Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 10, 2020

Daily Global Market Summary - November 10, 2020

European equity markets closed higher, while APAC and the US markets were mixed. US and benchmark European government bonds closed modestly lower on the day. iTraxx and CDX credit indices were close to unchanged across IG and high yield today after yesterday's significant rally. The US dollar was unchanged on the day, while oil, gold, and silver all closed higher.

Americas

- US equity markets closed mixed; Russell 2000 +1.9%, DJIA +0.9%, S&P 500 -0.1%, and Nasdaq -1.4%.

- 10yr US govt bonds closed +2bps/0.96% yield and 30yr bonds +3bps/1.75% yield.

- CDX-NAIG closed +1bp/53bps and CDX-NAHY -4bps/332bps.

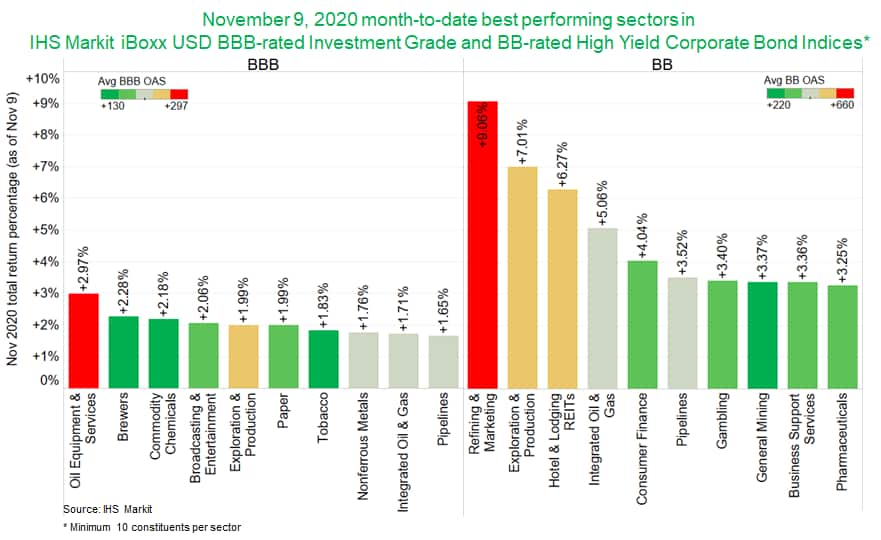

- The energy debt sector is outperforming across USD BBB and BB

rated corporate bond constituents in the IHS Markit iBoxx

Investment Grade and High Yield Corporate Bond Indices. The below

shows the top 10 performing sectors (MTD) as of Nov 9th.

- DXY US dollar index closed flat/92.72.

- Gold closed +1.2%/$1,876 per ounce and silver +3.2%/$24.46 per ounce.

- Crude oil closed +2.7%/$41.36 per barrel.

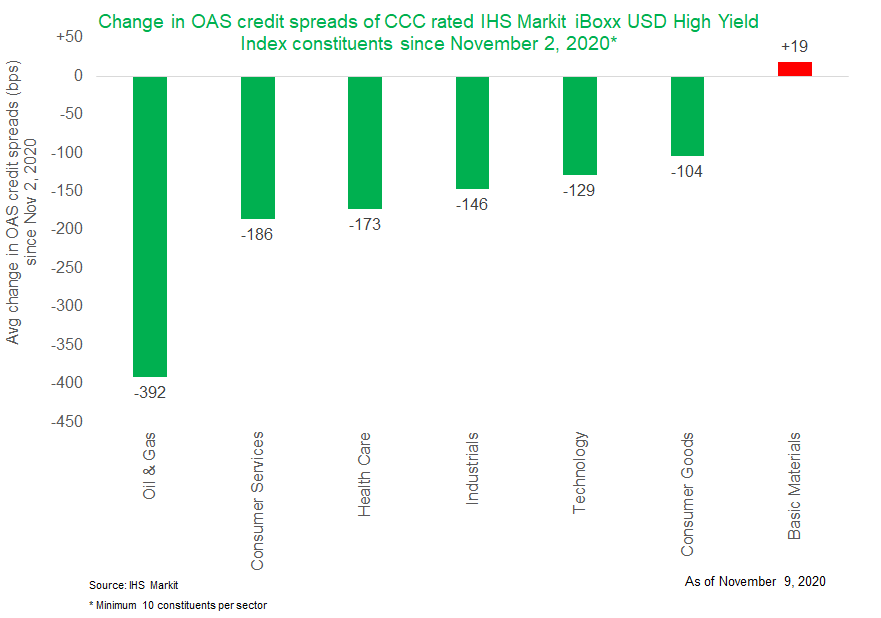

- The below chart shows the average change in OAS credit spreads

of CCC rated IHS Markit iBoxx USD High Yield Index constituents

since November 2, 2020. The oil & gas sector tightened in the

most at -392bps and basic materials is the only sector that is

actually wider at +18bps.

- In a press release, Occidental Petroleum Corporation reported third-quarter 2020 net loss of $3,778 million, compared with a net loss of $912 million in the year-ago quarter, and a net loss of $8,353 million in the prior quarter. Third-quarter 2020 adjusted loss of $783 million, compared with an adjusted income of $93 million in the year-ago quarter. The third quarter results included a write-down of approximately $2.4 billion related to its equity investment in Western Midstream Partners, LP and $700 million of losses associated with the announced divestitures of onshore Colombia and mineral and surface acreage in Wyoming, Colorado and Utah. Oil and gas segment adjusted loss was $339 million, compared with an adjusted income of $518 million a year ago. The decrease in the earnings was primarily due to pre-tax losses of $795 million associated with the announced divestitures of onshore Colombia and mineral and surface acreage in Wyoming, Colorado and Utah, the company said. Total production was 1,237,000 boe/d, up 11% from 1,112, 000 boe/d a year ago. Permian production was 420,000 boe/d, up 8% from a year ago. International production was 277,000 boe/d, remained flat with a year ago. Chemical segment adjusted income was $178 million, compared with $207 million a year ago. In October 2020, Occidental Petroleum signed an agreement to sell its entire Colombian onshore assets to The Carlyle Group for $700 million in cash plus contingent payments of up to $125 million. The transaction is expected to close in the fourth quarter of 2020. (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

- Coronavirus hospitalizations in the U.S. reached 61,964, topping a peak hit in April. The increase is already straining hospitals across several cities and states, and scientists believe it will likely get worse. (WSJ)

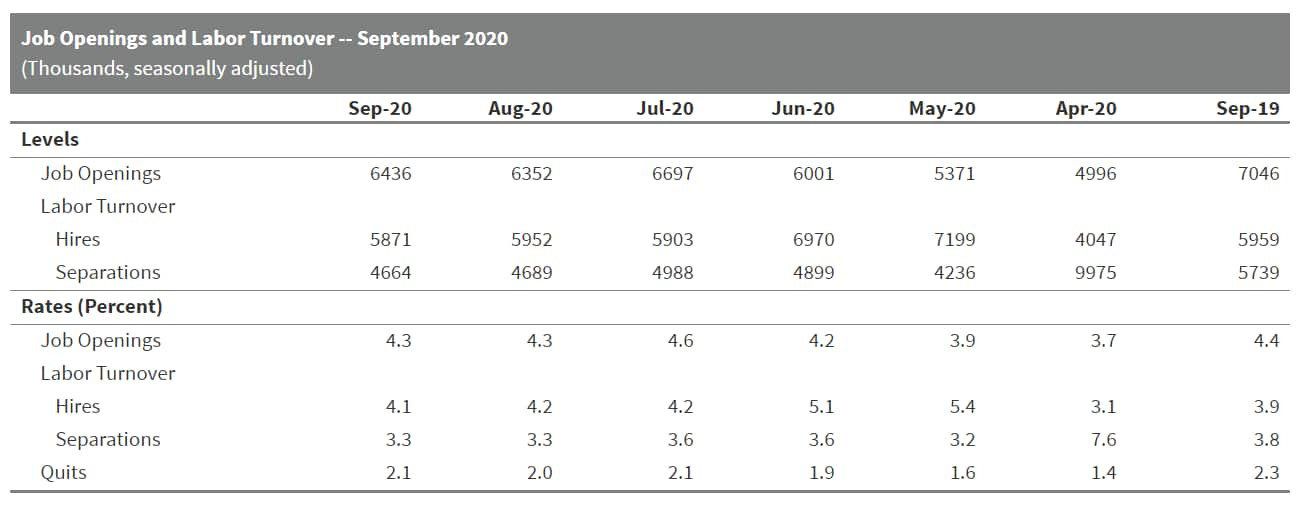

- The September JOLTS report suggests that the US labor market

recovery is losing steam, with employment still short of the

pre-pandemic peak. (IHS Markit Economist Akshat Goel)

- The number of hires was unchanged at 5.9 million and the number of job openings was unchanged at 6.4 million in September. Both are hovering near their long-term pre-pandemic averages.

- Job separations remained at 4.7 million in September and remain well below the all-time high of 10.0 million reached in April.

- The layoffs and discharges rate decreased to a series low of 0.9% in September. The quits rate, a valuable indicator of the general health of the labor market, edged up 0.1 percentage point to 2.1%; it remains below the two-year pre-pandemic average of 2.3%.

- Over the 12 months ending in September, there was a net employment loss of 6.0 million.

- There were 2.0 workers competing for every job opening in

September. In the two years prior to the pandemic, the number of

job openings exceeded the number of unemployed in every

report.

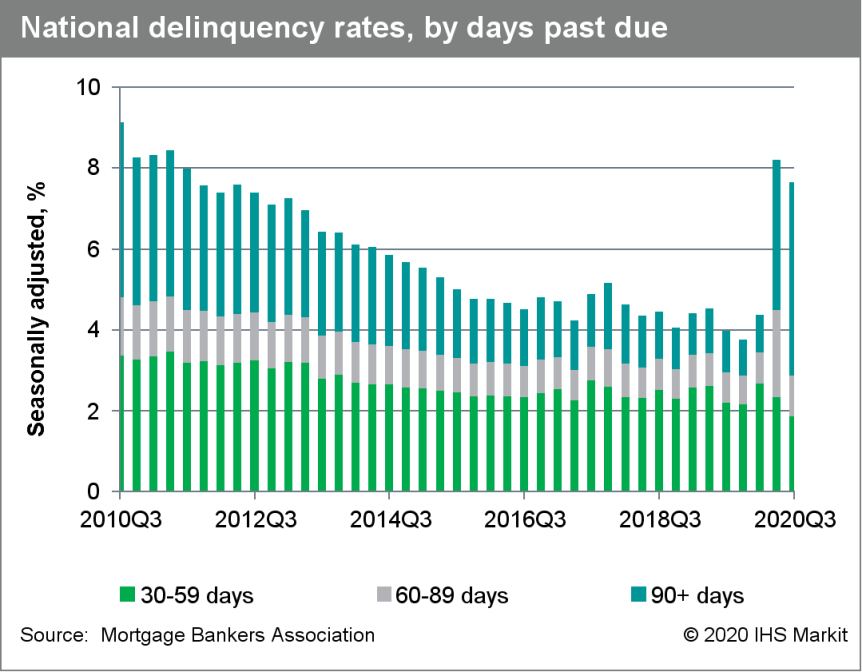

- The seasonally adjusted US mortgage delinquency rate fell 57

basis points from the end of the second quarter to 7.65% at the end

of the third quarter; it was up 368 basis points from a year ago.

(IHS Markit Economist Patrick Newport)

- The serious delinquency rate—those on loans more than 90 days delinquent or in foreclosure—soared to 5.16%, 335 basis points higher than a year earlier.

- The five states with the sharpest increase in delinquency rates from a year ago—New York, New Jersey, Nevada, Florida, and Hawaii—were all initially hit hard by the pandemic.

- This report was not all grim: the percentage of loans in the foreclosure process was 0.59%, down 25 basis points from a year earlier and the lowest reading since the second quarter of 1982; the 30-day delinquency sank to a record low; and the seasonally adjusted rate on new foreclosures remained at 0.03%—almost zero.

- The key to understanding this report is that the Mortgage Bankers Association considers loans in forbearance to be delinquent because "the payment was not made based on the original terms of the mortgage." A forbearance delays, not forgives, mortgage payments. On 28 September (the end of the third quarter), 3.4 million homeowners were in forbearance plans. That number has since dropped to 2.8 million. The Coronavirus Aid, Relief, and Economic Security (CARES) Act allows homeowners to delay mortgage payments for 90 days and apply for a one-year extension; currently, about 75% of loans in forbearance are in an extension.

- The delinquency rate, which is highly correlated with the

unemployment rate, is a serious risk. If the unemployment rate

follows our forecast trajectory—a decline from 8.8% in the

third quarter to 5.4% at the end of 2021—most homeowners in

forbearance will keep their homes and the housing market will not

be flooded with inventory. Our forecast assumes the virus is

contained and a vaccine is widely available next year.

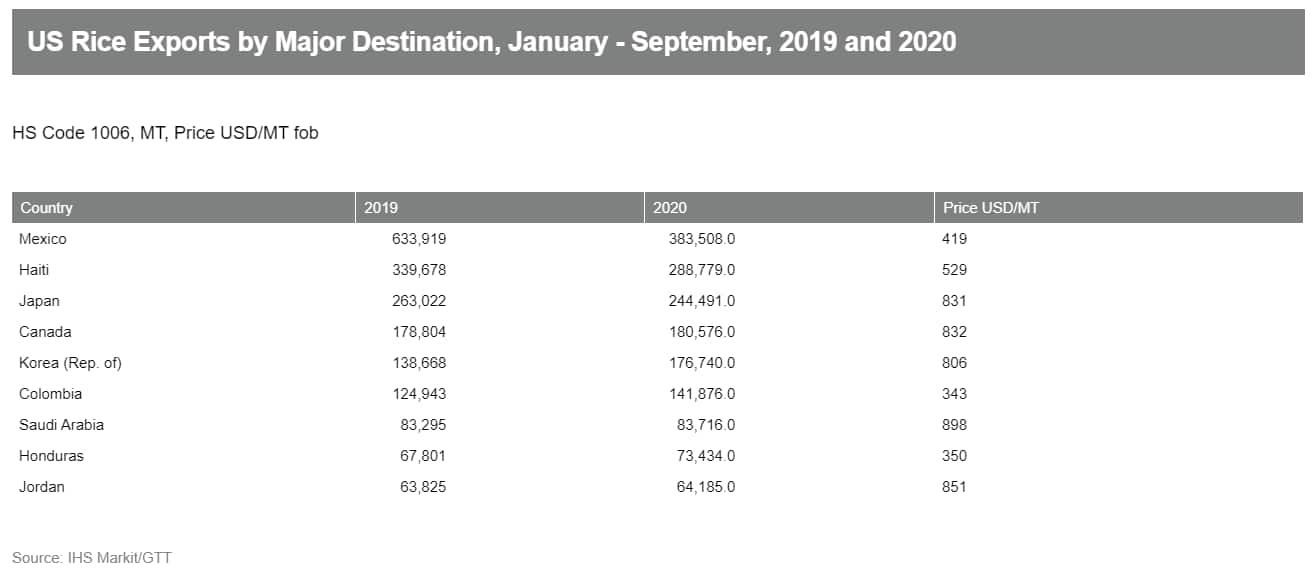

- The first 20-ton batch of US rice has completed customs

clearance at Xiamen, Fujian province. This is cause for cautious

optimism for US farmers even though negotiations for market access

to China took over a decade. The US-China Phase One Agreement

included a promise by China to purchase US rice. China is the

world's largest rice consumer. Domestic production is sufficient

for demand; imports will introduce more varieties, according to

Chinese officials. ADM sold the rice, a medium grain Calrose from

California, to an undisclosed Chinese private company. China may

also buy different varieties from other growing regions, including

Arkansas and Louisiana. The rice is intended for retail

distribution; no retail price has been reported yet. ADM will

organize a small marketing event later this month. Bobby Hanks,

chairman of the USA Rice Federation board, said: "China grows a lot

of long-grain rice. However, the US rice industry remains

optimistic about long-grain rice opportunities, even amid the

competition from neighboring countries to ship long-grain rice that

is cheaper than that delivered from the US." In the January to

September period, Chinese rice exports exceeded imports thanks to

large volumes sent to African countries. China is developing more

partners for grain and soybean, including Russia. (IHS Markit Food

and Agricultural Commodities' Hope Lee)

- Chevrolet has confirmed plans to introduce a Bolt electric utility vehicle (EUV) and updated Bolt electric vehicle (EV), which are due to see production in mid-2021. The programs were delayed as GM needed to conserve cash early on during the COVID-19 pandemic. Chevrolet also released an image of the Bolt EUV's new "power flow screen", which will provide critical information about regen braking use and the battery charge level. General Motors (GM) has been teasing out the Bolt EUV after the delay to the product; it was first shown to media under at GM's EV Day event earlier this year. GM has previously confirmed that the Bolt EUV will be the first Chevrolet product in which the company's Super Cruise system will be available. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Nuro, an autonomous delivery startup, has raised USD500 million in a Series C funding round led by T. Rowe Price Associates. New investors, including Fidelity Management & Research Company and Baillie Gifford, as well as existing investors, including SoftBank and Greylock, also participated in the funding. The valuation of Nuro has doubled to USD5 billion after the financing round, reports Reuters. The company will use the infused capital to expand its team and scale up manufacturing activities. Nuro, a small robotics company headquartered in California, has developed multi-purpose autonomous vehicles (AVs) that are able to carry goods including groceries and parcels. The company has been testing its AV system on the R1 vehicle and its updated version of the R2 via partnerships with retail companies such as Walmart, Kroger, and Domino's. In February, Nuro was granted approval by US regulator the National Highway Traffic Safety Administration (NHTSA) to deploy up to 5,000 AVs with no traditional controls in Houston, Texas. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- WR Grace has rejected a $4-billion takeover bid from private investment fund 40 North Management (New York), its largest shareholder. 40 North made a $60/share cash offer on 9 November, a 35% premium to Grace's closing share price on 6 November. Grace shares jumped 27% on the news, closing at $55.99/share on 9 November. 40 North owns a 14.9% stake in Grace and has two seats on the board following an agreement reached last year. Grace says its board "believes that 40 North's $60/share proposal significantly undervalues the company and is not a basis for further discussion." The company says it is "carefully evaluating and thoroughly discussing its value-creation opportunities. At the same time, Grace is focused on executing its long-term strategy and advancing its key investments to accelerate profitable growth, improve its competitive advantages, and strengthen its portfolio." 40 North says that a decline in margins in key businesses and failure to communicate effectively regarding environmental liabilities have created a drag on stock performance since the spin-off of its construction materials business GCP Applied Technologies in 2016. "Grace has underperformed the S&P 500 by 138% since the spin-off of GCP and is currently trading at 8.1x EV/EBITDA, which is [about] 2.5 times below its historical multiple and 3.0 times below its proxy peers," 40 North says. 40 North adds that the offer "is well in excess of what the company will be able to achieve on its current course" and that it would allow Grace to solicit competing proposals for a period following any agreement. The proposal "guarantees that the company can secure a healthy premium for its stockholders while holding open the opportunity to obtain an even higher valuation." In rejecting the bid, Grace says it has "a portfolio of high-value, specialty businesses and while end markets have been significantly impacted by the pandemic, the fundamentals of its businesses remain strong and demand trends continue to improve. As the company has communicated, most recently on its third-quarter 2020 earnings call, Grace has often pursued opportunities to maximize shareholder value." Grace says its board "remains open to all opportunities to maximize value for shareholders." (IHS Markit Chemical Advisory)

Europe/Middle East/Africa

- European equity markets closed higher across the region; Spain +3.4%, UK +1.8%, France +1.6%, and Germany/Italy +0.5%.

- 10yr European govt bonds closed lower across the region; UK/Germany +3bps and France/Spain/Italy +1bp.

- iTraxx-Europe closed flat/50bps and iTraxx-Xover -3bps/290bps.

- Brent crude closed +2.9%/$43.61 per barrel.

- The Paris region will cross the threshold of more than 99% of initial intensive-care unit capacity taken by COVID-19 patients on Tuesday, regional health agency head Aurelien Rousseau said in a tweet. That's up from about 96% a day earlier, and the highest in five months, after confirmed coronavirus cases in France rose to record levels last week. Nationwide, 92.5% of initial ICU beds were occupied by severely ill COVID patients on Monday, data from health authorities show. (Bloomberg)

- The newly elected President Joe Biden wants to allow

agriculture to participate in carbon markets, which would see US

food producers get paid for the carbon they remove from the

atmosphere. Wording in the 'Plan for Rural America' contains

stronger language than the Commission's F2F carbon farming plans

and if achieved could create a bigger opportunity for American

farmers to earn extra green capital - a source that the US could

strategically use to double-down on sustainability. (IHS Markit

Food and Agricultural Policy's Steve Gillman)

- Biden also wants to grow US agri-food profits through the bioeconomy and create this low-carbon manufacturing sector in every state. "This means taking every aspect of agricultural production - from corn stock to manure - to create chemicals, materials, fabrics, and fibers in a process that is good for the environment and creates new sources of revenue for farmers," the 'Plan for Rural America' reads.

- This could eventually see the US come up against the EU's bioeconomy as both blocs try to capture market share from this emerging sector, like bioplastics and biopharmaceuticals. However, the US could have a key advantage over the EU because of potentially more revenue streams for farmers to invest in the bioeconomy along with Biden's plan to make "American agriculture the first in the world to achieve net-zero emission".

- This goal could give the US agri-food sector stronger marketing potential on the international stage while also undermining the Commission's F2F hopes to make sustainability the EU's global "trade mark", something that has helped some of the bloc's agri-food producers already, notably Irish beef sold in China.

- The Commission would need to play catch up to succeed in its F2F plans, but currently the EU executive is facing a sustainability set-back after the bloc's agriculture ministers and members of the European Parliament both voted for a Common Agricultural Policy (CAP) with less legal strings attached to its Green Deal and F2F strategy - despite EU movements to make the overarching net-zero goal legally binding.

- According to the UK's Office for National Statistics (ONS), the

early estimate for October suggests that the number of workers on

payroll plunged by 763,000 over the 12-month period to 28.2

million. It fell for the eighth straight month, falling by 0.1%

month on month (m/m) during the month, equivalent to 33,000 people.

(IHS Markit Economist Raj Badiani)

- The new release is based on the experimental data of the number of employees on payroll using the HM Revenue and Customs' Pay As You Earn Real Time.

- The claimant count, which measures the number of people claiming benefit principally for being unemployed, dropped marginally to 2.6 million in October but still represented an increase of 112.4%, or 1.4 million, since March. The claimant count also includes the increasing number of people becoming eligible for unemployment-related benefit support despite still being employed.

- The ONS also published its traditional headline employment and unemployment data for the three months to September.

- According to the ONS, total UK employment (all aged 16 plus) shrunk by 164,000 to 32.507 million in the three months to September compared with the three months to June.

- In annual terms, the number of employed people in the three months to September was 0.8% lower compared with a year earlier.

- The number of unemployed people based on the Labour Force Survey (LFS) or the International Labour Organization (ILO) measure increased by 243,000 in the three months to September, standing at 1.624 million. The unemployment rate increased to 4.8% in the three months to September, the highest level since October 2016.

- The unemployment rate among young people (aged 16-24) was far higher, standing at 14.6% in the three months to September, reflecting the high incidence of young workers in the hospitality and retail sectors.

- The pace of redundancies is accelerating. Specifically, the number of redundancies increased by a record 181,000 to 314,000 in July-September compared with the three months to June. This was the highest level since February-April 2009. Firms made more workers redundant when they had assumed that the furlough scheme will expire at the end of October.

- Overall, ONS deputy national statistician and director general for economic statistics Jonathan Athow said, "We're seeing a continuation of a weakening of the labor market, fewer people on the payrolls and fewer people employed overall. That is now passing through to increasing unemployment altogether."

- More encouragingly, the number of job vacancies continued to recover after falling sharply during the COVID-19 virus-related lockdown. Specifically, it rose by 182,000 to 525,000 in the three months to October from a record low in April-June. However, it had stood at 818,000 in the three months to February. The ONS warned that rising vacancies is likely temporary in line with the reopening of the economy before the recent lockdown restrictions.

- Nominal- and real-wage developments were stronger. Average annual weekly earnings (total pay including bonuses) growth accelerated to 1.3% in the three months to September. In addition, regular pay (which excludes bonus payments) growth rose for the third time in 12 months and at a quicker pace, standing at 1.9% year on year (y/y) in the three months to September.

- Furthermore, total pay in real terms rose by 0.5% y/y in the three months to September, which was the first gain since March.

- We continue to anticipate tougher labor market conditions in the next few quarters.

- The number of redundancies could rise after a month-long national lockdown in England during November 2020, which is set to trigger renewed GDP losses in the final quarter of this year

- SSE Renewables has selected the team of Ramboll and Gavin & Doherty Geosolutions (GDG) to deliver the concept design for the wind turbine substructures for Phase 2 of the Arklow Bank Wind Park (ABWP) Project. The ABWP is located around 12 kilometers off the Wicklow Coast in the Irish Sea and is expected to deliver 520 MW of power by 2025. Ramboll will undertake the concept design while GDG will facilitate the technical assessment of the preferred foundation solutions. The work will allow the sizing of the foundations and more accurate cost estimates to be developed for the Irish government-led Renewable Energy Support Scheme (RESS) auction in 2021. Both companies are not new to ABWP, with Ramboll having delivered the original consent for the project and GDG, an Irish consultancy, having already worked on the development activities on Phase 2 for several years. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- The German federal parliament has passed an amendment to the Offshore Wind Energy Act, setting offshore wind targets of 20 GW by 2030 and 40 GW by 2040, and allowing for non-zero subsidy bids to be submitted in future tendering rounds. Previously, the Offshore Wind Energy Act, passed in 2017, stipulated that the lowest strike price in a previous tendering round must be the highest strike price in the next round. Given the successful zero-subsidy bids in the last two auctions, only zero-subsidy bids will be allowed in future. Such has changed with the newly passed amendment. The amendment also opens a possibility for the Contracts for Difference model, which is the option championed and preferred by the German offshore wind industry. (IHS Markit Upstream Costs and Technology's Chloe Lee)

- Porsche will not release a fully electric version of the 911 soon, according to the company's CEO Oliver Blume, who was speaking in an interview with the AutoBlog website. Blume explains that the basic philosophy of the company's iconic performance car is incompatible with full electrification. He said, "The 911 is a concept of a car prepared for internal combustion engines, and it's not useful to combine it with pure electric mobility. We believe in purpose-designed cars; either electric mobility or combustion engines, which can be combined with a hybrid system." As a result, it seems likely that some kind of hybrid set-up based on offering more performance and greater efficiency may be offered as part of the none-GT 911 range. The 911 offers the sharpest and most dynamic sports-car driving experience to Porsche's customers, with the GT3 and GT2 models the ultimate expression of this philosophy. However, lower range variants are also capable of being used as grand tourers and daily drivers, and it is this part of the range that a hybrid drive would be added to. The weight and short ranges of pure battery electric vehicles (BEVs) when driven hard are the obvious roadblocks to the possibility of the 911 ever becoming a full EV. (IHS Markit AutoIntelligence's Tim Urquhart)

- France's unemployment rate rose from 7.1% in the second quarter

to 9.0% in the third quarter. The third quarter's unemployment rate

was the highest in two years. (IHS Markit Economist Diego Iscaro)

- Despite the COVID-19 virus pandemic driving a strong decline in employment, the unemployment rate had been pushed downwards during the first half of 2020 owing to an even bigger fall in the labor force. This was the result of a large number of jobseekers not actively looking for a job during the March-May lockdown, as most businesses and schools were closed. As the economy reopened from mid-May, the labor participation rate rebounded sharply during the third quarter.

- The unemployment rate rose particularly strongly among the 25 to 49-year-old age bracket (up by 2.1 percentage points to 8.5%) and those aged 50 and over (up by 0.9 percentage point to 6.1%). The unemployment rate among youth, which had increased during the first half of the year, stood at 21.8% during the third quarter.

- Although underemployment (including those working part-time wishing to work longer hours or in a partial unemployment situation) fell from its exceptional increase during the second quarter (down from 20.0% to 7.2%), it remained well above its 2019 average of 5.3%.

- IHS Markit's measure of the U6 unemployment rate, which includes the International Labour Organization (ILO) unemployment rate plus all people marginally attached to the labor force and those employed part-time for economic reasons, declined from 33.4% in the second quarter to 20.5% in the third quarter. However, this is well above the pre-COVID-19 virus level of 17.6%. The U6 rate can provide a more accurate picture of labor market slack.

- In a separate release, a 'flash' estimate shows employment in the French private sector growing by 1.8% quarter on quarter (q/q) during the third quarter. This follows contractions of 2.5% q/q and 0.8% q/q during the first and second quarters, respectively. Employment remains 1.5% below its level during the fourth quarter of 2019.

- The third quarter's figures were within our estimates and will not drive a revision of our projections. While employment growth is likely to relapse during the fourth quarter, the reinstatement of national containment measures in early November may also put downward pressure on labor participation, injecting some volatility to the unemployment rate.

- The Danish passenger car market has fallen back during October,

according to the latest data published by the Danish Car Importers'

Association (De Danske Bilimportører). However, there has been a

further increase in registrations of light commercial vehicles

(LCVs) last month. (IHS Markit AutoIntelligence's Ian Fletcher)

- Passenger car registrations contracted by 17.9% year on year (y/y) to 15,071 units in October. The results for traditional types of passenger cars - hatchbacks, sedans, and station wagons (estates) - were weak, while the results for the standalone sport utility vehicle (SUV) category were relatively flat thanks to a gain of 28.6% y/y recorded by the sub-compact B SUV category.

- The fall in October means that passenger car registrations in the year to date (YTD) are now down 18.1% y/y at 157,231 units, compounded by the COVID-19 virus-related declines earlier in the year.

- As for the commercial vehicle categories, the trade association has reported that LCV registrations grew 7.8% y/y to 2,903 units in October, although sales in this category stand at 24,577 units in the YTD, down 9.9% y/y.

- Furthermore, Danish registrations of medium and heavy commercial vehicles (MHCVs) dropped by 22.4% y/y to 349 units in October and are now down 28% y/y at 3,156 units in the YTD.

- Greece's industrial production rose by 1.4% month on month

(m/m) in September, according to seasonally adjusted figures

released by the Hellenic Statistical Authority. Industrial output

declined by 1.1% m/m in August, following increases of 3.1% m/m in

June and 4.0% m/m in July, respectively. Output remained 1.2% below

its pre-pandemic level. (IHS Markit Economist Diego Iscaro)

- The m/m increase in September was mainly driven by a 14.5% m/m rise in electricity production. Manufacturing output, on the other hand, declined by 0.4% m/m in September.

- The breakdown by main industrial groupings shows the production of capital (+1.7% m/m) and consumer non-durables (+3.8% m/m) rising in September, while the production of intermediate (-1.9% m/m) and consumer durables (-2.2% m/m) declined.

- Aker Offshore Wind, recently spun-off from Aker Solutions, has received a grant of NOK 10 million (USD 1.1 million) from Enova, Norway's innovation fund for the reduction of greenhouse gas emissions, and the development of climate technology. Aker Offshore Wind will be the main funder of the study for the current project phase. The focus will be on reducing costs and increasing maturity in important technical segments of offshore floating wind. The project will also improve understanding of how technology solutions can enable the use and development of a Norwegian supply chain. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Belarusian commercial vehicle manufacturer MAZ is looking to begin trials of its electric bus in the Russian city of St Petersburg, according to a Belarus daily news report. The bus that will be used in the trial is the electric 303Е10, which features lithium-iron-phosphate batteries, which the company states have a "high unit capacity and long lifespan". In a statement MAZ said, "The cruising range is up to 300km, which is on par with the latest models of best European manufacturers. The storage batteries are charged from an autonomous transformer. Charging the battery to full at maximum voltage needs four to six hours." Although the specifications of the 303Е10 seem competitive, it remains to be seen what the potential take-up will be in Russia given that Russian President Vladimir Putin has backed compressed natural gas (CNG) over electrification, although MAZ may be able to find a niche in the bus market in the country. In total, a fleet of 27 buses will be used by the Kolpino public transport company on routes connecting St Petersburg to the suburbs. (IHS Markit AutoIntelligence's Tim Urquhart)

- Abu Dhabi National Oil Co. (Adnoc) and ADQ (Abu Dhabi) have

outlined plans to invest more than $5 billion in total for seven

chemical anchor projects and related infrastructure at a previously

announced derivatives park at Ruwais, Abu Dhabi. (IHS Markit

Chemical Advisory)

- The potential anchor projects specified for the first proposed phase of development at the park will manufacture chlor-alkali products, ethylene dichloride, maleic anhydride, methanol, ammonia, isopropyl alcohol, and elastomers, and have been chosen following a detailed feasibility study, Adnoc says. No production capacities for the facilities have been given, with the company saying only that the projects will manufacture the chemicals "at a global scale, with opportunities for additional investors and partners to participate."

- Initial chemicals production from the anchor projects is scheduled for 2025, with "several design and engineering contracts" to be awarded early in 2021 for the design of the chemical plants, as well as the required ecosystem, according to Adnoc.

- Total investment in the chemical projects is expected to exceed $3 billion, with at least a further $2 billion to be invested in infrastructure, Adnoc says. It adds that most of the chemicals would be produced for the first time in the UAE. The investments will be made via Adnoc and ADQ's recently established Ta'ziz joint venture (JV).

- The Ta'ziz JV will strengthen the UAE's position "as a globally competitive chemicals hub and destination for foreign direct investment," and leverage technology to grow its advanced manufacturing base, says Sultan Ahmed al-Jaber, Adnoc CEO and UAE minister for industry and advanced technology.

- Adnoc and ADQ, a holding company with enterprises spanning several key sectors in Abu Dhabi including ports, energy, rail, and steel, announced their intention in July to establish the JV. Adnoc holds a 60% stake in the JV, with ADQ holding the remaining 40%.

- Adnoc says the derivatives park will have strong synergies with the company's integrated downstream assets for feedstocks and services, as well as advantaged maritime, land, and air logistics, and transport links. The site is adjacent to the existing Ruwais industrial complex. Developing a robust derivatives industry at Ruwais is the cornerstone of Adnoc's downstream strategy, which it launched in 2018.

- The Reserve Bank of Malawi cut its key interest rate to 12%

from 13.5% during its monetary policy committee (MPC) meeting on

5-6 November to support economic recovery and job creation. The

short-term inflation outlook appears favorable, with headline

inflation anticipated to continue to weaken in 2021. (IHS Markit

Economist Archbold Macheka)

- The Malawian central bank's MPC also decided to keep the Lombard rate at 0.2 percentage point above the policy rate, while the liquidity reserve requirement (LRR) ratio on both local-currency and foreign-currency deposits was maintained at 3.75%.

- The central bank expects Malawi's real GDP growth to slow considerably to 1.2% in 2020, from 5.1% in 2019, driven by the adverse impact of the COVID-19 pandemic. The sectors that have been most affected by the pandemic include manufacturing, tourism and accommodation, health services, and wholesale and retail trade.

- Headline inflation continues to weaken, easing from 11.5% in January to 7.1% in September - the lowest reading of inflation since December 2017 - thanks to relatively lower food prices coupled with weak demand pressures due to the COVID-19 pandemic.

- Non-food inflation has also been low and stable, benefiting from a relatively stable exchange rate and softer energy prices. The Reserve Bank of Malawi projects headline inflation to average 8.6% in 2020, with further easing anticipated through 2021.

- The external account continues to deteriorate, driven by the trade deficit, which stood at USD1.5 billion during the first nine months of 2020, compared with a deficit of USD1.1 billion recorded in the corresponding period of 2019.

- The central bank also noted that inward remittances continue to recover, reaching USD52.5 million in the third quarter of 2020, from USD32.1 million in the second quarter, largely due to the easing of lockdown restriction measures, particularly in South Africa, Malawi's largest source of remittances.

- Since August, IHS Markit had been noticing an increased likelihood that the Reserve Bank of Malawi could cut rates earlier than expected given the continued decline in inflation and the global monetary easing cycle, but we had expected the bank to hold off any rate move until 2021.

- IHS Markit expects the central bank of Malawi to cut interest rates further in 2021, while monitoring domestic and external conditions. IHS Markit expects average annual headline inflation to remain in single-digit territory through the next 24 months, averaging 9.2% in 2020 and 6.9% in 2021, on condition of benign weather conditions supporting improved agriculture production and weaker global oil prices, together with a stable currency benefiting non-food inflation.

Asia-Pacific

- APAC equity markets closed mixed; India +1.6%, Hong Kong +1.1%, Australia +0.7%, Japan +0.3%, South Korea +0.2%, and Mainland China -0.4%.

- China's merchandise exports rose 11.4% year on year (y/y) in

October in terms of USD, up 1.5 percentage points from the figure

in September, according to the General Administration of Customs

(GAC). Merchandise imports growth fell by 8.5 percentage points

from September to 4.7% y/y this month. The year-to-date exports

returned to expansion for the first time since the beginning of the

year, while imports remained in 2.3% y/y contraction. Owing to

strong appreciation of Yuan against the USD, exports growth in

terms of RMB actually fell and the decline in imports growth was

bigger. (IHS Markit Economist Yating Xu)

- Continuous recovery of global production in major economies supported China's export growth. Manufacturing purchasing managers' index (PMI) of the United States (US) rose to 59.3, and the figures in Japan and European Union (EU) continued to improve. Given this, exports growth to the US accelerated to 22.5% y/y, and purchase from Japan improved to expansion from contraction in the previous months. However, exports growth to Korea and ASEAN slowed.

- By product, exports of light, furniture, auto and toys rose significantly in October, reflecting the increase of consumption during Christmas. Meanwhile, third outbreak of Covid-19 pandemic in the US and EU continued to support exports of epidemic control supplies and consumer electronics maintained strong growth.

- Rush purchase ahead of the National Day holiday could be a driver to the booming imports in September and the following slowdown in October, while domestic production remained strong reflected in October PMI.

- By country, except continuous acceleration of purchase from the US, imports from EU, Japan ASEAN and Korea all declined. By product, consumption goods such as auto and consumer electronics maintain fast growth. However, production goods such as natural gas, crude oil and coal dropped significantly, partially due to commodity price decline.

- Strong exports growth and slowdown in imports growth led trade surplus to increase by USD21.4 billion to USD58.4 billion in October. The year-to-date trade surplus registered USD384.5 billion, up 14.2% y/y.

- Exports are expected to maintain the current strength in the last two months of the year as global economy continues to recover. Re-lockdown in EU countries due to the reescalation of pandemic and disruptions from US election dispute may impede global demand and production recovery to some extent, but China may also benefit from overseas production limit.

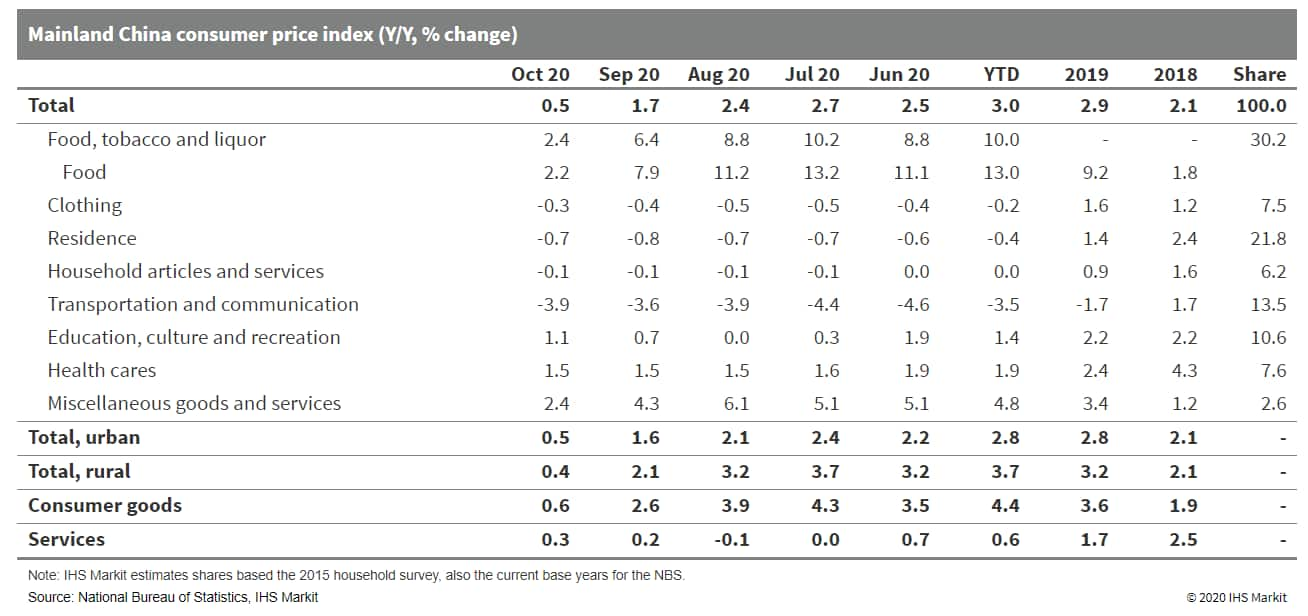

- Mainland China's consumer price index (CPI) registered an

increase of 0.5% year on year (y/y) in October, a level last seen

around the end of 2009, according to the data release from the

National Bureau of Statistics. Month-on-month (m/m) CPI inflation

reported decline of 0.3%, after staying in the positive territory

throughout the third quarter. (IHS Markit Economist Yating Xu)

- By component, slowing food price inflation continues to lead the headline CPI's disinflation in October. Notably, pork price, supported by supply restoration, declined by 2.8% y/y in October after rising for 19 consecutive months.

- Price deflation of transportation widened, owing to the 17.2% y/y drop in vehicle fuel price. Services price inflation further strengthened to 0.3% y/y, thanks to the resuming offline activities especially during the National Day holiday.

- Core CPI excluding food and crude oil stayed unchanged at 0.5% y/y for the fourth straight month.

- Producer price index (PPI) deflation stood at 2.1% y/y in October, same as September's reading. M/m PPI inflation fell from 0.1% to 0.0% in October, with 12 out of 40 surveyed industrial sectors reporting m/m price gains, compared with 15 in the previous month.

- Sustained oil price weakness was still behind headline PPI's stalled recovery in October. Price in oil-related sectors including petroleum and natural gas exploration and fuel processing further deflated m/m.

- Both prices in ferrous metals and non-ferrous metals smelting and pressing re-deflated m/m. Price deflation of consumer goods manufacturing expanded to 0.5% y/y in October with food sub-category being the main driver.

- Cumulatively, CPI had been up by 3.0% in the first 10 months, narrowing from 3.3% in the first three quarters; PPI deflated by 2.0% through October, unchanged from last monthly release.

- October's reading of CPI could bring downward revision risks to our full-year CPI forecast, which now stands at 3.0% for 2020. In the remainder of the year, headline CPI could further trend down, as high-base effect (mostly from food price and in particular pork) could outweigh the tailwinds from sustained economic recovery.

- Additionally, the food supply improvement (notably pork) could

outpace the demand rise during winter season; and the occurrence of

small regional outbreaks may also cloud the outlook of recovery on

the services front.

The emphasis on financial system stability suggests monetary policy would continue to refrain from large-scale stimulus.

- Tesla plans to produce 550,000 vehicles next year at its Gigafactory Shanghai, reports Chinese tech media 36kr. The report, citing an unnamed insider, indicates that 300,000 units of the Model 3 and 250,000 units of the Model Y will be produced in China at the Tesla factory next year. The report also indicates that around 100,000 units of the Model 3 and 10,000 units of the Model Y will be exported from Shanghai to overseas markets. According to Tesla's third-quarter report, the Model 3's production capacity has increased to 250,000 units per year at the Shanghai factory. In addition, a third shift of the Model 3's production has been added at the plant to meet rising demand for the entry-level Tesla model. Although the production plan reported by Chinese media has not been confirmed by Tesla, the automaker does intend to further leverage its capacity at Shanghai to serve overseas markets where it lacks a manufacturing presence. Exports of the Model 3 from the plant already began in October. Destination countries include Germany, France, Italy, and Switzerland. The second phase of the Shanghai plant, which will be completed by the end of 2020, will enable Tesla to increase production of its upcoming Model Y, a model that has a high potential in the Chinese market as a sport utility vehicle (SUV). The reported export volume of 10,000 units of the Model Y also reflects that the vehicle's main target market will still be mainland China in the first year of its production. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chinese automaker Dongfeng Motor Group plans to raise CNY21 billion (USD3.18 billion) through an initial public offering (IPO) in China. The automaker has submitted its IPO prospectus to the China Securities Regulatory Commission as it plans to list its shares on the Shenzhen Stock Exchange. The IPO will enable Dongfeng to float its shares on stock exchanges in both mainland China and Hong Kong SAR, where trading of its stock first began in 2005. Of the total funds raised, the company plans to allocate CNY7 billion to support product development for the VOYAH, its new energy vehicle (NEV) brand, CNY2.2 billion to electric vehicle (EV) platform development, CNY900 million for new modular platform development, and CN700 million for the development of electronic architecture and software technologies. The remainder of the funds are to be allocated for the development of connected vehicle technologies and autonomous driving technologies. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Japan's current-account surplus fell by 18.9% from the previous

month to JPY1.3 trillion (USD12.8 billion) on a seasonally adjusted

basis but rose by 4.2% year on year (y/y) to JPY1.6 trillion on a

non-seasonally adjusted basis. The first y/y rise in seven months

was due to an increase in the trade surplus, reflecting a softer

decline in exports (down 4.2% y/y) in line with the resumption of

economic activity in Japan's trading partners (particularly for

China and the US). (IHS Markit Economist Harumi Taguchi)

- The increase in the trade surplus was partially offset by larger deficits of the service balance and secondary income. While the surplus for the travel balance narrowed (down 88.6% y/y) because of border controls to contain the COVID-19 infections and the deficit of the service balance persisted, a surge in current transfers by corporations boosted the deficit of secondary income. The softer surplus for primary income largely reflected a decline in portfolio investment receipts.

- The September results suggest that a recovery in the trade balance is likely to contribute to a rebound in real GDP in the third quarter of 2020 (which will be released on 16 November). IHS Markit expects net exports to contribute 2.5 percentage points to a quarter-on-quarter rise of real GDP in the third quarter.

- IHS Markit maintained its view that Japan's current-account surplus will continue over the near term thanks to substantial primary income figures, underpinned by an uptrend of investment abroad. However, the global resurgence of COVID-19 infections could weigh on a recovery of exports while the resumption of economic activity could accelerate a recovery in imports. Although the government has gradually eased border controls, a resurgence of new confirmed cases could delay a recovery for tourism.

- Smulders has shipped out the first four transition pieces for the Akita-Noshiro offshore wind farm from its yard in Hoboken, Belgium. The transition pieces will arrive at Sif Group's storage area at its Maasvlakte 2 facility in Rotterdam, Netherlands, where they will be stored alongside the monopoles being produced by Sif Group. Sif signed a final contract with Kajima Corporation, the EPCI contractor, for the delivery of 33 monopiles and 33 transition pieces in March 2020. The transition pieces have been subcontracted to Smulders. The Akita Noshiro offshore wind farm project, developed off the coast of Japan, comprises the Akita and Noshiro offshore wind farms with a combined capacity of 139MW. The Akita site will have 13 typhoon variant Vestas V117-4.2 MW turbines, while the Noshiro site will comprise 20 turbines of the same. The project commenced in February 2020 and is expected to begin commercial operations in 2022. The project is being developed by special purpose company (SPC) Akita Offshore Wind (AOW) that was established by Marubeni in April 2016 and is estimated to cost around USD923 million. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Mahindra & Mahindra (M&M) has posted a steep decline in

net profit for the second quarter of fiscal year (FY) 2020/21 ended

30 September 2020. The result is for the combined operations of

M&M's automotive and farm equipment units, as well as Mahindra

Vehicle Manufacturers Limited (MVML), the company's

passenger-vehicle manufacturing arm. In a statement to the Bombay

Stock Exchange (BSE), the automaker said that its combined net

profit after exceptional items (EI) declined by 88% year on year

(y/y) to INR1.62 billion (USD22 million) in the second quarter of

the FY, down from INR13.96 billion in the corresponding period last

FY. (IHS Markit AutoIntelligence's Isha Sharma)

- Profit after tax (PAT; before EI) was down by 3% y/y to INR13.1 billion, down from INR13.5 billion, while operating margin improved to 17.8% from 14.1%. This was made possible on the back of the strong performance of tractors combined with cost-cutting measures that led to a high operating margin, despite a substantial fall in other income in the second quarter of FY 2020/21 compared with the second quarter of the previous FY.

- The EI on impairments worth INR11.49 billion representing an

impairment provision for a certain long-term investments have led

to a drop in the PAT in the quarter compared with the corresponding

quarter in the previous FY.

Sales revenues during the second quarter of the FY grew by 6% y/y to INR115.9 billion. - Within the combined entity, the automotive unit contributed revenues of INR63.5 billion in the quarter, down by 7.8% y/y, from INR68.9 billion last FY. M&M's total vehicle sales during the quarter stood at 87,332 units, down by 21% y/y, from 110,824 units in the corresponding period last FY.

- Tractor sales totaled 89,597 units, up by 31% y/y, while total exports reached 7,103 units, down by 33% y/y. In the first half of the FY, combined net profit after EI was down by 94% y/y to INR2.3 billion on revenues of INR171 billion, down by 28% y/y.

- M&M's earnings continued to remain under stress for yet another quarter. The company's operations were hit by the government's lockdown measures following the COVID-19 virus outbreak. These had greatly reduced demand and output.

- The early easing of the restrictions and important reforms of the agriculture sector, a rise in the minimum support prices (MSPs) of Kharif crops, and healthy reservoir levels along with positive rural sentiment helped tractor demand bounce back after April.

- Urban mobility startup Routematic has raised USD2 million in its latest round of funding from Bosch India. In return, Bosch will acquire a 7.14% stake in Nivaata Systems, which operates Routematic, reports The Economic Times. This comes after Routematic raised USD2.5 million in April last year and the company is now valued at USD28 million. Routematic will use the infused capital to expand its portfolio of mobility products and geographic presence. Surajit Das, CEO of Routematic, said, "Routematic will play a central role in determining how big cities handle problems like traffic congestion and envision mental issues. This partnership will enable us to build mobility products that are safe, efficient, and sustainable." Routematic was founded in 2013 to provide employee transportation software and solutions to large firms. The company aims to offer safe and reliable daily commuting options while reducing the global carbon footprint. Its platform uses features such as artificial intelligence-based routing, automated vehicle dispatch, live tracking, and paperless automated billing. Routematic, which is available in 16 Indian cities, claims to have over 80 clients and more than 150,000 users on its platform. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- LG Chem's shareholders have approved the plan to spin off the company's battery business as a standalone company, reports The Korea Times. The new company will be named LG Energy Solution and will be established as a fully owned subsidiary of LG Chem on 1 December 2020. LG Chem first announced plans to spin off its battery business in September. At the time, the decision had been approved by the board and was subject to shareholder approval. According to reports, the battery business accounted for over 1% of LG Chem's revenues in the third quarter ended 30 September 2020. The expected revenue of the new corporation is around KRW13 trillion (USD11.6 billion) in 2020, and it is expected to achieve sales of over KRW30 trillion in 2024. LG Chem's rationale behind the splitting of the company is that it feels that the time is optimal to re-evaluate corporate value and maximize stockholder value. It has currently procured more than KRW150 trillion in orders on hand in the electric vehicle (EV) battery business and is investing over KRW3 trillion annually in facilities, and it needs large investments. The battery division can attract large investments with an independent financial structure system. Recently, it was reported that LG Chem is planning to triple its production capacity for cylindrical battery cells. It is expected to expand production capacities in Europe and North America. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-10-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-10-2020.html&text=Daily+Global+Market+Summary+-+November+10%2c+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-10-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - November 10, 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-10-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+November+10%2c+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-10-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}