2010 to 2015 during the third quarter. Moreover, the incorporation of new and updated sources for the compilation of the national accounts has led to substantial revisions of historical data going back to 2010.

- For example, the country's GDP is now estimated to have increased by 1.6% in 2019, as opposed to 1.9% previously. Activity during the first quarter is now seen to have edged upwards by 0.1% q/q, as opposed to a contraction of 0.7% q/q.

- Despite its rebound, GDP was still down by 11.7% year on year (y/y) during the third quarter. Moreover, output was still 12.1% below its level during the fourth quarter of 2019. On this metric, Greece is the worst performing economy in the eurozone.

- The expenditure breakdown of the third-quarter figures shows exports, particularly of services, being a large drag on activity. On the other hand, domestic demand rebounded strongly.

- Private consumption was boosted by the reopening of the economy, following the national lockdown in place between March and April and large fiscal support that helped sustain households' incomes. Consumption rose by 15.3% q/q and 1.0% y/y and now stands 0.7% above its pre-pandemic level.

- On the other hand, fixed capital formation, which had risen by 2.2% q/q and 4.6% y/y during the second quarter, declined by 0.4% q/q and 0.3% y/y during the third quarter. Investment has been remarkably resilient, rising by 0.3% y/y during the first three quarters of 2020.

- However, this masks substantial differences among its components. While investment in transport equipment declined by almost a half during January-October, investment in machinery/equipment and dwellings rose by 3.6% y/y and 20.2% y/y, respectively.

- Very weak activity in the tourism sector, despite the loosening of restrictions since the second quarter, led to a 39.2% q/q decline in exports of services. This follows a fall of 63.4% q/q during the second quarter. According to the Bank of Greece, tourism revenues fell by almost 80% during the first nine months of 2020.

- Exports of goods, on the other hand, recovered by 6.5% q/q following a fall of 4.2% q/q in the previous quarter. The share of exports of services in total exports, which had been 56% in 2019, fell to just 21% during the third quarter.

- Imports of goods and services rebounded by 9.6% q/q, following a fall of 13.5% q/q during the second quarter.

- The modest rebound in activity during the third quarter was

disappointing and well below expectations. Nevertheless, the

figures also showed some encouraging signs.

- Turkey's banking sector regulator, the BDDK, is reportedly

considering extending regulatory forbearance on non-performing-loan

(NPL) reporting through June, Reuters reports. The BDDK did not

comment on the article and no decision has been finalized, but the

bankers who were interviewed suggested that the extended 180-day

timeline for NPL and Stage-2 loan reporting could be extended by

six months beyond the December 2020 expiration date. (IHS Markit

Banking Risk's Alyssa Grzelak)

- Extending the regulatory forbearance on NPL reporting would support bank profitability in Turkey initially. It will also give banks more time to make provisions for expected loan losses, and provide support to struggling companies' ability to access new credit and stay afloat until the new coronavirus disease 2019 (COVID-19)-virus-driven economic restrictions are lifted and the economic rebound gains a stronger foothold.

- Further extension of the forbearance on NPL reporting would further skew the asset quality picture. IHS Markit's analysis of Turkish bank financial statements and investor presentations suggests that regulatory forbearance is contributing 40-120 basis points of improvement to the sector's reported NPL ratio, which has declined during 2020 on the back of forbearance and very-rapid-credit growth rates, even as the volume of NPLs has risen. NPLss were up by 14% year on year in the third quarter even as the NPL ratio fell by 130 basis points to 4.1%, relative to the end of 2019.

- Although the extension of NPL forbearance seems to be widely anticipated in Turkey's banking sector, in our view, other more targeted measures supporting affected borrowers, such as loan payment moratoriums or enhanced restructuring assistance, would support the continued flow of credit to affected bank borrowers without further undermining the credibility of Turkey's banking sector statistics.

- If the forbearance is not extended, NPLs are likely to rise from the first quarter of 2021 because of the combined effect of a shorter NPL definition returning and our expectation of decelerating credit growth.

- On 7 December, Nairametrics reported that Nigerian banks have

increased their provisions by 15%, from NGN182.9 billion at the end

of 2019 to NGN211.2 billion (USD553.4 million), as banks brace

themselves for an increase in bad loans because of the economic

impact on borrowers, given the slump in global oil prices in

March-April and the COVID-19-virus outbreak. The banking sector is

significantly exposed to the oil and gas sector, directly through

the almost one-third of loans that are directed to it and

indirectly through the recycling of oil revenue through the

economy. (IHS Markit Banking Risk's Ana Souto)

- According to the Central Bank of Nigeria's (CBN) latest Monetary Policy Committee statement, released on 24 November, the banking sector's non-performing-loan (NPL) ratio reduced to 5.7% as of October, an improvement from the 6.4% NPL ratio reported in June.

- Although the reported NPL ratio is improving, the Nigerian banking sector has applied forbearance measures since the global decline in oil prices in 2014, which resulted in a large proportion of restructured loans in banks' balance sheets, particularly loans to the oil and gas sector. This masks the true level of problem loans in the banking sector and limits IHS Markit's ability to accurately assess the risk that bad loans present to capital buffers.

- The reduction in NPLs is also because of a significant increase in loan growth. Credit growth increased by 25.7% in November, compared with total loans disbursed at the end of 2019. The increase is mainly because of the CBN's policy for banks to maintain a minimum 65% loan-to-deposit ratio.

- We assess the increase in banks' provisions to be risk positive, given the high proportion of restructured loans as the CBN indicated in early November that 43% of total loans have been restructured, and economic challenges are likely to persist in 2021. However, the increase in provisions, coupled with the rising cost of funds from the market as banks' share prices have fallen, the lower interest-rate environment, and the CBN's requirement that banks maintain a cash reserve ratio of 27.5%, will put additional pressure on banks' earnings

Asia-Pacific

- APAC equity markets closed mixed; Hong Kong -1.2%, Mainland China/Japan -0.8%, South Korea +0.5%, Australia +0.6%, and India +0.8%.

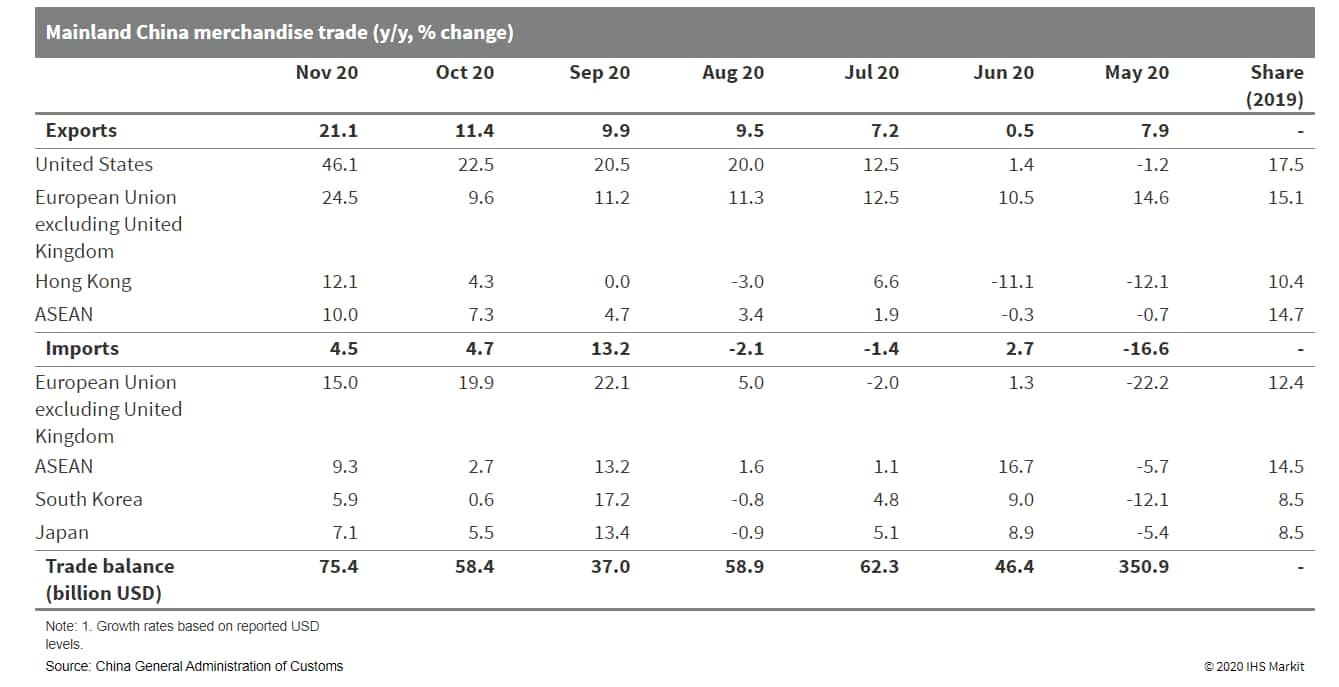

- Mainland Chinese merchandise exports rose 21.1% year on year

(y/y) in November in US dollar terms, up 9.7 percentage points from

October, according to the General Administration of Customs (GAC).

Merchandise imports growth continued to moderate, decreasing to

4.5% y/y from 4.7% y/y in October. Year-to-date total trade

returned to expansion for the first time since the beginning of

2019, while imports growth moderated month on month (m/m). Owing to

the strong appreciation of the Chinese yuan against the US dollar,

imports actually declined. (IHS Markit Economist Yating Xu)

- Strong overseas demand supported mainland Chinese exports. Despite tightening virus-containment restrictions in the United States and Europe due to surges in COVID-19 cases, overseas demand remained strong. The manufacturing Purchasing Manager's Index (PMI) in the United States and the European Union stayed in expansion territory, and Japan's PMI contracted at a slower rate. Meanwhile, a low base effect and the Christmas festive season - traditionally the season of peak consumption - contributed to the growth in mainland Chinese exports; exports to developed and emerging countries improved broadly. Growth of exports to the United States and European Union accelerated to 44.6% y/y and 24.5% y/y, respectively.

- By product, growth in exports of high-tech products and mechanical products accelerated to 21.1% y/y and 25.0% y/y, respectively, and agricultural product exports declined at a slower pace. Meanwhile, owing to the pandemic, exports of epidemic-prevention supplies regained strength after five consecutive months of decline. Additionally, exports of consumption goods such as home appliances, furniture, and textiles all registered faster expansion.

- Despite having moderated m/m in November, imports growth had been expanding over the preceding three months. The quantity and value of mainland China's imports of most major commodities such as soybeans, copper, and iron all slowed; however, crude oil imports declined at a slower rate, partially owing to the increase in the oil prices over the past months.

- Stronger exports growth and slowdown in imports growth led mainland China's trade surplus to increase to USD75.4 billion in November. The year-to-date trade surplus figure amounted to USD460 billion, up 23% y/y. Mainland China's trade surplus with the United States increased 6.8% y/y to USD2 trillion through November.

- Exports are expected to maintain the current strength in the

near term as re-lockdown in the European Union and the United

States owing to the resurgence of infections may impede global

production recovery and the gap of demand and supply will continue

to benefit China's exports.

- Jan de Nul reports the first steel has been cut for its 5,000-metic-ton crane wind-market newbuild, Les Alizés, at China Merchants Heavy Industry (Jiangsu) shipyard in China. Les Alizés is designed for loading, transporting, lifting and installing offshore wind turbine foundations. In addition to its crane, main features include a deck loading capacity of 61,000 metric tons and a deck space of 9,300 square meters. With these characteristics, Les Alizés can easily transport several of the heavier future foundations designed for larger wind turbines in a single trip, with direct benefits in planning, fuel consumption and emissions reduction. Unlike Jan De Nul's other offshore installation vessel under construction Voltaire, Les Alizés does not have four legs to lift itself above the sea surface: it is a DP2 crane vessel for floating installations, which means that the vessel is not dependent on the water depths and the seabed conditions. The vessel will meet several "green" standards: it will be equipped with a dual exhaust gas filtering system that complies with the strict European EURO STAGE V emissions guidelines. It will also be fitted with an Energy Storage System (ESS), forming a hybrid setup together with the main diesel engines. The ESS will compensate power peaks on the main engines and recover energy from the heavy lift crane, resulting in optimized engine operation and lowered fuel consumption and emissions. The vessel is set to obtain a Cleanship NDO7 label and a Green Passport EU label. The Cleanship label will confirm that the vessel checks and minimizes the waste water and all other residual waste, while the Green Passport label means all materials and hazardous substances are mapped out during the construction phase, in order to facilitate the recycling of the vessel when decommissioned. Both certificates will be issued by a specialized external agency. Jan de Nul intends to deploy its newbuild mainly to offshore wind farms, but will also market the unit for decommissioning offshore oil and gas platforms. Preparation, design, and planning leading up to the steel-cutting ceremony took approximately 13 months. (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

- China's Guangzhou Automobile Group (GAC Group) will set up a joint venture (JV) with the country's artificial intelligence (AI) company iFlytek to focus on smart interiors, internet of vehicles technology, and vehicle-related digital services, reports China Daily. The JV company will also offer solutions to other automakers in mainland China and overseas, the report added; the investment value was not disclosed by either company. "The car industry has entered into the critical stage of industrial revolution. Smart, connected and digital functions have become key to the industry's growth," said GAC on its official WeChat account, as reported by China Daily. The GAC Group is already at the forefront of connected-car technologies. The Aion V, GAC New Energy's electric sport utility vehicle, will be among the first cars globally to be equipped with the 5G plus V2X (vehicle-to-everything) intelligent communication system. The vehicle will be integrated with Huawei's Balong 5000 5G chip and will have a maximum cruising range of 600 km (373 miles). The Aion V will also have Level 3 autonomous driving, an Aion intelligent health cockpit, and a one-key remote-controlled parking in all scenarios. (IHS Markit AutoIntelligence's Jamal Amir)

- Malaysia's growers are enthusiastic about Chinese demand for durian fruits. Sales and prices will continue to be underpinned by Chinese demand while ecommerce sales grow in Asia. The pandemic has not affected the cultivation of the fruit. "Fresh volume sales increased in H2 while frozen durian shipments remained the same." Mr He, manager of New Leaf Plantation Berhad Co Ltd, said: "The consumers who can afford to buy durian are generally not affected by the pandemic as much as other consumers. Lockdown has actually increased consumption when people stay at home. Data from our domestic sales shows that express delivery orders grew rapidly." Demand for Malaysian Musang King durian has risen in Laos, Vietnam and China over the last few years. Musang King durian is listed at major Chinese ecommerce sites, JD.com. Both fresh and frozen products are sold. Malaysia obtained market access to China for whole durians last year. Many growers are expanding the planted area to capitalize the China potential. However, grafted durian trees only bear fruits after four to six years' planting. The current demand exceeds supply so prices remain high. He said that the Musang King costs about MYR55 per kilo (USD13.47/kg), 15% higher than last year. A Chinese online retailer told IHS Markit that she mainly sells Thai durians; the competition of Malaysian durians is good to raise the consumer awareness of varieties as Chinese consumers are aspired to widen their fruit baskets from the world. In January-October 2020, global fresh durian imports decreased by 5% to 850,000 tons, at a price of USD3,380 per ton cost, insurance, and freight (cif), up by 46% from last year. In the same period, China accounted for 65% of world's imports to 552,000 tons, at USD4,000/ton cif, up 50% compared to this time last year. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- Toyota and Mitsubishi Fuso have joined the newly formed Japan Hydrogen Association (JH2A). The association aims to promote the creation of a hydrogen-fueled society to combat global warming. The association will work in identifying the issues related to the widespread use of hydrogen, gather information for policy proposals, and make proposals to the government to address the issues. Both the automakers will contribute to the association's goals through the mass production of fuel-cell electric vehicles (FCEVs). Japan has committed to achieving a target of a carbon-neutral society and zero emissions of greenhouse gases by 2050. Although the main focus of the new policy is on reducing the use of fossil fuels to generate electricity, the country's automotive sector is likely to aim to increase the use of battery electric vehicles (BEVs) and FCEVs. Japan is also seeking to set up a commercial hydrogen-fuel supply chain by around 2030 to support the reduction of carbon emissions. The country is trying to speed up technological developments to scale up a transportation system for hydrogen using ships by around 2030. (IHS Markit AutoIntelligence's Surabhi Rajpal)

- The Reserve Bank of India's (RBI) Monetary Policy Committee

unanimously decided to keep the policy interest rates unchanged for

the third consecutive time on 4 December, and said that it would

keep its accommodative monetary policy stance "as long as necessary

- at least during the current financial year and into the next

financial year". (IHS Markit Economist Hanna Luchnikava-Schorsch)

- The repurchase (repo) rate remained at 4.0%, while the reverse repo and the marginal standing facility were kept at 3.35% and 4.25% respectively. Concurrently, the RBI lifted its real GDP projections for the current financial year (FY) ending March 2021 (FY 2020-21) to a negative 7.5% from a previous -9.5%, with growth now expected in both the third and fourth fiscal quarters (as opposed to a previously projected contraction in the third quarter).

- The inflation forecast was also raised to 6.3% for the second half of FY 2020 from a previous range of 4.5-5.4%.

- The RBI's growth forecast upgrade comes after a second-quarter FY 2020 GDP release that showed the Indian economy contracted by a smaller-than-expected 7.5% during July-September (see India: 1 December 2020: Indian economy enters technical recession in September quarter but contraction is smaller than expected).

- IHS Markit's projection for FY 2020 will also be upgraded in the December interim round to around 9-10% from a previous -10.6%. Our outlook remains more pessimistic than that of the RBI, as we still expect the economy to contract in the third and fourth quarters, given the likely resurgence in COVID-19 infections following the festival season and the reinstatement of containment measures in different parts of India. Our assumptions regarding the wide availability of the vaccine and the speed of the vaccination in India are also more conservative. In addition, the RBI's stronger inflation outlook indicates that we will remove an interest rate cut projected for January in our forecast.

- Although the easing policy cycle may not be over, the timing and size of any additional rate cuts will now depend on the path of inflation in December-January and the content of the Union budget to be announced in February 2021.

- LG Chem has completed the spin-off of its battery business into a new company, LG Energy Solution, according to a company statement. LG Chem announced that Kim Jong Hyun has been appointed as the first president of LG Energy Solution. "LG Energy Solution pioneered with an unwavering challenging spirit for the Korean battery industry, in which the said industry was practically nonexistent, and overcame many concerns and difficulties, and recently became the first to pave the foundation for creating structural profits in the EV battery business before any other competitor. We have now successfully spun off the company to reach for higher dreams and have now set out on a great voyage," said LG Energy Solution president Kim Jong Hyun. LG Chem first made the announcement in September, and in November, it was reported that LG Chem shareholders had approved it. LG Chem reported growth of 8.8% year on year (y/y) in its sales to KRW7.5 trillion (USD6.9 billion) for the third quarter ended 30 September 2020. Sales in LG Chem's battery business recorded the highest sales ever in a quarter reaching KRW3.1 trillion, which is a growth of 42.2% y/y. Furthermore, operating profits in the battery business also touched record levels with a growth of 137% y/y to KRW168.8 billion. LG Chem said that the launch of new models of electric automobiles by major European clients, an increase in sales of cylindrical batteries and an expanded supply of IT products, etc. made it possible to achieve the highest performance ever in the battery business. LG Energy Solution employs approximately 22,000 people (approximately 7,000 in South Korea and 15,000 abroad) globally and it has a global business system comprising production bases in Ochang (South Korea); Michigan (US); Xingang/Binjiang (China); and Wroclaw (Poland); as well as research and development (R&D) tech centres in Daejeon (South Korea); Troy (US); Nanjing (China); and Frankfurt (Germany). (IHS Markit AutoIntelligence's Jamal Amir)

- As per IHS Markit's Commodities at Sea, Australian iron ore

shipments during November 2020 stood at 74.6mt (down 2% y/y). The

shipments from the top three Australian iron ore ports - Port

Hedland (41.7mt, down 4% y/y), Port Walcott (16.7mt, up 4%), and

Dampier (11.7mt, down 2%). (IHS Markit Maritime and Trade's Rahul

Kapoor and Pranay Shukla)

- For the reported month, shipments from individual miners - Rio Tinto (28.3mt, up 2% y/y), BHP Billiton (23.1mt, at par), FMG (14.6mt, down 6%), Roy Hill (2.8mt, down 30%), CITIC Pacific (2mt, up 6%), and Atlas Iron (1.3mt, up 16%). FMG is a major miner of low-grade seaborne iron ore fines.

- In terms of destinations, shipments to China during November 2020 stood at 59.8mt (down 2percent y/y). In terms of Chinese regions, there was an increase in Australian cargoes to East China (32.6mt, up 6% y/y); but a decline to North China (21mt, down 20%) and South China (2.7mt, down 34%).

- Tangshan regional government had issued seasonal winter

production control measures on emissions from blast furnaces and

sintering operations at the steel mills in the region.

- This year the control measures were less stringent as air quality in the region was better compared to the last couple of years as mills added emission control measures.

- This time the control measures are from 01 Oct 2020 until 31 March 2021, and the mills are required to cut output basis a five-tier approach. A-category steel mills that have adequate emission control measures could undertake self-imposed production cuts.

- While B-category, B-Minus, C& D category mills to impose 10%, 20%, 35%, and 45%, respectively.

- This year production cuts in the Tangshan region to run for 2.3 weeks more, however, due to eased emission control measures, it will impact 3.5-4mt less production capacity.

- The announcement was anticipated to increase the usage of high-grade iron ore fines and lumps compared to previous winter demand. This was visible in lower shipments to the North China ports during November 2020.

- This year overall iron ore shipments from Australia are quite strong. During the first 11-months of 2020, total Australian iron ore shipments stood at 844mt, up 5% y/y.

- Among the top three ports, while loadings increased from Port Hedland (499mt, up 7% y/y) and Port Walcott (173mt, up 4%), while declined from Dampier (124mt, down 3%).

- In terms of miners, shipments during 11-months of 2020 increased from Rio Tinto (296mt, up 1% y/y), BHP Billiton (270mt, up 8%), FMG (164mt, up 5%), and Roy Hill (52mt, up 6%).

- For 4Q20 and full 2020, Australian iron ore shipments forecasted at 234.4mt (up 2% over the year) and 924mt (up 4%). For the calendar year 2021, Australian miners are expected to export 944 mt of iron ore cargoes.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-december-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-december-2020.html&text=Daily+Global+Market+Summary+-+7+December+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-december-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 7 December 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-december-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+7+December+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-december-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}