Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 09, 2021

Daily Global Market Summary - 9 August 2021

Most major US equity indices closed lower, while APAC and European markets were mixed. US government bonds closed lower, while most benchmark European bonds closed higher. European iTraxx closed almost unchanged across IG and high yield, CDX-NAIG was also flat, and CDX-NAHY was modestly wider on the day. The US dollar closed higher, while oil, natural gas, gold, silver, and copper were all lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Most major US equity indices closed lower except for Nasdaq +0.2%; S&P 500 -0.1%, DJIA -0.3%, and Russell 2000 -0.6%.

- 10yr US govt bonds closed +2bps/1.32% yield and 30yr bonds +2bps/1.97% yield.

- CDX-NAIG closed flat/49bps and CDX-NAHY +4bps/290bps.

- DXY US dollar index closed +0.2%/92.95.

- Gold closed -2.1%/$1,727 per troy oz, silver -4.3%/$23.27 per troy oz, and copper -1.3%/$4.29 per pound.

- Crude oil closed -2.6%/$66.48 per barrel and natural gas closed -1.9%/$4.06 per mmbtu.

- A slide in oil accelerated on Monday, sending prices around their lowest level in 2½ months with traders worried that fresh restrictions to slow the spread of the Delta variant will weaken the global economy and crunch fuel demand. Investors are particularly concerned about tumbling demand in China, where Beijing health authorities said last week that the city would cancel all large-scale exhibitions and events for the remainder of August. Similar measures in the world's largest commodity consumer stand to stall a recent rebound in travel, worrying traders because China's economic recovery had already shown signs of petering out in recent months. (WSJ)

- Global reaction to the UN Intergovernmental Panel on Climate

Change's (IPCC) latest climate assessment was as forceful as the

language of the report itself, as governments and NGOs said the

stark conclusions in the report provide further evidence that broad

and deep responses must be made to avoid the worst impacts of

global warming. Using terms like "sobering" and "frightening,"

climate leaders said the report raises the pressure on the

participants at the November COP26 meeting to produce stronger and

more enforceable measures to reduce global GHG emissions. Coming

less than three months before the COP26 meeting in Glasgow,

Scotland, the IPCC Sixth Assessment Report (AR6), "The Physical

Science Basis," firmly ties rising temperatures and more severe

weather to human activity. Also, it indicates that widespread

mitigation measures, especially for the regions that will be most

hard-hit by rising temperatures and sea levels, also will be

necessary. (IHS Markit Net-Zero Business Daily's Kevin Adler and Amena

Saiyid)

- AR6 is the first of a series of three IPCC reports, and it outlines the projected impacts of five emissions scenarios, which range from achieving net zero or even declining emissions by 2050, to a doubling of annual emissions, compared with current levels. AR6 will be followed by two reports to be published in 2022 that will look at how to adapt to these impacts and how to prevent the worst-case scenarios.

- The IPCC said in the report that it has "high confidence" that human activities are the main drivers of more frequent and intense heat, melting glaciers, warmer oceans, and acidification of rain. "It is unequivocal that human influence has warmed the atmosphere, ocean, and land," the IPCC said.

- The global surface temperature has increased in each of the last four decades. "The likely range of total human-caused global surface temperature increase from 1850-1900 to 2010-2019 is 0.8°C to 1.3 degrees C, with a best estimate of 1.07 degrees C," the report said. "Human influence has warmed the climate at a rate that is unprecedented in at least 2,000 years."

- IPCC added: "It is virtually certain that the global upper ocean (0-700 meters) has warmed since the 1970s and extremely likely that human influence is the main driver."

- The new estimates sped up the point when the world will pass 1.5 degrees C warming to 2040. If emissions are not checked over the balance of the century, the worst-case scenario in the report says that temperatures could rise by 4.4 degrees C or more.

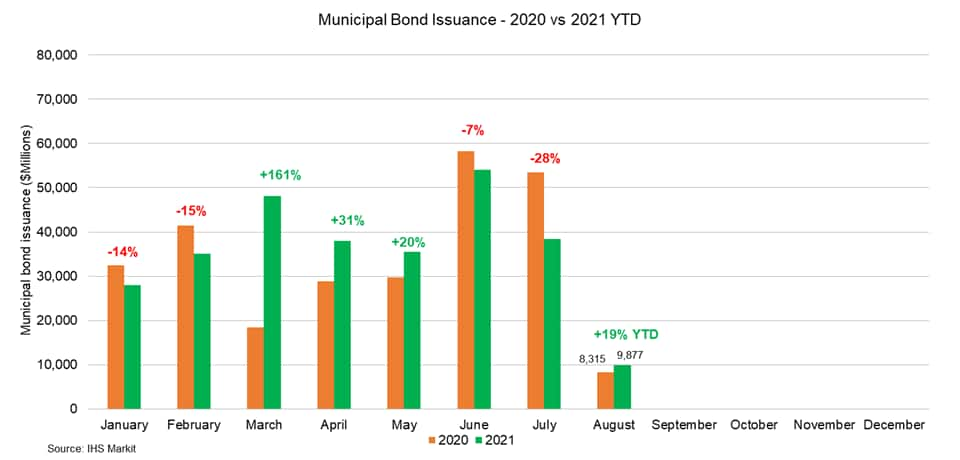

- US municipal bond issuance for the month has improved to +19%

MTD following last week's over $10 billion weekly calendar, which

was swiftly absorbed across buyside accounts as firms seek to

deploy cash during the negative net supply dynamic given the

progression of summer redemptions. As muni mutual fund flows remain

positive, accounts continue to scan the new issue calendar in an

effort to take down bonds, evidenced by last week's successful

pricing of the $932 million New York City Transitional Finance

Authority future tax secured subordinate bonds, offering greater

par size for institutional players. The state of Michigan also

experienced significant demand on a $854 million offering with

proceeds partially appropriated to the Rebuilding Michigan Program,

driving bumps of 2-8bps spread across the scale given overarching

buyer demand. This week's calendar is slated to offer $9 billion of

new issue paper across 107 negotiated deals representing ~75% of

the total weekly calendar with a greater presence of tax-exempt

issuance geared toward retail investors. Allegheny County Airport

will lead this week's negotiated calendar, selling $823 million of

revenue bonds for Pittsburgh International airport with maturities

ranging from 01/2026-01/2056. The Triborough Bridge and Tunnel

Authority of New York will also come to market with $450 million of

payroll bonds, scheduled to price Thursday. This week's competitive

calendar will provide 143 issues for a total of $2.25 billion led

by the Massachusetts Bay Transportation Authority (Aa3/AA/-),

auctioning $328 million of subordinated sales tax bonds with a

self-labeled sustainability designation selling on Tuesday. (IHS

Markit Global Market Group's Matthew Gerstenfeld)

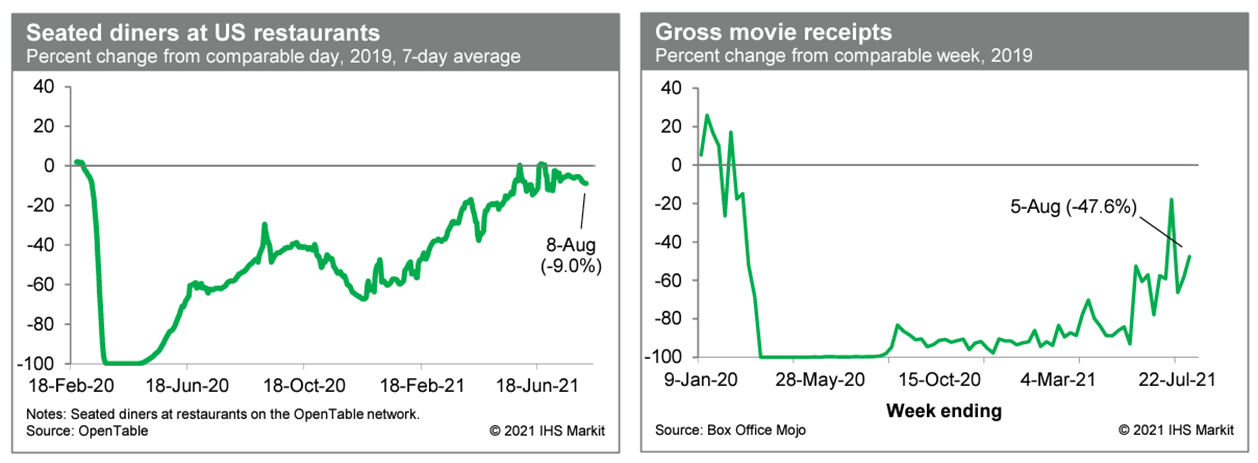

- Averaged over the last seven days, the count of US seated

diners on the OpenTable platform was about 9% below the comparable

period in 2019. This is below readings in late July and is the

first sign in the high-frequency data tracked in this space of

potential economic fallout from the rapid spread of the Delta

strain of COVID-19. Meanwhile, box office revenues turned up last

week but are still well below levels from 2019. (IHS Markit

Economists Ben

Herzon and Joel

Prakken)

- The latest US Job Openings and Labor Turnover Survey (JOLTS)

report points to a strong June for the labor market. With almost

50% of the total population fully vaccinated and a low tally of new

daily infections, most states have eliminated all pandemic-related

restrictions, giving a boost to the labor market, which is evident

in this release. (IHS Markit Economist Akshat Goel)

- Job openings rose to a new series high of 10.1 million in June. The number of hires rose to a 12-month high of 6.7 million.

- Job separations were also up, rising to 5.6 million in June while the layoffs and discharges fell to a series low of 1.3 million.

- The quits rate, a valuable indicator of the general health of the labor market, rose 0.2 percentage point to 2.7%. In June, 3.9 million people quit their jobs and were responsible for an outsized portion of the increase in total separations.

- Over the 12 months ending in June, there was a net employment gain of 6.9 million.

- There was 0.9 unemployed worker for every job opening in June. This is the first time since the start of the pandemic that the number of jobs exceeded the number of unemployed.

- US tobacco giant Philip Morris International (PMI) has increased its offer to acquire UK inhaled-therapeutics specialist Vectura to GBP1.65 (USD2.29) per share, in response to a rival offer of GBP1.55 per share made by US private equity company Carlyle. According to the Financial Times, PMI's new offer comes after Vectura's board and a group of investors representing 11.2% of Vectura's equity gave their support to Carlyle's offer. PMI's new offer equates to a total price of GBP1.02 billion, which compares with Carlyle's total of GBP928 million. Carlyle made its latest offer on 6 August, after its original offer was trumped by a rival bid from PMI almost one month ago. (IHS Markit Life Sciences' Milena Izmirlieva)

- Cargill and Continental Grain have together agreed to buy US

poultry giant Sanderson Farms in a deal valued at just over $4.5

billion. (IHS Markit Food and Agricultural Policy's Max Green)

- Upon completion of the transaction, Sanderson Farms will be combined with Wayne Farms, a subsidiary of Continental Grain, to form a new, privately held poultry business.

- Cargill said the combination will create a best-in-class US poultry company with a high-quality asset base, complementary operating cultures, and an industry-leading management team and workforce. "The new company will be well positioned to enhance its service to customers across retail and food service and drive organic growth in an industry fueled by affordability and key consumer trends around the health, sustainability, and versatility of chicken," it added.

- The purchase price of $203 per share represents a 30.3% premium to Sanderson Farms' unaffected share price of $155.74 on June 18, 2021, the last full trading day prior to media speculation about the potential takeover deal.

- The acquisition consortium said it has equity and debt financing in place to complete the transaction.

- Magna increased its full-year 2021 guidance after the first

quarter, but with its second-quarter results, it revised the

guidance downward. Magna's second quarter included sales reaching

USD9.0 billion, compared with USD4.3 billion in the second quarter

of 2020; year-on-year (y/y) results appeared strong. However, Magna

noted this was "well below our expectations for the second quarter

of 2021." Improvement came on the back of a weak first quarter of

2020, when the COVID-19 pandemic had affected production and sales

globally. (IHS Markit AutoIntelligence's Stephanie

Brinley)

- Magna reported net income of USD424 million in the second quarter, compared with a USD647-million loss in the corresponding quarter of 2020. Income from operations before income taxes was USD540 million in the second quarter, compared with a USD789-million loss a year ago.

- It posted adjusted EBIT of USD557 million, compared with USD600-million loss a year ago. Adjusted EBIT improved as a percentage of sales (6.2% instead of a loss a year earlier) on the negative impact of the pandemic on the second quarter of 2020, cost and operation efficiencies, higher tooling costs in the second quarter of 2021, and lower engineering costs on upcoming ADAS program launches. These factors were partially offset by production disruptions in the second quarter of 2021, higher employee profit sharing and executive compensation on the strong quarter, higher launch costs and net customer price concessions after the second quarter of 2020.

- All of Brazil's YTD light-vehicle sales metrics are positive as 2020 was hit hard by the pandemic, but in 2021 the semiconductor shortage is having an impact, as well as Brazil continuing to struggle with containment of COVID-19. Brazil's light-vehicle sales reached 162,206 units in July, down 0.7% y/y. Exports declined 21.2% while production slipped 9.3% y/y. Brazil's light-vehicle market is forecast for a weak recovery phase through until 2025, with recovery from the weak 2020 becoming more difficult. The full-year sales forecast for 2021 has been revised downward to 2.14 million units, up only 8.6% from 2020 and the fourth downward revision to the IHS Markit forecast this year. Brazil is forecast to see single-digit y/y improvements in the next few years, although the market is not expected to record full-year sales higher than in 2019 until 2024. After falling to 1.96 million units in 2020, IHS Markit forecasts Brazil's LV production will exceed 3 million units again in 2024. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/Africa

- Major European equity indices closed mixed; Italy +0.5%, UK +0.1%, France -0.1%, Germany -0.1%, and Spain -0.2%.

- Most 10yr European govt bonds closed higher except for Spain flat; UK -3bps, Italy -2bps, and France/Germany -1bp.

- iTraxx-Europe closed flat/46bps and iTraxx-Xover +1bps/233bps.

- Brent crude closed -2.3%/$69.04 per barrel.

- United Kingdom-based electric vehicle (EV) startup Arrival has collaborated with Microsoft to co-develop digital fleet and vehicle capabilities for the automotive industry. Microsoft Azure, a cloud-based solution, will be employed to offer advanced uses of telemetry, and vehicle and fleet data management across vehicle fleets. The open data platform will use Azure and machine learning to extract insights from the data as well as edge computing to reduce vehicle-to-cloud data flow. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Siemens Gamesa Renewable Energy (SGRE), part of Siemens Energy, will expand its offshore blade factory in Hull, England by 41,600 square meters, more than doubling the size of the manufacturing facilities. The expansion represents an investment of GBP186 million (USD258 million) and is planned to be completed in 2023. The manufacturing facility will grow to 77,600 square meters and add 200 additional direct jobs to the approximately 1,000 person-workforce already in place. Manufacturing of next-generation offshore wind turbine blades will take place at the new facility. Manufacturing of other offshore wind turbine blade types already in the SGRE's Hull factory pipeline will continue while the expansion is constructed. (IHS Markit Upstream Costs and Technology's Kamila Langklep)

- Mondelēz International has announced that it will move its Dairylea and Philadelphia processed cheese brands to fully-recyclable packaging in the UK and Ireland. The business said that it has now moved away from polystyrene into widely recycled PET plastic for Philadelphia Mini Tubs and Handi Snacks packaging, removing approximately 487 tons of polystyrene. The UK operations of the company has also started using recycled plastic (RPET) in its Dairylea Lunchables packaging as a result of a design optimization project reducing the virgin plastic needed by 75% or approximately 276 tons annually. The move is part of the UK business' Pack Light and Pack Right strategy which supports Mondelēz International's global goal of achieving 100% recyclable packaging, reducing its use of virgin plastic in its rigid plastic packaging by 25% and adding clear recycling labeling information to support consumers to recycle right by 2025. (IHS Markit Food and Agricultural Commodities' Jana Sutenko)

- Germany's exports increased more strongly in June after a

near-standstill during April-May, whereas import growth slowed

down. The restraining influence of supply-chain bottlenecks on

trade volumes continues but helpful inventories are preventing an

outright decline. (IHS Markit Economist Timo

Klein)

- Germany's Federal Statistical Office's external trade data for June (customs methodology, seasonally and calendar adjusted, nominal) reveal strengthening export growth of 1.3% month on month (m/m), alongside slowing import momentum (0.6%). Year-on-year (y/y) rates based on this adjusted series remain very high at 20.0% and 24.7%, respectively, reflecting still depressed levels a year ago after the initial shock of the COVID-19 virus pandemic.

- The seasonally adjusted trade surplus, which had peaked at EUR21.3 billion (USD25 billion) in January in the wake of the initial recovery from the pandemic before declining to EUR12.8 billion by May, rebounded modestly to EUR13.6 billion in June. This remains below the 2020 monthly average of EUR14.8 billion and the 2019 average of EUR18.9 billion.

- June's regional breakdown continues the pattern of annual export growth to EU countries in recent months, outpacing that of the non-EU world. This reflects the European Union's recent economic recovery as COVID-19-virus-related-restrictions are loosened, and the diminishing momentum of export growth to China (16.0% y/y in June) and to the United Kingdom (11.0% y/y, down from May's 46.3%); strong deliveries to the US (39.8%) offset this only in part. In contrast, annual import growth from countries outside the EU remained ahead of deliveries from the EU, driven especially by imports from a strongly recovering US economy (56.0% y/y).

- In unadjusted terms, trade and current-account surpluses rebounded markedly in June compared with May, whereas the comparison with June 2020 revealed only small increases. The other components of the current account posted diverging developments relative to June 2020, as the balances for services and secondary income deteriorated, whereas the primary income surplus expanded by an amount that more than offset those declines.

- German firm Bayer has announced plans to acquire US biotech Vividion Therapeutics, which focuses on generating first-in-class small molecules for targets that were previously considered undruggable in high-unmet-need indications. Vividion's chemoproteomics platform can be used to identify previously unknown binding pockets in well-validated "undruggable" protein targets by screening chemical probes against the entire human proteome, resulting in the selection of highly potent and specific targeted compounds with activities across multiple therapeutic areas. Vividion's main focus is on oncology and immune disorders, and the company is currently developing a transcription factor NRF2 antagonist for NRF2-mutated cancers, and NRF2 activators for inflammatory conditions including inflammatory bowel disease (IBD). Once the acquisition is completed, Bayer will own full rights to Vividion's proprietary discovery platform, including its chemoproteomic screening technology, integrated data portal, and proprietary chemistry library. Under the agreement, Bayer will pay an upfront fee of USD1.5 billion, with potential additional milestone payments of up to USD500 million. The transaction is expected to complete in the third quarter of this year, subject to regulatory approvals and closing conditions. (IHS Markit Life Sciences' Janet Beal)

- Austrian banking group Raiffeisen Bank International AG (RBI)

on 5 August announced that its Serbian subsidiary, Raiffeisen banka

Serbia, has committed to acquire 100% of Crédit Agricole Srbija.

According to RBI's CEO Johann Strobl, the purchase is an "excellent

strategic fit" and will support its "growth ambition in the

market"; the acquisition is subject to regulatory approvals. Upon

completion, RBI plans to merge Crédit Agricole Srbija with

Raiffeisen banka Serbia. Crédit Agricole representatives have

forecast that the disposal will be completed at the end of the

first quarter of 2022. (IHS Markit Banking Risk's Natasha

McSwiggan)

- Foreign-owned Crédit Agricole Srbija accounted for over 6% of total sector agriculture loans in 2020 and for 3.0% of total sector assets at the end of 2020. According to Crédit Agricole Srbija's 2020 annual report, its capital adequacy ratio was 17.26% while its non-performing loan ratio was 2.67%, suggesting that its sale was not a forced event due to underlying pressure on the bank's sustainability.

- Raiffeisen banka Serbia is the third-largest bank in the sector, with 7.9% of total sector assets at the end of 2020. If approved, the newly combined entity would have around 11% of total sector assets, potentially placing Raiffeisen banka Serbia as the largest bank in the sector, ahead of Komercijalna Banka Beograd and UniCredit Bank Serbia (with 10.4% and 10.1% of total sector assets, respectively, at the end of 2020).

- The sale follows the disposal of Crédit Agricole's Romanian unit earlier this year and reflects the French bank's strategy to dispose of non-strategic entities.

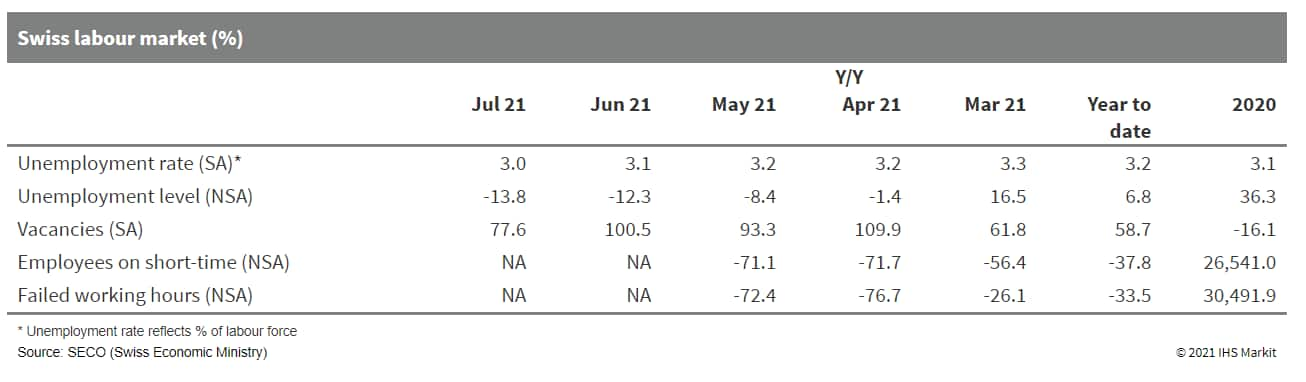

- The momentum of improvement seen in Switzerland's labor market

data is waning as the economic recovery's initial positive effect,

enabled by the loosening of COVID-19-virus-related restrictions

since March, is fading. (IHS Markit Economist Timo

Klein)

- The State Secretariat for Economic Affairs (SECO)'s data reveal that Switzerland's seasonally adjusted unemployment declined by 2.3% month on month (m/m) to 138,957 in July. However, the decline is smaller compared with June (-3.8%), and the previous month's drop has been curtailed from -4.2% initially. The job market recovery that began at the beginning of 2021 is continuing but appears to be losing its momentum.

- The seasonally adjusted unemployment rate, which had increased from 17-year lows of 2.3% in 2019 to an interim peak of 3.5% in May 2020, has nevertheless softened from June's 3.1% to 3.0% in July.

- Among other labor market indicators, seasonally adjusted job vacancies surprisingly fell by a sizable 7.0% m/m to 53,258 in July. Although this remains almost twice as high as at its pandemic-induced nadir of 27,510 in June 2020 and about one-and-a-half times its pre-pandemic level in late 2019, vacancies apparently have peaked now.

- The data regarding short-time workers (unadjusted for seasonal

variations), which always lag by two months, still reflect

improving conditions. The number of short-time workers declined by

15.4% m/m to 257,000 in May, which is about one-quarter of its peak

level of 1,077,000 in April 2020. Conversely, however, this remains

almost three times as high as its peak level during the recession

of 2009 in the wake of the global financial market crisis, and is

about 65 times larger than the pre-pandemic level of 4,000 in

February 2020.

- Volvo Cars has offered an insight into how it expects its electric vehicle (EV) battery technology to evolve over the next few years as it moves towards being a fully EV OEM, according to an Autocar report. Volvo is working on improving and evolving its existing lithium-ion battery technology as a first step. The nickel content of the cathode is being raised and the company is also reducing the reliance on cobalt, while work is taking place to improve the anode (the graphite-based negative electrode) by adding silicon to improve energy density. Volvo is looking for these improvements to combine for the launch of its second-generation battery in 2024, which should offer an energy density significantly above 700Wh per liter. The next stage will be to will bring more new materials that will end with pure-lithium anodes - which have proved very difficult to use so far as they lead to a build-up of excess material on the anode, which can short the cell completely. If this can be solved, this ultimate evolution of lithium-ion cell technology could offer up to 1,000Wh per liter of energy density, near the projected density of the next-generation solid state batteries, which are seen as eventually offering a step change in energy density and cost. (IHS Markit AutoIntelligence's Tim Urquhart)

- According to preliminary data from Saudi Arabia's General

Authority for Statistics (GASTAT), real GDP rose by 1.5% year on

year (y/y), with the oil sector's decline of -7.0% y/y still

dampening the economy, while the non-oil sector saw growth surging

by 10.1% y/y. (IHS Markit Economist Ralf

Wiegert)

- The low base effect of the second quarter 2020, when the pandemic had fully hit the Saudi economy, played a key role for the high increase of non-oil GDP.

- Compared with the first quarter, seasonally adjusted GDP edged by 1.1%, with oil being the driving force here as related activities grew by 2.5%, while the non-oil sector increased by 1.3%. Government activities, which are separated out from oil and non-oil GDP, saw a 2.6% decline quarter on quarter. More details on GDP, including a breakdown in demand-side components and sectoral drivers, will be published on 13 September, according to GASTAT.

Asia-Pacific

- Major APAC equity markets closed mixed; Mainland China +1.1%, Hong Kong +0.4%, India +0.2%, Australia flat, and South Korea -0.3%.

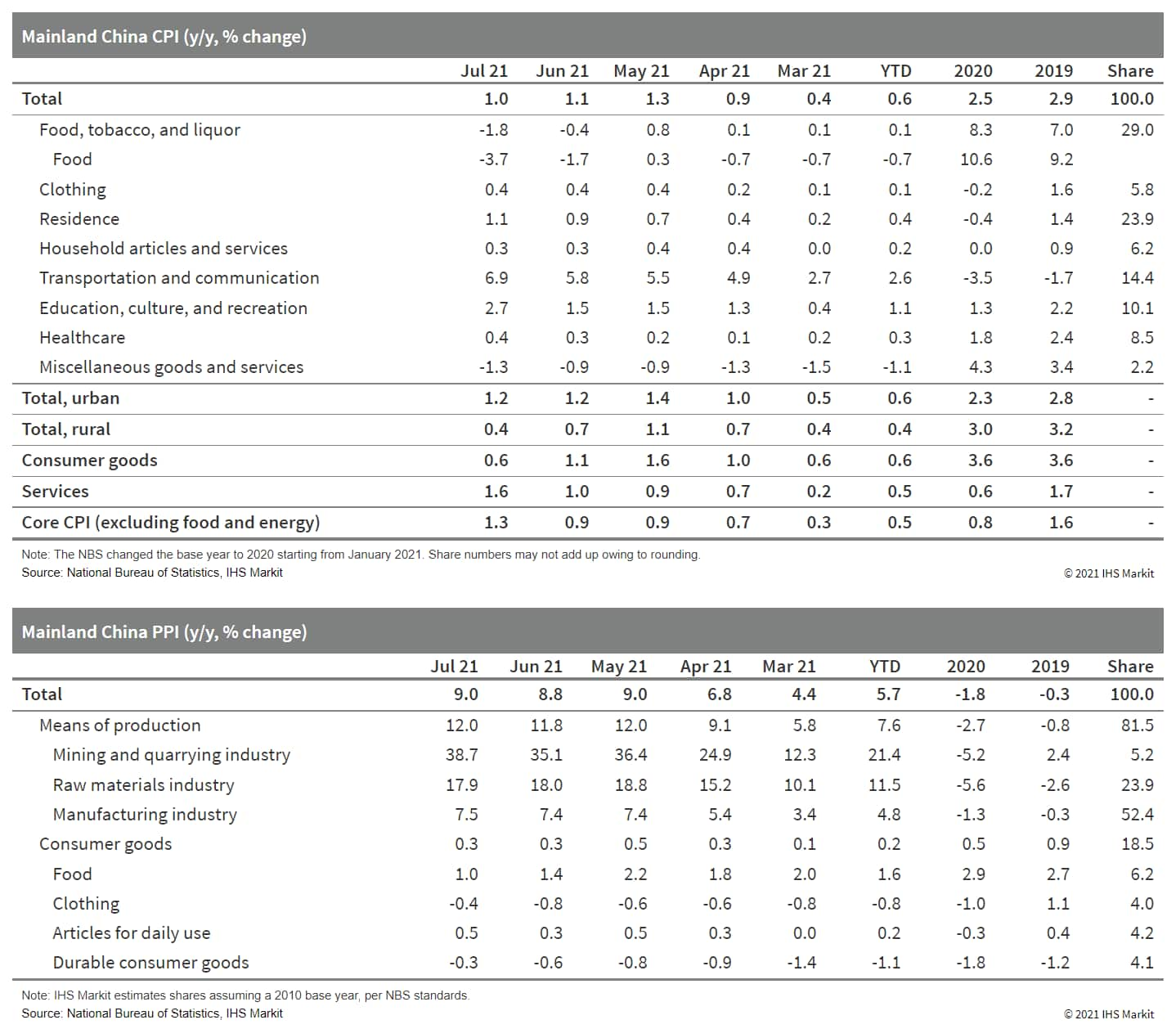

- Mainland China's Consumer Price Index (CPI) rose by 1.0% year

on year (y/y) in July, down by 0.1 percentage point from the June

reading, according to the National Bureau of Statistics (NBS).

Month-on-month (m/m) CPI inflation came in at 0.3%, ending the four

consecutive months of month-on-month deflation from March to June.

(IHS Markit Economist Lei Yi)

- The moderation in headline CPI inflation was again driven by falling food prices, for which the deflation widened to 3.7% y/y in July from 1.7% y/y in the previous month. Notably, pork prices plunged by 43.5% y/y in July, posting an even larger decline than June by 7.0 percentage points. Nevertheless, it is worth noting that the government's move to purchase pork for state reserves in July has made some progress in stabilizing pork prices, as the month-on-month deflation in pork prices narrowed by 11.7 percentage points to 1.9% m/m, after reporting double-digit declines for four consecutive months.

- The improvement in services prices to some extent helped offset the drag on CPI inflation from plunging pork prices. A relatively well-contained pandemic situation, together with the proliferating vaccination rate, supported the recovery in travel demand through most of July until the most recent outbreak in Jiangsu - which has since spread to other provinces - surfaced. That said, impact of the outbreak has yet to be reflected in the data, as services prices increased by 1.6% y/y and 0.6% m/m in July, the highest year-on-year and month-on-month increases since August 2019 and January 2020, respectively. Excluding the volatile food and energy components, core CPI increased by 1.3% y/y in July, the highest increase since January 2020.

- The Producer Price Index (PPI) ticked up to 9.0% y/y in July, up by 0.2 percentage point from June and back to the May level. Month-on-month PPI inflation edged up to 0.5% in July, compared with 0.3% m/m in the prior month.

- The government's move to sell commodity reserves did help to further tame the commodity price rally in July, as prices of ferrous and non-ferrous metal smelting and pressing sectors fell by 0.2% m/m and 0.1% m/m, respectively; however, rising crude oil and coal prices continued to drive month-on-month producer price gains. Prices in the coal mining and dressing sector increased by 6.6% m/m in July, up by 1.4 percentage points from June as high temperatures supported coal demand.

- Cumulatively, the CPI and core CPI increased by 0.6% and 0.5%

y/y, respectively, in the first seven months of 2021; year-to-date

PPI inflation reached 5.7% y/y through July, up 0.6 percentage

point from the preceding month.

- Tesla has once again dropped the prices of its Model 3 electric vehicle (EV) in China to give a push to its sales in the country, reports the China Daily. The price of the Model 3 Standard Range, after subsidies, has been reduced by CNY15,000 (USD2,315) to CNY235,900. According to the report, the price of the model has been dropped for the fourth time from the initial price of CNY328,000 since its production started at the EV maker's Shanghai factory. Tesla faces strong competition from local rivals such as NIO, Xpeng, and Li Auto. Tesla has recently witnessed a slowdown in sales as it faced a backlash in China amid customers' growing concerns over the build quality of Tesla models. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Baidu has launched a new-generation autonomous minibus, named Apolong II, which will be deployed for commercial services in Guangzhou's Huangpu district. Compared to the first generation, the Apolong II has received 155 capability enhancements. Its computing power has increased threefold to 372 trillion operations per second (TOPS) and its perception system has been enhanced to include two 40-channel LiDAR sensors. It uses Baidu's vehicle-to-everything (V2X) and 5G remote driving service, complete with dual redundancy to ensure safety and reliability. Inside the cabin, an intelligent 55-inch transparent window display, jointly developed by Baidu and BOE Technology, has been installed. The Apolong II, which is a multi-purpose vehicle (MPV), is highly configurable and can be customized for public transport, mobile policing, healthcare providers and other commercial industry uses. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Korea Corporate Governance Improvement (KCGI) fund has joined the consortium that Edison Motors formed with Keystone Private Equity and two other financial investors to buy debt-laden SsangYong at an upcoming auction, reports the Yonhap News Agency. "We decided to join the consortium as we agree with Edison Motors Chairman Kang Young-kwon's vision to transform SsangYong into an electric vehicle-focused carmaker in line with changes in the automobile market," said KCGI CEO Kang Sung-boo. SsangYong executives and employees must not stage any strikes and must fully co-operate in improving production efficiency until the company turns around, according to the Edison chairman, who added Edison is the right company to revive SsangYong as it has expertise in producing electric commercial vehicles. (IHS Markit AutoIntelligence's Jamal Amir)

- South Korean car-sharing platform Green Car says it plans to deploy advanced driver-assistance systems (ADAS) in its entire fleet of cars by the end of 2022, reports The Korea Herald. Currently, about 85% of Green Car's vehicles are equipped with standard ADAS functions such as autonomous emergency braking, smart cruise control, and lane-departure warning. The company also announced plans to change its fleet of cars to electric vehicles (EVs) by 2030. (IHS Markit Automotive Mobility's Surabhi Rajpal)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-august-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-august-2021.html&text=Daily+Global+Market+Summary+-+9+August+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-august-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 9 August 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-august-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+9+August+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-august-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}