Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 08, 2021

Daily Global Market Summary - 8 July 2021

Most major APAC and all major US and European equity indices closed lower. US government bonds closed higher, while benchmark European government bonds were mixed. European iTraxx and CDX-NA closed wider across IG and high yield. Natural gas and oil closed higher, while the US dollar, gold, silver, and copper were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower; Nasdaq -0.7%, DJIA -0.8%, and S&P 500/Russell 2000 -0.9%.

- 10yr US govt bonds closed -2bps/1.30% yield and -1bp/1.93% yield.

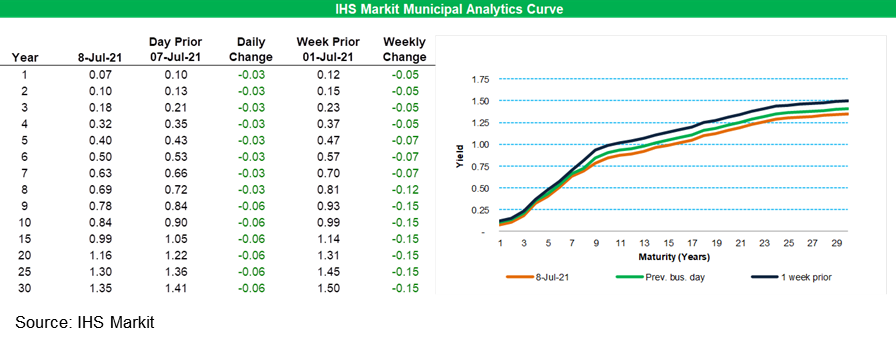

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC)

rallied 6bps for 9-year and longer paper, with that same part of

the curve 15bps better week-over-week.

- CDX-NAIG closed +1bp/49bps and CDX-NAHY +7bps/282bps.

- DXY US dollar index closed -0.2%/92.42.

- Gold closed -0.1%/$1,800 per troy oz, silver -0.5%/$25.99 per troy oz, and copper -1.3%/$4.27 per pound.

- Crude oil closed +1.0%/$72.94 per barrel and natural gas closed +2.6%/$3.69 per mmbtu.

- The highly transmissible Delta variant of SARS-CoV-2 has surpassed the Alpha variant to become the dominant strain of the virus in the United States, based on latest statistics published by the US Centers for Disease Control and Prevention (CDC). According to the agency's estimates, quoted by CNBC and Reuters, Delta accounted for 51.7% of new COVID-19 cases in the country in the two weeks ending on 3 July. The proportion of cases caused by the previously dominant Alpha variant was estimated at 28.7% over the same period. It comes as more than half of US states are reporting increases in COVID-19 incidence, according to data from the Johns Hopkins Institute quoted by CNN. According to the analysis, 24 states saw spikes of 10% or more in the number of new cases reported in the past week. (IHS Markit Life Sciences' Ewa Oliveira da Silva)

- US seasonally adjusted (SA) initial claims for unemployment

insurance edged up by 2,000 to 373,000 in the week ended 3 July.

The four-week moving average inched down by 250 to 394,500. The

number of workers seeking unemployment benefits is trending down as

companies are struggling to fill job openings and thus are hesitant

to lay off existing employees. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs) fell by 145,000 to 3,339,000 in the week ended 26 June, hitting its lowest level since 21 March 2020. The insured unemployment rate decreased by 0.1 percentage point to 2.4%.

- In the week ended 19 June, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) program fell by 353,884 to 4,908,107.

- There were 99,001 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 3 July. In the week ended 19 June, continuing claims for PUA dropped by 110,799 to 5,824,831.

- The disincentive effect of emergency and extended federal unemployment benefits came under scrutiny following employment reports for April and May that were below expectations. As a result, 21 states have already opted out of these programs and 4 more states will follow suit in the next two weeks; the programs are scheduled for termination on 6 September.

- In the week ended 19 June, the unadjusted total of continuing claims for benefits in all programs fell by 449,642 to 14,209,007.

- US outstanding nonmortgage consumer credit rose $35 billion to

$4.28 trillion in May in one of the largest monthly increases on

record. The 12-month change in outstanding consumer credit was

3.7%, 1.2 percentage points higher than in April and approaching

pre-pandemic rates of increase. (IHS Markit Economist David

Deull)

- Revolving credit rose $9 billion, its first sizable increase since the pandemic began.

- Despite the increase, outstanding revolving credit was 2.2% lower this May than last, as a substantial decrease in credit-card spending during the pandemic has yet to completely unwind.

- However, nonrevolving debts, which include student and auto loans, have seen an accelerating increase amid towering demand for new and used vehicles. Nonrevolving consumer credit surged $26 billion in May and the 12-month change in nonrevolving debt was 5.6%, the highest since July 2017.

- The ratio of nonmortgage consumer credit to disposable personal income rose, as expected, increasing 0.7 percentage point to 23.2%.

- May was a banner month for consumer borrowing as the tap of stimulus checks was mostly shut off, leading to increased reliance on plastic and auto loans. We expect this dynamic to continue, although perhaps not as energetically, as the economy continues to revert to a pre-pandemic "normal."

- Autonomous vehicle (AV) startup Argo AI has hired Citigroup Inc. and JPMorgan Chase & Co. as it prepares to go public as soon as this year, with a valuation expected to top USD7 billion. Argo AI and its bankers are looking at either a special-purpose acquisition company (SPAC) or a more traditional IPO approach in going public, reports Bloomberg. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Globally, avocado is projected to be the most exported tropical fruit by 2030 and should reach 3.9 million tons, overtaking pineapples and mangoes. High prices will also make avocado one of the most valuable fruit commodities, according to the recent OECD‑FAO Agricultural Outlook 2021‑2030. Mexico, the world's largest producer and exporter, is expected to see production grow by about 5% yearly over the next 10 years. Growth will be driven by strong demand in the US, the key Mexican avocado destination. Despite increasing competition from emerging countries of origins, Mexico is expected to further increase its share of global exports to 63% in 2030. The US and the EU are expected to be the main destinations, with 40% and 31% of global imports in 2030, respectively. However, imports are also rapidly rising in many other countries such as in China and some countries in the Middle East, and, as measured by the Herfindahl-Hirschman Index of all importers, the concentration of imports is gradually decreasing. (IHS Markit Food and Agricultural Commodities' Hope Lee)

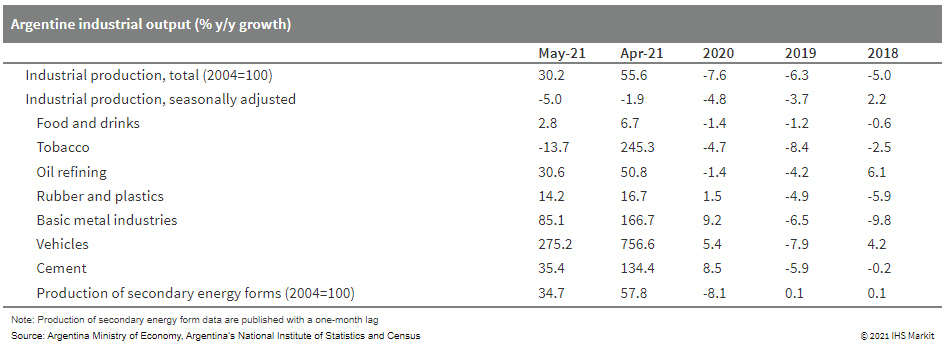

- According to Argentina's National Institute of Statistics and

Censuses (Instituto Nacional de Estadística y Censos: INDEC), the

country's industrial production increased by 30.2% year on year

(y/y) in May. Seasonally adjusted data show a 5% month-on-month

(m/m) decrease in May, compared with a 1.9% m/m decrease in April.

(IHS Markit Economist Paula

Diosquez-Rice)

- The largest annual increases in May were in vehicle assembly, other transportation equipment, clothing and apparel, general equipment, basic metals, and non-metallic minerals, among others. A few sectors posted a slower y/y expansion in May: food and beverages; chemicals; and wood, paper, and printing. Tobacco products posted an annual decline.

- A qualitative industrial poll of companies conducted by the

INDEC shows that 33% of respondents estimate that demand will

expand in June-August, compared with the same period in 2020 (down

from 39% in the previous month's survey). The percentage of

respondents that expect demand to remain relatively the same

increased to 42%, while 50% of respondents expect exports to remain

at a similar level during the period.

Europe/Middle East/Africa

- All major European equity indices closed sharply lower; UK -1.7%, Germany -1.7%, France -2.0%, Spain -2.3%, and Italy -2.6%.

- 10yr European govt bonds closed mixed; Germany/France -1bp and UK/Italy/Spain +1bp.

- iTraxx-Europe closed +2bp/48bps and iTraxx-Xover +7bps/238bps.

- Brent crude closed +0.9%/$74.12 per barrel.

- Britishvolt's planning application for its new large-scale electric vehicle (EV) battery plant has been approved, reports BBC News. Northumberland County Council has approved its plans to build the facility on the 243-hectare site of a former power station in Blyth (UK). Council leader Glen Sanderson was quoted by the news service as saying, "We're absolutely delighted this gigaplant has been granted planning permission. It's a real game changer for Northumberland. It's fantastic news - not just for the local area, but the wider county and the whole region. Here in Northumberland we're at the forefront of the offshore renewable energy industry and this is a massive boost." The approval is another stepping-stone towards Britishvolt beginning large-scale battery manufacturing. The location was confirmed late last year, production is planned to start in 2023 and GBP2.6 billion will eventually be invested in this area. (IHS Markit AutoIntelligence's Ian Fletcher)

- China's Didi Chuxing (DiDi) is planning to launch a ride-hailing service in the United Kingdom within weeks, reports the Daily Telegraph. This comes after DiDi was granted a one-year licence in Salford and a five-year permit in Sheffield. According to the report, DiDi is hiring staff at its London office and opening a base in Manchester. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Offshore wind foundation suppliers Smulders and SeAH Wind are set to receive grant funding from the United Kingdom government's GBP160 million (USD220 million) Offshore Wind Manufacturing Investment Support Scheme. The grant funding, will be to support major manufacturing investments into strategically important offshore wind components in the supply chain, from turbine blades to subsea cables. SeAH Wind will be investing in a new GBP 117 million (USD 161 million) monopile foundation factory at the Able Marine Energy Park. Smulders, through its UK entity Sumlders Projects UK, will invest GBP 70 million (USD 96 million) in new equipment and infrastructure to enable its Wallsend facility, in Newcastle, to manufacture transition pieces. The UK government announced in March earlier this year that it will spend GBP 95 million (USD 131 million) to establish two new ports at Humber and Teesside to support the next generation of offshore wind projects. The ports would have a capacity to house up to even manufacturers. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- German exports edged up only slightly in May, whereas imports

have now outperformed them in three of the last four months. It

appears that the restraining influence from supply-chain

bottlenecks is having a relatively greater impact on exports, thus

also dampening Germany's trade surplus. (IHS Markit Economist Timo

Klein)

- Federal Statistical Office (FSO) external trade data for May (customs methodology, seasonally and calendar-adjusted, nominal) reveal broadly flat exports during the month (up 0.3% m/m) and a sizeable increase for imports (3.4%).

- The seasonally adjusted trade surplus, which had peaked at EUR21.3 billion (USD25.2 billion) in January in the wake of the initial recovery from the coronavirus disease 2019 (COVID-19) virus outbreak, declined from April's EUR15.6 billion to 12.6 billion in May. This is not only below the 2019 monthly average of EUR18.9 billion but is even below the 2020 average of EUR14.8 billion.

- May's regional breakdown (only available in unadjusted terms) continues the pattern of recent months that shows outperforming EU trade relative to trade with the non-EU world. In part, this reflects the particularly pronounced slump in the European Union a year earlier, whereas trade with China had already started to recover in April 2020. Exports to China increased by "only" 17.1% y/y in May 2021, and imports from China even declined by 4.4% y/y. This underperformance of non-EU trade was only partly mitigated by surging trade with the United States (exports up 40.7%, imports up 32.6%) and the United Kingdom (exports up 46.3%, imports up 26.2%).

- German policies need to accelerate the sustainable

transformation of agriculture by helping farmers take better care

of the environment and earn a decent income, according to a new

report from a panel of experts. (IHS Markit Food and Agricultural

Policy's Steve Gillman)

- On 6 July, the country's 'Future Commission for Agriculture (ZKL)' published their main findings and said there is only a "short deadline" to enact systematic change to improve farmers' environmental and economic performance.

- The German government set up the ZKL in July 2020 following domestic pressure to make farming greener and more profitable. It brought together 31 experts from farming, retail, consumer groups and academia to provide long-term recommendations to address the sector's sustainability challenges.

- The report found that environmental progress must be accompanied by fairer remuneration for farmers because they will need to be incentivized to protect nature. The ZKL recommend that more funding from specific taxes and public subsidies should go to farmers, but also from market revenues, especially for those products grown in a sustainable way.

- Environmental progress is also dependent on a stable or increasing number of farms, the ZKL says. They suggest this could be delivered through fairer cooperation with upstream and downstream economic actors as well as new value creation and public procurement, which could ultimately see salaries increase and make the agriculture sector more attractive.

- Although Switzerland's labor market situation continues to

improve, June's unemployment decline relates to an upwardly revised

level in May. The degree of labor market support from the economic

recovery enabled by the loosening of pandemic-related restrictions

since March must therefore not be overstated. (IHS Markit Economist

Timo

Klein)

- State Secretariat for Economic Affairs (SECO) data reveal that Swiss seasonally adjusted unemployment declined by 4.2% month on month (m/m) to 141,595 in June, but this is qualified by an upward revision to the previous month's level of an even greater magnitude (by 5.5%).

- The seasonally adjusted unemployment rate, which had increased from 17-year lows of 2.3% in 2019 to an interim peak of 3.5% in December 2020, softened from May's 3.2% to 3.1% in June.

- Among other labor market indicators, the number of seasonally adjusted job vacancies increased by another 4.7% m/m to 57,227 in June. This is almost twice as high as in June 2020, a few months after the outbreak of the pandemic. Significantly, it is also more than one-and-a-half times its pre-pandemic level in late 2019.

- The data regarding short-time workers (unadjusted for seasonal variations), which always lags by two months, show a 10.8% monthly decline to 304,000 in April. This is less than one-third its peak level of 1,077,000 in April 2020, but still about 75 times larger than the pre-pandemic level of 4,000 in February 2020.

- Siemens Gamesa has obtained IEC type certification for typhoon resistance for its SG11.0-200 DD offshore wind turbine. The certificate was issued by TUV NORD and comes a month after the turbine obtained its full type certification, a year ahead of schedule. This is the second such certification covering resistance to extreme wind conditions issued to Siemens Gamesa. It currently also has the certification for its SG8.0-167 DD offshore wind turbine, and is pursuing the same certification for its flagship 14 MW SG 14-222 DD offshore wind turbine. The certification for typhoon wind speeds, or T-class, is determined as the ability of the rotor-nacelle assembly to withstand wind speeds, defined by the International Electrotechnical Commission (IEC), reaching 57 meters per second for 10 minutes, and three-second gusts of up to around 80 meters per second. Siemens Gamesa has revealed that the certification places them favorably in the growing Asia Pacific market, especially with its interest in Taiwan and Japan. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Ethiopia's government is to finance its latest budget largely

from domestic channels, including tax reallocations. Under the

budget, fiscal expansion is primarily to accommodate reconstruction

needs and infrastructure building, while external assistance is to

come predominately from multilateral institutions. (IHS Markit

Economists Eva Renon and Alisa Strobel)

- Ethiopia's budget for fiscal year (FY) 2021/22, commencing 8 July, was approved by parliament earlier this month and represents an 18% increase on the FY 2020/21 budget amounting to ETB561.7 billion (USD12.7 billion). The new budget is split into ETB162.2 billion of recurrent expenditure, ETB183.6 billion of capital expenditure, ETB204 billion of subsidy appropriation, and ETB12 billion to support achieving sustainable development goals.

- The growth boost envisaged by the latest budget is to be underpinned by implementing ongoing economic reforms and particularly increased participation of the private sector in the economy.

- Furthermore, the largest share of budget allocations is steered towards the construction sector and urban development, followed by the education segment, amounting to 14.9% and 11.8% of the total budget, respectively.

- The 2021/22 budget is largely targeted to be financed (65.7% of the total budget) through domestic channels, including tax revenue of ETB334 billion, while non-tax revenue is targeted at ETB34.7 billion. The profit tax for corporates is set to amount to 16.4% of total tax revenue, followed by taxes on wages and salaries at 6.5% of total tax revenue.

Asia-Pacific

- Most APAC equity markets closed lower except for Australia +0.2%; Mainland China -0.8%, Japan/India -0.9%, South Korea -1.0%, and Hong Kong -2.9%.

- Pony.ai has announced that it will begin a pilot operation of its robotaxi service in Shanghai (China) at the World Artificial Intelligence Conference (WAIC) 2021. It will deploy a fleet consisting of modified Lexus RX vehicles integrated with its latest autonomous system in Shanghai's Jiading district. Users can hail the robotaxi service by accessing the PonyPilot+ app. Pony.ai also shared the progress of its autonomous truck business during the event. It said that its autonomous trucks have so far travelled 37,466 km to transport roughly 13,650 tons of goods, reports Gasgoo. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Swancor Renewable Energy (RWE) has formed a consortium with local Taiwanese players Tien Li Offshore Wind Technology, Yeong Guan Energy, and J&V Energy Technology, referred to as the "Taiwan Team". The consortium seeks to develop two wind farms off the Taiwan coast, Formosa 4 and Formosa 5, using both fixed-bottom and floating foundation technologies. The Taiwan Team's companies have specific manufacturing experience, with Tien Li supplying turbine blades, and Yeong Guan specializing in castings. The suppliers have previously delivered to projects for Vestas and Siemens Gamesa. Relative newcomer is J&V Energy, which is engaged primarily in solar energy projects and stepped into wind farm development in 2020. Swancor had previously revealed in September 2020 that it intended to develop Formosa 4 in three stages (4-1, 4-2, 4-3), and had lodged the projects with Taiwan's Environmental Protection Agency. The Environmental Impact Assessment was subsequently submitted in three months later, in December. The Taiwan Team will focus on developing Formosa 4, located 20 kilometers from shore, using fixed-bottom foundations. Formosa 5 will be developed with floating foundations. Both projects are expected to be delivered after 2025. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- BW Ideol and Japan's ENEOS Corporation have signed a joint development agreement to develop a site-specific commercial-scale floating offshore wind farm off Japan using BW Ideol's floating barge technology. ENEOS, which is Japan's largest oil refiner and distributor, took part in an offshore wind project in Taiwan in April 2019, and participated in the development of coastal projects off Happo Town and Noshiro City, in Akita Prefecture, in September 2020. The company was also selected to operate the latest floating offshore wind power generation project off the coast of Goto City last month. BW Ideol's patented Damping Pool floating platform has previously been deployed on demonstration projects in Japan (Hibiki project), and France (Floatgen project). The foundation, weighing around 5,000 metric tons, features a ring-shaped hollow concrete hull, creating a moonpool-like still center that the BW Ideol claims will counteract the motion caused by wave swell, and provide stability to the floater. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Hyundai Transys has developed the electric vehicle (EV) all-wheel drive (AWD) disconnector system, according to a company statement. It claims that the in-house-developed EV AWD disconnector system is first of its kind globally. "The EV AWD disconnector system is a device attached to the EV system's reducer, disconnecting or connecting motors and drive shafts according to the environment," said the company, adding that the newly developed technology entered mass production in May-June this year. According to the company, the disconnector system allows the vehicle to disconnect the secondary axle from AWD in unnecessary circumstances, such as in the snow or rough terrains. It also allows the vehicle to transition the system to 2WD to enhance the vehicle's energy efficiency. (IHS Markit AutoIntelligence's Jamal Amir)

- Singapore's recent data point to temporary economic slowdown,

with monthly frequency data for Singapore suggesting a deceleration

in the second quarter, as a correction to the fast growth of the

first quarter (IHS Markit Economist Dan Ryan)

- The policy rate - the interbank overnight rate - is not directly affected by the Monetary Authority of Singapore, which operates through the exchange rate. Therefore, the low policy rate reflects the declining rates overseas and the perceived weakness in the current Singaporean economy.

- Singapore's long-term rates are still relatively stable. This suggests that the bond market does not expect a protracted slowdown for the country.

- The exchange rate has been fairly stable in the 1.33 range. This reflects the managed float by the Monetary Authority of Singapore, which has been buying foreign currency and selling Singapore dollars, to offset the strengthening effect of the large current-account surplus.

- In April and May, the first two months of the second quarter, exports and imports were stable. This kept the trade balance stable near USD5 billion per month.

- Malaysian low-cost airline AirAsia Group's digital venture arm, AirAsia Digital, has acquired ride-hailing and payment company Gojek's business operations in Thailand. The AirAsia Group has stated that it has reached an agreement to purchase 100% of the ownership stake in two Gojek subsidiaries in Thailand: Velox Technology (Thailand) Co. for USD40 million and Velox Fintech Co. for USD10 million. The investment will be finalized through a share agreement under which Gojek will receive a 4.76% stake in AirAsia SuperApp, valued at USD1 billion. This deal supports AirAsia in its efforts to step up its digital ambitions as it plans to boost revenue from digital services to 50% within five years. With the incorporation of the ride-hailing service in AirAsia SuperApp, the battle between the "super apps" in Thailand is expected to heat up. The arrangement also demonstrates how Gojek is transforming its regional business after its merger deal with Indonesian e-commerce company Tokopedia to form GoTo Group. (IHS Markit Automotive Mobility's Surabhi Rajpal)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-july-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-july-2021.html&text=Daily+Global+Market+Summary+-+8+July+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-july-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 8 July 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-july-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+8+July+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-july-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}