Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 09, 2020

Daily Global Market Summary - 9 September 2020

US and European equity markets closed higher across both regions on the heels of Tuesday's major selloff, while APAC markets were all lower on the day. European/US government bonds and the US dollar were all weaker, while iTraxx and CDX high yield closed tighter. Oil rallied to close higher and recover some of yesterday's losses and gold closed higher for a second consecutive day. COVID-19 infection rates in the US continue to decline, which could translate into an improvement in tomorrow's report on US weekly initial claims for unemployment insurance.

Americas

- US equity markets closed higher today; Nasdaq +2.7%, S&P 500 +2.0%, DJIA +1.6%, and Russell 2000 +1.5%.

- 10yr US govt bonds closed +3bps/0.71% yield and 30yr bonds +4bps/1.46% yield.

- CDX-NAIG closed -3bps/66bps and CDX-NAHY -14bps/370bps.

- DXY US dollar index closed -0.2%/93.24.

- Gold closed +0.6%/$1,955 per ounce.

- Crude oil closed +3.5%/$38.05 per barrel.

- California reported 2,676 new coronavirus cases, the lowest single-day tally since mid-June, and well below the 14-day average of 4,630. The state recorded 32 new deaths, less than the 14-day average of 107. The average rate of positive tests over the past 14 days reached 4.3%, a three-month low. The data may partly reflect delays in laboratory reporting over the long holiday weekend. (Bloomberg)

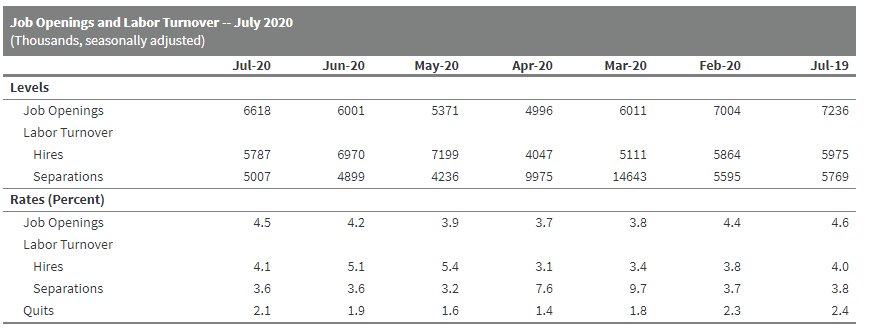

- The July JOLTS report illustrates the continued recovery in the

US labor market from the resumption of economic activity across the

country. (IHS Markit Economist Akshat Goel)

- The number of hires decreased to 5.8 million in July, moving towards the pre-pandemic steady state level. The number of job openings increased to 6.6 million in July, continuing its recovery from a low of 5.0 million in April.

- Job separations inched up to 5.0 million in July but are well below the all-time high of 10.0 million reached in April.

- The layoffs and discharges rate decreased to 1.2% in July; this is roughly equal to the two-year pre-pandemic average of the rate. The quits rate, a valuable indicator of the general health of the labor market, continued to recover and rose to 2.1%; it is still below its two-year pre-pandemic average of 2.3%.

- Over the 12 months ending in July, there was a net employment loss of 8.2 million.

- There were 2.5 workers competing for every job opening in July.

In the two years prior to the pandemic, the number of job openings

exceeded the number of unemployed in every report. This report

illustrates the continued recovery in the labor market from the

gradual resumption of economic activity across the country.

- Mall owners Simon Property Group Inc. and Brookfield Property Partners LP agreed to acquire J.C. Penney Co. out of bankruptcy for $800 million, keeping the beleaguered department-store chain alive amid the coronavirus pandemic. The landlords will own about 490 of Penney's remaining 650 stores outright, a person familiar with the matter said. They will lease 160 other stores plus distribution centers from the lenders, which will own those assets in return for forgiving some of Penney's $5 billion in debt. (WSJ)

- Huntsman says its polyurethanes segment is performing well above expectations owing to continued strength in construction-related markets, faster improvement in automotive demand, and higher overall margins. The company says third-quarter results in its other segments are still roughly in line with previous guidance. During its second-quarter earnings call on 28 July, Huntsman forecast a 30% year-over-year (YOY) decline in the segment's third-quarter adjusted EBITDA, but the company now expects a figure close to the year-ago value of $146 million. During the second quarter of 2020, the polyurethanes segment turned in adjusted EBITDA of $31 million, down 80% YOY, and revenue of $730 million, down 28% YOY, both reflecting lower average selling prices for methylene di-para-phenylene isocyanate (MDI) and lower overall polyurethanes sales volumes.

- Uber has announced a target of 2040 for 100% of its ride-hailing fleet globally to be zero-emission vehicles. By 2030, the company has set a goal of converting all its vehicles to electric vehicles (EVs) in the United States, Canada, and Europe. To achieve this, the company has earmarked USD800 million on programs to help drivers switch to EVs by 2025, including discounts for vehicles bought or leased from partner automakers. Uber has partnered with General Motors (GM) to provide special pricing and financing for Uber drivers in the US and Canada. GM will offer employee pricing for the purchase of a new 2020 Chevrolet Bolt EV, as well as offering US drivers access to 20% below manufacturer's suggested retail price (MSRP) for accessories, including at-home charging equipment. The company will also work with car rental company Avis to make EVs more accessible for drivers to rent. Uber has formed a similar partnership with Renault-Nissan to provide attractive offers on EVs to drivers in Europe, notably in the United Kingdom, France, the Netherlands, and Portugal. With this news, Uber announced the launch of the Uber Green surcharge in 15 US and Canadian cities. Uber drivers running hybrid EVs will get an extra 50 cents after every Uber Green trip is completed, while those running a battery EVs will receive an extra USD1.50. By the end of the year, Uber plans to expand Uber Green in 65 cities around the world. (IHS Markit Automotive Mobility's Surabhi Rajpal and Stephanie Brinley)

- US startup Ouster, a digital lidar sensor provider, has raised USD42 million in a Series B funding round. The round was backed by existing investors including Cox Automotive, Fontinalis Partners, and Tao Capital Partners, reports TechCrunch. The capital infusion will be used for product development and to ramp up sales globally. Angus Pacala, CEO of Ouster, said, "Ouster's digital lidar architecture gives us fundamental advantages that are winning over customers in every market we serve. Digital CMOS technology is the future of lidar and Ouster was the first to invent, build, patent, and commercialize digital lidar." Ouster, a San Francisco-based technology company that is engaged in the development of 3D sensing solutions and lidar sensors for autonomous vehicles, robotics, and drones. Lidar sensors are necessary for autonomous vehicles as they measure distance via pulses of laser light and generate 3D maps of the world around them. The company has raised USD140 million to date. In January, Ouster launched its second-generation lidar sensors, which included three new 128-beam models that offer better resolution in comparison to its previous 64-beam models. The company announced that its 12-month revenue has grown by 62%, with third quarter bookings up 209% year on year. Ouster has over 800 customers across 15 markets and has offices in Hamburg and Frankfurt in Germany, Hong Kong and Suzhou in China, and Paris in France. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Enterprise Product Partners has announced that is has cancelled the Midland-to-ECHO 4 crude oil pipeline project ("M2E4") and will use existing pipelines to support its transportation agreements. The cancellation of M2E4 will reduce Enterprise's aggregate capital expenditures in 2020, 2021 and 2022 by USD800 million. The 700 km, 30-inch, 450,000b/d project was announced in the fall of 2019 and was originally expected to be in service by mid-2021. (IHS Markit Upstream Costs and Technology's Amy Groeschel)

- The lifting of global containment measures is boosting Canada's

demand-side factors, but a growing first wave of infections in some

regions and the onset of a second wave is reducing the odds of a

sustained lift in demand. These downside factors will play into the

Bank's upcoming October Monetary Policy Report (to be released on

28 October). (IHS Markit Economist Arlene Kish)

- Domestically, low interest rates and fiscal policy measures are supporting a grand—if partial—consumer and residential sector rebound in the third quarter thanks to pent-up demand.

- Non-residential investment is soft as business confidence measures and investment have yet to take off.

- Canadian exports are gaining but remain below pre-pandemic levels.

- The Bank of Canada will keep the overnight rate at 0.25% for a while longer when the inflation rate hits 2% on a sustainable basis.

- The overnight policy rate is unchanged at 0.25%. The Bank rate of 0.50% and the deposit rate of 0.25% were also unchanged.

- Large-scale asset purchases of at least $5 billion per week continues and will remain in place if needed.

- The second-quarter plunge in economic activity was near the bank's central forecast scenario and the sharp rebound in the third quarter is coming in stronger than expected in the July Monetary Policy Report.

- Total housing starts in Canada increased 6.9% month on month

(m/m) to 262,369 units. (IHS Markit Economist Jeannine Cataldi)

- Overall urban housing starts increased 7.1% m/m, as multifamily units, hitting an all-time high, showed strong growth, at 9.1%, while single-family starts declined 1.0% m/m. Rural starts grew by 4.5% m/m.

- Ontario and British Columbia were the only provinces to report higher levels of housing starts in August m/m.

- Year-to-date housing starts are above 2019 levels in Ontario, Quebec, Saskatchewan, and New Brunswick.

- With strength in both July and August, real residential construction spending is expected to surpass year-earlier levels in the third quarter.

- Housing starts growth in Canada was led by the multifamily segment, which grew 9.1% m/m in August. Ontario saw an increase in multifamily starts of 49.3% m/m, reaching 92,006 units. British Columbia also saw growth in the multifamily segment, expanding 6.9% m/m. The largest declines were in Saskatchewan and Nova Scotia.

- Single-family starts declined by 1.0% m/m in August, after increasing 10.4% m/m in July. Starts in Quebec reversed course and fell by 12.1% m/m after growth of 9.8% m/m in the previous month. Ontario, which saw starts surge last month by 17.1% m/m, leveled off in August with a gain of just 0.7% m/m.

- Copec Voltex, a subsidiary of Copec S.A., an energy and mobility company, has announced the migration of its electric vehicle (EV) charging infrastructure to Driivz, an Israeli EV charging start-up. According to company sources, the Driivz technology will enable Copec Voltex to continue to deliver electromobility to Chile's citizens, in a multi-year deal ensuring sustainable resource management through an integrated cloud-based platform. The platform includes EV charging operations, network management, energy management, industry-specific billing, and driver self-service tools. Doron Frenkel, founder and CEO at Driivz, said, "Copec Voltex is taking a leadership role in expanding EV charging in South America." He added, "We are happy to support Copec Voltex's vision of building a more resilient and sustainable future for everyone, while enabling them to provide their customers with a reliable, advanced, easy, and convenient EV charging experience." Driivz was established in 2012 and offers a cloud-based end-to-end EV charging operating solution for operators, users, and utilities. This includes all aspects of EV deployment from charging, account management, and driver billing to onsite power management, which allows businesses to optimize output to chargers in line with site energy demand and costs. (IHS Markit AutoIntelligence's Tarun Thakur)

Europe/Middle East/Africa

- European equity markets closed higher across the region; Germany +2.1%, Italy +2.0%, France/UK +1.4%, and Spain +1.0%.

- Most 10yr European govt bonds closed lower except for Italy -2bps; UK +5bps, Germany/France +3bps, and Spain +1bp.

- iTraxx-Europe closed flat/53bps and iTraxx-Xover -16bps/312bps.

- Brent crude closed +2.5%/$40.79 per barrel.

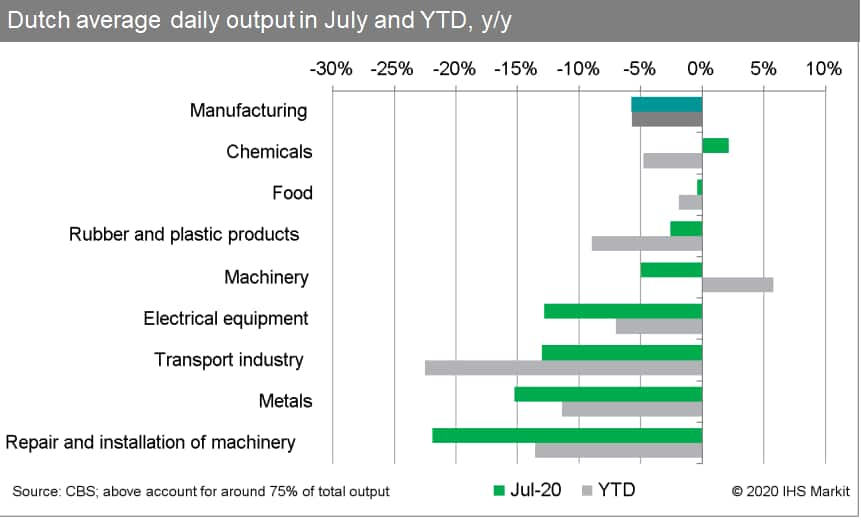

- In July 2020, on a seasonally and working-day-adjusted basis,

Dutch manufacturing output was up by 2.9% month on month (m/m), an

acceleration from an increase of 2.6% m/m in June. On an annual

basis, output was down by 5.7% year on year (y/y) and by 5.9%

compared with February, prior to the impact of the COVID-19-virus

pandemic. (IHS Markit Economist Daniel Kral)

- On a seasonally unadjusted basis, in July average daily output of the Dutch manufacturing sector was down by 5.8% y/y. On a three-month moving average basis, output was down by 9.2% y/y - an improvement from 10.9% in June.

- In July, most major sub-components were a drag in annual terms. The biggest drops were recorded in repair and installation of machinery, which was down by 21.9% y/y; metals, down by 15.2% y/y; and transport, down by 13.0% y/y.

- At 52.3 in August, the Dutch manufacturing purchasing managers' index has improved significantly since the May low of 40.5. The output sub-index jumped to 54.7, indicating a continued strong rebound in output in the short term.

- The latest output and survey data reinforce our baseline of a

strong, but partial, bounce back in the third quarter after a

record contraction in the previous quarter. The manufacturing

sector benefits from the reopening of economies mid-year and a

recovery in international trade.

- State Secretariat for Economic Affairs (SECO) data reveal that

Switzerland's seasonally adjusted unemployment increased by just

638 people, or 0.4% month on month (m/m), to 156,152 in August (see

table below). This follows a level of 155,514 in July, revised up

by about 500. While these numbers signal the beginning of a

stabilization, they remain above the previous cycle's peak near

150,000 (mid-2016) and are around 50% above the low point of around

103,000 seen in mid-2019. (IHS Markit Economist Timo Klein)

- The seasonally adjusted unemployment rate, which had hovered at 17-year lows of 2.3% in 2019, remained at 3.4%. Upward momentum has slowed down as expected, enabled by the easing of administrative restrictions since May. The cyclical high of 4.1% seen in 2009 due to the global financial crisis (GFC) appears unlikely to be reached this time, although some upward potential remains in the pipeline owing to an expected increase in company insolvencies in late 2020 and early 2021 once fiscal support measures are scaled back. Note that the Swiss unemployment rate is measured against a fixed labor force figure used as the denominator, which is currently at 4,636,100 (2015-17 average; used for rates since January 2017).

- Among other labor market indicators, seasonally adjusted job vacancies are recovering now. They increased by 4.5% m/m to 31,345 in August, with July's level additionally being revised up modestly. Owing to a base effect, the year-on-year (y/y) decline decreased slightly from -8% in July to -9% in August, however.

- The number of short-time workers - lagging by two months and unadjusted for seasonal variations - was down sharply in June. Having reached an all-time high of 1,077,000 in April and declined to 891,000 in May, the level plunged by 45.2% to 488,312 in June. This compares with a mere 4,000 in February. The number of lost working hours plummeted even more strongly in June. Following April's peak of 90.2 million hours and 57.9 million hours in May, the level dropped by another 51% to 28.4 million hours. Nevertheless, this is still six times larger than the maximum reached during the GFC in 2009, reflecting the huge impact that the COVID-19 virus pandemic has had on the service sector this time.

- Germany's Agriculture Ministry says it has found a suspected case of African Swine Fever (ASF) in wild boar carcasses - a development with major implications for the global pigmeat industry. The possible infection was found in the state of Brandenberg, a few kilometers from the border with Poland, where ASF has been present since 2014. Further tests are being conducted and German Agriculture Minister Julia Kloeckner will provide more information as it becomes available on Thursday, according to a ministry statement. If confirmed, this would be Germany's first case of ASF - a disease which has already hit ten other EU member states, while also causing huge losses in Asia and Africa. Based on past experience, an outbreak would lead several major markets to close their doors to German pork. Several Asian countries, including China, Japan and South Korea, normally opt to block imports from entire countries affected by ASF rather than just the affected regions. Once the disease is pinned down to a specific area however, Germany would still be free to export to many other parts of the world, which recognize EU regionalization arrangements. Germany has been ramping up defenses against ASF since the disease spread to western Poland in March 2020. Poland has already reported 82 cases of ASF on pig farms this year and more than 3,000 in wild boar. Although the majority of affected properties are small farms with only a handful of animals, one recent case was on a property with almost 6,500 pigs. (IHS Markit Food and Agricultural Commodities' Max Green)

- Tesla plans to use giant aluminum casting machines to build the Model Y in Germany, reports Reuters, citing a Twitter post by CEO Elon Musk in August. According to the report, Musk stated that the company intends to replace 70 components glued and riveted into the electric vehicle (EV)'s rear underbody with a single module made using an aluminum casting machine. In addition, Reuters reports unnamed sources as saying that Tesla's next target is to use the machine to address the vehicle's front module and other parts. On Twitter, Musk posted, "Will be amazing to see it in operation! Biggest casting machine ever made. Will make rear body in single piece, including crash rails." Additionally, a blog that focuses on Tesla has reported that the company's Gigafactory under construction in Berlin-Brandenburg, Germany, is to receive eight large aluminum casting machines, which are being called "Gigapress" machines. According to Reuters, the Gigapress machines will be supplied by Italian company IDRA and the machines are the size of a small house. However, reportedly, the supplier declined to comment on the matter. Tesla's manufacturing efforts have long been aimed at simplifying production, and the use of aluminum castings potentially will reduce the need to connect components, while getting around some of the difficulties of aluminum stampings. Although Musk referred to the machine on Twitter, Tesla has not confirmed when the new casting machines will be installed. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Aeva, a start-up that develops sensing and perceptions paradigms for autonomous vehicles (AVs), has partnered with German automotive industry supplier ZF Friedrichshafen to put the sensors into production. Aeva provides a unique lidar solution by employing frequency modulated continuous wave (FMCW) technology that can measure distance as well as instant velocity without losing range. Under this partnership, Aeva will develop core sensing functionality, performance, and algorithms of FMCW lidar and ZF will produce an "automotive grade" sensor that meets the carmaker's requirements. Soroush Salehian, co-founder of Aeva, said, "From early on we have believed in building an ecosystem of the world's most capable partners across the industry and this partnership is one part of that plan. ZF's capability as one of the largest Tier-1s globally with expertise in automotive scale production of sensing systems is a key step to accelerating the introduction of safe and scalable autonomous vehicles." ZF is increasingly positioning itself as a supplier of complete systems for AV functions and is collaborating with other players to expand its presence in the market. This year, ZF partnered with TuSimple to co-develop sensors required for autonomous trucks' operation, such as cameras, radar, lidar, and a central. ZF has confirmed plans for a Level 4 automation system for commercial vehicle applications, which it expects to introduce in 2024 or 2025. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- After some brief respite in July, the Danish passenger car

market declined again during August. According to the latest data

published by the Danish Car Importers' Association (De Danske

Bilimportører), registrations declined by 5.8% year on year (y/y)

to 17,608 units last month. (IHS Markit AutoIntelligence's Ian

Fletcher)

- Looking at the August results by segment, there were mixed performances. Traditional types of passenger cars - hatchbacks, sedans, and station wagons (estates) - mainly recorded steep declines.

- The smallest A segment posted a drop of 26.2% y/y to 1,497 units, while the compact C and mid-size D segments recorded falls of 35.1% y/y to 2,212 units and 35.6% y/y to 1,327 units, respectively.

- The sub-compact B segment improved by 14.8% y/y to 4,815 units, while the standalone sport utility vehicle (SUV) category witnessed a jump of 19.6% y/y to 6,918 units.

- When the SUV category is broken down by segment, we can see that it was the sub-compact B segment that lifted sales in this category, leaping 94.3% y/y to 4,011 units during the month.

- The August decline means that registrations in the year to date (YTD) are now down by 20.7% y/y at 124,974 units, compounded by the COVID-19 virus-related declines earlier in the year.

- Data for light commercial vehicle (LCV) registrations show a decline of 10.8% y/y in August to 2,723 units, while YTD sales stand at 18,704 units, down 15.4% y/y.

- Danish registrations of medium and heavy commercial vehicles (MHCVs) contracted by 14.8% y/y to 299 units in August and are now down by 31.5% y/y at 2,442 units in the YTD.

- Statistics Sweden (SCB) reports that Sweden's private-sector

production grew by 3.2% month on month (m/m) in July, after growth

of 1.6% m/m in both May and June. On an annual basis, production

was down by 4.1% year on year (y/y) in July, a significant

improvement compared with June (-8.5% y/y). (IHS Markit Economist

Daniel Kral)

- On a monthly basis, the main driver of growth in July was services, up by 4.5% m/m, followed by industry, up by 3.4% m/m. Construction declined for the second consecutive month, by 0.8% m/m in July, although its performance was largely unaffected by the COVID-19-virus pandemic since March.

- On an annual basis, the main drag in July came from industry, down by 6.5% y/y, albeit an improvement from -9.1% in June, and services, down by 3.5% y/y, albeit an improvement from -8.3% y/y in June. The decline in construction was relatively mild, at just 1.2% y/y.

- On a cumulative basis, private-sector production in July was down by 5.2% compared with January. Industry was down by 7.3%, services down by 5.2%, while construction was up by 6.8%.

- Leading confidence indicators suggest that the recovery continued in August. The strong performance and positive leading indicators present an upside risk to our baseline of a partial rebound of around 2.5% quarter on quarter (q/q) in the third quarter of 2020, after a record drop of 8.3% q/q in the second quarter. For the full year, we expect the Swedish economy to contract by less than 5%, among the best in Europe.

- Norwegian passenger car registrations slipped back during August, according to the latest data published by the country's Road Traffic Information Council (Opplysningsrådet for Veitrafikken: OFV). Registrations in this market fell by 10.5% y/y to 10,802 units last month. The leading brand during the month was Volkswagen (VW) with 1,112 units, although its registrations plummeted 51.3% y/y. By contrast, Audi in second place posted an increase of 24.2% y/y to 861 units, while Mercedes in third saw its sales leap 242.3% y/y to 849 units. Elsewhere in the market, registrations of light commercial vehicles (LCVs) of up to 3.5 tonnes fell 36.4% y/y to 3,015 units during August, meaning that their year-to-date (YTD) total is now down 26.5% y/y at 19,805 units. At the same time, medium and heavy commercial vehicle (MHCV) registrations plummeted by 40.5% y/y to 446 units in August, resulting in their YTD registrations falling by 18.5% y/y to 4,177 units. (IHS Markit AutoIntelligence's Ian Fletcher)

- At its September meeting, the National Bank of Kazakhstan (NBK)

decided to keep its base interest rate unchanged at 9.0%, while

keeping the interest-rate corridor at +/-1.5 percentage points.

This decision followed a 50-basis-point cut in July, when the

spread between interest rates for standing facilities for liquidity

provision and liquidity withdrawal for banks was also narrowed by

50 basis points on either side. (IHS Markit Economist Venla Sipilä)

- The board of the NBK identified inflation risks due to high and weakly anchored inflation expectations, increased volatility in financial markets caused by a rising risk of international sanctions against Russia, an increased likelihood of a slower recovery in oil demand than previously expected, and a greater risk of additional economic stimulus in the form of fiscal and quasi-fiscal stimulus. On the other hand, weakening economic activity, in particular lackluster consumer demand, and an expected fall in global food prices will have a disinflationary impact.

- According to the board, stable rates balance these opposing inflation risks, paving the way for a gradual deceleration of inflation in the medium term. The latest inflation data from the State Statistics Agency show consumer price inflation in July edging down marginally to 7.0% year on year (y/y), from 7.1% y/y in June. Food-price growth made the greatest contribution to price growth, while the reintroduction of quarantine measures in response to the COVID-19 virus pandemic suppressed non-food inflation.

- The NBK has lowered its GDP forecast for this year, now expecting a contraction of 2.0-2.3% in 2020 instead of 1.8%. It expects a recovery to growth of 3.5-3.8% in 2021. The reintroduction of COVID-19 virus-related lockdown measures in July-August suppresses the outlook for consumer activity, while the contraction in fixed capital investment appears to be steeper than previously envisaged.

- The Dubai Electricity and Water Authority (DEWA) has announced the facilitation of electric-vehicle (EV) charging via smart app in Dubai, reports Gulf News. Users can now charge their electric vehicles by scanning a QR code, which will be placed at 240 charging stations across Dubai. According to the source, EV Green Charger customers will still be able to use the conventional Green Charger cards at DEWA charging stations. DEWA had launched the EV Green Charger initiative in 2015 in order to encourage electric vehicle adoption within Dubai and support sustainable transportation. DEWA has currently installed over 240 EV Green Charging stations all over Dubai. (IHS Markit AutoIntelligence's Tarun Thakur)

- South Africa's real GDP contracted by 16.1% quarter on quarter

(q/q) on a seasonally adjusted annualized basis or 51% q/q on an

annualized basis during the second quarter, latest official

statistics compiled by Statistics South Africa (StatsSA) show. (IHS

Markit Economist Thea Fourie)

- The steep decline lowered the year-on-year (y/y) growth rate to a contraction of 17.1%, on a seasonally adjusted annualized basis, during the second quarter.

- This left headline real, seasonally adjusted annualized GDP down by 8.7% y/y during the first half of 2020.

- South Africa's y/y percentage fall in GDP during the second quarter ranked among the highest recorded in the world, but was still less severe than the GDP falls of 21.7% y/y in the United Kingdom, 22.1% y/y in Spain, and 23.9% y/y in India.

- The agriculture, forestry, and fishing sector was the only sector making a positive contribution, of 0.3 percentage point, to the q/q (annualized) growth during the second quarter. All other sectors of the economy showed a sharp fall in output, with the steepest declines recorded in manufacturing (minus 10.8-percentage-point contribution); trade, catering, and accommodation (minus 10.5-percentage-point contribution); and transport, storage, and communication (minus 6.6-percentage-point contribution).

- Demand-side GDP shows that household consumer spending took a severe hit during the second quarter, falling by 49.8% q/q (annualized).

- Fixed invested slowed by 59.9% q/q (annualized) and exports of goods and services were down 72.9% q/q (annualized).

- Imports of goods and services slowed by 54.2% q/q (annualized), while government consumption expenditure dropped by 0.9% q/q (annualized) over the period.

- The 51% q/q (annualized) fall in South Africa's real seasonally adjusted GDP is well below the expectations of IHS Markit (38.8% q/q annualized) and overall market expectations (45% q/q annualized). The lower growth figure for the second quarter is likely to mean an overall contraction in GDP of 10.2% in 2020, down from IHS Markit's initial forecast of a 9.8% contraction this year.

- Angola is currently engaged in confidential sovereign debt negotiations with China, in an attempt to reduce debt service obligations amid a deepening economic crisis caused by the COVID-19-virus pandemic and the related impacts on energy demand and prices. Angola's public debt is expected to stand at the equivalent of 123% of GDP at end-2020, and without new agreements with lenders, Angola's 2020 external debt service would be around USD5-7 billion. Roughly USD22 billion of Angola's total USD49 billion in external debt is owed to China. Of this, Angola owes USD14.6 billion to the China Development Bank (CDB), mostly in the form of oil-backed loans, along with USD4.7 billion owed directly to the Chinese government and USD2.4 billion to the Bank of China. Along with China potentially agreeing a pause on Angola's loan repayments, some sources have suggested that debt-for-equity swaps could also be employed. Although this approach could in theory give Chinese entities partial ownership of national oil company (NOC) Sonangol and other state-owned firms, it is more likely that Sonangol would instead cede some equity in upstream oil projects to Chinese NOCs. For Angola, reaching a debt restructuring agreement with China is vital to both easing liquidity pressures and unlocking a potentially increased Extended Fund Facility (EFF) from the International Monetary Fund (IMF). Angola has requested an increase in the EFF from USD3.7 billion to USD4.5 billion, and the IMF now appears likely to assent after Angola agreed a debt repayment standstill under the G20's Debt Service Suspension Initiative (DSSI) in early September. Some Chinese loans are covered by that agreement, and IHS Markit sources suggest that Angola has tentatively reached an additional bilateral agreement with China for a standstill on other loans, probably those issued by the CDB. (IHS Markit E&P Terms and Above-Ground Risk's Roderick Bruce)

Asia-Pacific

- APAC equity markets closed lower across the region; Australia -2.2%, Mainland China -1.9%, South Korea -1.1%, Japan -1.0%, Hong Kong -0.6%, and India -0.5%.

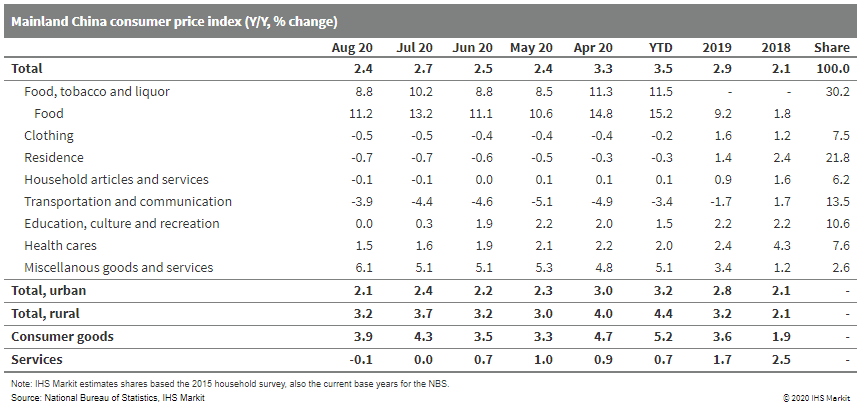

- Mainland China's consumer price index (CPI) registered at 2.4%

year on year in August, down by 0.3 percentage points from July,

according to the data released by the National Bureau of

Statistics. Month-on-month CPI came out at 0.4%, staying in the

positive territory though slightly lower compared with July's

reading of 0.6%. (IHS Markit Economist Lei Yi)

- By component, slowing food price inflation was the main driver for headline CPI to edge down in August, as supply shortages ease with receding summer floods, and the high-base effect driving down pork price growth. Price inflation of non-food components remains weak, with only transportation and communication slightly narrowing its price deflation. Notably, services price weakened into deflation territory in August, recording year-on-year decline of 0.1%. Core CPI excluding food and crude oil stayed unchanged from July, reporting growth of 0.5% year on year.

- Producer price index (PPI) deflation stood at 2.0% year on year in August, improving further from 2.4% year on year in July thanks to the sustained demand recovery. Month-on-month PPI inflation fell by 0.1 percentage points to 0.3%; and 17 out of 40 surveyed industrial sectors reported month-on-month price gain, compared with 21 in July.

- The recovery in global commodity prices continued to support domestic industrial output price. Prices in oil-related sectors as well as ferrous metals and non-ferrous metals smelting and pressing continued to pick up month on month, though at a slower pace in industries including petroleum and natural gas exploration and fuel processing. The output price inflation of consumer goods manufacturing slowed down slightly year on year due to the decline in food manufacturing PPI inflation; while year on year price deflation for daily use and durable consumer goods both narrowed in August.

- Cumulatively, CPI rose by 3.5% year on year through August, down from the 3.7% year on year growth in the first seven months; PPI deflated by 2.0% through August, same as in the first seven months.

- While sustained economy recovery could underpin CPI inflation,

falling food price thanks to supply restoration, together with weak

services demand weighed by infection fears, could prevail towards

the year end and put downward pressure on CPI

inflation—especially as monetary policy would mostly likely

stay measured. IHS Markit now forecasts 2020 CPI inflation to reach

3.0% year on year.

- The South China Morning Post reported on 9 September that the China Banking and Insurance Regulatory Commission (CBIRC) is organizing a three-day training program for about 500 banking officials from Chinese banks, including the largest four banks, with an aim to raise awareness regarding credit risk detection and management. The officials will also learn about data management to drive the digital transformation of banks. Banking regulators CBIRC and People's Bank of China have made it clear that asset quality will deteriorate because of the COVID-19-virus outbreak and the associated economic headwinds. They are also aware that smaller banks will have to face worsening asset quality with more lending to micro, small, and medium-sized enterprises (MSMEs). (IHS Markit Banking Risk's Angus Lam)

- Electric vehicle (EV) manufacturer Tesla delivered 11,811 units of the Model 3 in China during August, up 7% month on month (m/m), according to data from the China Passenger Car Association (CPCA). In the sales rankings, the SAIC-General Motors (GM)-Wuling (SGMW) joint venture claimed the top position in China's new energy vehicle (NEV) market with 18,300 vehicles sold during August. SGMW was followed in the rankings by BYD with NEV sales of 14,300 units and then Tesla. Tesla delivered more Model 3 vehicles in China in August than in July. Since production of the Model 3 began in China at the beginning of 2020, orders for the standard-range Model 3 have been growing steadily, especially in first-tier cities, such as Shanghai and Beijing. However, SGMW's Hongguang MINI, a mini EV, outsold the Model 3 in August. The Hongguang MINI EV had a retail sales volume of 15,000 units last month, the model's second month on the market. The two models, however, are targeting different groups of EV buyers. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Changan Auto has reported total sales volumes of 169,415 units

in August, up 35.6% year on year (y/y). (IHS Markit

AutoIntelligence's Abby Chun Tu)

- Of the total, the Chinese automaker's Changan Ford joint venture (JV) posted an increase in sales of 37.0% y/y to 20,229 units in August, while the Changan Mazda JV's sales rose 11.5% y/y to 11,475 units.

- Sales of Chongqing Changan and Hefei Changan, Changan's passenger car subsidiaries, stood at 65,749 units and 7,547 units in August, up 45.1% y/y and 29.6% y/y, respectively.

- In the year to date (January to August), Changan's sales have increased 9.5% y/y to 1,165 million units.

- Changan Auto's two JVs are making increasing contributions to the group's sales as both JVs are beginning to gain volumes thanks to the arrival of new models.

- The recovery of Changan Ford's sales continued during August. The rebound was in part due to a low sales base from August last year, while Ford's new models, including the Ford Escape and Lincoln Corsair, are helping to strengthen the automaker's sales in the sport utility vehicle (SUV) market.

- The Beijing-based dairy company Sanyuan achieved a revenue of CNY3.404 billion (USD486 million), down 34% compared with the same period of last year, net profits declined by 155%. The company stated that Covid-19 severely impacted its subsidiary Islay Faxi, Milk Delivery Division, milk for students, catering and other businesses. The implementation of the new revenue calculation standard this year has brought a decline of 7.3% in its overall operating income. In H1, Chinese national liquid milk sales decreased. Sanyuan reported that its liquid milk sales also declined, but it still performed better than the industry average. Its core Beijing region enjoyed growth and managed market share gains. Sanyuan's liquid milk sales reached CNY2.0 billion in H1, solid milk (dairy products such as cheese) CNY314 million, ice cream CNY631 million. Geographically, Beijing contributed CNY1.8 billion; outside Beijing CNY1.6 billion. The company launched a new product, 72℃ Pasteurized Milk. It became the China National Mountaineering Team's 'Nutritional Dairy Supplier'. Sanyuan is planning to boost its stake in its subsidiary Islay Faxi. It would own 95% of the company if the deal proceeds. Unlike Yili and Mengniu, Sanyuan lacks nationally strong brands. Although it has acquired some regional companies, its lack of national scale still makes it incomparable to Yili and Mengniu. Sanyuan owns 50% stakes of Beijing McDonald Co Ltd and 25% in Guangdong, which made a loss of CNY1.08 million in H1 as an investment income. In 2019, McDonald contributed CNY234 million. The company carries massive long-term debt, reaching CNY3.088 billion for some acquisitions such as the French Brassica Holdings in 2018. Its debt ratio is 57.27% compared to 33.84% in 2017. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- Mahindra Electric, the electric vehicle (EV) division of Mahindra & Mahindra (M&M), has announced in a press release that the MESMA 48 light electric vehicle (EV) platform is available for global players. The Mahindra Electric Scalable Modular Architecture (MESMA) 48 is highly scalable in terms of performance and range, offering voltage systems ranging from 44V to 96V, and it has been used on more than 11,000 EVs on Indian roads, including three-wheelers, quadricycles, and compact cars. Mahesh Babu, managing director and CEO of Mahindra Electric Mobility, India, said, "Our goal with EVs is to revolutionize first and last mile transportation globally and take e-mobility to the masses. World EV Day is a great forum for us to discuss the next big ideas for the global markets and we take this opportunity to launch our MESMA 48 platform globally." Mahindra Electric has detailed the key features of MESMA 48, which include better acceleration than internal combustion engine (ICE) counterparts; a top speed of up to 80 km/h, making it suitable for passenger as well as load-carrying segments; and compatibility with both rigid and flexible axle systems, making it suitable for L5, L6, and L7 categories. As per requirements, components are available in both liquid and air-cooled configurations, while the drivetrain, with power ranging from 6 to 40 kW and subsequent torque ranging from 40 to 120 Nm, can be made available with three varying transmission ratios to suit the performance requirements. Cost effectiveness is achieved by use of an integrated drivetrain solution for higher power density, and by use of robust, temperature-tolerant lithium iron phosphate (LFP) cells and high-energy-density nickel manganese cobalt oxide (NMC) cells that can match the performance, range, price, and environment requirements of a wide set of customers. (IHS Markit AutoIntelligence's Isha Sharma)

- Ride-hailing firm Grab is in advanced talks with potential investors to secure USD300-500 million in funding for its financial services unit. Grab is likely to reach agreements with insurance companies Prudential PLC, AIA Group, and others as early as October, reports Reuters. According to the report, the insurance companies are expected to provide half of the target over several fundraising rounds. This year, Grab laid off 360 employees, representing 5% of its total workforce, owing to the pandemic (see Singapore: 16 June 2020: Ride-hailing company Grab to lay off 5% of employees). Since the start of the pandemic, Grab added food delivery and insurance services to its platform. This investment will allow Prudential and AIA to market their products by exploring Grab's technology and data. Grab is focusing on expanding its range of services, from transport to food delivery and payments, and making aggressive efforts to expand. Recently, the company raised USD200 million in funding from South Korean private equity firm STIC Investments. (IHS Markit Automotive Mobility's Surabhi Rajpal)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-september-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-september-2020.html&text=Daily+Global+Market+Summary+-+9+September+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-september-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 9 September 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-september-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+9+September+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-september-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}