Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 08, 2021

Daily Global Market Summary - 8 October 2021

Most major APAC equity indices closed higher, Europe was mixed, and US markets were lower on Friday. US and benchmark European government bonds closed sharply lower. European iTraxx and CDX-NA closed wider across IG and high yield. Oil, copper, and silver closed higher, while the US dollar, gold, and natural gas closed lower.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Most major US equity indices closed lower; DJIA flat, S&P 500 -0.2%, Nasdaq -0.5%, and Russell 2000 -0.8%.

- 10yr US govt bonds closed +4bps/1.61% yield and 30yr bonds +3bps/2.17% yield.

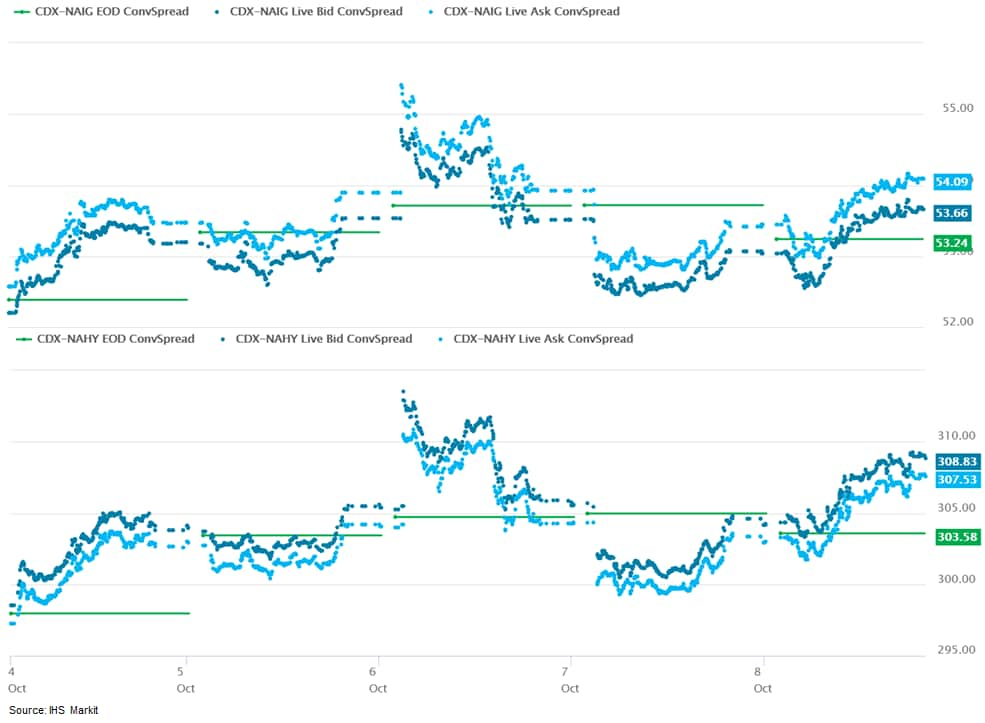

- CDX-NAIG closed +1bp/54bps and CDX-NAHY +5bps/308bps, which is

+2bps and +10bps week-over-week, respectively.

- DXY US dollar index closed -0.2%/94.07.

- Gold closed -0.1%/$1,757 per troy oz, silver +0.2%/$22.71 per troy oz, and copper +0.8%/$4.28 per pound.

- Crude oil closed +1.3%/$79.35 per barrel and natural gas closed -2.0%/$5.57 per mmbtu.

- US Nonfarm payroll employment rose 194,000 in September, short

of expectations. Prior months' gains, though, were revised higher.

The unemployment rate declined 0.4 point to 4.8%, reflecting a

large increase in civilian employment and a decline in the civilian

labor force. (IHS Markit Economists Ben

Herzon and Michael

Konidaris)

- The deceleration in payroll employment was more than accounted for by a sharp decline in employment in education services (public and private), a sector with strong seasonal patterns and, hence, subject to seasonal distortions.

- In the typical September before the pandemic, employment in public and private education services would rise by about 1.5 million before seasonal adjustment. Employment in this sector rose 1.3 million this September, leading to a 180,000 decline after seasonal adjustment.

- Outside of this sector, payrolls expanded 374,000 in September, up from a gain of 303,000 in August. These are reasonably solid gains but are down from considerably stronger gains earlier in the year.

- The Delta wave of new COVID-19 infections is taking a toll on employment in accommodation and food services. After rising an average of 282,000 per month over the six months ending in July, employment in this sector has risen only a cumulative 20,000 since.

- Voyager Therapeutics (US) has announced that it has entered into an agreement giving Pfizer (US) the option to license novel capsids generated from its proprietary RNA-driven TRACER (Tropism Redirection of AAV by Cell-type-specific Expression of RNA) screening technology, using two undisclosed transgenes to treat certain neurologic and cardiovascular diseases. Under the terms of the deal, Voyager will receive USD30 million upfront, and stands to receive up to USD20 million in exercise fees for two options, which Pfizer can select within 12 months. In addition, Voyager could potentially earn up to USD580 million in total development, regulatory, and commercial milestones associated with licensed products incorporating the two Pfizer transgenes together with a Voyager licensed capsid. Voyager is also eligible to receive mid- to high-single-digit tiered royalties based on net sales of Pfizer's products incorporating the licensed capsids. Voyager's TRACER system is an RNA-based functional screening platform that is designed to enable rapid in vivo evolution of adeno-associated virus (AAV) capsids with enhanced tropisms and cell- and tissue-specific transduction properties in multiple species, including non-human primates (NHPs). Initial data have demonstrated that the capsids that are produced can effectively penetrate the blood-brain barrier. For Pfizer, the deal with Voyager aligns with its efforts to develop, manufacture, and commercialize gene therapies. (IHS Markit Life Science's Milena Izmirlieva)

- Tesla CEO has reportedly confirmed the company's plans to move its headquarters from Palo Alto, California, to Austin, Texas. Automotive News reported that Elon Musk made the remarks at an annual shareholder meeting held at the company's new Texas plant. Musk reportedly said that the company is not abandoning California, and also plans to increase California production. Tesla indicated that it intends to increase production in California by 50%, with a similar target planned for the company's Nevada battery production. Musk was quoted as saying, "We will continue to expand our activities in California. This is not a matter of Tesla leaving California." The move is not entirely unexpected, as Musk has been signaling a break with California and personally moved to Texas as well. (IHS Markit AutoIntelligence's Stephanie Brinley)

- At an Investor Day presentation, GM's senior leadership laid out the company's strategy for transforming from an automaker to a "platform innovator," including creating new revenue streams that could potentially double revenue and improve margins by 2030. The forward plan capitalizes on where GM sees its strengths and builds in the expertise that it does not have GM sees itself as a "platform innovator," as it will layer its new Ultifi software and services platform to add new services and features which improve vehicle ownership and create revenue. GM also laid out the intent to leverage its existing manufacturing base to move through the transition to a fully electric light-vehicle future at whatever pace consumers are willing to shift, whether that is in line with the company's target of 100% zero-emission light-vehicles by 2035 or faster. Not unlike presentations by Ford and VW, GM expects to use software services to create a tighter bond with consumers and generate significant, high-margin revenue to complement its automotive sales and finance revenue. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Among the topics at the GM Investor Event on 6 October was an update on the Cruise business by Cruise president Dan Ammann. The key takeaways from the event are that Cruise is very close to being ready to offer paid rides to consumers and sees opportunity to generate a revenue of USD50 billion in 2030. Cruise sees that once the cost per mile of these rides falls to about USD1.00 (or the average cost of US low-mileage car ownership), the total addressable market (TAM) reaches USD500 billion per year, with Cruise and GM expecting that they can capture at least USD50 billion of that. Once the cost can be pulled down to USD0.60 per mile, which is close to the US average mileage car ownership cost in many areas today, the TAM reaches USD1 trillion. Many of Cruise's fundamental cost expectations remain consistent, although the pandemic has changed the development pace and could alter consumer behavior. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The historic drought conditions plaguing much of the Western US

look unlikely to change any time soon and farmers and ranchers

should brace for further water restrictions in the coming year,

state and federal officials told a Senate panel on Wednesday

(October 6). (IHS Markit Food and Agricultural Policy's JR Pegg)

- More than 90% of West is suffering from drought and water levels at two major reservoirs ─Lake Mead and Lake Powell─hit record lows in August, triggering a water conservation plan that will impact all eight states within the Colorado River Basin.

- "The likelihood of deeper cuts in the future is high," said Tom Buschatzke, director of the Arizona Department of Water Resources.

- Arizona alone could lose 18% of its Colorado River allotment next year, he said, and farmers will likely suffer from the reduction despite state programs intended to mitigate the reduction. Those programs may help in the short-term, but the lingering drought could force lasting changes, Buschatzke told the Senate Energy and Natural Resources Subcommittee on Water and Power.

- The future is "going to be very different" for farmers in the West, he said. "They're not going to be able to farm the way they have farmed historically and it's a real paradigm shift for the agriculture community."

- Federal and state officials are going to have to work cooperatively to figure out how to deal with impacts of the "megadrought" and ensure water is stored responsibly and distributed fairly, said subcommittee Chair Mark Kelly (D-Ariz.), who tried to sound a voice of optimism.

- September was another hot month for Canada's job creation, as

net employment leapt by a jaw-dropping 157,100 positions and the

unemployment rate dipped 0.2 percentage point to 6.9%. (IHS Markit

Economist Arlene

Kish)

- The bulk of the net job gains were in services, with solid gains across most industries. Goods employment advanced only 14,700. Full-time positions solidly expanded by 193,600 while part-time positions were cut by 36,500 positions. The number of self-employed workers trended lower with a 19,300 reduction. The total job gain was about evenly split between the broad private sector and the public sector.

- The labor force participation rate popped up 0.4 percentage point to 65.5%, returning to the pre-pandemic level.

- The robust increase in employment and the 1.1% jump in total hours worked from the previous month suggests that the economy continues to forge ahead.

- After a brief respite in August, inflation in Mexico increased

again in September, driven by higher energy and food prices. The

Bank of Mexico (Banco de México: Banxico) is likely to increase the

policy rate at its November meeting. (IHS Markit Economist Rafael

Amiel)

- The country's National Statistics Office of Mexico (Instituto Nacional de Estadística y Geografía: INEGI) reported that the consumer price index (CPI) increased by 0.6% in September, sizably higher than the 0.2% expansion posted in August.

- Annual CPI inflation amounted to 6.0% in September, up from 5.6% year on year (y/y) in August, remaining above the upper-limit target set by the Banxico; the bank targets inflation at 3.0% +/- 1 percentage point. Inflation has been above the targeted range since March.

- Similar to many other countries in the region, inflation was driven by higher food and energy prices. Costs of liquefied petroleum gas (LPG), or propane, alone went up by 4.7% and accounted for 10 basis points in September's inflation (60 basis points); had LPG prices stayed flat, inflation would have been 0.5% in September.

- The core rate of annual inflation, which strips out from the CPI some volatile items such as energy and food, advanced to 4.9%; the core index goods were up by 6.26% and services by 3.43%.

Europe/Middle East/Africa

- Major European equity indices closed mixed; UK +0.3%, Italy +0.2%, Spain -0.1%, Germany -0.3%, and France -0.6%.

- 10yr European govt bonds closed sharply lower; Germany/Italy/Spain +3bps. France +4bps, and UK +8bps.

- iTraxx-Europe closed +1bp/52bps and iTraxx-Xover +5bps/264bps,

which is +2bps and +10bps week-over-week, respectively.

- Aker Offshore Wind has revealed its plans to utilize subsea substations for its ScotWind floating offshore wind bids. The company will leverage on sister company Aker Solutions, which has technical expertise on developing subsea substations and related power system designs. Aker Offshore Wind has stated that underwater substations will be more reliable and cost-effective as they will have fewer components, no rotating parts, potentially use seawater as a coolant, and experience more stable temperatures at the seabed. They will also require less maintenance resulting in lower operational costs. The company will target the use of such underwater substations at deepwater sites where fixed foundations are unsuitable. Underscoring its commitment to support the local industry, Aker Offshore Wind has revealed that the multi-million innovation will be developed, manufactured, and supplied in Scotland, out of Aberdeen. Aker Offshore Wind, together with partner Ocean Winds, have submitted a series of ScotWind bids for floating wind projects in the Outer Moray Firth that could deliver up to 6 GW of energy. This is by far the largest floating wind development in the United Kingdom. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- European cattle prices have risen over for the eleventh week in

a row, as short supplies in a number of member states continue to

dominate market conditions. The EU's benchmark price is now

knocking at the door of EUR400 per 100kg for the first time in over

three years, as processors and wholesalers compete for access to

scarce livestock resources. Official data for the first six months

of 2021 show that total beef production was down by 0.5%

year-on-year across the EU - but this figure masks substantial

regional variations. While output was substantially higher in some

of the less significant markets across the EU, output for the first

half-year was down 8.8% year-on-year in Ireland, by 4.1% in

Austria, by 1.5% in Germany, and by 0.4% in the Netherlands. France

saw an increase in output of just 0.6%, while production in Italy

was stable year-on-year. With imports from South America

constrained by a combination of Covid, transport bottlenecks and

high energy costs - and with UK competitors still adjusting to life

outside the Single Market - the EU beef and cattle sector is

characterized by a fundamental shortage of supplies which is now

evident for both male and female cattle. In the week ending 3

October, the Commission's overall benchmark price for A/C/Z R3

cattle was EUR398.35 per 100kg, up by 0.6% on the previous week.

(IHS Markit Food and Agricultural Commodities' Chris Horseman)

- Germany's Federal Statistical Office - FSO - external trade

data (customs methodology, seasonally and calendar adjusted,

nominal) reveal that exports declined by 1.2% m/m in August, having

increased for 15 months straight since May 2020. In contrast,

imports recouped July's large dip, increasing by 3.5% m/m. Supply

chain problems increasingly are hurting exports more than imports -

based on this adjusted series, the year-on-year (y/y) rate for

exports in August is 10.9%, well below the 15.2% rate for imports.

The discrepancy is even larger when compared with February 2020,

the last pre-pandemic month: Exports are broadly at the same level

(up 0.5%), whereas imports are up by 9.9%. (IHS Markit Economist Timo

Klein)

- The seasonally adjusted trade surplus, which had peaked at EUR21.3 billion in January in the wake of the initial recovery from the coronavirus disease 2019 (COVID-19) virus pandemic, has been on a declining trajectory since. In August, the surplus fell to EUR13.0 billion, fully unwinding July's short-lived spike to EUR17.7 billion and falling below the 2020 monthly average of EUR14.8 billion, let alone the 2019 average of EUR18.9 billion.

- The regional breakdown in August (only available in unadjusted terms, see table below) reveals that annual export growth to the eurozone now does better than to either the remainder of the EU or to the non-EU world. This reflects the ongoing economic recovery in the eurozone in the wake of loosened COVID-19 restrictions since the first or second quarter of 2021. Persistent global supply chain problems are more of a hindrance to trade beyond eurozone borders. This is reflected in modest export growth to China (4.4% y/y) and even sharply declining exports to the UK (-15.1% y/y) given additional issues linked to Brexit. August exports to the US were the only major exception at 22.4% y/y.

- Automotive industry supplier ZF Friedrichshafen AG will invest an undisclosed amount in British autonomous vehicle software startup Oxbotica, according to a company statement. In return, ZF will take a 5% stake and a seat in Oxbotica's advisory board. This investment is a strategic partnership under which both the companies will develop a Level 4 autonomous system, which will initially be deployed in passenger shuttles in major cities. This system can be integrated into various vehicles including mobility-as-a-service (MaaS) shuttles to provide on-demand transportation of passengers and goods in urban environment. ZF is increasingly positioning itself as a complete system for autonomous functions and is collaborating with other players to expand its presence. In 2019, it acquired Dutch firm 2getthere to support development of a range of driverless electric transport applications. The supplier has confirmed plans for a Level 4 automation system for commercial vehicle applications, which it expects to introduce in 2024 or 2025. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Repsol has hiked its planned low-carbon investments by €1.0

billion ($1.15 billion) in 2021-25, to €6.5 billion, and increased

its emission-reduction targets to achieve net-zero emissions by

2050. The company says the additional €1.0 billion will raise its

total investments for the five-year period to €19.3 billion. The

low-carbon spending increase compares with figures given by Repsol

in its last strategic plan, issued in November 2020, and represents

35% of the company's total planned expenditure in 2021-25. This

proportion of expenditure will rise to 45% in 2030, the company

says. (IHS Markit Chemical Advisory)

- Repsol has raised its intermediate decarbonization milestones to 15% by 2025, 28% by 2030, and 55% by 2040, up from 12%, 25%, and 50%, respectively. "The upgrade of our targets demonstrates the solid progress the company is making towards becoming carbon neutral by 2050. Ambition, technology, and project execution are enabling us to increase the speed at which we will achieve this target," says Repsol CEO Josu Jon Imaz.

- The company has also announced an absolute emission-reduction target for the first time, committing to a 55% reduction in emissions from its operated assets (Scope 1 and 2) and 30% cut in net emissions (Scope 1, 2, and 3) by 2030. It has also increased its internal carbon price applied to all new investments, with prices per metric ton of carbon dioxide (CO2) differentiated for investments within the EU and rest of the world. Repsol has set a carbon price of $70/metric ton in 2025 and $100/metric ton in 2030 for the EU, up respectively from $40/metric ton and $70/metric ton previously. In the rest of the world, the price has been set at $60/metric ton in 2025, up from $40/metric ton. "Establishing a carbon price allows new projects to be designed efficiently and investment decisions to be evaluated, and is made taking all variables into account," it says.

- Repsol says its investment plans for the period 2021-25 include €1.5 billion for its chemicals business, with the company aiming to recycle the equivalent of 20% of its polyolefins production by 2030. It will also progress mechanical- and chemical-recycling projects for polyolefins, polyurethanes, and the production of methanol from waste to incorporate these in the production of materials, it says.

- Volvo Trucks has revealed that it has received its largest order so far for its new FM Electric heavy commercial vehicle (HCV). In a statement, the truck-maker revealed that shipping and logistics firm DFDS has ordered 100. The first deliveries are set to take place during the fourth quarter of 2022 and continue through 2023. The statement added that DFDS intends to use the vehicles on short and long transport deliveries within Europe. Volvo revealed its line-up of electric HCVs earlier this year. As well as an electric variant of the FM, it is also introducing this powertrain in the FH and FMX. Customers will be able to specify a range of options for the vehicle with a gross combination weight of 44 tons. This includes having either two or three electric motors with performance between 330 and 490kW, the equivalent of between 450 and 666hp, as well as 2,400Nm of torque. Customers will be able to choose battery capacity of between 180kWh and 540kWh that offers a range of up to 300km. Customers will also have the option of charging the battery pack overnight at the depot using a 43kW AC point which is expected to take around 9.5 hours, or on a 250kW DC point which will take around 2.5 hours. (IHS Markit AutoIntelligence's Ian Fletcher)

- The African Union's top health official, John Nkengasong, said yesterday (7 October) that the organisation will soon begin discussions with the World Health Organization (WHO) and Gavi, the Vaccine Alliance, to facilitate the rollout of GlaxoSmithKline (GSK, UK)'s RTS,S/AS01 (RTS,S; Mosquirix) malaria vaccine. According to Reuters, Nkengasong, who is the director of the Africa Centres for Disease Control and Prevention (Africa CDC), told a news conference: "We will be engaging with GAVI and WHO in the coming days to understand first of all the availability of this vaccine." His comments were made following the announcement of the WHO's recommendation for the malaria vaccine to be deployed for widespread use among children in Sub-Saharan Africa and in other regions with moderate to high P. falciparum malaria transmission, deeming it to be a useful complementary tool on top of existing tools to prevent malaria. The health official indicated that the African Union intends to work swiftly with the WHO and Gavi to clarify costs and funding required to facilitate access to the vaccine in member states. Nkengasong stated that it is currently unclear when the vaccine will be accessible in countries where malaria is endemic, "because the cost per dose is not known and it is not clear how quickly production can be scaled up", according to Reuters. Although GSK has so far committed to produce 15 million doses of the vaccine annually up to 2028, at the cost of production plus no more than a 5% margin, this volume falls well below projected demand, and methods of financing remain uncertain. (IHS Markit Life Sciences' Sacha Baggili)

Asia-Pacific

- Most major APAC equity indices closed higher Except for South Korea -0.1%; Japan +1.3%, Australia +0.9%, Mainland China +0.7%, India +0.6%, and Hong Kong +0.6%.

- As required by the National Development and Reform Commission

(NDRC), three of mainland China's major coal-producing provinces,

Shanxi, Inner Mongolia, and Shaanxi pledged to increase long-term

thermal coal supply by a total of 145 million tons at a discount

price in the fourth quarter. (IHS Markit Economist Yating

Xu)

- Shanxi province, which produces nearly 30% of the country's coal has signed a long-term contract at a price 60% lower than the market price. Coal producers Ordos in Inner Mongolia, which produces 17% of the country's coal guaranteed 53 million tons of coal supply to 18 provinces, including 13 million tons to the northeastern provinces, where a recent power outage caused 23 deaths.

- Meanwhile, the government started unloading Australian coal shipments despite an unofficial import ban a year ago, in an effort to ease the coal shortage.

- Despite the government's efforts to increase coal supply, the issue of power shortage is likely to remain in the fourth quarter because of increasing power demand in the upcoming heating season. Meanwhile, local governments are likely to lift industrial production curbs as the quarterly evaluation of decarbonization target has drawn a conclusion at the end of September, which will increase power demand.

- Chinese electric vehicle (EV) startup WM Motor has raised more than USD300 million in a new funding round led by two Hong Kong-listed companies, reports Nikkei Asia. The company plans to use the funding to develop autonomous vehicle operation and other smart technologies. It is planning to raise another USD200 million in funding from unnamed "prestigious international investors" in a D2 round. According to media reports from the beginning of this year, WM Motor is moving steadily towards its plan to launch an IPO this year on China's Nasdaq-like STAR board. The company had earlier reached an agreement with a group of banks and financial institutions for a credit line of CNY11.5 billion. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Japan's real household expenditures fell by 3.9% month on month

(m/m) in August for the fourth consecutive month of decline, and

the year-on-year (y/y) figure also dropped by 3.0%. The m/m

decrease was primarily driven by continued declines in spending on

culture and education, clothing and footwear, and food (such as

eating out) because of Delta-variant containment measures. (IHS

Markit Economist Harumi

Taguchi)

- Spending on transportation fell by 4.2% m/m partially because of weak spending for motor vehicle purchases. Declines in auto production because of shortages of chips and other parts led to a 34.3% y/y drop (or 27.6% m/m drop; seasonally adjusted by IHS Markit) for new passenger car sales in September, according to the Japan Automobile Manufacturers Association (JAMA).

- Despite sluggish business conditions because of the prolonged

state of emergency, nominal monthly average cash earnings rose by

0.7% y/y in August following a 0.6% y/y increase in July. The

improvement reflected 2.0% y/y growth in special earnings (mainly

seasonal bonuses) following two consecutive months of declines.

Scheduled cash earnings and non-scheduled cash earnings also rose

by 0.2% y/y and 6.5% y/y, respectively. Despite overall

improvement, nominal monthly average cash earnings declined from a

year earlier in the medical and healthcare, information and

communication, finance and insurance, life-related services,

education services, and some other industry groupings.

- The transport ministry of Japan has announced that it will begin testing a dynamic pricing system that will allow taxi fares to be set flexibly based on the degree of traffic congestion. The test will be conducted in some areas of Tokyo between 11 October and 13 December, covering around 8,100 taxis registered with the Go taxi dispatch app and about 1,000 taxis available through the Uber ride-hailing app. During the trial, the taxi operators are required to show sliding fares on smartphone apps so that users can check the prices in advance. To avoid excessive fluctuations, the ministry has requested taxi companies to fix fares within a particular range, reports The Japan Times. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Ride-hailing platform Ola has revealed its plans to move into the pre-owned and new vehicle sales business using the tradename Ola Cars, reports the Times of India. According to the source, the ride-hailing company will enable transactions via the Ola app, with a goal to reach 100 cities by 2022. According to a statement issued by the company, "Ola Cars will begin with pre-owned and, over time, will open it up for new vehicles from Ola Electric and other automotive brands ... Starting with 30 cities, Ola Cars will soon scale up to over 100 cities." The statement added, "It will be a onestop-shop for customers looking at hassle-free buying, selling and managing cars." The Ola Cars business will include services such as vehicle purchases, vehicle finance and insurance, registration, maintenance, vehicle health diagnostics, servicing, accessories, as well as resale of the vehicle back to Ola Cars. Ola has appointed Arun Sirdeshmukh as CEO of Ola Cars. With this plan, Ola will diversify into the Indian automotive business. With the pre-owned car business, it will compete with brands such as Droom, CarDekho, and Cars24, and it will later enter the new car business beginning with Ola Electric. (IHS Markit AutoIntelligence's Tarun Thakur)

- Tata Motors has revealed that it is in the advanced stages of raising USD1 billion through a stock sale of its electric vehicle (EV) unit, reports the Times of India. According to the source, the planned fundraising will value Tata Motors' EV unit at USD8 billion. The national daily reports that the stock sale has attracted private equity (PE) funds TPG, California Public Employees' Retirement System, and Temasek, among others, to lead or co-lead the financing exercise. (IHS Markit AutoIntelligence's Tarun Thakur)

- Tata Motors has announced that it is in the early stages of

talks with Ford to buy the latter's Sanand and Maraimalai Nagar

factories, reports the Times of India. Tata Motors currently has

three passenger vehicle manufacturing plants in the country: its

Sanand facility in Gujarat and its Pune and Ranjangaon plants in

Maharashtra. If Tata were to buy these plants from Ford it would be

its second major transaction with the US automaker after it

completed the acquisition of the Jaguar and Land Rover brands from

the company in June 2008 for USD2.3 billion. (IHS Markit

AutoIntelligence's Tarun Thakur)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-october-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-october-2021.html&text=Daily+Global+Market+Summary+-+8+October+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-october-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 8 October 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-october-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+8+October+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-october-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}