Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 09, 2021

Daily Global Market Summary - 9 July 2021

All major US and European equity indices closed higher, while APAC markets were mixed. US and most benchmark European government bonds closed lower, with the former selling off sharply. European iTraxx and CDX-NA closed tighter across IG and high yield. The US dollar and natural gas closed lower, while oil, copper, silver, and gold were higher on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher, with the DJIA +1.3%, S&P 500 +1.1%, and Nasdaq +1.0% all closing at new record highs; Russell 2000 +2.1%.

- 10yr US government bonds closed +6bps/1.36% yield and 30yr bonds +7bps/1.99% yield.

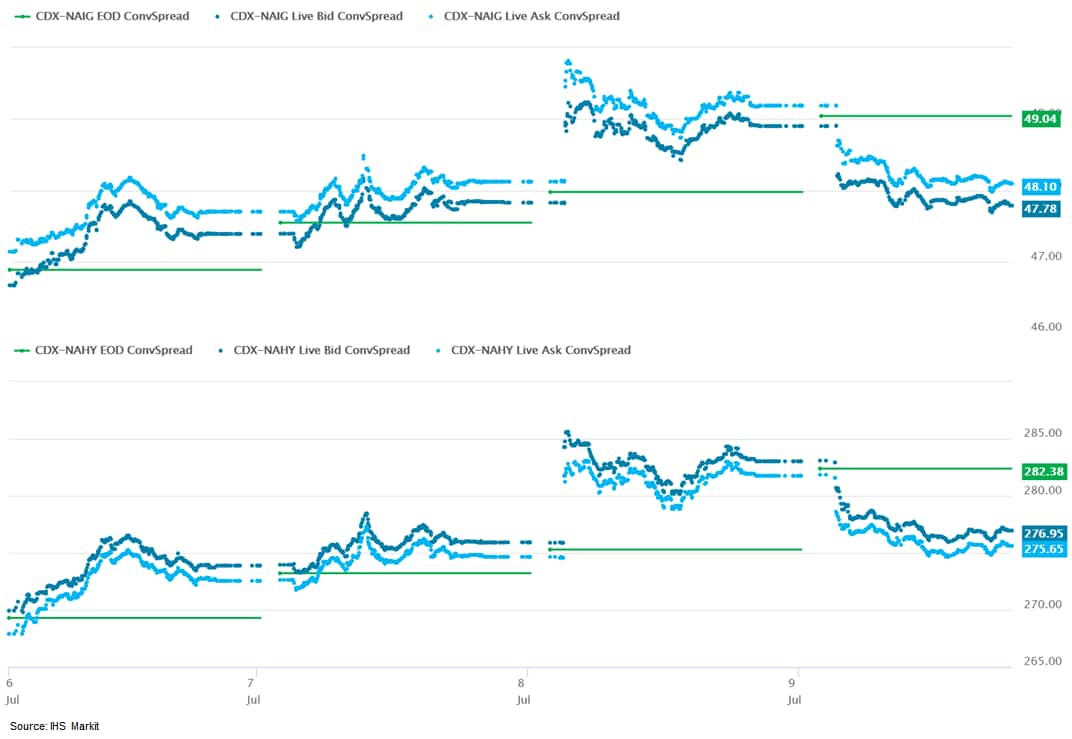

- CDX-NAIG closed -1bp/48bps and CDX-NAHY -6bps/276bps, which is

+1bp and +7bps week-over-week, respectively.

- DXY US dollar index closed -0.3%/92.13.

- Gold closed +0.6%/$1,811 per troy oz, silver +1.0%/$26.23 per troy oz, and copper +1.9%/$4.35 per pound.

- Crude oil closed +2.2%/$74.56 per barrel and natural gas closed -0.4%/$3.67 per mmbtu.

- An executive order will be signed by President Joe Biden later

today (July 9) that will provide more detail on several topics

regarding competition in several sectors including agriculture. A

fact sheet released by the White House does provide some initial

general actions/issues that will be covered in the order. (IHS

Markit Food and Agricultural Policy's Roger Bernard)

- Calls on the leading antitrust agencies, the Department of Justice (DOJ) and Federal Trade Commission (FTC), to enforce the antitrust laws vigorously and recognizes that the law allows them to challenge prior bad mergers that past Administrations did not previously challenge.

- Announces a policy that enforcement should focus in particular on labor markets, agricultural markets, healthcare markets (which includes prescription drugs, hospital consolidation, and insurance), and the tech sector.

- Establishes a White House Competition Council, led by the Director of the National Economic Council, to monitor progress on finalizing the initiatives in the Order and to coordinate the federal government's response to the rising power of large corporations in the economy.

- Directs USDA to consider issuing new rules under the Packers and Stockyards Act making it easier for farmers to bring and win claims, stopping chicken processors from exploiting and underpaying chicken farmers, and adopting anti-retaliation protections for farmers who speak out about bad practices.

- Directs USDA to consider issuing new rules defining when meat can bear "Product of USA" labels, so that consumers have accurate, transparent labels that enable them to choose products made here.

- Directs USDA to develop a plan to increase opportunities for farmers to access markets and receive a fair return, including supporting alternative food distribution systems like farmers markets and developing standards and labels so that consumers can choose to buy products that treat farmers fairly.

- Encourages the FTC to limit powerful equipment manufacturers from restricting people's ability to use independent repair shops or do DIY repairs—such as when tractor companies block farmers from repairing their own tractors, as well as ban or limit non-compete agreements and unnecessary occupational licensing restrictions that impede economic mobility.

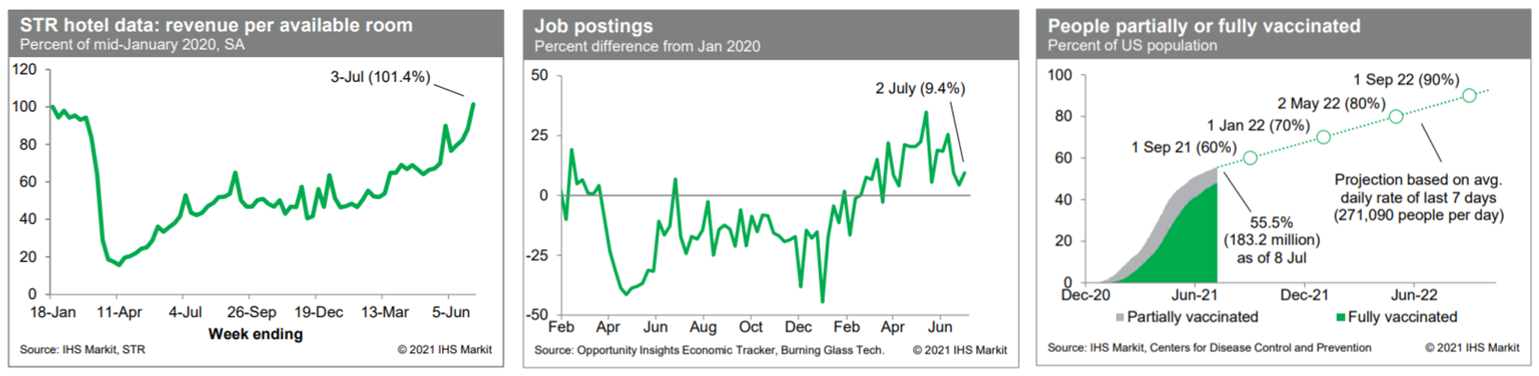

- Revenues at US hotels (seasonally adjusted) last week were

101.4% of the mid-January 2020 level, according to our estimate

based on weekly data from STR. Combined with robust readings on

airport passenger traffic from the Transportation Security

Administration (TSA) in recent weeks, this is consistent with full

recovery in the travel sector. Meanwhile, job openings last week

were 9.4% above the January 2020 level, according to the

Opportunity Insights Economic Tracker. This is close to readings

over the prior two weeks and below averages in the spring,

suggesting healthy albeit cooling labor demand. Averaged over the

last seven days, about 271,000 people per day received a first (or

only) dose of a COVID-19 vaccination, down sharply from an average

daily rate of about 430,000 per day over the prior week. The

slowdown could reflect reduced demand because of the holiday

weekend. As of yesterday, 183.2 million US residents, or about 56%

of the population, were at least partially vaccinated against

COVID-19. At the current rate, the US would achieve widespread

vaccination (70-80%) by early next year. (IHS Markit Economists Ben

Herzon and Joel

Prakken)

- Halo has launched a remotely operated electric car service using the T-Mobile 5G network in Las Vegas (United States). Halo has deployed its RemotePilot technology, which enables remote drivers to control the vehicles. A vehicle can be booked through a mobile app and will be delivered to a waiting customer by a remote operator. Once the car has been delivered, the user may get behind the wheel to operate it, and after completing the trip the remote operator takes control to drive the vehicle to the next customer in line. Halo has also developed Advanced Safe Stop technology, which allows the car to come to a complete stop if a potential safety hazard or system anomaly is detected. (IHS Markit Automotive Mobility's Surabhi Rajpal)

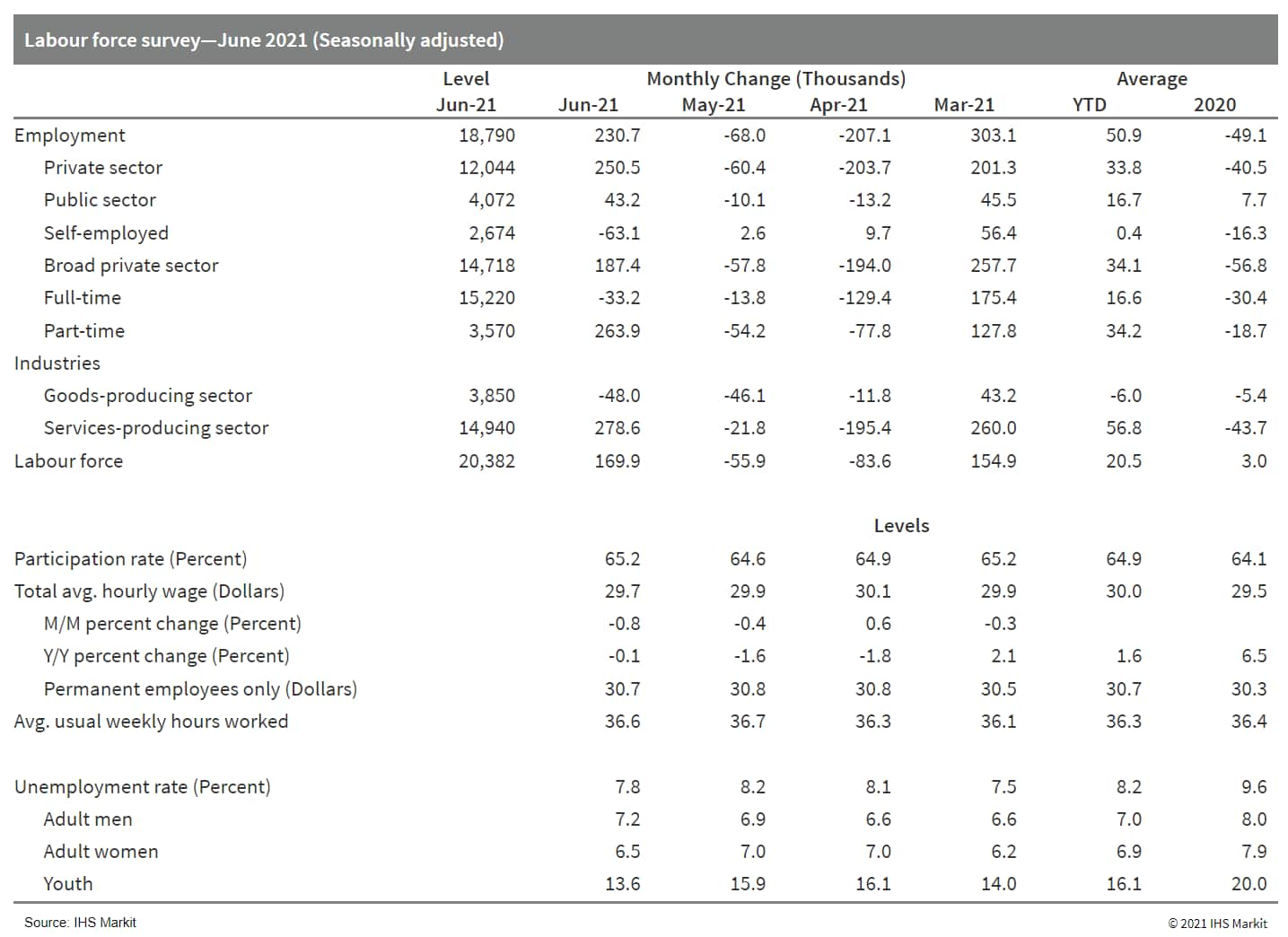

- Coming in a bit below the IHS Markit above-consensus call,

Canada's net employment advanced by 230,700 positions in June.

Part-time positions surged by 263,900, retracing most of the

previous two months of losses. Full-time positions were lowered by

33,200. (IHS Markit Economist Arlene

Kish)

- The labor force participation rate climbed to 65.2% and the unemployment rate fell 0.4 percentage point to 7.8%.

- Total average hourly wages were down 0.8% from the previous month given the boost in part-time positions.

- Total hours worked dipped 0.2% from the previous month with hefty losses in goods-producing industries, excluding manufacturing.

- If Canada can avoid a fourth wave, solid job creation is

anticipated, easing any downside risks for the Bank of Canada.

Europe/Middle East/Africa

- All major European equity indices closed higher; France +2.1%, Germany/Italy +1.7%, Spain +1.5%, and UK +1.3%.

- Most 10yr European govt bonds closed lower except for Italy flat; UK +5bps and Germany/France/Spain +2bps.

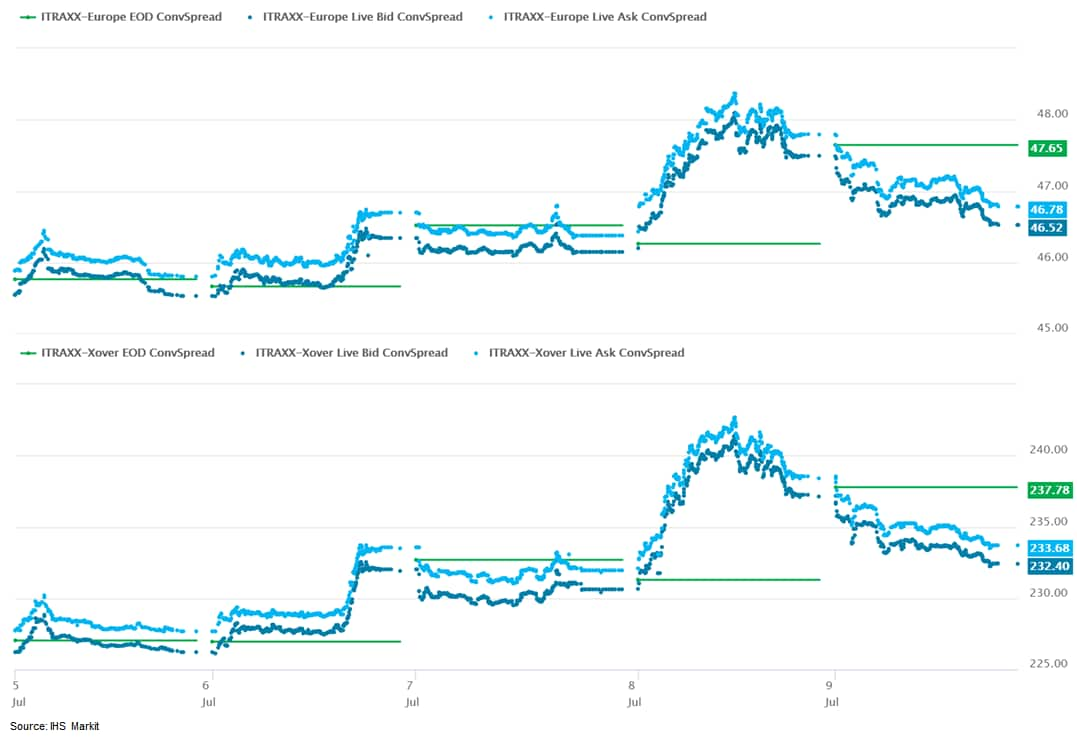

- iTraxx-Europe closed -1bp/47bps and iTraxx-Xover -5bps/233bps,

which is +1bp and +6bps week-over-week, respectively.

- Brent crude closed +1.9%/$75.55 per barrel.

- The UK's Office for National Statistics (ONS) reports that the

UK economy grew by 0.8% month on month (m/m) in May, after gains of

2.0% m/m in April and 2.4% m/m in March. GDP was still 3.1% below

the level before the first COVID-19-related lockdown in February

2020. (IHS Markit Economist Raj

Badiani)

- GDP shrank by 1.6% quarter on quarter (q/q) in the first three months of 2021.

- The figure for May this year was below the market consensus, which had predicted a 1.5% m/m gain during the month.

- A breakdown by type of output reveals that the services sector increased by 0.9% m/m in May but was still 3.4% lower than the February 2020 level

- The UK's fiscal watchdog believes the UK government can pay for the net-zero transition with less than it borrowed to recover from the COVID-19 pandemic—but only if it acts now. In total, £42 billion a year is required to decarbonize sectors like household heating, manufacturing, construction, and vehicles, according to the Climate Change Committee (CCC), which oversees the UK's compliance with emissions budgets. If it doesn't pay this amount in the next 10 years, the cost will double, according to the UK Treasury-funded arm's length body, the Office for Budget Responsibility (OBR). The watchdog forecast the net public sector debt under various net-zero-related scenarios in its 2021 Fiscal Risks Report. It said "unmitigated global warming" would cost the UK 289% of GDP by the end of the century due to the cost of dealing with and adapting to ever-hotter weather and economic shocks caused by mass migration and conflict. This would also create cyclical debt as certain economic shocks like weather events, on the rise globally since the 1980s, become more severe and frequent, leaving less time to pay back the deficit they create. (IHS Markit Climate and Sustainability News' Cristina Brooks)

- The European Central Bank's (ECB) current inflation target will

be replaced by a symmetrical target of a 2% inflation rate over the

medium term, but monetary policy is unlikely to be substantially

different as a result. (IHS Markit Economist Diego

Iscaro)

- Background: In January 2020, the ECB started undertaking the first review of its monetary policy strategy since 2003. This was initially scheduled to conclude before the end of 2020 but the timetable was delayed by the coronavirus disease 2019 (COVID-19) shock (see Eurozone: 15 October 2020: Follow the leader: Will the ECB adopt the Fed's new approach to inflation targeting?).

- The strategic review sets a new definition of what constitutes price stability. The current definition of a year-on-year increase in the Harmonised Index of Consumer Prices (HICP) "below, but close to, 2% over the medium term" will be replaced by a symmetrical target of a 2% inflation rate over the medium term.

- Under the new definition, a 2% inflation rate is not a ceiling. This means that the ECB will deem negative and positive deviations in the inflation rate as equally undesirable.

- As the ECB's press release explains, monetary policy will have to be particularly forceful on occasions, such as currently, when the economy is operating close to the lower bound on nominal interest rates. As a result, this would imply transitory periods when inflation is above the 2% target.

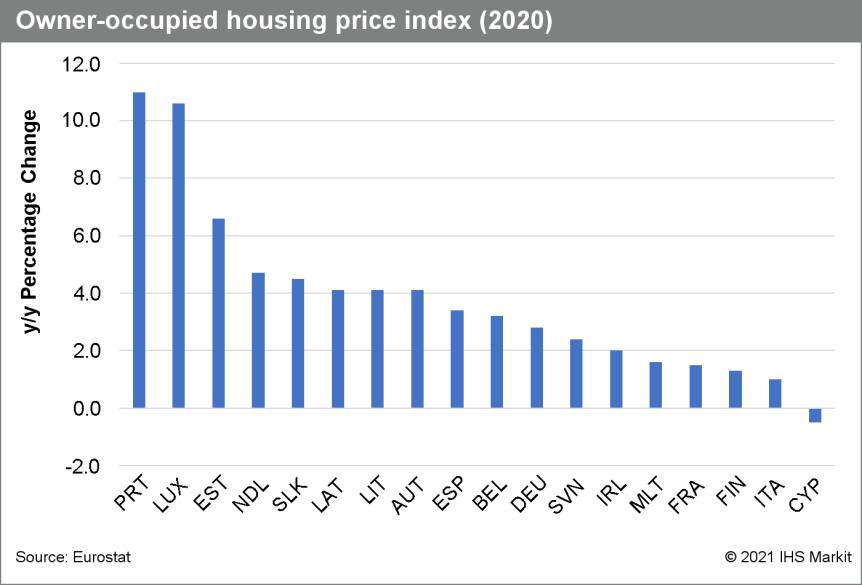

- Although the review concluded that the HICP remains the appropriate measure of price stability, it recommended the inclusion of costs related to owner-occupied housing. These costs are already included in the inflation measures in other major developed economies such as the United States, Japan, and Switzerland. The current HICP includes actual rents but not all housing costs.

- The inclusion of housing costs in the HICP is a multi-year project. In the meantime, the current HICP will continue to be used as a reference, but temporary measures of housing costs will be taken into account to conduct monetary policy.

- What has not changed: Interest rates - the rate on the main refinancing operations, the deposit facility rate, and the marginal lending rate - will remain the ECB's primary monetary policy instrument. Moreover, the Governing Council has also confirmed that other monetary policy instruments - such as forward guidance, asset purchases, and longer-term refinancing operations, which have all been increasingly important over the last decade - will continue to be an integral part of the ECB's toolkit.

- The new strategy will be in place from the next regular

monetary policy meeting of the Governing Council on 22 July. The

next assessment of the ECB's monetary policy strategy is expected

to be held in 2025.

- In the first half of 2021, the number of combined in-and

out-bound Sino-Euro trains reached 9,100, according to New Silkroad

Discovery, a local Belt and Road media outlet. Given the congestion

at sea ports and high sea freight rates, the railway route is

growing fast. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- There are five Chinese land boarder ports for the Sino-Euro railway: Alashankou, Horgos, Erlianhot, Manshouli and Suifenhe. About 40 Chinese and 90 foreign cities have connected to the route.

- China's Horgos Custom, which was expanded and restructured at the end of last year, has the largest number of trains passing, with 18 Sino-European trains passing daily in H1. At Horgos, imported goods include household appliances, raw material for textiles and foods.

- Manzhouli, connecting to Russia, is currently being expanded and goods include agriculture commodities such as fertilizers, grains and general foodstuff.

- In H1, there were 3,033 trains at Alashankou Port, with a cargo volume of 2,280,700 tons, an increase of 41% year-on-year and 56% y/o/y, a record high.

- The Erlianhot Port, connecting to Mongolia, managed 1,241 trains in and out of China and Europe in H1. Mongolia exports meat and foods to China.

- The Suifenhe Port, connecting to Russia, managed 214 trains, a 168% increase y/o/y. The key destinations are Poland, Germany and Belgium. Goods imported include grains, confectionery, alcoholic beverages etc.

- Stellantis held its first EV Day on 8 July, providing an overview of platform and battery technology plans, as well as highlighting changes for key brands. Stellantis promises its electric vehicle (EV) range will fit the needs of 80% of customers in the small-car segment, 90% of compact and mid-size car segments, and 100% of the needs of light commercial vehicle (LCV) customers and is spending EUR30 billion through 2025 on EVs and EV-related software (CEO Carlos Tavares clarified that non-EV software development will be drawn from other capex spending), which will include equity investments made in joint ventures (JVs) to fund their activities. In addition, Stellantis expects that from 2026, the total cost of EV ownership will be equal to internal combustion engine (ICE) products; a statement that includes costs from maintenance to insurances, as well as vehicle price. While some competitors are looking at only one or two BEV platforms to meet their customer needs, Stellantis's approach recognizes its broad consumer base around the world. It also anticipates the tightening emissions regulations facing the automotive industry during the next decade. For example, the European Commission is expected to set out its proposed changes to emissions targets in the next week, which are expected to be far stiffer than the current 37.5% fleet reduction in CO2 by 2030. (IHS Markit AutoIntelligence's Stephanie Brinley and Ian Fletcher)

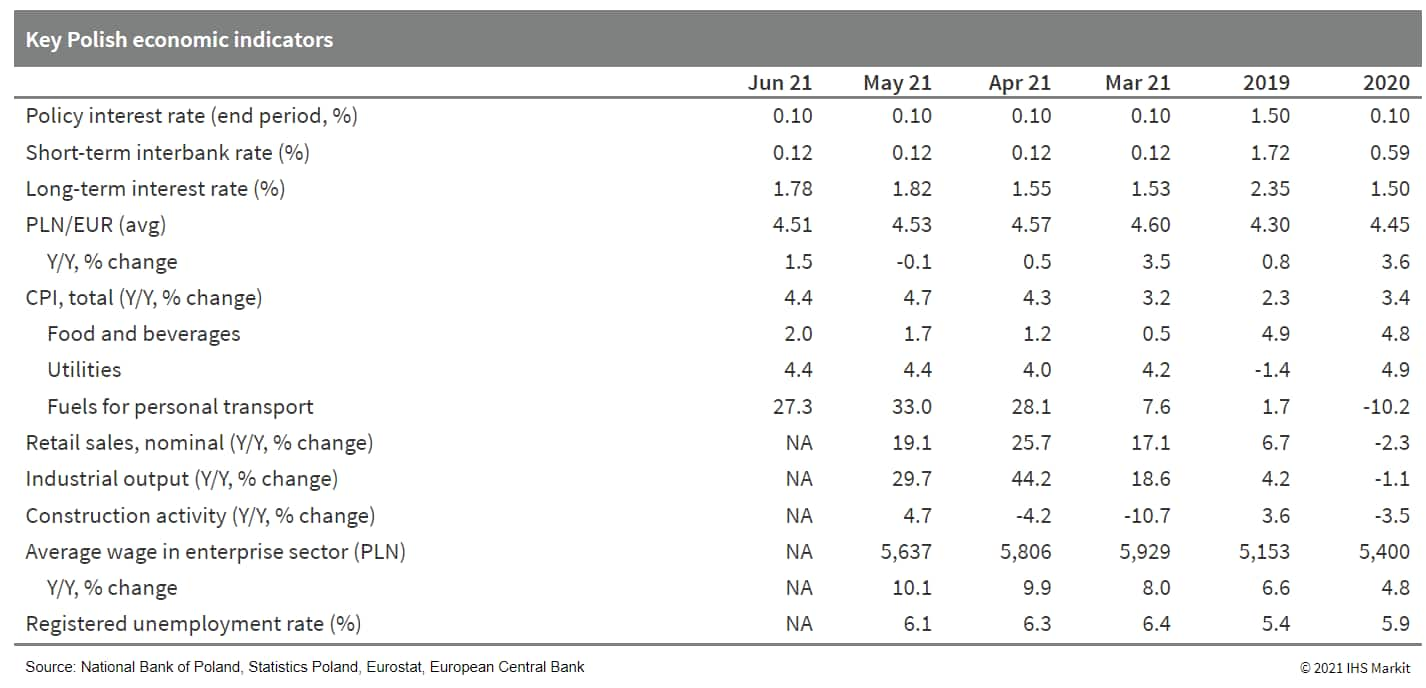

- During its session on 8 July, the National Bank of Poland's

(NBP) Monetary Policy Council (MPC) kept the base interest rate

stable at a record low of 0.1% while vowing to continue with its

unconventional monetary policy measures. (IHS Markit Economist Sharon

Fisher)

- The 'flash' estimate for June put inflation at 4.4% year on year (y/y), an improvement over the May peak but still well above the upper band of the NBP's 1.5-3.5% target. Meanwhile, core inflation (excluding food and energy prices) is estimated to have fallen to the lowest level in more than a year.

- Inflation has been boosted in recent months by higher commodity

prices and supply-chain disruptions, which the NBP believes will

keep inflation above target during the coming months. Nevertheless,

the NBP views the upswing in inflation as temporary and beyond its

control.

- Polestar is said to be moving forward with discussions over a possible merger with a special purpose acquisition company (SPAC). Sources with knowledge of the matter have told Bloomberg News that talks are taking place in relation to a merger with Gores Guggenheim that could value the combined business at around USD25 billion. The sources added that no deal has yet been reached and it is possible that talks could fall apart. Representatives for Gores Guggenheim and Polestar declined to comment. (IHS Markit AutoIntelligence's Ian Fletcher)

- FEV Turkey has developed Level 4 autonomous TRAGGER vehicles, a new generation of battery electric utility vehicles. The vehicles are designed to move freight and people in a variety of commercial and industrial environments and their production will take place at TRAGGER's facility in Bursa (Turkey). The vehicles feature seven LiDAR sensors, one radar device, and one camera and this enables it to detect a 360-degree surrounding environment. They also employ a high-resolution camera and artificial intelligence (AI)-based image-processing algorithms, which allow the vehicles to operate more safely in heavy traffic environments as they can recognize features such as lanes, pedestrians, and obstacles. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Egypt's annual headline inflation has gone up to 4.9% in June,

marginally higher than May's 4.8% and up from 4.1% in April, while

the overall rate in urban and rural areas rose more sharply to 5.7%

in June compared to 4.9% in May and 4.4% in April, according to the

official statistics agency CAPMAS. June's inflation reading is the

highest this year, with the acceleration being the fastest since it

attained 5.4% in December 2020, yet the urban figures are still

more muted than policymakers had penciled in. (IHS Markit Economist

Yasmine Ghozzi)

- Inflation continues to slow down even further month on month (m/m) with urban prices rising only 0.2% in June compared to 0.7% in May and 0.9% during April.

- As far as urban Egypt is concerned, an annual price increase of 20% took place in the education sector, whereas annual inflation in the recreation and culture segment increased by 7.1%. Similarly, the transport sector registered an annual hike in prices by 6.5%, whereas the food and beverages segment had an annual change of 3.4%.

- In rural Egypt, the annual surge in the cost of education was recorded at 44.2%, 9.4% in transport, 10% in miscellaneous goods and services, 5.6% in housing, water, electricity, and gas, and 5.5% in health. The food and beverages component in the consumer price index (CPI) registered an annual surge of 3.1% in June, with a m/m increase of 1.1%.

Asia-Pacific

- APAC equity markets closed mixed; Hong Kong +0.7%, Mainland China 0%, India -0.4%, Japan -0.6%, Australia -0.9%, and South Korea -1.1%.

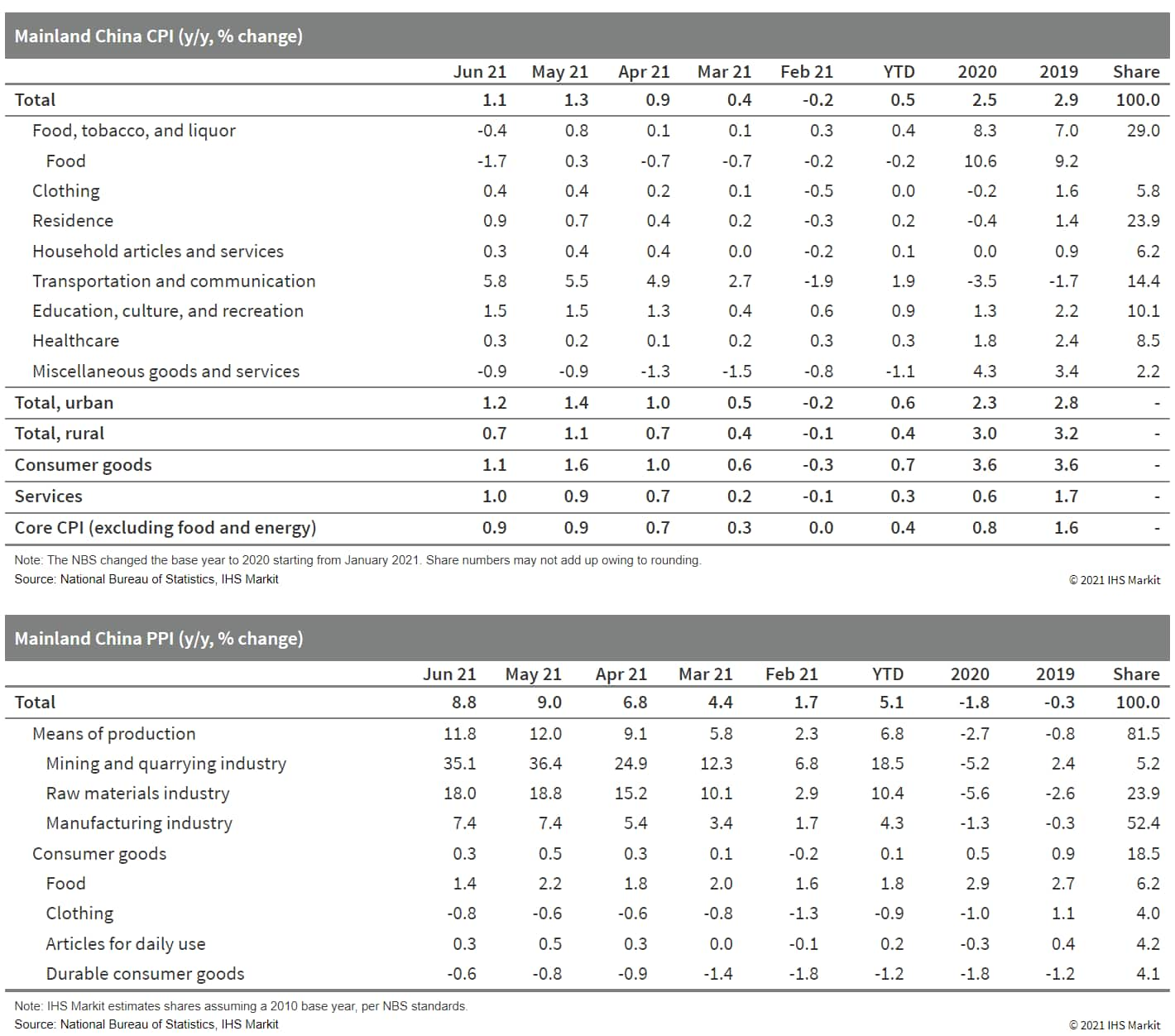

- Mainland China's Consumer Price Index (CPI) increased by 1.1%

year on year (y/y) in June, down by 0.2 percentage point from the

previous month, according to the National Bureau of Statistics

(NBS). Month-on-month (m/m) CPI deflation widened to 0.4% in June,

0.2 percentage point lower than the May reading. (IHS Markit

Economist Lei Yi)

- The weakening of consumer price inflation largely resulted from falling food prices, which declined 1.7% y/y in June. In particular, pork prices plunged by 36.5% y/y, owing to the mismatch between relatively strong supply restoration and seasonally weak consumer demand. Services prices, although recording a larger year-on-year inflation of 1.0% in June, declined 0.1% in month-on-month terms.

- With June being a relatively slack season for travel in addition to the COVID-19 Delta variant outbreak in Guangdong, prices of tourism-related services like air tickets and hotel accommodation all registered month-on-month declines. Excluding the volatile food and energy components, the core CPI rose 0.9% y/y in June, unchanged from the prior month.

- The Producer Price Index (PPI) came in at 8.8% y/y in June,

showing signs of easing as a result of government intervention

after hitting a 13-year high of 9.0% in May. Similarly,

month-on-month PPI inflation edged down to 0.3%, compared with 1.6%

m/m in May.

- China's market regulator has fined several internet companies, including Didi Chuxing (DiDi), Tencent, and Alibaba, for not seeking approval for earlier merger and acquisition deals, reports Reuters. The fines were announced by the State Administration for Market Regulation (SAMR) on its website, saying that it had charged the companies CNY500,000 (USD77,099) in each case for failing to obtain approval for a total of 22 deals. Subsidiaries of DiDi were involved in 8 of the 22 deals. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Tesla has announced plans to set up a design studio in China to develop models locally for Chinese customers, according to China Daily. In a statement, the automaker said, "We look forward to soon seeing China-designed and China-made Tesla models sold in the world". It also said that it will continue to increase its investment in the country. Tesla also announced started taking orders for a new variant of the China-made Model Y sport utility vehicle (SUV). The new addition has a driving range of 525 kilometers. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Chinese electric vehicle (EV) maker NIO has announced plans to have 4,000 battery swapping stations globally by 2025, reports Reuters news agency, citing comments from NIO's president, Qin Lihong. The automaker aims to have 700 battery swapping stations by the end of this year. Currently, NIO has built 301 NIO Power Swap stations, 204 Power Charger stations, and 382 destination charging stations in China, reports news source Gasgoo. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- A group of Taiwanese clean energy companies plan to develop "mega-scale" offshore wind projects, banding together to form "Taiwan Team." The ambitions of the joint venture (JV) led by Swancor Renewable Energy extend beyond the horizons of its native land too, with plans to win business elsewhere in Asia, which is now and is expected to remain the top region for global wind sector growth in the coming decade. The unveiling of the potential homegrown champion 5 July comes ahead of a ramping up of local procurement requirements in the third phase of Taiwan's offshore wind development program, said Shan Xue, IHS Markit principal research analyst. Taiwan's plans for offshore wind development involve a three-stage strategy. It is targeting 5.7 GW of installed capacity by 2025 during the first two stages. In May, Taiwan raised the bar for the third stage, or "Phase III" of development, by 5 GW to 15 GW. It aims to build 1.5 GW of resources per year between 2026 and 2035. The country plans to start auctioning off 3 GW for 2026-27 in 2022, and then a further 3 GW each in 2023 and 2024, for 2028-29 and 2030-31, respectively. Until now, the offshore wind sector in Taiwan has been dominated by overseas players such as Denmark's Ørsted and Copenhagen Infrastructure Partners, Germany's wpd and EnBW, Japanese utility JERA, and various affiliates of Australian financial services group Macquarie. (IHS Markit Climate and Sustainability News' Keiron Greenhalgh)

- South Korea's major battery manufacturers - LG Energy Solution, Samsung SDI, and SK Innovation - have pledged to invest KRW40.6 trillion (USD35.4 billion) in the electric vehicle (EV) battery industry over the next decade as part of a government-led initiative to position the country as the global leader in this field, reports the Maeil Business Newspaper. Under the initiative, the three battery majors will spend a combined KRW20.1 trillion on research and development (R&D) and invest KRW20.5 trillion in facilities until 2030. LG Energy Solution has announced plans to invest KRW15.1 trillion by 2030, including KRW9.7 trillion in R&D. It will build an institute in South Korea for training in battery technology, expected to be completed in January 2023. Samsung SDI is also expected to inject more than KRW9 trillion in battery R&D projects and facility investments at home by 2030. Furthermore, SK Innovation plans to invest KRW18 trillion in battery research and production facilities at home and abroad by 2025. (IHS Markit AutoIntelligence's Jamal Amir)

- Hyundai and affiliate Kia have signed a memorandum of understanding (MOU) with Next Hydrogen Corporation, a Canadian company specializing in water electrolysis technology and a subsidiary of Next Hydrogen Solutions Inc, according to a company press release. Under the MOU, the companies will jointly develop an alkaline water electrolysis system and its related stack for the purpose of generating green hydrogen economically, as well as exploring new business opportunities and technological applications. The aim is to advance stack-related technologies that are at the core of the alkaline water electrolysis system to reduce the cost of building the system and maintaining and operating it. The key benefit to be derived from the project is that, by enhancing the performance of stack-related technologies in the alkaline water electrolysis process, it will be possible to develop a new stack that can be operated at high current density and produce green hydrogen economically, according to the automaker. Hyundai and Kia will also oversee the test performance of the new stack. A pilot test is planned for next year. (IHS Markit AutoIntelligence's Jamal Amir)

- Vietnam has imposed its strictest COVID-19 containment measures

to Ho Chi Minh City, its largest city, and its surrounding

provinces from 9 to 24 July, following the biggest rise in cases

since May. According to the Ministry of Health, as of 9 July there

have been 21,560 confirmed cases nationwide, with 104 fatalities.

(IHS Markit Country Risk's

Anton Alifandi)

- Vietnam's slow vaccination progress means that further similar government containment measures are likely in the one-year outlook. The government has issued Directive 16, the strictest of its three containment levels, to Ho Chi Minh City (city-wide) and the provinces of Dong Nai (province-wide), An Giang (province-wide), and Binh Duong (four biggest cities). Under Directive 16, all events and gatherings are prohibited, all intercity transport and public transport are stopped, and people are ordered to stay at home except for essential and emergency needs such as buying groceries or medicines.

- As the government continues with its containment measures to combat COVID-19 infection, the likelihood of supply-chain disruptions in the electronics, footwear, and garment sectors is high. Until June, the northern provinces have been the worst hit, in particular Bac Giang (5,696 cases), Bac Ninh (1,646 cases), and Hanoi (490 cases), according to the Ministry of Health's figures as of 9 July. Those cases led to a number of industrial parks being shut down, including those hosting suppliers of global electronic companies such as Foxconn and Samsung.

- Ride-hailing firm Grab has announced that it will trial a new service using hybrids or electric vehicles (EVs) in central Singapore, reports The Straits Times. The service, called JustGrab Green, will use vehicles such as the Hyundai Kona Electric, Toyota Prius, and Kia Niro Hybrid, having at least an A2 Vehicular Emissions Scheme banding. Grab claims that these vehicles emit less than 125g CO2/km, a 55% reduction compared with gasoline (petrol) vehicles. The service will be initially launched in central Singapore covering the areas of Central Business District, Bukit Merah, Bukit Timah, Orchard, Bishan, Marine Parade and Geylang. The service will be expanded to all of Singapore progressively. (IHS Markit Automotive Mobility's Surabhi Rajpal)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-july-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-july-2021.html&text=Daily+Global+Market+Summary+-+9+July+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-july-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 9 July 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-july-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+9+July+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-july-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}