Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 08, 2021

Daily Global Market Summary - 8 February 2021

Several major US equity indices closed at new record highs today, as most major European and APAC markets were also higher. US government bonds were close to flat on the day and European bonds closed mixed. European iTraxx and CDX-NA were almost unchanged on the day across IG and high yield. The US dollar closed modestly lower, while oil, gold, silver, and copper were all higher on the day.

Americas

- US equity indices closed higher; Russell 2000 2.5%, Nasdaq +1.0%, DJIA +0.8%, and S&P 500 +0.7% and all closed at new record highs.

- 10yr US govt bonds closed flat/1.17% yield and 30yr bonds closed -1bp/1.96% yield. 30yr bonds breached a 2.00% yield intraday for the first time since 20 February.

- CDX-NAIG closed -1bp/50bps and CDX-NAHY -3bps/283bps.

- DXY US dollar index closed -0.1%/90.93.

- Gold closed +1.2%/$1,834 per ounce, silver +2.1%/$27.58 per ounce, and copper +1.1%/$3.67 per pound.

- Crude oil closed +2.0%/$57.97 per barrel.

- As vaccinations speed up across the U.S., key COVID-19 metrics are declining from a record-setting fall surge. Newly reported cases fell below 100,000 for the first time this year. Hospitalizations dropped for the 26th day in a row, and the number of Covid-19 patients requiring intensive-care treatment fell to its lowest level since Nov. 19. The country is now averaging about 1.4 million vaccinations a day, and nearly 10% of the U.S. population has been given at least one dose, according to a Wall Street Journal analysis of data from the Centers for Disease Control and Prevention. (WSJ)

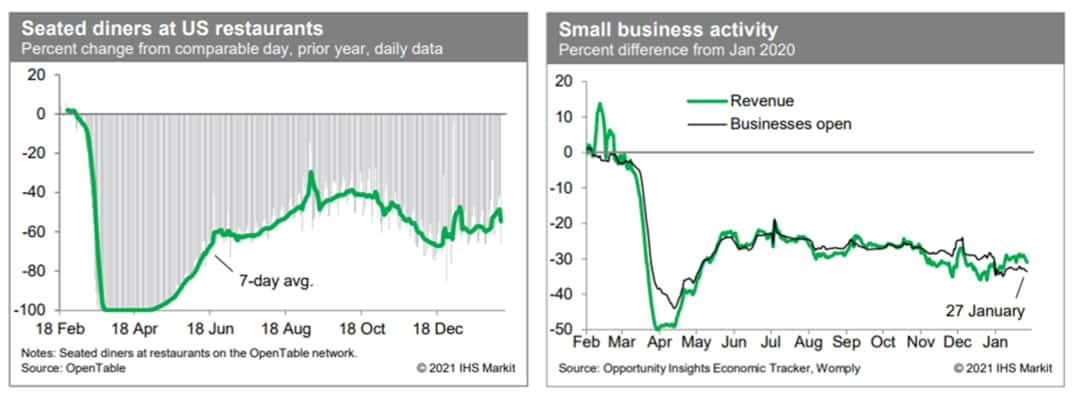

- The trend in the count of seated diners on the OpenTable

platform appears to be improving, as recent seven-day averages (of

year-earlier comparisons) are up from readings in mid-December.

Meanwhile, both revenues at small businesses and the number of

small businesses open through January remained depressed, according

to the Opportunity Insights Economic Tracker. While revenues have

shown some recent improvement, those gains have been modest, and

revenues remain down roughly 30% from January 2020. (IHS Markit

Economists Ben Herzon and Joel Prakken)

- The annual Super Bowl game is consistently one of the most-watched single sporting events on TV in the world. With the high cost of TV advertising time during the game - the estimated cost was USD5.5 million for a 30-second slot in 2021 - automakers most frequently use the annual event as part of brand-building efforts or key new-product launches. The Super Bowl LV (55) this year saw a decrease in automotive participation in its advertising, with four auto brands showing national TV adverts during the game, compared with seven in 2020. Changes in media consumption require new approaches to communication with consumers and to marketing, and the impact of advertising during the Super Bowl is no longer on the upswing; in 2021, the COVID-19 pandemic also seems to have had an effect. However, ongoing interest in the Super Bowl provides opportunities to supplement more-targeted advertising methods with broad-based, national marketing, particularly as part of telling a brand's story. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Autonomous vehicle (AV) startup Pony.ai has raised USD100 million in an extension of its Series C funding round, reports VentureBeat. The Ontario Teachers' Pension Plan board's Teachers' Innovation Platform led the Series C extension, with participation from Fidelity China Special Situations PLC, 5Y Capital, ClearVue Partners, Eight Roads, and others. This funding round brings Pony.ai's total raised capital to over USD1 billion at a post-money valuation of USD5.3 billion, up from USD3 billion as of February 2020. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Vietnamese car manufacturer, VinFast, has received a permit to test autonomous vehicles (AVs) on public streets in California (US). VinFast, a unit of Vietnam's largest conglomerate Vingroup JSC, is among the 57 companies that are allowed to test AVs with a driver in the city. VinFast said it has developed three electric smart cars with autonomous features, adding that two of the models will be sold in the US, Canadian and European markets from 2022. VinFast has obtained the permit from the California Vehicle Administration in order to commercialize its electric vehicles (EVs) in the US market, reports Reuters. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Fruit drop and increased demand during the pandemic may

"significantly impact the availability" of Florida orange juice

throughout the season, according to the Florida Citrus Commission.

(IHS Markit Food and Agricultural Commodities' Neil Murray)

- Coming into the 2020-21 season, beginning inventory was down by 20% for frozen concentrated orange juice (FCOJ) and 26% for not from concentrate (NFC) juice. Single-strength orange juice (SSOJ), primarily used to make NFC, is up by 30% year over year.

- Utilization of the processed orange crop into FCOJ, on the other hand, was down by 52% by mid-January.

- In a recent meeting, Marisa Zansler, Florida Department of Citrus (FDOC) director of economic and market research, provided an update on Florida orange juice (OJ) movement and availability.

- NFC packaged movement, which represents about 96% of present NFC orange juice movement, is up by more than 10%. NFC pack from Florida-sourced fruit is presently outpacing NFC imports. However, imports are up from last season, which is helping to maintain market share for processors. Total overall movement of FCOJ, on the other hand, is down by 4%, probably due to the decline in foodservice. At the same time, imports of concentrate are currently outpacing pack from Florida-sourced fruit and are up, compared with last season.

- The increase in packaged movement is offsetting the decline in bulk movement. Overall movement is currently up 2.5% so far this season for Florida processors.

- There is currently an estimated surplus of FCOJ. At this time of the season, the industry would expect to have a current supply of about 31-33 weeks instead of the present 45 weeks' supply. There is about 15 weeks' supply of NFC juice, so Florida processors may need to receive more to meet present demand for NFC juice.

- Guatemala's remittance inflows grew by 7.9% year on year (y/y)

in 2020, despite a significant drop during the height of the

COVID-19-virus pandemic. Record-high remittances in the second half

of the year counteracted the earlier decline. (IHS Markit Economist

Lindsay Jagla)

- Growth continued into January 2021, with remittance inflows increasing by 8.7% y/y. The resilience of remittances amid the COVID-19-virus crisis has partially been a result of the stimulus packages enacted in the United States, which included cash transfers and greater unemployment benefits.

- Remittances play a key role in Guatemala's economy, providing approximately 30% of foreign-exchange inflows and amounting to nearly 15% of GDP. The inflows boost domestic consumption and investment, especially amid shocks such as the COVID-19 virus, during which the economic downturn heightened unemployment and lowered disposable income.

- Private consumption is key to Guatemala's economy, amounting to 85% of GDP, and remittances play a key role in supplementing disposable income and expanding consumption capabilities. We expect Guatemala to recover by 3.8% y/y in 2021, with domestic consumption as a primary growth driver.

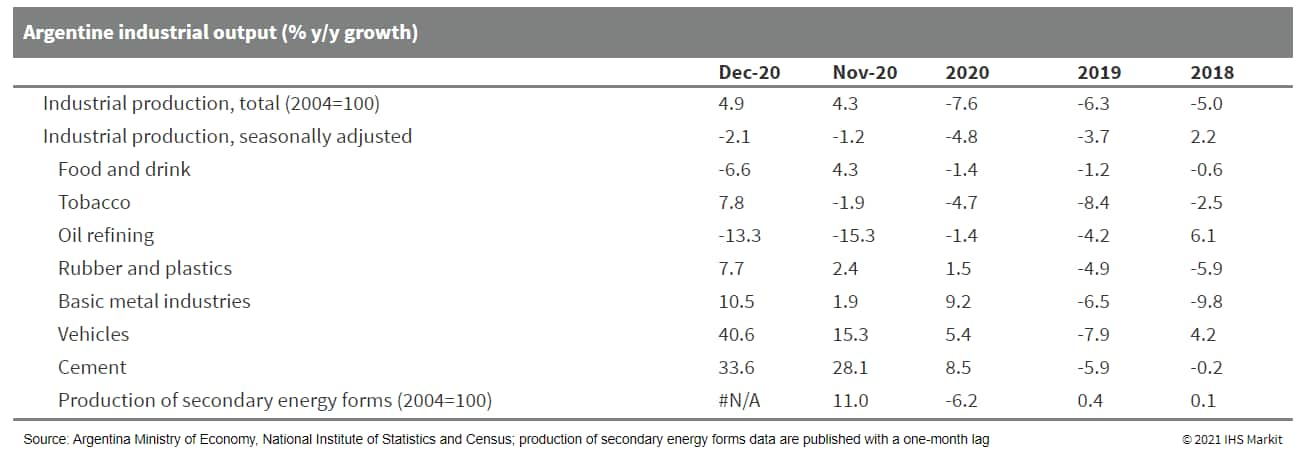

- According to Argentina's National Institute of Statistics and

Census (Instituto Nacional de Estadística y Censos: INDEC), the

country's industrial production increased by 4.9% year on year

(y/y) in December. Seasonally adjusted data show a 0.9%

month-on-month (m/m) rise in October, compared with a 4.3% m/m rise

in November (revised figure). The cumulative change for the whole

of 2020 is a decline of 7.6% y/y. (IHS Markit Economist Paula

Diosquez-Rice)

- The biggest annual decreases in December were in oil refining, other transport equipment, clothing and apparel, and food and beverages, among others. However, a few sectors posted a strong y/y expansion in December: the vehicle assembly sector, the rubber and plastics sector, the non-metal minerals sector, the machinery and equipment sector, and the general equipment sector.

- A qualitative industrial poll of companies conducted by INDEC shows that 26% of respondents estimate that demand will deteriorate in January 2021 to March 2021, compared with the same period in 2019-20 (down from 29% in the previous month's survey). The percentage of respondents expecting demand to improve remained relatively stable at 31%, while 54% of respondents expect exports to remain at a similar level during the period.

- Construction activity increased by 4.3% m/m in seasonally

adjusted terms in December and jumped by 27.4% compared with

December 2019 (the comparison base was massively depressed as

construction activity dropped by more than 6% y/y in December 2019

and by more than 20% y/y in December 2018).

Europe/Middle East/Africa

- European equity markets closed higher; Italy +1.5%, France/UK +0.5%, Spain +0.1%, and Germany flat.

- 10yr European govt bonds closed mixed; Italy -3bps, UK -1bp, France flat, and Germany/Spain +1bp.

- 10yr Italian govt bonds closed -3bps/0.51% yield, which is tied (when rounded to the second decimal place) with the 17 December lowest closing yield on record.

- iTraxx-Europe closed flat/47bps and iTraxx-Xover +1bp/244bps.

- Brent crude closed +2.1%/$60.56 per barrel, which is the first time it has closed above $60 per barrel since 24 January 2020.

- After a brief plateau in the mid-$50s, a fresh wave of bullish momentum pushed crude prices up by another $5/bbl last week to just under $60/bbl. With this latest push, markets have effectively transitioned from pricing on anticipation of future tightening to pricing in significant first quarter global oil deficits, potentially as high as 1.5-2.0 MMb/d. This shift is important as it immediately puts the physical recovery to the test, with the sustainability of prices hanging in the balance. As opposed to the more aggressive stock draws getting priced in, our latest global balances point to a much less tight global picture, with mild draws outside of China as Atlantic Basin demand continues to stumble. As we discussed in our 1Q2021 quarterly outlook, earlier higher prices add a threat to the physical recovery through the supply signals they send to both OPEC+ producers and the industry as a whole, further raising the stakes on the demand recovery to deliver the salvation markets now strongly price in. (IHS Markit Energy Advisory's Roger Diwan, Karim Fawaz, Ian Stewart, Edward Moe, and Sean Karst)

- British doctors who spent 102 days treating a cancer survivor for COVID-19 documented how the virus mutated after the man was treated with convalescent plasma. The case study suggests the use of blood plasma donated from COVID-19 survivors may have put enough pressure on the virus to force it to evolve. The result: Less susceptibility to immune system antibodies that normally fight off infection, according to the report published Friday in the journal Nature. (Bloomberg)

- German manufacturing output increased anew in December 2020,

defying the implementation of a strict lockdown in mid-month that

admittedly did not hit the sector directly. In contrast, orders

corrected downwards, dragged lower by a plunge in investment goods

demand from eurozone countries. (IHS Markit Economist Timo Klein)

- Seasonally and calendar-adjusted German industrial production excluding construction increased by 0.6% month on month (m/m) in December 2020, its eighth consecutive month of recovery. It is only about 4% below its February 2020 pre-pandemic level and about 2% below the average production level in the fourth quarter of 2019.

- Total production including construction was flat m/m in December 2020, reflecting marked declines in both construction and energy output (-3.2% and -2.9% m/m, respectively). In the case of construction, this only partly corrects the cumulative surge of 8% during August-November 2020, however, and the December output level still exceeds that of December 2019 by almost 3%.

- Consumer and intermediate goods production did quite well, the latter despite having shown uninterrupted increases since June 2020 already. Intermediate goods output thus has essentially returned to last February's pre-pandemic level now. Investment goods production dipped but only slightly.

- A different split according to industrial branches reveals more of a mixed picture - corrective declines in machinery/equipment (-2.4% m/m) and computers and electrical equipment (-1.0% m/m) and gains of around 3.3% m/m each in food/beverages/tobacco and chemicals/pharmaceuticals, 1.9% m/m in the metal industry, and 1.2% m/m in motor vehicles and parts.

- Germany's industrial sector has proven quite resilient to the fallout from the second wave of the COVID-19 virus pandemic that triggered increasingly tight administrative restrictions during the fourth quarter of 2020. This reflects that most measures affect the services sector and retail trade rather than manufacturing.

- Meat production in Germany fell by 1.6% in in 2020 - partly

because some processing facilities had to suspend or slow

operations following COVID-19 outbreaks among workers. (IHS Markit

Food and Agricultural Commodities' Max Green)

- Production of all types of meat amounted to 7.82 million tons, down from 7.95 million tons in 2019, according to data from Federal Statistics Agency, Destatis.

- Pork production for the year as a whole fell 2.4% y/y to 5.1 million tons, continuing the downward trend seen in the past five years.

- With 53.2 million animals slaughtered in 2020, the total number of pigs slaughtered was down 3.5% compared to the previous year. Of the total, some 50.9 million were born and raised in Germany, down 1.7% y/y.

- With several processing facilities hit by COVID outbreaks, the number of imported pigs slaughtered in Germany fell by 31.3% to 2.3 million animals. Towards the end of the year, a backlog of one million pigs had built up as a result of COVID-related disruption to meat processors.

- The number of cattle commercially slaughtered in 2020 fell by 4.2% compared to 2019 to 3.2 million animals. The slaughter volume of 1.1 million tons of beef produced was 2.8% below the previous year's result.

- In contrast to pork and beef production, the amount of poultry meat produced in 2020 increased by 1.9% compared to 2019 to 1.6 million tons. Of this total, broiler meat accounted for 1.1 million tons - up 2.9% y/y. The production of turkey meat also increased by 1.3% to 0.5 million tons. Last year's increase means the amount of poultry meat produced in Germany has increased by 17% since 2010.

- Daimler and BMW are reportedly in talks to sell their parking-app joint venture (JV) Park Now to European rival EasyPark Group. Park Now, which allows drivers to pay for parking using a mobile app, is currently available in more than 1,000 cities and EasyPark provides digital services for parking in more than 2,200 cities. If the talks follow through, the companies could announce an agreement as soon as the next few weeks. However, there is no certainty that these talks will result in a deal, and the carmakers might opt to revive discussions with other suitors, reports Automotive News Europe (ANE). (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Siemens Energy has provided measures aimed to enhance its long-term cost structure, resulting in workforce reduction by 7,800 people. The company initially announced plans in September 2020 to reduce costs by a minimum of EUR300 million (USD361 million) in its Gas and Power segment. This is in addition to programs already under implementation. The measures range from cost reductions related to external service providers, purchasing and logistics, to streamlining the IT landscape. Siemens Energy has already initiated its portfolio-reshaping process by modifying its range of aero-derivative gas turbines. In addition, the company will no longer bid on contracts for new coal-fired power plants. (IHS Markit Upstream Costs and Technology's Kamila Langklep)

- Spanish industrial output rose by 1.1% month on month (m/m) in

December after a 0.9% m/m drop in November. This implies it

increased in seven of the last eight months. (IHS Markit Economist

Raj Badiani)

- Nevertheless, it remained 0.5% lower when compared to February's level, which was the last month before the first national COVID-19 restrictions. Factories closed during late March and April, with output falling by 13.2% m/m and 21.8% m/m, respectively.

- Rising output between November and December was because of improving energy and capital goods output, rising by 9.2% m/m and 1.7% m/m, respectively. This offset falling output of consumer non-durables, down by 0.7% m/m.

- Nevertheless, in annual terms, industrial production in December was still 0.2% lower than a year ago, implying it fell by a record 9.6% in the full year 2020.

- In 2020, the output of consumer durables fell by 14.1%, while capital goods plunged by 16.0%.

- Latest survey data suggest that conditions in the industrial sector deteriorated in January. The IHS Markit Spain Manufacturing PMI - a composite indicator of overall activity - was subdued during January 2021 when retreating to a seven-month low of 49.3 with a score below 50 signifying contraction.

- AkzoNobel says it no longer intends to pursue the acquisition of Tikkurila, following an offer by PPG Industries on 4 February to acquire Tikkurila for approximately €1.52 billion ($1.82 billion), or €34.00/share, 8.8% above AkzoNobel's competing bid of €1.4 billion or €31.25/share, submitted on 18 January. "Despite a strong cultural fit—and more synergies than any other combination with Tikkurila—the intended transaction no longer meets AkzoNobel's criteria for superior value creation," the company says. (IHS Markit Chemical Advisory)

- State Secretariat for Economic Affairs (SECO) data reveal that

Swiss seasonally adjusted unemployment increased by 3,522 persons

or 2.2% m/m to 164,246 in January, this being accompanied by an

upward revision to December data. The upward tendency that has

developed since August has gathered momentum during the last two

months, owing not least to the shift of Swiss authorities towards

stricter lockdown measures in response to the deteriorating

pandemic situation. (IHS Markit Economist Timo Klein)

- The level of unemployment in January is clearly above the peak of the previous economic cycle now (then near 150,000 in mid-2016) and also more than 50% above the low point of around 104,000 in mid-2019.

- The seasonally adjusted unemployment rate, which had hovered at 17-year lows of 2.3% in 2019, has remained at 3.5% (given December's upward revision from 3.4% initially). We still do not expect the 4.1% cyclical high of 2009 - caused by the global financial market crisis (GFC) - to be reached this time, but an interim peak around 3.8% in the third quarter of 2021 now appears likely. Company insolvencies will increase in the coming months given the extended duration of effects from the pandemic. Note that the Swiss unemployment rate is measured against a fixed labor force figure used as denominator, which is currently at 4,636,100 (2015-17 average, used for rates since January 2017).

- Among other labor market indicators, seasonally adjusted job vacancies were a bright spot, reversing their recent downturn and increasing by 931 persons or 2.9% m/m to 33,394 in January. In year-on-year (y/y) terms, vacancies nonetheless are about 15% below the levels of January 2020 according to the unadjusted series (-8.2% based on seasonally adjusted data).

- In contrast, the number of short-time workers unadjusted for seasonal variations - lagging by two months - is continuing to rebound now. In November 2020, it surged by 35.2% m/m to 296,592. This compares to last September's interim low of 204,191 but also an all-time high of 1,077,000 in April 2020. Just before the pandemic broke, in February 2020, merely 4,000 employees were on short-time.

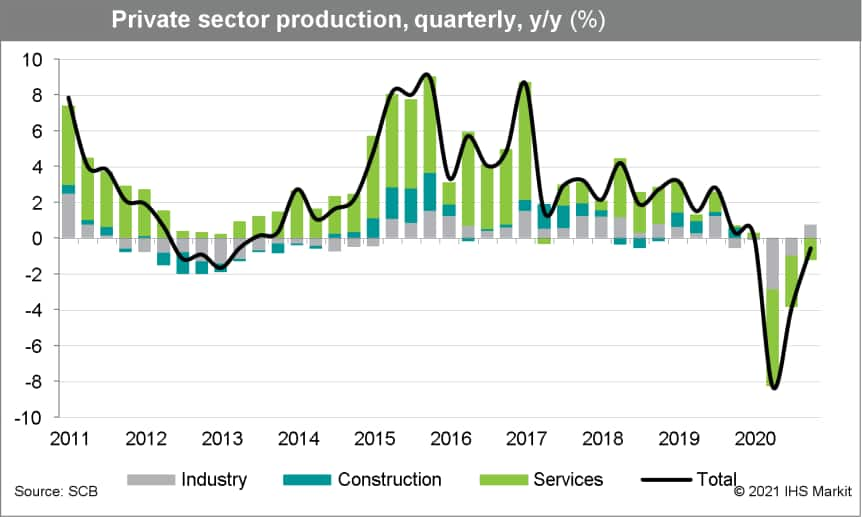

- Statistics Sweden (SCB) has reported that Sweden's

private-sector production dropped by 0.5% month on month (m/m) in

December 2020, after growth of 1.8% m/m in October and 0.8% m/m in

November. Production was down by 1.5% year on year (y/y) in

December 2020, a deterioration from November, when it was down by

0.9% y/y. (IHS Markit Economist Daniel Kral)

- Manufacturing was up by 1.4% m/m, reflecting strong domestic and external demand for the goods-producing sector, while services were down by 0.8%, as a resurgence of COVID-19 cases had affected segments of the services sector. Data on construction-sector output continue to be unavailable.

- Compared with January 2020, private-sector output was down by

2.3% in December 2020, manufacturing was up by 1.7%, and services

were down by 4.1%. In the fourth quarter of 2020, private-sector

output was down by 1.3% y/y/

- Infinity-e (a subsidiary of Infinity Solar) has said that it will invest EGP300 million (USD19 million) to build electric vehicle (EV) charging stations in Egypt, reports Daily News Egypt. The company plans to construct 300 charging stations across the country by 2023. Infinity-e currently has about 150 charging points at 40 charging stations across Egypt. The country is stepping up its efforts to expand the nationwide network of compressed natural gas (CNG) filling stations, which is in line with the government's program to convert gasoline (petrol)-powered vehicles to dual-fuel engines. According to the source, the Petroleum Ministry is working on developing 368 CNG filling stations (along with the existing 225 present in the country) and a further 170 filling stations between mid-March and mid-April. It also plans to establish 1,000 natural gas filling stations. Egypt is on track to promote cleaner fuels in the country. In January 2021, the Central Bank of Egypt (CBE) launched an EGP15-billion initiative to finance a dual-fuel vehicle conversion plan. In July 2020, Egyptian President Abdel Fattah al-Sisi said that the government will grant licenses to new vehicles only when they can operate in the bi-fuel system. (IHS Markit AutoIntelligence's Tarun Thakur)

- On 7 February, GhanaWeb reported that the chief executive of

the Ghana Association of Bankers, John Awuah, has indicated that

commercial banks in Ghana restructured more than GHS6 billion

(USD1.03 billion) in business loans during 2020. According to the

Bank of Ghana's (BoG) latest monetary press release on 1 February,

the banks' restructured outstanding loans amounted to GHS4.47

billion by December 2020. Affected sectors are mostly in trade and

hospitality; the trade sector represented 29.3% of the banking

sector's total loans as of September 2020, when last reported. (IHS

Markit Banking Risk's Ana Souto)

- The overall amount of loans restructured by the end of 2019 represents 9.4% of the total stock of credit given by the banking sector. At the onset of the COVID-19-virus pandemic, Ghanaian banks were already struggling with asset-quality challenges because of high sectorial and single-obligor concentrations.

- The non-performing-loan ratio stood at 14.5% in March 2020, when Ghana reported the first COVID-19 case in the country, which increased to 15.5% as of September 2020. This is expected to continue to increase as macroeconomic challenges brought about by the pandemic put additional pressure on borrowers' capacity to service their debt.

- The deterioration in asset quality has led banks to reduce lending to the private sector and increase their holdings to less risky government securities. According to the BoG, in 2020 investments in government bonds rose by 33.4%, thus exposing banks to sovereign-related risks.

Asia-Pacific

- Most APAC equity markets closed higher, except for South Korea -0.9%; Japan +2.1%, India +1.2%, Mainland China +1.0%, Australia +0.6%, and Hong Kong +0.1%.

- CNOOC plans to spend CNY 90 billion to CNY 100 billion (USD 13.9 billion to USD 15.4 billion) on exploration and production in 2021. The company's 2021 exploration and budget is 5% higher year on year. Capital expenditures for exploration, development and production will account for approximately 17%, 61% and 20% of the total capital expenditure, respectively. In 2021, 17 new projects in China are scheduled to come on stream, including the deepwater Lingshui (LS) 17-2 gas field, Lufeng oil fields regional development and Liuhua (LH) 29-2 field. (IHS Markit Upstream Costs and Technology's Kelvin Sam)

- Luokung Technology has partnered with EMG and BAIC BJEV to jointly develop mapping services for autonomous vehicles (AVs). The companies will co-operate in depth on Level 3 and Level 4 AV projects for BAIC BJEV's electric vehicles. Darwin Lu, CEO of EMG said, "We are very pleased to begin working with BAIC BJEV on projects that leverage our HD Map capabilities with their manufacturing and brand awareness throughout China for the development of autonomous driving. We believe this is the future of the industry, and want to remain well-positioned to take advantage as further developments occur in China's infrastructure." EMG is a subsidiary of Luokung Technology and offers users with navigation systems electronic maps, advanced driver assistance system (ADAS) maps, and HD maps of China. EMG's map database covers 9 million km of road networks in mainland China, Hong Kong SAR, and Macao SAR. BAIC BJEV recently partnered with EMG to provide HD map services for autonomous valet parking function for its new energy vehicles. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Hyundai along with its affiliate Kia have announced that they are not in talks with Apple over an autonomous electric vehicle (EV) manufacturing project, reports Reuters. "We are receiving requests for cooperation in joint development of autonomous electric vehicles from various companies, but they are at early stage and nothing has been decided," said the automakers in compliance with stock market rules requiring regular updates to investors regarding market rumors, adding, "We are not having talks with Apple on developing autonomous vehicles." Earlier, it was reported that Hyundai Motor Group was in preliminary talks with Apple over a business partnership to make EVs and batteries and that Kia was likely to sign a KRW4-trillion (USD3.6-billion) deal with Apple to produce the latter's autonomous EVs at its Georgia plant in the United States. However, executives at Hyundai Motor Group were divided over a potential tie-up with Apple. One of the main concerns was that the automotive group may end up becoming a contract manufacturer for the US tech giant. Apple, known for its secrecy around product development, has never acknowledged talks with the South Korean automotive group about building vehicles. (IHS Markit AutoIntelligence's Jamal Amir)

- Indonesia's economic activity picked up slightly in the fourth

quarter of 2020, supported by mild improvements in domestic demand,

but the economy still contracted by 2.19% year on year (y/y). High

frequency data such as consumer price inflation continue to point

to a subdued domestic demand outlook, which could remain a drag on

growth throughout 2021 unless containment of COVID-19 through

social distancing measures or vaccinations beats expectations. (IHS

Markit Economist Bree Neff)

- Government spending for individual consumption rose only 3.2% y/y in real terms during the fourth quarter, down from a 16.2% y/y rise during the third quarter, as the pace of payouts to households slowed.

- It was reported by the finance minister in early January 2021 that the government spent only 83.4% of its COVID-19 relief fund during 2020, highlighting the issues with meeting fiscal spending targets during the year because of red tape and other capacity constraints.

- Private consumption spending improved thanks to easing contractions for transport and communication and restaurant and hotel services, although both still contracted by -9.5% and -7.3% y/y, respectively.

- Households pulled back spending on non-restaurant food and beverages during the quarter, with that category contracting -1.4% y/y in the fourth quarter vs -0.7% y/y in the third quarter, hinting at households potentially reining in their spending because of tighter budgets.

- Fixed investment spending improved very marginally as continued weakness in building investment (- 6.6% y/y) was mitigated by improvements in spending on machinery and equipment (-7.6% y/y in the fourth quarter versus -21.0% y/y in the third quarter).

- The fourth quarter 2020 result was stronger than IHS Markit had expected; as such, it appears that our 2021 GDP forecast will need to be upgraded from 2.9% possibly to the mid-3% range because of better momentum. Our view is that risks to the outlook remain skewed towards the downside; as such, our forecasts will remain close to the bottom of market forecasts.

- Australia is considering setting up a carbon-neutrality target by 2050, according to Go Auto citing remarks from Prime Minister Scott Morrison. The minister made it clear that Australia's carbon neutrality would not be achieved through taxes, but rather the advancement of science and technology. Scott said, "In Australia, we will do this by investing and partnering in the technology breakthroughs needed to reduce and offset emissions in a way that enables our heavy industry in particular, industry more broadly, jobs and living standards, especially in regional Australia, to continue and to keep energy costs down… In Australia, my government will not tax our way to net zero emissions. I will not put that cost on Australians and I will particularly not ask regional Australians to carry that burden". The Federal Chamber of Automotive Industries (FCAI) and Australian Automobile Association (AAA) have supported the idea that the means to achieve carbon neutrality is through focusing on science and technology, and not just on taxes. Australia has already started working towards a near-term goal to reduce emissions. In April 2019, the Labor Party proposed a climate change policy aimed at cutting emissions by 45% by 2030, including a push to increase the number of EVs on the country's roads. The EV policy package included a national EV sales target of 50% of all new car sales by 2030, a government fleet target of 50% by 2025, and tax deductions for businesses purchasing EVs. (IHS Markit AutoIntelligence's Nitin Budhiraja)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-february-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-february-2021.html&text=Daily+Global+Market+Summary+-+8+February+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-february-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 8 February 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-february-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+8+February+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-february-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}